0001566610

false

Q2

--12-31

0001566610

2023-01-01

2023-06-30

0001566610

VERB:CommonStock0.0001ParValueMember

2023-01-01

2023-06-30

0001566610

VERB:CommonStockPurchaseWarrantsMember

2023-01-01

2023-06-30

0001566610

2023-08-08

0001566610

2023-06-30

0001566610

2022-12-31

0001566610

us-gaap:RelatedPartyMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

2022-12-31

0001566610

us-gaap:NonrelatedPartyMember

2023-06-30

0001566610

us-gaap:NonrelatedPartyMember

2022-12-31

0001566610

us-gaap:CommonClassAMember

2023-06-30

0001566610

us-gaap:CommonClassAMember

2022-12-31

0001566610

2023-04-01

2023-06-30

0001566610

2022-04-01

2022-06-30

0001566610

2022-01-01

2022-06-30

0001566610

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2022-12-31

0001566610

us-gaap:CommonStockMember

2022-12-31

0001566610

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001566610

us-gaap:RetainedEarningsMember

2022-12-31

0001566610

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2021-12-31

0001566610

us-gaap:CommonStockMember

2021-12-31

0001566610

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001566610

us-gaap:RetainedEarningsMember

2021-12-31

0001566610

2021-12-31

0001566610

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001566610

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001566610

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001566610

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001566610

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001566610

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001566610

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001566610

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001566610

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2023-06-30

0001566610

us-gaap:CommonStockMember

2023-06-30

0001566610

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001566610

us-gaap:RetainedEarningsMember

2023-06-30

0001566610

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2022-06-30

0001566610

us-gaap:CommonStockMember

2022-06-30

0001566610

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001566610

us-gaap:RetainedEarningsMember

2022-06-30

0001566610

2022-06-30

0001566610

2023-06-13

2023-06-13

0001566610

2023-06-10

0001566610

2023-01-24

2023-01-24

0001566610

VERB:SecuritiesPurchaseAgreementMember

VERB:JanuaryNoteHoldersMember

2022-01-12

0001566610

VERB:SecuritiesPurchaseAgreementMember

VERB:JanuaryNoteHoldersMember

2022-01-01

2022-12-31

0001566610

VERB:SecuritiesPurchaseAgreementMember

VERB:JanuaryNoteHoldersMember

2022-12-31

0001566610

VERB:SecuritiesPurchaseAgreementMember

VERB:JanuaryNoteHoldersMember

2023-01-26

0001566610

VERB:USSmallBusinessAdministrationMember

2022-09-30

0001566610

VERB:PromissoryNoteMember

VERB:NotePurchaseAgreementMember

2022-11-07

0001566610

VERB:PromissoryNoteMember

VERB:NotePurchaseAgreementMember

2022-11-01

2022-11-07

0001566610

VERB:PromissoryNoteMember

VERB:NotePurchaseAgreementMember

2023-05-01

2023-05-16

0001566610

VERB:PromissoryNoteMember

VERB:NotePurchaseAgreementMember

2023-06-30

0001566610

VERB:PromissoryNoteMember

VERB:NotePurchaseAgreementMember

2022-12-31

0001566610

us-gaap:RelatedPartyMember

2023-02-16

0001566610

2023-02-14

2023-02-16

0001566610

2023-02-16

0001566610

us-gaap:CommonStockMember

2023-04-18

2023-04-18

0001566610

us-gaap:CommonStockMember

2023-04-18

0001566610

2023-06-10

2023-06-10

0001566610

VERB:SoundConceptsMember

2022-12-01

2022-12-31

0001566610

VERB:SolofireMember

2020-12-01

2020-12-31

0001566610

2022-01-01

2022-12-31

0001566610

us-gaap:SeriesBPreferredStockMember

2023-02-17

0001566610

us-gaap:SeriesBPreferredStockMember

2023-04-20

0001566610

us-gaap:SeriesBPreferredStockMember

2023-02-17

2023-02-17

0001566610

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-06-30

0001566610

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-06-30

0001566610

us-gaap:WarrantMember

2023-06-30

0001566610

us-gaap:WarrantMember

2022-06-30

0001566610

us-gaap:RestrictedStockMember

2023-01-01

2023-06-30

0001566610

us-gaap:RestrictedStockMember

2022-01-01

2022-06-30

0001566610

VERB:ConvertibleNotesMember

2023-01-01

2023-06-30

0001566610

VERB:ConvertibleNotesMember

2022-01-01

2022-06-30

0001566610

VERB:ConvertibleNotesMember

2023-06-30

0001566610

VERB:ConvertibleNotesMember

2022-06-30

0001566610

VERB:ConvertibleNotesMember

us-gaap:RelatedPartyMember

2023-01-01

2023-06-30

0001566610

VERB:ConvertibleNotesMember

us-gaap:RelatedPartyMember

2022-01-01

2022-06-30

0001566610

VERB:ConvertibleNotesMember

us-gaap:RelatedPartyMember

2023-06-30

0001566610

VERB:ConvertibleNotesMember

us-gaap:RelatedPartyMember

2022-06-30

0001566610

VERB:RevenuesAndAccountsReceivablesMember

us-gaap:SupplierConcentrationRiskMember

VERB:CustomersMember

2023-01-01

2023-06-30

0001566610

VERB:RevenuesAndAccountsReceivablesMember

us-gaap:SupplierConcentrationRiskMember

VERB:CustomersMember

2022-01-01

2022-06-30

0001566610

VERB:PurchaseMember

us-gaap:SupplierConcentrationRiskMember

VERB:FirstVendorMember

2023-01-01

2023-06-30

0001566610

VERB:PurchaseMember

us-gaap:SupplierConcentrationRiskMember

VERB:FirstVendorMember

2022-01-01

2022-06-30

0001566610

VERB:PurchaseMember

us-gaap:SupplierConcentrationRiskMember

VERB:SecondVendorMember

2022-01-01

2022-06-30

0001566610

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2023-06-30

0001566610

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2022-12-31

0001566610

VERB:LicenseAndServicesAgreementMember

2021-10-01

2021-10-31

0001566610

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2021-10-01

2021-10-31

0001566610

VERB:PrimaryContractorMember

2022-04-30

0001566610

us-gaap:SoftwareDevelopmentMember

2023-04-01

2023-06-30

0001566610

us-gaap:SoftwareDevelopmentMember

2022-04-01

2022-06-30

0001566610

us-gaap:SoftwareDevelopmentMember

2023-01-01

2023-06-30

0001566610

us-gaap:SoftwareDevelopmentMember

2022-01-01

2022-06-30

0001566610

2021-08-31

0001566610

2021-08-01

2021-08-31

0001566610

VERB:LeaseArrangementMember

2022-01-03

0001566610

VERB:SubLeaseAgreementMember

2022-04-24

2022-04-26

0001566610

VERB:SubLeaseAgreementMember

2022-04-26

0001566610

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0001566610

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-06-30

0001566610

VERB:NoteOneMember

VERB:AdvanceOnFutureReceiptsMember

2023-01-01

2023-06-30

0001566610

VERB:NoteOneMember

VERB:AdvanceOnFutureReceiptsMember

2023-06-30

0001566610

VERB:NoteOneMember

VERB:AdvanceOnFutureReceiptsMember

2022-12-31

0001566610

VERB:NoteTwoMember

VERB:AdvanceOnFutureReceiptsMember

2023-01-01

2023-06-30

0001566610

VERB:NoteTwoMember

VERB:AdvanceOnFutureReceiptsMember

2023-06-30

0001566610

VERB:NoteTwoMember

VERB:AdvanceOnFutureReceiptsMember

2022-12-31

0001566610

VERB:NoteThreeMember

VERB:AdvanceOnFutureReceiptsMember

2023-01-01

2023-06-30

0001566610

VERB:NoteThreeMember

VERB:AdvanceOnFutureReceiptsMember

2023-06-30

0001566610

VERB:NoteThreeMember

VERB:AdvanceOnFutureReceiptsMember

2022-12-31

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteOneMember

2022-08-25

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteOneMember

2022-08-23

2022-08-25

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteOneMember

2022-12-31

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteOneMember

2023-01-01

2023-06-30

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteOneMember

2023-02-16

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteTwoMember

2022-10-25

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteTwoMember

2022-10-23

2022-10-25

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteTwoMember

2022-12-31

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteTwoMember

2023-01-01

2023-06-30

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteTwoMember

2023-02-16

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteThreeMember

2023-02-16

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteThreeMember

2023-02-16

2023-02-16

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteThreeMember

2023-06-13

2023-06-13

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteThreeMember

2023-01-01

2023-06-30

0001566610

VERB:UnaffiliatedThirdPartyMember

VERB:NoteThreeMember

2023-06-30

0001566610

VERB:NoteOneMember

2023-01-01

2023-06-30

0001566610

VERB:NoteOneMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteOneMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteOneMember

2022-12-31

0001566610

VERB:NoteTwoMember

2023-01-01

2023-06-30

0001566610

VERB:NoteTwoMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteTwoMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteTwoMember

2022-12-31

0001566610

VERB:NoteThreeMember

2023-01-01

2023-06-30

0001566610

VERB:NoteThreeMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteThreeMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteThreeMember

2022-12-31

0001566610

VERB:NoteFourMember

2023-01-01

2023-06-30

0001566610

VERB:NoteFourMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteFourMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteFourMember

