true

The purpose of this Amendment No. 1 to the Current Report on Form 8-K filed by Tonix Pharmaceuticals Holding Corp. (the Company) on June 13, 2024 (the Original 8-K), is solely to replace the Exhibit 5.2 opinion filed therewith which was inadvertently filed with the Exhibit 5.2 opinion filed below.

0001430306

0001430306

2024-06-11

2024-06-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (date of earliest event reported): June

11, 2024

TONIX PHARMACEUTICALS HOLDING CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

001-36019 |

26-1434750 |

(State

or Other Jurisdiction of Incorporation) |

(Commission

File Number) |

(IRS

Employer Identification No.) |

26 Main Street, Chatham, New Jersey 07928

(Address of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (862) 904-8182

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

TNXP |

The NASDAQ Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANTORY NOTE

The purpose of this Amendment

No. 1 to the Current Report on Form 8-K filed by Tonix Pharmaceuticals Holding Corp. (the “Company”) on June 13, 2024 (the

"Original 8-K"), is solely to replace the Exhibit 5.2 opinion filed therewith which was inadvertently filed with the Exhibit

5.2 opinion filed below. The correct opinion is filed as Exhibit 5.2 hereto and supersedes and replaces in its entirety the opinion filed

as Exhibit 5.2 to the Original 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

| (d) |

Exhibit

No. |

|

Description. |

| |

1.01 |

|

Placement Agency Agreement, dated June 12, 2024, between Tonix Pharmaceuticals Holding Corp. and Dawson James Securities Inc. (incorporated by reference to Exhibit 1.01 to the Company’s Current Report on Form 8-K filed on June 13, 2024) |

| |

4.01 |

|

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.01 to the Company’s Current Report on Form 8-K filed on June 13, 2024) |

| |

4.02 |

|

Warrant Agent Agreement, dated June 13, 2024, between Tonix Pharmaceuticals Holding Corp. and VStock Transfer (incorporated by reference to Exhibit 4.02 to the Company’s Current Report on Form 8-K filed on June 13, 2024) |

| |

5.01 |

|

Opinion of Brownstein Hyatt Farber Schreck, LLP (incorporated by reference to Exhibit 5.01 to the Company’s Current Report on Form 8-K filed on June 13, 2024) |

| |

5.02 |

|

Opinion of Lowenstein Sandler LLP |

| |

23.01 |

|

Consent of Brownstein Hyatt Farber Schreck, LLP (incorporated by reference to Exhibit 23.01 to the Company’s Current Report on Form 8-K filed on June 13, 2024) |

| |

23.02 |

|

Consent of Lowenstein Sandler LLP (contained in Exhibit 5.02) |

| |

99.01 |

|

Press Release, dated June 11, 2024 (incorporated by reference to Exhibit 99.01 to the Company’s Current Report on Form 8-K filed on June 13, 2024) |

| |

99.02 |

|

Press Release, dated June 12, 2024 (incorporated by reference to Exhibit 99.02 to the Company’s Current Report on Form 8-K filed on June 13, 2024) |

| |

99.03 |

|

Press Release, dated June 13, 2024 (incorporated by reference to Exhibit 99.03 to the Company’s Current Report on Form 8-K filed on June 13, 2024) |

| |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirement of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

TONIX PHARMACEUTICALS HOLDING CORP. |

| |

|

| |

|

| Date: June 14, 2024 |

By: |

/s/ Bradley Saenger |

|

| |

|

Bradley Saenger |

| |

|

Chief Financial Officer |

Tonix Pharmaceuticals Holding Corp. 8-K/A

Exhibit 5.02

June 13, 2024

Tonix Pharmaceuticals

Holding Corp.

26 Main Street – Suite 101

Chatham, NJ 07928

Ladies and Gentlemen:

We have acted as counsel

to Tonix Pharmaceuticals Holding Corp., a Nevada corporation (the “Company”) in connection with the sale and issuance

of 1,199,448 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock” and such shares,

the “Shares”) and Pre-Funded Warrants (the “Warrants”) to purchase up to an aggregate of 2,568,110

shares of Common Stock (the “Warrant Shares”) being issued to certain purchasers, pursuant to the Registration Statement

on Form S-3 (File No. 333-266982) (the “Registration Statement”) filed by the Company with the Securities and Exchange

Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”),

and the rules and regulations promulgated thereunder, together with a base prospectus dated May 5, 2021 included in the Form S-3 (the

“Base Prospectus”) and a final prospectus supplement dated June 12, 2024 filed with the Commission pursuant to Rule

424(b)(5) under the Securities Act (together with the Base Prospectus, the “Prospectus”). The Shares and Warrants are

to be sold pursuant to a Placement Agency Agreement, dated June 12, 2024, between the Company and Dawson James Securities, Inc. We have

been requested by the Company to render this opinion in connection with the filing of the Form 8-K with respect to the sale and issuance

by the Company of the Warrants (the “Form 8-K”).

