As filed

with the Securities and Exchange Commission on November 20, 2024

Registration No. 333-

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

VISIONARY HOLDINGS

INC.

(Exact name of

registrant as specified in its charter)

| Canada |

Not Applicable |

|

(State or Other Jurisdiction

of Incorporation) |

(I.R.S. Employer

Identification

Number)

|

105 Moatfield

Dr. Unit 1003

Toronto,

Ontario, Canada M3B 0A2

(Address of

Principal Executive Offices) (Zip Code)

Visionary

Holdings Inc. 2024 Restricted Stock Plan

(Full title

of the plan)

Charles Y.

Fu, Esq.

GH Law Firm

LLC

880 Third

Avenue, 5th Fl.

New York,

NY 10022

Tel.: (212)

705-8798

Fax: (212)

937-5242

(Name and

address of agent for service)

(Telephone

number, including area code, of agent for service)

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer |

[ ] |

Accelerated filer |

[ ] |

| Non-accelerated filer |

[X] |

Smaller reporting company |

[ ] |

| Emerging growth company |

[X] |

|

|

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

EXPLANATORY

NOTE

This registration statement

on Form S-8 (the “Registration Statement”) is being filed for the purpose of registering 620,000 common shares, no par value

(the “Common Shares”), of Visionary Holdings Inc. (the “Registrant” or “Company”) issuable under the

Registrant’s 2024 Restricted Stock Plan (the “Equity Plan”).

PART I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Information required by

Part I to be contained in the Section 10(a) prospectus is omitted from the Registration Statement in accordance with Rule 428 under the

Act and Note 1 to Part I of Form S-8.

| ITEM 2. | REGISTRANT INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION. |

Information required by

Part I to be contained in the Section 10(a) prospectus is omitted from the Registration Statement in accordance with Rule 428 under the

Act and Note 1 to Part I of Form S-8.

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

| ITEM 3. | INCORPORATION OF DOCUMENTS BY REFERENCE. |

The Registrant hereby incorporates

by reference into this Registration Statement the following documents previously filed by the Registrant with the Securities and Exchange

Commission (the “SEC”):

| (a) | The Registrant’s latest annual report on Form 20-F for the

year ended March 31, 2024 filed with the SEC on August 15, 2024 (File No. 001-41385) under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”); |

| (b) | The Company’s Form 6-K Reports of Foreign Issuer filed pursuant

to Section 13(a) or Section 15(d) of the Exchange Act, from the end of the fiscal year covered by the annual report referenced in section

(a) through the date hereof; |

| (c) | The Company’s Form 8A-12B, filed with the SEC on May 9,

2022 pursuant to Section 12(b) of the Exchange Act; and |

| (d) | Any document filed by the Company with the SEC pursuant to Sections

13(a) or 15(d) of the Exchange Act subsequent to the date hereof, but prior to the filing of a post-effective amendment to this registration

statement which indicates that all shares registered hereunder have been sold or that deregisters all such shares then remaining unsold,

such documents being deemed to be incorporated by reference herein and to be part hereof from the date of filing of such documents. |

| ITEM 4. | DESCRIPTION OF SECURITIES. |

Not applicable.

| ITEM 5. | INTERESTS OF NAMED EXPERTS AND COUNSEL. |

Not applicable.

| ITEM 6. | INDEMNIFICATION OF DIRECTORS AND OFFICERS. |

The Company’s by-laws

provide the right to indemnify of our officers and directors, former directors and officers, and persons who act at our request as a director

or officer of which we are a shareholder or creditor, to the fullest extent permitted by the Canada Business Corporations Act (Ontario)

(the “Act”), as follows:

Subject to the Act, the

Company shall indemnify a director or officer of the Corporation, a former director of officer of the Corporation or a person who acts

or acted at the Corporation's request as a director or officer of a body corporate of which the Corporation is or was a shareholder or

creditor, and his heirs and legal representatives, against all costs, charges and expenses, including an amount paid to settle an action

or satisfy a judgment, reasonably incurred by him in respect of any civil, criminal administrative, investigative or other action or proceeding

to which he is made a party by reason of being or having been a director or officer of such corporation or body corporate if,

| · | he acted he acted honestly and in good faith with a view to the

best interests of the Corporation; and |

| · | in the case of a criminal or administrative action or proceeding

that is enforced by a monetary penalty, he had reasonable grounds for believing that his conduct was lawful. |

Subject to the Act, our

by-laws authorize us to purchase and maintain such insurance for the benefit of any person entitled to be indemnified by the Corporation

pursuant to the immediately preceding section as the board may from time to time determine.

Insofar as indemnification for

liabilities arising under the Securities Act, as amended, may be permitted to such directors, officers and controlling persons pursuant

to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public

policy as expressed in the Securities Act and is, therefore, unenforceable.

| ITEM 7. | EXEMPTION FROM REGISTRATION CLAIMED. |

Not applicable.

See the Exhibit Index.

A. The undersigned

Registrant hereby undertakes:

(1) To file,

during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

| (i) | To include any prospectus required by section 10(a)(3) of the

Securities Act; |

| (ii) | To reflect in the prospectus any facts or events arising after

the effective date of this Registration Statement (or the most recent post-effective amendment hereof) which, individually or in the

aggregate, represent a fundamental change in the information set forth in this Registration Statement; |

| (iii) | To include any material information with respect to the plan

of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration

Statement. |

Provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d)

of the Exchange Act that are incorporated by reference into this Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof.

(3) To remove

from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

B. The undersigned

registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s

annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in this Registration Statement

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of

the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such

indemnification is against public policy as expressed in such Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling

person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the city of Toronto, province of Ontario, Canada, on November 20, 2024.

VISIONARY HOLDINGS INC.

By: /s/ Xiyong Hou

Name: Xiyong Hou

Title: Chief Executive Officer

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE

PRESENTS, that each person whose signature appears below hereby constitutes and appoints Xiyong Hou and Leong Sui, and each of them, as

his true and lawful attorneys-in-fact and agents, with full power of substitution, for him in any and all capacities, to sign the Registration

Statement on Form S-8 of Visionary Holdings Inc., and any or all amendments thereto (including post-effective amendments), and to file

the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting

unto said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary

to be done in connection therewith, as fully for all intents and purposes as he might or could do in person, hereby and about the premises

hereby ratifying and confirming all that said attorneys-in-fact and agent, proxy and agent, or his substitute, may lawfully do or cause

to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the date

indicated.

| Signature |

Title |

Date |

/s/ Xiyong Hou

Name: Xiyong Hou |

Chief Executive Officer

(principal executive officer) |

November 20, 2024 |

/s/ Leong Sui

Name: Leong Sui |

Chief Financial Officer

(principal financial officer and principal accounting officer) |

November 20, 2024 |

/s/ William Chai

Name: William Chai |

Chairman of the Board |

November 20, 2024 |

/s/ Marc Kealey

Name: Marc Kealey |

Director and Vice Chairman of the Board |

November 20, 2024 |

/s/ Charles Fu

Name: Charles Fu |

Director and Senior Vice President |

November 20, 2024 |

/s/ Zhong Chen

Name: Zhong Chen |

Director |

November 20, 2024 |

/s/ Fan Zhou

Name: Fan Zhou |

Director |

November 20, 2024 |

/s/ Simon Tang

Name: Simon Tang |

Director |

November 20, 2024 |

/s/ Wen He

Name: Wen He |

Director |

November 20, 2024 |

/s/ Zongjiang He

Name: Zongjiang He |

Director |

November 20, 2024 |

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of

Section 6(a) of the Securities Act of 1933, the undersigned has signed this Registration Statement on Form S-8, solely in the capacity

of the duly authorized representative of the Registrant in the United States, on this 20th day of November, 2024.