2022-12-31

0001566610

VERB:NoteFiveMember

2023-01-01

2023-06-30

0001566610

VERB:NoteFiveMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteFiveMember

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NoteFiveMember

2022-12-31

0001566610

VERB:NoteOneMember

VERB:Mr.CutaiaMember

2021-05-19

0001566610

VERB:NoteOneMember

VERB:Mr.CutaiaMember

2022-05-11

2022-05-12

0001566610

VERB:NoteOneMember

VERB:Mr.CutaiaMember

2023-06-30

0001566610

VERB:NoteOneMember

VERB:Mr.CutaiaMember

2022-12-31

0001566610

VERB:NoteOneMember

VERB:Mr.CutaiaMember

2023-01-01

2023-06-30

0001566610

VERB:NoteOneMember

VERB:Mr.CutaiaMember

2022-01-01

2023-06-30

0001566610

VERB:NoteTwoMember

VERB:Mr.CutaiaMember

2016-04-04

0001566610

VERB:NoteTwoMember

VERB:Mr.CutaiaMember

2021-05-19

0001566610

VERB:NoteTwoMember

VERB:Mr.CutaiaMember

2023-06-30

0001566610

VERB:NoteTwoMember

VERB:Mr.CutaiaMember

2022-12-31

0001566610

VERB:NoteTwoMember

VERB:Mr.CutaiaMember

2023-01-01

2023-06-30

0001566610

VERB:NoteTwoMember

VERB:Mr.CutaiaMember

2022-01-01

2023-06-30

0001566610

VERB:NoteThreeMember

VERB:Mr.CutaiaMember

2020-05-15

0001566610

VERB:NoteThreeMember

VERB:Mr.CutaiaMember

2023-06-30

0001566610

VERB:NoteThreeMember

2022-12-31

0001566610

VERB:NoteFourMember

2022-01-12

0001566610

VERB:NoteFourMember

2022-01-11

2022-01-12

0001566610

VERB:NoteFourMember

2022-12-31

0001566610

VERB:NoteFiveMember

2022-11-07

0001566610

VERB:NoteFiveMember

2022-11-01

2022-11-07

0001566610

VERB:NoteFiveMember

2022-12-31

0001566610

2023-05-16

2023-05-16

0001566610

us-gaap:RelatedPartyMember

VERB:NotesPayableMember

2023-04-01

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NotesPayableMember

2022-04-01

2022-06-30

0001566610

VERB:NotesPayableMember

2023-04-01

2023-06-30

0001566610

VERB:NotesPayableMember

2022-04-01

2022-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NotesPayableMember

2023-01-01

2023-06-30

0001566610

us-gaap:RelatedPartyMember

VERB:NotesPayableMember

2022-01-01

2022-06-30

0001566610

VERB:NotesPayableMember

2023-01-01

2023-06-30

0001566610

VERB:NotesPayableMember

2022-01-01

2022-06-30

0001566610

us-gaap:MeasurementInputSharePriceMember

2023-06-30

0001566610

us-gaap:MeasurementInputSharePriceMember

2022-12-31

0001566610

us-gaap:MeasurementInputExercisePriceMember

2023-06-30

0001566610

us-gaap:MeasurementInputExercisePriceMember

2022-12-31

0001566610

us-gaap:MeasurementInputExpectedTermMember

2023-01-01

2023-06-30

0001566610

us-gaap:MeasurementInputExpectedTermMember

2022-01-01

2022-12-31

0001566610

us-gaap:MeasurementInputPriceVolatilityMember

2023-06-30

0001566610

us-gaap:MeasurementInputPriceVolatilityMember

2022-12-31

0001566610

us-gaap:MeasurementInputExpectedDividendRateMember

2023-06-30

0001566610

us-gaap:MeasurementInputExpectedDividendRateMember

2022-12-31

0001566610

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-06-30

0001566610

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001566610

2023-01-24

0001566610

us-gaap:CommonStockMember

VERB:OfficersAndEmployeesMember

2023-01-01

2023-06-30

0001566610

srt:MaximumMember

2023-01-26

2023-01-26

0001566610

us-gaap:StockOptionMember

2023-01-01

2023-06-30

0001566610

us-gaap:StockOptionMember

2023-06-30

0001566610

us-gaap:StockOptionMember

2023-06-20

2023-06-21

0001566610

us-gaap:StockOptionMember

2023-06-21

0001566610

2023-04-09

0001566610

2023-04-10

0001566610

2023-04-10

2023-04-10

0001566610

VERB:TwoThousandAndNinteenIncentiveCompensationPlanMember

2023-06-30

0001566610

us-gaap:RestrictedStockMember

2023-01-01

2023-06-30

0001566610

us-gaap:RestrictedStockMember

2023-06-30

0001566610

VERB:EmployeesAndConsultantsMember

2023-01-01

2023-06-30

0001566610

VERB:EmployeesAndConsultantsMember

2023-06-30

0001566610

us-gaap:WarrantMember

2022-12-31

0001566610

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001566610

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001566610

us-gaap:WarrantMember

2023-06-30

0001566610

2021-10-04

2021-10-05

0001566610

2023-02-28

2023-03-01

0001566610

VERB:SecuritiesPurchaseAgreementMember

VERB:IroquoisCapitalInvestmentGroupLLCMember

2022-05-03

2022-05-05

0001566610

VERB:FiveBoardMembersMember

2023-06-30

0001566610

VERB:NotesPayableMember

us-gaap:SubsequentEventMember

VERB:ExchangeAgreementMember

2023-07-06

2023-07-07

0001566610

us-gaap:SubsequentEventMember

us-gaap:RestrictedStockUnitsRSUMember

VERB:MrCutaiaMember

2023-07-28

2023-07-29

0001566610

us-gaap:SubsequentEventMember

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended June 30, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ________ to ________

Commission

file number: 001-38834

Verb

Technology Company, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

90-1118043 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| 3401

North Thanksgiving Way, Suite 240, Lehi, Utah |

|

84043 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(855)

250-2300

(Registrant’s

telephone number, including area code)

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

VERB |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

VERBW |

|

The

Nasdaq Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| |

|

|

|

|

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

|

|

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

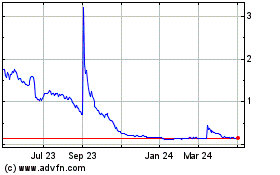

As

of August 8, 2023, there were 4,501,340 shares of common stock, $0.0001 par value per share, outstanding.

VERB

TECHNOLOGY COMPANY, INC.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Quarterly Report on Form 10-Q for the three months ended June 30, 2023 (the “Quarterly Report”), includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which statements are subject to considerable

risks and uncertainties. These forward-looking statements are intended to qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not statements of historical

facts and can be identified by words such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “seeks,” “should,” “will,” “would” or similar expressions and

the negatives of those expressions. Forward-looking statements also include the assumptions underlying or relating to such statements.

Our

