As

filed with the Securities and Exchange Commission on February 11, 2025

Registration

No. 333-__________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Vivos

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

8011 |

|

81-3224056 |

| (State

or other jurisdiction of incorporation or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

7921

Southpark Plaza, Suite 210

Littleton,

Colorado 80120

(844)

672-4357

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

R.

Kirk Huntsman

Chief

Executive Officer

Vivos

Therapeutics, Inc.

7921

Southpark Plaza, Suite 210

Littleton,

Colorado 80120

(844)

672-4357

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Please

send a copy of all communications to:

Barry

I. Grossman, Esq.

Lawrence

A. Rosenbloom, Esq.

Ellenoff

Grossman & Schole LLP

1345

Avenue of the Americas

New

York, New York 10105-0302

(212)

370-1300

Approximate

date of commencement proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell the securities until the Registration Statement filed

with the Securities and Exchange Commission, of which this prospectus is a part, is effective. This prospectus is not an offer to sell

these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| Preliminary

Prospectus |

Subject

to Completion, Dated February 11, 2025 |

VIVOS

THERAPEUTICS, INC.

$50,000,000

COMMON

STOCK

PREFERRED

STOCK

WARRANTS

SUBSCRIPTION

RIGHTS

DEBT

SECURITIES

UNITS

We

may offer and sell from time to time, in one or more series, any one of the following securities of our company, for total gross proceeds

of up to $50,000,000:

| |

● |

common

stock; |

| |

● |

preferred

stock; |

| |

● |

warrants

to purchase common stock, preferred stock, debt securities, other securities or any combination of those securities; |

| |

● |

subscription

rights to purchase common stock, preferred stock, debt securities, other securities or any combination of those securities; |

| |

● |

secured

or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness which may be senior debt securities,

senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities; or |

| |

● |

units

comprised of, or other combinations of, the foregoing securities. |

We

may offer and sell these securities separately or together, in one or more series or classes and in amounts, at prices and on terms described

in one or more offerings. We may offer securities through underwriting syndicates managed or co-managed by one or more underwriters or

dealers, through agents or directly to purchasers. The prospectus supplement for each offering of securities will describe in detail

the plan of distribution for that offering. For general information about the distribution of securities offered, please see “Plan

of Distribution” in this prospectus.

Each

time our securities are offered, we will provide a prospectus supplement containing more specific information about the particular offering

and attach it to this prospectus. The prospectus supplements may also add, update or change information contained in this prospectus.

This

prospectus may not be used to offer or sell securities without a prospectus supplement which includes a description of the method and

terms of this offering.

Our

common stock is quoted on the Nasdaq Capital Market under the symbol “VVOS.” The last reported sale price of our common stock

on the Nasdaq Capital Market on February 10, 2024 was $4.13 per share.

If

we decide to seek a listing of any preferred stock, purchase contracts, warrants, subscriptions rights, depositary shares, debt securities

or units offered by this prospectus, the related prospectus supplement will disclose the exchange or market on which the securities will

be listed, if any, or where we have made an application for listing, if any.

Investing

in our securities is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page

S-11 and the risk factors in our most recent Annual Report on Form 10-K, which is incorporated by reference herein, as well as in

any other recently filed quarterly or current reports and, if any, in the relevant prospectus supplement. We urge you to carefully

read this prospectus and the accompanying prospectus supplement, together with the documents we incorporate by reference, describing

the terms of these securities before investing.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is __, 2025.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, utilizing

a “shelf” registration process. Under this shelf registration process, we may offer and sell, either individually or in combination,

in one or more offerings, any of the securities described in this prospectus, for total gross proceeds of up to $50,000,000. This prospectus

provides you with a general description of the securities we may offer. Each time we offer securities under this prospectus, we will

provide a prospectus supplement to this prospectus that will contain more specific information about the terms of that offering. We may

also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings.

The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or

change any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus.

We

urge you to read carefully this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized

for use in connection with a specific offering, together with the information incorporated herein by reference as described under the

heading “Incorporation of Documents by Reference,” before investing in any of the securities being offered. You should rely

only on the information contained in, or incorporated by reference into, this prospectus and any applicable prospectus supplement, along

with the information contained in any free writing prospectuses we have authorized for use in connection with a specific offering. We

have not authorized anyone to provide you with different or additional information. This prospectus is an offer to sell only the securities

offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

The

information appearing in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only

as of the date on the front of the document and any information we have incorporated by reference is accurate only as of the date of

the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or

any related free writing prospectus, or any sale of a security.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled

“Where You Can Find Additional Information.”

This

prospectus contains, or incorporates by reference, trademarks, tradenames, service marks and service names of Vivos Therapeutics, Inc.

and its consolidated subsidiaries.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus and any accompanying prospectus or prospectus supplement and the documents incorporated by reference herein and therein may

contain forward looking statements that involve significant risks and uncertainties. All statements other than statements of historical

fact contained in this prospectus and any accompanying prospectus supplement and the documents incorporated by reference herein, including

statements regarding future events, our future financial performance, business strategy, and plans and objectives of management for future

operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,”

“believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predicts,” “should,”

or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements

unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions

and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or

elsewhere in this prospectus and the documents incorporated by reference herein, which may cause our or our industry’s actual results,

levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a highly

regulated, very competitive, and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict

all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors,

may cause our actual results to differ materially from those contained in any forward-looking statements.

We

have based these forward-looking statements largely on our current expectations and assumptions about future events and financial trends

that we believe may affect our financial condition, results of operations, business strategy, short term and long term business operations,

and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results

to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences

include, but are not limited to, those discussed in this prospectus, and in particular, the risks discussed below and under the heading

“Risk Factors” and those discussed in other documents we file with the SEC which are incorporated by reference herein. This

prospectus, and any accompanying prospectus or prospectus supplement, should be read in conjunction with the consolidated financial statements

for the fiscal years ended December 31, 2023 and 2022 and related notes, which are incorporated by reference herein.

We

undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required

by law. In light of the significant risks, uncertainties and assumptions that accompany forward-looking statements, the forward-looking

events and circumstances discussed in this prospectus and any accompanying prospectus or prospectus supplement may not occur and actual

results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You

should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this prospectus, or any

accompanying prospectus or any prospectus supplement. Except as required by law, we undertake no obligation to update or revise publicly

any of the forward-looking statements after the date of this prospectus to conform our statements to actual results or changed expectations.