VISIONARY HOLDINGS INC.

By: /s/ Xiyong Hou

Name: Xiyong Hou

Title: Chief Executive Officer

EXHIBITS INDEX

Description

| Exhibit Number |

Description |

Form |

File No. |

Exhibit |

Filing Date |

| 4.1 |

Articles of Incorporation dated August 20, 2013 |

F-1 |

333-263290 |

3.1 |

May 6, 2022 |

| 4.2 |

Articles of Amendment dated March 25, 2021 |

F-1 |

333-263290 |

3.2 |

May 6, 2022 |

| 4.3 |

Articles of Amendment dated January 19, 2022 |

F-1 |

333-263290 |

3.3 |

May 6, 2022 |

| 4.4 |

By-Law No. 1 dated August 20, 2013 |

F-1 |

333-263290 |

3.4 |

May 6, 2022 |

| 4.5 |

By-Law No. 2 dated August 20, 2013 |

F-1 |

333-263290 |

3.5 |

May 6, 2022 |

| 4.6* |

Visionary Holdings Inc. 2024 Restricted Stock Plan |

|

|

|

|

| 4.7* |

Form of Restricted Stock Award |

|

|

|

|

| 5.1* |

Opinion of DC Law Professional Corporation |

|

|

|

|

| 23.1* |

Consent of YCM CPA Inc. |

|

|

|

|

| 23.2* |

Consent of DC Law Professional Corporation (incorporated by reference to Exhibit 5.1) |

|

|

|

|

| 24.1* |

Power of Attorney (contained on signature page hereto) |

|

|

|

|

| 107.1* |

Calculation of Filing Fees Table |

|

|

|

|

* Filed herewith.

Exhibit 4.6

VISIONARY

HOLDINGS INC. 2024 RESTRICTED STOCK PLAN

Adopted

November 11, 2024

1. Purpose.

The purpose

of the Visionary Holdings Inc., f/k/a Visionary Technology Holdings Group Inc., (the “Company”) 2024 Restricted Stock Plan

(the “Plan”) is to advance the interests of the Company and its shareholders by providing the means to attract, retain, and

motivate Service Providers (as defined below) of the Company and its subsidiaries and affiliates upon whose judgment, initiative and

efforts the continued success, growth and development of the Company is dependent.

2. Definitions.

For purposes

of the Plan, the following terms shall be defined as set forth below:

(a) “Affiliate”

means any entity other than the Company and its Subsidiaries that is designated by the Board or the Committee as a participating employer

under the Plan; provided, however, that the Company directly or indirectly owns at least 20% of the combined voting power of all classes

of equity interests of such entity or at least 20% of the ownership interests in such entity.

(b) “Applicable

Laws” means the requirements related to or implicated by the administration of the Plan under applicable state corporate laws,

United States federal and state securities laws, the Code, any stock exchange or quotation system on which the Shares are listed or quoted,

and the applicable laws of any foreign country or jurisdiction where Awards are granted.

(c) “Award”

means any Restricted Share or Restricted Stock Unit granted to a Service Provider under the Plan.

(d) “Award

Agreement” means any written agreement, contract, or other instrument or document evidencing an Award.

(e) “Board”

means the Board of Directors of the Company.

(f) “Consultant”

means any natural person, including an advisor, engaged by the Company or a Parent or Subsidiary of the Company to render bona fide services

to such entity, provided the services (i) are not in connection with the offer or sale of securities in a capital-raising transaction,

and (ii) do not directly or indirectly promote or maintain a market for the Company's securities. For the purposes of this Plan, a Consultant

shall not be considered an Employee or Director of the Company, but their services must contribute to the success or development of the

business.

(g) “Code”

means the Internal Revenue Code of 1986, as amended from time to time. References to any provision of the Code shall be deemed to include

successor provisions thereto and regulations thereunder.

(h) “Committee”

means the Compensation Committee of the Board, or such other Board committee (which may include the entire Board) as may be designated

by the Board to administer the Plan; provided, however, that, unless otherwise determined by the Board, the Committee shall consist of

two or more directors of the Company, each of whom is a “non-employee director” within the meaning of Rule 16b-3

under the

Exchange Act; provided further, however, that the mere fact that the Committee shall fail to qualify under either of the foregoing requirements

shall not invalidate any Award made by the Committee which Award is otherwise validly made under the Plan.

(i) “Company”

means Visionary Holdings Inc., or any successor corporation.

(j) “Director”

means a member of the Board.

(k) “Employee”

means any person, including Officers and Directors, employed by the Company or any Parent or Subsidiary of the Company. Neither service

as a Director nor payment of a director’s fee by the Company will be sufficient to constitute “employment” by the Company.

(l) “Exchange

Act” means the Securities Exchange Act of 1934, as amended from time to time. References to any provision of the Exchange Act shall

be deemed to include successor provisions thereto and regulations thereunder.

(m) “Fair

Market Value” means, with respect to Shares or other property, the fair market value of such Shares or other property determined

by such methods or procedures as shall be established from time to time by the Committee. If the Shares are listed on any established

stock exchange or a national market system, unless otherwise determined by the Committee in good faith, the Fair Market Value of Shares

shall mean the closing price per Share on the date in question (or, if the Shares were not traded on that day, the next preceding day

that the Shares were traded) on the principal exchange or market system on which the Shares are traded, as such prices are officially

quoted on such exchange.

(n) “Non-Employee

Director” will have the meaning set forth in Rule 16b-3(b)(3)(i) promulgated by the Securities and Exchange Commission under the

Exchange Act, or any successor definition adopted by the Securities and Exchange Commission.

(o) “Parent”

means a “parent corporation,” whether now or hereafter existing, as defined in Code Section 424(e).

(p) “Participant”

means the holder who has been granted an Award under the Plan.

(q) “Plan”

means this 2024 Restricted Stock Plan, as amended from time to time.

(r) “Restricted

Shares” means an Award of Shares under Section 5 thereof that may be subject to certain restrictions and to a risk of forfeiture.

(s) “Restricted

Stock Units” means an Award of Restricted Stock Units under Section 5 hereof, which represent the right to receive Shares or cash

or a combination thereof upon settlement of the Award, subject to the specific terms and conditions of the Award as set forth in the

Award Agreement.

(t) “Rule

16b-3” means Rule 16b-3, as from time to time in effect and applicable to the Plan and Participants, promulgated by the Securities

and Exchange Commission under Section 16 of the Exchange Act.

(u) “Service

Provider” means an Employee, Director or Consultant.

(v) “Shares”

means common shares, no par value, of the Company.

(w) “Subsidiary”

means any entity (other than the Company) in an unbroken chain of entities beginning with the Company if each of the entities (other

than the last entity in the unbroken chain) owns shares

possessing

50% or more of the total combined voting power of all classes of equity interests in one of the other entities in the chain.

3. Administration.

(a) Authority

of the Committee. The Plan shall be administered by the Committee; provided that, notwithstanding anything to the contrary herein, in

its sole discretion, the Board may at any time and from time to time exercise any and all rights and duties of the Committee under the

Plan except with respect to matters which under Applicable Law are required to be determined in the sole discretion of the Committee.

