0001111335false00011113352024-02-192024-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported) February 20, 2024 (February 19, 2024)

VISTEON CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | 1-15827 | 38-3519512 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | |

One Village Center Drive, | Van Buren Township, | Michigan | 48111 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code (800)-VISTEON

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | VC | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

SECTION 2 - FINANCIAL INFORMATION

Item 2.02. Results of Operations and Financial Condition.

On February 20, 2024, the registrant issued a press release regarding its financial results for the fourth quarter and full-year of 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

On February 19, 2024, the Company entered into an Amendment (the “Amended Employment Agreement”) to the Amended and Restated Employment Agreement with Sachin Lawande, the Company’s President and Chief Executive Officer, which amends the Amended and Restated Employment Agreement between the Company and Mr. Lawande dated as of October 22, 2020 (the “Prior Employment Agreement”). The term of the Prior Employment Agreement was scheduled to expire on September, 2025. Pursuant to the Amended Employment Agreement, the term of the Amended Employment Agreement was extended through September 30, 2030. All of the other terms and conditions of the Prior Employment Agreement remain in full force and effect. The foregoing description of the modification made in the Amended Employment Agreement is qualified in its entirety by reference to (a) the full text of the Amended Employment Agreement, attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated in this Item 5.02 by reference, and (b) the full text of the Prior Employment Agreement, attached as Exhibit 10.1 to the prior filed Current Report on Form 8-K, as originally filed by the Company on October 26, 2020.

On February 19, 2024, the Organization and Compensation Committee of Company approved compensation adjustments for Mr. Lawande consisting of an annualized base salary in the amount of $1,150,000 effective as of April 1, 2024, annual incentive opportunity in the amount of $1,725,000, and long-term incentive opportunity in the amount of $8,850,000.

SECTION 7 - REGULATION FD

Item 7.01. Regulation FD Disclosure.

See “Item 2.02. Results of Operations and Financial Condition” above.

SECTION 9 - FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| VISTEON CORPORATION |

| | |

| By: | /s/Brett D. Pynnonen |

| | Brett D. Pynnonen |

| | Senior Vice President and Chief Legal Officer |

Date: February 20, 2024

AMENDMENT TO

EMPLOYMENT AGREEMENT

This Amendment (this “Amendment”) to the Amended and Restated Employment Agreement, dated October 22, 2020, between Visteon Corporation, a Delaware corporation (the “Company”) and Sachin Lawande (the “Employee”) (the “Employment Agreement”), is made and entered into on this 19th day of February, 2024 (the “Effective Date”) by and between the Company and the Employee.

WHEREAS, the Employee has been performing employment services to the Company pursuant to the Employment Agreement;

WHEREAS, the Employee and the Company mutually desire to amend the Employment Agreement in certain respects; and

WHEREAS, pursuant to Section 23 of the Employment Agreement, the Employment Agreement may only be amended upon written amendment executed by the Company and the Employee.

NOW, THEREFORE, the Company and the Employee hereby agree that, effective on the Effective Date, the Employment Agreement shall be amended as follows:

1. Section 2 of the Employment Agreement shall be amended and restated to read as follows:

“The term of the Agreement shall extend through September 30, 2030 (the “Term”). The Term, but not Employee’s employment with the Company, shall terminate on September 30, 2030 without further action by the Company or the Employee unless they have before that date mutually agreed to an extension of the Term. However, both the Term of the Agreement and the Employee’s employment shall terminate sooner pursuant to Section 7 hereof, subject to Section 8 hereof. If the Term is not earlier terminated in accordance with Section 7 hereof, it will automatically terminate on September 30, 2030, without further action by the Company or the Employee unless both the Company and the Employee have, before that date, mutually agreed to an extension of the Term.”

2. All of the terms and conditions of the Employment Agreement as amended by this Amendment shall remain in full force, and effect and the Employee and the Company agree to continue to be legally bound by the obligations and undertakings in the Employment Agreement, other than those that have been amended by this Amendment and/or those that are no longer applicable due to the lapse of time since the initial execution of the Employment Agreement.

IN WITNESS WHEREOF, the undersigned, intending to be legally bound, have executed this Amendment, effective as of the date set forth above.

