0000914156 False 0000914156 2024-07-31 2024-07-31 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

_______________________________

UFP Technologies, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-12648 | 04-2314970 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

100 Hale Street

Newburyport, Massachusetts - USA 01950-3504

(Address of Principal Executive Offices) (Zip Code)

(978) 352-2200

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | UFPT | The NASDAQ Stock Market L.L.C. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 31, 2024, UFP Technologies, Inc. issued a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

Limitation on Incorporation by Reference. The information furnished in this Item 2.02, including the press release attached hereto as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements. Except for historical information contained in the press release attached as an exhibit hereto, the press release contains forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. Please refer to the cautionary note in the press release regarding these forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | UFP Technologies, Inc. |

| | | |

| | | |

| Date: August 2, 2024 | By: | /s/ Ronald J. Lataille |

| | | Ronald J. Lataille |

| | | Chief Financial Officer and Senior Vice President |

| | | |

EXHIBIT 99.1

UFP Technologies Announces Record Q2 Results

NEWBURYPORT, Mass., July 31, 2024 (GLOBE NEWSWIRE) -- UFP Technologies, Inc. (Nasdaq: UFPT), an innovative designer and custom manufacturer of components, subassemblies, products, and packaging primarily for the medical market, today reported net income of $13.6 million or $1.75 per diluted common share outstanding for its second quarter ended June 30, 2024, compared to net income of $11.9 million or $1.55 per diluted common share outstanding for the same quarter in 2023. Sales for the second quarter were $110.2 million compared to sales of $100.0 million in the second quarter of 2023. Net income for the six-month period ended June 30, 2024, was $26.2 million or $3.38 per diluted common share outstanding compared to $21.6 million or $2.81 per diluted common share outstanding for the same period in 2023. Sales for the six-month period ended June 30, 2024, were $215.2 million compared to sales of $197.8 million for the same period in 2023.

“I am very pleased with our Q2 results,” said R. Jeffrey Bailly, Chairman & CEO. “Sales grew 10.1%, driven by strength in the robotic surgery and infection prevention markets. Gross margins grew to 30.0%, due in part to improved manufacturing efficiency and contained fixed overhead costs. And net income grew 14.0% to $13.6 million.”

“We also completed three acquisitions between June 24 and July 15: Marble Medical, AJR Enterprises, and Welch Fluorocarbon. We expect that these collectively will add an estimated $90 million in revenue and $20 million in EBITDA,” said Bailly. “Marble Medical brings expertise in high-speed die cutting, medical stick-to-skin adhesives, and a strategically important 3M/Solventum preferred distributorship. AJR Enterprises brings a strategic leadership position in the growing patient-handling space, as well as expertise in specialty fabrics and a very efficient low-cost manufacturing operation. And Welch Fluorocarbon brings expertise in thin film molding of specialty materials utilized for implantable medical devices.” EBITDA is a non-GAAP measure. See Table 3 for a reconciliation.

“Each of these acquisitions is expected to bring important synergies and make us more valuable to our customers,” Bailly said. “With these additions, along with our strong pipeline of product development business, additional acquisition opportunities, and a new $275 million line of credit, we remain very excited about our future.”

Financial Highlights for Q2 and YTD 2024

- Sales for the second quarter increased 10.1% to $110.2 million, from $100.0 million in the same period of 2023. Year-to-date sales through June increased 8.8% to $215.2 million, from $197.8 million in the same period of 2023.

- Second-quarter sales to the medical market increased 10.8% to $95.4 million. Non-medical sales increased 6.3% to $14.8 million.

- Sales to the medical market increased 9.1% to $185.5 million for the six-month period ended June 30, 2024, from the same period in 2023. Non-medical sales increased 6.9% to $29.7 million for the six-month period ended June 30, 2024, from the same period in 2023.

- Gross profit as a percentage of sales (“gross margin”) increased to 30.0% for the second quarter of 2024, from 29.6% in the same quarter of 2023. Gross margin for the six-month period ended June 30, 2024, decreased slightly to 29.3% from 29.5% in the same period of 2023.

