TScan Therapeutics, Inc. (Nasdaq: TCRX), a clinical-stage

biotechnology company focused on the development of T cell receptor

(TCR)-engineered T cell (TCR-T) therapies for the treatment of

patients with cancer, today reported financial results for the

third quarter ended September 30, 2024, and provided a corporate

update.

“As we approach the end of the year, we remain

committed to advancing our clinical-stage pipeline across both heme

and solid tumor malignancies and providing an update on the ALLOHA

Phase 1 trial following ASH. We are encouraged to see that none of

the 16 patients on the treatment arm relapsed, including five

patients at least one-year post-transplant as of the July 8th

abstract cutoff date. We look forward to sharing updated data,

including several additional patients, at ASH,” said Gavin

MacBeath, Ph.D., Chief Executive Officer. “During the third quarter

we continued to prioritize screening, enrolling, and dosing

patients in the solid tumor program and remain on track to dose our

first patient with multiplex therapy and provide an update on our

Phase 1 study by the end of the year.”

Recent Corporate Highlights

- The Company recently announced an

upcoming oral presentation at the 66th ASH Annual Meeting. The data

in the abstract included 16 treatment-arm patients and 11

control-arm patients with a data cutoff of July 8, 2024. No dose

limiting toxicities were observed across all treatment-arm patients

and the safety profile was generally consistent with hematopoietic

cell transplantation (HCT). All treatment-arm patients (16 of 16)

were relapse-free and minimal residual disease (MRD)-negative as of

the data cutoff, whereas three control-arm patients (3 of 11)

relapsed, two of whom died from their disease. These data support

both the safety and potential of TSC-100 and TSC-101 to reduce

relapses and increase relapse-free survival in patients receiving

reduced intensity conditioning HCT. Updated data will be presented

at the annual meeting.

- The Company will host a virtual KOL

event featuring Ran Reshef, M.D., M.Sc., on Tuesday, December 10th,

at 8:00 a.m. ET to discuss the data presented at the ASH Annual

Meeting. The Company will also discuss its clinical development

strategy for the heme program. Dr. Reshef is the Professor of

Medicine and Director of the Cellular Immunotherapy Program at

Columbia University Irving Medical Center. Additional details

around the call will be provided closer to the event. Registration

for the event can be found here.

- The Company recently increased its

internal manufacturing capacity as well as identified a global

contract development and manufacturing organization (CDMO) with

commercial capabilities to support both the heme and solid tumor

programs. The Company is on track to transfer the commercial heme

manufacturing process to the CDMO in 2025.

- The Company recently presented

three posters at the Society for Immunotherapy of Cancer (SITC)

39th Annual Meeting held in Houston, TX and virtually:

- Discovery of a MAGE-A4-specific

TCR-T Therapy Candidate for Multiplex Treatment of Solid

Tumors

- Preclinical Models for T-Plex, a

Customized Multiplexed TCR-T Cell Therapy Addressing Intra-Tumor

Antigen and HLA Heterogeneity

- Development of a Target Agnostic

Platform to Assess the Reactivity of T Cell Receptor

(TCR)-Engineered T Cell (TCR-T) Therapies to Primary Human

Tissues

Copies of the presentation materials can be

found under the “Publications” section of the Company’s website

at tscan.com.

Upcoming Anticipated

Milestones

Heme Malignancies Program: TScan’s two lead

TCR-T therapy candidates, TSC-100 and TSC-101, are designed to

treat residual disease and prevent relapse in patients with acute

myeloid leukemia (AML), acute lymphoblastic leukemia (ALL), or

myelodysplastic syndrome (MDS) undergoing allogeneic HCT (the

ALLOHATM trial, NCT05473910).

- Plans to open expansion cohorts at the proposed recommended

Phase 2 dose level to further characterize safety and evaluate

translational and efficacy endpoints by the end of 2024.

- One-year clinical and translational data on initial patients to

be reported by the end of 2024.

- Initiate a registration trial, pending feedback from regulatory

authorities, and plans to report two-year clinical and

translational data in 2025.

Solid Tumor Program: TScan continues to expand

the ImmunoBank, a collection of therapeutic TCR-Ts that target

different cancer-associated antigens presented on diverse HLA

types. TScan’s strategy is to treat patients with multiple TCR-Ts

to overcome tumor heterogeneity and prevent resistance that may

arise from either target or HLA loss (screening

protocol: NCT05812027; treatment

protocol: NCT05973487).

- Actively screening, enrolling, and dosing patients across the

TCR-T therapy candidates.

- Update on solid tumor program expected by the end of 2024.

- Investigational new drug (IND) filing for TCR targeting MAGE-A4

on HLA-A*02:01 (TSC-202-A0201) planned by the end of the year.

- Response data for multiplex therapy anticipated in 2025.