Visteon Corporation

/s/Francis M. Scricco

By: Francis M. Scricco

EMPLOYEE

/s/Sachin S. Lawande

Sachin S. Lawande

Exhibit 99.1

NEWS RELEASE

Visteon Announces 2023 Financial Results and 2024 Outlook

VAN BUREN TOWNSHIP, Mich., Feb. 20, 2024 — Visteon Corporation (NASDAQ: VC) today reported fourth quarter and full-year 2023 financial results. Highlights include:

•$990 million net sales in Q4 and $3,954 million for the full year

•Net income of $366 million including a $313 million non-cash U.S. tax benefit in Q4, and net income of $486 million for the full year

•Adjusted EBITDA of $117 million in Q4 and $434 million or 11.0% of sales for the full year

•Operating cash flow of $267 million and adjusted free cash flow of $150 million for the full year

•Repurchased $106 million of shares in 2023

•Launched 129 new products and won $7.2 billion of new business in 2023

Fourth Quarter Financial Results

Visteon reported net sales of $990 million compared to $1,064 million in the fourth quarter of last year. The decline in net sales was primarily due to lower recoveries resulting from improved semiconductor supply in 2023. When excluding the impact of these recoveries, Visteon's base sales grew 1% from the prior year. Base sales performance was driven by the ongoing ramp up of our recent product launches, partially offset by production disruptions at our OEM customers, including the UAW strike.

Gross margin in the fourth quarter was $130 million, and net income attributable to Visteon was $366 million, or $12.98 per diluted share. Net income included a non-cash tax benefit of $313 million related to a reduction in the valuation allowance against U.S. deferred tax assets that contributed $11.10 to diluted earnings per share. Adjusted EBITDA, a non-GAAP measure as defined below, was $117 million, an increase of $14 million compared to the prior year. The increase in adjusted EBITDA primarily reflects strong operating performance, the ongoing benefits of cost and commercial discipline, and lower net engineering cost due in part to the timing of project spending. Adjusted EBITDA margin was 11.8% of sales, an increase of 210 basis points compared to the prior year.

Full-Year Financial Results

Visteon reported record net sales of $3,954 million, representing year-over-year growth of 5%. When excluding the impact of pricing from supply chain recoveries, Visteon's base sales grew 12% from the prior year. Base sales performance was driven by the ongoing ramp up of production of our recent product launches and higher customer vehicle production, partially offset by foreign exchange.

Gross margin was $487 million, and net income attributable to Visteon was $486 million or $17.05 per diluted share, including the non-cash tax benefit noted above. Adjusted EBITDA was a record $434 million, an increase of $86 million compared to the prior year. The increase in adjusted EBITDA primarily reflects the impact of higher sales while leveraging an efficient cost structure with modest increases in engineering and SG&A costs. Adjusted EBITDA margin was 11.0% of sales, an increase of 170 basis points compared to the prior year.

Cash provided by operations was $267 million and capital expenditures were $125 million. Adjusted free cash flow, a non-GAAP financial measure as defined below, was $150 million, a $49 million improvement compared to the prior year. Adjusted free cash flow benefited from the strong year-over-year improvement in adjusted EBITDA and working capital, partially offset by higher capital expenditures to support our growth.

Visteon repurchased $106 million of shares during 2023 under the $300 million share repurchase authorization announced in March 2023.

New Business Wins and Product Launch Highlights

Visteon won $7.2 billion of new business in 2023, leveraging its strong, diversified product portfolio that addresses key industry trends of digitalization and electrification. Visteon won significant new business throughout the year in all core product lines including our first EV power electronics win with a European OEM luxury brand. Fourth quarter wins included an infotainment system and 10" display for an SUV platform with a Global OEM and an infotainment system and 10" display for multiple vehicles with an Indian OEM. Visteon also won a follow-on 12” digital cluster and 13” center display for an electric model on an SUV platform with a German luxury OEM.

Visteon launched 129 new products in 2023. These product launches continue to build the foundation for Visteon’s long-term market outperformance. Key fourth quarter product launches included a SmartCore™ cockpit domain controller and 12” display for the JMC-Ford Ranger in China, a SmartCore™ cockpit domain controller and 10” display for the Mahindra XUV, and a 12" digital cluster for the Nissan Rogue for the North American market.