The Committee shall have full and final authority to take the following actions, in each case subject to and consistent with the provisions

of the Plan:

| (i) | to select Service Providers to whom Awards may be granted; |

| (ii) | to designate Affiliates; |

| (iii) | to determine the number of Awards to be granted, the number of

Shares to which an Award may relate, the terms and conditions of any Award granted under the Plan (including, but not limited to, any

restriction or condition, any schedule for lapse of restrictions or conditions relating to transferability or forfeiture, and waiver

or accelerations thereof, and waivers of performance conditions relating to an Award, based in each case on such considerations as the

Committee shall determine), and all other matters to be determined in connection with an Award; |

| (iv) | to determine whether, to what extent, and under what circumstances

an Award may be settled in cash, Shares, other Awards, or other property, or an Award may be canceled, forfeited, exchanged, or surrendered; |

| (v) | to determine whether, to what extent, and under what circumstances

cash, Shares, other Awards, or other property payable with respect to an Award will be deferred either automatically, at the election

of the Committee or at the election of the Participant; |

| (vi) | to prescribe the form of each Award Agreement, which need not

be identical for each Participant; |

| (vii) | to adopt, amend, suspend, waive, and rescind such rules and regulations

and appoint such agents as the Committee may deem necessary or advisable to administer the Plan; |

| (viii) | to correct any defect or supply any omission or reconcile any

inconsistency in the Plan and to construe and interpret the Plan and any Award, rules and regulations, Award Agreement or other instrument

hereunder; |

| (ix) | to accelerate the vesting of all or any portion of any Award; |

| (x) | to determine whether uncertificated Shares may be used in satisfying

Awards and otherwise in connection with the Plan; and |

| (xi) | to make all other decisions and determinations as may be required

under the terms of the Plan or as the Committee may deem necessary or advisable for the administration of the Plan. |

(b) Manner

of Exercise of Committee Authority. The Committee shall have sole discretion in exercising its authority under the Plan. Any action of

the Committee with respect to the Plan shall be final, conclusive, and binding on all persons, including the Company, Subsidiaries, Affiliates,

Service Providers, Participants, any person claiming any rights under the Plan from or through any Participant and shareholders of any

of the foregoing. The express grant of any specific power to the Committee, and the taking of any action by the Committee, shall not

be construed as limiting any power or authority of the Committee. The Committee may delegate to other members of the Board or officers

or managers of the Company or any Subsidiary or Affiliate the authority, subject to such terms as the Committee shall determine, to perform

administrative functions with respect to the Plan.

(c) Limitation

of Liability. Each member of the Committee shall be entitled to, in good faith, rely or act upon any report or other information furnished

to him or her by any officer or other employee of the Company or any Subsidiary or Affiliate, the Company’s independent certified

public accountants or other professional retained by the Company to assist in the administration of the Plan. No member of the Committee,

and no officer or employee of the Company acting on behalf of the Committee, shall be personally liable for any action, determination,

or interpretation taken or made in good faith with respect to the Plan, and all members of the Committee and any officer or employee

of the Company acting on their behalf shall, to the extent permitted by law, be fully indemnified and protected by the Company with respect

to any such action, determination or interpretation.

4. Shares

Subject to the Plan.

(a) Shares

Subject to the Plan. Subject to adjustment pursuant to Section 4(b) hereof, as of the Effective Date, the maximum number of Shares reserved

for issuance under the Plan shall be Six Hundred Twenty Thousand (620,000) Shares (the “Share Limit”).

No Award

may be granted if the number of Shares to which such Award relates, when added to the number of Shares previously issued under the Plan

exceeds the Share Limit. If any Awards are forfeited, canceled, terminated, exchanged or surrendered, or such Award is settled in cash

or otherwise terminates without a distribution of Shares to the Participant, any Shares counted against the number of Shares reserved

and available under the Plan with respect to such Award shall, to the extent of any such forfeiture, settlement, termination, cancellation,

exchange or surrender, again be available for Awards under the Plan.

(b) Adjustments.

In the event that the Committee shall determine that any dividend in Shares, recapitalization, Share split, reverse split, reorganization,

merger, consolidation, spin-off, combination, repurchase or share exchange, or other similar corporate transaction or event, affects

the Shares such that an adjustment is appropriate in order to prevent dilution or enlargement of the rights of the Participants under

the Plan, then the Committee shall make such equitable changes or adjustments as it deems appropriate and, in such manner as it may deem

equitable, adjust any or all of (i) the number and kind of shares which may thereafter be issued under the Plan, and (ii) the number

and kind of shares, other securities or other consideration issued or issuable in respect of outstanding Awards. In addition, the Committee

is authorized to make adjustments in the terms and conditions of, and the criteria and performance objectives, if any, included in, Awards

in recognition of unusual or non-recurring events (including, without limitation, events described in the preceding sentence) affecting

the Company or any Subsidiary or Affiliate or the financial statements of the Company or any Subsidiary or Affiliate, or in response

to changes in Applicable Laws, regulations, or accounting principles.

(c) Available

Shares. Any Shares distributed pursuant to an Award may consist, in whole or in part, of authorized and unissued Shares or treasury Shares

including Shares acquired by purchase in the open market or in private transactions.

5. Specific

Terms of Awards.

(a) General.

Awards may be granted on the terms and conditions set forth in this Section 5. In addition, the Committee may impose on any Award, at

the date of grant or thereafter (subject to Section 7(d) hereof), such additional terms and conditions, not inconsistent with the provisions

of the Plan, as the Committee shall determine.

(b) Restricted

Shares. The Committee is authorized to grant Restricted Shares to Service Providers on the following terms and conditions:

| (i) | Issuance and Restrictions. Restricted Shares shall be subject

to such restrictions on transferability and other restrictions, if any, as the Committee may impose at the date of grant or thereafter,

which restrictions may lapse separately or in combination at such times, under such circumstances (including, without limitation, upon

achievement of performance criteria if deemed appropriate by the Committee), in such installments or otherwise, as the Committee may

determine. Except to the extent restricted under the Award Agreement relating to the Restricted Shares, a Service Provider granted Restricted

Shares shall have all of the rights of a shareholder including, without limitation, the right to vote Restricted Shares and the right

to receive dividends thereon. |

| (ii) | Forfeiture. Except as otherwise determined by the Committee,

at the date of grant or thereafter, upon termination of service during the applicable restriction period, Restricted Shares and any accrued

but unpaid dividends that are at that time subject to restrictions shall be forfeited; provided, however, that the Committee may provide,

by rule or regulation or in any Award Agreement, or may determine in any individual case, that restrictions or forfeiture conditions

relating to Restricted Shares will be waived in whole or in part in the event of terminations resulting from specified causes, and the

Committee may in other cases waive in whole or in part the forfeiture of Restricted Shares. |

| (iii) | Certificates for Shares. Restricted Shares granted under the

Plan may be evidenced in such manner as the Committee shall determine. If certificates representing Restricted Shares are registered

in the name of the Service Provider, such certificates shall bear an appropriate legend referring to the terms, conditions, and restrictions

applicable to such Restricted Shares, and the Company shall retain physical possession of the certificate. |

| (iv) | Dividends. Dividends paid on Restricted Shares shall be either

paid at the dividend payment date, or deferred for payment to such date as determined by the Committee, in cash or in unrestricted Shares

having a Fair Market Value equal to the amount of such dividends. Shares distributed in connection with a Share split or dividend in

Shares, and other property distributed as a dividend, shall be subject to restrictions and a risk of forfeiture to the same extent as

the Restricted Shares with respect to which such Shares or other property has been distributed. |

(c) Restricted

Stock Units. The Committee is authorized to grant Restricted Stock Units to Service Providers on the following terms and conditions:

| (i) | Nature of Restricted Stock Units; Accounts. Each Restricted Stock

Unit awarded shall represent a right for one Share to be delivered upon settlement of the Award, which right shall be subject to a risk

of forfeiture and cancellation and to the other terms and conditions set forth in the Plan and the Award Agreement. The Company shall

establish and maintain a Participant account to record Restricted Stock Units and transactions and events affecting such units. Restricted

