Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-267109

The

information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these

securities has been declared effective by the Securities and Exchange Commission. This preliminary prospectus supplement and the accompanying

prospectus are not an offer to sell these securities, and we are not soliciting offers to buy these securities, in any jurisdiction where

the offer or sale is not permitted. These securities are not qualified for sale in any Province or Territory of Canada, directly or indirectly,

on behalf of the issuer, except in accordance with applicable Canadian securities laws.

Subject

to Completion, dated July 5, 2023

PRELIMINARY

PROSPECTUS SUPPLEMENT

(To

Prospectus dated September 6, 2022)

Common Shares

and

Warrants

to Purchase Common

Shares

We

are offering common shares and accompanying common warrants to purchase

common shares in this offering. The combined

public offering price for each common share and accompanying common warrant to purchase one common share is $ .

The common warrants have an exercise price of $ per share, are exercisable immediately and will expire years from the date of issuance.

We are also offering the common shares that are issuable from time to time upon exercise of the common warrants.

The

common shares and the common warrants can only be purchased together in this offering but will be issued separately and will be immediately

separable upon issuance. Our common shares are listed for trading on the Nasdaq Capital Market under the symbol “VBIV.” On

July 3, 2023, the last reported sale price of our common shares on the Nasdaq Capital Market was $2.64 per share. There

is no established public trading market for the common warrants, and we do not expect a market to develop. We do not intend to apply

for listing of the common warrants on the Nasdaq Capital Market or any securities exchange or nationally recognized trading system. Without

an active trading market, the liquidity of the common warrants will be limited.

On

April 12, 2023, we effected a 1-for-30 reverse stock split (the “Reverse Stock Split”) of our issued and outstanding common

shares effective as of April 12, 2023, pursuant to which every 30 of our issued and outstanding common shares were automatically converted

into one common share without any change in the par value per share. All share and per share prices in this prospectus supplement have

been adjusted to reflect the Reverse Stock Split; however, share and per share amounts in the accompanying prospectus and certain of

the documents incorporated by reference herein have not been adjusted to give effect to the Reverse Stock Split.

Concurrently

with this offering of common shares and pursuant to a separate prospectus supplement, we intend to sell up to an aggregate of

common shares and accompanying common warrants to purchase up to

common shares to a certain investor in a registered direct offering at the same price per share and accompanying common warrant

as the combined public offering price per share and accompanying common warrant set forth in the table below, for aggregate gross

proceeds of approximately $3,000,000, which we refer to herein as our concurrent registered direct offering. The concurrent registered

direct offering is being made without an underwriter or placement agent. The closing of the concurrent registered direct offering is

contingent upon the closing of this offering for aggregate gross proceeds of at least $5,000,000 (excluding potential proceeds

from the concurrent registered direct offering and before deducting the estimated underwriting discounts and commissions and estimated

offering expenses payable by us in this offering). This offering is not contingent upon the completion of the concurrent registered direct

offering.

Our

business and an investment in our securities involve significant risks. These risks are described under the caption “Risk Factors”

beginning on page S-9 of this prospectus supplement, on page S-1 of the accompanying prospectus, and under similar headings in the documents

incorporated by reference into this prospectus supplement.

| | |

Per

Share and Accompanying Common Warrant | | |

Total | |

| Combined public

offering price(1) | |

$ | | | |

$ | | |

| Underwriting discounts and

commissions(1) | |

$ | | | |

$ | | |

| Proceeds, before expenses,

to us | |

$ | | | |

$ | | |

(1)

Includes $0.01 per warrant for the accompanying common warrants.

(2)

We refer you to “Underwriting” beginning on page S-26 of this prospectus supplement for additional information regarding

total underwriting compensation.

We

have granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to purchase up to

additional

common shares at a price of $ per share and/or common

warrants to purchase up to additional common

shares at a price of $ per common warrant, less underwriting

discounts and commissions. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable

by us will be $ and the total proceeds to us, before

expenses, will be

$ .

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

The

underwriters expect to deliver the common shares and common warrants against payment in New York, New York, on or about , 2023.

Sole

Book-Running Manager

Raymond

James

Lead

Manager

Newbridge

Securities Corporation

The

date of this prospectus supplement is , 2023.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the U.S. Securities and

Exchange Commission utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus

supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying

prospectus and the documents incorporated by reference herein. The second part, the accompanying prospectus, provides more general information.

Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict

between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any document

incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus

supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later

date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having

the later date modifies or supersedes the earlier statement.

We

further note that the representations, warranties, and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties, and covenants should not be relied on as accurately representing the current state of our affairs.

You

should rely only on the information contained in this prospectus supplement, the accompanying prospectus, any free writing prospectus

or document incorporated by reference herein. We have not authorized, and the underwriters have not authorized, anyone to provide you

with different or additional information. The information contained in this prospectus supplement, the accompanying prospectus, any free

writing prospectus or document incorporated by reference herein or therein is accurate only as of the respective dates thereof, regardless

of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our securities. Our business,

financial condition, results of operations and prospects may have changed since those dates. It is important for you to read and consider

all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference

herein and therein, in making your investment decision. You should also read and consider the information in the documents to which we

have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain

Information By Reference” in this prospectus supplement and in the accompanying prospectus, respectively.

We

are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution

of this prospectus supplement and the accompanying prospectus and the offering of our securities in certain jurisdictions may be restricted

by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must

inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus

supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not

constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by

this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

This

prospectus supplement, the accompanying prospectus, and the information incorporated herein and therein by reference includes trademarks,

service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated

by reference into this prospectus supplement or the accompanying prospectus are the property of their respective owners.

All

references in this prospectus supplement and the accompanying prospectus to “VBI,” the “Company,” “we,”

“us,” “our,” or similar references refer to VBI Vaccines Inc., a company incorporated under the laws of British

Columbia, Canada, and its subsidiaries taken as a whole, except where the context otherwise requires or as otherwise indicated. References

in this prospectus to “$” are to United States dollars, and Canadian dollars are indicated by the symbol “C$”.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus and the information incorporated by reference herein and therein contain “forward-looking

statements,” which include information relating to future events, future financial performance, strategies, expectations, competitive

environment, and regulation. Words such as “may,” “will,” “should,” “could,” “would,”

“hopes,” “projects,” “predicts,” “potential,” “continue,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,”

and similar expressions, as well as statements in future tense, identify forward-looking statements within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements should not be read as a guarantee

of future performance or results and will probably not be accurate indications of when such performance or results will be achieved.

Forward-looking statements are based on information we have when those statements are made or our management’s good faith belief

as of that time with respect to future events, and are subject to numerous factors, risks and uncertainties that could cause actual performance,

the outcome of events, timing, or results to differ materially from those expressed in or suggested by the forward-looking statements.

