TEXAS CAPITAL BANCSHARES INC/TX0001077428false00010774282023-07-202023-07-200001077428us-gaap:CommonStockMember2023-07-202023-07-200001077428us-gaap:SeriesBPreferredStockMember2023-07-202023-07-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 20, 2023

TEXAS CAPITAL BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34657 | 75-2679109 |

(State or other jurisdiction of

incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

2000 McKinney Avenue, Suite 700, Dallas, Texas, U.S.A.

(Address of principal executive offices)

75201

(Zip Code)

Registrant’s telephone number, including area code: (214) 932-6600

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | TCBI | | Nasdaq Stock Market |

| | | | |

| 5.75% Non-Cumulative Perpetual Preferred Stock Series B, par value $0.01 per share | | TCBIO | | Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

(a)On July 20, 2023, Texas Capital Bancshares, Inc. (the “Company”) issued a press release and made available presentation slides regarding its operating and financial results for its fiscal quarter ended June 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1. A copy of the presentation is attached hereto as Exhibit 99.2.

The information in Item 2.02 of this report (including Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Date: | July 20, 2023 | TEXAS CAPITAL BANCSHARES, INC. |

| | | By: | | /s/ J. Matthew Scurlock |

| | | | | J. Matthew Scurlock

Chief Financial Officer |

Exhibit 99.1

| | | | | | | | |

| | INVESTOR CONTACT |

| | Jocelyn Kukulka, 469.399.8544 |

| | jocelyn.kukulka@texascapitalbank.com |

| | |

| | MEDIA CONTACT |

| | Julia Monter, 469.399.8425 |

| | julia.monter@texascapitalbank.com |

TEXAS CAPITAL BANCSHARES, INC. ANNOUNCES SECOND QUARTER 2023 RESULTS

Net Income doubled to $68.7 million in the second quarter of 2023, as compared to second quarter 2022

Second quarter 2023 Pre-Provision Net Revenue(1) grew $28.9 million (43%) compared to second quarter 2022

Capital and liquidity positions continue to be strong

DALLAS - July 20, 2023 - Texas Capital Bancshares, Inc. (NASDAQ: TCBI), the parent company of Texas Capital Bank, announced operating results for the second quarter of 2023.

Net income available to common stockholders was $64.3 million, or $1.33 per diluted share, for the second quarter of 2023, compared to $34.3 million, or $0.70 per diluted share, for the first quarter of 2023 and $29.8 million, or $0.59 per diluted share, for the second quarter of 2022.

“Our talent, the strength of our balance sheet and the breadth of our platform continues to be a competitive differentiator in our markets,” said Rob C. Holmes, President and CEO. “Steadily maturing capabilities resulted in another quarter of improving financial results consistent with expectations. We are steadfast in our commitment to our long-term plan and will continue to execute on our vision to serve the best clients in our markets.”

| | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL RESULTS | | | | | | | | | |

| (dollars and shares in thousands) | | | | | | | | | |

| 2nd Quarter | | 1st Quarter | | 2nd Quarter | | | | |

| 2023 | | 2023 | | 2022 | | | | |

| OPERATING RESULTS | | | | | | | | | |

| Net income | $ | 68,651 | | | $ | 38,661 | | | $ | 34,159 | | | | | |

| Net income available to common stockholders | $ | 64,339 | | | $ | 34,348 | | | $ | 29,847 | | | | | |

| Diluted earnings per common share | $ | 1.33 | | | $ | 0.70 | | | $ | 0.59 | | | | | |

| Diluted common shares | 48,421 | | | 48,881 | | | 50,802 | | | | | |

| Return on average assets | 0.95 | % | | 0.53 | % | | 0.44 | % | | | | |

| Return on average common equity | 9.17 | % | | 5.06 | % | | 4.35 | % | | | | |

| | | | | | | | | |

| BALANCE SHEET | | | | | | | | | |

| Loans held for investment | $ | 16,227,203 | | | $ | 16,014,497 | | | $ | 17,517,866 | | | | | |

| Loans held for investment, mortgage finance | 5,098,812 | | | 4,060,570 | | | 6,549,507 | | | | | |

| Total loans held for investment | 21,326,015 | | | 20,075,067 | | | 24,067,373 | | | | | |

| Loans held for sale | 29,097 | | | 27,608 | | | 4,266 | | | | | |

| Total assets | 28,976,544 | | | 28,596,653 | | | 32,338,963 | | | | | |

| Non-interest bearing deposits | 9,429,352 | | | 9,500,583 | | | 12,555,367 | | | | | |

| Total deposits | 23,318,240 | | | 22,179,697 | | | 25,440,021 | | | | | |

| Stockholders’ equity | 3,081,927 | | | 3,079,974 | | | 3,006,832 | | | | | |

| | | | | | | | | |

(1) Net interest income and non-interest expense, less non-interest expense.

SECOND QUARTER 2023 COMPARED TO FIRST QUARTER 2023

For the second quarter of 2023, net income available to common stockholders was $64.3 million, or $1.33 per diluted share, compared to $34.3 million, or $0.70 per diluted share, for the first quarter of 2023.

Provision for credit losses for the second quarter of 2023 was $7.0 million, compared to a $28.0 million provision for credit losses for the first quarter of 2023. The $7.0 million provision for credit losses recorded in the second quarter of 2023 resulted primarily from decreases in net charge-offs and non-accrual loans, partially offset by increases in total loans held for investment (“LHI”) and criticized loans.

Net interest income was $232.0 million for the second quarter of 2023, compared to $235.3 million for the first quarter of 2023. The decrease in net interest income was primarily due to a decrease in total average earning assets and an increase in funding costs, partially offset by an increase in yields on average earning assets. Net interest margin for the second quarter of 2023 was 3.29%, a decrease of 4 basis points from the first quarter of 2023. LHI, excluding mortgage finance, yields increased 36 basis points from the first quarter of 2023 and LHI, mortgage finance yields decreased 20 basis points from the first quarter of 2023. Total cost of deposits was 2.37% for the second quarter of 2023, a 31 basis point increase from the first quarter of 2023.

Non-interest income for the second quarter of 2023 increased $8.6 million, or 23%, compared to the first quarter of 2023, primarily due to an increase in investment banking and trading income.

Non-interest expense for the second quarter of 2023 decreased $12.4 million, or 6%, compared to the first quarter of 2023, primarily due to decreases in salaries and benefits expense, resulting from a decline in headcount, and marketing expense, partially offset by an increase in communications and technology expense.

SECOND QUARTER 2023 COMPARED TO SECOND QUARTER 2022

Net income available to common stockholders was $64.3 million, or $1.33 per diluted share, for the second quarter of 2023, compared to $29.8 million, or $0.59 per diluted share, for the second quarter of 2022.

The second quarter of 2023 included a $7.0 million provision for credit losses, reflecting decreases in net charge-offs and non-accrual loans, partially offset by growth in LHI, compared to a $22.0 million provision for credit losses for the second quarter of 2022.

Net interest income increased to $232.0 million for the second quarter of 2023, compared to $205.5 million for the second quarter of 2022, primarily due to an increase in yields on average earning assets, partially offset by an increase in funding costs and a decrease in total average earning assets. Net interest margin increased 61 basis points to 3.29% for the second quarter of 2023, as compared to the second quarter of 2022. LHI, excluding mortgage finance, yields increased 326 basis points compared to the second quarter of 2022 and LHI, mortgage finance yields decreased 10 basis points from the second quarter of 2022. Total cost of deposits increased 204 basis points compared to the second quarter of 2022.

Non-interest income for the second quarter of 2023 increased $19.8 million, or 75%, compared to the second quarter of 2022. The increase was primarily due to increases in investment banking and trading income and other non-interest income.

Non-interest expense for the second quarter of 2023 increased $17.3 million, or 11%, compared to the second quarter of 2022 primarily due to increases in salaries and benefits, legal and professional and communications and technology expenses, partially offset by a decrease in marketing expense.

CREDIT QUALITY

Net charge-offs of $8.2 million were recorded during the second quarter of 2023, compared to net charge-offs of $19.9 million and $2.6 million during the first quarter of 2023 and the second quarter of 2022, respectively. Criticized loans totaled $619.4 million at June 30, 2023, compared to $561.1 million at March 31, 2023 and $603.5 million at June 30, 2022. Non-accrual LHI totaled $81.0 million at June 30, 2023, compared to $94.0 million at March 31, 2023 and $50.5 million at June 30, 2022. The ratio of non-accrual LHI to total LHI for the second quarter of 2023 was 0.38%, compared to 0.47% for the first quarter of 2023 and 0.21% for the second quarter of 2022.