Stock Units and other items reflected in the account will represent only bookkeeping entries by the Company to evidence unfunded obligations

of the Company. |

| (ii) | Forfeiture and Vesting. A Restricted Stock Unit Award Agreement

may provide for forfeiture and cancellation of the Restricted Stock Units upon termination of the Participant’s employment with

the Company or nonperformance of specified performance measures established by the Committee. A Restricted Stock Unit Award Agreement

may also provide for vesting periods which require the passage of time and/or the occurrence of events in order for the Restricted Stock

Units to vest and become no longer subject to forfeiture. |

| (iii) | Settlement and Certificates for Shares. Restricted Stock Units

(if not previously cancelled or forfeited) shall be settled on the date or dates set forth in the Award Agreement. Settlement of a Restricted

Stock Unit Award shall be made in accordance with the terms and conditions of the applicable Award Agreement. A Restricted Stock Unit

Award Agreement may provide that settlement may be made (A) solely through the issuance of Shares or (B) at the mutual election of the

Participant and the Company, in a combination of Shares and cash. Upon the settlement of a Restricted Stock Unit Award, the Company may

deliver to the Participant a certificate for the number of Shares issued to the Participant in settlement of the Award. |

| (iv) | Dividend Equivalents. Restricted Stock Units shall not be credited

with Dividend Equivalents unless specifically provided for in the Award Agreement, and then only upon such terms and conditions as set

forth in the Award Agreement. For purposes of this provision, the term “Dividend Equivalent” means a right with respect to

a Restricted Stock Unit to receive cash, Shares or other property equal in value and form to dividends declared by the Board and paid

with respect to outstanding Shares. Dividend Equivalents shall not apply to a Restricted Stock Unit Award unless specifically provided

for in the Award Agreement, and if specifically provided for in the Award Agreement shall be subject to such terms and conditions set

forth in the Award Agreement as the Committee shall determine. |

6. Certain

Provisions Applicable to Awards.

(a) Stand-Alone,

Additional, Tandem and Substitute Awards. Awards granted under the Plan may, in the discretion of the Committee, be granted to Service

Providers either alone or in addition to, in tandem with, or in exchange or substitution for, any other Award granted under the Plan

or any award granted under any other plan or agreement of the Company, any Subsidiary or Affiliate, or any business entity to be acquired

by the Company or a Subsidiary or Affiliate, or any other right of an Service Provider to receive payment from the Company or any Subsidiary

or Affiliate. Awards may be granted in addition to or in tandem with such other Awards or awards, and may be granted either as of the

same time as or a different time from the grant of such other Awards or awards.

(b) Form

of Payment Under Awards. Subject to the terms of the Plan and any applicable Award Agreement, payments to be made by the Company or a

Subsidiary or Affiliate upon the grant or maturation of an Award may be made in such forms as the Committee shall determine at the date

of grant or thereafter, including, without limitation, cash, Shares, notes, or other property, and may be made in a single payment or

transfer, in installments, or on a deferred basis. The Committee may make rules relating to installment or deferred payments with respect

to Awards, including the rate of interest to be credited with respect to such payments, and the Committee may require deferral of payment

under an Award if, in the sole judgment of the Committee, it may be necessary in order to avoid non-deductibility of the payment under

Section 162(m) of the Code.

(c) Non-transferability.

Unless otherwise set forth by the Committee in an Award Agreement, Awards shall not be transferable by a Participant except by will or

the laws of descent and distribution. A Participant’s rights under the Plan may not be pledged, mortgaged, hypothecated, or otherwise

encumbered, and shall not be subject to claims of the Participant’s creditors.

(d) Annual

Compensation Limitations for Non-Employee Directors. Beginning with the calendar year following the year in which the Effective Date

occurs, the aggregate amount of equity and cash compensation (collectively “Compensation”) payable to a Non-Employee Director

with respect to a calendar year, whether under the Plan or otherwise, for services as a Non-Employee Director, shall not exceed $750,000;

provided however, that such amount shall be $1,000,000 for the calendar year in which the applicable Non-Employee Director is initially

elected or appointed to the Board (collectively, the “Director Limit”). Equity incentive awards shall be counted towards

the Director Limit in the year in which they are granted, based on the grant date fair value of such awards for financial reporting purposes

(but excluding the impact of estimated forfeitures related to service-based vesting provisions). Cash fees shall be counted towards the

Director Limit in the year for which they are reported as compensation in the Company’s director compensation disclosures pursuant

to Item 402 of Regulation S-K under the US Securities Act of 1933, or a successor provision. The Director Limit shall not apply to (i)

Compensation earned by a Non-Employee Director solely in his or her capacity as chairman of the Board or lead independent director; (ii)

Compensation earned with respect to services a Non-Employee Director provides in a capacity other than as a Non-Employee Director, such

as an advisor or consultant to the Company; and (iii) Compensation awarded by the Board to a Non-Employee Director in extraordinary circumstances,

as determined by the Board in its discretion, in each case provided that the Non-Employee Director receiving such additional Compensation

does not participate in the decision to award such Compensation.

7. General

Provisions.

(a) Compliance

with Legal and Trading Requirements. The Plan, the granting and exercising of Awards thereunder, and the other obligations of the Company

under the Plan and any Award Agreement, shall be subject to all applicable federal, state and foreign laws, rules and regulations, and

to such approvals by any regulatory or governmental agency as may be required. The Company, in its discretion, may postpone the issuance

or delivery of Shares under any Award until completion of such stock exchange or market system listing or registration or qualification

of such Shares or other required action under any state or federal law, rule or regulation as the Company may consider appropriate, and

may require any Participant to make such representations and furnish such information as it may consider appropriate in connection with

the issuance or delivery of Shares in compliance with Applicable Laws, rules and regulations. No provisions of the Plan shall be interpreted

or construed to obligate the Company to register any Shares under federal, state or foreign law. The Shares issued under the Plan may

be subject to such other restrictions on transfer as determined by the Committee.

(b) No Right

to Continued Employment or Service. Neither the Plan nor any action taken thereunder shall be construed as giving any employee the right

to be retained in the employ of the Company or any of its Subsidiaries or Affiliates, nor shall it interfere in any way with the right

of the Company or any of its Subsidiaries or Affiliates to terminate any employee’s employment at any time.

(c) Taxes.

No later than the date as of which an amount first becomes includible in the gross income of the Participant for applicable federal,

state, local and foreign income tax purposes with respect to any Award under the Plan, the Participant will pay to the Company, or make

arrangements satisfactory to the

Company

regarding the payment of, any federal, state, local or foreign taxes of any kind required by law to be withheld with respect to such

amount. To the extent authorized by the Committee, the required tax withholding may be satisfied by the withholding of Shares subject

to the Award based on the Fair Market Value on the date of withholding, but in any case not in excess of the amount determined based

on the maximum statutory tax rate in the applicable jurisdiction. The obligations of the Company under the Plan will be conditioned on

such payment or arrangements and the Company will have the right to deduct any such taxes from any payment of any kind otherwise due

to the Participant.