Important factors that could cause such differences include, but are not limited to:

●

the timing of, and our ability to, obtain and maintain regulatory approvals for our clinical trials, products, and pipeline candidates;

●

our ability to achieve and sustain commercial success of PreHevbrio in the United States and Canada and PreHevbri in Europe;

●

the timing and results of our ongoing and planned clinical trials for products and pipeline candidates;

●

the amount of funds we require for our prophylactic and therapeutic pipeline candidates;

●

the potential benefits of strategic partnership agreements and our ability to enter into strategic partnership arrangements;

●

our ability to manufacture, or to have manufactured, our 3-antigen hepatitis B vaccine and our pipeline candidates, at commercially viable

scales to the standards and requirements of regulatory agencies;

●

the impact of the COVID-19 pandemic and the continuing effects of the COVID-19 pandemic on our clinical studies, research programs, manufacturing,

business plan, regulatory review including site inspections, and the global economy;

●

our ability to effectively execute and deliver our plans related to commercialization, marketing, manufacturing capabilities and strategy;

●

our ability to retain and maintain a good relationship with our current employees, and our ability to competitively attract new employees

with relevant experience and expertise;

●

the suitability and adequacy of our office, manufacturing, and research facilities and our ability to secure term extensions or expansions

of leased space;

●

the ability of our vendors and suppliers to manufacture and deliver materials in a timely manner that meet regulatory agency and our

standards and requirements to meet planned timelines and milestones;

●

any disruption in the operations of our Rehovot, Israel manufacturing facility where we manufacture all of our clinical and commercial

supplies of our 3-antigen hepatitis B vaccine and clinical supplies of our hepatitis B immunotherapeutic, VBI-2601;

●

our compliance with all laws, rules, and regulations applicable to our business and products;

●

our ability to continue as a going concern;

●

our history of losses;

●

our ability to generate revenues and achieve profitability;

●

emerging competition and rapidly advancing technology in our industry that may outpace our technology;

●

customer demand for our 3-antigen hepatitis B vaccine and pipeline candidates;

●

the impact of competitive or alternative products, technologies, and pricing;

●

general economic conditions and events and the impact they may have on us and our potential customers;

●

our ability to obtain adequate financing in the future on reasonable terms, as and when we need it;

●

our ability to implement network systems and controls that are effective at preventing cyber-attacks, malware intrusions, malicious viruses,

and ransomware threats;

●

our ability to secure and maintain protection over our intellectual property;

●

our ability to maintain our existing licenses with licensors of intellectual property, or obtain new licenses for intellectual property;

●

changes to legal and regulatory processes for biosimilar approval and marketing that could reduce the duration of market exclusivity

for our products;

●

our ability to maintain compliance with the Nasdaq Capital Market’s (“Nasdaq”) listing standards; and

●

our success at managing the risks involved in the foregoing items.

You

should review carefully the section entitled “Risk Factors” beginning on page S-9 of this prospectus supplement,

on page S-1 of the accompanying prospectus and under similar headings in the documents incorporated by reference into this prospectus

supplement for a discussion of these and other risks that relate to our business and investing in our securities. The forward-looking

statements contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and under similar headings

in the documents incorporated by reference into this prospectus supplement are expressly qualified in their entirety by this cautionary

statement. We do not undertake any obligation to publicly update any forward-looking statement to reflect events or circumstances after

the date on which any such statement is made or to reflect the occurrence of unanticipated events.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus supplement, in

the accompanying prospectus and in the documents incorporated by reference herein and therein. This summary is not complete and does

not contain all the information you should consider before investing in our securities pursuant to this prospectus supplement and the

accompanying prospectus. Before making an investment decision, to fully understand this offering and its consequences to you, you should

carefully read this entire prospectus supplement and the accompanying prospectus, and any free writing prospectus we have authorized

for use in connection with this offering, including “Risk Factors,” the financial statements, and related notes, and the

other information incorporated by reference herein and therein.

Company

Overview

We

are a commercial stage biopharmaceutical company driven by immunology in the pursuit of prevention and treatment of disease. Through

our innovative approach to virus-like particles (“VLPs”), including a proprietary enveloped VLP (“eVLP”) platform

technology, we develop vaccine candidates that mimic the natural presentation of viruses, designed to elicit the innate power of the

human immune system. We are committed to targeting and overcoming significant infectious diseases, including hepatitis B (“HBV”),

COVID-19 and coronaviruses, and cytomegalovirus (“CMV”), as well as aggressive cancers including glioblastoma (“GBM”).

We are headquartered in Cambridge, Massachusetts, with research operations in Ottawa, Canada, and a research and manufacturing site in

Rehovot, Israel.

Product

Pipeline

Our

pipeline is comprised of vaccine and immunotherapeutic programs developed by virus-like particle technologies to target two distinct,

but often related, disease areas - infectious disease and oncology. We prioritize the development of programs for disease targets that

are challenging, underserved, and where the human immune system, when powered and stimulated appropriately, can be a formidable opponent.

VLP

vaccines are a type of sub-unit vaccine, in which only the portions of viruses critical for eliciting an immune response are presented

to the body. Because of their structural similarity to viruses presented in nature, including their particulate nature and repetitive

structure, VLPs can stimulate potent immune responses. VLPs can be customized to present any protein antigen, including multiple antibody

and T cell targets, making them, we believe, ideal technologies for the development of both prophylactic and therapeutic vaccines. However,

only a few antigenic proteins self-assemble into VLPs, which limit the number of potential targets. Notably, HBV antigens are among those

that are able to spontaneously form orderly VLP structures. Our eVLP platform technology expands the list of potentially viable target

indications for VLPs by providing a stable core (Gag Protein) and lipid bilayer (the “envelope”). It is a flexible platform

that enables the synthetic manufacture of an “enveloped” VLP, or “eVLP”, which looks structurally and morphologically

similar to the virus, with no infectious material.

Our

product pipeline includes an approved vaccine and multiple late- and early-stage investigational programs. The investigational programs

are in various stages of clinical development and the scientific information included about these therapeutics is preliminary and investigative.

The investigational programs have not been approved by the United States Food and Drug Administration, European Medicines Agency, United

Kingdom Medicines and Healthcare products Regulatory Agency, Health Canada, or any other health authority and no conclusion can or should

be drawn regarding the safety or efficacy of these investigational programs.

In

addition to our existing pipeline programs, we may also seek to in-license clinical-stage vaccines or vaccine-related technologies that

we believe complement our pipeline, as well as technologies that may supplement our efforts in both immuno-oncology and infectious disease.

Key

Targeted Disease Areas

Hepatitis

B Virus

HBV

infection can cause liver inflammation, fibrosis, and liver injury, resulting in potentially life-threatening conditions through acute

illness and chronic disease, including liver failure, cirrhosis, and cancer. HBV remains a significant public health burden with as many

as 2.2 million chronically infected people in the United States (“U.S.”) alone. Worldwide, this number is estimated to be

as high as 350 million, with approximately 800,000 deaths resulting from the consequences of HBV infection each year.

Despite

the highly infectious nature of HBV, due to its often-asymptomatic nature, it is estimated that as many as 67% of chronically infected

adults in the U.S. are unaware of their infection status. There is no cure available for HBV infection and while public health initiatives

highlight immunization as the most effective strategy for the prevention of HBV infections, the U.S. adult HBV vaccination rates remain

persistently low at only about 30% of all adults aged 19 years and older.

In

April 2022, the Centers for Disease Control and Prevention (“CDC”) Advisory Committee on Immunization Practices (“ACIP”)

implemented a change to the adult HBV vaccine recommendations. As incorporated in the CDC’s 2022 Adult Immunization Schedule and

as published in the April 1, 2022, CDC Morbidity and Mortality Weekly Report, adults aged 19 to 59 years are now universally recommended

to be vaccinated against HBV infection. Additionally, while adults aged 60 years and older with risk factors for HBV infection are still

recommended to receive HBV vaccinations, adults aged 60 years and older without known risk factors for HBV may now also receive HBV vaccinations.

