U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a

registered investment advisory firm with longstanding experience in

global markets and specialized sectors from gold mining to

airlines, today reported operating income of $215,000 for the

quarter ended September 30, 2023, on total revenues of $3.1

million. The Company recorded a net loss of $176,000, or $0.01 per

share.

Average assets under management (AUM) for the three-month period

ended September 30, 2023, were $2.1 billion, a decrease of $835

million, or 28%, from the same quarter a year earlier.

“The decline in assets was predominantly driven by the U.S.

Global Jets ETF (NYSE: JETS), which saw net outflows totaling $668

million from January 2023 to September 2023 as mostly foreign

investors, fearing a global recession, cut their exposure to ETFs,”

says Frank Holmes, the Company’s CEO and Chief Investment Officer.

“However, as I highlight below, trading activity in JETS has

improved in the current December quarter as the price of crude oil

has fallen below its 200-day moving average; airfare remains

strong; and the rate of annual inflation has eased, suggesting that

the Federal Reserve may be nearing the end of its monetary

tightening policy.”

Total Shareholder Yield, Including Share

Repurchases

Shareholder yield is a ratio that shows how much money

shareholders receive from a company in the form of cash dividends,

net share repurchases and debt reduction. For the 12 months ended

September 30, 2023, the Company’s shareholder yield was 6.84%.1

During the three-month period, the Company purchased a total of

198,213 class A shares using cash of approximately $611,000. This

is almost five times the number of shares that the Company

repurchased during the same period a year earlier. The repurchase

program has been in place since December 2012. The Company buys

back stock on flat or down days.

Global Airline Industry’s Historic Rebound

Nearly four years after the Covid-19 pandemic grounded planes

and shocked the industry, Thanksgiving air travel in the U.S. set a

new daily record for passenger numbers. On Sunday, November 26,

2023, the Transportation Security Administration (TSA) screened a

record 2.9 million passengers, painting a picture of an industry on

the cusp of a historic rebound.2

Delta Air Lines reported robust holiday travel demand and

increasing corporate bookings, reflecting a bright end to 2023 and

solid beginning to 2024. Speaking at the Morgan Stanley Global

Consumer & Retail Conference, Delta CEO Ed Bastian doubled down

on the carrier’s positive 2023 guidance, citing record revenues for

the Thanksgiving holiday. Christmas bookings look to be “very, very

strong,” Bastian said.3

On a related note, the International Air Transport Association

(IATA) forecasts net profits of $25.7 billion for the global

airline industry in 2024, with operating profits reaching

a record $49.3 billion. North American carriers, which

were first to return to profitability in 2022, are set to collect a

combined $14.4 billion in profits, the IATA says.4

“The positive sentiment surrounding air travel has translated

into higher AUM in JETS,” says Mr. Holmes. “In the fourth calendar

quarter through Friday, December 8, 2023, JETS saw net inflows of

$294 million, reversing a series of outflows in the first three

quarters of the year.”

Interest Rates and Consumer Spending Impact on Luxury

Stocks

In the quarter ended September 30, 2023, luxury stocks underwent

a correction, which followed a period of consolidation in the

second quarter and strong performance in the first quarter,

primarily attributed to China’s reopening. The initial optimism

that surrounded China’s reopening at the beginning of the year

diminished rapidly as the country began to release weaker economic

data, and the property sector continued to lag behind.

Additional factors that contributed to the correction in the

luxury sector included rising interest rates and the depletion of

pandemic stimulus measures, which resulted in a decrease in

consumer spending. Notably, only the wealthiest 20% of Americans

still retained excess pandemic savings, according to a Fed

study.

“Despite the macro challenges, the global luxury market has

demonstrated great resilience in 2023, generating an estimated €1.5

trillion (about $1.6 trillion) in sales. This marks an 8%-10%

increase over 2022 and sets a new all-time sales record for the

luxury industry, according to Bain & Company. Personal luxury

goods were projected to hit €362 billion ($390 billion),5” Mr.

Holmes continues. “Furthermore, I was pleased to see that our

Global Luxury Goods Fund (USLUX) managed to beat the S&P Global

Luxury Index for the quarter ended September 30, 2023.”