(d) Changes

to the Plan and Awards. Except as otherwise set forth in this Section 7(d), the Board or the Committee may amend, alter, suspend, discontinue

or terminate the Plan at any time; provided, however, that no amendment will be effective unless approved by the Company’s

shareholders to the extent shareholder approval is necessary to satisfy any Applicable Laws. However, no such amendment, alteration,

suspension, discontinuation, or termination of the Plan or any Award may materially and adversely affect the rights of any Participant

under any previously granted Award without the Participant’s consent. The Board or the Committee retains the authority to waive

conditions, amend terms, or otherwise alter any Award granted, whether prospectively or retrospectively, provided that such changes do

not materially and adversely affect the rights of the affected Participant without their consent.

(e) No Rights

to Awards; No Shareholder Rights. No Service Providers shall have any claim to be granted any Award under the Plan, and there is no obligation

for uniformity of treatment of Service Providers. No Award shall confer on any Service Provider any of the rights of a shareholder of

the Company unless and until Shares are duly issued or transferred to the Service Provider in accordance with the terms of the Award.

(f) Unfunded

Status of Awards. With respect to any payments not yet made to a Participant pursuant to an Award, nothing contained in the Plan or any

Award shall give any such Participant any rights that are greater than those of a general creditor of the Company; provided, however,

that the Committee may authorize the creation of trusts or make other arrangements to meet the Company’s obligations under the

Plan to deliver cash, Shares, other Awards, or other property pursuant to any Award, which trusts or other arrangements shall be consistent

with the “unfunded” status of the Plan unless the Committee otherwise determines with the consent of each affected Participant.

(g) Non-exclusivity

of the Plan. Neither the adoption of the Plan by the Board nor its submission to the shareholders of the Company for approval shall be

construed as creating any limitations on the power of the Board to adopt such other incentive arrangements as it may deem desirable,

and such arrangements may be either applicable generally or only in specific cases.

(h) Not

Compensation for Benefit Plans. No Award payable under this Plan shall be deemed salary or compensation for the purpose of computing

benefits under any benefit plan or other arrangement of the Company for the benefit of its employees unless the Company shall determine

otherwise.

(i) No Fractional

Shares. Unless otherwise determined by the Committee, no fractional Shares shall be issued or delivered pursuant to the Plan or any Award.

The Committee shall determine whether cash, other Awards, or other property shall be issued or paid in lieu of such fractional Shares

or whether such fractional Shares or any rights thereto shall be forfeited or otherwise eliminated.

(j) Governing

Law. The validity, construction, and effect of the Plan, any rules and regulations relating to the Plan, and any Award Agreement shall

be determined in accordance with the laws of the Province of Ontario, Canada, and the laws of Canada as applicable therein without giving

effect to principles of conflict of laws thereof.

(k) Effective

Date; Plan Termination. The Plan shall become effective as of November 11, 2024. The Plan shall terminate as to future Awards on November

10, 2034, which is ten (10) years after the date that the Board of Directors of the Company approved this provision, as amended.

(l) Titles

and Headings. The titles and headings of the Sections in the Plan are for convenience of reference only. In the event of any conflict,

the text of the Plan, rather than such titles or headings, shall control.

SIGNATURE PAGE FOLLOWS

DATED THIS

11th day of November, 2024

VISIONARY

HOLDINGS INC.

By: /s/

Xiyong Hou

Xiyong Hou,

Chief Executive Officer

Exhibit

4.7

VISIONARY

HOLDINGS INC.

RESTRICTED

STOCK GRANT NOTICE

VISIONARY HOLDINGS

INC. (together with any successor thereof, the “Company”), pursuant to the Company’s 2024 Restricted Stock

Plan (the “Plan”), hereby grants to the holder listed below (“Participant”), the number of

shares of the Company’s common shares, no par value, set forth below (individually and collectively referred to as the “Restricted

Shares”). The Restricted Shares are subject to all of the terms and conditions set forth herein and in the Restricted Stock

Award Agreement attached hereto as Exhibit A (the “Restricted Stock Agreement”) and the Plan, each of which

are incorporated herein by reference. Unless otherwise defined herein, the terms defined in the Plan shall have the same defined meanings

in this Grant Notice and the Restricted Stock Agreement.

Participant: Grant Date:

Total Number of Restricted Shares:

| Period of Restrictions: |

____% of the Restricted Shares shall vest on ______, 20__. |

As a condition to the grant

of the Restricted Shares, Participant represents and warrants that Participant is purchasing the Restricted Shares solely for investment

purposes and not with an intention to transfer, sell or otherwise dispose of such Restricted Shares, except as permitted pursuant to the

Plan and in compliance with applicable securities laws. Participant also acknowledges that Participant understands that the Restricted

Shares are subject to the transfer restrictions under the Plan and the Restricted Stock Agreement. Each certificate evidencing Restricted

Shares issued to the Participant hereunder shall bear a legend in substantially the following form:

THE OFFER

AND SALE OF THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (THE “ACT”) AND MAY

NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED UNLESS AND UNTIL REGISTERED UNDER THE ACT OR, IN THE OPINION OF

COUNSEL SATISFACTORY TO THE ISSUER OF THESE SECURITIES, SUCH OFFER, SALE OR TRANSFER, PLEDGE OR HYPOTHECATION OTHERWISE COMPLIES WITH

THE ACT.

By signing below,

Participant agrees to be bound by the terms and conditions of the Plan, the Restricted Stock Agreement and this Grant Notice. Participant

has reviewed the Restricted Stock Agreement, the Plan and this Grant Notice in their entirety, has had an opportunity to obtain the advice

of counsel prior to executing this Grant Notice and fully understands all provisions of this Grant Notice, the Restricted Stock Agreement

and the Plan. Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Committee

or the Board upon any questions arising under the Plan, this Grant Notice or the Restricted Stock Agreement.

IN WITNESS WHERE,

the undersigned have executed this Grant Notice effective as of the Grant Date:

| Participant |

|

Company |

| |

|

Visionary Holdings Inc. |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| Name: |

|

, Chief Executive Officer |

EXHIBIT

A

THE SECURITIES REPRESENTED

BY THIS RESTRICTED STOCK AWARD AGREEMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES

LAWS. THESE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, PLEDGED, HYPOTHECATED OR OTHERWISE TRANSFERRED AT ANY TIME WITHOUT THE COMPANY’S

PRIOR WRITTEN CONSENT WHICH MAY BE GRANTED OR WITHHELD IN THE COMPANY’S SOLE DISCRETION, UNLESS A REGISTRATION STATEMENT IS IN EFFECT

WITH RESPECT THERETO UNDER SECURITIES ACT OF 1933 AND, IN ANY EVENT, IN COMPLIANCE WITH ANY AND ALL REASONABLE REQUIREMENTS IMPOSED BY

THE COMPANY AND PURSUANT TO SECURITIES ACT OF 1933 AND ALL APPLICABLE STATE SECURITIES LAWS.

RESTRICTED

STOCK AWARD

Pursuant to the Restricted

Stock Grant Notice (the “Grant Notice”) to which this Restricted Stock Agreement (this “Agreement”) is attached,

Visionary Holdings Inc. (together with any successor thereof, the “Company”), has granted to Participant restricted shares

of the Company’s common shares, no par value (the “Restricted Shares”) under the Company’s 2024 Restricted Stock

Plan (the “Plan”) as indicated in the Grant Notice.

1.

General.

1.1

Defined Terms. Capitalized terms not specifically defined herein shall have the meanings specified in the Plan and the Grant

Notice, unless the context clearly indicates otherwise.

1.2

Incorporation of Terms of Plan. The Restricted Shares are subject to the terms and conditions of the Plan which are

incorporated herein by reference. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan shall control.

2.

Grant of Restricted Shares.

