false

0000803578

0000803578

2024-06-10

2024-06-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 10, 2024

WAVEDANCER, INC

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-41092

|

54-1167364

|

| |

|

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

12015 Lee Jackson Memorial Highway

Suite 210

Fairfax, VA 22033

(Address of principal executive offices, including zip code)

703-383-3000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

WAVD

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On June 10, 2024, with an effective date of June 7, 2024, WaveDancer, Inc. and its wholly-owned subsidiary Tellenger, Inc. (collectively the “Borrowers”) executed a Change of Terms (“CIT”) to the Commercial Line of Credit Agreement and Note dated April 16, 2021, as amended on September 11, 2023 (the “LOC Agreement”), with Summit Community Bank, a division of Burke & Herbert Bank & Trust (the “Lender”). Through prior agreements with the Lender the LOC Agreement expired on May 16, 2024. Prior to the execution of the CIT, the amount due to the Lender was $500,000.

In connection with such CIT, the maturity date was extended to July 16, 2024 in consideration of the Borrowers making a principal curtailment of $100,000 and paying an extension fee of $2,500, and making an additional $100,000 payment by June 28, 2024 plus an additional $4,000 extension fee.

A copy of the CIT is filed as exhibit 10.1.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

|

Description

|

| |

|

|

|

10.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

WAVEDANCER, INC.

|

|

| |

|

|

|

|

Date: June 13, 2024

|

By:

|

/s/ G. James Benoit, Jr.

|

|

| |

|

G. James Benoit, Jr.

|

|

| |

|

Chief Executive Officer

|

|

Exhibit 10.1

CHANGE OF TERMS:

COMMERCIAL LINE OF CREDIT AGREEMENT AND NOTE

| Lender: |

SUMMIT COMMUNITY BANK, a Division of Burke & Herbert Bank & Trust |

| |

9757 Phair Way |

| |

Manassas, VA 20110 |

| |

|

| Borrowers: |

WAVEDANCER, INC. |

| |

12015 Lee Jackson Memorial Highway, Suite 210 |

| |

Fairfax, VA 22033 |

| |

|

| |

|

| |

TELLENGER INC. |

| |

2275 Research Blvd. |

| |

Rockville, MD 20850 |

| |

|

| Loan No: |

8069577 |

IMPORTANT NOTICE

THIS INSTRUMENT CONTAINS A CONFESSION OF JUDGMENT PROVISION WHICH CONSTITUTES A WAIVER OF IMPORTANT RIGHTS YOU MAY HAVE AS A DEBTOR AND ALLOWS THE CREDITOR TO OBTAIN A JUDGMENT AGAINST YOU WITHOUT ANY FURTHER NOTICE.

| |

Manassas, Virginia |

| Original Principal Amount: $1,000,000.00 |

Date of Change: June 7, 2024 |

| |

|

| Revised Principal Amount: $500,000.00 |

|

| |

|

| Modified Principal Amount: $400,000.00 |

|

NOW COME, Summit Community Bank, a Division of Burke & Herbert Bank & Trust (the “Lender”), WaveDancer, Inc., a Delaware stock corporation, and Tellenger Inc., a Maryland stock corporation (collectively the “Borrowers”) and enter this Change of Terms: Commercial Line of Credit Agreement and Note (the “CIT Agreement”) relative to the original Commercial Line of Credit Agreement and Note dated April 16, 2021 (the “Note” or “Existing Debt”).

WHEREAS the Borrowers entered that certain Note with Lender on April 16, 2021 in the original principal amount of One Million and 00/100 Dollars ($1,000,000.00); and

WHEREAS the Lender revised the principal amount of the loan to Five Hundred and 00/100 Dollars ($500,000.00) on September 11, 2023; and

WHEREAS, the Lender extended the Maturity Date of the Note to May 16, 2024; and

WHEREAS the Borrowers and Lender are desirous of entering into a Change in Terms Agreement extending the maturity date from May 16, 2024 to July 16, 2024 upon certain express conditions.