Outlook for 2024

Visteon's full-year 2024 guidance anticipates sales in the range of $4.0 billion to $4.2 billion, adjusted EBITDA in the range of $470 million to $500 million, and adjusted free cash flow in the range of $155 million to $185 million.

"Visteon delivered another strong performance in 2023 with approximately $400 million of growth in our base sales. I am especially proud of our team’s continued focus on execution, cost control, and cash flow generation," said President and CEO Sachin Lawande. "Our impressive $7.2 billion of new business wins and high number of new product launches in 2023 lay the foundation for continued growth in 2024 and years to come."

About Visteon

Visteon is advancing mobility through innovative technology solutions that enable a software-defined and electric future. With next-generation digital cockpit and electrification products, Visteon leverages the strength and agility of its global network with a local footprint to deliver a cleaner, safer and more connected vehicle experience. Headquartered in Van Buren Township, Michigan, Visteon operates in 17 countries worldwide, recorded approximately $3.95 billion in annual sales and booked $7.2 billion of new business in 2023. Learn more at investors.visteon.com/.

Conference Call and Presentation

Today, Tuesday, Feb. 20, at 9 a.m. ET, Visteon will host a conference call for the investment community to discuss the quarter’s results and other related items. The conference call is available to the general public via a live audio webcast.

The dial-in numbers to participate in the call are:

•U.S./Canada Participants Toll-Free Dial-In Number: 1-888-330-2508

•International Participants Toll Dial-In Number: 1-240-789-2735

•Conference ID: 8897485

(Dial-in approximately 10 minutes before the start of the conference.)

__

Use of Non-GAAP Financial Information

Because not all companies use identical calculations, adjusted EBITDA, adjusted net income, adjusted EPS, free cash flow and adjusted free cash flow used throughout this press release may not be comparable to other similarly titled measures of other companies.

In order to provide the forward-looking non-GAAP financial measures for full-year 2024, the Company provides reconciliations to the most directly comparable GAAP financial measures on the subsequent slides. The provision of these comparable GAAP financial measures is not intended to indicate that the Company is explicitly or implicitly providing projections on those GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this press release and the adjustments that management can reasonably predict.

Forward-looking Information

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The words "will," "may," "designed to," "outlook," "believes," "should," "anticipates," "plans," "expects," "intends," "estimates," "forecasts" and similar expressions identify certain of these forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various factors, risks and uncertainties that could cause our actual results to differ materially from those expressed in these forward-looking statements, including, but not limited to:

•continued and future impacts related to the conflict between Russia and the Ukraine including supply chain disruptions, reduction in customer demand, and the imposition of sanctions on Russia;

•significant or prolonged shortage of critical components from our suppliers, including but not limited to semiconductors, and particularly those who are our sole or primary sources;

•failure of the Company’s joint venture partners to comply with contractual obligations or to exert undue influence in China;

•conditions within the automotive industry, including (i) the automotive vehicle production volumes and schedules of our customers, (ii) the financial condition of our customers and the effects of any restructuring or reorganization plans that may be undertaken by our customers, including work stoppages at our customers, and (iii) possible disruptions in the supply of commodities to us or our customers due to financial distress, work stoppages, natural disasters or civil unrest;

•our ability to avoid or continue to operate during a strike, or partial work stoppage or slow down at any of our principal customers;

•our ability to satisfy future capital and liquidity requirements; including our ability to access the credit and capital markets at the times and in the amounts needed and on terms acceptable to us; our ability to comply with financial and other covenants in our credit agreements; and the continuation of acceptable supplier payment terms; our ability to access funds generated by foreign subsidiaries and joint ventures on a timely and cost-effective basis;

•general economic conditions, including changes in interest rates and fuel prices; the timing and expenses related to internal restructurings, employee reductions, acquisitions or dispositions and the effect of pension and other post-employment benefit obligations;

•disruptions in information technology systems including, but not limited to, system failure, cyber-attack, malicious computer software (malware including ransomware), unauthorized physical or electronic access, or other natural or man-made incidents or disasters;

•increases in raw material and energy costs and our ability to offset or recover these costs; increases in our warranty, product liability and recall costs or the outcome of legal or regulatory proceedings to which we are or may become a party;

•changes in laws, regulations, policies or other activities of governments, agencies and similar organizations, domestic and foreign, that may tax or otherwise increase the cost of, or otherwise affect, the manufacture, licensing, distribution, sale, ownership or use of our products or assets; and

•those factors identified in our filings with the SEC (including our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as updated by our subsequent filings with the Securities and Exchange Commission).