2.1

Grant of Restricted Shares. In consideration of Participant’s employment with or service to the Company or a Subsidiary

and for other good and valuable consideration, effective as of the Grant Date set forth in the Grant Notice (the “Grant Date”),

the Company grants to Participant the Restricted Shares, upon the terms and conditions set forth in the Plan and this Agreement, subject

to adjustments as provided in Section 15 of the Plan.

2.2

Consideration to the Company. In consideration of the grant of the Restricted Shares by the Company, Participant

agrees to render faithful and efficient services to the Company or any Subsidiary. Nothing in the Plan or this Agreement shall confer

upon Participant any right to continue in the employ or service of the Company or any Subsidiary or shall interfere with or restrict in

any way the rights of the Company and its Subsidiaries, which rights are hereby expressly reserved, to discharge or terminate the services

of Participant at any time for any reason whatsoever, with or without cause, except to the extent expressly provided otherwise in a written

agreement between the Company or a Subsidiary and Participant.

3. Restrictions.

Unless and until the Restricted Shares vest, Participant shall have no right to sell, assign, transfer, pledge or otherwise encumber

Restricted Shares in any manner. Any purported attempt to sell, assign, transfer, pledge or otherwise encumber any Restricted Shares

under this Agreement shall be void and shall result in the forfeiture and cancellation of such Restricted Shares. Upon Participant’s

Termination of Services, any Restricted Shares that are unvested as of the date of such Termination of Service (and whose vesting is

not accelerated pursuant to Section 15(c) of Plan in the event of a Change of Control) shall be forfeited, and Participant shall have

no further rights with respect to such Restricted Shares under this Agreement or otherwise.

4.

Delivery of Shares. The Restricted Shares shall be registered in book entry in the name of Participant and

shall not be transferred to Participant until the Restricted Shares have vested in accordance with this Agreement. Participant acknowledges

that prior to the vesting of the Restricted Shares, the certificates representing the Restricted Shares may be stamped with a legend indicating

the possibility of cancellation and the restrictions on transfer. Upon vesting of any of the Restricted Shares, such Restricted Shares

shall be transferred or delivered to Participant as soon as practicable thereafter. Upon such transfer or delivery to Participant, the

vested Restricted Shares will not be subject to any restrictions other than those that may arise under the securities laws or the Company’s

policies.

5.

Tax Withholding. The vesting of the Restricted Shares under this Agreement will result in Participant’s recognition

of income for U.S. and federal tax purposes (and/or foreign tax purposes, if applicable) and shall be subject to tax and tax withholdings

as appropriate. The Company or any Subsidiary shall have the authority and the right to deduct or withhold, or require Participant to

remit to the Company, an amount sufficient to satisfy federal, state, local and foreign taxes (including Participant’s FICA or employment

tax obligations) required by law to be withheld with respect to the vesting of the Restricted Shares. The Committee or the Board may,

in its sole discretion and in satisfaction of the foregoing requirement, withhold, or allow Participant to elect to have the Company withhold,

Shares otherwise issuable upon the vesting of any of the Restricted Shares (or allow the surrender of Shares). The number of Shares so

withheld or surrendered shall be limited to the number of Shares that have a Fair Market Value on the date of withholding or repurchase

no greater than the aggregate amount of such liabilities based on the minimum statutory withholding rates for federal, state, local and

foreign income tax and payroll tax purposes that are applicable to supplemental taxable income.

Participant agrees to

consult with any tax advisors that Participant thinks necessary in connection with its receipt of the Restricted Shares and Participant

acknowledges that it is not relying, and will not rely, on the Company or any of its affiliates for any tax advice.

6.

Section 83(b) Election. If Participant makes an election under Section 83(b) of the Code to be taxed with

respect to the Restricted Shares as of the date of transfer of the Restricted Shares rather than as of the date or dates upon which Participant

would otherwise be taxable under Section 83 of the Code, Participant shall be required to deliver a copy of such election to the Company

promptly after filing such election with the Internal Revenue Service.

7.

Rights as Stockholder. Upon issuance of the Restricted Shares and until the forfeiture or cancellation of

the Restricted Shares, Participant shall have, unless otherwise provided by the Committee, all of the rights of a stockholder with respect

to the Restricted Shares, subject to the transferability and other restrictions set forth in this Agreement, including the right to receive

all dividends and other distributions paid or made with respect to the Shares; provided, however, that, in the sole discretion

of the Committee or the Board, the Committee or the Board may provide that any extraordinary distributions with respect to the Shares

received by Participant in the form of Shares shall be subject to the same vesting and other restrictions as the Restricted Shares to

which they relate.

8.

Lock-Up.

8.1

One Year Prohibition on Sales or Transfers. The Participant, including the Participant’s Affiliated Entities (as defined

below), hereby agrees that for a period of one year from the Effective Date (the “Lock-Up Period”), the Participant will not

offer, sell, contract to sell, pledge, give, donate, transfer or otherwise dispose of, directly or indirectly, any common shares, no par

value, of the Restricted Shares issued to the Agreement (the “Lock-Up Shares”), enter into a transaction which would have

the same effect, or enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic or voting

consequences of ownership of such securities, whether any such aforementioned transaction is to be settled by delivery of the Lock-Up

Shares or such other securities, in cash or otherwise, or publicly disclose the intention to make any such offer, sale, pledge or disposition,

or to enter into any such transaction, swap, hedge or other arrangement (the “Lock-Up Agreement”). As used in this Agreement

“Affiliated Entities” shall mean any legal entity, including any corporation, limited liability company, partnership, not-forprofit

corporation, estate planning vehicle or trust, which is directly or indirectly owned or controlled by the Participant or his or her descendants

or spouse, of which such Participant or his or her descendants or spouse are beneficial owners, or which is under joint control or ownership

with any other person or entity subject to a lock-up agreement regarding the Company’s stock with terms substantially identical

to this Lock-Up Agreement.

8.2

Allowable Sales During Lock-Up Period and Thereafter. Notwithstanding the terms of Section 8.1 above, during

the Lock-Up Period the Participant may:

(a)

Transfer Lock-Up Shares to the Company or its designee.

(b)

Make a bona fide charitable donation to a non-profit, religious organization or institution that is independent of the Participant

(a “Charitable Donee”).

(c)

Transfer Lock-Up Shares to one of the Participant’s Affiliated Entities, so long as such Participant’s Affiliated Entity

agrees in an additional written instrument delivered to the Company to be subject to the terms and conditions of this Lock-Up Agreement.

(d)

Transfers by bona fide gift to a member of the Participant’s immediate family or to a trust, the beneficiary of which is

the Participant or a member of the Participant’s immediate family, so long as such assignee and/or donee agrees in an additional

written instrument delivered to the Company to be subject to the terms and conditions of this Lock-Up Agreement.

(e)

By virtue of the laws of descent and distribution upon death of the Participant.

(f)

by operation of law or pursuant to a court order, such as a qualified domestic relations order, divorce decree or separation agreement.

8.3

Attempted Transfers. Any attempted or purported sale or other transfer of any Lock-Up Shares by the Participant in

violation or contravention of the terms of this Lock-Up Agreement shall be null and void ab initio. The Company shall, and shall instruct

its transfer agent to, reject and refuse to transfer on its books any Lock-Up Shares that may have been attempted to be sold or otherwise

transferred in violation or contravention of any of the provisions of this Agreement and shall not recognize any person or entity

8.4

Acknowledgement of Representation. The Participant has reviewed this Lock-Up Agreement and was given the opportunity

to review this Lock-Up Agreement with his, her or its legal counsel and other advisors and understands the terms and conditions hereof.