Any

forward-looking statement you read in this prospectus, any accompanying prospectus, or any prospectus supplement or any document incorporated

by reference reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions

relating to our operations, operating results, growth strategy and liquidity. You should not place undue reliance on these forward-looking

statements because such statements speak only as to the date when made. We assume no obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking

statements, even if new information becomes available in the future, except as otherwise required by applicable law. You are advised,

however, to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K filed with the SEC.

You should understand that it is not possible to predict or identify all risk factors. Consequently, you should not consider any such

list to be a complete set of all potential risks or uncertainties.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that

you should consider before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated

by reference herein. In particular, attention should be directed to our “Risk Factors,” “Information With Respect to

the Company,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the

financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto, before making an investment

decision.

As

used herein, and any amendment or supplement hereto, unless otherwise indicated, “we,” “us,” “our,”

the “Company,” or “Vivos” means Vivos Therapeutics, Inc. and its consolidated subsidiaries.

Business

Overview

We

are a revenue stage medical technology company focused on the development and commercialization of a suite of innovative diagnostic and

multi-disciplinary treatment modalities for patients with dentofacial abnormalities and the wide array of medical conditions that may

result from them, including mild to severe obstructive sleep apnea (known as OSA) and snoring in adults. We believe our proprietary oral

appliances, diagnostic tools, myofunctional therapy, clinical treatments, continuing education, and practice solutions represent a powerful

and highly effective set of resources for healthcare providers of all disciplines who treat patients suffering from debilitating and

even life-threatening breathing and sleep disorders and their comorbidities.

To

date, our primary focus has been on expanding awareness of, and providing treatment options for OSA for and through the dental industry,

which we believe represents a large and relatively untapped market for OSA treatment. As our business has evolved, we have expanded our

marketing, provider outreach, and treatment programs to encompass a broader more multidisciplinary approach, with a greater emphasis

on working with medical doctors and other healthcare providers beyond dentists. Now that we have established a national network of Vivos-trained

dentists, we are pivoting our focus to the source of where we believe the vast majority of OSA patients are first diagnosed and treated—the

medical profession (including sleep centers and doctors and dentists who offer OSA treatment) as well durable medical equipment (DME)

companies who manufacture and distribute OSA therapies. See “New Marketing and Distribution Alliance Strategy” below for

more information.

In

this prospectus, we sometimes refer to doctors, dentists and other medical professionals who treat OSA as “providers” (including

our own Vivos-trained dentists).

Studies

have shown our comprehensive and multidisciplinary approach represents a significant improvement in the treatment of mild to severe OSA

in comparison to or when combined with other largely palliative treatments such as continuous positive airway pressure (or CPAP) or oral

myofunctional therapy. We call our solution The Vivos Method.

Our

Products and Services

Currently,

The Vivos Method comprises the following products and services:

| |

● |

Vivos

Complete Airway Repositioning and/or Expansion (CARE) oral appliance therapy including our: |

| |

○ |

Daytime

Nighttime Appliance (or DNA appliance®) was granted 510(k) clearance from the U.S. Food & Drug Administration

(or FDA) as a Class II medical device in December 2022 for the treatment of snoring and mild to moderate OSA, jaw repositioning and

snoring in adults. It is the only oral appliance ever to receive FDA clearance to treat OSA without mandibular advancement as its

primary mechanism of action. In November 2023, our DNA appliance was cleared by the FDA to treat moderate and severe OSA in adults,

18 years of age and older along with positive airway pressure (PAP) and/or myofunctional therapy, as needed. |

| |

|

|

| |

○ |

Mandibular

Repositioning Nighttime Appliance (or mRNA appliance®) has 510(k) clearance from the FDA as a Class II medical

device for the treatment of snoring and mild to moderate OSA in adults. In November 2023, our mRNA appliance was cleared by the FDA

to treat moderate and severe OSA in adults, 18 years of age and older along with positive airway pressure (PAP) and/or myofunctional

therapy, as needed. |

| |

|

|

| |

○ |

Modified

Mandibular Repositioning Nighttime Appliance (or mmRNA appliance), for which we were granted FDA Class II market clearance

in August 2021 for treating mild to moderate OSA, jaw reposition and snoring in adults. In November 2023, our mmRNA appliance was

cleared by the FDA to treat moderate and severe OSA in adults, 18 years of age and older along with positive airway pressure (PAP)

and/or myofunctional therapy, as needed. |

The

November 2023 clearance of our CARE appliances for the indication described above represents the first time the FDA has ever granted

an oral appliance a clearance to treat severe OSA. We believe this unprecedented decision by the FDA will generate broader acceptance

throughout the medical community for our treatment options, leading to the potential for higher patient referrals and case starts as

well as collaboration with medical professionals. We also believe it will enhance our value proposition to third-party distribution partners

such as DME companies. This approval could also clear the way for greater reimbursement levels from medical insurance payors and Medicare.

For example, in April 2024 we received the required regulatory approvals to enable Medicare reimbursement for our CARE oral medical devices.

| |

● |

Vivos

oral appliances and therapies outside of CARE system include: |

| |

|

|

| |

○ |

Vivos

Guides are pre-formed, flexible, BPA-free, base polymer, monoblock intraoral guide and rescue appliances. The Guides are

FDA Class I registered product for orthodontic tooth positioning typically used by dentists in children to address malocclusions

and promote proper guided growth and development of the mouth and jaws. |

| |

|

|

| |

○ |

Vivos

VersaTM is an FDA 510(k) cleared Class II device for treating mild to moderate OSA in adults. It is a comfortable,

easy-to-wear, medical grade nylon, 3D printed oral appliance featuring mandibular advancement as its mechanism of action. It is priced

to be very cost effective and offers Vivos providers and patients a comfortable and effective product at a much lower price point

for treatment. As with all other non-CARE oral appliances, the Vivos Versa must be worn nightly for life in order to remain clinically

effective. We believe many Vivos Versa patients will eventually migrate up to our proprietary Vivos CARE products. While we do not

own this product, we are a reseller of this product. |

| |

|

|

| |

○ |

Vivos

MyoCorrect oral myofunctional therapy (OMT) services. Studies have shown OMT to be a clinically valuable adjunctive treatment

for patients with breathing and sleep disorders. When combined with Vivos’ CARE products and treatments, OMT can deliver an

enhanced effect in many patients using our appliances. MyoCorrect treatment services are cost-effective for providers and convenient

for patients. MyoCorrect is billable to medical insurance in most cases and constitutes an additional profit center for both Vivos

and providers. |

| |

|

|

| |

○ |

Vivos

Vida ™ is an FDA cleared appliance as unspecified classification for the alleviation of TMD symptoms, and aids in treating

bruxism and TMJ Dysfunction. The Vivos Vida help to alleviate symptoms such as TMJ/TMD, headaches and facial muscle pain. The Vivos

Vida is worn during sleep, and serves to protect the teeth and restorations from destructive forces of bruxism. It is a custom fabricated

appliance, designed for patient comfort. |

| |

|

|

| |

○ |

Vivos

Vida Sleep ™ is an FDA 510(k) cleared Class II for treating mild to moderate OSA in adults. It uses the Vivos Unilateral

BiteBlock Technology and is designed to advance the mandible incrementally to stabilize the patient’s oropharyngeal airway.