COVID-19

and Other Coronaviruses

Coronaviruses

are a large family of enveloped viruses that cause respiratory illness of varying severities. Only seven coronaviruses are known to cause

disease in humans, four of which most frequently cause symptoms typically associated with the common cold. Three of the seven coronaviruses,

however, have more serious outcomes in people. These more pathogenic coronaviruses are (1) SARS-CoV-2, a novel coronavirus identified

as the cause of COVID-19; (2) MERS-CoV, identified in 2012 as the cause of Middle East Respiratory Syndrome (“MERS”); and

(3) SARS-CoV, identified in 2002 as the cause of Severe Acute Respiratory Syndrome (“SARS”).

The

virus that causes COVID-19 continues to evolve and several SARS-CoV-2 variants have emerged and certain of these variants have been identified

as having a significant public health impact. To date, notable Variants of Concern (“VOC”) have included:

●

Alpha (B.1.1.7) – First identified as in the United Kingdom (“UK”), VOC in December 2020

●

Beta (B.1.351) – First identified in South Africa, VOC in December 2020

●

Gamma (P.1) – First identified in Brazil, VOC in January 2021

●

Delta (B.1.617.2) – First identified in India, VOC in May 2021

●

Omicron and subvariants – First identified in South Africa, VOC in November 2021

Glioblastoma

GBM

is among the most common and aggressive malignant primary brain tumors in humans. In the U.S. alone, about 12,000 new GBM cases are diagnosed

each year. The current standard of care for GBM is surgical resection, followed by radiation and chemotherapy. Even with intensive treatment,

GBM progresses rapidly and has a high mortality rate, with median overall survival for primary GBM of about 14 months. Median overall

survival for recurrent GBM is even lower, at about 8 months.

Cytomegalovirus

CMV

is a common virus that is a member of the herpes family. It infects one in every two people in many developed countries. Most CMV infections

are “silent”, meaning the majority of people who are infected exhibit no signs or symptoms. Despite its typically asymptomatic

nature in older children and adults, CMV may cause severe infections in newborn children (congenital CMV) and may also cause serious

infections in people with weakened immune systems, such as solid organ or bone marrow transplant recipients. Congenital CMV infection

can be treated – but not cured – and there are currently no approved vaccines available for the prevention of infection in

either the congenital or the transplant setting.

Zika

Zika

is a mosquito-borne virus that is spread primarily through the bite of an infected Aedes species mosquito, but can also be transmitted

sexually, during pregnancy, or during childbirth. Acute infections are typically mild, but Zika has been associated with a number of

neurological complications in newborns. The first formal description of Zika virus was published in 1952, but it was not until 2007 that

the first Zika outbreak in humans was recorded. Over the past decade, Zika has begun to spread globally, and between January 2014 and

February 2016, 33 countries reported circulation of the Zika virus, including in North America. There is currently no vaccine to prevent

Zika infection.

Pipeline

Programs

The

table below is an overview of our commercial vaccine and our investigational programs as of June 28, 2023:

| Indication |

|

Program |

|

Technology |

|

Current

Status |

Approved

Vaccine

●

Hepatitis B |

|

PreHevbrio1,2,3

Hepatitis

B Vaccine |

|

VLP |

|

Registration/Commercial |

| |

|

(Recombinant) |

|

|

|

|

| Prophylactic

Candidates |

|

|

|

|

|

|

| ●

Coronaviruses (Multivalent) |

|

VBI-2901 |

|

eVLP |

|

Ongoing

Phase I |

| ●

COVID-19 (Beta variant) |

|

VBI-2905 |

|

eVLP |

|

Phase

Ib Completed |

| ●

COVID-19 (Ancestral) |

|

VBI-2902 |

|

eVLP |

|

Phase

Ia Completed |

| ●

Cytomegalovirus |

|

VBI-1501 |

|

eVLP |

|

Phase

I Completed |

| ●

Coronaviruses (Multivalent) |

|

Undisclosed |

|

eVLP |

|

Pre-Clinical |

| ●

Zika |

|

VBI-2501 |

|

eVLP |

|

Pre-Clinical |

| |

|

|

|

|

|

|

| Therapeutic

Candidates |

|

|

|

|

|

|

| ●

Hepatitis B |

|

VBI-2601 |

|

VLP |

|

Ongoing

Phase II |

| ●

Glioblastoma |

|

VBI-1901 |

|

eVLP |

|

Phase

I/IIa |

| ●

Other CMV-Associated Cancers |

|

Undisclosed |

|

eVLP |

|

Preclinical |

1Approved

for use in the U.S. and Canada, under the brand name PreHevbrio, for the prevention of infection caused by all known subtypes of HBV

in adults 18 years of age and older.

2

Approved for use in the European Union (“EU”) / European Economic Area (“EEA”) and the UK, under the brand

name PreHevbri, for active immunization against infection caused by all known subtypes of the HBV in adults. It can be expected that

hepatitis D will also be prevented by immunization with PreHevbri as hepatitis D (caused by the delta agent) does not occur in the absence

of HBV infection.

3Approved

for use in Israel, under the brand name Sci-B-Vac, for active immunization against hepatitis B virus (HBV infection).

A

summary of our marketed product, lead pipeline programs, and recent developments follows.

Marketed

Product

PreHevbrio

[Hepatitis B Vaccine (Recombinant)]

PreHevbrio

[Hepatitis B Vaccine (Recombinant)] was approved by the FDA on November 30, 2021, for the prevention of infection caused by all known

subtypes of HBV in adults aged 18 years and older. PreHevbrio contains the S, pre-S2, and pre-S1 HBV surface antigens, and is the only

approved 3-antigen HBV vaccine for adults in the U.S. On February 23, 2022, following discussion at the CDC’s ACIP meeting, PreHevbrio

joined the list of recommended products for prophylactic adult vaccination against HBV infection. The inclusion of PreHevbrio in the

ACIP recommendation was reflected in a CDC publication on April 1, 2022 and was a notable milestone as many insurance plans and institutions

require an ACIP recommendation before a vaccine can be reimbursed or is made available to patients. Additionally, PreHevbrio was included

in the 2023 annual update of the CDC Adult Immunization Schedule, as detailed in the CDC publication on February 10, 2023. VBI launched

PreHevbrio in the U.S. at the end of the first quarter of 2022, and revenue generation began in the second quarter of 2022. In June

2023, PreHevbrio was also awarded part of the CDC 2023 Adult Vaccine contract, for up to $25,350,000. The CDC vaccine contracts are established

for the purchase of vaccines by immunization programs that receive CDC immunization cooperative agreement funds (i.e., state health departments,

certain large city immunization projects, and certain current and former U.S. territories).

Commercial

and regulatory activity for VBI’s 3-antigen HBV vaccine outside of the U.S. include:

●

EU: On May 2, 2022, we announced that the European Commission (the “EC”) granted Marketing Authorization for PreHevbri [Hepatitis

B Vaccine (Recombinant, Adsorbed)]. The European Commission’s centralized marketing authorization is valid in all EU Member States

as well as in the EEA countries (Iceland, Liechtenstein, and Norway). On September 8, 2022, we announced a partnership with Valneva SE

(“Valneva”) for the marketing and distribution of PreHevbri in select European markets, initially including the UK, Sweden,

Norway, Denmark, Finland, Belgium, and the Netherlands. As part of this partnership, VBI expects PreHevbri will be available in certain

European Union countries beginning in the third quarter of 2023.