As counsel to the Company

in connection with the proposed potential issuance and sale of the above-referenced Shares, Warrants and Warrant Shares, we have reviewed

the Registration Statement, Prospectus and the respective exhibits thereto. We have also reviewed such corporate documents and records

of the Company, such certificates of public officials and officers of the Company and such other matters as we have deemed necessary or

appropriate for purposes of this opinion. In our examination, we have assumed: (i) the authenticity of original documents and the genuineness

of all signatures; (ii) the conformity to the originals of all documents submitted to us as copies; (iii) the truth, accuracy and completeness

of the information, representations and warranties contained in the instruments, documents, certificates and records we have reviewed;

(iv) that, as set forth in a separate opinion delivered to the Company on the date hereof by Brownstein Hyatt Farber Schreck, LLP,

special Nevada counsel to the Company, the Warrants have been duly authorized; and (v) the legal capacity for all purposes relevant hereto

of all natural persons and, with respect to all parties to agreements or instruments relevant hereto other than the Company, that such

parties had the requisite power and authority (corporate or otherwise) to execute, deliver and perform such agreements or instruments,

that such agreements or instruments have been duly authorized by all requisite action (corporate or otherwise), executed and delivered

by such parties and that such agreements or instruments are the valid, binding and enforceable obligations of such parties. As to any

facts material to the opinions expressed herein that were not independently established or verified, we have relied upon oral or written

statements and representations of officers and other representatives of the Company.

Based on the foregoing,

and subject to the assumptions, limitations and qualifications set forth herein, we are of the opinion that when the Warrants are duly

executed and delivered by the Company and paid for by certain purchasers, such Warrants will constitute the legal, valid and binding obligation

of the Company, enforceable against the Company in accordance with their terms, subject to bankruptcy, insolvency or other similar laws

affecting creditors’ rights and to general equitable principles.

The opinion set forth above

is subject to the following exceptions, limitations and qualifications: (i) the effect of bankruptcy, insolvency, reorganization, fraudulent

conveyance, moratorium or other similar laws now or hereafter in effect relating to or affecting the rights and remedies of creditors;

(ii) the effect of general principles of equity, including without limitation, concepts of materiality, reasonableness, good faith and

fair dealing and the possible unavailability of specific performance or injunctive relief, regardless of whether enforcement is considered

in a proceeding in equity or at law, and the discretion of the court before which any proceeding therefor may be brought; and (iii) the

unenforceability under certain circumstances under law or court decisions of provisions providing for the indemnification of, or contribution

to, a party with respect to liability where such indemnification or contribution is contrary to public policy. We express no opinion concerning

the enforceability of any waiver of rights or defenses with respect to stay, extension or usury laws.

Our opinion is limited

to the laws of New York. We express no opinion as to the effect of the law of any other jurisdiction. Our opinion is rendered as of the

date hereof, and we assume no obligation to advise you of changes in law or fact (or the effect thereof on the opinions expressed herein)

that hereafter may come to our attention. We advise you that matters of Nevada law are covered in the opinion of Brownstein Hyatt

Farber Schreck, LLP, special Nevada counsel for the Company, in Exhibit 5.1 to the Form 8-K.

We hereby consent to the

inclusion of this opinion as Exhibit 5.2 to the Form 8-K and to the references to our firm in the Prospectus under the caption “Legal

Matters.” In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section

7 of the Securities Act or the rules and regulations thereunder.

Very truly yours,

/s/ Lowenstein Sandler LLP

-2-

v3.24.1.1.u2

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

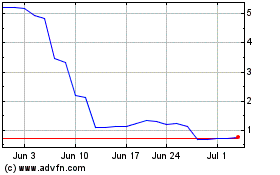

Tonix Pharmaceuticals (NASDAQ:TNXP)

Historical Stock Chart

From Oct 2024 to Nov 2024

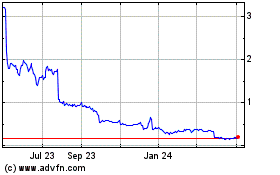

Tonix Pharmaceuticals (NASDAQ:TNXP)

Historical Stock Chart

From Nov 2023 to Nov 2024