NOW, THEREFORE, the Lender and the Borrowers, in consideration of the terms and provisions contained herein, have agreed to Modify the Terms of the Note by way of following:

| |

1.

|

Extended Maturity Date. The maturity date, as defined in the Note, is hereby extended from May 16, 2024 to July 16, 2024 in accordance with the terms of Curtailment contained in this CIT Agreement (“Extended Maturity Date”).

|

| |

2.

|

Curtailment and Fee. The Extended Maturity Date shall be granted to the Borrowers by the Lender so long as the Borrowers provide a principal curtailment payment of One Hundred Thousand and 00/100 Dollars ($100,000.00)(the “Curtailment”) and payment of a CIT Agreement fee of Two Thousand Five Hundred and 00/100 Dollars ($2,500.00) at the time of signing this CIT Agreement.

|

| |

3.

|

Additional Curtailment and Fee. The Borrowers must provide an additional principal curtailment payment of One Hundred Thousand and 00/100 Dollars ($100,000.00)(the “Additional Curtailment”) on or before June 28, 2024, and payment of a second CIT Agreement fee (i) of Two Thousand Five Hundred and 00/100 Dollars ($2,500.00) if the Additional Curtailment is made on or before June 16, 2024; or (ii) of Four Thousand and 00/100 Dollars ($4,000.00) if the Additional Curtailment is made on June 28, 2024.

|

| |

4.

|

Release of Claims. As additional consideration for this CIT Agreement, the Borrowers, on behalf of themselves and their heirs, successors, assigns, administrators, personal representatives, executors, general and limited partners, agents, attorneys, contractors, affiliates and employees, and the officers, directors and shareholders of its respective partners, and the guarantors (collectively the “Releasing Parties”) do hereby release, remise, and discharge Lender, and each of Lender’s subsidiaries, divisions, affiliate corporations, trustees, beneficiaries, officers, directors, agents, employees, servants, successors, attorneys and assigns (collectively the “Released Parties”) from and against any and all claims, demands, debts, liabilities, contracts, obligations, accounts, causes of action or claims for relief of whatever kind or nature, whether known or unknown, suspected or unsuspected by the Releasing Parties, which arise from or by reason of, or are in any way connected with any agreements, transactions, occurrences, conduct, acts, or omissions of the Released Parties, whatsoever, in respect of (a) the Note; (b) any of the loan documents and obligations evidenced thereby, including, without implied limitation, the terms thereof, (c) any notices of default or sale in reference to the existing Note or any other matter pertaining to the collection or enforcement by Lender of the Note or recourse to collateral or security thereof by Lender, (d) any alleged oral or written agreements or understandings by and between Releasing Parties and Released Parties in any way arising out of or related to the Note, the loan documents, the indebtedness or any modifications, amendments, representations or warranties related thereto, or (e) the disbursement, administration and modification of the Note and the loan documents. Releasing Parties further agree to refrain and forbear from commencing, instituting, or participating in, either as a named or unnamed party, any lawsuit, action or other proceedings against Released Parties, or any of them, which is in any way connected with, based upon, related to or arising out of, directly or indirectly, the matters released herein. Releasing Parties acknowledge and agree that the loan documents continue and remain in full force and effect without waiver, modification, or amendment other than as expressly set forth in this Agreement.

|

| |

5.

|

All other provisions of the Note remain in full force and effect.

|

RATIFICATION AND CONTINUED VALIDITY. Except for the terms expressly modified by this Agreement, the undersigned Parties hereby acknowledge they are still bound by the terms of the instruments and prior modifications, extensions, and supplements evidencing the Existing Debt as if they were fully set forth in this Agreement and that those terms will continue to bind the Parties as provided in this Agreement and those instruments. Consent to this Agreement does not waive the right to strictly enforce any rights under this Agreement or the instruments evidencing the Existing Debt. Consent to this Agreement does not require the Parties to enter into another agreement like this one in the future. The Parties and Lender agree that this Agreement shall not be construed as a novation or extinguishment of the Existing Debt, but a restatement of the Existing Debt with modifications.

OTHER RESPONSIBLE PARTIES. Any Parties liable for the Existing Debt, including without limitation, cosigners, guarantors, and hypothecators, are not relieved of any obligation except as expressly relieved in this Agreement or any other writing. The liability of any Party who signed the instruments evidencing the Existing Debt, whether primary or secondary, continues in full force and effect, even if that Party does not sign this Agreement.