8.5

Legends on Certificates. All Lock-Up Shares now or hereafter owned by the Participant, shall be subject to the provisions

of this Lock-Up Agreement and the certificates representing such Lock-Up Shares shall bear the following legend:

THE SALE, ASSIGNMENT, GIFT,

BEQUEST, TRANSFER, DISTRIBUTION, PLEDGE, HYPOTHECATION OR OTHER ENCUMBRANCE OR DISPOSITION OF THE SHARES REPRESENTED BY THIS CERTIFICATE

IS RESTRICTED BY AND MAY BE MADE ONLY IN ACCORDANCE WITH THE TERMS OF A LOCK-UP AGREEMENT, A COPY OF WHICH MAY BE EXAMINED AT THE OFFICE

OF THE CORPORATION.

9.

Other Provisions.

9.1

Notices. Any notice to be given under the terms of this Agreement to the Company shall be addressed to the Company in care

of the Secretary of the Company (or any other person or entity as designated by the Committee) at the Company’s principal office,

and any notice to be given to Participant shall be addressed to Participant at Participant’s last address reflected on the Company’s

records. By a notice given pursuant to this Section 8.1, either party may hereafter designate a different address for notices to be given

to that party. A notice shall be deemed duly given when sent via email or when sent by certified mail (return receipt requested) and deposited

(with postage prepaid) in a post office or branch post office regularly maintained by the United States Postal Service.

9.2

Titles and Headings. Titles are provided herein for convenience only and are not to serve as a basis for interpretation

or construction of this Agreement.

9.3

Governing Law. The laws of the Province of Ontario, Canada, and the laws of Canada as applicable, shall govern the

interpretation, validity, administration, enforcement and performance of the terms of this Agreement.

9.4

Conformity to Laws. Participant acknowledges that the Plan and this Agreement are intended to conform to the extent

necessary with all provisions of the Securities Act of 1933, as amended, the Exchange Act and the Code, and any and all regulations and

rules promulgated thereunder, state securities laws and regulations and all other applicable law. Notwithstanding anything herein to the

contrary, the Plan shall be administered, and the Restricted Shares are granted and shall be administered only in such a manner as to

conform to such laws, rules and regulations. To the extent permitted by Applicable Law, the Plan and this Agreement shall be deemed amended

to the extent necessary to conform to such laws, rules and regulations.

9.5

Amendments, Suspension and Termination. To the extent permitted by the Plan, this Agreement may be wholly

or partially amended or otherwise modified, suspended or terminated at any time or from time to time by the Committee or the Board; provided,

that except as may otherwise be provided by the Plan, no amendment, modification, suspension or termination of this Agreement shall adversely

affect the Restricted Shares in any material way without the prior written consent of Participant.

9.6

Successors and Assigns. The Company may assign any of its rights under this Agreement to single or multiple assignees,

and this Agreement shall inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer herein

set forth in Section 3.2 hereof, this Agreement shall be binding upon Participant and his or her heirs, executors, administrators, successors

and assigns.

9.7

Not a Contract of Employment. Nothing in this Agreement or in the Plan shall confer upon Participant any right

to continue to serve as an employee or other service provider of the Company or any of its Subsidiaries.

9.8

Entire Agreement. The Plan, the Grant Notice and this Agreement (including all Exhibits thereto) constitute the entire

agreement of the parties and supersede in their entirety all prior undertakings and agreements of the Company and Participant with respect

to the subject matter hereof.

SHAREHOLDER’S SPOUSE

(as applicable):

The undersigned spouse of

the Shareholder has read and hereby approves the Lock-Up Agreement and agrees to be irrevocably bound by the Lock-Up Agreement and further

agrees that any community property interest shall be similarly bound by the Lock-Up Agreement. I hereby irrevocably appoint my spouse

as my attorney-in-fact with respect to any amendment or exercise of any rights under the Agreement.

Name:

_______________________________________

_______________________________________

Signature of Authorized Signatory

of Spouse

Exhibit 5.1

Exhibit 5.1 November 19, 2024 Visionary Holdings Inc. I05 Moatfield Dr. Unit I003 Toronto. Ontario, Canada M3B 0A2 DC Law Professional Corporation 3100 Steeles Avenue East, Suite 200 Markham, Ontario, Canada L 3 R 8 T 3 T: 647 - 255 - 8433 F: 437 - 836 - 9853 Email: office@dcuilaw.com Re: Registration Statement of Visionary Holdings Inc. on Form S - 8 Dear Sirs/Mesdames: We have acted as Canadian counsel to Visionary Holdings Inc . (the Corporation), a corporation incorporated under the Business Corporations Act (Ontario), in connection with the registration under the United States Securities Act of 1933 , as amended (the Securities Act) . pursuant to a Registration Statement on Form S - 8 (the Registration Statement), filed on or about the date hereof with the United States Securities and Exchange Commission (the SEC), of up to an aggregate of 620 , 000 common shares of the Corporation (the Common Shares) which are issuable by the Corporation to eligible participants pursuant to awards granted under the Corporation's 2024 Restricted Stock Plan dated November I I, 2024 (the Plan) . As counsel, we have made such investigations and examined the originals, or duplicate, certified, conformed, telecopied or photostatic copies of such corporate records, agreements, documents and other instruments and have made such other investigations as we have considered necessary or relevant for the purposes of this opinion . including : a) the Registration Statement; b) the Plan; c) the Articles of Incorporation, as amended, of the Corporation; d) the Unanimous Consent of the Board of Directors of the Corporation dated November 11, 2024; e) the certificate of a duly authorized Officer of Corporation (the Officer's Certificate) as to certain facts set forth herein dated November 19, 2024, attached hereto as Exhibit "A"; and f) the certificate of status dated November 18, 2024 issued for the Corporation under the Business C01porations Act (Ontario) (the Certificate of Compliance). With respect to the accuracy of factual matters material to this opinion, we have relied upon certificates or comparable documents and representations of public officials and of officers of the Corporation and have not performed any independent check or verification of such factual matters . In giving this opinion, we have assumed the genuineness of all signatures, the legal capacity of natural persons . the authenticity of all documents submitted to us as originals, the conformity to authentic original documents of all documents submitted to us as duplicates, certified, conformed . telecopied or photostatic copies and the authenticity of the originals of such latter documents, and that all facts set