●

UK: On June 1, 2022, we announced that the UK Medicines and Healthcare Products Regulatory Agency granted marketing authorization for

PreHevbri [Hepatitis B Vaccine (Recombinant, Adsorbed)]. This follows the EC centralized marketing authorization received in May 2022

and was conducted as part of the EC Decision Reliance Procedures. The UK is included in the Valneva marketing and distribution agreement

for PreHevbri. On June 15, 2023, VBI announced the launch and availability of PreHevbri in the UK as part of the Valneva partnership.

●

Canada: On December 8, 2022, we announced that Health Canada approved PreHevbrio [3-antigen Hepatitis B Vaccine (Recombinant)] for the

prevention of infection caused by all known subtypes of HBV in adults aged 18 years and older. VBI expects to make PreHevbrio available

in Canada by year-end 2023.

●

Israel: Approved and commercially available under the brand name Sci-B-Vac® since 2000.

●

APAC: On July 5, 2023, we announced a license and collaboration agreement with Brii Biosciences (“Brii Bio”) for the

development and commercialization of PreHevbri in the Asia Pacific region (“APAC”), excluding Japan.

Prophylactic

Investigational Candidates

VBI-2900:

Coronavirus Vaccine Program (VBI-2901, VBI-2902, VBI-2905)

In

response to the ongoing SARS-CoV-2 (COVID-19) pandemic, VBI initiated development of a prophylactic coronavirus vaccine program. Coronaviruses

are enveloped viruses by nature which make them a prime target for VBI’s flexible eVLP platform technology.

On

August 26, 2020, we announced data from three pre-clinical studies conducted to enable selection of optimized clinical candidates for

our coronavirus vaccine program. As a result of these studies, VBI selected two vaccine candidates with the goal of bringing forward

candidates that add meaningful clinical and medical benefit to those already approved: (1) VBI-2901, a multivalent coronavirus vaccine

candidate expressing the SARS-CoV-2, SARS, and MERS spike proteins; and (2) VBI-2902, a monovalent vaccine candidate expressing an optimized

“prefusion” form of the SARS-CoV-2 spike protein.

In

March 2021, a Phase I study of VBI-2902 was initiated and on June 29, 2021, we announced initial positive data from the Phase Ia portion

of this study that evaluated one- and two-dose regimens of 5µg of VBI-2902 in 61 healthy adults aged 18-54 years. After two doses,

VBI-2902 induced neutralization titers in 100% of participants, with 4.3x higher geometric mean titer (“GMT”) than that of

the convalescent serum panel (n=25), and peak antibody binding GMT of 1:4,047. VBI-2902 was also well tolerated with no safety signals

observed.

In

response to the increased circulation of SARS-CoV-2 variants, the Phase Ib portion of the Phase I study was initiated in September 2021

to assess VBI-2905, our eVLP vaccine candidate directed against the SARS-CoV-2 Beta variant. On April 5, 2022, we announced new data

from the Phase Ib study (n=53). A single-dose booster of VBI-2905 increased the GMT of neutralizing antibodies directed against the Beta

variant 3.8-fold, at day 28, in participants who had previously received two-doses of an mRNA vaccine (ancestral strain) – approximately

2-fold increases were also seen at day 28 in antibody GMTs against both the ancestral and delta variant. New preclinical data announced

at the same time showed that against a panel of coronavirus variants in mice, reactivity was seen with VBI-2902 against all variants

including the ancestral strain, Delta, Beta, Omicron, Lambda, and RaTG13 (a bat coronavirus that is distant to circulating human strains).

In this same panel, VBI-2901 was able to elicit an even stronger response against all variants tested – as the strains became more

divergent from the ancestral strain, VBI-2901 elicited a greater difference in GMT from VBI-2902, ranging from 2.5-fold higher against

the ancestral strain to 9.0-fold higher against the bat coronavirus. Additionally, a validated pseudoparticle neutralization assay benchmarked

against the WHO reference standard demonstrated that VBI-2902 elicited neutralizing antibody responses of 176 IU50/mL in its Phase Ia

study – this international standard measure would predict a greater than 90% efficacy, with two internationally approved vaccines

estimated to have 90% efficacy at 83 and 140 IU50/mL (Gilbert, PB, 2021).

The

clinical and preclinical data for all three candidates continue to support the potential of the eVLP platform against coronaviruses.

On September 29, 2022, we announced that we initiated the first clinical study of VBI’s multivalent coronavirus candidate, VBI-2901,

designed to increase breadth of protection against COVID-19 and related coronaviruses. Interim data from this study are expected mid-year

2023.

The

VBI-2900 program is supported by a partnership with the Coalition for Epidemic Preparedness Innovations (“CEPI” and the partnership,

the “CEPI Funding Agreement”), with contributions of up to $33 million; a partnership with the Strategic Innovation Fund,

established by the Government of Canada, with an award of up to CAD $56 million; contribution of up to CAD $1 million from the Industrial

Research Assistance Program (“IRAP”) of the National Research Council of Canada (“NRC”); and a collaboration

with the NRC. On December 6, 2022, we and CEPI announced that we expanded the scope of the CEPI Funding Agreement to advance the development

of multivalent coronavirus vaccines that could be deployed against COVID-19 as well as a future “Coronavirus X”.

VBI-1501:

Prophylactic CMV Vaccine Candidate

Our

prophylactic CMV vaccine candidate uses the eVLP platform to express a modified form of the CMV glycoprotein B antigen and is adjuvanted

with alum, an adjuvant used in FDA-approved products.

Following

the successful completion of the Phase I study in May 2018, and positive discussions with Health Canada, we announced plans for a Phase

II clinical study evaluating VBI-1501 on December 20, 2018. We received similarly positive guidance from the FDA in July 2019. The Phase

II study is expected to assess the safety and immunogenicity of dosages of VBI-1501 up to 20µg with alum. We are currently evaluating

the timing of the Phase II study.

Therapeutic

Investigational Candidates

VBI-2601:

HBV Immunotherapeutic Candidate

VBI-2601

is our novel, recombinant, protein-based immunotherapeutic candidate in development for the treatment of chronic HBV infection. VBI-2601

is formulated to induce broad immunity against HBV, including T-cell immunity which plays an important role in controlling HBV infection.

On

April 12, 2021, and June 23, 2021, we announced data from the completed Phase Ib/IIa clinical study in patients with chronic HBV infection,

which was conducted by our partner Brii Bio. The study was a randomized, controlled study designed to assess the safety, tolerability,

antiviral and immunologic activity of VBI-2601. The study was a two-part, dose-escalation study assessing different dose levels of VBI-2601

with and without an immunomodulatory adjuvant, conducted at multiple study sites in New Zealand, Australia, Thailand, South Korea, Hong

Kong Special Administrative Region of China, and China.

The

data from the Phase Ib/IIa for 33 evaluable patients across all study arms suggested: (1) VBI-2601 was well tolerated at all dose levels

with and without the adjuvant with no significant adverse events identified; (2) VBI-2601 induced both B cell (antibody) and T cell responses

in chronically-infected HBV patients, (3) VBI-2601 induced restimulation of T cell responses to HBV surface antigens, including S, Pre-S1,

and Pre-S2, in greater than 50% of the evaluable patients compared to no detectable response in the control arm; (4) the T cell responses

and antibody responses were comparable across the 20µg and 40µg unadjuvanted study arms; and (5) T cell response rates between

the adjuvanted and unadjuvanted cohorts were also comparable. Based on the acceptable safety profile and vaccine-induced adaptive immune

responses seen in this study, VBI-2601 advanced to Phase II studies.

