SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

TO

(Amendment No. 1)

Tender

Offer Statement Under Section 14(d)(1) or 13(e)(1)

of

the Securities Exchange Act of 1934

TIGO

ENERGY, INC.

(Name

of Subject Company (Issuer))

TIGO

ENERGY, INC.

(Name

of Filing Person (Offeror))

Options

To Purchase Common Stock, Par Value $0.0001 Per Share

(Title

of Class of Securities)

77867P104

(CUSIP

Number of Class of Securities)

Bill

Roeschlein

Chief

Financial Officer

Tigo

Energy, Inc.

655

Campbell Technology Parkway, Suite 150

Campbell,

CA 95008

(408)

402-0802

(Name,

Address and Telephone Number of Person Authorized To Receive Notices and Communications on Behalf of the Filing Person)

Copies

to:

Laura

Katherine Mann

White

& Case LLP

609

Main Street

Houston,

Texas 77002

Telephone:

(713) 496-9700 |

Joel

Rubinstein

White

& Case LLP

1221

Avenue of the Americas

New

York, New York 10020

Telephone:

(212) 819-8200 |

| ☐ | Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| ☐ | third-party

tender offer subject to Rule 14d-1. |

| ☒ | issuer

tender offer subject to Rule 13e-4. |

| ☐ | going-private

transaction subject to Rule 13e-3. |

| ☐ | amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If

applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ☐ | Rule

13e-4(i) (Cross-Border Issuer Tender Offer). |

| ☐ | Rule

14d-1(d) (Cross-Border Third-Party Tender Offer). |

SCHEDULE

TO

This Amendment No. 1 amends and supplements

the Tender Offer Statement on Schedule TO filed by Tigo Energy, Inc., a Delaware corporation (“Tigo” or the “Company”),

with the Securities and Exchange Commission (the “SEC”) on November 12, 2024 (as so amended, this “Schedule TO”).

This Schedule TO relates to an offer (the

“Offer”) by the Company to eligible employees and directors to exchange certain outstanding options to purchase shares of

our Common Stock (“Common Stock”) for new options to purchase a number of shares of our Common Stock (“Replacement

Options”), upon the terms and subject to the conditions set forth in the Offer to Exchange Certain Outstanding Options to Purchase

Common Stock for a Number of Replacement Options, dated November 12, 2024 (the “Offer to Exchange”), attached hereto as Exhibit

(a)(1)(i) and incorporated herein by reference.

Only Eligible Options may be exchanged in

the Option Exchange. For these purposes, “Eligible Options” are those options that (i) were granted under the Tigo Energy,

Inc. 2023 Equity Incentive Plan (the “Equity Incentive Plan”), (ii) have an exercise price greater than $10.64 per share

and (iii) are held by an employee or director of the Company or its subsidiaries as of the grant date of the Replacement Options.

You

are eligible to participate in the Offer only if you (i) are an employee or director of the Company or any of its subsidiaries on the

date the Offer commences and remain an employee or director, as applicable, through the grant date of the Replacement Options, (ii) are

resident in the United States or Italy and (iii) hold at least one Eligible Option as of the Offer Expiration Date.

The

Offer commenced on November 12, 2024 and is currently scheduled to expire at 11:59 P.M. Eastern Time on December 10, 2024 (as may be

extended, the “Offer Expiration Date”).

This Amendment No. 1 is made to amend and supplement

the Schedule TO and the Offer to Exchange. In connection with the filing of this Amendment No. 1, the Company sent an email to holders

of Eligible Options notifying them of the filing of this Amendment No. 1, which is attached hereto as Exhibit (a)(1)(viii).

Except as otherwise set forth in this Amendment No. 1, the information

set forth in the Schedule TO and the Offer to Exchange remains unchanged and is incorporated herein by reference to the extent relevant

to the items in this Amendment No. 1. Capitalized terms used but not defined herein have the meanings ascribed to them in the Schedule

TO. You should read this Amendment No. 1 together with the Schedule TO and the Offer to Exchange.