forward-looking statements are based on our management’s current beliefs, assumptions and expectations about future events and

trends, which affect or may affect our business, strategy, operations, financial performance or liquidity. Although we believe these

forward-looking statements are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties

and are made in light of information currently available to us. Some of the risks and uncertainties that may impact our forward-looking

statements include, but are not limited to, the following factors:

● our incursion of significant net losses and uncertainty whether we will achieve or maintain profitable operations;

● our ability to continue as a going concern;

● our ability to grow and compete in the future, which is dependent upon whether capital is available to us on favorable terms;

● our ability to maintain and expand our customer base and our ability to convince our customers to increase the use of our services and/or platform;

● the competitive market in which we operate;

● our ability to increase the number of our strategic relationships or grow the revenues received from our current strategic relationships;

● our ability to develop enhancements and new features to our existing service or acceptable new services that keep pace with technological developments;

● our ability to successfully launch new product platforms, including MARKET.live, the rate of adoption of these platforms and the revenue generated from these platforms;

● the novel coronavirus (“COVID-19”) pandemic, which has had a sustained impact on our business, sales, results of operations and financial condition;

● our ability to deliver our services, as we depend on third party Internet providers;

● our ability to raise additional capital or borrow additional funds to fund our operations and execute our business strategy, and the impact of these transactions on our business and existing stockholders;

● our ability to attract and retain qualified management personnel;

● our ability to pay our debt obligations as they become due;

● our susceptibility to security breaches and other disruptions; and

● global economic, political, and social trends, including inflation, rising interest rates, and recessionary concerns.

The

foregoing list may not include all of the risk factors that impact the forward-looking statements made in this Quarterly Report. Our

actual financial condition and results could differ materially from those expressed or implied by our forward-looking statements as a

result of various additional factors, including those discussed in the sections entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and “Risk Factors” in this Quarterly Report and

in our Annual Report on Form 10-K for the year ended December 31, 2022 (the “Annual Report”), as well as in the other reports

we file with the Securities and Exchange Commission (the “SEC”). You should read this Quarterly Report, and the other documents

we file with the SEC, with the understanding that our actual future results may be materially different from the results expressed or

implied by our forward-looking statements.

We

operate in an evolving environment. New risks and uncertainties emerge from time to time and it is not possible for our management to

predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or

combination of factors, may cause actual future results to be materially different from those expressed or implied by any forward-looking

statements.

Forward-looking

statements speak only as of the date they were made, and, except to the extent required by law or the rules of the Nasdaq Capital Market,

we undertake no obligation to update or review any forward-looking statement because of new information, future events or other factors.

We

qualify all of our forward-looking statements by these cautionary statements.

PART

I — FINANCIAL INFORMATION

ITEM

1 – FINANCIAL STATEMENTS

VERB

TECHNOLOGY COMPANY, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(in

thousands, except share and per share data)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 3,526 | | |

$ | 2,429 | |

| Assets held for sale - current | |

| - | | |

| 1,323 | |

| Prepaid expenses and other current assets | |

| 238 | | |

| 306 | |

| Total current assets | |

| 3,764 | | |

| 4,058 | |

| | |

| | | |

| | |

| Assets held for sale – non-current | |

| - | | |

| 10,467 | |

| Capitalized software development costs, net | |

| 5,122 | | |

| 6,176 | |

| ERC receivable | |

| 1,528 | | |

| 1,528 | |

| Property and equipment, net | |

| 449 | | |

| 533 | |

| Operating lease right-of-use assets | |

| 1,220 | | |

| 1,354 | |

| Intangible assets, net | |

| 83 | | |

| 83 | |

| Other assets | |

| 294 | | |

| 293 | |

| | |

| | | |

| | |

| Total assets | |

$ | 12,460 | | |

$ | 24,492 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 2,786 | | |

$ | 3,975 | |

| Liabilities related to assets held for sale | |

| - | | |

| 2,483 | |

| Liabilities of discontinued operations | |

| 898 | | |

| 1,641 | |

| Accrued expenses | |

| 1,433 | | |

| 1,287 | |

| Accrued officers’ salary | |

| 764 | | |

| 764 | |

| Notes payable – related party, current | |

| 765 | | |

| 765 | |

| Notes payable, current | |

| 5,605 | | |

| 3,704 | |

| Convertible notes payable, current | |

| - | | |

| 1,334 | |

| Operating lease liabilities, current | |

| 482 | | |

| 355 | |

| Derivative liability | |

| 16 | | |

| 222 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 12,749 | | |

| 16,530 | |

| | |

| | | |

| | |

| Long-term liabilities | |

| | | |

| | |

| Notes payable, non-current | |

| 150 | | |

| 1,215 | |

| Operating lease liabilities, non-current | |

| 1,379 | | |

| 1,581 | |

| Total liabilities | |

| 14,278 | | |

| 19,326 | |

| | |

| - | | |

| - | |

| Commitments and contingencies (Note 13) | |

| - | | |

| - | |

| | |

| - | | |

| - | |

| Series B Redeemable Preferred Stock | |

| | | |

| | |

| | |

| - | | |

| - | |

| Stockholders’ equity (deficit) | |

| | | |

| | |

| Class A units, 3 shares issued and authorized as of June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Common stock, $0.0001 par value, 400,000,000 shares authorized, 4,317,561 and 2,918,017 shares issued and outstanding as of June 30, 2023 and December 31, 2022 | |

