Vicor Corporation (NASDAQ: VICR) today reported financial results

for the third quarter ended September 30, 2021. These results will

be discussed later today at 5:00 p.m. Eastern Time, during

management’s quarterly investor conference call. The details for

the call are presented below.

Revenues for the third quarter ended September

30, 2021 totaled $84.9 million, an 8.7% increase from $78.1 million

for the corresponding period a year ago, but an 11.0% sequential

decrease from $95.4 million in the second quarter of 2021.

Gross margin increased to $42.8 million for the

third quarter of 2021, compared to $33.3 million for the

corresponding period a year ago, but decreased sequentially from

$49.9 million for the second quarter of 2021. Gross margin, as a

percentage of revenue, increased to 50.4% for the third quarter of

2021, compared to 42.7% for the corresponding period a year ago,

but decreased from 52.3% for the second quarter of 2021.

Net income for the third quarter was $13.3

million, or $0.29 per diluted share, compared to net income of $5.8

million or $0.13 per diluted share, for the corresponding period a

year ago and net income of $19.4 million, or $0.43 per diluted

share, for the second quarter of 2021.

Cash flow from operations totaled $10.1 million

for the third quarter, compared to cash flow from operations of

$11.6 million for the corresponding period a year ago, and cash

flow from operations of $12.3 million in the second quarter of

2021. Capital expenditures for the third quarter totaled $15.2

million, compared to $8.1 million for the corresponding period a

year ago and $6.5 million for the second quarter of 2021. The sum

of cash, cash equivalents, and short-term investments as of

September 30, 2021 remained basically unchanged at $229.0 million,

compared to June 30, 2021.

Commenting on third quarter performance, Dr.

Patrizio Vinciarelli, Chief Executive Officer, stated,

“Semiconductor component shortages and capacity constraints caused

Q3 revenues to fall short of expectations with a negative impact on

margins. Improved semiconductor component availability and

increased capacity should support a significant step up in Q4

revenues.”

The Q3 book-to-bill ratio came in at 2.0 and Q3

ending backlog stood at $296 million, as compared with $140 million

at the end of Q3, 2020. Advanced Products shipments in Q4 are

expected to significantly exceed legacy bricks. Our factory

expansion is on track to be completed in Q4 with production

equipment coming on line starting in Q1 ’22.”

Dr. Vinciarelli concluded, “In Q3, we executed

our first OEM License Agreement and received initial license

purchase orders from a major OEM wishing to secure access to

systems utilizing power modules covered by Vicor IP.”

For more information on Vicor and its products,

please visit the Company’s website at www.vicorpower.com.

Earnings Conference Call

Vicor will be holding its investor conference

call today, Thursday, October 21, 2021 at 5:00 p.m. Eastern Time.

Vicor encourages investors and analysts who intend to ask questions

via the conference call to pre-register with BT Conferencing,

the service provider hosting the conference call, so that he or

she, on the day of the call, may avoid waiting for the BT

Conferencing operator to register callers individually. Those

pre-registering on BT Conferencing’s website will receive a

special dial-in number and PIN for call access. Pre-registration

may be completed at any time prior to 5:00

p.m. on October 21, 2021. Telephone participants

who are unable to pre-register should dial 800-230-3019 at

approximately 4:45 p.m. and use the Passcode 94629394. Internet

users may listen to a real-time audio broadcast of the conference

call on the Investor Relations section of Vicor’s website at

www.vicorpower.com. Please go to the website at least 15 minutes

prior to the call to register, download and install any necessary

software. For those who cannot participate in the conference call,

a replay will be available, shortly after the conclusion of the

call, through November 5, 2021. The replay dial-in number is

888-286-8010 and the Passcode is 33342563. In addition, a webcast

replay of the conference call will also be available on the

Investor Relations section of Vicor’s website at

www.vicorpower.com beginning shortly after the conclusion of

the call.

This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Any statement in this

press release that is not a statement of historical fact is a

forward-looking statement, and, the words “believes,” “expects,”

“anticipates,” “intends,” “estimates,” “plans,” “assumes,” “may,”

“will,” “would,” “should,” “continue,” “prospective,” “project,”

and other similar expressions identify forward-looking statements.