Caution should be taken not to place undue reliance on our forward-looking statements, which represent our view only as of the date of this release, and which we assume no obligation to update. The financial results presented herein are preliminary and unaudited; final financial results will be included in the Company's Annual Report on Form 10-K for the fiscal quarter ended December 31, 2023. New business wins and re-wins do not represent firm orders or firm commitments from customers, but are

based on various assumptions, including the timing and duration of product launches, vehicle production levels, customer price reductions and currency exchange rates.

Follow Visteon

Visteon Contacts

Media:

Media@Visteon.com

Investors:

Investor@Visteon.com

VISTEON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In millions except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net sales | $ | 990 | | | $ | 1,064 | | | $ | 3,954 | | | $ | 3,756 | |

| Cost of sales | (860) | | | (950) | | | (3,467) | | | (3,388) | |

| Gross margin | 130 | | | 114 | | | 487 | | | 368 | |

| Selling, general and administrative expenses | (51) | | | (54) | | | (207) | | | (188) | |

Restructuring and impairment | (3) | | | (2) | | | (5) | | | (14) | |

| Interest expense | (4) | | | (4) | | | (17) | | | (14) | |

| Interest income | 4 | | | 1 | | | 10 | | | 4 | |

Equity in net (loss) income of non-consolidated affiliates | (2) | | | (4) | | | (10) | | | (1) | |

Other income (expense), net | 3 | | | 5 | | | (1) | | | 20 | |

Income (loss) before income taxes | 77 | | | 56 | | | 257 | | | 175 | |

Benefit from (provision for) income taxes | 296 | | | (21) | | | 248 | | | (45) | |

| | | | | | | |

| | | | | | | |

Net income (loss) | 373 | | | 35 | | | 505 | | | 130 | |

Less: Net (income) loss attributable to non-controlling interests | (7) | | | (1) | | | (19) | | | (6) | |

Net income (loss) attributable to Visteon Corporation | $ | 366 | | | $ | 34 | | | $ | 486 | | | $ | 124 | |

| | | | | | | |

| Comprehensive income (loss) | $ | 347 | | | $ | 120 | | | $ | 461 | | | $ | 141 | |

| Less: Comprehensive income (loss) attributable to non-controlling interests | 10 | | | 5 | | | 16 | | | 1 | |

| Comprehensive income (loss) attributable to Visteon Corporation | 337 | | | 115 | | | 445 | | | 140 | |

| | | | | | | |

Earnings per share data: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic earnings (loss) per share attributable to Visteon Corporation | $ | 13.17 | | | $ | 1.21 | | | $ | 17.30 | | | $ | 4.41 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted earnings (loss) per share attributable to Visteon Corporation | $ | 12.98 | | | $ | 1.18 | | | $ | 17.05 | | | $ | 4.35 | |

| | | | | | | |

| Average shares outstanding (in millions) | | | | | | | |

| Basic | 27.8 | | | 28.2 | | | 28.1 | | | 28.1 | |

| Diluted | 28.2 | | | 28.7 | | | 28.5 | | | 28.5 | |

2023 includes a non-cash tax benefit of $313 million, or $11.10 per diluted share in the fourth quarter, and $10.98 per diluted share for the full year, related to a reduction in the valuation allowance against the U.S. deferred tax assets.

VISTEON CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In millions)

| | | | | | | | | | | |

| | | |

| December 31, | | December 31, |

| 2023 | | 2022 |

| ASSETS | | | |

| Cash and equivalents | $ | 515 | | | $ | 520 | |

| Restricted cash | 3 | | | 3 | |

| Accounts receivable, net | 666 | | | 672 | |

| Inventories, net | 298 | | | 348 | |

| Other current assets | 134 | | | 167 | |

| Total current assets | 1,616 | | | 1,710 | |

| | | |

| Property and equipment, net | 418 | | | 364 | |

| Intangible assets, net | 90 | | | 99 | |

| Right-of-use assets | 109 | | | 124 | |

| Investments in non-consolidated affiliates | 35 | | | 49 | |

| Deferred tax assets | 384 | | | 42 | |

| Other non-current assets | 75 | | | 62 | |

| Total assets | $ | 2,727 | | | $ | 2,450 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Short-term debt | $ | 18 | | | $ | 13 | |