The ratio of total allowance for credit losses to total LHI was 1.32% at June 30, 2023, compared to 1.41% and 1.03% at March 31, 2023 and June 30, 2022, respectively. In the second quarter of 2023, changes were made to certain estimates used in the Company’s current expected credit loss model, the most significant of which are more granular estimates of historical loss rates to incorporate probability of default and loss severities and allocations of expected losses to outstanding loan balances and off-balance sheet financial instruments. These changes resulted in adjustments to the Company’s portfolio segments and in a reallocation of the allowance for credit losses between loan portfolio segments and allowance balances allocated to off-balance sheet financial instruments, the results of which are included in the Summary of Credit Loss Experience table below. The changes made result in a higher allocation of losses to off-balance sheet financial instruments.

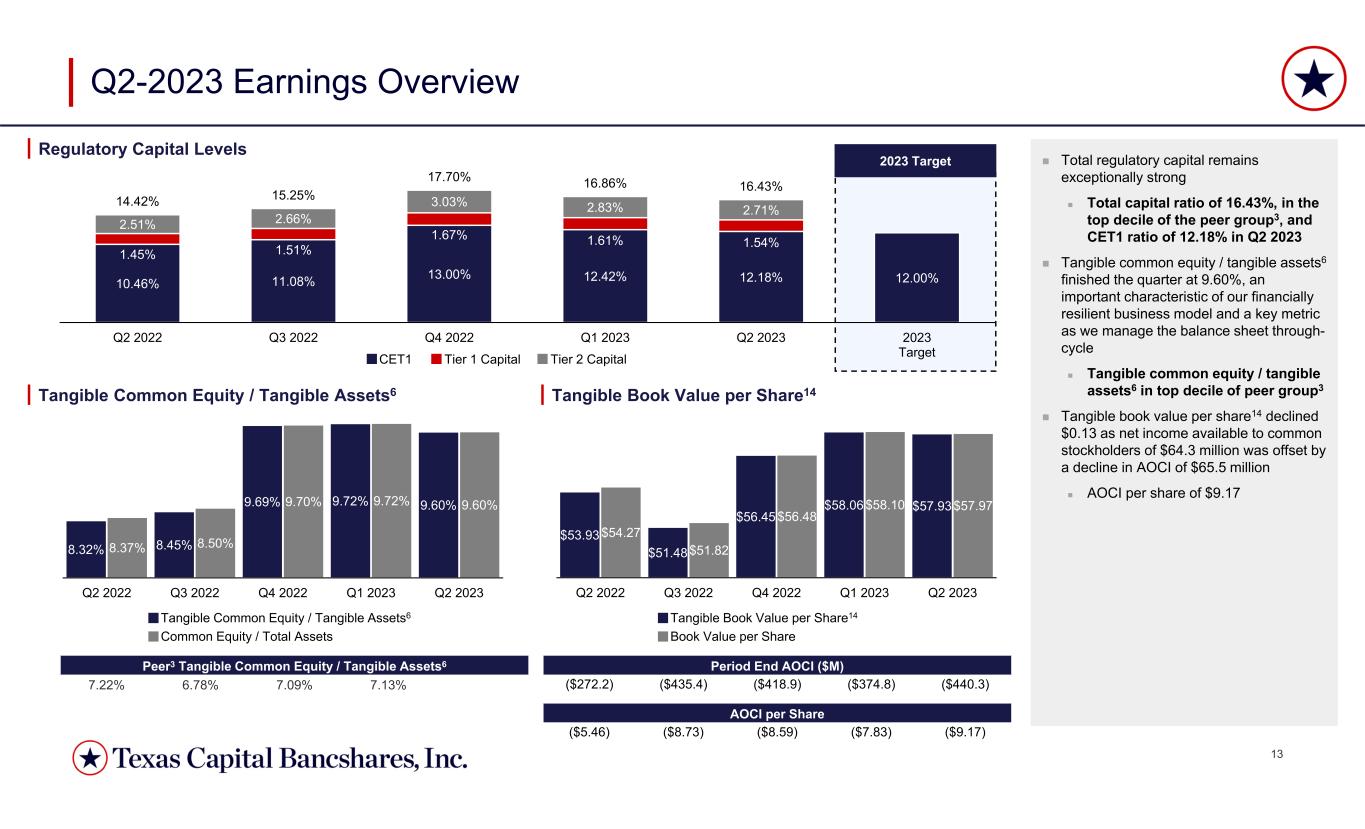

REGULATORY RATIOS AND CAPITAL

All regulatory ratios continue to be in excess of “well capitalized” requirements as of June 30, 2023. Our CET1, tier 1 capital, total capital and leverage ratios were 12.2%, 13.7%, 16.4% and 12.4%, respectively, at June 30, 2023, compared to 12.4%, 14.0%, 16.9%

and 12.0%, respectively, at March 31, 2023 and 10.5%, 11.9%, 14.4% and 10.7%, respectively, at June 30, 2022. At June 30, 2023, our ratio of tangible common equity to total tangible assets was 9.6%, compared to 9.7% at March 31, 2023 and 8.3% at June 30, 2022.

About Texas Capital Bancshares, Inc.

Texas Capital Bancshares, Inc. (NASDAQ: TCBI), a member of the Russell 2000 Index and the S&P MidCap 400, is the parent company of Texas Capital Bank, a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers. Founded in 1998, the institution is headquartered in Dallas with offices in Austin, Houston, San Antonio, and Fort Worth, and has built a network of clients across the country. With the ability to service clients through their entire lifecycles, Texas Capital Bank has established commercial banking, consumer banking, investment banking and wealth management capabilities.

Forward Looking Statements

This communication contains “forward-looking statements” within the meaning of and pursuant to the Private Securities Litigation Reform Act of 1995 regarding, among other things, TCBI’s financial condition, results of operations, business plans and future performance. These statements are not historical in nature and may often be identified by the use of words such as “believes,” “projects,” “expects,” “may,” “estimates,” “should,” “plans,” “targets,” “intends” “could,” “would,” “anticipates,” “potential,” “confident,” “optimistic” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy, objectives, estimates, trends, guidance, expectations and future plans.

Because forward-looking statements relate to future results and occurrences, they are subject to inherent and various uncertainties, risks, and changes in circumstances that are difficult to predict, may change over time, are based on management’s expectations and assumptions at the time the statements are made and are not guarantees of future results. Numerous risks and other factors, many of which are beyond management’s control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. While there can be no assurance that any list of risks is complete, important risks and other factors that could cause actual results to differ materially from those contemplated by forward-looking statements include, but are not limited to, credit quality and risk, the unpredictability of economic and business conditions that may impact TCBI or its customers, recent adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, liquidity and regulatory responses to these developments, the Company’s ability to effective manage its liquidity risk and any growth plans and the availability of capital and funding, the Company’s ability to effectively manage information technology systems, cyber incidents or other failures, disruptions or security breaches, interest rates, including the impact of rising rates on the Company’s securities portfolio and funding costs, commercial and residential real estate values, adverse or unexpected economic conditions, including inflation, recession, the threat of recession, and market conditions in Texas, the United States or globally, including governmental and consumer responses to those economic and market conditions, fund availability, accounting estimates and risk management processes, the transition away from the London Interbank Offered Rate (LIBOR), legislative and regulatory changes, enforcement actions and regulatory examinations and investigations, ratings or interpretations, business strategy execution, the failure to identify, attract and retain key personnel, and other employees, increased or expanded competition from banks and other financial service providers in TCBI’s markets, the failure to maintain adequate regulatory capital, environmental liability associated with properties related to TCBI’s lending activities, and severe weather, natural disasters, acts of war, terrorism, global conflict, or other external events, climate change and related legislative and regulatory initiatives as well as the risks more fully described in TCBI’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in its other documents and filings with the SEC. The information contained in this communication speaks only as of its date. Except to the extent required by applicable law or regulation, we disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments.