On

April 21, 2021, we announced that the first patient had been dosed in a Phase II clinical study evaluating VBI-2601 in combination with

BRII-835 (VIR-2218), an investigational small interfering ribonucleic acid targeting HBV, for the treatment of chronic HBV infection.

The multi-center, randomized, open-label study is designed to evaluate the safety and efficacy of this combination with and without interferon-alpha

as a co-adjuvant. The study is being conducted at clinical sites in Australia, Taiwan, Hong Kong Special Administrative Region of China,

South Korea, New Zealand, Singapore, and Thailand. Our partner, Brii Bio, is the study sponsor. A total of 50 adult, non-cirrhotic patients

who received NRTI therapy for at least 12 months were randomized and dosed across three cohorts:

| ● |

Cohort A: BRII-835 Alone

Regimen – Nine subcutaneous 100mg doses of BRII-835, dosed every four (4) weeks through Week 32 |

| ● |

Cohort B: BRII-835 Alone

Regimen + nine 40µg intramuscular doses of VBI-2601 admixed with interferon-alpha (IFN-α) as co-adjuvant every four weeks

from Week 8 through Week 40 |

| ● |

Cohort C: BRII-835 Alone

Regimen + nine 40µg intramuscular doses of VBI-2601 without IFN-α every four weeks from Week 8 through Week 40 |

On

February 15, 2023, we announced interim data from the Phase II combination study. The data, which was featured in an oral presentation

at the 32nd Conference of the Asian Pacific Association for the Study of the Liver on February 18, 2023, demonstrated that

the combination therapy was generally well-tolerated, restored strong anti-HBsAg antibody responses, and led to improved HBsAg-specific

T-cell responses, when compared to BRII-835 alone. Notably:

| |

● |

Mean changes in HBsAg reduction

relative to baseline at week 40 were -1.68 log10 IU/mL in Cohort A, -1.75 log10 IU/mL in Cohort B, and -1.77

log10 IU/mL in Cohort C |

| |

● |

Potent HBV surface antibody

levels (> 100 IU/L) were observed in more than 40% of participants in Cohorts B and C at week 40 – by comparison, no antibody

responses were detected in Cohort A |

| |

● |

Out of 25 evaluable patients,

a higher proportion of Cohort B and C patients demonstrated potent HBsAg-specific T-cell responses (70%; 14/20) relative to those

in Cohort A (20%; 1/5) through week 44 |

| |

● |

To date, two participants

receiving combination regimens achieved either HBsAg below LLOQ (0.05 mIU/mL), to an undetectable level, or at LLOQ with maximum

reductions of ≥ 4 log10 HBsAg – both participants mounted potent anti-HBs antibody and HBV-specific T-cell responses |

Additional

data from the study are expected to be announced around the end of the year.

On

January 5, 2022, we announced that the first patient was dosed in a second Phase IIa/IIb clinical study evaluating VBI-2601. This Phase

II study assesses VBI-2601 as an add-on therapy to the standard-of-care in China nucleos(t)ide reverse transcriptase inhibitor (“NRTI”)

and pegylated interferon therapy (PEG-IFN-α,). Interim topline clinical data from part one of this Phase IIa/IIb clinical study

are expected in the second half of 2023.

On

July 5, 2023, we announced an amended license and collaboration agreement with Brii Bio, expanding Brii Bio’s rights to

the development and commercialization of VBI-2601 from Greater China rights to Global rights for VBI-2601.

VBI-1901:

Glioblastoma (GBM)

Our

cancer vaccine immunotherapeutic program, VBI-1901, targets CMV proteins present in tumor cells. CMV is associated with a number of solid

tumors including GBM, breast cancer, and pediatric medulloblastoma.

In

January 2018, we initiated dosing in a two-part, multi-center, open-label Phase I/IIa clinical study of VBI-1901 in 38 patients with

recurrent GBM. Phase I (Part A) of the study was a dose-escalation phase that defined the safety, tolerability, and optimal dose level

of VBI-1901 adjuvanted with granulocyte-macrophage colony-stimulating factor (GM-CSF) in recurrent GBM patients with any number of prior

recurrences. In December 2018, this phase completed enrollment of 18 patients across three dose cohorts, the highest of which (10 µg)

was selected as the optimal dose level to test in the Phase IIa portion (Part B) of the study. Phase IIa of the study, which initiated

enrollment in July 2019, is a two-arm study that enrolled 20 first-recurrent GBM patients to receive 10 µg of VBI-1901 in combination

with either GM-CSF or GSK proprietary adjuvant system, AS01, as immunomodulatory adjuvants. AS01 is provided pursuant to a Clinical Collaboration

and Support Study Agreement with GSK, which we entered into on September 10, 2019. Enrollment of the 10 patients in the VBI-1901 with

GM-CSF arm was completed in March 2020 and enrollment of the 10 patients in the VBI-1901 with AS01 arm was completed in October 2020.

Data

from the Phase IIa portion of the study was announced throughout 2020, 2021, and 2022, with the latest data presented in November 2022

at the 2022 Society for Neuro-Oncology (SNO) Annual Meeting. The data from the Phase IIa portion of this study demonstrate: (1) improvement

in 6-month, 12-month, and 18-month overall survival (“OS”) data compared to historical controls; (2) 12-month OS of 60% (n=6/10)

in the VBI-1901 + GM-CSF study arm and 70% (n=7/10) in the VBI-1901 + AS01 study arm, compared to historical controls of ~30%; (3) 18-month

OS of 30% (3/10) in the VBI-1901 + GM-CSF study arm and 40% (n=4/10) in the VBI-1901 + AS01 study arm; (4) 2 patients with partial tumor

responses, one of whom remained on protocol for over two years and had achieved a 93% tumor reduction relative to baseline at initiation

of treatment at the start of the study, and 10 stable disease observations across all study arms; and (5) VBI-1901 continues to be safe

and well tolerated at all doses tested, with no safety signals observed.

On

June 8, 2021, we announced that the FDA granted Fast-Track Designation for VBI-1901 formulated with GM-CSF for the treatment of recurrent

GBM patients with first tumor recurrence. The designation was granted based on data from the Phase I/IIa study.

On

June 22, 2022, we announced that the FDA granted Orphan Drug Designation for VBI-1901 for the treatment of GBM.

Based

on the data seen to-date, as part of the next phase of development we anticipate assessing VBI-1901 in randomized, controlled studies

in both primary and recurrent GBM patients. In the recurrent setting, we aim to expand the number of patients in the current trial and

add a control arm, with the potential to support an accelerated approval application based on tumor response rates and improvement in

overall survival. Subject to discussion with the FDA, the amended protocol is expected to initiate enrollment of additional patients

mid-year 2023.

On

October 12, 2022, we announced a collaboration with Agenus Inc. to evaluate VBI-1901 in combination with anti-PD-1 balstilimab in a Phase

II study as part of the INSIGhT adaptive platform trial in patients with primary GBM. Subject to approval from regulatory bodies, we

expect enrollment to initiate in the VBI-1901 study arm in INSIGhT in the third quarter of 2023.