Third Quarter 2024 Financial

Results

Revenue: Revenue for the

third quarter of 2024 was $1.0 million, compared to $3.9 million

for the third quarter of 2023. The decrease was primarily due to

timing of research activities pursuant to the Company’s

collaboration agreement with Amgen which commenced in May 2023.

R&D Expenses: Research

and development expenses for the third quarter of 2024 were $26.3

million, compared to $22.7 million for the third quarter of 2023.

The increase of $3.5 million was primarily driven by an increase in

clinical studies expense associated with the ongoing enrollment of

our ALLOHA Phase 1 heme trial and start-up activities and initial

enrollment in our Phase 1 solid tumor clinical trial, as well as an

increase in personnel expenses due to additional headcount in

support of our expanded research and development activities.

Research and development expenses included non-cash stock

compensation expense of $1.2 million and $0.9 million for the third

quarter of 2024 and 2023, respectively.

G&A Expenses: General

and administrative expenses for the third quarter of 2024 were $7.4

million, compared to $5.9 million for the third quarter of 2023.

The increase of $1.5 million was primarily driven by an increase in

personnel expenses due to increased headcount to support business

activities. General and administrative expenses included non-cash

stock compensation expense of $1.3 million and $0.4 million for the

third quarter of 2024 and 2023, respectively.

Net Loss: Net loss was

$29.9 million for the third quarter of 2024, compared to $23.0

million for the third quarter of 2023, and included net interest

income of $2.7 million and $1.8 million, respectively.

Cash Position: Cash, cash

equivalents, and marketable securities as of September 30, 2024,

were $271.1 million, excluding $5.0 million of restricted cash. The

Company believes that its existing cash resources will continue to

fund its current operating plan into the fourth quarter of

2026.

Share Count: As of

September 30, 2024, the Company had issued and outstanding shares

of 53,354,124, which consists of 49,077,536 shares of voting common

stock and 4,276,588 shares of non-voting common stock, and

outstanding pre-funded warrants to purchase 65,587,945 shares of

voting common stock at an exercise price of $0.0001 per share.

About TScan Therapeutics,

Inc.

TScan is a clinical-stage biotechnology company

focused on the development of T cell receptor (TCR)-engineered T

cell (TCR-T) therapies for the treatment of patients with cancer.

The Company’s lead TCR-T therapy candidates, TSC-100 and TSC-101,

are in development for the treatment of patients with hematologic

malignancies to prevent relapse following allogeneic hematopoietic

cell transplantation (the ALLOHATM Phase 1 heme trial). The Company

is also developing TCR-T therapy candidates for the treatment of

various solid tumors. The Company has developed and continues to

expand its ImmunoBank, the Company’s repository of therapeutic TCRs

that recognize diverse targets and are associated with multiple HLA

types, to provide customized multiplex TCR-T therapies for patients

with a variety of cancers.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, but not limited to, express or implied

statements regarding the Company’s plans, progress, and timing

relating to the Company’s hematologic malignancies program,

including clinical updates of the ALLOHA Phase 1 heme trial,

presentation of data, opening of expansion cohorts, and initiation

of registrational trials; the Company’s plans, progress, and timing

relating to the Company’s solid tumor program, including,

screening, enrolling, and dosing patients, presentation of data,

and submission of additional INDs to expand the ImmunoBank; the

progress of the hematologic malignancies and solid tumor programs

being indicative or predictive of the success of each program; the

engagement of CDMO being indicative of successful initiation or

support of manufacturing activities or execution of definitive

agreements; the Company’s current and future research and

development plans or expectations; the structure, timing and

success of the Company’s planned preclinical development,

submission of INDs, and clinical trials; the potential benefits of

any of the Company’s proprietary platforms, multiplexing, or

current or future product candidates in treating patients; the

Company’s ability to fund its operating plan with its existing

cash, cash equivalents, and marketable securities; and the

Company’s goals, strategy and anticipated financial performance.

TScan intends such forward-looking statements to be covered by the

safe harbor provisions for forward-looking statements contained in

Section 21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by terms such as, but not

limited to, “may,” “might,” “will,” “objective,” “intend,”

“should,” “could,” “can,” “would,” “expect,” “believe,”

“anticipate,” “project,” “target,” “design,” “estimate,” “predict,”

“potential,” “plan,” “on track,” or similar expressions or the

negative of those terms. Such forward-looking statements are based

upon current expectations that involve risks, changes in

circumstances, assumptions, and uncertainties. The express or

implied forward-looking statements included in this release are

only predictions and are subject to a number of risks,

uncertainties and assumptions, including, without limitation: the

beneficial characteristics, safety, efficacy, therapeutic effects

and potential advantages of TScan’s TCR-T therapy candidates;