| 1 | | |

| 1 | |

| Common stock, value | |

| 1 | | |

| 1 | |

| | |

| | | |

| | |

| Additional paid-in capital | |

| 167,179 | | |

| 158,629 | |

| Accumulated deficit | |

| (168,998 | ) | |

| (153,464 | ) |

| | |

| | | |

| | |

| Total stockholders’ equity (deficit) | |

| (1,818 | ) | |

| 5,166 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity (deficit) | |

$ | 12,460 | | |

$ | 24,492 | |

See

accompanying notes to the condensed consolidated financial statements

VERB

TECHNOLOGY COMPANY, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(in

thousands, except share and per share data)

(unaudited)

| | |

| | |

| | |

| | |

| |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 3 | | |

$ | - | | |

$ | 5 | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 1 | | |

| - | | |

| 2 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross margin | |

| 2 | | |

| - | | |

| 3 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 583 | | |

| 44 | | |

| 1,166 | | |

| 86 | |

| General and administrative | |

| 2,685 | | |

| 4,760 | | |

| 6,230 | | |

| 9,893 | |

| Total operating expenses | |

| 3,268 | | |

| 4,804 | | |

| 7,396 | | |

| 9,979 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss from continuing operations | |

| (3,266 | ) | |

| (4,804 | ) | |

| (7,393 | ) | |

| (9,979 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Other income (expense), net | |

| 831 | | |

| 19 | | |

| 780 | | |

| (16 | ) |

| Financing costs | |

| (1,239 | ) | |

| - | | |

| (1,239 | ) | |

| - | |

| Interest expense | |

| (299 | ) | |

| (368 | ) | |

| (770 | ) | |

| (661 | ) |

| Change in fair value of derivative liability | |

| 198 | | |

| 1,024 | | |

| 206 | | |

| 2,162 | |

| Total other income (expense), net | |

| (510 | ) | |

| 675 | | |

| (1,023 | ) | |

| 1,485 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss from continuing operations | |

| (3,776 | ) | |

| (4,129 | ) | |

| (8,416 | ) | |

| (8,494 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from discontinued operations, net of tax | |

| (6,080 | ) | |

| (2,245 | ) | |

| (6,954 | ) | |

| (4,869 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (9,856 | ) | |

| (6,374 | ) | |

| (15,370 | ) | |

| (13,363 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Deemed dividend due to warrant reset | |

| - | | |

| - | | |

| (164 | ) | |

| - | |

| Net loss to common stockholders | |

$ | (9,856 | ) | |

$ | (6,374 | ) | |

$ | (15,534 | ) | |

$ | (13,363 | ) |

| Loss per share - basic and diluted | |

$ | (2.45 | ) | |

$ | (2.63 | ) | |

$ | (4.09 | ) | |

$ | (6.16 | ) |

| Loss per share - basic | |

$ | (2.45 | ) | |

$ | (2.63 | ) | |

$ | (4.09 | ) | |

$ | (6.16 | ) |

| Weighted average number of common shares outstanding - basic and diluted | |

| 4,022,947 | | |

| 2,423,831 | | |

| 3,801,599 | | |

| 2,169,057 | |

| Weighted average number of common shares outstanding - basic | |

| 4,022,947 | | |

| 2,423,831 | | |

| 3,801,599 | | |

| 2,169,057 | |

See

accompanying notes to the condensed consolidated financial statements

VERB

TECHNOLOGY COMPANY, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in

thousands, except share and per share data)

(unaudited)

For

the six months ended June 30, 2023

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Class A Units | | |

Common Stock | | |

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| Balance at December 31, 2022 | |

| 3 | | |

$ | - | | |

| 2,918,017 | | |

$ | 1 | | |

$ | 158,629 | | |

$ | (153,464 | ) | |

$ | 5,166 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of common stock from public offering | |

| - | | |

| - | | |

| 901,275 | | |

| - | | |

| 6,578 | | |

| - | | |

| 6,578 | |

| Fair value of vested restricted stock awards, stock options, and warrants | |

| - | | |

| - | | |

| 197,414 | | |

| - | | |

| 1,362 | | |

| - | | |

| 1,362 | |

| Deemed dividend due to warrant reset | |

| - | | |

| - | | |

| - | | |

| - | | |

| 164 | | |

| (164 | ) | |

| - | |

| Issuance of shares for fractional adjustments related to reverse stock split | |

| - | | |

| - | | |

| 31,195 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Fair value of common shares issued to settle accrued expenses | |

| - | | |

| - | | |

| 93,190 | | |

| - | | |

| 146 | | |

| - | | |

| 146 | |

| Fair value of common shares issued as payment on notes payable | |

| - | | |

| - | | |

| 176,470 | | |

| - | | |

| 300 | | |

| - | | |

| 300 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (15,370 | ) | |

| (15,370 | ) |

| Balance at June 30, 2023 | |

| 3 | | |

$ | - | | |

| 4,317,561 | | |

$ | 1 | | |

$ | 167,179 | | |

$ | (168,998 | ) | |

$ | (1,818 | ) |

VERB

TECHNOLOGY COMPANY, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in

thousands, except share and per share data)

(unaudited)

For

the six months ended June 30, 2022

| | |

| | |

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Class A Units | | |

Common Stock | | |

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| Balance at December 31, 2021 | |

| 3 | | |

$ | - | | |

| 1,823,574 | | |

$ | 1 | | |

$ | 129,348 | | |

$ | (116,027 | ) | |

$ | 13,322 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of common stock from public offering | |

| - | | |

| - | | |

| 646,106 | | |

| - | | |

| 20,150 | | |

| - | | |

| 20,150 | |

| Issuance of common stock for commitment fee related to equity line of credit agreement | |

| - | | |

| - | | |

| 15,182 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Issuance of common stock from option exercise | |

| - | | |

| - | | |

| 8,318 | | |

| - | | |

| 377 | | |

| - | | |

| 377 | |

| Fair value of common shares issued for services | |

| - | | |

| - | | |

| 32,283 | | |

| - | | |

| 1,126 | | |

| - | | |

| 1,126 | |

| Fair value of common shares issued to settle accounts payable and accrued expenses | |

| - | | |

| - | | |

| 11,926 | | |

| - | | |

| 450 | | |

| - | | |

| 450 | |

| Fair value of vested restricted stock awards, stock options and warrants | |

| - | | |

| - | | |

| 11,581 | | |

| - | | |

| 1,468 | | |

| - | | |

| 1,468 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (13,363 | ) | |

| (13,363 | ) |

| Balance at June 30, 2022 | |

| 3 | | |

$ | - | | |

| 2,548,970 | | |

$ | 1 | | |

$ | 152,919 | | |

$ | (129,390 | ) | |

$ | 23,530 | |

See

accompanying notes to the condensed consolidated financial statements

VERB

TECHNOLOGY COMPANY, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in

thousands)