| | | | | | | | | | | | | | | | | |

| TEXAS CAPITAL BANCSHARES, INC. |

| SELECTED FINANCIAL HIGHLIGHTS (UNAUDITED) |

| (dollars in thousands except per share data) |

| 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | 2nd Quarter |

| 2023 | 2023 | 2022 | 2022 | 2022 |

| CONSOLIDATED STATEMENTS OF INCOME | | | | | |

| Interest income | $ | 401,916 | | $ | 385,166 | | $ | 371,292 | | $ | 322,072 | | $ | 242,351 | |

| Interest expense | 169,926 | | 149,821 | | 123,687 | | 82,991 | | 36,818 | |

| Net interest income | 231,990 | | 235,345 | | 247,605 | | 239,081 | | 205,533 | |

| Provision for credit losses | 7,000 | | 28,000 | | 34,000 | | 12,000 | | 22,000 | |

| Net interest income after provision for credit losses | 224,990 | | 207,345 | | 213,605 | | 227,081 | | 183,533 | |

| Non-interest income | 46,011 | | 37,403 | | 277,667 | | 25,332 | | 26,240 | |

| Non-interest expense | 181,644 | | 194,027 | | 213,090 | | 197,047 | | 164,303 | |

| Income before income taxes | 89,357 | | 50,721 | | 278,182 | | 55,366 | | 45,470 | |

| Income tax expense | 20,706 | | 12,060 | | 60,931 | | 13,948 | | 11,311 | |

| Net income | 68,651 | | 38,661 | | 217,251 | | 41,418 | | 34,159 | |

| Preferred stock dividends | 4,312 | | 4,313 | | 4,312 | | 4,313 | | 4,312 | |

| Net income available to common stockholders | $ | 64,339 | | $ | 34,348 | | $ | 212,939 | | $ | 37,105 | | $ | 29,847 | |

| Diluted earnings per common share | $ | 1.33 | | $ | 0.70 | | $ | 4.23 | | $ | 0.74 | | $ | 0.59 | |

| Diluted common shares | 48,421,276 | | 48,880,725 | | 50,282,663 | | 50,417,884 | | 50,801,628 | |

| | | | | |

| CONSOLIDATED BALANCE SHEET DATA | | | | | |

| Total assets | $ | 28,976,544 | | $ | 28,596,653 | | $ | 28,414,642 | | $ | 30,408,513 | | $ | 32,338,963 | |

| Loans held for investment | 16,227,203 | | 16,014,497 | | 15,197,307 | | 14,878,959 | | 17,517,866 | |

| Loans held for investment, mortgage finance | 5,098,812 | | 4,060,570 | | 4,090,033 | | 4,908,822 | | 6,549,507 | |

| Loans held for sale | 29,097 | | 27,608 | | 36,357 | | 3,142,178 | | 4,266 | |

| Interest bearing cash and cash equivalents | 2,587,131 | | 3,385,494 | | 4,778,623 | | 3,399,638 | | 4,032,931 | |

| Investment securities | 4,226,653 | | 4,345,969 | | 3,585,114 | | 3,369,622 | | 3,552,699 | |

| Non-interest bearing deposits | 9,429,352 | | 9,500,583 | | 9,618,081 | | 11,494,685 | | 12,555,367 | |

| Total deposits | 23,318,240 | | 22,179,697 | | 22,856,880 | | 24,498,563 | | 25,440,021 | |

| Short-term borrowings | 1,350,000 | | 2,100,000 | | 1,201,142 | | 1,701,480 | | 2,651,536 | |

| Long-term debt | 857,795 | | 932,119 | | 931,442 | | 930,766 | | 917,098 | |

| Stockholders’ equity | 3,081,927 | | 3,079,974 | | 3,055,351 | | 2,885,775 | | 3,006,832 | |

| | | | | |

| End of period shares outstanding | 47,992,521 | | 47,851,862 | | 48,783,763 | | 49,897,726 | | 49,878,041 | |

| Book value per share | $ | 57.97 | | $ | 58.10 | | $ | 56.48 | | $ | 51.82 | | $ | 54.27 | |

Tangible book value per share(1) | $ | 57.93 | | $ | 58.06 | | $ | 56.45 | | $ | 51.48 | | $ | 53.93 | |

| | | | | |

| SELECTED FINANCIAL RATIOS | | | | | |

| Net interest margin | 3.29 | % | 3.33 | % | 3.26 | % | 3.05 | % | 2.68 | % |

| Return on average assets | 0.95 | % | 0.53 | % | 2.80 | % | 0.52 | % | 0.44 | % |

| Return on average common equity | 9.17 | % | 5.06 | % | 30.66 | % | 5.36 | % | 4.35 | % |

| Non-interest income to average earning assets | 0.66 | % | 0.54 | % | 3.70 | % | 0.33 | % | 0.34 | % |

Efficiency ratio(2) | 65.3 | % | 71.1 | % | 40.6 | % | 74.5 | % | 70.9 | % |

| Non-interest expense to average earning assets | 2.61 | % | 2.78 | % | 2.84 | % | 2.53 | % | 2.16 | % |

| Common equity to total assets | 9.6 | % | 9.7 | % | 9.7 | % | 8.5 | % | 8.4 | % |

Tangible common equity to total tangible assets(3) | 9.6 | % | 9.7 | % | 9.7 | % | 8.5 | % | 8.3 | % |

| Common Equity Tier 1 | 12.2 | % | 12.4 | % | 13.0 | % | 11.1 | % | 10.5 | % |

| Tier 1 capital | 13.7 | % | 14.0 | % | 14.7 | % | 12.6 | % | 11.9 | % |

| Total capital | 16.4 | % | 16.9 | % | 17.7 | % | 15.2 | % | 14.4 | % |

| Leverage | 12.4 | % | 12.0 | % | 11.5 | % | 10.7 | % | 10.7 | % |

(1) Stockholders’ equity excluding preferred stock, less goodwill and intangibles, divided by shares outstanding at period end.

(2) Non-interest expense divided by the sum of net interest income and non-interest income.

(3) Stockholders’ equity excluding preferred stock, less goodwill and intangibles, divided by total assets, less goodwill and intangibles.

| | | | | | | | | | | |

| TEXAS CAPITAL BANCSHARES, INC. |

| CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

| (dollars in thousands) |

| June 30, 2023 | June 30, 2022 | % Change |

| Assets | | | |

| Cash and due from banks | $ | 260,314 | | $ | 242,425 | | 7 | % |

| Interest bearing cash and cash equivalents | 2,587,131 | | 4,032,931 | | (36) | % |

| Available-for-sale debt securities | 3,292,478 | | 2,535,646 | | 30 | % |

| Held-to-maturity debt securities | 900,315 | | 980,935 | | (8) | % |

| Equity securities | 33,860 | | 36,118 | | (6) | % |

| Investment securities | 4,226,653 | | 3,552,699 | | 19 | % |

| Loans held for sale | 29,097 | | 4,266 | | N/M |

| Loans held for investment, mortgage finance | 5,098,812 | | 6,549,507 | | (22) | % |

| Loans held for investment | 16,227,203 | | 17,517,866 | | (7) | % |

| Less: Allowance for credit losses on loans | 237,343 | | 229,013 | | 4 | % |

| Loans held for investment, net | 21,088,672 | | 23,838,360 | | (12) | % |

| | | |

| Premises and equipment, net | 26,096 | | 28,722 | | (9) | % |

| Accrued interest receivable and other assets | 757,085 | | 622,501 | | 22 | % |

| Goodwill and intangibles, net | 1,496 | | 17,059 | | (91) | % |

| Total assets | $ | 28,976,544 | | $ | 32,338,963 | | (10) | % |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Liabilities: | | | |

| Non-interest bearing deposits | $ | 9,429,352 | | $ | 12,555,367 | | (25) | % |

| Interest bearing deposits | 13,888,888 | | 12,884,654 | | 8 | % |

| Total deposits | 23,318,240 | | 25,440,021 | | (8) | % |

| Accrued interest payable | 29,658 | | 8,928 | | N/M |

| Other liabilities | 338,924 | | 314,548 | | 8 | % |

| Short-term borrowings | 1,350,000 | | 2,651,536 | | (49) | % |

| Long-term debt | 857,795 | | 917,098 | | (6) | % |

| Total liabilities | 25,894,617 | | 29,332,131 | | (12) | % |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock, $.01 par value, $1,000 liquidation value: | | | |

| Authorized shares - 10,000,000 | | | |

Issued shares - 300,000 shares issued at June 30, 2023 and 2022 | 300,000 | | 300,000 | | — | % |

| Common stock, $.01 par value: | | | |

| Authorized shares - 100,000,000 | | | |

Issued shares - 51,087,965 and 50,820,337 at June 30, 2023 and 2022, respectively | 511 | | 508 | | 1 | % |

| Additional paid-in capital | 1,035,063 | | 1,015,105 | | 2 | % |

| Retained earnings | 2,362,189 | | 2,013,458 | | 17 | % |

Treasury stock - 3,095,444 and 942,296 shares at cost at June 30, 2023 and 2022, respectively | (175,528) | | (50,031) | | N/M |

| Accumulated other comprehensive loss, net of taxes | (440,308) | | (272,208) | | 62 | % |

| Total stockholders’ equity | 3,081,927 | | 3,006,832 | | 2 | % |

| Total liabilities and stockholders’ equity | $ | 28,976,544 | | $ | 32,338,963 | | (10) | % |

| | | | | | | | | | | | | | |

| TEXAS CAPITAL BANCSHARES, INC. | | | | |

| CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) | | | | |

| (dollars in thousands except per share data) | | | | |

| Three Months Ended June 30, | Six Months Ended June 30, |

| 2023 | 2022 | 2023 | 2022 |

| Interest income | | | | |

| Interest and fees on loans | $ | 332,867 | | $ | 218,292 | | $ | 630,305 | | $ | 405,948 | |

