UFP Technologies Announces Record Q1 Results

May 01 2024 - 9:00AM

UFP Technologies, Inc. (Nasdaq: UFPT), a designer and custom

manufacturer of comprehensive solutions primarily for the medical

market, today reported net income of $12.7 million or $1.64 per

diluted common share outstanding for its first quarter ended March

31, 2024, compared to net income of $9.7 million or $1.27 per

diluted common share outstanding for the first quarter of 2023. Net

Sales for the first quarter were $105.0 million compared to 2023

first quarter sales of $97.8 million.

“I am very pleased with our financial results

and continued progress on a number of key strategic fronts,” said

R. Jeffrey Bailly, Chairman & CEO. “In Q1 we generated 7.4%

organic sales growth in both our MedTech and Advanced Components

businesses. Operating income and net income grew 24% and 30%,

respectively. Our growth in the MedTech space was primarily

attributable to an increase in robotic surgery and infection

prevention revenue. This more than offset continued softness in

other segments such as orthopedics and patient surfaces, where

multiple important customers are still taking below-normal levels

of product as they work through excess inventory.”

“We strengthened our platform and positioned

ourselves for future growth with the addition of new talent and the

completion of large long-term customer and vendor agreements,”

Bailly said. “Our expansion in the Dominican Republic is largely

complete, with most of the start-up inefficiencies related to

equipment validation and operator training behind us. This allowed

us to revert to a more efficient 2-shift operation, helping to

enhance gross margins, which have improved sequentially from our

second half of 2023. In addition, our Mexico operation, where sales

grew 47% over the prior year, is now a solid contributor to

profitability.”

“We also have an exciting pipeline of active

acquisition opportunities, with multiple projects already in the

due diligence phase,” Bailly said. “Given this, combined with our

continued growth, progress on strategic initiatives, and strong

balance sheet with only around $34 million in debt, I remain very

bullish about our future.”

Financial Highlights:

- Sales for the first quarter increased

7.4% to $105.0 million, from $97.8 million in the first quarter of

2023. First quarter sales to the medical market increased 7.4% to

$90.0 million from $83.8 million in the first quarter of 2023.

First quarter sales to all other markets increased 7.4% to $15.0

million from $13.9 million in the first quarter of 2023.

- Gross profit as a percentage of sales

(“gross margin”) decreased to 28.6% for the first quarter of 2024,

from 29.4% in the first quarter of 2023.

- Selling, general, and administrative

expenses (“SG&A”) for the first quarter increased 7.0% to $13.9

million compared to $13.0 million in the first quarter of 2023. As

a percentage of sales, SG&A decreased to 13.2% in the first

quarter of 2024 compared to 13.3% in the first quarter of

2023.

- Operating income for the first quarter

of 2024 increased 24.0% to $15.9 million, from $12.8 million in the

first quarter of 2023. Adjusted operating income for the first

quarter increased 3.0% to $16.2 million from $15.7 million in the

first quarter of 2023. See the reconciliation provided in

Table 1. Adjusted Operating Income is a financial measure not

presented in accordance with generally accepted accounting

principles ("GAAP") (a "Non-GAAP Financial Measure"). Please see

"Non-GAAP Financial Information" at the end of this news

release.

- Net income increased 30.3% to $12.7

million in the first quarter of 2024, from $9.7 million in the

first quarter of 2023. Adjusted net income increased 8.6% to

$12.9 million in the first quarter of 2024, from $11.9 million in

the first quarter of 2023. See the reconciliation provided in

Table 2. Adjusted Net Income is a Non-GAAP financial measure.

Please see "Non-GAAP Financial Information" at the end of this news

release.

- Earnings per share increased to $1.64

per diluted share outstanding in the first quarter of 2024, from

$1.27 in the first quarter of 2023.

- Adjusted EBITDA increased 6.5% to $20.7

million from $19.5 million in the first quarter of 2023. See the

reconciliation provided in Table 3. EBITDA and adjusted EBITDA are

Non-GAAP Financial Measures. Please see "Non-GAAP Financial

Information" at the end of this news release.

About UFP Technologies,

Inc.

UFP Technologies is a designer and custom

manufacturer of comprehensive solutions for medical devices,

sterile packaging, and other highly engineered custom products. UFP

is an important link in the medical device supply chain and a

valued outsource partner to many of the top medical device

manufacturers in the world. The Company’s single-use and

single-patient devices and components are used in a wide range of

medical devices and packaging for minimally invasive surgery,

infection prevention, wound care, wearables, orthopedic soft goods,

and orthopedic implants.