(unaudited)

| | |

| | |

| |

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (15,370 | ) | |

$ | (13,363 | ) |

| Loss from discontinued operations, net of tax | |

| 6,954 | | |

| 4,869 | |

| | |

| | | |

| | |

| Adjustments to reconcile net loss to net cash used in operating activities, net of discontinued operations: | |

| | | |

| | |

| Share-based compensation | |

| 1,402 | | |

| 2,618 | |

| Amortization of debt discount | |

| 163 | | |

| 171 | |

| Amortization of debt issuance costs | |

| 127 | | |

| 264 | |

| Change in fair value of derivative liability | |

| (206 | ) | |

| (2,162 | ) |

| Depreciation and amortization | |

| 1,166 | | |

| 86 | |

| Finance costs | |

| 1,239 | | |

| - | |

| Loss on disposal of property and equipment | |

| - | | |

| 14 | |

| Effect of changes in assets and liabilities, net of discontinued operations: | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| 66 | | |

| (384 | ) |

| Operating lease right-of-use assets | |

| 134 | | |

| 127 | |

| Accounts payable, accrued expenses, and accrued interest | |

| (285 | ) | |

| 360 | |

| Deferred incentive compensation | |

| - | | |

| (377 | ) |

| Operating lease liabilities | |

| (75 | ) | |

| (177 | ) |

| Net cash used in operating activities attributable to continuing operations | |

| (4,685 | ) | |

| (7,954 | ) |

| Net cash used in operating activities attributable to discontinued operations | |

| (1,855 | ) | |

| (3,048 | ) |

| | |

| | | |

| | |

| Investing Activities: | |

| | | |

| | |

| Capitalized software development costs | |

| (239 | ) | |

| (4,108 | ) |

| Purchases of property and equipment | |

| (5 | ) | |

| (20 | ) |

| Purchases of intangible assets | |

| - | | |

| (82 | ) |

| Net cash used in investing activities attributable to continuing operations | |

| (244 | ) | |

| (4,210 | ) |

| Net cash provided by (used in) investing activities attributable to discontinued operations | |

| 4,750 | | |

| (1 | ) |

| | |

| | | |

| | |

| Financing Activities: | |

| | | |

| | |

| Proceeds from sale of common stock | |

| 6,578 | | |

| 20,150 | |

| Proceeds from convertible notes payable | |

| - | | |

| 6,000 | |

| Payment of notes payable | |

| (375 | ) | |

| (1,896 | ) |

| Payment of convertible notes payable | |

| (1,350 | ) | |

| - | |

| Proceeds from option exercise | |

| - | | |

| 377 | |

| Payment for debt issuance costs | |

| - | | |

| (445 | ) |

| Net cash provided by financing activities attributable to continuing operations | |

| 4,853 | | |

| 24,186 | |

| Net cash used in financing activities attributable to discontinued operations | |

| (1,722 | ) | |

| (4,363 | ) |

| | |

| | | |

| | |

| Net change in cash | |

| 1,097 | | |

| 4,610 | |

| | |

| | | |

| | |

| Cash - beginning of period | |

| 2,429 | | |

| 937 | |

| | |

| | | |

| | |

| Cash - end of period | |

$ | 3,526 | | |

$ | 5,547 | |

See

accompanying notes to the condensed consolidated financial statements

VERB

TECHNOLOGY COMPANY, INC.

Notes

to Condensed Consolidated Financial Statements

For

the Three and Six Months Ended June 30, 2023 and 2022

(in

thousands, except share and per share data)

(unaudited)

1.

DESCRIPTION OF BUSINESS

Our

Business

References in this document to the “Company,” “Verb,”

“we,” “us,” or “our” are intended to mean Verb Technology Company, Inc., individually, or as the context

requires, collectively with its subsidiaries on a consolidated basis.

As

set forth more particularly below, through June 13, 2023 of the six months ended June 30, 2023, the Company operated three distinct lines

of business through separate wholly owned subsidiaries. The first was Verb Direct, LLC, a sales Software-as-a-Service (“SaaS”)

platform for the direct sales industry; the second was Verb Acquisition Co., LLC, which was a sales SaaS platform for the Life Sciences

industry and sports teams; and the third is verbMarketplace, LLC, which operates MARKET.live, a multivendor social shopping platform

for retailers, brands, manufacturers, creators, influencers and entrepreneurs who seek to participate in an open market-style eco-system

environment.

MARKET.live

is akin to a virtual shopping mall, a centralized online destination where shoppers could explore hundreds, and over time thousands,

of shoppable stores for their favorite brands, influencers, creators and celebrities, all of whom can host livestream shopping events

from their virtual stores that can be seen by all shoppers at the virtual mall. Every store operator can host livestream events, even

simultaneously, and over time we expect there will be thousands of such events, across numerous product and service categories, being

hosted by people from all over the world, always on – 24/7 - where shoppers could communicate directly with the hosts in real time

to comment or ask questions about products through an on-screen chat visible to all shoppers. Through the on-screen chat, shoppers can

also communicate directly with each other in real time, invite their friends and family to join them at any of the live shopping events

to share the experience, and then simply click on a non-intrusive - in-video overlay to place items in an on-screen shopping cart for

purchase – all without interrupting the video. Shoppers can visit any number of other shoppable events to meet up and chat with

friends, old and new, and together watch, shop and chat with the hosts, discover new products and services, and become part of an immersive

entertaining social shopping experience. Throughout the experience, the shopping cart follows shoppers seamlessly from event to event,

shoppable video to shoppable video, host to host, store to store and product to product.

Among

the big differentiators for MARKET.live is that it allows anyone that streams on MARKET.live to simultaneously broadcast their stream

(multi-cast or simulcast) over most popular social media sites to reach a substantially larger audience, which is especially attractive

for creators and influencers that have large numbers of followers on other social media platforms.

A

very compelling new feature recently developed for MARKET.live allows shoppers watching the stream on a popular social media site to

stay on that site and actually check out through that site, eliminating the friction or reluctance to leave their favorite social site

in order to check-out on MARKET.live. Currently in use by certain creators in beta, the Company expects this new capability will enhance sales growth and be a meaningful revenue generator

when fully launched later this summer.

Last

fall the Company launched its “Creators on MARKET.live,” a program that allows creators to monetize their content through

livestream shopping and personalized storefronts on MARKET.live. With more than 12 million products from brands like Athleta, Best Buy,

Target, Container Store, Banana Republic, GAP, Saks Off 5th, SSENSE, LOFT, DERMSTORE, INTERMIX, UNCOMMON GOODS, and many more, participants

can choose to feature their favorite products and promote and sell them to their fans, followers and customers.