Recent

Developments

Organizational

Changes

On

April 4, 2023, we announced that we intend to reduce our internal workforce by 30-35%, which began in April and is expected to be largely

completed by the end of June 2023. As a result of this and other reductions in spend, we expect our operating expenses

from normal business to be 30-35% lower in the second half of 2023 as compared with the second half of 2022. However, there is

no assurance that the planned reduction in workforce and other expenses will result in the expected overall reduction of our operating

expenses.

Reverse

Stock Split

On

April 12, 2023, we effected the Reverse Stock Split of our issued and outstanding common shares effective as of April 12, 2023, pursuant

to which every 30 of our issued and outstanding common shares were automatically converted into one common share without any change in

the par value per share. Per the requirements of the Business Corporations Act (British Columbia), under which we are regulated,

if fractional shares held by registered shareholders were to be converted into whole shares, each fractional share remaining after the

completion of the Reverse Stock Split that was less than half of a share was cancelled and each fractional share that was at least half

of a share was rounded up to one whole share. No shareholders received cash in lieu of fractional shares. All share and per share prices

in this prospectus supplement have been adjusted to reflect the Reverse Stock Split; however, share and per share amounts in the accompanying

prospectus and certain of the documents incorporated by reference herein have not been adjusted to give effect to the Reverse Stock Split.

Nasdaq

Minimum Bid Price Listing Requirement

On

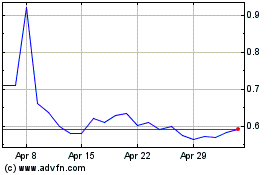

April 26, 2023, we received a letter from the Listing Qualifications Department of Nasdaq stating that for the last 10 consecutive business

days, from April 12, 2023 to April 25, 2023, the closing bid price of our common shares had been at or greater than $1.00 per share and

accordingly, we had regained compliance with Nasdaq Listing Rule 5550(a)(2) and that the matter was now closed.

Launch

of PreHevbri in the UK

On

June 15, 2023, we announced that PreHevbri® [Hepatitis B vaccine (recombinant, adsorbed)] is now available in the UK for active immunization

against infection caused by all known subtypes of the hepatitis B virus (HBV) in adults. As part of the marketing and distribution partnership

announced in September 2022, PreHevbri will be available in the UK through Valneva’s existing commercial infrastructure and distribution

networks.

CDC Adult Vaccine Contract Award

On June 30 2023, the CDC released its 2023 Adult Vaccine contract, which included PreHevbrio

and an award of part of the contract for up to $25,350,000. The CDC vaccine contracts are established for the purchase of vaccines by

immunization programs that receive CDC immunization cooperative agreement funds (i.e., state health departments, certain large city immunization

projects, and certain current and former U.S. territories).

Expanded

Hepatitis B Partnership with Brii Bio

On

July 5, 2023, we announced the expansion of our hepatitis B partnership with Brii Bio. Through two license and collaboration agreements,

Brii Bio expanded its exclusive license to VBI-2601 to global rights and acquired an exclusive license for PreHevbri in APAC,

excluding Japan. As part of this collaboration, Brii Bio will pay VBI an upfront payment of $15,000,000, including approximately

$3,000,000 equity investment in the concurrent registered direct offering. VBI is also eligible to receive up to an additional $422,000,000

in potential regulatory and commercial milestone payments (combined for both licenses), and potential double-digit royalties in the licensed territories, which is worldwide for VBI-2601 and APAC, excluding Japan, for PreHevbri. Brii Bio will be

responsible for all development, regulatory, and commercial activities and costs for the two programs in their respective licensed territories.

Corporate

Information

Our

principal office is located at 160 Second Street, Floor 3, Cambridge, Massachusetts 02142. Our telephone number at our headquarters is

(617) 830-3031.

Additional

information about us is available on our website at www.vbivaccines.com. The information contained on, or that may be obtained from our

website is not, and shall not be deemed to be, a part of this prospectus supplement.

For

a description of our business, financial condition, results of operations and other important information regarding us, we refer you

to our filings with the Securities and Exchange Commission incorporated by reference in this prospectus supplement. For instructions

on how to find copies of these documents, see “Where You Can Find More Information.”

| THE OFFERING |

| |

|

|

| Issuer |

|

VBI Vaccines Inc. |

| |

|

|

| Common shares offered by us |

|

common shares |

| |

|

|

| Common warrants offered by us |

|

Common

warrants to purchase an aggregate of

common shares. Each of our common shares is being sold together with an accompanying common warrant to purchase one common share.

Each common warrant has an exercise price of $

per share, is immediately exercisable and will expire on the anniversary of the original issuance date. The exercise price of

the common warrants is subject to customary adjustments for share dividends, share splits, reclassifications and the like, and subject

to price-based adjustment, on a “full ratchet” basis, in the event of any issuances of common shares, or securities convertible,

exercisable or exchangeable for common shares, at a price below the then-applicable exercise price (subject to certain exceptions).

The common shares and the accompanying common warrants can only be purchased together in this offering but will be issued separately

and will be immediately separable upon issuance. This offering also relates to the offering of the common shares issuable upon exercise

of the common warrants. See “Description of Securities We Are Offering” on page S-25 of this prospectus supplement. |

| |

|

|

| Common shares outstanding immediately after this offering

and the concurrent registered direct offering(1) |

|

shares

(or approximately

shares if the underwriters exercise their option to purchase additional common shares and/or common warrants in full). |

| |

|

|

| Option to purchase additional common shares and/or

common warrants |

|

We

have granted the underwriters an option to purchase up to additional

common shares and/or common warrants to purchase up to additional

common shares. This option is exercisable, in whole or in part, for a period of 30 days from the date of this prospectus supplement. |

| |

|

| Concurrent registered direct offering |

|

Concurrently

with this offering, we are offering

common shares and accompanying common warrants to purchase up to

common shares to a certain investor in a concurrent registered direct offering, at the

same price per common share and accompanying common warrant as the combined public

offering price, for aggregate gross proceeds of approximately $3,000,000. The

concurrent registered direct offering is being conducted without an underwriter or placement

agent as a separate offering by means of a separate prospectus supplement.

Closing

of the concurrent registered direct offering is contingent upon us completing, following the date of the stock purchase agreement

to be entered into between us and the investor participating in the concurrent registered direct offering, financings for an aggregate

amount of at least $5,000,000 (excluding potential proceeds from the concurrent registered direct offering and before deducting

the estimated underwriting discounts and commissions and estimated offering expenses payable by us in this offering). Therefore,

closing of the concurrent registered direct offering is contingent upon the closing of this offering for aggregate gross proceeds

of at least $5,000,000. This offering is not contingent upon the completion of the concurrent registered direct offering.

|

| |

|

|

| Use of proceeds |

|

We intend to use the net

proceeds from this offering and the concurrent registered direct offering for (i) commercialization activities for PreHevbrio/PreHevbri

in the United States, Europe, and Canada; (ii) manufacturing of PreHevbrio/PreHevbri and clinical materials for our pipeline programs;

(iii) ongoing activities related to our development stage candidates, including VBI-1901 (GBM) and VBI-2901 (coronaviruses); and