| |

|

Consolidated Condensed Statements of Income(in

thousands, except per share data)(unaudited) |

| |

| |

Three Months Ended |

| |

March, 31 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net sales |

$ |

105,009 |

|

|

$ |

97,753 |

|

|

Cost of sales |

|

74,926 |

|

|

|

69,052 |

|

|

Gross profit |

|

30,083 |

|

|

|

28,701 |

|

|

Selling, general and administrative expenses |

|

13,912 |

|

|

|

13,006 |

|

|

Change in fair value of contingent consideration |

|

238 |

|

|

|

2,853 |

|

|

Loss on disposal of fixed assets |

|

9 |

|

|

|

1 |

|

|

Operating income |

|

15,924 |

|

- |

|

12,841 |

|

|

Interest expense, net |

|

631 |

|

|

|

869 |

|

|

Other (income) expense |

|

(42 |

) |

|

|

77 |

|

|

Income before income tax expense |

|

15,335 |

|

|

|

11,895 |

|

|

Income tax expense |

|

2,642 |

|

|

|

2,156 |

|

|

Net income |

$ |

12,693 |

|

|

$ |

9,739 |

|

|

|

|

|

|

|

Net income per share |

$ |

1.66 |

|

|

$ |

1.28 |

|

|

Net income per diluted share |

$ |

1.64 |

|

|

$ |

1.27 |

|

|

|

|

|

|

|

Weighted average shares outstanding |

|

7,651 |

|

|

|

7,592 |

|

|

Weighted average diluted shares outstanding |

|

7,737 |

|

|

|

7,681 |

|

| |

|

|

|

|

Consolidated Condensed Balance Sheets(in

thousands)(unaudited) |

|

|

|

|

March 31, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

11,372 |

|

|

$ |

5,263 |

|

|

Receivables, net |

|

61,250 |

|

|

|

64,449 |

|

|

Inventories |

|

73,900 |

|

|

|

70,191 |

|

|

Other current assets |

|

4,017 |

|

|

|

4,730 |

|

|

Property, plant, and equipment, Net |

|

61,931 |

|

|

|

62,137 |

|

|

Goodwill |

|

113,104 |

|

|

|

113,263 |

|

|

Intangible assets, net |

|

62,914 |

|

|

|

64,116 |

|

|

Other assets |

|

19,191 |

|

|

|

19,987 |

|

|

Total assets |

$ |

407,679 |

|

|

$ |

404,136 |

|

|

Liabilities and equity: |

|

|

|

|

Accounts payable |

$ |

23,654 |

|

|

$ |

22,286 |

|

|

Current portion of long-term debt |

|

4,000 |

|

|

|

4,000 |

|

|

Other current liabilities |

|

24,782 |

|

|

|

31,923 |

|

|

Long-term debt, excluding current installments |

|

30,000 |

|

|

|

28,000 |

|

|

Other liabilities |

|

30,227 |

|

|

|

31,836 |

|

|

Total liabilities |

|

112,663 |

|

|

|

118,045 |

|

|

Total equity |

|

295,016 |

|

|

|

286,091 |

|

|

Total liabilities and stockholders' equity |

$ |

407,679 |

|

|

$ |

404,136 |

|

| |

|

|

|

Forward-Looking Statements

Certain statements in this press release may be

considered “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements

generally relate to future events or the Company’s future financial

or operating performance and may be identified by words such as

“may,” “should,” “expect,” “intend,” “will,” “estimate,”

“anticipate,” “believe,” “predict,” or similar words. Such

statements include, but are not limited to, statements about the

Company’s future financial or operating performance; the continuing

operation of the Company’s locations, the maintenance of its

facilities and the sufficiency of the Company’s supply chain,

inventory, liquidity and capital resources, including increased

costs in connection with such efforts; statements about the

Company’s acquisition strategies and opportunities and the

Company’s growth potential and strategies for growth; statements

about the integration and performance of recent acquisitions;

statements about the Company’s ability to realize the benefits

expected from our pipeline of acquisition opportunities and

recently completed acquisitions, including any related synergies;

expectations regarding customer demand and the impact of long-term

customer and vendor agreements; and any indication that the Company

may be able to sustain or increase its sales, earnings or earnings

per share, or its sales, earnings or earnings per share growth

rates. Such forward-looking statements are based upon assumptions

made by the Company as of the date hereof and are subject to risks,

uncertainties, and other factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements. Factors that may cause actual results

to differ materially from current expectations include, but are not

limited to: the Company's general ability to execute its business

plans; industry conditions, including fluctuations in supply,

demand and prices for the Company's products and services due to

inflation, the war in Ukraine, or otherwise; risks relating to the

Company’s ability to achieve anticipated benefits of acquisitions

and other risks; risks relating to delayed payments by our

customers and the potential for reduced or canceled orders; risks

related to customer concentration; risks relating to our

performance and the performance of our counterparties under the

agreements we have entered into; risks that our customers will not

purchase the expected volume of goods under the agreements we have

entered into; risks that we will not achieve expected rebates under

our vendor supply agreements that we have entered into; and

uncertainties set forth in the sections entitled "Risk Factors" and

"Cautionary Note Regarding Forward-Looking Statements" in the

Company's filings with the Securities and Exchange Commission

("SEC"), which are available on the SEC's website at www.sec.gov.