| Investment securities | 27,478 | | 14,665 | | 52,770 | | 31,967 | |

| Interest bearing cash and cash equivalents | 41,571 | | 9,394 | | 104,007 | | 12,965 | |

| Total interest income | 401,916 | | 242,351 | | 787,082 | | 450,880 | |

| Interest expense | | | | |

| Deposits | 137,391 | | 20,566 | | 257,485 | | 34,196 | |

| Short-term borrowings | 18,253 | | 4,859 | | 32,997 | | 5,617 | |

| Long-term debt | 14,282 | | 11,393 | | 29,265 | | 21,988 | |

| Total interest expense | 169,926 | | 36,818 | | 319,747 | | 61,801 | |

| Net interest income | 231,990 | | 205,533 | | 467,335 | | 389,079 | |

| Provision for credit losses | 7,000 | | 22,000 | | 35,000 | | 20,000 | |

| Net interest income after provision for credit losses | 224,990 | | 183,533 | | 432,335 | | 369,079 | |

| Non-interest income | | | | |

| Service charges on deposit accounts | 5,158 | | 6,102 | | 10,180 | | 12,217 | |

| Wealth management and trust fee income | 3,715 | | 4,051 | | 7,144 | | 7,963 | |

| Brokered loan fees | 2,415 | | 4,133 | | 4,310 | | 8,103 | |

| | | | |

| Investment banking and trading income | 27,498 | | 11,126 | | 46,266 | | 15,305 | |

| | | | |

| | | | |

| Other | 7,225 | | 828 | | 15,514 | | 2,935 | |

| Total non-interest income | 46,011 | | 26,240 | | 83,414 | | 46,523 | |

| Non-interest expense | | | | |

| Salaries and benefits | 113,050 | | 103,358 | | 241,720 | | 203,217 | |

| Occupancy expense | 9,482 | | 8,874 | | 19,101 | | 17,759 | |

| Marketing | 6,367 | | 8,506 | | 15,411 | | 13,483 | |

| Legal and professional | 15,669 | | 11,288 | | 30,183 | | 21,590 | |

| Communications and technology | 20,525 | | 15,649 | | 38,048 | | 30,349 | |

| Federal Deposit Insurance Corporation insurance assessment | 3,693 | | 3,318 | | 5,863 | | 7,299 | |

| | | | |

| | | | |

| Other | 12,858 | | 13,310 | | 25,345 | | 23,698 | |

| Total non-interest expense | 181,644 | | 164,303 | | 375,671 | | 317,395 | |

| Income before income taxes | 89,357 | | 45,470 | | 140,078 | | 98,207 | |

| Income tax expense | 20,706 | | 11,311 | | 32,766 | | 24,398 | |

| Net income | 68,651 | | 34,159 | | 107,312 | | 73,809 | |

| Preferred stock dividends | 4,312 | | 4,312 | | 8,625 | | 8,625 | |

| Net income available to common stockholders | $ | 64,339 | | $ | 29,847 | | $ | 98,687 | | $ | 65,184 | |

| | | | |

| Basic earnings per common share | $ | 1.34 | | $ | 0.59 | | $ | 2.05 | | $ | 1.29 | |

| Diluted earnings per common share | $ | 1.33 | | $ | 0.59 | | $ | 2.02 | | $ | 1.28 | |

| | | | | | | | | | | | | | | | | |

| TEXAS CAPITAL BANCSHARES, INC. |

| SUMMARY OF CREDIT LOSS EXPERIENCE |

| (dollars in thousands) |

| 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | 2nd Quarter |

| 2023 | 2023 | 2022 | 2022 | 2022 |

| Allowance for credit losses on loans: | | | | | |

| Beginning balance | $ | 260,928 | | $ | 253,469 | | $ | 234,613 | | $ | 229,013 | | $ | 211,151 | |

| Loans charged-off: | | | | | |

| Commercial | 8,852 | | 20,732 | | 17,106 | | 3,135 | | 2,868 | |

| | | | | |

| | | | | |

| | | | | |

| Total charge-offs | 8,852 | | 20,732 | | 17,106 | | 3,135 | | 2,868 | |

| Recoveries: | | | | | |

| Commercial | 611 | | 819 | | 2,105 | | 400 | | 217 | |

| | | | | |

| | | | | |

| Consumer | 2 | | 3 | | 2 | | 2 | | 2 | |

| Total recoveries | 613 | | 822 | | 2,107 | | 402 | | 219 | |

| Net charge-offs | 8,239 | | 19,910 | | 14,999 | | 2,733 | | 2,649 | |

| Provision for credit losses on loans | (15,346) | | 27,369 | | 33,855 | | 8,333 | | 20,511 | |

| Ending balance | $ | 237,343 | | $ | 260,928 | | $ | 253,469 | | $ | 234,613 | | $ | 229,013 | |

| | | | | |

| Allowance for off-balance sheet credit losses: | | | | | |

| Beginning balance | $ | 22,424 | | $ | 21,793 | | $ | 21,648 | | $ | 17,981 | | $ | 16,492 | |

| Provision for off-balance sheet credit losses | 22,346 | | 631 | | 145 | | 3,667 | | 1,489 | |

| Ending balance | $ | 44,770 | | $ | 22,424 | | $ | 21,793 | | $ | 21,648 | | $ | 17,981 | |

| | | | | |

| Total allowance for credit losses | $ | 282,113 | | $ | 283,352 | | $ | 275,262 | | $ | 256,261 | | $ | 246,994 | |

| Total provision for credit losses | $ | 7,000 | | $ | 28,000 | | $ | 34,000 | | $ | 12,000 | | $ | 22,000 | |

| | | | | |

| Allowance for credit losses on loans to total loans held for investment | 1.11 | % | 1.30 | % | 1.31 | % | 1.19 | % | 0.95 | % |

| Allowance for credit losses on loans to average total loans held for investment | 1.15 | % | 1.38 | % | 1.31 | % | 1.06 | % | 1.02 | % |

Net charge-offs to average total loans held for investment(1) | 0.16 | % | 0.43 | % | 0.31 | % | 0.05 | % | 0.05 | % |

Net charge-offs to average total loans held for investment for last 12 months(1) | 0.23 | % | 0.19 | % | 0.09 | % | 0.03 | % | 0.03 | % |

Total provision for credit losses to average total loans held for investment(1) | 0.14 | % | 0.60 | % | 0.70 | % | 0.22 | % | 0.39 | % |

Total allowance for credit losses to total loans held for investment | 1.32 | % | 1.41 | % | 1.43 | % | 1.30 | % | 1.03 | % |

(1)Interim period ratios are annualized.

| | | | | | | | | | | | | | | | | |

| TEXAS CAPITAL BANCSHARES, INC. | | | | | |

| SUMMARY OF NON-PERFORMING ASSETS AND PAST DUE LOANS | | | |

| (dollars in thousands) | | | | | |

| 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | 2nd Quarter |

| 2023 | 2023 | 2022 | 2022 | 2022 |

| Non-accrual loans held for investment | $ | 81,039 | | $ | 93,951 | | $ | 48,338 | | $ | 35,864 | | $ | 50,526 | |

Non-accrual loans held for sale(1) | — | | — | | — | | 1,340 | | — | |

| Other real estate owned | — | | — | | — | | — | | — | |

| Total non-performing assets | $ | 81,039 | | $ | 93,951 | | $ | 48,338 | | $ | 37,204 | | $ | 50,526 | |

| | | | | |

| Non-accrual loans held for investment to total loans held for investment | 0.38 | % | 0.47 | % | 0.25 | % | 0.18 | % | 0.21 | % |

| Total non-performing assets to total assets | 0.28 | % | 0.33 | % | 0.17 | % | 0.12 | % | 0.16 | % |

| Allowance for credit losses on loans to non-accrual loans held for investment | 2.9x | 2.8x | 5.2x | 6.5x | 4.5x |

| Total allowance for credit losses to non-accrual loans held for investment | 3.5x | 3.0x | 5.7x | 6.9x | 4.9x |

| | | | | |

| | | | | |

Loans held for investment past due 90 days and still accruing | $ | 64 | | $ | 3,098 | | $ | 131 | | $ | 30,664 | | $ | 3,206 | |

| Loans held for investment past due 90 days to total loans held for investment | — | % | 0.02 | % | — | % | 0.15 | % | 0.01 | % |

Loans held for sale past due 90 days and still accruing(1)(2) | $ | — | | $ | — | | $ | — | | $ | 4,877 | | $ | 1,602 | |

(1)Third quarter 2022 includes $1.3 million in non-accrual loans and $3.1 million in loans past due 90 days and still accruing associated to our insurance premium finance subsidiary that were transferred from loans held for investment to loans held for sale as of September 30, 2022.