Forward-looking statements also include statements regarding

bookings, shipments, revenue, profitability, targeted markets,

increase in manufacturing capacity and utilization thereof, future

products and capital resources. These statements are based upon

management’s current expectations and estimates as to the

prospective events and circumstances that may or may not be within

the company’s control and as to which there can be no assurance.

Actual results could differ materially from those projected in the

forward-looking statements as a result of various factors,

including those economic, business, operational and financial

considerations set forth in Vicor’s Annual Report on Form 10-K for

the year ended December 31, 2020, under Part I, Item I —

“Business,” under Part I, Item 1A — “Risk Factors,” under

Part I, Item 3 — “Legal Proceedings,” and under

Part II, Item 7 — “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.” The risk factors

set forth in the Annual Report on Form 10-K may not be exhaustive.

Therefore, the information contained in the Annual Report on Form

10-K should be read together with other reports and documents filed

with the Securities and Exchange Commission from time to time,

including Forms 10-Q, 8-K and 10-K, which may supplement, modify,

supersede or update those risk factors. Vicor does not undertake

any obligation to update any forward-looking statements as a result

of future events or developments.

Vicor Corporation designs, develops,

manufactures and markets modular power components and complete

power systems based upon a portfolio of patented technologies.

Headquartered in Andover, Massachusetts, Vicor sells its products

primarily to customers in the higher-performance, higher-power

segments of the power systems market, including aerospace and

defense electronics, enterprise and high performance computing,

industrial equipment and automation, telecommunications and network

infrastructure, and vehicles and transportation markets.

For further information contact:

James F. Schmidt, Chief Financial OfficerVoice:

978-470-2900Facsimile: 978-749-3439invrel@vicorpower.com

|

|

|

|

|

|

|

|

|

|

|

VICOR CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS |

|

(Thousands except for per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

QUARTER ENDED |

|

NINE MONTHS ENDED |

|

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

SEPT 30, |

|

SEPT 30, |

|

SEPT 30, |

|

SEPT 30, |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

$ |

84,911 |

|

|

$ |

78,112 |

|

|

$ |

269,083 |

|

|

$ |

212,274 |

|

|

Cost of revenues |

|

42,098 |

|

|

|

44,765 |

|

|

|

131,699 |

|

|

|

121,278 |

|

|

Gross margin |

|

42,813 |

|

|

|

33,347 |

|

|

|

137,384 |

|

|

|

90,996 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

17,322 |

|

|

|

15,212 |

|

|

|

50,865 |

|

|

|

47,036 |

|

|

Research and development |

|

13,519 |

|

|

|

12,032 |

|

|

|

39,818 |

|

|

|

38,197 |

|

|

Total operating expenses |

|

30,841 |

|

|

|

27,244 |

|

|

|

90,683 |

|

|

|

85,233 |

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

11,972 |

|

|

|

6,103 |

|

|

|

46,701 |

|

|

|

5,763 |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

394 |

|

|

|

334 |

|

|

|

999 |

|

|

|

715 |

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

12,366 |

|

|

|

6,437 |

|

|

|

47,700 |

|

|

|

6,478 |

|

|

|

|

|

|

|

|

|

|

|

|

Less: (Benefit) provision for income taxes |

|

(886 |

) |

|

|

651 |

|

|

|

(30 |

) |

|

|

(249 |

) |

|

|

|

|

|

|

|

|

|

|

|

Consolidated net income |

|

13,252 |

|

|

|

5,786 |

|

|

|

47,730 |

|

|

|

6,727 |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net income (loss) attributable to |