The Company expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any such statement to

reflect any change in the Company’s expectations or any change in

events, conditions, or circumstances on which any such statement is

based. Forward-looking statements are also subject to the risks and

other issues described above under “Use of Non-GAAP Financial

Information,” which could cause actual results to differ materially

from current expectations included in the Company’s forward-looking

statements included in this press release.

Non-GAAP Financial Information

This news release includes non-generally

accepted accounting principles (“GAAP”) performance measures.

Management considers Adjusted Operating Income, Adjusted Net

Income, EBITDA and Adjusted EBITDA, non-GAAP measures. The Company

uses these non-GAAP financial measures to facilitate management's

financial and operational decision-making, including evaluation of

the Company’s historical operating results. The Company’s

management believes these non-GAAP measures are useful in

evaluating the Company’s operating performance and are similar

measures reported by publicly listed U.S. competitors, and

regularly used by securities analysts, institutional investors, and

other interested parties in analyzing operating performance and

prospects. These non-GAAP financial measures reflect an additional

way of viewing aspects of the Company's operations that, when

viewed with GAAP results and the reconciliations to corresponding

GAAP financial measures, may provide a more complete understanding

of factors and trends affecting the Company’s business. By

providing these non-GAAP measures, the Company’s management intends

to provide investors with a meaningful, consistent comparison of

the Company’s performance for the periods presented. These non-GAAP

financial measures should be considered supplemental to, and not a

substitute for, financial information prepared in accordance with

GAAP. The Company's definition of these non-GAAP measures may

differ from similarly titled measures of performance used by other

companies in other industries or within the same industry.

|

Table 1: Adjusted Operating Income

Reconciliation(in thousands) |

| |

| |

Three Months Ended |

| |

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating income (GAAP) |

$ |

15,924 |

|

$ |

12,841 |

|

Adjustments: |

|

|

|

|

Change in fair value of contingent consideration |

|

238 |

|

|

2,853 |

|

Loss on disposal of fixed assets |

|

9 |

|

|

1 |

|

Adjusted operating income (Non-GAAP) |

$ |

16,171 |

|

$ |

15,695 |

| |

|

|

|

|

Table 2: Adjusted Net Income and Diluted Common Share

Outstanding Reconciliation(in thousands, except per share

data) |

| |

| |

Three Months Ended |

| |

March 31 |

|

|

|

2024 |

|

|

2023 |

|

Net income (GAAP) |

$ |

12,693 |

|

$ |

9,739 |

|

Adjustments (net of taxes): |

|

|

|

|

Change in fair value of contingent consideration |

|

177 |

|

|

2,120 |

|

Loss on disposal of fixed assets |

|

7 |

|

|

1 |

|

Adjusted net income (Non-GAAP) |

$ |

12,877 |

|

$ |

11,860 |

| |

|

|

|

|

Adjusted Net Income per diluted share outstanding (Non-GAAP) |

$ |

1.66 |

|

$ |

1.54 |

|

Weighted average diluted common shares outstanding |

|

7,737 |

|

|

7,681 |

| |

|

|

|

|

Table 3: EBITDA Reconciliation(in thousands) |

| |

| |

Three Months Ended |

| |

March 31, |

|

|

2024 |

|

2023 |

|

Net income (GAAP) |

$ |

12,693 |

|

$ |

9,739 |

| Income tax expense |

2,642 |

|

2,156 |

| Interest expense, net |

631 |

|

869 |

| Depreciation |

1,899 |

|

1,671 |

| Amortization of intangible

assets |

1,099 |

|

1,106 |

|

EBITDA (Non-GAAP) |

$ |

18,964 |

|

$ |

15,541 |

| Adjustments: |

|

|

|

|

Share based compensation |

1,513 |

|

1,056 |

|

Change in fair value of contingent consideration |

238 |

|

2,853 |

|

Loss on disposal of fixed assets |

9 |

|

1 |

| Adjusted EBITDA

(Non-GAAP) |

$ |

20,724 |

|

$ |

19,451 |

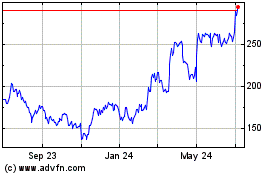

Ufp Technologies (NASDAQ:UFPT)

Historical Stock Chart

From Dec 2024 to Jan 2025

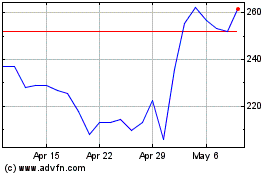

Ufp Technologies (NASDAQ:UFPT)

Historical Stock Chart

From Jan 2024 to Jan 2025