Healthy Liquidity and Capital Resources

As of September 30, 2023, the Company had net working capital of

approximately $37.7 million, an increase of $246,000 from June 30,

2023. Total assets, including various corporate investments, stood

at $54.1 million. With approximately $26.8 million in cash and cash

equivalents, the Company has adequate liquidity to meet its current

obligations, in addition to investments in our funds and

convertible notes.

Selected Financial Data (unaudited):

(dollars in thousands, except per share

data)

|

|

Three months ended |

|

|

9/30/2023 |

9/30/2022 |

|

Operating Revenues |

$3,133 |

|

$4,412 |

|

|

Operating Expenses |

|

2,918 |

|

|

2,827 |

|

|

Operating Income |

|

215 |

|

|

1,585 |

|

|

|

|

|

|

Total Other Income (Loss) |

|

(456) |

|

|

(1,399) |

|

|

Income (Loss) Before Income Taxes |

|

(241) |

|

|

186 |

|

|

|

|

|

|

Income Tax Expense (Benefit) |

|

(65) |

|

|

133 |

|

| Net

Income (Loss) |

$(176) |

|

$53 |

|

|

|

|

|

| Net

Income (Loss) Per Share (Basic and Diluted) |

$(0.01) |

|

$0.00 |

|

|

|

|

|

|

Avg. Common Shares Outstanding (Basic) |

|

14,465,510 |

|

|

14,948,688 |

|

|

Avg. Common Shares Outstanding (Diluted) |

|

14,465,701 |

|

|

14,949,275 |

|

|

|

|

|

|

Avg. Assets Under Management (Billions) |

$2.1 |

|

$2.9 |

|

About U.S. Global Investors, Inc.The story of

U.S. Global Investors goes back more than 50 years when it began as

an investment club. Today, U.S. Global Investors, Inc.

(www.usfunds.com) is a registered investment adviser that focuses

on niche markets around the world. Headquartered in San Antonio,

Texas, the Company provides investment management and other

services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors

may include certain “forward-looking statements,” including

statements relating to revenues, expenses and expectations

regarding market conditions. You can identify these forward-looking

statements by the use of words such as “outlook,” “believes,”

“expects,” “potential,” “opportunity,” “seeks,” “anticipates” or

other comparable words. Such statements involve certain risks and

uncertainties and should be read with corporate filings and other

important information on the Company’s website, www.usfunds.com, or

the Securities and Exchange Commission’s website at

www.sec.gov.

These filings, such as the Company’s annual report and Form

10-Q, should be read in conjunction with the other cautionary

statements that are included in this release. Future events could

differ materially from those anticipated in such statements and

there can be no assurance that such statements will prove accurate

and actual results may vary. The Company undertakes no obligation

to publicly update or review any forward-looking statements,

whether as a result of new information, future developments or

otherwise.

Please consider carefully a fund’s investment

objectives, risks, charges and expenses. For this and other

important information, obtain a fund prospectus by visiting

www.usfunds.com. Read it carefully before investing. U.S. Global

mutual funds are distributed by Foreside Fund Services, LLC,

Distributor. U.S. Global Investors is the investment adviser.

Past performance does not guarantee

future results.

Total Annualized Returns as of 09/30/2023:

|

Fund |

One-Year |

Five-Year |

Ten-Year |

Since Inception |

Expense Ratio |

|

Global Luxury Goods Fund |

22.89% |

5.59% |

5.66% |

7.78%(10/17/94) |

1.51% |

|

S&P Global Luxury Index |

20.47% |

8.63% |

7.76% |

10.14%(08/31/2011) |

n/a |

The performance data quoted represents past performance. Past

performance does not guarantee future results. The investment

return and principal value of an investment will fluctuate so that

an investor's shares, when sold or redeemed, may be worth more or

less than their original cost and current performance may be lower

or higher than the performance quoted. Short term performance, in

particular, is not a good indication of the fund’s future

performance, and an investment should not be made based solely on

returns. Performance does not include the effect of any direct fees

described in the fund’s prospectus which, if applicable, would

lower your total returns. Performance quoted for periods of one

year or less is cumulative and not annualized. Obtain performance

data current to the most recent month-end at www.usfunds.com or

1-800-US-FUNDS.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors

is the investment adviser. JETS, GOAU and SEA are distributed by

Quasar Distributors, LLC. U.S. Global Investors is the investment

adviser to JETS, GOAU and SEA. Foreside Fund Services, LLC and

Quasar Distributors, LLC are affiliated.