Amendments to Offer to Exchange

The Offer to Exchange and the corresponding

Items of the Schedule TO into which such information is incorporated by reference are hereby amended and supplemented as follows:

Offer to Exchange – Summary Term Sheet Overview; Offer to Exchange – Summary Term Sheet

and Questions and Answers; Offer to Exchange – The Offers

As further described in the Offer to Exchange,

the Company will distribute by email to you at your Company email (or if you are a director, at the email we have on file for you) the

exact exchange ratios to be used in the Offer with respect to each of your Eligible Options in a personalized notification form. The

Company has determined that such notification form will be delivered by the Company no later than 5:00 P.M. Eastern Time on the Offer

Expiration Date. The Offer to Exchange previously contemplated the delivery of such notification forms no later than 8:00 P.M. Eastern

Time. Therefore, the references to “(and no later than 8:00 P.M.) Eastern Time” in the Summary Term Sheet and on pages 1,

2, 4, 12, 13 and 20 of the Offer to Exchange are hereby amended to be references to “(and no later than 5:00 P.M.) Eastern Time.”

Offer to Exchange - Summary Term Sheet

and Questions and Answers — 3. How many Replacement Options will I receive for the Eligible Options that I exchange?

Question 3 on pages 2 -3 of the Offer to Exchange is hereby amended

and restated as follows:

3. How many Replacement Options will I receive

for the Eligible Options that I exchange?

The exchange ratio applicable to

each of your Eligible Options and the number of Replacement Options that may be granted in exchange for each of your Eligible Options

will be set forth in a personalized notification form sent to you at your Company email address (or if you are a director, at the email

address we have on file for you) after 3:00 P.M. (and no later than 5:00 P.M.) Eastern Time, on the Offer Expiration Date. The exchange

ratios will be calculated on an approximate “value-for-value” basis, meaning that the exchange ratios will be determined

in a manner intended to result in the grant of Replacement Options with an aggregate fair value that is approximately the same as the

aggregate fair value of the Eligible Options they replace, calculated as of the Offer Expiration Date, which will be the time that we

set the exchange ratios.

The value of the Eligible Options

was calculated using the Black-Scholes option pricing model. The value of the Replacement Options will be calculated using the Hull-White

I Lattice Model (the “Lattice Model”) as of the Replacement Option Grant Date. This valuation model calculates the theoretical

present value of a stock option using variables such as stock price, exercise price, volatility, and expected exercise behavior. Because

underwater stock options will be less valuable than Replacement Options, you will need to exchange more than one Eligible Option to receive

one Replacement Option.

Because options with different exercise

prices and expiration dates have different Lattice Model values, different grants may have different exchange ratios. The exchange ratios

will show you how many Eligible Options you need to exchange to get one Replacement Option.

The exchange ratio for each Eligible

Option cannot be calculated as of the date of this Offer because the ratios will be based in part on the future value of our common stock

during and at the end of the Offer. The exchange ratios are structured so that in no event would the number of Replacement Options received

by you exceed the number of shares underlying the Eligible Options exchanged for the Replacement Options.

After 3:00 P.M. (and no later than

5:00 P.M.) Eastern Time, on the Offer Expiration Date (as defined below), we will distribute to you at your Company email (or if you

are a director, at the email we have on file for you) the exact exchange ratios to be used in the Offer with respect to each of your

Eligible Options.

If your total exchanged options

would result in less than one Replacement Option, we will round up your Replacement Options so that you get a minimum of one Replacement

Option. See Section 1 of the Offer to Exchange entitled “Eligibility; Number of Options; Offer Expiration Date” and Section

8 of the Offer to Exchange entitled “Source and Amount of Consideration; Terms of Replacement Options” below for additional

information.