| Accounts payable | 551 | | | 657 | |

| Accrued employee liabilities | 99 | | | 90 | |

| Current lease liability | 30 | | | 29 | |

| Other current liabilities | 233 | | | 246 | |

| Total current liabilities | 931 | | | 1,035 | |

| | | |

| Long-term debt, net | 318 | | | 336 | |

| Employee benefits | 160 | | | 115 | |

| Non-current lease liability | 79 | | | 99 | |

| Deferred tax liabilities | 31 | | | 27 | |

| Other non-current liabilities | 85 | | | 64 | |

| | | |

| Stockholders’ equity: | | | |

| Common stock | 1 | | | 1 | |

| Additional paid-in capital | 1,356 | | | 1,352 | |

| Retained earnings | 2,274 | | | 1,788 | |

| Accumulated other comprehensive loss | (254) | | | (213) | |

| Treasury stock | (2,339) | | | (2,253) | |

| Total Visteon Corporation stockholders’ equity | 1,038 | | | 675 | |

| Non-controlling interests | 85 | | | 99 | |

| Total equity | 1,123 | | | 774 | |

| Total liabilities and equity | $ | 2,727 | | | $ | 2,450 | |

VISTEON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

OPERATING | | | | | | | |

Net income (loss) | $ | 373 | | | $ | 35 | | | $ | 505 | | | $ | 130 | |

| Adjustments to reconcile net income (loss) to net cash provided from operating activities: | | | | | | | |

Depreciation and amortization | 25 | | | 29 | | | 104 | | | 108 | |

Non-cash stock-based compensation | 8 | | | 7 | | | 34 | | | 26 | |

Equity in net income of non-consolidated affiliates, net of dividends remitted | 7 | | | 4 | | | 15 | | | 4 | |

| Impairments | — | | | 1 | | | — | | | 5 | |

U.S. tax valuation allowance benefit | (313) | | | — | | | (313) | | | — | |

Other non-cash items | (3) | | | 1 | | | (6) | | | (1) | |

Changes in assets and liabilities: | | | | | | | |

Accounts receivable | 32 | | | 88 | | | 13 | | | (156) | |

Inventories | 29 | | | 7 | | | 52 | | | (105) | |

Accounts payable | (76) | | | (27) | | | (130) | | | 146 | |

Other assets and other liabilities | 16 | | | 20 | | | (7) | | | 10 | |

Net cash provided from operating activities | 98 | | | 165 | | | 267 | | | 167 | |

INVESTING | | | | | | | |

Capital expenditures, including intangibles | (43) | | | (27) | | | (125) | | | (81) | |

| Contributions to equity method investments | — | | | (2) | | | (1) | | | (3) | |

Net investment hedge transactions | — | | | 3 | | | — | | | 12 | |

| | | | | | | |

| Other, net | — | | | 2 | | | 3 | | | 4 | |

Net cash used by investing activities | (43) | | | (24) | | | (123) | | | (68) | |

FINANCING | | | | | | | |

Borrowings on term debt facility | — | | | — | | | — | | | 350 | |

| Payments on term debt facility | — | | | — | | | — | | | (350) | |

Short-term debt, net | — | | | — | | | — | | | (4) | |

| Principal repayment of term debt facility | (5) | | | — | | | (13) | | | — | |

Dividends paid to non-controlling interests | (2) | | | (2) | | | (29) | | | (2) | |

Repurchase of common stock | (30) | | | — | | | (106) | | | — | |

| Stock based compensation tax withholding payments | — | | | — | | | (16) | | | — | |

| Proceeds from the exercise of options | — | | | — | | | 8 | | | — | |

| Other | — | | | — | | | — | | | (3) | |

Net cash used by financing activities | (37) | | | (2) | | | (156) | | | (9) | |

Effect of exchange rate changes on cash | 15 | | | 19 | | | 7 | | | (22) | |

Net increase (decrease) in cash, equivalents, and restricted cash | 33 | | | 158 | | | (5) | | | 68 | |