(2)Includes loans guaranteed by U.S. government agencies that were repurchased out of Ginnie Mae securities. Loans are recorded as loans held for sale and carried at fair value on the balance sheet. Interest on these past due loans accrues at the debenture rate guaranteed by the U.S. government.

| | | | | | | | | | | | | | | | | |

| TEXAS CAPITAL BANCSHARES, INC. |

| CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) |

| (dollars in thousands) |

| | | | | |

| 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | 2nd Quarter |

| 2023 | 2023 | 2022 | 2022 | 2022 |

| Interest income | | | | | |

| Interest and fees on loans | $ | 332,867 | | $ | 297,438 | | $ | 295,372 | | $ | 282,474 | | $ | 218,292 | |

| Investment securities | 27,478 | | 25,292 | | 16,210 | | 15,002 | | 14,665 | |

| Interest bearing deposits in other banks | 41,571 | | 62,436 | | 59,710 | | 24,596 | | $ | 9,394 | |

| Total interest income | 401,916 | | 385,166 | | 371,292 | | 322,072 | | 242,351 | |

| Interest expense | | | | | |

| Deposits | 137,391 | | 120,094 | | 96,150 | | 60,317 | | 20,566 | |

| Short-term borrowings | 18,253 | | 14,744 | | 13,449 | | 10,011 | | 4,859 | |

| Long-term debt | 14,282 | | 14,983 | | 14,088 | | 12,663 | | 11,393 | |

| Total interest expense | 169,926 | | 149,821 | | 123,687 | | 82,991 | | 36,818 | |

| Net interest income | 231,990 | | 235,345 | | 247,605 | | 239,081 | | 205,533 | |

| Provision for credit losses | 7,000 | | 28,000 | | 34,000 | | 12,000 | | 22,000 | |

| Net interest income after provision for credit losses | 224,990 | | 207,345 | | 213,605 | | 227,081 | | 183,533 | |

| Non-interest income | | | | | |

| Service charges on deposit accounts | 5,158 | | 5,022 | | 5,252 | | 5,797 | | 6,102 | |

| Wealth management and trust fee income | 3,715 | | 3,429 | | 3,442 | | 3,631 | | 4,051 | |

| Brokered loan fees | 2,415 | | 1,895 | | 2,655 | | 3,401 | | 4,133 | |

| | | | | |

| Investment banking and trading income | 27,498 | | 18,768 | | 11,937 | | 7,812 | | 11,126 | |

| | | | | |

| Gain on disposal of subsidiary | — | | — | | 248,526 | | — | | — | |

| Other | 7,225 | | 8,289 | | 5,855 | | 4,691 | | 828 | |

| Total non-interest income | 46,011 | | 37,403 | | 277,667 | | 25,332 | | 26,240 | |

| Non-interest expense | | | | | |

| Salaries and benefits | 113,050 | | 128,670 | | 102,925 | | 128,764 | | 103,358 | |

| Occupancy expense | 9,482 | | 9,619 | | 17,030 | | 9,433 | | 8,874 | |

| Marketing | 6,367 | | 9,044 | | 10,623 | | 8,282 | | 8,506 | |

| Legal and professional | 15,669 | | 14,514 | | 37,493 | | 16,775 | | 11,288 | |

| Communications and technology | 20,525 | | 17,523 | | 20,434 | | 18,470 | | 15,649 | |

| Federal Deposit Insurance Corporation insurance assessment | 3,693 | | 2,170 | | 3,092 | | 3,953 | | 3,318 | |

| | | | | |

| Other | 12,858 | | 12,487 | | 21,493 | | 11,370 | | 13,310 | |

| Total non-interest expense | 181,644 | | 194,027 | | 213,090 | | 197,047 | | 164,303 | |

| Income before income taxes | 89,357 | | 50,721 | | 278,182 | | 55,366 | | 45,470 | |

| Income tax expense | 20,706 | | 12,060 | | 60,931 | | 13,948 | | 11,311 | |

| Net income | 68,651 | | 38,661 | | 217,251 | | 41,418 | | 34,159 | |

| Preferred stock dividends | 4,312 | | 4,313 | | 4,312 | | 4,313 | | 4,312 | |

| Net income available to common shareholders | $ | 64,339 | | $ | 34,348 | | $ | 212,939 | | $ | 37,105 | | $ | 29,847 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TEXAS CAPITAL BANCSHARES, INC. |

TAXABLE EQUIVALENT NET INTEREST INCOME ANALYSIS (UNAUDITED)(1) |

| (dollars in thousands) |

| 2nd Quarter 2023 | | 1st Quarter 2023 | | 4th Quarter 2022 | | 3rd Quarter 2022 | | 2nd Quarter 2022 |

| Average

Balance | Income/

Expense | Yield/

Rate | | Average

Balance | Income/

Expense | Yield/

Rate | | Average

Balance | Income/

Expense | Yield/

Rate | | Average

Balance | Income/

Expense | Yield/

Rate | | Average

Balance | Income/

Expense | Yield/

Rate |

| Assets | | | | | | | | | | | | | | | | | | | |

Investment securities(2) | $ | 4,306,881 | | $ | 27,478 | | 2.36 | % | | $ | 4,060,456 | | $ | 25,292 | | 2.31 | % | | $ | 3,385,372 | | $ | 16,210 | | 1.70 | % | | $ | 3,509,044 | | $ | 15,002 | | 1.58 | % | | $ | 3,543,576 | | $ | 15,065 | | 1.60 | % |

| Interest bearing cash and cash equivalents | 3,286,091 | | 41,571 | | 5.07 | % | | 5,541,341 | | 62,436 | | 4.57 | % | | 6,158,769 | | 59,710 | | 3.85 | % | | 4,453,806 | | 24,596 | | 2.19 | % | | 4,747,377 | | 9,394 | | 0.79 | % |

| Loans held for sale | 28,414 | | 599 | | 8.46 | % | | 43,472 | | 938 | | 8.75 | % | | 1,053,157 | | 12,064 | | 4.54 | % | | 1,029,983 | | 11,316 | | 4.36 | % | | 8,123 | | 62 | | 3.07 | % |

| Loans held for investment, mortgage finance | 4,376,235 | | 36,198 | | 3.32 | % | | 3,286,804 | | 28,528 | | 3.52 | % | | 4,279,367 | | 43,708 | | 4.05 | % | | 5,287,531 | | 52,756 | | 3.96 | % | | 5,858,599 | | 49,914 | | 3.42 | % |

Loans held for investment(3) | 16,217,314 | | 296,183 | | 7.33 | % | | 15,598,854 | | 268,131 | | 6.97 | % | | 15,105,083 | | 239,746 | | 6.30 | % | | 16,843,922 | | 218,513 | | 5.15 | % | | 16,616,234 | | 168,409 | | 4.07 | % |

Less: Allowance for credit losses on loans | 261,027 | | — | | — | | | 252,727 | | — | | — | | | 233,246 | | — | | — | | | 229,005 | | — | | — | | | 211,385 | | — | | — | |

| Loans held for investment, net | 20,332,522 | | 332,381 | | 6.56 | % | | 18,632,931 | | 296,659 | | 6.46 | % | | 19,151,204 | | 283,454 | | 5.87 | % | | 21,902,448 | | 271,269 | | 4.91 | % | | 22,263,448 | | 218,323 | | 3.93 | % |

| Total earning assets | 27,953,908 | | 402,029 | | 5.69 | % | | 28,278,200 | | 385,325 | | 5.45 | % | | 29,748,502 | | 371,438 | | 4.89 | % | | 30,895,281 | | 322,183 | | 4.10 | % | | 30,562,524 | | 242,844 | | 3.16 | % |

| Cash and other assets | 1,049,145 | | | | | 1,041,745 | | | | | 989,900 | | | | | 918,630 | | | | | 870,396 | | | |

| Total assets | $ | 29,003,053 | | | | | $ | 29,319,945 | | | | | $ | 30,738,402 | | | | | $ | 31,813,911 | | | | | $ | 31,432,920 | | | |

| | | | | | | | | | | | | | | | | | | |

| Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | | | | | | |

| Transaction deposits | $ | 1,345,742 | | $ | 9,468 | | 2.82 | % | | $ | 776,500 | | $ | 3,853 | | 2.01 | % | | $ | 1,105,466 | | $ | 4,977 | | 1.79 | % | | $ | 1,444,964 | | $ | 5,239 | | 1.44 | % | | $ | 1,671,729 | | $ | 3,920 | | 0.94 | % |