It is highly efficient and has a sleep design which promotes space for the tongue to sit in the roof of the palate. It’s novel

design decreases contact points between the maxillary and mandibular teeth that may help reduce clenching and overall bite forces

that occur during sleep. |

| |

|

|

| |

● |

VivoScore

(from SleepImage), Rhinomanometry (from GM Instruments), Cone Beam Computerized Tomography or CBCT (from multiple vendors), Joint

Vibration Analysis (from BioResearch) and other key diagnostic technologies play an essential role as part of The Vivos Method

in patient assessment, proper clinical diagnosis, treatment planning, progress measurement, and optimal outcome facilitation. We

believe the combination and integration of such diagnostic tools and equipment as particularly taught to and practiced by Vivos-trained

providers constitutes a key trade secret of our company. |

| |

|

|

| |

● |

Vivos

AireO2 is an Electronic Health Record (EHR) software program specifically designed for use as a full practice

management software program in a medical or dental practice environment where treating breathing and sleep disorders is performed.

The program is very well suited to handle both medical and dental billing and is integral in our Treatment Navigator program. |

| |

|

|

| |

● |

Adjunctive

Treatment from specialty chiropractors and other healthcare providers according to a very specific set of particular integrated

protocols has also proven to enhance and improve clinical outcomes using CARE and other Vivos devices. |

| |

|

|

| |

● |

Treatment

Navigator is our most recent program to assist a clinician’s patients who may have a breathing or sleep disorder to

get screened, diagnosed by a board-certified sleep specialist, obtain insurance verification of benefits and preauthorization (where

required), have their questions answered, and receive assistance with scheduling, financing, medical billing or any other concerns

regarding treatment options best suited to their individual situation. Dentists typically pay set fees to us for this service. |

| |

● |

Vivos

Billing Intelligence Service (BIS) is our medical and dental billing service. It is both a subscription and fee for service

program for healthcare practitioners who wish to optimize their insurance reimbursement by leveraging both medical and dental benefits.

We are unaware of any other software platform or service on the market that offers the same set of features or capabilities. |

| |

|

|

| |

● |

Vivos

Airway Intelligence Service (AIS) is our technical support and advisory service that supports clinicians in their patient

data analysis, case selection, treatment planning and treatment implementation. AIS reports and services are priced into the cost

of appliances to providers. |

| |

|

|

| |

● |

The

Vivos Institute® (TVI) is widely regarded as one of the top educational and learning centers for dentofacial related

breathing and sleep disorders in North America. Opened in 2021, TVI is housed in a state-of-the-art 18,000 square foot facility near

the Denver International Airport where doctors from around the world come to receive instruction and advanced clinical training in

a wide range of topics delivered by leading national and international medical sleep specialists, cardiologists, pediatric sleep

specialists, dentists, orthodontists, specially trained chiropractors, nutritionists, key industry business leaders, and university-based

clinical researchers. |

These

products and services are used in a collaborative multidisciplinary treatment model comprising dentists, general practice physicians,

sleep specialist physicians, myofunctional therapists, nutritionists, chiropractors, physical therapists, and healthcare professionals.

Our subscription-based program to train dentists and offer them other value-added services is called the Vivos Integrated Practice

(VIP) program.

During

2023, we expanded our product portfolio by acquiring certain devices (now known as Vivos Vida, Vivos Versa

and Vivos Vida Sleep) from Advanced Facialdontics, LLC. During 2024, we continued our screening and home sleep test (or

HST) program (which we call our VivoScore Program) featuring SleepImage® technology, a 510(k)

cleared ring-based recorder and diagnostic platform for home sleep apnea testing. We market and distribute our SleepImage HST in the

U.S. and Canada pursuant to a licensing agreement with MyCardio LLC. Based on our direct experience with our Vivos-trained providers,

approximately 53,000 VivoScore HSTs were performed during 2024. Due to the volume of home sleep test screening business that we have

generated with MyCardio LLC, we now receive pricing and terms for SleepImage® products and services that are well below

their published retail prices. We believe the growth of our VivoScore program confirms our belief that the SleepImage®

HST offers significant commercial advantages over existing home sleep apnea products and technologies in the market and allows healthcare

providers to more efficiently screen, diagnose and initiate treatment for OSA in their patients.

We

have not yet seen a corresponding increase in patient enrollment in The Vivos Method treatment. Based on feedback from our Vivos-trained

providers, we believe this to be a function of staffing turnover in their practices and labor shortages that continue to plague the dental

workplace. Throughout 2024, we continued to address this by conducting additional regional dental team training sessions on integrating

Vivos products and treatment protocols. In addition, we drastically reduced the number of Practice Advisors who had previously been dispatched

as “boots on the ground” to help facilitate case starts and provide Vivos-trained providers with support, and we replaced

them with a new service called Treatment Navigator which we piloted and began to rollout in the late summer and fall of 2022.

Treatment

Navigators work effectively as extensions of the dental office, working directly with perspective patients to provide them information

on The Vivos Method, aiding in education, screening, insurance verification of benefits and preauthorization, coordination among various

professional practitioners, recordkeeping, problem solving, as well as, delivering a home sleep test and following up with scheduling

an appointment with a VIP in their area. Dental offices who wish to avail themselves of this service pay Vivos enrollment fees and per

case fees for the service, thus adding an important new revenue line and profit center to the business. Based on our evaluation of the

Treatment Navigator program, we have restructured the Treatment Navigator program into a monthly subscription-based model.