(iv) general corporate purposes, including working capital and capital expenditures. See “Use of Proceeds” on

page S-13. |

| |

|

|

| Dividend Policy |

|

We have not declared or

paid any cash or other dividends on our capital stock since January 1, 2015, and we do not expect to declare or pay any cash or other

dividends in the foreseeable future. In addition, our Loan and Guaranty Agreement, dated May 22, 2020 (the “Loan Agreement”),

with K2 HealthVentures (“K2HV”), prohibits us from declaring or paying cash dividends or making distributions on any

class of our capital stock. See “Dividend Policy” on page S-15. |

| |

|

|

| Risk factors |

|

Investing in our securities

involves a high degree of risk. You should carefully read and consider the information set forth under the caption “Risk Factors”

beginning on page S-9 of this prospectus supplement, on page S-1 of the accompanying prospectus, and under similar headings in the

documents incorporated by reference into this prospectus supplement before deciding to invest in our securities. |

| |

|

|

| Nasdaq symbol |

|

Our common shares are listed

on Nasdaq under the symbol “VBIV”. There is no established trading market for the common warrants, and we do not expect

a trading market to develop. We do not intend to list the common warrants on any securities exchange or nationally recognized trading

system. Without a trading market, the liquidity of the common warrants will be extremely limited. |

| (1) |

The number

of shares to be outstanding after this offering and the concurrent registered direct offering is based on 8,608,539 common shares

outstanding as of March 31, 2023, and excludes as of that date: |

| |

● |

803,894 common

shares issuable upon the exercise of outstanding options having a weighted average exercise price of $68.32 per share; |

| |

|

|

| |

● |

8,169 common shares reserved

for issuance under our equity incentive plans; |

| |

|

|

| |

● |

118,816 common shares issuable

upon the exercise of outstanding warrants having a weighted average exercise price of $29.20 per share; and |

| |

|

|

| |

● |

205,396 common shares issuable

upon the conversion of our debt having a weighted average conversion price of $34.08 per share. |

Except

as otherwise indicated, all information contained in this prospectus supplement assumes no exercise of the underwriters’ option

to purchase additional common shares and/or common warrants and no exercise of the common warrants offered and sold in this offering.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks described below, together with the other information in this prospectus supplement, the accompanying prospectus,

the information and documents incorporated herein and therein by reference, and in any free writing prospectus that we have authorized

for use in connection with this offering. You should also consider the risks, uncertainties and assumptions discussed under the heading

“Risk Factors” included in our most recent Annual Report on Form 10-K, as amended, which is on file with the Securities and

Exchange Commission, and are incorporated herein by reference. If any of these risks actually occurs, our business, financial condition,

results of operations or cash flow could be seriously harmed. This could cause the trading price of our common shares to decline, resulting

in a loss of all or part of your investment. The risks and uncertainties described below are not the only ones facing us. Additional

risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. Please also read

carefully the section above entitled “Special Note Regarding Forward-Looking Statements.”

Risks

Related to Our Common Shares and this Offering and the Concurrent Registered Direct Offering

The

price of our common shares has been, and may continue to be, volatile. The COVID-19 pandemic and its ongoing effects have resulted in

significant financial market volatility, and its impact on the global economy remains uncertain. A continuation or worsening of such

effects could have a material adverse impact on the market price of our common shares. This may affect the ability of our investors to

sell their shares, and the value of an investment in our common shares may decline.

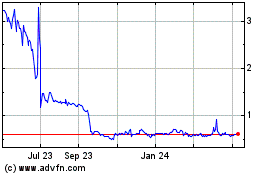

During

the 12-month period ended July 5, 2023, our common shares traded as high as $40.50 per share on August 16, 2022 and as

low as $1.79 per share on June 27, 2023. The market prices of our common shares may continue to be volatile and could fluctuate

widely in response to various factors, many of which are beyond our control, including the following:

| |

● |

future announcements about

us, our collaborators, or competitors, including the results of testing, technological innovations, or new products and services; |

| |

● |

clinical trial results; |

| |

● |

depletion of cash reserves; |

| |

● |

additions or departures

of key personnel; |

| |

● |

operating results that

fall below expectations; |

| |

● |

announcements by us relating

to any strategic relationship; |

| |

● |

sales of equity securities

or issuance of additional debt; |

| |

● |

industry developments; |

| |

● |

changes in state, provincial,

or federal regulations affecting us and our industry; |

| |

● |

the continued large declines

in major stock market indexes which causes investors to sell our common shares; |

| |

● |

economic, political, and

other external factors; and |

| |

● |

period-to-period fluctuations

in our financial results. |

Furthermore,

the stock market in general and the market for biotechnology companies, in particular, have from time-to-time experienced extreme price

and volume fluctuations that are unrelated or disproportionate to the operating performance of the affected companies. The COVID-19 pandemic

and its ongoing effects resulted in significant financial market volatility and uncertainty. A continuation or worsening of the levels

of market disruption and volatility seen in the recent past could have an adverse effect on our ability to access capital, on our business,

results of operations and financial condition, and on the market price of our common shares.

You

will experience immediate and substantial dilution.

Since

the combined public offering price per common share and accompanying common warrant being offered is substantially higher than the net

tangible book value per common share, your interest will be diluted to the extent of the difference between the combined public offering

price per common share and accompanying common warrant you pay and the net tangible book value per common share. After giving effect

to the sale of common shares and accompanying common warrants in this offering and the sale of

common shares and accompanying common warrants to purchase up to

common shares in the concurrent registered direct offering at a combined public offering price of $

per share and accompanying common warrant (attributing no value to the common warrants or proceeds from the sale of the accompanying

common warrants being so offered), and based on our net tangible book value as of March 31, 2023, if you purchase securities in this

offering, you will suffer substantial and immediate dilution of $

per share in the net tangible book value of the common shares. The future exercise of outstanding options and warrants, and the exercise

of common warrants issued in this offering, will result in further dilution of your investment. See the section entitled “Dilution”

below for a more detailed discussion of the dilution you will incur if you participate in this offering.

The

common warrants contain “full ratchet” anti-dilution provisions, which may result in a greater number of common shares issued

upon exercise of the common warrants than if the common warrants were exercised at the exercise price in effect at the time of this offering.

The

common warrants contain “full ratchet” anti-dilution provisions applicable to the exercise price. If in the future, while

any of the common warrants are outstanding, we issue securities at an effective purchase price per common share that is less than the

applicable exercise price of the common warrants as then in effect, we will be required, subject to certain limitations and adjustments

as provided in the common warrants, to further reduce the relevant exercise price, which will result in a greater number of common shares

being issuable upon the exercise of the common warrants, which in turn will have a greater dilutive effect on our shareholders. The potential

for such additional issuances may depress the price of common shares regardless of our business performance. We may find it more difficult

to raise additional equity capital while any of the common warrants are outstanding.

Our

management will have broad discretion as to the use of proceeds from this offering and the concurrent registered direct offering, and

we may not use the proceeds effectively.

We

currently intend to use the net proceeds of this offering and the concurrent registered direct offering for (i) commercialization activities

for PreHevbrio/PreHevbri in the United States, Europe, and Canada; (ii) manufacturing of PreHevbrio/PreHevbri and clinical materials

for our pipeline programs; (iii) ongoing activities related to our development stage candidates, including VBI-1901 (GBM) and VBI-2901

(coronaviruses); and (iv) general corporate purposes, including working capital and capital expenditures. For more information, see “Use

of Proceeds” on page S-13. However, our management will have broad discretion in the application of the net proceeds from this

offering and the concurrent registered direct offering and could spend the proceeds in ways that do not improve our results of operations

or enhance the value of our common shares. You will not have the opportunity, as part of your investment decision, to assess whether

these proceeds are being used appropriately.