Shares of any ETF are bought and sold at market price (not NAV),

may trade at a discount or premium to NAV and are not individually

redeemed from the funds. Brokerage commissions will reduce returns.

Stock markets can be volatile and share prices can fluctuate in

response to sector-related and other risks as described in the fund

prospectus. Foreign and emerging market investing involves special

risks such as currency fluctuation and less public disclosure, as

well as economic and political risk. Companies in the consumer

discretionary sector are subject to risks associated with

fluctuations in the performance of domestic and international

economies, interest rate changes, increased competition and

consumer confidence. The COVID-19 pandemic and the resulting

actions to control or slow the spread has had a significant

detrimental effect on the global and domestic economies, financial

markets and industries, including airlines. U.S. Global Investors

continues to monitor the impact of COVID-19, but it is too early to

determine the full impact this virus may have on commercial

aviation. Should this emerging macro-economic risk continue for an

extended period, there could be an adverse material financial

impact to the U.S. Global Jets ETF.

All opinions expressed and data provided are subject to change

without notice. Some of these opinions may not be appropriate to

every investor.

Fund holdings and allocations are subject to change at any time.

Click to view fund holdings for JETS.

Please carefully consider a fund’s investment objectives, risks,

charges and expenses. For this and other important information,

obtain a statutory and summary prospectus for JETS by clicking

here. Read it carefully before investing.

Distributed by Quasar Distributors, LLC. U.S. Global Investors

is the investment adviser to JETS.

The S&P Global Luxury Index is comprised of 80 of the

largest publicly traded companies engaged in the production or

distribution of luxury goods or the provision of luxury services

that meet specific investibility requirements. It is not possible

to invest in an index. The shareholder yield is a ratio that

shows how much money the company is sending back to shareholders

through a combination of dividends and share repurchases.

Contact:Holly SchoenfeldtDirector of Marketing

210.308.1268hschoenfeldt@usfunds.com

1 The Company computes shareholder yield by adding the

percentage of change in shares outstanding to the dividend yield

for the 12 months ending September 30, 2023. The Company did not

have debt; therefore, no debt reduction was included.2 1 day, 3

million U.S. fliers: Holiday record is broken, with more jam-packed

travel ahead. (2023, November 28). Los Angeles Times.

https://www.latimes.com/california/story/2023-11-27/number-of-airline-passengers-traveling-for-thanksgiving-holiday-breaks-record3

Delta Air Lines Morgan Stanley Global Consumer & Retail

Conference. (2023).

https://static.seekingalpha.com/uploads/sa_presentations/275/98275/original.pdf4

Airlines Set to Earn 2.7% Net Profit Margin on Record Revenues in

2024. (n.d.). www.iata.org.

https://www.iata.org/en/pressroom/2023-releases/2023-12-06-01/5

D’Arpizio, C., & Levato, F. (2023, November 14). Global

luxury market projected to reach €1.5 trillion in 2023, a new

record for the sector, as consumers seek luxury experiences. Bain.

https://www.bain.com/about/media-center/press-releases/2023/global-luxury-market-projected-to-reach-1.5-trillion-in-2023-a-new-record-for-the-sector-as-consumers-seek-luxury-experiences/

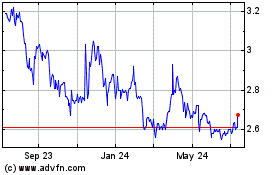

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Jan 2025 to Feb 2025

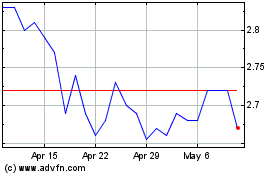

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Feb 2024 to Feb 2025