Background

on OSA

OSA

is a serious and chronic disease that negatively impacts a patient’s sleep, health, and quality of life. According to a 2019 article

published in Chest Physician, it is estimated that OSA afflicts 54 million adults in the U.S. alone. According to a 2016 report

by Frost & Sullivan, OSA has an annual societal cost of over $149.6 billion. According to the study “Global Prevalence of

Obstructive Sleep Apnea (OSA)” conducted by an international panel of leading researchers, nearly 1 billion people worldwide

have sleep apnea, and as many as 80% remain undiagnosed. Research has shown that when left untreated, OSA can increase the risk of comorbidities,

such as high blood pressure, heart failure, stroke, diabetes, dementia, chronic pain and other debilitating, life-threatening diseases.

Unfortunately

for OSA patients, the medical profession has not been able to provide them with solutions that are both effective and desirable. CPAP

is the “gold standard” treatment for over 90% of OSA patients, but no one wants to wear those devices to bed every night

for life, rendering long-term compliance rates low. Traditional oral appliances can be effective over limited time frames, but often

create other problems with temporomandibular joint (or TMJ) dysfunction, open bites, infections, and more. As with CPAP, they too must

be worn every night for life to be effective. More radical and invasive options such as neuro-stimulation devices, or maxillomandibular

advancement surgery are likewise viewed more as treatments of last resort. When The Vivos Method is presented as a viable treatment option

against the alternatives discussed above, we believe it will be the preferred choice of most patients.

We

believe our proprietary products comprising the Vivos CARE oral appliances represent the first non-surgical, minimally-invasive

treatment option for patients diagnosed with mild to severe OSA that offers cost-effective treatment featuring (i) limited treatment

times; with (ii) lasting or durable effects; and (iii) the prospect of seeing a complete reversal of symptoms. Combining treatment technologies

that impact the upper airway by altering the size, shape, patency and position of corresponding hard and soft tissues, Vivos CARE represents

a completely new treatment modality in the treatment of dentofacial abnormalities that often lead to OSA and many other health conditions.

The

Vivos Method is estimated to be indicated and potentially effective (within the scope of the FDA cleared uses) in approximately 80% of

cases of OSA where patients are compliant with clinical treatments. Our patented oral appliances have been utilized in approximately

40,000 patients treated worldwide by more than 1,850 trained dentists.

Our

Target Customers

The

House of Delegates of the American Dental Association in 2017 adopted a policy statement describing the important role dentists can play

in helping identify patients at greater risk of sleep related breathing disorders. By virtue of the close connection and relationship

between the oral cavity and airway form and function, properly trained dentists can play a pivotal and even leading role in the treatment

of dentofacial abnormalities which are known to impact breathing and sleep, which in turn can lead to serious health conditions. The

VIP program provides dentists with compelling clinical reasons coupled with strong economic incentives to provide their breathing and

sleep disordered patients the best care possible.

We

have recently expanded our mission and product line positioning to extend the reach and scope of The Vivos Method beyond the dental profession

and to allow for greater collaboration and mutual referrals from other healthcare practitioners, including primary care physicians, medical

specialists, chiropractors, nutritionists, physical therapists, and others who see and treat patients with breathing and sleep disorders.

We believe this extension of our approach will broaden the knowledge among various professions as to what our technology and products

can do for their patients, ultimately leading more patients into treatment with Vivos products and services. We also incorporate courses

and curricula at The Vivos Institute into our Vivos Method training that provides information, tools, techniques, and systems that enable

other healthcare professionals to engage directly with dentists and actively contribute to the best possible clinical outcome for patients.

During

the second half of 2021, we increased our efforts to market The Vivos Method and related products and services to larger dental support

organizations (or DSOs). Marketing to DSOs creates an opportunity to enroll and onboard multiple dental practices as VIPs under one common

ownership structure. This would allow us to leverage training and support across multiple VIP practices and gain economies of scale with

the goal of faster growth, both in VIP enrollments and in Vivos case starts. As of September 30, 2023, we believe we have made important

progress in penetrating this market, but as we cautioned previously, DSOs tend to move slowly when adopting new technologies or programs.

Our

Mission

Our

mission is to rid the world of sleep apnea by being a leading technology platform and go-to resource for the latest and most effective

treatment modalities, products, and clinical education available to healthcare providers of all specialties who treat patients suffering

from breathing and sleep disorders and their comorbidities. We fully recognize that breathing and sleep disorders, including OSA,

are often complex conditions with multiple contributing factors that require more than a single solution. To that end, we have broadened

our product and services lines that comprise The Vivos Method to go beyond the proprietary technologies featured in our CARE oral appliances,

and now offer providers far greater optionality in selecting a diagnostic or treatment solution that is best for their patients. This

approach recognizes that there is no “one size fits all” solution for patients, and that both providers and patients are

best served by offering a variety of solutions at various price points that can meet the needs of a larger segment of the population.

We

believe this evolution of our mission (which was originally focused almost exclusively on the dental community) will appeal to a much

broader array of healthcare professionals, including chiropractors, nutritionists, primary care physicians, cardiologists, physical therapists,

dentists and others, all of whom have a strong vested interest in the overall health and wellbeing of their patients, and each of whom

has something meaningful to contribute when properly educated and trained. As word spreads among a broader array of professionals and

their patients, we expect more people to come to know and understand the compelling advantages of The Vivos Method. We believe this will

allow us to scale our business and grow our company more rapidly.

Our

Market Opportunity

According

to a March 2021 Sleep Apnea Devices Market Size & Share Report, the global sleep apnea devices market size was valued at $3.7 billion

in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2021 to 2028. According to an American Sleep Association

study published in 2020, an estimated 50 million to 70 million people in the U.S. are suffering from some form of sleep disorders. Moreover,

according to Canadian Respiratory Journal in 2014, around 5.4 million adults in Canada were diagnosed with sleep apnea or were at higher

risk of developing OSA. According to a study conducted by ResMed in 2018, around 175 million people in Europe were suffering from sleep

apnea. We therefore believe that effective diagnostic and treatment strategies are needed to minimize the negative health impacts of

OSA and to maximize cost-effectiveness.

Based

on our direct experience with our Vivos-trained providers performing nearly 53,000 VivoScore HSTs during 2024, we strongly believe the

published estimates from available public information, which range from 12% to 20% of the population, seriously underestimate the extent

of the condition and scope of the problem in the United States and Canada. Our VivoScore testing routinely results in approximately 50%

of patients testing positive OSA, a number consistent with a recent study published in the Journal of the American Heart Association

on a sample consisting of ~2000 middle-aged to older adults from the Multi-Ethnic Study of Atherosclerosis (MESA), where 47 percent had

moderate-to-severe OSA. We therefore believe our prior estimate that approximately 15% of the adult population in the United States and

Canada suffers from OSA to be extremely conservative. Based on the estimated total adult population of 284 million in the United States

and Canada, we believe the total addressable United States and Canadian market could be as high as 80 million adults. To be conservative

and based on available data and our internal market analysis, we estimate that over 80% of individuals diagnosed with OSA in the North

American addressable market may be candidates for The Vivos Method, leaving us with a total addressable consumer market of approximately

64 million adults.