The

program has recently been restructured to be marketed not only to video content creators across multiple social media channels, but

also to entrepreneurs eager to launch their own ecommerce store and drop-ship businesses on MARKET.live. Through this new program,

creators, influencers, and entrepreneurs can quickly and easily establish their own storefronts, essentially their own website, and

choose the products they love from hundreds of brands and retailers on MARKET.live to import into their storefront and offer their

fans, followers, and would-be customers those products through livestream shopping events broadcast live on MARKET.live and

simulcast on other social platforms.

Livestream

events are also recorded and available to watch in their personally branded stores on MARKET.live for those fans, followers and customers

to return 24/7 after the livestream events to browse and purchase any of the featured products, as the recorded livestream videos remain

shoppable. Depending on the products chosen, participants in the program can earn between 5% and 20% of their gross sales at no cost

and no risk to the Creators selected to participate in the Creator program. Entrepreneurs that participate in the dropship programs will pay

a fixed monthly fee for access to the products in the program and to maintain their MARKET.live ecommerce storefronts.

On

April 12, 2019, the Company acquired Sound Concepts Inc. (“Sound Concepts”) through a merger into the Company’s wholly owned subsidiary, Verb Direct, LLC (“Verb Direct”).

On

September 4, 2020, the Company acquired Ascend Certification, LLC, dba SoloFire (“SoloFire”) through a merger into the Company’s wholly owned subsidiary, Verb Acquisition Co., LLC (“Verb Acquisition”).

On

October 18, 2021, the Company established verbMarketplace, LLC (“Market LLC”), a Nevada limited liability company. Market

LLC is a wholly owned subsidiary of the Company established to operate the MARKET.live platform.

On

June 13, 2023, the Company disposed of all of its operating SaaS assets of Verb Direct and Verb Acquisition, (referred to

collectively as the “SaaS business”) pursuant to an asset purchase agreement in consideration of the sum of $6,500,

$4,750

of which was paid in cash by the buyer at the closing of the transaction.

Additional payments of $1,750 will be paid by the buyer if certain profitability and revenue targets are met within the next two years

as set forth more particularly in the asset purchase agreement.

Going

Concern

The

accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets

and the settlement of liabilities and commitments in the normal course of business. As reflected in the accompanying consolidated financial

statements, during the six months ended June 30, 2023, the Company incurred a net loss from continuing operations of $8,416 and used

cash in continuing operations of $4,685. These factors raise substantial doubt about the Company’s ability to continue as a going

concern within one year after the date of the financial statements being issued. As a result, the Company’s continuation as a going concern is dependent on its ability to obtain additional

financing until the Company can generate sufficient cash flows from operations to meet our obligations. The Company intends to continue

to seek additional debt or equity financing to continue its operations.

As

of June 30, 2023, the Company had cash of $3,526.

Equity

financing:

On

January 24, 2023, the Company issued 901,275 shares of the Company’s common stock which resulted in proceeds of $6,578, net of

offering costs of $622.

Debt

financing:

On

January 12, 2022, the Company entered into a securities purchase agreement (the “January Note Purchase Agreement”) with three

institutional investors (collectively, the “January Note Holders”) providing for the sale and issuance of an aggregate original

principal amount of $6,300 in convertible notes due January 2023 (each, a “Note,” and, collectively, the “Notes,”

and such financing, the “January Note Offering”). The Company and the January Note Holders also entered into a security agreement,

dated January 12, 2022, in connection with the January Note Offering, pursuant to which the Company granted a security interest to the

January Note Holders in substantially all of its assets. During the year ended December 31, 2022, the Company repaid $4,950 in principal

payments and $357 of accrued interest to January Note Holders pursuant to the terms of the Notes. On January 26, 2023, the Company repaid

the remaining principal balance of $1,350 and $208 of accrued interest under the January Note Offering dated January 12, 2022.

In

September 2022, the U.S. Small Business Administration approved a loan of $350,

which, as of August 14, 2023, the Company has not received these funds.

On

November 7, 2022, the Company entered into a note purchase agreement (the “November Note Purchase Agreement”) and promissory

note with an institutional investor (the “November Note Holder”) providing for the sale and issuance of an unsecured, non-convertible

promissory note in the original principal amount of $5,470, which has an original issue discount of $470, resulting in gross proceeds

to the Company of approximately $5,000 (the “November Note,” and such financing, the “November Note Offering”).

The November Note matures eighteen months following the date of issuance. Commencing six months from the date of issuance, the Company

is required to make monthly cash redemption payments in an amount not to exceed $600. The November Note may be repaid in whole or in

part prior to the maturity date for a 10% premium. The November Note requires the Company to use up to 20% of the gross proceeds raised

from future equity or debt financings, or the sale of any subsidiary or material asset, to prepay the November Note, subject to a $2,000

cap on the aggregate prepayment amount. Until all obligations under the November Note have been paid in full, the Company is not permitted

to grant a security interest in any of its assets, or to issue securities convertible into shares of common stock, subject in each case

to certain exceptions. verbMarketplace, LLC entered into a guaranty, dated November 7, 2022, in connection with the November Note Offering,

pursuant to which it guaranteed the obligations of the Company under the November Note in exchange for receiving a portion of the loan

proceeds.

On

May 16, 2023, the Company received a redemption notice under the terms of the November Note Purchase Agreement for $300.

The Company missed two payments resulting in a Payment Failure Balance Increase of 10% on the outstanding principal balance per

occurrence pursuant to the terms of the agreement totaling $1,205.

These costs have been recorded as finance costs in the Company’s condensed consolidated statements of

operations for the three and six months ended June 30, 2023.

As

of June 30, 2023 and December 31, 2022, the outstanding balance of the November Notes amounted to $6,375 and $5,544, respectively.

On

February 16, 2023, the Company modified and combined the unpaid balances of the previous two advances on future receipts with a new

advance from the same third party totaling $1,550

for the purchase of future receipts/revenues of $2,108,

resulting in a debt discount of $558.

As of June 30, 2023, the outstanding balance of the note was $915

and is being repaid by making daily payments of $10

on each banking day with a scheduled maturity date of November 7, 2023. The amounts related to this financing agreement have been

reclassified to liabilities of discontinued operations for purposes of presenting discontinued operations.

Other:

The

Company, through its Professional Employer Organization, filed for federal government assistance for the second and third quarters

of 2021 in the aggregate amount of $1,528

through Employee Retention Credit (“ERC”) provisions of the Consolidated Appropriations Act of 2021. The purpose of the

ERC is to encourage employers to keep employees on the payroll, even if they are not working during the covered period due to the

effects of the COVID-19 pandemic. As of June 30, 2023, and December 31, 2022, the Company had a receivable of $1,528

as the amended payroll tax returns have been filed with the IRS related to the quarterly periods ending June 2021 and September

2021. Due to the uncertain timing of the receipt of this receivable, it is being classified as a long-term asset in the condensed

consolidated balance sheet at June 30, 2023.