PARAGRAPH HEADINGS; SINGULAR AND PLURAL TERMS. Paragraph headings of this Agreement are solely for the convenience of the Parties and shall not be used to interpret this Agreement. Whoever used, the singular shall include the plural, the plural shall include the singular, and the use of any gender shall be applicable to all genders.

ORAL AGREEMENTS DISCLAIMER. This Agreement represents the final agreement between the Parties and may not be contradicted by evidence of prior, contemporaneous, or subsequent oral agreements of the parties. There are no unwritten oral agreements between the parties.

[SIGNATURE INTENTIONALLY ON THE NEXT PAGE]

PRIOR TO SIGNING THIS NOTE, BORROWER READ AND UNDERSTOOD ALL THE PROVISIONS OF THIS NOTE. BORROWER AGREES TO THE TERMS OF THIS NOTE AND ACKNOWLEDGES RECEIPT OF A COMPLETED COPY OF THIS NOTE.

|

|

WAVEDANCER, INC.

|

|

| |

a Delaware stock company |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

|

(SEAL)

|

|

|

|

G. James Benoit, Jr., its CEO

|

|

STATE OF VIRGINIA

COUNTY OF , to wit:

The foregoing CIT Agreement was acknowledged before me on June , 2024, by G. James Benoit, Jr., as CEO of WaveDancer, Inc., a Delaware stock company, on its behalf.

My Commission Expires:

My Registration No.:

| |

|

| |

Notary Public |

| |

|

| |

|

| |

(Print name and affix seal.) |

PRIOR TO SIGNING THIS NOTE, BORROWER READ AND UNDERSTOOD ALL THE PROVISIONS OF THIS NOTE. BORROWER AGREES TO THE TERMS OF THIS NOTE AND ACKNOWLEDGES RECEIPT OF A COMPLETED COPY OF THIS NOTE.

|

|

TELLENGER, INC.

|

|

| |

a Maryland stock company |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

|

(SEAL)

|

|

|

|

Stanley A. Reese, its President

|

|

STATE OF VIRGINIA

COUNTY OF , to wit:

The foregoing CIT Agreement was acknowledged before me on June , 2024, by Stanley A. Reese, as President of Tellenger, Inc., a Maryland stock company, on its behalf.

My Commission Expires:

My Registration No.:

| |

|

| |

Notary Public |

| |

|

| |

|

| |

(Print name and affix seal.) |

|

|

LENDER: SUMMIT COMMUNITY BANK, a Division of Burke & Herbert Bank & Trust

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

|

|

|

|

|

Name:

|

Gary L. Jones II

|

|

|

|

|

Title:

|

Market President – Commercial Lending

|

|

COMMONWEALTH OF VIRGINIA

CITY/COUNTY OF , to-wit:

I HEREBY CERTIFY, that on this day of June 2024, before me, a Notary Public of said jurisdiction, personally appeared Gary L. Jones II, in his capacity as Market President – Commercial Lending of SUMMIT COMMUNITY BANK, a Division of Burke & Herbert Bank & Trust, known to me (or satisfactorily proven) to be the persons whose name is subscribed to the foregoing instrument and acknowledged that he/she has executed the same for the purposes therein contained.

WITNESS my hand and notarial seal.

My Commission Expires:

v3.24.1.1.u2

Document And Entity Information

|

Jun. 10, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

WAVEDANCER, INC

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jun. 10, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-41092

|

| Entity, Tax Identification Number |

54-1167364

|

| Entity, Address, Address Line One |

12015 Lee Jackson Memorial Highway

|

| Entity, Address, Address Line Two |

Suite 210

|

| Entity, Address, City or Town |

Fairfax

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

22033

|

| City Area Code |

703

|

| Local Phone Number |

383-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

WAVD

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000803578

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

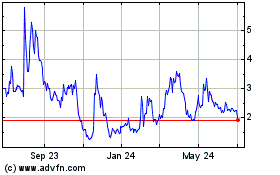

WaveDancer (NASDAQ:WAVD)

Historical Stock Chart

From Dec 2024 to Jan 2025

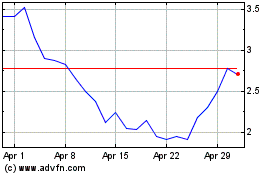

WaveDancer (NASDAQ:WAVD)

Historical Stock Chart

From Jan 2024 to Jan 2025