fort h in th e certificates s upplied by o ffi ce rs of the Co rp o rati o n are comp l e t e, tru e and acc urat e a s o f th e date hereof . W e ha ve a l so assumed th at th e Certificat e of Co mp Iian ce referred t o above wi II co ntinue t o be accurate a s a t th e d a te of i ss u ance o f any Common S har es und e r the Regi s trati o n Sta t e m ent . The op inion se t fort h below i s limited t o the law s o f th e Pro v inc e of Ontario a nd th e fed e ral l aws of C anada applicable th e rein , in eac h cas e in e ffe c t o n th e date hereof . Our opinion is rendered as of th e d a t e hereof , a nd we a ss ume n o obli g ati on t o advise y ou o f c h a n ges in l aw o r fact (o r th e e ffect there of o n the o pini o n s ex pre sse d h erei n ) that h e r eafter ma y come to our att e nti on . The op ini on se t fo rth b e low i s s ubj ec t t o the fo ll ow in g excep ti o n s, limit ations and qualification s : (i) the effect of bankruptc y , in so l vency , r eo rganizati o n , arrangemen t , moratorium , fra udul e nt co n veya nc e, fraudul e nt tran sfe r a nd other s imilar l aws r e latin g to o r aff ec ting the ri g ht s of cred itor s ; (ii) the effe ct o f genera l prin c ipl es of e quit y (i ncludin g , w ith out limit at i on . con ce pt s of m ater ialit y , r easonab len ess , goo d fait h and fair d ea lin g and the p oss ibl e una va ilability o f s p ec ifi c performan ce , i njun c ti ve r e li ef a nd o ther eq u i t able r e m e di es), r eg ardl ess o f w h e ther considered in a proceed in g a t l aw o r in equi t y ; ( iii ) the e ff ec t o f publi c p o li cy c o n s ideration s that 111 ay limit th e ri g ht s of the partie s t o o btain furth e r rem e di es ; (iv) we express no o pini o n as t o w h e th e r th e R eg i s trati o n State m e nt conta in s full , tru e and plain di sc lo s ur e o f all materi a l fa c t s r e l ating t o th e Plan o r th e C omm o n S hare s i ss uable th e reunder o r any ot h e r matt e r s for the purpo ses of th e Sec 11 ri 1 i es Act ( O ntari o ) ; and (v) wher e o ur o pini o n be l ow r efe r s to th e Co mmon S h ares as b e in g " fully paid and n o n - a ssessa ble , " s u c h op ini o n a ss ume s that a ll requir e d co n s id e rati o n ( in w hat ev er form) h as b ee n o r w ill b e p a id or pr ov id ed, a nd we ex pr ess n o op ini o n w ith r es pect to th e adequac y of any cons id eration received . Based o n th e fore g oin g, and s ubj ec t t o the assumptions , limit at i o n s and qualifi c ations se t forth her ei n , we are of th e opinion that up o n i ss u a n ce and deliv e r y of a nd pa y m e n t fo r s u c h Co mm o n S har es in accordance with th e term s a n d co nditi o n s of th e Regi s tr at i o n Stateme nt and th e Plan , suc h Commo n Shares b e ing i ss ued by th e Corporat i o n , will b e va lidl y i ss u e d , full y paid and n o n - ass ess abl e s har es in the s har e ca pital of th e Co rp o rati o n . T hi s opin i o n ha s been prepared fo r yo ur u se in con n ec ti o n w ith th e Regi s trati o n Statement and i s ex pre sse d a s o f the date here of . Ou r op ini on i s exp re ss l y limited t o th e matt e r s set forth above and we r e nder n o o pinion , whet h er b y im p li ca ti o n o r ot herwi se , as t o a n y o th e r matt e r s relating to th e Co rp o rati o n , t h e Regi s trati o n Statement o r th e Com m o n S h ares . We h e r eby co n sen t t o the filing of thi s o pinion wit h th e SEC as an ex hibit to th e R eg i s t ration S tatem e nt and t o the r efe r e n ce ofo ur name th e rein and in the pr ospec tu s forming a p a rt th e r eo f . In g i v in g s u c h co n se nt , we d o n o t thereb y admit that we are in the ca t egory o f per so n s who se consent i s required und e r Sec tion 7 o f the Sec uriti es Act o r the Rules and R eg ul at i ons of the SEC promul g at e d ther e under . Your s trul y, DC Law Profes s ional Corpo ration I h ave the a uth o ri ty t o bind the corpora ti o n. ZHUYU CUI Barrllter, Solicitor, Notary Public and 8 Commissioner for Oaths in and for Ontario. DC Law ProflllSlonal Corporation 3100 Steeles Ave E , Suite 200 Markham . ON L.3R 8T3 Tel: 647 - 255·8433 Fax: 437 - 836·9853 offlce@dcu ll aw . com

5 Exhibit “A” Officer’s Certificate Of Visionary Holdings Inc. (the “Corporation”) To: DC Law Professional Corporation Barristers and Solicitors RE: Registration Statement of Visionary Holdings Inc. on Form S - 8 The undersigned, in his/her capacity as an officer or director of the Corporation and without personal liability, hereby certifies that, as of the date hereof: 1. I am the Chief Executive Officer of the Corporation, and as such I have personal knowledge of the matters hereinafter declared ; and 2. There are no incorporating documents, shareholder’s agreements, or other agreements or instruments relating to the Corporation that would restrict or prevent the Corporation from issuing any Common Shares of the Corporation in any manner . DATED this 19 th day of November, 2024. Name: Xiyong Hou Title: Chief Executive Officer

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

We consent

to the incorporation by reference in this Registration Statement on Form S-8 of Visionary Holdings Inc. of our report dated August 14,

2024, with respect to the consolidated balance sheet of Visionary Holdings Inc., and its subsidiaries as of March 31, 2024 and 2023,

and the related consolidated statements of income and comprehensive income (loss), changes in shareholders’ equity and cash flows

for the years ended March 31, 2024 and 2023. Our report contains an explanatory paragraph regarding the Company’s ability to continue

as a going concern. We also consent to the reference to our firm under the heading “Experts” in the Registration Statement.

/s/ YCM

CPA, INC.

PCAOB ID

6781

Irvine,

California

October 31, 2024

Exhibit 107

CALCULATION

OF FILING FEE TABLE

FORM S-8

(Form Type)

Visionary Holdings

Inc.

(Exact Name of Registrant as Specified

in its Charter)

Table 1: Newly Registered Securities

| |

Security

Type |

Security

Class

Title |

Fee

Calculation

or Carry

Forward

Rule |

Amount

Registered |

Proposed

Maximum

Offering

Price Per

Unit |

Maximum

Aggregate

Offering

Price |

Fee

Rate |

Amount

of

Registration

Fee |

Carry

Forward

Form

Type |

Carry

Forward

File

Number |

Carry

Forward

Initial

effective

date |

Filing

Fee

Previously

Paid In

Connection

with

Unsold

Securities

to be

Carried

Forward |

| Newly

Registered Securities |

Fees

to Be

Paid |

Equity |

Common

Shares, no par value |

457(c)

and 457(h) |

620,000

(3) |

$855,600 |

$855,600 |

0.00015310 |

$130.99 |

|

|

|

|

Fees

Previously

Paid |

|

|

|

|

|

|

|

|

|

|

|

|

| Carry

Forward Securities |

Carry

Forward

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Offering Amounts |

|

$855,600 |

|

$130.99 |

|

|

|

|

| |

Total

Fees Previously Paid |

|

|

|

– |

|

|

|

|

| |

Total

Fee Offsets |

|

|

|

– |

|

|

|

|

| |

Net

Fee Due |

|

|

|

$130.99 |

|

|

|

|

| (1) | Pursuant

to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”),

this Registration Statement on Form S-8 shall also cover any additional common shares, no

par value (“Common Shares”) of Visionary Holdings Inc. (the “Company”)

that may be offered or issued under the Company’s 2024 Restricted Stock Plan (the “Equity

Plan”) by reason of any stock dividend, stock split, recapitalization or other similar

transaction. |

| (2) | Estimated

solely for the purpose of calculating the registration fee and computed pursuant to Rule

457(c) and 457(h) under the Securities Act, based upon the average of the high and low prices

of the Company’s Common Shares on The Nasdaq Stock Market on November 20, 2024, which

was $1.38. |

| (3) | Represents

the number of Common Shares authorized for issuance under the Equity Plan. |

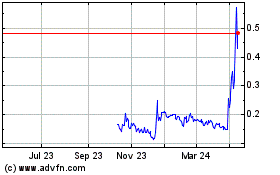

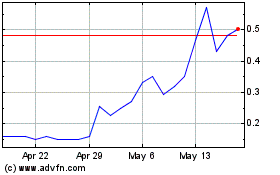

Visionary (NASDAQ:GV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Visionary (NASDAQ:GV)

Historical Stock Chart

From Dec 2023 to Dec 2024