Cash, equivalents, and restricted cash at beginning of the period | 485 | | | 365 | | | 523 | | | 455 | |

Cash, equivalents, and restricted cash at end of the period | $ | 518 | | | $ | 523 | | | $ | 518 | | | $ | 523 | |

VISTEON CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(In millions except per share amounts)

(Unaudited)

Adjusted EBITDA: Adjusted EBITDA is presented as a supplemental measure of the Company's performance that management believes is useful to investors because the excluded items may vary significantly in timing or amounts and/or may obscure trends useful in evaluating and comparing the Company's operating activities across reporting periods. The Company defines adjusted EBITDA as net income attributable to the Company adjusted to eliminate the impact of depreciation and amortization, provision for (benefit from) income taxes, non-cash stock-based compensation expense, restructuring and impairment expense, net interest expense, net income attributable to non-controlling interests, equity in net income of non-consolidated affiliates, gain on non-consolidated affiliate transactions, and other gains and losses not reflective of the Company's ongoing operations. Because not all companies use identical calculations, this presentation of adjusted EBITDA may not be comparable to similarly titled measures of other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | Estimated |

| December 31, | | December 31, | | Full Year |

Visteon: | 2023 | | 2022 | | 2023 | | 2022 | | 2024 |

| Net income (loss) attributable to Visteon Corporation | $ | 366 | | | $ | 34 | | | $ | 486 | | | $ | 124 | | | $ | 220 | |

| Depreciation and amortization | 25 | | | 29 | | | 104 | | | 108 | | | 105 | |

| Restructuring and impairment expense | 3 | | | 2 | | | 5 | | | 14 | | | 5 | |

| (Benefit from) provision for income tax | (296) | | | 21 | | | (248) | | | 45 | | | 80 | |

| Non-cash, stock-based compensation expense | 8 | | | 7 | | | 34 | | | 26 | | | 35 | |

| Net income attributable to non-controlling interests | 7 | | | 1 | | | 19 | | | 6 | | | 20 | |

| Interest expense, net | — | | | 3 | | | 7 | | | 10 | | | 5 | |

| Equity in net loss (income) of non-consolidated affiliates | 2 | | | 4 | | | 10 | | | 1 | | | 10 | |

| | | | | | | | | |

| Other non-operating costs, net | 2 | | | 2 | | | 17 | | | 14 | | | 5 | |

| Adjusted EBITDA | $ | 117 | | | $ | 103 | | | $ | 434 | | | $ | 348 | | | $ | 485 | 1 |

2023 includes a non-cash tax benefit of $313 million related to a reduction in the valuation allowance against the U.S. deferred tax assets.

Adjusted EBITDA is not a recognized term under U.S. GAAP and does not purport to be a substitute for net income as an indicator of operating performance or cash flows from operating activities as a measure of liquidity. Adjusted EBITDA has limitations as an analytical tool and is not intended to be a measure of cash flow available for management's discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. In addition, the Company uses adjusted EBITDA (i) as a factor in incentive compensation decisions, (ii) to evaluate the effectiveness of the Company's business strategies, and (iii) because the Company's credit agreements use similar measures for compliance with certain covenants.

1 Based on mid-point of the range of the Company's financial guidance.

Free Cash Flow and Adjusted Free Cash Flow: Free cash flow and adjusted free cash flow are presented as supplemental measures of the Company's liquidity that management believes are useful to investors in analyzing the Company's ability to service and repay its debt. The Company defines free cash flow as cash flow provided from operating activities less capital expenditures, including intangibles. The Company defines adjusted free cash flow as cash flow provided from operating activities less capital expenditures, including intangibles as further adjusted for restructuring related payments. Because not all companies use identical calculations, this presentation of free cash flow and adjusted free cash flow may not be comparable to other similarly titled measures of other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | Estimated |

| December 31, | | December 31, | | Full Year |

Total Visteon: | 2023 | | 2022 | | 2023 | | 2022 | | 2024 |

| Cash provided from operating activities | $ | 98 | | | $ | 165 | | | $ | 267 | | | $ | 167 | | | $ | 305 | |

| Capital expenditures, including intangibles | (43) | | | (27) | | | (125) | | | (81) | | | (145) | |

| Free cash flow | $ | 55 | | | $ | 138 | | | $ | 142 | | | $ | 86 | | | $ | 160 | |

| Restructuring related payments | 2 | | | 3 | | | 8 | | | 15 | | | 10 | |

| Adjusted free cash flow | $ | 57 | | | $ | 141 | | | $ | 150 | | | $ | 101 | | | $ | 170 | 2 |