The

amount and timing of our actual expenditures will depend upon numerous factors, including the results of our research and development

efforts, the timing and success of preclinical and clinical studies, our clinical trials we may commence in the future and the timing

of regulatory submissions. The costs and timing of development activities, particularly conducting clinical trials and preclinical studies,

are highly uncertain, subject to substantial risks and can often change. Depending on the outcome of these activities and other unforeseen

events, our plans and priorities may change, and we may apply the net proceeds of this offering and the concurrent registered direct

offering in different proportions than we currently anticipate.

Our

failure to apply these funds effectively could have a material adverse effect on our business, delay the further development of our product

candidates and cause the price of our common shares to decline.

Because

the closing of the concurrent registered direct offering requires us to raise aggregate gross proceeds of at least $5 million, there

can be no assurance that the concurrent registered direct offering will ultimately be completed.

Pursuant

to the stock purchase agreement among us and the investor participating in the concurrent registered direct offering, closing of the

concurrent registered direct offering is contingent upon us raising aggregate gross proceeds of at least $5 million, following the date

of the stock purchase agreement entered into between us and the investor participating in the concurrent registered direct offering (excluding

potential proceeds from the concurrent registered direct offering). Therefore, closing of the concurrent registered direct offering is

contingent upon the closing of this offering for aggregate gross proceeds of at least $5 million. In the event we do not sell at least

common shares and raise aggregate gross proceeds of at least $5 million in this offering, we cannot close the concurrent registered

direct offering. There can be no assurance that we will successfully raise at least $5 million in this offering or that the concurrent

registered direct offering will ultimately be completed or will result in any proceeds being made available to us from the concurrent

registered direct offering. If we cannot close the concurrent registered direct offering, we may be unable to fully execute on our business

plan.

We

may not continue to meet the continued listing requirements of Nasdaq, which could result in a delisting of our common shares.

Our

common shares are listed on Nasdaq. While we are currently in compliance, we have in the past been, and may in the future be, unable

to comply with certain of the listing standards that we are required to meet to maintain the listing of our common shares on Nasdaq.

For instance, on July 1, 2022, we received a letter from the Listing Qualifications Department of Nasdaq indicating that, based upon

the closing bid price of our common shares for the 30 consecutive business day period between May 18, 2022 through June 30, 2022, we

did not meet the minimum bid price of $1.00 per share required for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2).

On April 12, 2023, we effected the Reverse Stock Split to regain compliance and on April 26, 2023 we received notice from Nasdaq indicating

that we had regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2), and the matter is now closed.

The primary intent for the Reverse Stock Split was that the anticipated increase in the price of our common shares immediately following

and resulting from a reverse stock split due to the reduction in the number of issued and outstanding common shares would help us meet

the minimum bid price requirement. It cannot be assured that the Reverse Stock Split will result in any sustained proportionate increase

in the market price of our common shares, which is dependent upon many factors, including our business and financial performance, general

market conditions, and prospects for future success, which are unrelated to the number of common shares outstanding. It is not uncommon

for the market price of a company’s common shares to decline in the period following a reverse stock split. Thus, while we have

regained compliance with the continued listing requirements for Nasdaq, it cannot be assured that we will continue to do so. If Nasdaq

delists our common shares from trading on its exchange for failure to meet the listing standards, an investor would likely find it significantly

more difficult to dispose of or obtain accurate quotations as to the value of our shares, and our ability to raise future capital through

the sale of our shares could be severely limited. Delisting could also have other negative results, including the potential loss of confidence

by employees, the loss of institutional investor interest and fewer business development opportunities.

We

have no immediate plans to pay dividends.

We

plan to reinvest all of our earnings, to the extent we have earnings, in order to market our products and to cover operating costs and

to otherwise become and remain competitive. We do not plan to pay any cash dividends with respect to our securities in the foreseeable

future. We cannot assure you that we would, at any time, generate sufficient surplus cash that would be available for distribution to

the holders of our common shares as a dividend. In addition, our Loan Agreement with K2HV prohibits us from declaring or paying cash

dividends or making distributions on any class of our capital stock. We currently intend to retain earnings, if any, for reinvestment

in our business. Therefore, holders of our common shares should not expect to receive cash dividends on our common shares.

Common

shares eligible for future sale may cause the price of our common shares to decline.

From

time to time, certain of our shareholders may be eligible to sell all or some of their restricted common shares by means of ordinary

brokerage transactions in the open market pursuant to Rule 144, promulgated under the Securities Act of 1933, as amended, subject to

certain limitations. In general, pursuant to Rule 144, non-affiliate shareholders may sell freely after six months, subject only to the

current public information requirement (which disappears after one year). Of the 8,608,539 common shares outstanding as of March 31,

2023, approximately 74.1% common shares are held by “non-affiliates,” all of which are currently freely tradable either because

those were issued in a registered offering or pursuant to Rule 144.

Any

substantial sale of our common shares pursuant to Rule 144 or pursuant to any resale prospectus may have a material adverse effect on

the market price of our common shares.

In

addition, as of March 31, 2023, we had outstanding options, awards, convertible debt, and warrants for the purchase of 1,128,106 common

shares. Of this amount, options, awards, convertible debt, and warrants for the purchase of 569,036 common shares are held by non-affiliates,

who may sell these shares in the public markets from time to time, without limitations on the timing, amount, or method of sale. If our

share price rises, the holders may exercise their options and sell a large number of shares. This could cause the market price of our

common shares to decline.

Although

we expect that we will not be classified as a passive foreign investment company (“PFIC”) in 2023, there can be no assurance

that we will not be classified as a PFIC in 2023 or any subsequent year, which would result in adverse U.S. federal income tax consequences

to U.S. holders of our common shares.

A

non-U.S. corporation, such as us, would be classified as a PFIC for U.S. federal income tax purposes for any taxable year if either (i)

75% or more of its gross income is passive income, or (ii) 50% or more of the value of its assets (based on an average of the values

of the assets during a taxable year) is attributable to assets that produce or are held for the production of passive income. We do not

expect to be a PFIC for the 2023 taxable year. However, the fair market value of our assets may be determined in large part by the market

price of our common shares, which is likely to fluctuate, and the composition of our income and assets will be affected by how, and how

quickly, we spend any cash that is raised in any financing transaction. No assurance can be provided that we will not be classified as

a PFIC for the 2023 taxable year or any future taxable year. If we are a PFIC in any year, U.S. Holders (as defined in “Certain

United States Income Tax Considerations” below) will be subject to certain adverse U.S. federal income tax consequences. Prospective

U.S. Holders should consult their tax advisors regarding our PFIC status.

The

concentration of the capital stock ownership with our insiders will likely limit the ability of other shareholders to influence corporate

matters.

As

of March 31, 2023, approximately 25.9% of our outstanding common shares were controlled by our officers, directors, beneficial owners

of 10% or more of our securities, and their respective affiliates. As a result, these shareholders, if they acted together, may be able

to determine or influence matters that require approval by our shareholders, including the election of directors and approval of significant

corporate transactions. Corporate actions might be taken even if other shareholders oppose them. This concentration of ownership might