- Selling, general and administrative expenses (“SG&A”) for the second quarter increased 13.0% to $13.9 million in 2024 compared to $12.3 million in the same quarter of 2023. As a percentage of sales, SG&A increased to 12.6% in the second quarter of 2024, from 12.3% in the same period of 2023. For the six-month period ended June 30, 2024, SG&A increased 9.9% to $27.8 million from $25.3 million in the same period of 2023. As a percentage of sales, SG&A in the six-month period ended June 30, 2024, increased slightly to 12.9% from 12.8% in the same period of 2023.

- For the second quarter, operating income increased to $18.0 million, from $17.0 million in the same quarter of 2023. Adjusted operating income for the second quarter increased 10.3% to 19.1 million from $17.3 million in the second quarter of 2023. For the six-month period ended June 30, 2024, operating income increased to $33.9 million, from $29.9 million in the same period of 2023. Adjusted operating income for the six-month period ended June 30, 2024, increased 6.8% to $35.3 million from $33.0 million in the same period of 2022. See the reconciliation provided in Table 1. Adjusted operating income is a financial measure not presented in accordance with generally accepted accounting principles (“GAAP”) (a “non-GAAP Financial Measure”). Please see “non-GAAP Financial Information” at the end of this news release.

- Net income increased to $13.6 million in the second quarter of 2024, from $11.9 million in the same period of 2023. Adjusted net income increased to $14.4 million in the second quarter of 2024, from $12.1 million in the same period of 2023. For the six-month period ended June 30, 2024, net income increased to $26.2 million, from $21.6 million in the same period of 2023. Adjusted net income increased to $27.3 million for the six-month period ended June 30, 2024, from $24.0 in the same period of 2023. See the reconciliation provided in Table 2. Adjusted net income is a financial measure not presented in accordance with generally accepted accounting principles (“GAAP”) (a “non-GAAP Financial Measure”). Please see “non-GAAP Financial Information” at the end of this news release.

- Adjusted EBITDA for the second quarter increased 11.7% to $23.9 million from $21.4 million in the second quarter of 2023. Adjusted EBITDA for the six-month period ended June 30, 2024 increased 9.2% to $44.6 million from $40.8 million in the same period of 2023. See the reconciliation provided in Table 3. Adjusted EBITDA is a non-GAAP Financial Measure. Please see "non-GAAP Financial Information" at the end of this news release.

- Upon completion of the acquisitions of Marble Medical, AJR Enterprises and Welch Fluorocarbon and the related borrowings from the Company’s $275 million amended credit facility, the pro-forma leverage ratio (non-GAAP term defined as total debt divided by EBITDA) is approximately 1.8X, which leaves the Company with sufficient capacity under the loan agreement.

About UFP Technologies, Inc.

UFP Technologies is a designer and custom manufacturer of comprehensive solutions for medical devices, sterile packaging, and other highly engineered custom products. UFP is an important link in the medical device supply chain and a valued outsource partner to many of the top medical device manufacturers in the world. The Company’s single-use and single-patient devices and components are used in a wide range of medical devices and packaging for minimally invasive surgery, infection prevention, wound care, wearables, orthopedic soft goods, and orthopedic implants.

Consolidated Condensed Statements of Income

(in thousands, except per share data)

(Unaudited) |

| | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | | 2024 | | | | 2023 | | | | 2024 | | | 2023 |

| Net sales | $ | 110,177 | | | $ | 100,037 | | | $ | 215,186 | | | $ | 197,790 |

| Cost of sales | | 77,146 | | | | 70,392 | | | | 152,072 | | | | 139,444 |

| Gross profit | | 33,031 | | | | 29,645 | | | | 63,114 | | | | 58,346 |

| SG&A | | 13,900 | | | | 12,299 | | | | 27,812 | | | | 25,306 |

| Change in fair value of contingent consideration | | 238 | | | | 198 | | | | 476 | | | | 3,051 |

| (Gain) loss on disposal of fixed assets | | (1 | ) | | | 106 | | | | 7 | | | | 107 |

| Acquisition costs | | 943 | | | | - | | | | 943 | | | | - |

| Operating income | | 17,951 | | - | | 17,042 | | | | 33,876 | | | | 29,882 |

| Interest expense, net | | 577 | | | | 1,089 | | | | 1,208 | | | | 1,958 |

| Other expense (income) | | 2 | | | | (20 | ) | | | (39 | ) | | | 56 |

| Income before income taxes | | 17,372 | | | | 15,973 | | | | 32,707 | | | | 27,868 |