|

|

|

|

|

|

|

|

|

noncontrolling interest |

|

(7 |

) |

|

|

1 |

|

|

|

(15 |

) |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to |

|

|

|

|

|

|

|

|

|

Vicor Corporation |

$ |

13,259 |

|

|

$ |

5,785 |

|

|

$ |

47,745 |

|

|

$ |

6,717 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share attributable |

|

|

|

|

|

|

|

|

|

to Vicor Corporation: |

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.30 |

|

|

$ |

0.13 |

|

|

$ |

1.10 |

|

|

$ |

0.16 |

|

|

Diluted |

$ |

0.29 |

|

|

$ |

0.13 |

|

|

$ |

1.06 |

|

|

$ |

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

43,710 |

|

|

|

43,164 |

|

|

|

43,573 |

|

|

|

41,814 |

|

|

Diluted |

|

45,034 |

|

|

|

44,743 |

|

|

|

44,905 |

|

|

|

43,567 |

|

| |

|

|

|

|

|

|

|

|

|

VICOR CORPORATION |

|

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEET |

|

(Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

SEPT 30, |

|

DEC 31, |

|

|

2021 |

|

2020 |

|

|

(Unaudited) |

|

(Unaudited) |

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

178,663 |

|

|

$ |

161,742 |

|

|

Short-term investments |

|

50,217 |

|

|

|

50,166 |

|

|

Accounts receivable, net |

|

51,080 |

|

|

|

40,999 |

|

|

Inventories, net |

|

63,409 |

|

|

|

57,269 |

|

|

Other current assets |

|

6,633 |

|

|

|

6,756 |

|

|

Total current assets |

|

350,002 |

|

|

|

316,932 |

|

|

|

|

|

|

|

Long-term deferred tax assets |

|

221 |

|

|

|

226 |

|

|

Long-term investment, net |

|

2,598 |

|

|

|

2,517 |

|

|

Property, plant and equipment, net |

|

104,446 |

|

|

|

74,843 |

|

|

Other assets |

|

1,563 |

|

|

|

1,721 |

|

|

|

|

|

|

|

Total assets |

$ |

458,830 |

|

|

$ |

396,239 |

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

18,346 |

|

|

$ |

14,121 |

|

|

Accrued compensation and benefits |

|

13,994 |

|

|

|

14,094 |

|

|

Accrued expenses |

|

3,589 |

|

|

|

2,624 |

|

|

Sales allowances |

|

1,661 |

|

|

|

597 |

|

|

Short-term lease liabilities |

|

1,625 |

|

|

|

1,629 |

|

|

Income taxes payable |

|

10 |

|

|

|

139 |

|

|

Short-term deferred revenue and customer

prepayments |

|

3,390 |

|

|

|

7,309 |

|

| |

|

|

|

|

Total current liabilities |

|

42,615 |

|

|

|

40,513 |

|

|

|

|

|

|

|

Long-term deferred revenue |

|

493 |

|

|

|

733 |

|

|

Contingent consideration obligations |

|

- |

|

|

|

227 |

|

|

Long-term income taxes payable |

|

564 |

|

|

|

643 |

|

|

Long-term lease liabilities |

|

3,504 |

|

|

|

2,968 |

|

|

Total liabilities |

|

47,176 |

|

|

|

45,084 |

|

|

|

|

|

|

|

Equity: |

|

|

|

|

Vicor Corporation stockholders' equity: |

|

|

|

|

Capital stock |

|

342,569 |

|

|

|

328,943 |

|

|

Retained earnings |

|

208,753 |

|

|

|

161,008 |

|

|

Accumulated other comprehensive loss |

|

(1,040 |

) |

|

|

(204 |

) |

|

Treasury stock |

|

(138,927 |

) |

|

|

(138,927 |

) |

|

Total Vicor Corporation stockholders' equity |

|

411,355 |

|

|

|

350,820 |

|

|

Noncontrolling interest |

|

299 |

|

|

|

335 |

|

|

Total equity |

|

411,654 |

|

|

|

351,155 |

|

|

|

|

|

|

|

Total liabilities and equity |

$ |

458,830 |

|

|

$ |

396,239 |

|

|

|

|

|

|

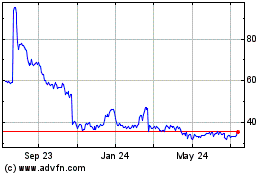

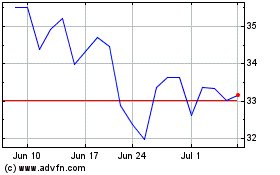

Vicor (NASDAQ:VICR)

Historical Stock Chart

From Jul 2024 to Jul 2024

Vicor (NASDAQ:VICR)

Historical Stock Chart

From Jul 2023 to Jul 2024