Walgreens Profit Squeezed by Generic Drugs -- 2nd update

June 27 2019 - 12:31PM

Dow Jones News

By Sharon Terlep and Aisha Al-Muslim

Walgreens Boots Alliance Inc. needs a new business model to

offset thinning profits from the sale of generic drugs, which

continue to drag down results, the drugstore chain's chief

executive said Thursday.

The comments from Stefano Pessina came after the Deerfield,

Ill.-based company said profit fell in the latest quarter from a

year earlier even as sales increased.

While the results are an improvement from the previous quarter

and better than analysts expected, Walgreens remains squeezed by

pharmacy-benefit managers, which wrest lower prices from both

makers and sellers of drugs on behalf of insurers and other

clients.

Walgreens and rival CVS Health Corp. have been remodeling

hundreds of stores into medical-service centers targeted at

customers with chronic conditions such as diabetes, heart disease

and hypertension.

Their plan comes as both chains are under pressure to find new

ways to counter slowing revenue from prescription drugs, especially

generics, which drive the bulk of their sales.

Mr. Pessina said the company must become less reliant on drug

reimbursements and find new revenue streams, which requires

overhauling its business.

"We have a lot of work ahead to get the business growing again,"

Mr. Pessina said on a call with analysts, adding that the company

must proceed cautiously in launching new ventures. "We are far from

complacent about the pressure we face."

Walgreens improved U.S. retail sales, U.S. same-store sales, and

prescription growth in the most recent quarter.

For the third quarter ended May 31, profit fell 23.6%, partly

driven by its gross profit falling. Gross profit decreased in the

quarter about 4.2% as the company faced reimbursement pressure in

pharmacy and lower retail sales in the U.S., as well as a lower

pharmacy margin and retail sales at Boots UK, the company's

retailer and pharmacy chain in the U.K.

Net income slipped to $1.03 billion, or $1.13 a share, down from

$1.34 billion, or $1.35 a share, a year earlier. Adjusted earnings

came in at $1.47 a share.

Walgreens said sales rose 0.7% to $34.6 billion, primarily due

to growth in its U.S. retail pharmacy and pharmaceutical wholesale

divisions.

In the quarter, U.S. retail pharmacy sales rose 2.3% to $26.5

billion, reflecting higher brand inflation and prescription

volume.

Same-store pharmacy sales increased 6%, while comparable retail

sales were down 1.1% primarily due to the continued de-emphasis of

tobacco.

Shares rose 4.5% to $54.75 in midday trading Thursday. Shares

are down 17% in the past year.

For fiscal 2019, Walgreens maintained its expectations of

adjusted earnings per share at constant currency rates to be

roughly flat.

Write to Sharon Terlep at sharon.terlep@wsj.com and Aisha

Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

June 27, 2019 12:16 ET (16:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

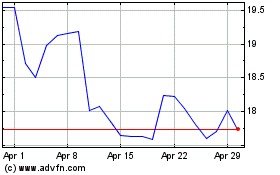

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2024 to May 2024

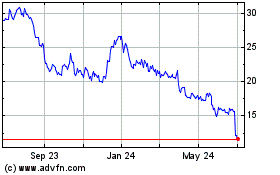

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From May 2023 to May 2024