We

currently charge clinicians an average sales price of approximately $1,500 per adult case for The Vivos Method. There are approximately

200,000 general dentists and dental specialists in the United States and another 30,000 in Canada who could potentially offer the Vivos

Method to their patients. Add to that the nearly 80,000 licensed chiropractors and over 1.1 million medical doctors across all specialties

who routinely see and treat patients with OSA. Each of them see and treat patients with OSA for many related conditions on a regular

basis even though the vast majority remain undiagnosed with respect to their OSA. As we raise awareness, and now that new technologies

such as SleepImage have driven the cost of diagnosis down dramatically, more providers will be able to integrate evaluations of breathing

and sleep into their basic clinical treatments, and more patients will get diagnosed and seek treatment. Therefore, based on the addressable

U.S. and Canadian consumer market described above and average sales price, we believe the addressable consumer market for adults in the

United States and Canada is approximately $96 billion.

Our

Treatment Alternative for OSA - The Vivos Method

The

Vivos Method is a non-invasive, non-surgical, non-pharmaceutical, multi-disciplinary treatment modality for the treatment of dentofacial

abnormalities and/or mild, moderate and severe OSA and snoring in adults. Proprietary and virtually painless, The Vivos Method has been

shown to typically expand the upper airway and offers patients what we believe to be an effective treatment alternative based on published

peer-reviewed retrospective clinical data. Based on feedback from independent VIPs and their patients, we believe initial therapeutic

benefits from using the treatment guidance’s and devices are often achieved relatively quickly (in days or weeks) and final clinical

results are typically achieved in 12 to 18 months), all at a relatively low cost to consumers ranging between $7,000 and $10,000 for

adults (costs vary by provider) when compared to other options such as lifetime CPAP or surgery.

The

Vivos Method alters the size, shape and position of the tissues that surround and define the functional space known as the upper airway.

Our treatment also improves nasal breathing, reduces mouth breathing, reduces Apnea Hypopnea Index (AHI) scores, and generally facilitates

better breathing and sleep. These statements are based on retrospective raw data with validated before and after sleep studies, rhinomanometry

testing before and after treatment, Cone Beam Computerized Tomography (CBCT) scans from treating clinicians and patient testimony. As

The Vivos Method treatment process progresses, the airway typically expands, with many patients reporting a significant reduction of

their OSA and snoring symptoms. The primary products used in The Vivos Method are our CARE devices - the DNA appliance®,

the mRNA appliance®, and the mmRNA appliance®- each of which is a specifically designed, customized oral

appliance that is worn primarily in the evening hours and overnight. The treatment time may range from 9 to 18 months, with 12 to 15

months being typical. Our appliances may require periodic adjustments some of which can be performed by the patient and others that are

typically rendered at the dental office where treatment was initiated.

Our

Growth Strategy

Our

goal is to be the global leader in providing a clinically effective non-surgical, non-invasive, non-pharmaceutical, and low-cost alternative

for patients with dentofacial abnormalities and/or mild to severe OSA and snoring in adults. We believe the following strategies will

play a critical role in achieve this goal and in establishing more predictable and growing revenue leading, ultimately, to cash flow

positive and profitable operations:

| |

● |

Expand

public awareness of the life-threatening and debilitating nature of OSA and its prevalence throughout the world, while letting the

world know of our proprietary and highly effective treatment as an alternative to CPAP. |

| |

|

|

| |

● |

Cultivate

Active Referral Sources Among Physicians, Sleep Specialists, Dentists and Other Healthcare Providers. |

| |

|

|

| |

● |

Drive

more qualified new patients to our VIP practices and teach VIPs how to better present and close Vivos treatment via the “Boost”

and “Kick-Off” programs. |

| |

|

|

| |

● |

Achieve

full payment by in network major insurance carriers for Vivos Method treatment. |

| |

|

|

| |

● |

Make

it easy for both dental and medical professionals to interact and do business with Vivos. |

| |

|

|

| |

● |

Continue

to drive medical and dental community awareness of The Vivos Method and build bridges between medical doctors and dentists through

DSO marketing and our Medical Integration Division. |

| |

|

|

| |

● |

Expand

our market penetration with DME distribution agreements. |

| |

|

|

| |

● |

Invest

in research and development to drive innovation and expand indications. |

| |

|

|

| |

● |

Pursue

strategically adjacent markets and international opportunities. |

Our

Revenue Model

Our

revenue is currently derived from the following primary sources:

| |

● |

VIP

office training and enrollment fees. These fees are comprised of one-time, up-front fees, as well as optional renewal fees

after 12 months. |

| |

|

|

| |

● |

Recurring

Vivos appliance sales. Once we train the VIP on how dentists can help treat OSA, the goal is to have them initiate “new

case starts” with patients, which leads to sales of our appliances and guides. We are also seeking to drive appliance sales

through our distribution arrangements with DMEs. |

| |

|

|

| |

● |

Recurring

VIP subscription fees. These are recurring fees that a portion of our VIPs pay us to receive additional value-added services

and training. |

| |

|

|

| |

● |

SleepImage

HST revenue. In 2022, we modified our agreement with MyCardio LLC relating to our SleepImage HST for sleep apnea, which creates

the potential for revenue from our leasing of SleepImage HST ring recorders to our VIPs as part of the VivoScore Program. |

| |

|

|

| |

● |

The

Vivos Institute. Our TVI provides product-specific training for the use of our products and services. Revenue from such courses

is not material at the present time, but our expectation is that increased training awareness of OSA and the promotion of our products

and services will be enhanced by our TVI. |

| |

● |

The

Airway Intelligence Service (AIS). This service provides a complete resource for VIPs to help simplify the diagnostic and

appliance design matrix and expedite the treatment planning process. AIS is provided as part of the price of each appliance and is

not a separate revenue stream. |

| |

|

|

| |

● |

Billing

Intelligence Services (BIS). This complete third-party billing solution includes a comprehensive integrated revenue cycle

management software system that allows dentists to focus on running their practice and delivering the best care for their patients.

