Tradeweb Markets Inc. (Nasdaq: TW), a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets, today announced it has completed its acquisition of

Institutional Cash Distributors (“ICD”), an investment technology

provider for corporate treasury organizations trading short-term

investments. The $785 million, all-cash transaction was announced

in April 2024.

With the acquisition of ICD, Tradeweb adds corporate treasury

professionals as a fourth client channel, complementing its

existing focus on institutional, wholesale and retail clients, and

giving it access to a $2+ billion addressable market. Tradeweb

expects the ICD acquisition to be accretive to its adjusted

earnings per share over the next 12 months.

Tradeweb CEO Billy Hult said: “We are excited to complete the

acquisition of ICD and launch corporates as a new client channel,

offering a key new avenue for growth and building on our strong

presence across our other core markets. Corporate treasurers

represent an increasingly large and underserved opportunity within

fixed income markets, and ICD’s differentiated technology offers

the perfect gateway between corporates and global fixed income

markets. The ICD team shares our commitment to continuous

innovation and exceptional client service, and it is a pleasure to

officially welcome them to Tradeweb.”

As a part of Tradeweb, ICD will provide an increasingly

comprehensive solution for corporate treasury organizations

worldwide, enhancing its leadership in this space with a range of

Tradeweb integration opportunities. In the future, ICD clients will

have the ability to optimize yield and duration via Tradeweb’s

existing suite of products and partnerships, as well as manage

liquidity needs and related FX risk. In addition to cross-selling

its products to ICD’s clients, Tradeweb will leverage its

international presence to aim to accelerate ICD’s growth and

expansion.

ICD is one of the largest U.S. institutional money market fund

portals, enabling more than 500 corporate treasury organizations

from growth and blue-chip companies (including approximately 17% of

the S&P 100 as of December 31, 2023) across 65 industries and

more than 45 countries to invest in money market funds and other

short-term products to manage liquidity.

About Tradeweb Markets

Tradeweb Markets Inc. (Nasdaq: TW) is a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets. Founded in 1996, Tradeweb provides access to markets, data

and analytics, electronic trading, straight-through-processing and

reporting for more than 50 products to clients in the

institutional, wholesale retail and corporate markets. Advanced

technologies developed by Tradeweb enhance price discovery, order

execution and trade workflows while allowing for greater scale and

helping to reduce risks in client trading operations. Tradeweb

serves more than 2,500 clients in more than 70 countries. On

average, Tradeweb facilitated more than $1.7 trillion in notional

value traded per day over the past four quarters. For more

information, please go to www.tradeweb.com.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the federal securities laws. Statements related to,

among other things, the potential benefits of the acquisition, our

plans, objectives, expectations and intentions regarding ICD, our

and ICD’s future performance, the industry and markets in which we

and ICD operate, as well as our other expectations, beliefs, plans,

strategies, objectives, prospects and assumptions and other future

events are forward-looking statements.

We have based these forward-looking statements on our current

expectations, assumptions, estimates and projections. While we

believe these expectations, assumptions, estimates and projections

are reasonable, such forward-looking statements are only

predictions and involve known and unknown risks and uncertainties,

many of which are beyond our control. Risks and uncertainties

include, among others, risks related to our ability to successfully

integrate ICD’s operations, implement our plans, objectives,

expectations and intentions with respect to ICD’s business and

realize the expected benefits and synergies from the acquisition.

These and other important factors, including those discussed under

the heading “Risk Factors” in documents of Tradeweb Markets Inc. on

file with or furnished to the SEC, may cause actual results,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements. Given

these risks and uncertainties, you are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements contained in this release are not guarantees of future

performance and our actual results of operations, financial

condition or liquidity, and the development of the industry and

markets in which we operate, may differ materially from the

forward-looking statements contained in this release. In addition,

even if our results of operations, financial condition or

liquidity, and events in the industry and markets in which we

operate, are consistent with the forward-looking statements

contained in this release, they may not be predictive of results or

developments in future periods.

Any forward-looking statement that we make in this release

speaks only as of the date of such statement. Except as required by

law, we do not undertake any obligation to update or revise, or to

publicly announce any update or revision to, any of the

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date of this release.

Market and Industry Data

This press release includes estimates regarding market and

industry data, including addressable market data related to certain

corporate treasury activities, that we prepared based on our

management’s knowledge and experience in the markets in which we

operate, together with information obtained from various sources,

including ICD, publicly available information, industry reports and

publications, surveys, our clients, trade and business

organizations and other contacts in the markets in which we

operate. In presenting this information, we have made certain

assumptions that we believe to be reasonable based on such data and

other similar sources and on our knowledge of, and our experience

to date in, the markets in which we operate. While such information

is believed to be reliable for the purposes used herein, no

representations are made as to the accuracy or completeness thereof

and we take no responsibility for such information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801596448/en/

Media: Daniel Noonan, Tradeweb +1 646 767 4677

Daniel.Noonan@Tradeweb.com Investors: Ashley Serrao,

Tradeweb +1 646 430 6027 Ashley.Serrao@Tradeweb.com

Sameer Murukutla, Tradeweb +1 646 767 4864

Sameer.Murukutla@Tradeweb.com

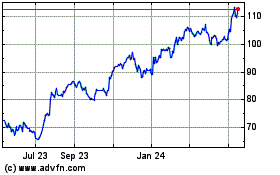

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Feb 2025 to Mar 2025

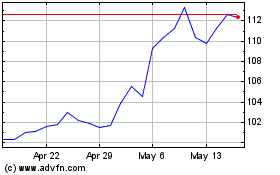

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Mar 2024 to Mar 2025