Free cash flow and adjusted free cash flow are not recognized terms under U.S. GAAP and do not purport to be a substitute for cash flows from operating activities as a measure of liquidity. Free cash flow and adjusted free cash flow have limitations as analytical tools as they do not reflect cash used to service debt and do not reflect funds available for investment or other discretionary uses. In addition, the Company uses free cash flow and adjusted free cash flow (i) as factors in incentive compensation decisions and (ii) for planning and forecasting future periods.

2 Based on mid-point of the range of the Company's financial guidance.

Adjusted Net Income (Loss) and Adjusted Earnings Per Share: Adjusted net income and adjusted earnings per share are presented as supplemental measures that management believes are useful to investors in analyzing the Company's profitability, providing comparability between periods by excluding certain items that may not be indicative of recurring business operating results. The Company believes management and investors benefit from referring to these supplemental measures in assessing company performance and when planning, forecasting and analyzing future periods. The Company defines adjusted net income as net income attributable to Visteon adjusted to eliminate the impact of restructuring and impairment expense, loss on divestiture, gain on non-consolidated affiliate transactions, other gains and losses not reflective of the Company's ongoing operations and related tax effects. The Company defines adjusted earnings per share as adjusted net income divided by diluted shares. Because not all companies use identical calculations, this presentation of adjusted net income and adjusted earnings per share may not be comparable to other similarly titled measures of other companies.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) attributable to Visteon | $ | 366 | | | $ | 34 | | | $ | 486 | | | $ | 124 | |

| | | | | | | |

Diluted earnings (loss) per share: | | | | | | | |

| Net income (loss) attributable to Visteon | $ | 366 | | | $ | 34 | | | $ | 486 | | | $ | 124 | |

| Average shares outstanding, diluted | 28.2 | | | 28.7 | | | 28.5 | | | 28.5 | |

| Diluted earnings (loss) per share | $ | 12.98 | | | $ | 1.18 | | | $ | 17.05 | | | $ | 4.35 | |

| | | | | | | |

Adjusted net income (loss) and adjusted earnings (loss) per share: | | | | | | |

| Net income (loss) attributable to Visteon | $ | 366 | | | $ | 34 | | | $ | 486 | | | $ | 124 | |

| Restructuring and impairment expense | 3 | | | 2 | | | 5 | | | 14 | |

| Other | 2 | | | 2 | | | 17 | | | 14 | |

| | | | | | | |

| Tax impacts of adjustments | (4) | | | — | | | (4) | | | — | |

| Adjusted net income (loss) | $ | 367 | | | $ | 38 | | | $ | 504 | | | $ | 152 | |

| Average shares outstanding, diluted | 28.2 | | | 28.7 | | | 28.5 | | | 28.5 | |

| Adjusted earnings (loss) per share | $ | 13.01 | | | $ | 1.32 | | | $ | 17.68 | | | $ | 5.33 | |

| | | | | | | |

2023 includes a non-cash tax benefit of $313 million, or $11.10 per diluted share in the fourth quarter, and $10.98 per diluted share for the full year, related to a reduction in the valuation allowance against the U.S. deferred tax assets.

v3.24.0.1

Document and Entity Information Document

|

Feb. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 19, 2024

|

| Entity Registrant Name |

VISTEON CORPORATION

|

| Entity Central Index Key |

0001111335

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-15827

|

| Entity Address, Address Line One |

One Village Center Drive,

|

| Entity Address, City or Town |

Van Buren Township,

|

| Entity Tax Identification Number |

38-3519512

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48111

|

| City Area Code |

800

|

| Local Phone Number |

VISTEON

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $.01 per share

|

| Trading Symbol |

VC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

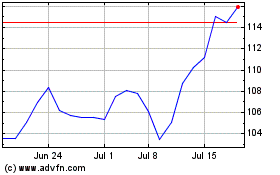

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Visteon (NASDAQ:VC)

Historical Stock Chart

From Feb 2024 to Feb 2025