This medical billing service generates recurring subscription fees from participating VIPs and independent dentists in the United

States. |

| |

|

|

| |

● |

AireO2

Patient Management Software. This management software enables healthcare professionals to diagnose, treat and monitor patients

with OSA and its related conditions more effectively. Developed in collaboration with Lyon Dental, AireO2 contains features that

enhance a VIP’s billing services and practice management systems. AireO2 is a complement to our BIS software system. |

| |

|

|

| |

● |

Medical

Integration Division (MID). In late 2020, we launched our MID to assist VIP practices to establish clinical collaboration

ties to local primary care physicians, sleep specialists, ear, nose a throat doctors (ENTs), cardiologists, pediatricians, pulmonologists

and other healthcare providers who routinely see or treat patients with sleep and breathing disorders. The primary objective of our

MID is to promote The Vivos Method to medical providers and thus facilitate the potential for additional mild to severe OSA patients

gaining access to The Vivos Method while offering continuum of care. The MID seeks to fulfill that objective by meeting with VIP

dentists and medical providers in their local areas to establish physician practices using the trademarked name “Pneusomnia

Sleep Reimagined Center” (which are referred to as Pneusomnia Centers). These independent medical practices will be managed

by our company under a management and development agreement which pays us six (6% to 8%) percent of all net revenue from sleep-related

services. We also collect a development fee for each clinic prior to opening establishing all operational treatments. |

| |

|

|

| |

● |

MyoCorrect

(Orofacial Myofunctional Therapy) Program. In March 2021, we introduced orofacial myofunctional therapy (or OMT) as a service

that is part of The Vivos Method, under the name MyoCorrect. Through MyoCorrect, dentists enrolled in the VIP program will have access

to trained therapists who provide OMT via telemedicine technology. Our CARE appliances are cleared by the FDA to treat moderate and

severe OSA in adults, 18 years of age and older along with positive airway pressure (PAP) and/or myofunctional therapy, as needed. |

Our

Competitive Strengths

We

believe that The Vivos Method has numerous advantages that, taken together, set us apart from the competition and position us for success

in the marketplace:

| |

● |

Significant

barriers to entry. |

| |

|

|

| |

● |

Vivos

Method insurance reimbursement. |

| |

|

|

| |

● |

Body

of published research and strong patient outcomes. |

| |

|

|

| |

● |

First

mover advantage. |

| |

● |

Differentiated

products. |

| |

|

|

| |

● |

Intellectual

property portfolio and research and development capabilities. |

| |

|

|

| |

● |

Extensive

Training and Support Systems. |

| |

|

|

| |

● |

Targeted

approach to market development. |

| |

|

|

| |

● |

Marketplace

acceptance. |

New

Marketing and Distribution Alliance Strategy

In

June 2024, we announced the execution of a strategic marketing and distribution alliance with Rebis Health Holdings, LLC (Rebis), an

operator of multiple sleep testing and treatment centers in Colorado. This alliance, which we hope will be the first of a series of similar

alliances and potential acquisitions across the country, marks an important pivot in our marketing and distribution model for our cutting-edge

OSA appliances. Under the new alliance, we are collaborating with Rebis to offer OSA patients a full spectrum of evidence-based treatments

such as our own advanced, proprietary and FDA-cleared CARE oral medical devices, oral appliances and additional adjunctive therapies

and methods including CPAP machines. The program commenced in August of 2024 in the Longmont, CO office of Rebis.

We

believe the advantages of this new strategic marketing and distribution model are compelling. First, it provides Vivos-trained providers

direct access to far more OSA patients who are likely candidates for Vivos treatment. As we roll out this new model going forward, potentially

thousands of patients each month could be exposed to Vivos treatment options. Second, we expect to close more cases using Vivos-trained

personnel. In our pilot testing, which we conducted at over 45 separate locations around the United States during 2023 and 2024, our

Vivos-trained personnel were able to consistently close over 70% of patients into some form of Vivos treatment. These figures held relatively

consistent across diverse demographic and economic patient profiles and geographies. Third, top line revenue and profit per case are

expected to rise. We project that each patient who signs up for Vivos treatment represents a potential increase to Vivos top line revenue

with contribution margins of up to 50%. This significantly alters the economics to Vivos, when compared to our prior model, increasing

top-line revenues per case start by approximately 4-6 times. In summary, under our new model, we expect to present Vivos treatments to

more patients, close a higher percentage of cases into Vivos treatment, and generate more revenue and profit per case.

The

Rebis strategic alliance was announced alongside a $7.5 million equity private placement by us with an affiliate of New Seneca Partners,

Inc. (Seneca). The new marketing and distribution strategic alliance is based on a profit-sharing model between

us and Rebis. Subject to certain conditions, Seneca will participate in our net cash flow allocation from the alliance up to an agreed-upon

amount as partial consideration for the management advisory services Seneca is providing to us.

Corporate

Information

Our

principal executive offices are located at 7921 Southpark Plaza, Suite 210, Littleton, Colorado 80120, and our telephone number is (844)

672-4357, and our internet website address is https://www.vivos.com. The information on our website is not a part of, or incorporated

in, this prospectus.

RISK

FACTORS

Investing

in our securities is highly speculative and involves a high degree of risk. Before deciding whether to invest in our securities,

you should carefully consider the risk factors we describe in any accompanying prospectus or any future prospectus supplement, as well

as in any related free writing prospectus for a specific offering of securities, and the risk factors incorporated by reference into

this prospectus, any accompanying prospectus or such prospectus supplement. You should also carefully consider other information contained

and incorporated by reference in this prospectus and any applicable prospectus supplement, including our financial statements and the

related notes thereto incorporated by reference in this prospectus. The risks and uncertainties described in the applicable prospectus

supplement and our other filings with the SEC incorporated by reference herein are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently consider immaterial may also adversely affect us. If any of the described risks occur,

our business, financial condition or results of operations could be materially harmed. In such case, the value of our securities could

decline and you may lose all or part of your investment.

USE

OF PROCEEDS

Unless

otherwise indicated in a prospectus supplement, we intend to use the net proceeds from these sales for general corporate purposes, which

includes, without limitation, sales and marketing expenses generally, research and development expenses, sales and support staff and

software development including enterprise resource planning and practice management implementations. The amounts and timing of these

expenditures will depend on numerous factors, including the development of our current business initiatives.