In

November 2022, a cost savings plan was approved and implemented to improve liquidity and preserve cash for operations (the “Cost

Savings Plan”). This plan was expected to further reduce expenses moving forward through such actions as a reduction in force,

elimination of certain services provided by various vendors, and a 25% reduction in cash compensation by senior management over a four-month

period in exchange for shares of common stock. Subsequently, the Company extended the Cost Savings Plan through April 30, 2023.

If

the Company is unable to generate sufficient cash flow from operations to operate its business and pay its debt obligations as they become

due, it will need to seek to raise additional capital, borrow additional funds, dispose of subsidiaries or assets, reduce or delay capital

expenditures, or change its business strategy. However, in light of the restrictive covenants imposed by certain of the Company’s

prior financing arrangements, in combination with the recent decline in the trading price of the common stock, the Company may be unable

to raise additional capital in sufficient amounts when needed to operate its business, service its debt or execute on its strategic plans.

Further, notwithstanding such restrictions, there can be no assurance that debt or equity financing will be available in the amounts,

on terms, or at times deemed acceptable by the Company. The issuance of additional equity securities would result in significant dilution

in the equity interests of the Company’s current stockholders and could include rights or preferences senior to those of the current

stockholders. Borrowing additional funds would increase the Company’s liabilities and future cash commitments and potentially impose

significant operational or financial restrictions and require the Company to further encumber its assets. If the Company is unable to

obtain financing in the amounts and on terms deemed acceptable, the Company may be unable to continue to operate its business or pay

its obligations as they become due, and as a result may be required to curtail or cease operations, which may result in stockholders

or noteholders losing some or all of their investment.

Economic

Disruption

Our

business is dependent in part on general economic conditions. Many jurisdictions in which our customers are located and our products

are sold have experienced and could continue to experience unfavorable general economic conditions, such as inflation, increased interest

rates and recessionary concerns, which could negatively affect demand for our products. Under difficult economic conditions, customers

may seek to cease spending on our current products or fail to adopt our new products, which could negatively affect our financial performance.

We cannot predict the timing or magnitude of an economic slowdown or the timing or strength of any economic recovery. These and other

economic factors could have a material adverse effect on our business, financial condition, and results of operations.

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND SUPPLEMENTAL DISCLOSURES

Basis

of Presentation

The

accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial

statements have been prepared in accordance with accounting principles generally accepted in the United States of America

(“GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding

interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in

accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed

consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto

contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on April

17, 2023 (the “2022 Annual Report”). The condensed consolidated balance sheet as of December 31, 2022 included herein

was derived from the audited consolidated financial statements as of that date.

On

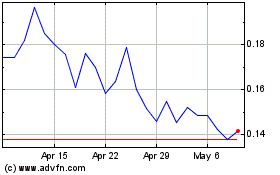

April 18, 2023, we implemented a 1-for-40 reverse stock split (the “Reverse Stock Split”) of our common stock, $0.0001 par

value per share (the “Common Stock”). Our Common Stock commenced trading on a post Reverse Stock Split basis on April 19,

2023. As a result of the Reverse Stock Split, every forty (40) shares of our pre-Reverse Stock Split Common Stock were combined and reclassified

into one share of our Common Stock. The number of shares of Common Stock subject to outstanding options, warrants, and convertible securities

were also reduced by a factor of forty and the exercise price of such securities increased by a factor of forty, as of April 18, 2023.

All historical share and per-share amounts reflected throughout our condensed consolidated financial statements and other financial information

in this Quarterly Report have been adjusted to reflect the Reverse Stock Split. The par value per share of our Common Stock was not affected

by the Reverse Stock Split.

On

June 10, 2023, the Board of Directors approved the sale of the SaaS Business assets to an unrelated third party, SW Direct Sales LLC

(“SW Sales” or the “buyer”), for $6,500

with $4,750

cash proceeds paid by buyer upon closing of the transaction. Additional payments of $1,750

will be paid by the buyer if certain profitability and revenue targets are met within the next two years. The contingent payments

were not recorded at the closing date of the sale, rather will be recognized as the cash is received and the contingency resolved

pursuant to ASC 450-30.

Accordingly,

the Company’s condensed consolidated financial statements are being presented pursuant to ASC 360-10-45-9 which requires that a

disposal group be classified as held for sale in the period in which all of the held for sale criteria are met. Accordingly, the Company’s

condensed consolidated balance sheet at December 31, 2022 has been reclassified to reflect held for sale accounting. In addition to held

for sale accounting, the Company has also met the criterion pursuant to ASC 205-20, Discontinued Operations, as a strategic shift

from operating and managing a SaaS business to operating and managing a live streaming shopping platform has occurred because of the

sale. The Company’s condensed consolidated results of operations and statements of cash flows have been reclassified to reflect

the presentation of discontinued operations. See Note 4 for details of the assets and liabilities related to the SaaS sale and discontinued

operations.

In

the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to

fairly present the Company’s financial position and results of operations for the interim periods reflected. Except as noted, all

adjustments contained herein are of a normal recurring nature. Results of operations for the fiscal periods presented herein are not

necessarily indicative of fiscal year-end results.

Principles

of Consolidation

The

condensed consolidated financial statements have been prepared in accordance with GAAP and include the accounts of Verb, Verb

Direct, LLC, Verb Acquisition Co., LLC, and verbMarketplace, LLC. All intercompany accounts have been eliminated in the

consolidation. Certain prior period amounts have been reclassified to conform to the current year presentation within the

condensed consolidated balance sheets as of June 30, 2023 and December 31, 2022.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the

reported periods. Significant estimates include assumptions made in analysis of reserves for allowance of doubtful accounts, inventory,

assumptions made in purchase price allocations, impairment testing of long-term assets, realization of deferred tax assets, determining

fair value of derivative liabilities, and valuation of equity instruments issued for services. Amounts could materially change in the

future.

Revenue

Recognition

The

Company recognizes revenue in accordance with Financial Accounting Standard Board’s (“FASB”) ASC 606, Revenue

from Contracts with Customers (“ASC 606”). Revenues during the six months ended June 30, 2023 were derived primarily

from providing application services through the SaaS application, digital marketing and sales support services. During that period,

the Company also derived revenue from the sale of customized print products and training materials, branded apparel, and digital

tools, as demanded by its customers. As a result of the sale of the SaaS business, revenue that was recorded historically from the SaaS business has been

reclassified as part of discontinued operations. See Note 4 for revenue disclosures related to the SaaS business.