| Savings deposits | 10,590,558 | | 114,275 | | 4.33 | % | | 11,195,402 | | 105,707 | | 3.83 | % | | 10,563,049 | | 80,801 | | 3.03 | % | | 10,249,387 | | 46,555 | | 1.80 | % | | 8,696,819 | | 15,462 | | 0.71 | % |

| Time deposits | 1,531,922 | | 13,648 | | 3.57 | % | | 1,430,657 | | 10,534 | | 2.99 | % | | 1,625,857 | | 10,372 | | 2.53 | % | | 1,701,238 | | 8,523 | | 1.99 | % | | 877,399 | | 1,184 | | 0.54 | % |

| Total interest bearing deposits | 13,468,222 | | 137,391 | | 4.09 | % | | 13,402,559 | | 120,094 | | 3.63 | % | | 13,294,372 | | 96,150 | | 2.87 | % | | 13,395,589 | | 60,317 | | 1.79 | % | | 11,245,947 | | 20,566 | | 0.73 | % |

| Short-term borrowings | 1,397,253 | | 18,253 | | 5.24 | % | | 1,242,881 | | 14,744 | | 4.81 | % | | 1,387,660 | | 13,449 | | 3.84 | % | | 1,931,537 | | 10,011 | | 2.06 | % | | 2,232,119 | | 4,859 | | 0.87 | % |

| Long-term debt | 883,871 | | 14,282 | | 6.48 | % | | 931,796 | | 14,983 | | 6.52 | % | | 931,107 | | 14,088 | | 6.00 | % | | 921,707 | | 12,663 | | 5.45 | % | | 929,616 | | 11,393 | | 4.92 | % |

| Total interest bearing liabilities | 15,749,346 | | 169,926 | | 4.33 | % | | 15,577,236 | | 149,821 | | 3.90 | % | | 15,613,139 | | 123,687 | | 3.14 | % | | 16,248,833 | | 82,991 | | 2.03 | % | | 14,407,682 | | 36,818 | | 1.02 | % |

| Non-interest bearing deposits | 9,749,105 | | | | | 10,253,731 | | | | | 11,642,969 | | | | | 12,214,531 | | | | | 13,747,876 | | | |

| Other liabilities | 389,155 | | | | | 436,621 | | | | | 426,543 | | | | | 305,554 | | | | | 227,701 | | | |

| Stockholders’ equity | 3,115,447 | | | | | 3,052,357 | | | | | 3,055,751 | | | | | 3,044,993 | | | | | 3,049,661 | | | |

| Total liabilities and stockholders’ equity | $ | 29,003,053 | | | | | $ | 29,319,945 | | | | | $ | 30,738,402 | | | | | $ | 31,813,911 | | | | | $ | 31,432,920 | | | |

Net interest income | | $ | 232,103 | | | | | $ | 235,504 | | | | | $ | 247,751 | | | | | $ | 239,192 | | | | | $ | 206,026 | | |

| Net interest margin | | | 3.29 | % | | | | 3.33 | % | | | | 3.26 | % | | | | 3.05 | % | | | | 2.68 | % |

(1) Taxable equivalent rates used where applicable.

(2) Yields on investment securities are calculated using available-for-sale securities at amortized cost.

(3) Average balances include non-accrual loans.

© 2023 Texas Capital Bank Member FDIC July 20, 2023 Q2-2023 Earnings

2 Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of and pursuant to the Private Securities Litigation Reform Act of 1995 regarding, among other things, TCBI’s financial condition, results of operations, business plans and future performance. These statements are not historical in nature and may often be identified by the use of words such as “believes,” “projects,” “expects,” “may,” “estimates,” “should,” “plans,” “targets,” “intends” “could,” “would,” “anticipates,” “potential,” “confident,” “optimistic” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy, objectives, estimates, trends, guidance, expectations and future plans. Because forward-looking statements relate to future results and occurrences, they are subject to inherent and various uncertainties, risks, and changes in circumstances that are difficult to predict, may change over time, are based on management’s expectations and assumptions at the time the statements are made and are not guarantees of future results. Numerous risks and other factors, many of which are beyond management’s control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. While there can be no assurance that any list of risks is complete, important risks and other factors that could cause actual results to differ materially from those contemplated by forward- looking statements include, but are not limited to, credit quality and risk, the unpredictability of economic and business conditions that may impact TCBI or its customers, recent adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, liquidity and regulatory responses to these developments, the Company’s ability to effective manage its liquidity risk and any growth plans and the availability of capital and funding, the Company’s ability to effectively manage information technology systems, cyber incidents or other failures, disruptions or security breaches, interest rates, including the impact of rising rates on the Company’s securities portfolio and funding costs, commercial and residential real estate values, adverse or unexpected economic conditions, including inflation, recession, the threat of recession, and market conditions in Texas, the United States or globally, including governmental and consumer responses to those economic and market conditions, fund availability, accounting estimates and risk management processes, the transition away from the London Interbank Offered Rate (LIBOR), legislative and regulatory changes, enforcement actions and regulatory examinations and investigations, ratings or interpretations, business strategy execution, the failure to identify, attract and retain key personnel, and other employees, increased or expanded competition from banks and other financial service providers in TCBI’s markets, the failure to maintain adequate regulatory capital, environmental liability associated with properties related to TCBI’s lending activities, and severe weather, natural disasters, acts of war, terrorism, global conflict, or other external events, climate change and related legislative and regulatory initiatives as well as the risks more fully described in TCBI’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in its other documents and filings with the SEC. The information contained in this communication speaks only as of its date. Except to the extent required by applicable law or regulation, we disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments.

3 Foundational Tenants of Value Creation in Place Financial Priorities Described 9/1/2021 Building Tangible Book Value // Reinvesting organically generated capital to improve client relevance and create a more valuable franchise Investment // Re-aligning the expense base to directly support the business and investing aggressively to take advantage of market opportunities that we are uniquely positioned to serve Revenue Growth // Growing top- line revenue as a result of expanded banking capabilities for best-in-class clients in our Texas and national markets Flagship Results Proactive, disciplined engagement with the best clients in our markets to provide the talent, products, and offerings they need through their entire life-cycles Structurally higher, more sustainable earnings driving greater performance and lower annual variability Consistent communication, enhanced accountability, and a bias for action ensure execution and delivery Commitment to financial resilience allowing us to serve clients, access markets, and support communities through all cycles Higher quality earnings and a lower cost of capital drive a significant expansion in incremental shareholder returns