TScan’s expectations regarding its preclinical studies being

predictive of clinical trial results; TScan’s recently approved

INDs being indicative or predictive of bringing TScan closer to its

goal of providing customized TCR-T therapies to treat patients with

cancer; the timing of the launch, initiation, progress, expected

results and announcements of TScan’s preclinical studies, clinical

trials and its research and development programs; TScan’s ability

to enroll patients for its clinical trials within its expected

timeline; TScan’s plans relating to developing and commercializing

its TCR-T therapy candidates, if approved, including sales

strategy; estimates of the size of the addressable market for

TScan’s TCR-T therapy candidates; TScan’s manufacturing

capabilities and the scalable nature of its manufacturing process;

TScan’s estimates regarding expenses, future milestone payments and

revenue, capital requirements and needs for additional financing;

TScan’s expectations regarding competition; TScan’s anticipated

growth strategies; TScan’s ability to attract or retain key

personnel; TScan’s ability to establish and maintain development

partnerships and collaborations; TScan’s expectations regarding

federal, state and foreign regulatory requirements; TScan’s ability

to obtain and maintain intellectual property protection for its

proprietary platform technology and our product candidates; the

sufficiency of TScan’s existing capital resources to fund its

future operating expenses and capital expenditure requirements; and

other factors that are described in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of TScan’s most recent Annual

Report on Form 10-K and any other filings that TScan has made or

may make with the SEC in the future. Any forward-looking statements

contained in this release represent TScan’s views only as of the

date hereof and should not be relied upon as representing its views

as of any subsequent date. Except as required by law, TScan

explicitly disclaims any obligation to update any forward-looking

statements.

Contacts

Heather SavelleTScan Therapeutics, Inc.VP, Investor

Relations857-399-9840hsavelle@tscan.com

Maghan MeyersArgot

Partners212-600-1902TScan@argotpartners.com

|

TScan Therapeutics, Inc. |

|

|

Condensed Consolidated Balance Sheet Data |

|

|

(unaudited, in thousands, except share

amount) |

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

| Assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

133,118 |

|

|

$ |

133,359 |

|

|

|

Other assets |

|

|

214,909 |

|

|

|

138,790 |

|

|

|

Total assets |

|

$ |

348,027 |

|

|

$ |

272,149 |

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

|

Total liabilities |

|

$ |

118,940 |

|

|

$ |

121,282 |

|

|

|

Total stockholders' equity |

|

|

229,087 |

|

|

|

150,867 |

|

|

|

Total liabilities and stockholders' deficit |

|

$ |

348,027 |

|

|

$ |

272,149 |

|

|

|

Common stock and pre-funded warrants outstanding (1) |

|

|

118,942,069 |

|

|

|

94,840,055 |

|

|

| |

|

|

|

|

|

|

|

|

(1) Both periods include outstanding pre-funded warrants to

purchase shares of voting common stock at an exercise price of

$0.0001 per share; 65,587,945 and 47,010,526 pre-funded warrants

issued and outstanding at September 30, 2024 and December 31, 2023,

respectively. |

|

|

|

TScan Therapeutics, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(unaudited, in thousands, except share and per share

amounts) |

|

|

|

|

|

|

|

|

|

| |

|

Three Months EndedSeptember

30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

| Revenue |

|

|

|

|

|

|

|

|

Collaboration and license revenue |

|

$ |

1,049 |

|

|

$ |

3,887 |

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

|

26,262 |

|

|

|

22,741 |

|

|

|

General and administrative |

|

|

7,409 |

|

|

|

5,894 |

|

|

|

Total operating expenses |

|

|

33,671 |

|

|

|

28,635 |

|

|

| Loss from operations |

|

|

(32,622 |

) |

|

|

(24,748 |

) |

|

|

Interest and other income, net |

|

|

3,693 |

|

|

|

2,733 |

|

|

|

Interest expense |

|

|

(958 |

) |

|

|

(982 |

) |

|

| Net loss |

|

$ |

(29,887 |

) |

|

$ |

(22,997 |

) |

|

| Net loss per share, basic and

diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.24 |

) |

|

| Weighted average common shares

outstanding—basic and diluted (2) |

|

|

118,700,362 |

|

|

|

94,829,844 |

|

|

| |

|

|

|

|

|

|

|

|

(2) For the three months ended September 30, 2024 and 2023,

65,587,945 and 47,010,526 shares of the Company's voting common

stock issuable upon exercise of the pre-funded warrants are

included as outstanding common stock in the calculation of basic

and diluted net loss per share. |

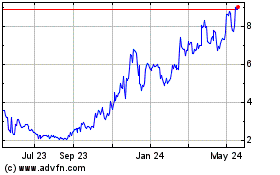

TScan Therapeutics (NASDAQ:TCRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

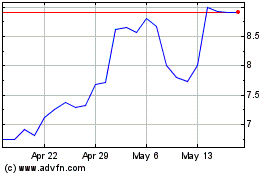

TScan Therapeutics (NASDAQ:TCRX)

Historical Stock Chart

From Dec 2023 to Dec 2024