A description of our principal revenue generating activities is as follows:

| |

MARKET.live,

launched at the end of July 2022, generates revenue through several sources as follows: |

| |

a. |

All

sales run through our ecommerce facility on MARKET.live from which we deduct a platform fee that ranges from 10% to 20% of gross

sales, with an average of approximately 15%, depending upon the pricing package the vendors select as well as the product category

and profit margins associated with such categories. The revenue is derived from sales generated during livestream events, from sales

realized through views of previously recorded live events available in each vendor’s store, as well as from sales of product

and merchandise displayed in the vendors’ online stores, all of which are shoppable 24/7. |

| |

|

|

| |

b.

|

Produced

events. MARKET.live offers fee-based services that range from full production of livestream events, to providing professional hosts and

event consulting.

|

| |

|

|

| |

c. |

Drop

ship programs. MARKET.live is expected to generate recurring fee revenue from soon to be launched new drop ship programs for entrepreneurs. |

| |

|

|

| |

d. |

The

MARKET.live site is designed to incorporate sponsorships and other advertising based on typical industry rates. |

Capitalized

Software Development Costs

The

Company capitalizes internal and external costs directly associated with developing internal-use software, and hosting arrangements that

include an internal-use software license, during the application development stage of its projects. The Company’s internal-use

software is reported at cost less accumulated amortization. Amortization begins once the project has been completed and is ready for

its intended use. The Company will amortize the asset on a straight-line basis over a period of three years, which is the estimated useful

life. Software maintenance activities or minor upgrades are expensed in the period performed.

Amortization

expense related to capitalized software development costs are recorded in depreciation and amortization in the condensed

consolidated statements of operations.

Intangible

Assets

The

Company had certain intangible assets that were initially recorded at their fair value at the time of acquisition. The finite-lived intangible

assets consist of developed technology and customer contracts. Indefinite-lived intangible assets consist of domain names. Intangible

assets with finite useful lives are amortized using the straight-line method over their estimated useful life of five years.

The

Company reviews all finite-lived intangible assets for impairment when circumstances indicate that their carrying values may not be recoverable.

If the carrying value of an asset group is not recoverable, the Company recognizes an impairment loss for the excess carrying value over

the fair value in our consolidated statements of operations.

In

December 2022, the Company recorded an impairment loss of $440 on its indefinite-lived intangible assets that had been recognized as

part of the Sound Concepts acquisition in 2019. The Company also recorded an impairment loss of $2 that had been recognized as part of

the Solofire acquisition in 2020. As a result, the carrying amount of the Company’s indefinite-lived intangible assets was reduced

to $0 as of December 31, 2022.

The

Company did not record any impairment charges related to finite-lived intangible assets during the six months ended June 30, 2023.

Goodwill

In

accordance with FASB ASC 350, Intangibles-Goodwill and Other, the Company reviews goodwill and indefinite-lived intangible assets

for impairment at least annually or whenever events or circumstances indicate a potential impairment. The Company’s impairment

testing is performed annually at December 31 (its fiscal year end). Impairment of goodwill and indefinite-lived intangible assets is

determined by comparing the fair value of the Company’s reporting unit to the carrying value of the underlying net assets in the

reporting unit. If the fair value of the reporting unit is determined to be less than the carrying value of its net assets, goodwill

is deemed impaired and an impairment loss is recognized to the extent that the carrying value of goodwill exceeds the difference between

the fair value of the reporting unit and the fair value of its other assets and liabilities. In accordance with the “Segment Reporting”

Topic of the ASC, the Company’s chief operating decision maker (the Company’s Chief Executive Officer) determined that there

is only one reporting unit.

The

Company’s annual impairment analysis includes a qualitative assessment to determine if it is necessary to perform the quantitative

impairment test. In performing a qualitative assessment, the Company reviewed events and circumstances that could affect the significant

inputs used to determine if the fair value is less than the carrying value of goodwill. As a result of this qualitative assessment, the

Company determined that a triggering event had occurred to necessitate performing the quantitative impairment test.

After

performing the quantitative impairment test at December 31, 2022 in accordance with ASC 350-20-35-3C, the Company determined that goodwill

was impaired by $10,183. As a result of the impairment losses recognized, the carrying amount of the Company’s goodwill was reduced

to $9,581 as of December 31, 2022.

On

June 13, 2023, the Company entered into a definitive agreement to sell all of the operating assets and liabilities of the SaaS

business to SW Sales for $6,500,

including $4,750

of cash paid upon closing. The operations of the SaaS business have been presented within discontinued operations. Upon completion

of the sale of assets to SW Sales, in which the buyer assumed all liabilities related to the SaaS business, the Company recorded an

impairment of $5,441

within loss from discontinued operations as the carrying amount of the net assets exceeded the sale price, less selling

costs.

Series

B Redeemable Preferred Stock

On

February 17, 2023, the Company entered into a subscription agreement with Rory J. Cutaia, its Chief Executive Officer, pursuant to which

the Company agreed to issue and sell one (1) share of the Company’s Series B Preferred Stock, par value $0.0001 per share, for

$5 in cash. On April 20, 2023, the Company redeemed the Series B Preferred Stock for $5 in cash.

The

Certificate of Designation setting for the rights and preferences of the Series B Preferred Stock provides that the holder of the Series

B Preferred Stock will have 700,000,000 votes and will vote together with the outstanding shares of the Company’s common stock

as a single class exclusively with respect to any proposal to amend the Company’s Articles of Incorporation, as amended, to effect

a reverse stock split of the Company’s common stock and to increase the number of authorized shares of common stock of the Company.

The Preferred Stock will be voted, without action by the holder, on any such proposal in the same proportion, both For and Against, as

the shares of common stock are voted. The Preferred Stock otherwise has no voting rights except as otherwise required by the Nevada Revised

Statutes.

The

Series B Preferred Stock is not convertible into, or exchangeable for, shares of any other class or series of stock or other securities

of the Company. The Series B Preferred Stock has no rights with respect to any distribution of assets of the Company, including upon

a liquidation, bankruptcy, reorganization, merger, acquisition, sale, dissolution or winding up of the Company, whether voluntarily or

involuntarily. The holder of the Series B Preferred Stock will not be entitled to receive dividends of any kind.

The

outstanding share of Series B Preferred Stock shall be redeemed in whole, but not in part, at any time (i) if such redemption is ordered

by the Board of Directors in its sole discretion or (ii) automatically upon the effectiveness of the amendment to the Certificate of

Incorporation implementing a reverse stock split and the increase in authorized shares of common stock of the Company.

Fair

Value of Financial Instruments

The

Company follows the guidance of FASB ASC 820 and ASC 825 for disclosure and measurement of the fair value of its financial instruments.

FASB ASC 820 establishes a framework for measuring fair value under GAAP and expands disclosures about fair value measurements. To increase

consistency and comparability in fair value measurements and related disclosures, ASC 820 establishes a fair value hierarchy which prioritizes

the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest

priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable

inputs.

The

three (3) levels of fair value hierarchy defined by ASC 820 are described below:

| |

Level

1: |

Quoted

market prices available in active markets for identical assets or liabilities as of the reporting date. |

| |

Level

2: |

Pricing

inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the

reporting date. |

| |

Level

3: |

Pricing

inputs that are generally observable inputs and not corroborated by market data. |

The

carrying amount of the Company’s financial assets and liabilities, such as cash and cash equivalents, prepaid expenses, and accounts

payable and accrued expenses approximate their fair value due to their short-term nature. The carrying values financing obligations approximate

their fair values due to the fact that the interest rates on these obligations are based on prevailing market interest rates. The Company

uses Level 2 inputs for its valuation methodology for the derivative liabilities.

Derivative

Financial Instruments

The