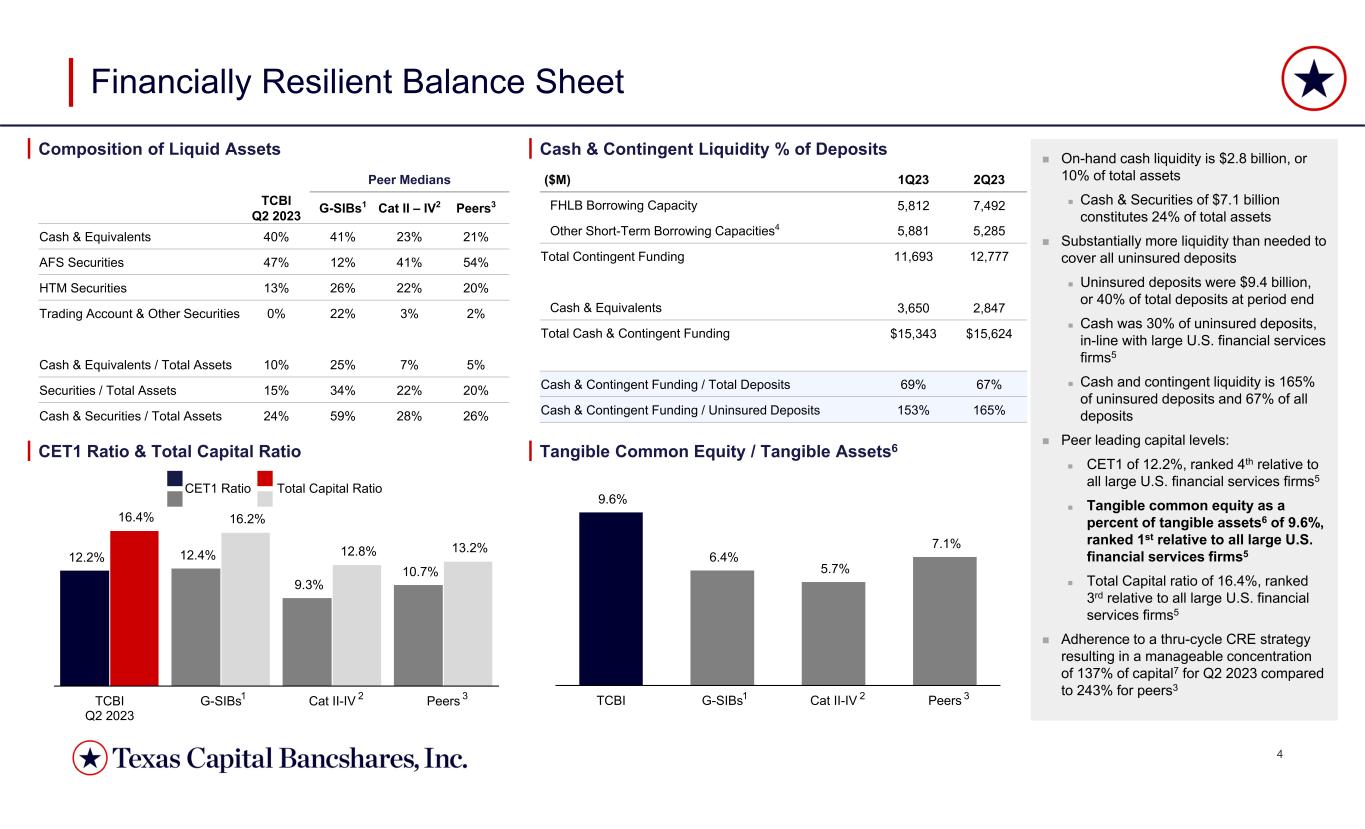

4 12.2% 12.4% 9.3% 10.7% 16.4% 16.2% 12.8% 13.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% TCBI Q2 2023 G-SIBs Cat II-IV Peers CET1 Ratio Total Capital Ratio Financially Resilient Balance Sheet On-hand cash liquidity is $2.8 billion, or 10% of total assets Cash & Securities of $7.1 billion constitutes 24% of total assets Substantially more liquidity than needed to cover all uninsured deposits Uninsured deposits were $9.4 billion, or 40% of total deposits at period end Cash was 30% of uninsured deposits, in-line with large U.S. financial services firms5 Cash and contingent liquidity is 165% of uninsured deposits and 67% of all deposits Peer leading capital levels: CET1 of 12.2%, ranked 4th relative to all large U.S. financial services firms5 Tangible common equity as a percent of tangible assets6 of 9.6%, ranked 1st relative to all large U.S. financial services firms5 Total Capital ratio of 16.4%, ranked 3rd relative to all large U.S. financial services firms5 Adherence to a thru-cycle CRE strategy resulting in a manageable concentration of 137% of capital7 for Q2 2023 compared to 243% for peers3 Composition of Liquid Assets Cash & Contingent Liquidity % of Deposits CET1 Ratio & Total Capital Ratio Tangible Common Equity / Tangible Assets6 Peer Medians Peers3Cat II – IV2G-SIBs1TCBI Q2 2023 21%23%41%40%Cash & Equivalents 54%41%12%47%AFS Securities 20%22%26%13%HTM Securities 2%3%22%0%Trading Account & Other Securities 5%7%25%10%Cash & Equivalents / Total Assets 20%22%34%15%Securities / Total Assets 26%28%59%24%Cash & Securities / Total Assets 9.6% 6.4% 5.7% 7.1% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% TCBI G-SIBs Cat II-IV Peers 2Q231Q23($M) 7,492 5,812 FHLB Borrowing Capacity 5,285 5,881 Other Short-Term Borrowing Capacities4 12,777 11,693 Total Contingent Funding 2,847 3,650 Cash & Equivalents $15,624 $15,343 Total Cash & Contingent Funding 67%69%Cash & Contingent Funding / Total Deposits 165%153%Cash & Contingent Funding / Uninsured Deposits 1 2 3 1 2 3

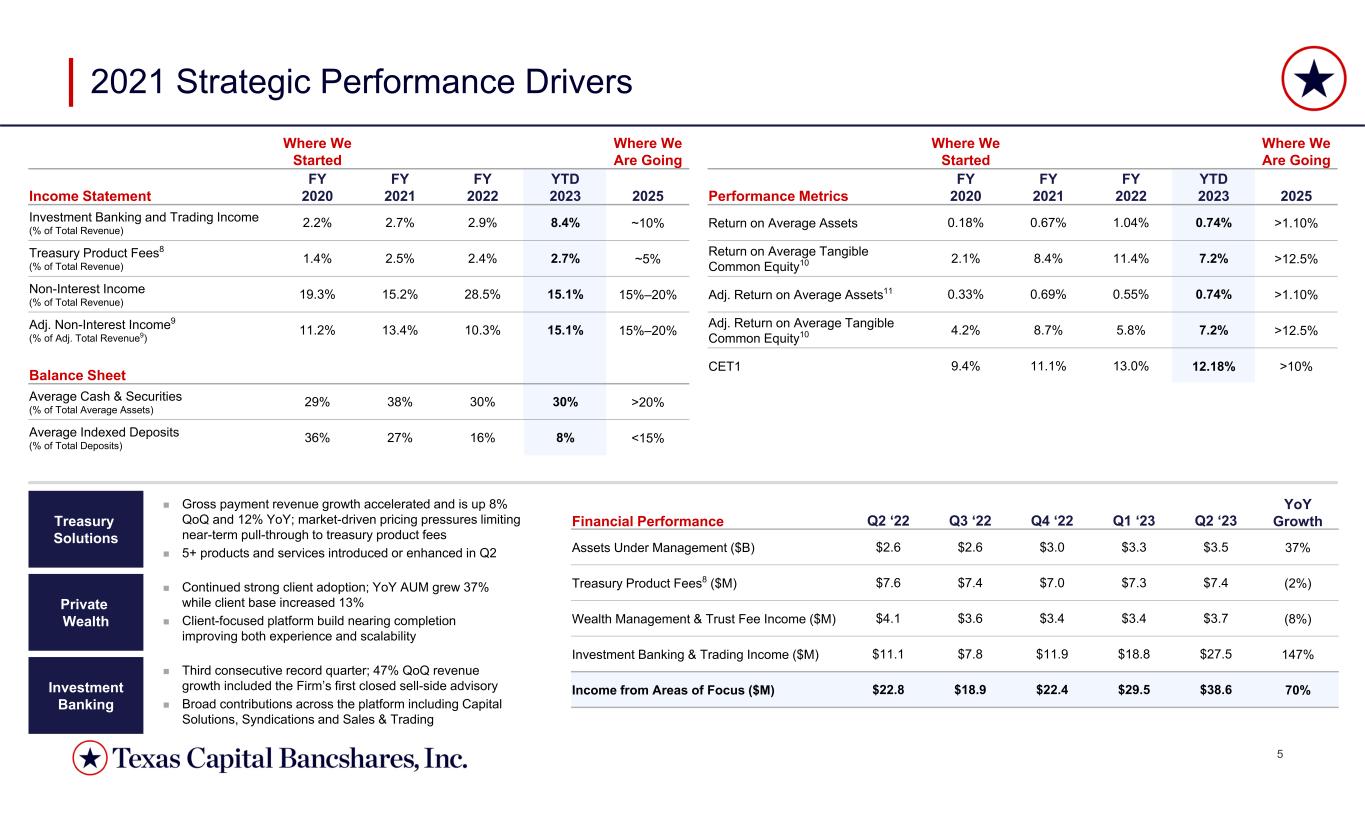

5 2021 Strategic Performance Drivers Where We Are Going Where We Started Where We Are Going Where We Started 2025 YTD 2023 FY 2022 FY 2021 FY 2020Performance Metrics2025 YTD 2023 FY 2022 FY 2021 FY 2020Income Statement >1.10%0.74%1.04%0.67%0.18%Return on Average Assets~10%8.4%2.9%2.7%2.2%Investment Banking and Trading Income (% of Total Revenue) >12.5%7.2%11.4%8.4%2.1%Return on Average Tangible Common Equity10~5%2.7%2.4%2.5%1.4%Treasury Product Fees8 (% of Total Revenue) >1.10%0.74%0.55%0.69%0.33%Adj. Return on Average Assets1115%–20% 15.1%28.5%15.2%19.3%Non-Interest Income (% of Total Revenue) >12.5%7.2%5.8%8.7%4.2%Adj. Return on Average Tangible Common Equity1015%–20%15.1%10.3%13.4%11.2%Adj. Non-Interest Income9 (% of Adj. Total Revenue9) >10%12.18%13.0%11.1%9.4%CET1Balance Sheet >20%30%30%38%29%Average Cash & Securities (% of Total Average Assets) <15%8%16%27%36%Average Indexed Deposits (% of Total Deposits) Treasury Solutions Private Wealth Investment Banking Gross payment revenue growth accelerated and is up 8% QoQ and 12% YoY; market-driven pricing pressures limiting near-term pull-through to treasury product fees 5+ products and services introduced or enhanced in Q2 Continued strong client adoption; YoY AUM grew 37% while client base increased 13% Client-focused platform build nearing completion improving both experience and scalability Third consecutive record quarter; 47% QoQ revenue growth included the Firm’s first closed sell-side advisory Broad contributions across the platform including Capital Solutions, Syndications and Sales & Trading YoY GrowthQ2 ‘23Q1 ‘23Q4 ‘22Q3 ‘22Q2 ‘22Financial Performance 37%$3.5$3.3$3.0$2.6$2.6Assets Under Management ($B) (2%)$7.4$7.3$7.0$7.4$7.6Treasury Product Fees8 ($M) (8%)$3.7$3.4$3.4$3.6$4.1Wealth Management & Trust Fee Income ($M) 147%$27.5$18.8$11.9$7.8$11.1Investment Banking & Trading Income ($M) 70%$38.6$29.5$22.4$18.9$22.8Income from Areas of Focus ($M)