For illustrative purposes only,

below is a table setting forth hypothetical exchange ratios that would be used in the Offer assuming various closing prices of

shares of our Common Stock on Nasdaq for the preceding 60 days. The high and low closing sales prices of shares of our Common Stock

as listed on Nasdaq during such period have ranged from $1.70 to $1.00, respectively. Because the exact exchange ratios will be

based in part on the future value of our common stock during and at the end of the Offer, the exact exchange ratios may

vary from the ratios presented in the table below. For example, if you hold an Eligible Option to purchase 1,000 shares at an

exercise price of $10.65 per share and the closing price of our Common Stock on Nasdaq on the Offer Expiration Date is $1.12, the

exchange ratio would be 28.47%, which means you would receive 0.2847 Replacement Options for every one share underlying an Eligible

Option; accordingly, your 1,000 Eligible Options would be exchanged for 284 Replacement Options (i.e., 1,000 x 28.47%, rounded down

to the nearest whole number.)

| | |

Hypothetical Exchange Ratios for Eligible Options | |

| | |

Exchange Ratio at a Given Closing

Price | |

| Eligible Option Exercise Price | |

$1.00 | | |

$1.12 | | |

$1.25 | | |

$1.47 | | |

$1.70 | |

| $10.65 | |

| 26.10 | % | |

| 28.47 | % | |

| 30.35 | % | |

| 33.89 | % | |

| 37.19 | % |

| $11.50 | |

| 25.19 | % | |

| 27.47 | % | |

| 29.28 | % | |

| 32.68 | % | |

| 35.84 | % |

Offer to Exchange – This Offer –

1. Eligibility; Number of Options; Offer Expiration Date

The information contained in Section 1 of the

Offer to Exchange entitled “Eligibility; Number of Options; Offer Expiration Date” on page 13 is hereby amended and supplemented

by inserting the following between the ninth and tenth paragraphs of such section:

For illustrative

purposes only, below is a table setting forth hypothetical exchange ratios that would be used in the Offer assuming various closing prices

of shares of our Common Stock on Nasdaq for the preceding 60 days. The high and low closing sales prices of shares of our Common Stock

as listed on Nasdaq during such period have ranged from $1.70 to $1.00, respectively. Because the exact exchange ratios will be based

in part on the future value of our common stock during and at the end of the Offer, the exact exchange ratios may vary from the

ratios presented in the table below. For example, if you hold an Eligible Option to purchase 1,000 shares at an exercise price of $10.65

per share and the closing price of our Common Stock on Nasdaq on the Offer Expiration Date is $1.12, the exchange ratio would be 28.47%,

which means you would receive 0.2847 Replacement Options for every one share underlying an Eligible Option; accordingly, your 1,000 Eligible

Options would be exchanged for 284 Replacement Options (i.e., 1,000 x 28.47%, rounded down to the nearest whole number.)

| |

|

Hypothetical Exchange Ratios for Eligible Options |

|

| |

|

Exchange Ratio at a Given Closing Price |

|

| Eligible Option Exercise Price |

|

$1.00 |

|

|

$1.12 |

|

|

$1.25 |

|

|

$1.47 |

|

|

$1.70 |

|

| $10.65 |

|

|

26.10 |

% |

|

|

28.47 |

% |

|

|

30.35 |

% |

|

|

33.89 |

% |

|

|

37.19 |

% |

| $11.50 |

|

|

25.19 |

% |

|

|

27.47 |

% |

|

|

29.28 |

% |

|

|

32.68 |

% |

|

|

35.84 |

% |

Offer to Exchange – This Offer

– 9. Information Concerning the Company – Summary Financial Information

The information contained under the sub-heading

“Summary Financial Information” on page 28 of the Offer to Exchange is hereby amended and restated as follows:

Set forth below are summary consolidated

balance sheet data presented as of December 31, 2023 and 2022, and summary consolidated statement of operations and comprehensive

loss data for the years ended December 31, 2023 and 2022, which should be read in conjunction with the “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and the audited financial statements and the notes thereto

included in our Annual Report for the year ended December 31, 2023, and summary consolidated balance sheet data as of September 30,