DIVIDEND

POLICY

We

have never paid or declared any cash dividends on our common stock, and we do not anticipate paying any cash dividends on our common

stock in the foreseeable future. We intend to retain all available funds and any future earnings to fund the development and expansion

of our business. Any future determination to pay dividends will be at the discretion of our board of directors and will depend upon a

number of factors, including our results of operations, financial condition, future prospects, contractual restrictions, restrictions

imposed by applicable law and other factors our board of directors deems relevant. Our future ability to pay cash dividends on our stock

may also be limited by the terms of any future debt or preferred securities or future credit facility.

PLAN

OF DISTRIBUTION

We

may sell the securities from time to time to or through underwriters or dealers, through agents, or directly to one or more purchasers.

A distribution of the securities offered by this prospectus may also be effected through the issuance of derivative securities, including

without limitation, warrants, rights to purchase and subscriptions. In addition, the manner in which we may sell some or all of the securities

covered by this prospectus includes, without limitation, through:

| |

● |

a

block trade in which a broker-dealer will attempt to sell as agent, but may position or resell a portion of the block, as principal,

in order to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer, as principal, and resale by the broker-dealer for its account; or |

| |

|

|

| |

● |

ordinary

brokerage transactions and transactions in which a broker solicits purchasers. |

A

prospectus supplement or supplements with respect to each series of securities will describe the terms of the offering, including, to

the extent applicable:

| |

● |

the

terms of the offering; |

| |

|

|

| |

● |

the

name or names of the underwriters or agents and the amounts of securities underwritten or purchased by each of them, if any; |

| |

|

|

| |

● |

the

public offering price or purchase price of the securities or other consideration therefor, and the proceeds to be received by us

from the sale; |

| |

|

|

| |

● |

any

delayed delivery requirements; |

| |

|

|

| |

● |

any

over-allotment options under which underwriters may purchase additional securities from us; |

| |

|

|

| |

● |

any

underwriting discounts or agency fees and other items constituting underwriters’ or agents’ compensation; |

| |

|

|

| |

● |

any

discounts or concessions allowed or re-allowed or paid to dealers; and |

| |

|

|

| |

● |

any

securities exchange or market on which the securities may be listed. |

The

offer and sale of the securities described in this prospectus by us, the underwriters or the third parties described above may be effected

from time to time in one or more transactions, including privately negotiated transactions, either:

| |

● |

at

a fixed price or prices, which may be changed; |

| |

|

|

| |

● |

in

an “at the market” offering within the meaning of Rule 415(a)(4) of the Securities Act of 1933, as amended, or the Securities

Act; |

| |

|

|

| |

● |

at

prices related to such prevailing market prices; or |

| |

|

|

| |

● |

at

negotiated prices. |

Only

underwriters named in the prospectus supplement will be underwriters of the securities offered by the prospectus supplement.

Underwriters

and Agents; Direct Sales

If

underwriters are used in a sale, they will acquire the offered securities for their own account and may resell the offered securities

from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices

determined at the time of sale. We may offer the securities to the public through underwriting syndicates represented by managing underwriters

or by underwriters without a syndicate.

Unless

the prospectus supplement states otherwise, the obligations of the underwriters to purchase the securities will be subject to the conditions

set forth in the applicable underwriting agreement. Subject to certain conditions, the underwriters will be obligated to purchase all

of the securities offered by the prospectus supplement, other than securities covered by any over-allotment option. Any public offering

price and any discounts or concessions allowed or re-allowed or paid to dealers may change from time to time. We may use underwriters

with whom we have a material relationship. We will describe in the prospectus supplement, naming the underwriter, the nature of any such

relationship.

We

may sell securities directly or through agents we designate from time to time. We will name any agent involved in the offering and sale

of securities, and we will describe any commissions we will pay the agent in the prospectus supplement. Unless the prospectus supplement

states otherwise, our agent will act on a best-efforts basis for the period of its appointment.

We

may authorize agents or underwriters to solicit offers by certain types of institutional investors to purchase securities from us at

the public offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery

on a specified date in the future. We will describe the conditions to these contracts and the commissions we must pay for solicitation

of these contracts in the prospectus supplement.

Dealers

We

may sell the offered securities to dealers as principals. The dealer may then resell such securities to the public either at varying

prices to be determined by the dealer or at a fixed offering price agreed to with us at the time of resale.

Institutional

Purchasers

We

may authorize agents, dealers or underwriters to solicit certain institutional investors to purchase offered securities on a delayed

delivery basis pursuant to delayed delivery contracts providing for payment and delivery on a specified future date. The applicable prospectus

supplement or other offering materials, as the case may be, will provide the details of any such arrangement, including the offering

price and commissions payable on the solicitations.

We

will enter into such delayed contracts only with institutional purchasers that we approve. These institutions may include commercial

and savings banks, insurance companies, pension funds, investment companies and educational and charitable institutions.

Indemnification;

Other Relationships

We

may provide agents, underwriters, dealers and remarketing firms with indemnification against certain civil liabilities, including liabilities

under the Securities Act, or contribution with respect to payments that the agents or underwriters may make with respect to these liabilities.

Agents, underwriters, dealers and remarketing firms, and their affiliates, may engage in transactions with, or perform services for,

us in the ordinary course of business. This includes commercial banking and investment banking transactions.

Market-Making;

Stabilization and Other Transactions

There

is currently no market for any of the offered securities, other than our common stock, which is quoted on the Nasdaq Capital Market.

If the offered securities are traded after their initial issuance, they may trade at a discount from their initial offering price, depending

upon prevailing interest rates, the market for similar securities and other factors. While it is possible that an underwriter could inform

us that it intends to make a market in the offered securities, such underwriter would not be obligated to do so, and any such market-making

could be discontinued at any time without notice. Therefore, no assurance can be given as to whether an active trading market will develop

for the offered securities. We have no current plans for listing of the debt securities, preferred stock, warrants or subscription rights

on any securities exchange or quotation system; any such listing with respect to any particular debt securities, preferred stock, warrants

or subscription rights will be described in the applicable prospectus supplement or other offering materials, as the case may be.

Any

underwriter may engage in over-allotment, stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation

M under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Over-allotment involves sales in excess of the offering

size, which create a short position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing

bids do not exceed a specified maximum price. Syndicate-covering or other short-covering transactions involve purchases of the securities,

either through exercise of the over-allotment option or in the open market after the distribution is completed, to cover short positions.

Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the securities originally sold by the dealer

are purchased in a stabilizing or covering transaction to cover short positions. Those activities may cause the price of the securities

to be higher than it would otherwise be. If commenced, the underwriters may discontinue any of the activities at any time.

