Form 8-K - Current report

December 16 2024 - 4:02PM

Edgar (US Regulatory)

0000737468FALSE00007374682024-12-162024-12-16

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 16, 2024

| | |

| WASHINGTON TRUST BANCORP, INC. |

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Rhode Island | | 001-32991 | | 05-0404671 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| | | | | | | | | | | |

| 23 Broad Street | | |

| Westerly, | Rhode Island | | 02891 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | |

| (401) | 348-1200 |

| (Registrant's telephone number, including area code) |

| | |

| N/A |

| (Former name or address, if changed from last report) |

| | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

COMMON STOCK, $.0625 PAR VALUE PER SHARE | WASH | The NASDAQ Stock Market LLC |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | |

| Emerging growth company | ☐ |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition |

| period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the |

| Exchange Act. | ☐ |

Item 8.01. Other Events.

On December 16, 2024, Washington Trust Bancorp, Inc. (the “Corporation”) issued a press release announcing the closing of the previously disclosed underwritten public offering of the shares of its common stock (the “Offering”). The offer and sale of the shares of common stock in the Offering was registered under the Securities Act of 1933, as amended (the “Act”), pursuant to the Corporation’s shelf registration statement on Form S-3 (File No. 333-274430), which was declared effective by the Securities and Exchange Commission (the “SEC”) on September 29, 2023, including the base prospectus contained therein, as supplemented by a prospectus supplement dated December 12, 2024, and filed by the Corporation with the SEC pursuant to Rule 424(b) under the Act. A copy of the press release issued by the Corporation announcing the closing of the Offering is attached to this report as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | | | | | | | |

| (d) | Exhibits. | | |

| | | | |

| | Exhibit No. | | Exhibit |

| | | | |

| | | | |

| | 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | WASHINGTON TRUST BANCORP, INC. |

| Date: | December 16, 2024 | | By: | /s/ Ronald S. Ohsberg |

| | | | Ronald S. Ohsberg |

| | | | Senior Executive Vice President, Chief Financial Officer and Treasurer |

NASDAQ: WASH

Media Contact: Sharon M. Walsh

SVP, Director of Marketing Strategy and Planning

Telephone: (401) 348-1286

E-mail: smwalsh@washtrust.com

Date: December 16, 2024

FOR IMMEDIATE RELEASE

Washington Trust Announces Closing of Upsized Stock Offering

WESTERLY, R.I., December 16, 2024 (PR NEWSWIRE)…Washington Trust Bancorp, Inc. (Nasdaq: WASH) (the “Corporation”), parent company of The Washington Trust Company, of Westerly (the “Bank”), today announced the closing of its previously announced underwritten public offering of 1,911,764 shares of its common stock at a public offering price of $34.00 per share. The 2,198,528 shares sold in the offering include 286,764 shares sold pursuant to the exercise of the underwriters’ purchase option. BofA Securities is serving as the sole book-running manager for the offering.

The expected proceeds to the Corporation, after deducting underwriting discounts and commissions but before deducting operating expenses payable by the Corporation, are approximately $71.01 million. The Corporation intends to use the net proceeds of this offering for general corporate purposes to support continued organic growth and capital generation, which are expected to include investments in the Bank and Bank balance sheet optimization strategies involving the sale of lower-yielding loans and available for sale debt securities, the repayment of wholesale funding balances and the purchase of debt securities with current market yields.

SPECIAL NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains statements that are “forward-looking statements.” Forward looking-statements include all statements that are not historical facts and include any statements regarding the intended use of net proceeds from the offering. We may also make forward-looking statements in other documents we file with the SEC, in our annual reports to shareholders, in press releases and other written materials, and in oral statements made by our officers, directors, or employees. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “outlook,” “will,” “should,” and other expressions that predict or indicate future events and trends and which do not relate to historical matters. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. A detailed discussion of factors that could affect our results is included in the Corporation’s SEC filings, including Item 1A. “Risk Factors” of its Annual Report on Form 10-K for the year ended December 31, 2023. You should not rely on forward-looking statements, because they involve known and unknown risks, uncertainties, and other factors, some of which are beyond our control. These risks, uncertainties, and other factors may cause our actual results, performance, or achievements to be materially different from the anticipated future results, performance, or

achievements expressed or implied by the forward-looking statements. The Corporation undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in our expectations, except as required by law.

ABOUT WASHINGTON TRUST BANCORP, INC.

Washington Trust Bancorp, Inc., NASDAQ: WASH, is the publicly-owned holding company of The Washington Trust Company (“Washington Trust”, “the Bank”), with $7.1 billion in assets as of September 30, 2024. Founded in 1800, Washington Trust is recognized as the oldest community bank in the nation, the largest state-chartered bank headquartered in Rhode Island and one of the Northeast’s premier financial services companies. Washington Trust values its role as a community bank and is committed to helping the people, businesses, and organizations of New England improve their financial lives. The Bank offers a wide range of commercial banking, mortgage banking, personal banking and wealth management services through its offices in Rhode Island, Connecticut and Massachusetts and a full suite of convenient digital tools. Washington Trust is a member of the FDIC and an equal housing lender.

v3.24.4

Cover Page Document

|

Dec. 16, 2024 |

| Cover Page [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 16, 2024

|

| Entity Registrant Name |

WASHINGTON TRUST BANCORP, INC.

|

| Entity Incorporation, State or Country Code |

RI

|

| Entity File Number |

001-32991

|

| Entity Tax Identification Number |

05-0404671

|

| Entity Address, Address Line One |

23 Broad Street

|

| Entity Address, City or Town |

Westerly,

|

| Entity Address, State or Province |

RI

|

| Entity Address, Postal Zip Code |

02891

|

| City Area Code |

(401)

|

| Local Phone Number |

348-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000737468

|

| Amendment Flag |

false

|

| Title of 12(b) Security |

COMMON STOCK, $.0625 PAR VALUE PER SHARE

|

| Trading Symbol |

WASH

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

wash_CoverPageAbstract |

| Namespace Prefix: |

wash_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

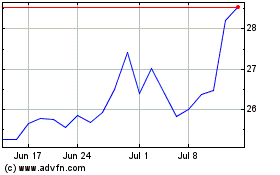

Washington Trust Bancorp (NASDAQ:WASH)

Historical Stock Chart

From Nov 2024 to Dec 2024

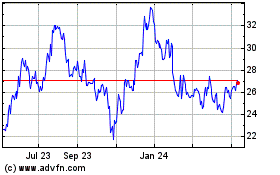

Washington Trust Bancorp (NASDAQ:WASH)

Historical Stock Chart

From Dec 2023 to Dec 2024