2024, and summary consolidated statement of operations and comprehensive (loss) income for the nine months ended September 30, 2024

and 2023, which should be read in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and the unaudited financial statements and the notes thereto included in our Quarterly Report on Form 10-Q for the

quarter ended September 30, 2024, each of which is incorporated herein by reference in this Offer to Exchange.

| Consolidated

statement of income and comprehensive income data | |

Year Ended

December 31, | | |

Nine Months Ended

September 30, | |

| (in thousands,

except per share data) | |

2023 | | |

2022 | | |

2024 | | |

2023 | |

| Net revenue | |

$ | 145,233 | | |

$ | 81,323 | | |

$ | 36,740 | | |

$ | 135,988 | |

| Cost of revenue | |

| 93,924 | | |

| 56,552 | | |

| 28,333 | | |

| 87,555 | |

| Total operating expenses | |

| 59,584 | | |

| 25,667 | | |

| 36,315 | | |

| 43,166 | |

| (Loss) income from operations | |

| (8,275 | ) | |

| (896 | ) | |

| (27,908 | ) | |

| 5,267 | |

| Total other (income) expenses, net | |

| (7,429 | ) | |

| 6,070 | | |

| 8,020 | | |

| (8,552 | ) |

| (Loss) income before income tax expense | |

$ | (846 | ) | |

$ | (6,966 | ) | |

$ | (35,928 | ) | |

$ | 13,819 | |

| Income tax expense | |

| 138 | | |

| 71 | | |

| 16 | | |

| 29 | |

| Net (loss) income | |

$ | (984 | ) | |

$ | (7,037 | ) | |

$ | (35,944 | ) | |

$ | 13,790 | |

| (Loss) earnings per common share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.08 | ) | |

$ | (2.71 | ) | |

$ | (0.60 | ) | |

$ | 0.19 | |

| Diluted | |

$ | (0.14 | ) | |

$ | (2.71 | ) | |

$ | (0.60 | ) | |

$ | 0.04 | |

| (Loss) income from operations per common share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.22 | ) | |

$ | (0.18 | ) | |

$ | (0.46 | ) | |

$ | 0.17 | |

| Diluted | |

$ | (0.19 | ) | |

$ | (0.18 | ) | |

$ | (0.46 | ) | |

$ | 0.13 | |

| Weighted-average shares of common stock outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 38,048,516 | | |

| 4,940,562 | | |

| 60,130,249 | | |

| 31,070,476 | |

| Diluted | |

| 43,223,134 | | |

| 4,940,562 | | |

| 60,130,249 | | |

| 40,487,517 | |

| Consolidated balance sheet data (in thousands,

except per share data) | |

September 30,

2024 | | |

December 31,

2023 | | |

December 31,

2022 | |

| Total current assets | |

$ | 78,715 | | |

$ | 104,710 | | |

$ | 85,092 | |

| Total assets | |

$ | 98,571 | | |

$ | 127,777 | | |

$ | 88,078 | |

| Total current liabilities | |

$ | 19,902 | | |

$ | 26,419 | | |

$ | 39,588 | |

| Total liabilities | |

$ | 65,102 | | |

$ | 64,953 | | |

$ | 56,630 | |

| Total stockholders’ equity (deficit) | |

$ | 33,469 | | |

$ | 62,824 | | |

$ | (55,692 | ) |

| Net Tangible Book Value Per Share | |

$ | 0.32 | | |

$ | 0.82 | | |

$ | 5.75 | |

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Dated:

November 22, 2024 |

TIGO

ENERGY, INC. |

| |

|

|

| |

By: |

/s/

Bill Roeschlein |

| |

Name: |

Bill

Roeschlein |

| |

Title: |

Chief

Financial Officer |

EXHIBIT

INDEX

6

Exhibit (a)(1)(viii)