Any

underwriters or agents that are qualified market makers on the Nasdaq Capital Market may engage in passive market making transactions

in our common stock on the Nasdaq Capital Market in accordance with Regulation M under the Exchange Act, during the business day prior

to the pricing of the offering, before the commencement of offers or sales of our common stock. Passive market makers must comply with

applicable volume and price limitations and must be identified as passive market makers. In general, a passive market maker must display

its bid at a price not in excess of the highest independent bid for such security; if all independent bids are lowered below the passive

market maker’s bid, however, the passive market maker’s bid must then be lowered when certain purchase limits are exceeded.

Passive market making may stabilize the market price of the securities at a level above that which might otherwise prevail in the open

market and, if commenced, may be discontinued at any time.

Fees

and Commissions

If

5% or more of the net proceeds of any offering of securities made under this prospectus will be received by a FINRA member participating

in the offering or affiliates or associated persons of such FINRA member, the offering will be conducted in accordance with FINRA Rule

5121.

DESCRIPTION

OF SECURITIES WE MAY OFFER

General

This

prospectus describes the general terms of our capital stock. The following description is not complete and may not contain all the information

you should consider before investing in our capital stock. For a more detailed description of these securities, you should read the applicable

provisions of Delaware law and our certificate of incorporation, as amended, referred to herein as our certificate of incorporation,

and our amended and restated bylaws, referred to herein as our bylaws. When we offer to sell a particular series of these securities,

we will describe the specific terms of the series in a supplement to this prospectus. Accordingly, for a description of the terms of

any series of securities, you must refer to both the prospectus supplement relating to that series and the description of the securities

described in this prospectus. To the extent the information contained in the prospectus supplement differs from this summary description,

you should rely on the information in the prospectus supplement.

The

total number of shares of capital stock we are authorized to issue is 250,000,000 shares, of which (1) 200,000,000 shares are common

stock, par value $0.0001 per share (or common stock) and (2) 50,000,000 shares are preferred stock, par value $0.0001 per share (or preferred

stock), which may, at the sole discretion of our board of directors be issued in one or more series.

We,

directly or through agents, dealers or underwriters designated from time to time, may offer, issue and sell, together or separately,

up to $50,000,000 in the aggregate of:

| |

● |

common

stock; |

| |

● |

preferred

stock; |

| |

● |

warrants

to purchase common stock, preferred stock, debt securities, other securities or any combination of those securities; |

| |

● |

subscription

rights to purchase common stock, preferred stock, debt securities, other securities or any combination of those securities; |

| |

● |

secured

or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness which may be senior debt securities,

senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities; or |

| |

● |

units

comprised of, or other combinations of, the foregoing securities. |

We

may issue the debt securities as exchangeable for or convertible into shares of common stock, preferred stock or other securities that

may be sold by us pursuant to this prospectus or any combination of the foregoing. The preferred stock may also be exchangeable for and/or

convertible into shares of common stock, another series of preferred stock or other securities that may be sold by us pursuant to this

prospectus or any combination of the foregoing. When a particular series of securities is offered, a supplement to this prospectus will

be delivered with this prospectus, which will set forth the terms of the offering and sale of the offered securities.

Common

Stock

As

of February 10, 2024, there were 5,889,520 shares of common stock issued and outstanding, held of record by approximately

8,150 stockholders. Subject to preferential rights with respect to any outstanding preferred stock, all outstanding shares of common

stock are of the same class and have equal rights and attributes.

Dividend

Rights

Holders

of the common stock may receive dividends when, as and if declared by our board of directors out of the assets legally available for

that purpose and subject to the preferential dividend rights of any other classes or series of stock of our Company. We have never paid,

and have no plans to pay, any dividends on our shares of common stock.

Voting

Rights

Holders

of the common stock are entitled to one vote per share in all matters as to which holders of common stock are entitled to vote. Holders

of not less than a majority of the outstanding shares of common stock entitled to vote at any meeting of stockholders constitute a quorum

unless otherwise required by law.

Election

of Directors

Directors

hold office until the next annual meeting of stockholders and are eligible for re-election at such meeting. Directors are elected by

a plurality of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors.

There is no cumulative voting for directors.

Liquidation

In

the event of any liquidation, dissolution or winding up of the Company, holders of the common stock have the right to receive ratably

and equally all of the assets remaining after payment of liabilities and liquidation preferences of any preferred stock then outstanding.

Redemption

The

common stock is not redeemable or convertible and does not have any sinking fund provisions.

Preemptive

Rights

Holders

of the common stock do not have preemptive rights.

Other

Rights

Our

common stock is not liable to further calls or to assessment by the registrant and for liabilities of the registrant imposed on its stockholders

under state statutes.

Right

to Amend Bylaws

The

board of directors has the power to adopt, amend or repeal the bylaws. Bylaws adopted by the board of directors may be repealed or changed,

and new bylaws made, with the requisite vote of our stockholders, and our stockholders may prescribe that any bylaw made by them shall

not be altered, amended or repealed by the board of directors.

Change

in Control

Provisions

of Delaware law and our certificate of incorporation and bylaws could make the acquisition of our company by means of a tender offer,

proxy contest or otherwise, and the removal of incumbent officers and directors, more difficult. These provisions include:

Section

203 of the DGCL, which prohibits a merger with a 15%-or-greater stockholder, such as a party that has completed a successful tender offer,

until three years after that party became a 15%-or-greater stockholder;

The

authorization in our certificate of incorporation of undesignated preferred stock, which could be issued without stockholder approval

in a manner designed to prevent or discourage a takeover; and

Provisions

in our bylaws regarding stockholders’ rights to call a special meeting of stockholders limit such rights to stockholders holding

together at least a sixty-six and two-thirds percent of the shares of the Company entitled to vote at the meeting, which could make it

more difficult for stockholders to wage a proxy contest for control of our board of directors or to vote to repeal any of the anti-takeover

provisions contained in our certificate of incorporation and bylaws.

Together,

these provisions may make the removal of management more difficult and may discourage transactions that could otherwise involve payment

of a premium over prevailing market prices for our common stock.

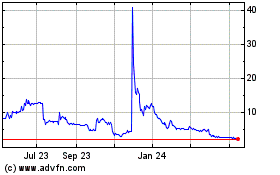

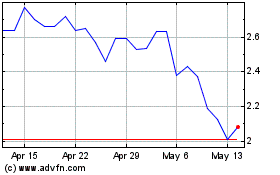

Market,