| Income taxes | | 3,820 | | | | 4,090 | | | | 6,462 | | | | 6,246 |

| Net income | $ | 13,552 | | | $ | 11,883 | | | $ | 26,245 | | | $ | 21,622 |

| | | | | | | | |

| Net income per share | $ | 1.77 | | | $ | 1.56 | | | $ | 3.43 | | | $ | 2.84 |

| Net income per diluted share | $ | 1.75 | | | $ | 1.55 | | | $ | 3.38 | | | $ | 2.81 |

| | | | | | | | |

| Weighted average common shares outstanding | | 7,672 | | | | 7,625 | | | | 7,662 | | | | 7,608 |

| Weighted average diluted common shares outstanding | | 7,753 | | | | 7,690 | | | | 7,756 | | | | 7,689 |

| | | | | | | | |

Consolidated Condensed Balance Sheets

(in thousands)

(Unaudited) |

| | | | |

| | June 30, | | December 31, |

| | 2024 | | 2023 |

| | | | |

| Assets: | | | |

| Cash and cash equivalents | $ | 16,728 | | $ | 5,263 |

| Receivables, net | | 60,985 | | | 64,449 |

| Inventories | | 77,976 | | | 70,191 |

| Other current assets | | 6,472 | | | 4,730 |

| Net property, plant, and equipment | | 63,736 | | | 62,137 |

| Goodwill | | 115,616 | | | 113,263 |

| Intangible assets, net | | 62,382 | | | 64,116 |

| Other assets | | 18,501 | | | 19,987 |

| Total assets | $ | 422,396 | | $ | 404,136 |

| Liabilities and equity: | | | |

| Accounts payable | | 22,966 | | | 22,286 |

| Current installments, net of long-term debt | | - | | | 4,000 |

| Other current liabilities | | 28,821 | | | 31,923 |

| Long-term debt, excluding current installments | | 35,200 | | | 28,000 |

| Other liabilities | | 25,233 | | | 31,836 |

| Total liabilities | | 112,220 | | | 118,045 |

| Total stockholders' equity | | 310,176 | | | 286,091 |

| Total liabilities and stockholders' equity | $ | 422,396 | | $ | 404,136 |

| | | | |

Forward-Looking Statements

Certain statements in this press release may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance and may be identified by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. Such statements include, but are not limited to, statements about the Company’s future financial or operating performance; statements of the Company’s position in the marketplace; statements about the Company’s acquisition strategies and opportunities and the Company’s growth potential and strategies for growth; statements about the integration and performance of recent acquisitions, including that such acquisitions will be accretive to the Company’s revenue, income and EBITDA; statements about the Company’s ability to realize the benefits expected from our recently completed acquisitions, including any related synergies; expectations regarding customer demand; and any indication that the Company may be able to sustain or increase its sales, earnings or earnings per share, or its sales, earnings or earnings per share growth rates. Such forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the Company's general ability to execute its business plans; industry conditions, including fluctuations in supply, demand and prices for the Company's products and services due to inflation or otherwise; risks related to our indebtedness and compliance with covenants contained in our financing arrangements, and whether any available financing may be sufficient to address our needs; risks relating to delayed payments by our customers and the potential for reduced or canceled orders; risks related to customer concentration; risks relating to the Company’s ability to achieve anticipated benefits of acquisitions and other risks and uncertainties set forth in the sections entitled "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements" in the Company's filings with the Securities and Exchange Commission ("SEC"), which are available on the SEC's website at www.sec.gov. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions, or circumstances on which any such statement is based. Forward-looking statements are also subject to the risks and other issues described above under “Use of non-GAAP Financial Information,” which could cause actual results to differ materially from current expectations included in the Company’s forward-looking statements included in this press release.

Non-GAAP Financial Information

This news release includes non-generally accepted accounting principles (“GAAP”) performance measures. Management considers Adjusted Operating Income, Adjusted Net Income, EBITDA, Adjusted EBITDA and pro-forma leverage ratio, non-GAAP measures. The Company uses these non-GAAP financial measures to facilitate management's financial and operational decision-making, including evaluation of the Company’s historical operating results. The Company’s management believes these non-GAAP measures are useful in evaluating the Company’s operating performance and are similar measures reported by publicly listed U.S. competitors, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company's operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. By providing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s performance for the periods presented. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The Company's definition of these non-GAAP measures may differ from similarly titled measures of performance used by other companies in other industries or within the same industry.