FORM OF EMAIL REGARDING AMENDMENTS TO THE OFFER

From: Bill Roeschlein, Chief Financial Officer

To: Eligible Tigo Participants

Subject: Tigo Energy, Inc. Offer to Exchange Certain Outstanding Options

for New Options – Amendment to Terms of the Offer

Date: November 22, 2024

As previously communicated to you on November

12, 2024, Tigo Energy, Inc. (“Tigo,” the “Company,” “we,” “our” or “us”) announced

an offer (the “Offer”) by the Company to eligible employees and directors to exchange certain outstanding options to purchase

shares of our Common Stock (“Common Stock”) for new options to purchase a number of shares of our Common Stock (“Replacement

Options”).

We are writing to inform you that we have amended

and supplemented the Offer to Exchange Certain Outstanding Options to Purchase Common Stock for a Number of Replacement Options, dated

November 12, 2024 (as so amended, the “Offer to Exchange”), by filing Amendment No. 1 to our Tender Offer Statement on Schedule

TO (as so amended, the “Schedule TO”) with the U.S. Securities and Exchange Commission (the “SEC”), which you

may access on our website at https://investors.tigoenergy.com/financials-filings/sec-filings or through the SEC website at www.sec.gov.

We recommend that you review the materials that we have filed with the SEC before making a decision on whether or not to surrender your

eligible stock options for exchange.

The terms of the Offer are described in detail

in the Schedule TO and the related exhibits, including the Offer to Exchange (the “Offer to Exchange” and, such exhibits collectively,

the “Offering Documents”), that has been filed with the U.S. Securities and Exchange Commission, which you may access on our

website at https://investors.tigoenergy.com/financials-filings/sec-filings or through the SEC website at www.sec.gov. These materials

will help you to understand the terms and conditions of the Offer and the related risks.

The Offer currently is scheduled to expire on

December 10, 2024, at 11:59 p.m., Eastern Time (as such date may be extended in accordance with the Offer to Exchange, the “Offer

Expiration Date”), and Replacement Options are scheduled to be granted effective promptly following the Offer Expiration Date, which

is currently expected to be on or about December 10, 2024 (the “Replacement Option Grant Date”). If your employment or service,

as applicable, is terminated prior to the expiration of the Offer, you will keep your eligible options and the eligible options will vest

and expire in accordance with their original terms. If your employment terminates after the expiration of the Offer but prior to the Replacement

Option Grant Date, the eligible options that you tendered for exchange will be cancelled but you will not receive Replacement Options.

Although our Board has approved the Offer, consummation

of the Offer is subject to the satisfaction or waiver of certain conditions that are described in the Offer to Exchange. Neither we nor

our Board (or the compensation committee thereof) makes any recommendation as to whether you should participate in the Offer, nor have

we authorized any person to make such recommendation. Participation in the Offer is completely voluntary. Participating in the Offer involves

risks that are discussed in the Offer to Exchange. We recommend that you consult with your personal financial, tax and/or legal advisors

about whether to participate in the Offer.

This notice does not constitute an offer. The

full terms of the Offer are described in the Schedule TO and accompanying documents, which you may access on our website at https://investors.tigoenergy.com/financials-filings/sec-filings or

through the SEC website at www.sec.gov. Capitalized terms used but not otherwise defined in this email shall have the meanings set

forth in the Offering Documents.

Thank you,

Bill Roeschlein

Chief Financial Officer

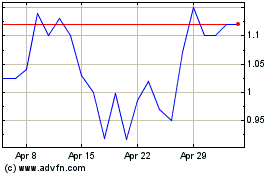

Tigo Energy (NASDAQ:TYGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

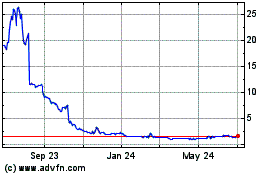

Tigo Energy (NASDAQ:TYGO)

Historical Stock Chart

From Feb 2024 to Feb 2025