Table 1: Adjusted Operating Income Reconciliation

(in thousands) |

| | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | | 2024 | | | 2023 | | 2024 | | 2023 |

| Operating income (GAAP) | $ | 17,951 | | | $ | 17,042 | | $ | 33,876 | | $ | 29,882 |

| Adjustments: | | | | | | | |

| Acquisition Costs | | 943 | | | | - | | | 943 | | | - |

| Change in fair value of contingent consideration | | 238 | | | | 198 | | | 476 | | | 3,051 |

| (Gain) loss on disposal of fixed assets | | (1 | ) | | | 106 | | | 7 | | | 107 |

| Adjusted operating income (Non-GAAP) | $ | 19,131 | | | $ | 17,346 | | $ | 35,302 | | $ | 33,040 |

| | | | | | | | |

Table 2: Adjusted Net Income and Diluted Common Share Outstanding Reconciliation

(in thousands, except per share data) |

| | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (GAAP) | $ | 13,552 | | $ | 11,883 | | $ | 26,245 | | $ | 21,622 |

| Adjustments (net of taxes): | | | | | | | |

| Acquisition Costs | | 701 | | | - | | | 701 | | | - |

| Change in fair value of contingent consideration | | 177 | | | 149 | | | 354 | | | 2,296 |

| Loss on disposal of fixed assets | | - | | | 80 | | | 5 | | | 81 |

| Adjusted net income (Non-GAAP) | $ | 14,430 | | $ | 12,112 | | $ | 27,305 | | $ | 23,999 |

| | | | | | | | |

| Adjusted Net Income per diluted share outstanding (Non-GAAP) | $ | 1.86 | | $ | 1.58 | | $ | 3.52 | | $ | 3.12 |

| Weighted average diluted common shares outstanding | | 7,753 | | | 7,690 | | | 7,756 | | | 7,689 |

| | | | | | | | |

Table 3: EBITDA Reconciliation

(in thousands) |

| | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | | 2024 | | | 2023 | | 2024 | | 2023 |

| Net income (GAAP) | $ | 13,552 | | | $ | 11,883 | | $ | 26,245 | | $ | 21,622 |

| Income tax expense | | 3,820 | | | | 4,090 | | | 6,462 | | | 6,246 |

| Interest expense, net | | 577 | | | | 1,089 | | | 1,208 | | | 1,958 |

| Depreciation | | 1,934 | | | | 1,731 | | | 3,833 | | | 3,402 |

| Amortization of intangible assets | | 1,098 | | | | 1,099 | | | 2,198 | | | 2,205 |

| EBITDA (Non-GAAP) | $ | 20,981 | | | $ | 19,892 | | $ | 39,946 | | $ | 35,433 |

| Adjustments: | | | | | | | |

| Share based compensation | | 1,736 | | | | 1,197 | | | 3,249 | | | 2,253 |

| Acquisition Costs | | 943 | | | | - | | | 943 | | | - |

| Change in fair value of contingent consideration | | 238 | | | | 198 | | | 476 | | | 3,051 |

| (Gain) loss on disposal of fixed assets | | (1 | ) | | | 106 | | | 7 | | | 107 |

| Adjusted EBITDA (Non-GAAP) | $ | 23,897 | | | $ | 21,393 | | $ | 44,621 | | $ | 40,844 |

| | | | | | | | |

Contact: Ron Lataille

978-234-0926

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

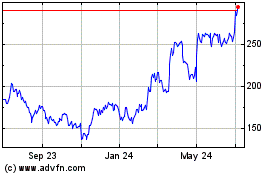

Ufp Technologies (NASDAQ:UFPT)

Historical Stock Chart

From Dec 2024 to Jan 2025

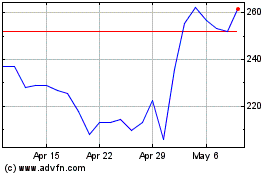

Ufp Technologies (NASDAQ:UFPT)

Historical Stock Chart

From Jan 2024 to Jan 2025