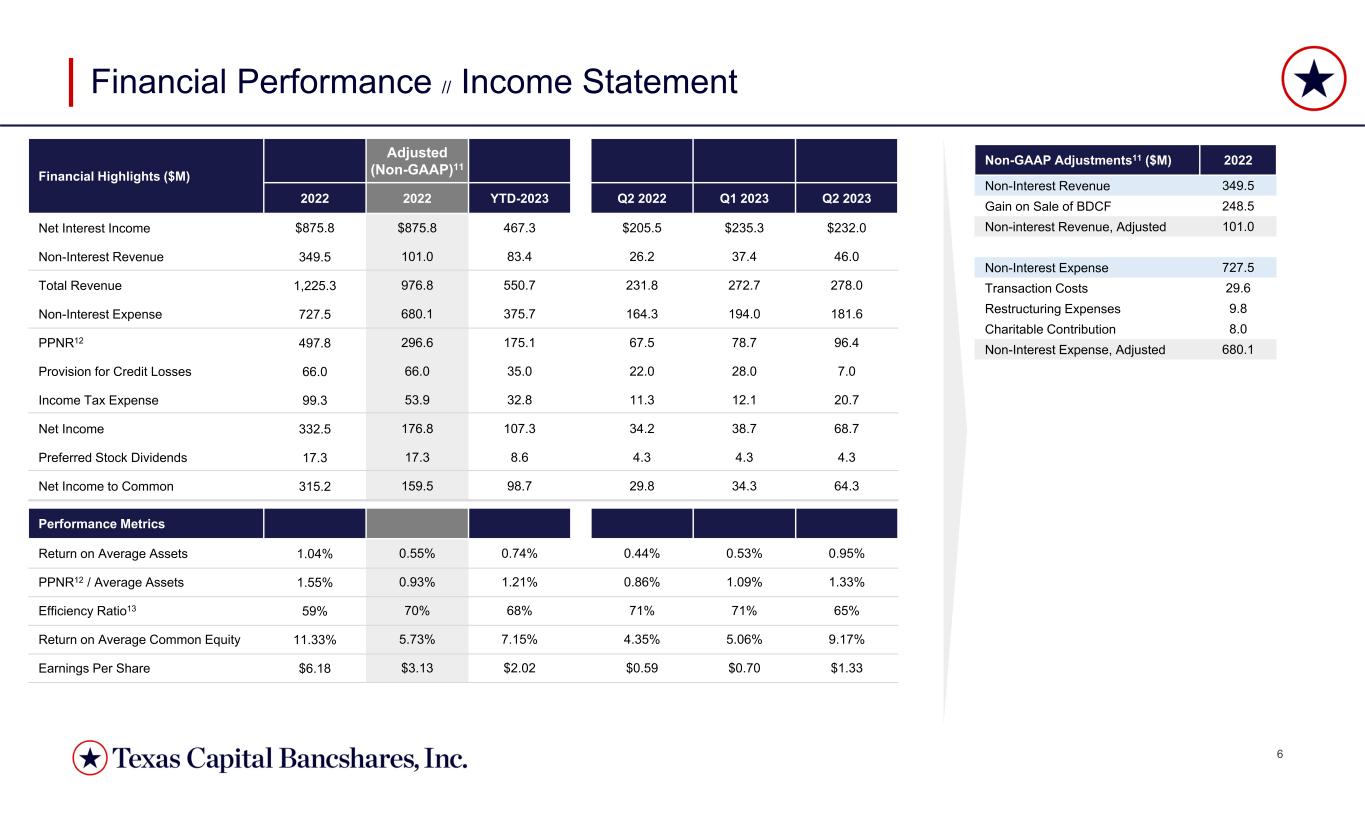

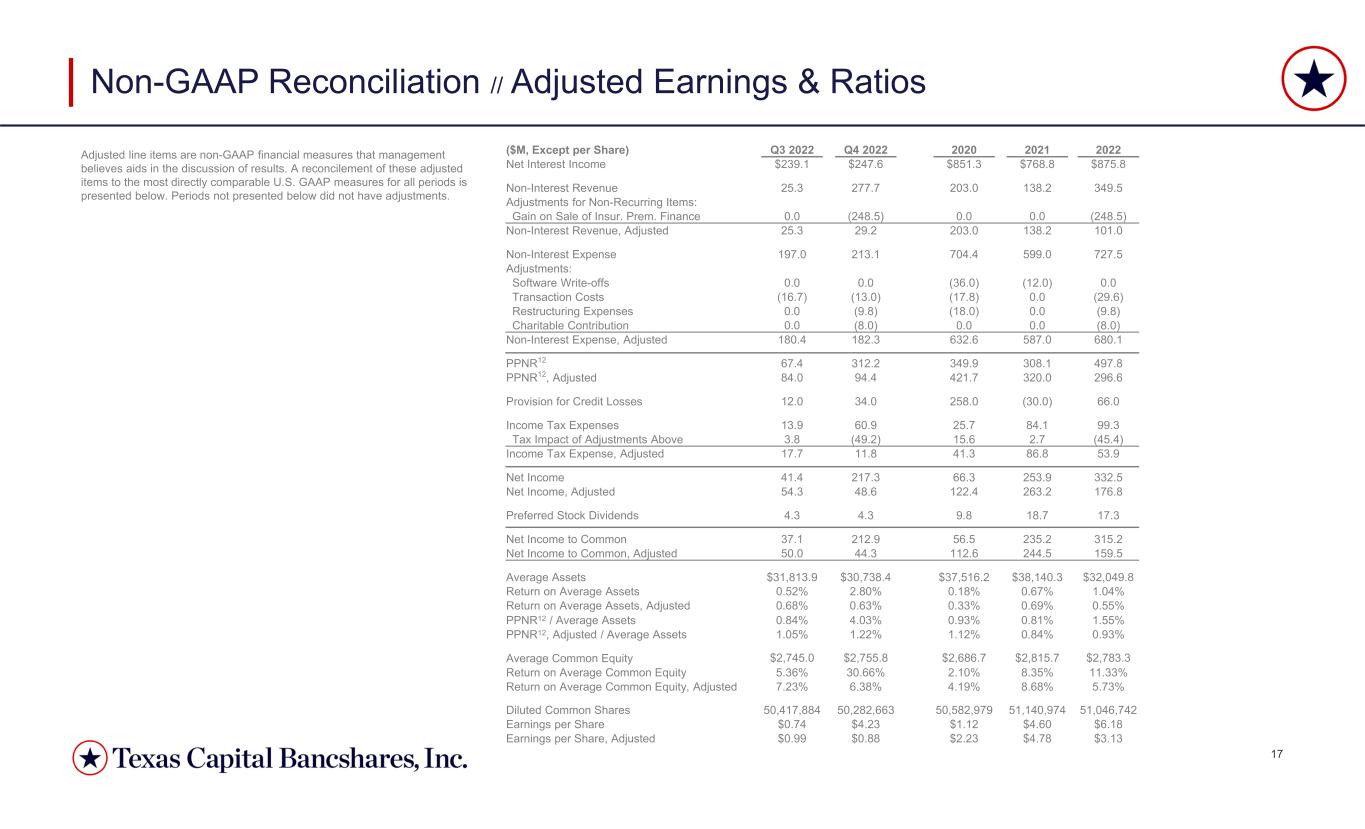

6 Financial Performance // Income Statement Adjusted (Non-GAAP)11 Financial Highlights ($M) Q2 2023Q1 2023Q2 2022YTD-202320222022 $232.0$235.3$205.5467.3$875.8$875.8Net Interest Income 46.037.426.283.4101.0349.5Non-Interest Revenue 278.0272.7231.8550.7976.81,225.3Total Revenue 181.6194.0164.3375.7680.1727.5Non-Interest Expense 96.478.767.5175.1296.6497.8PPNR12 7.028.022.035.066.066.0Provision for Credit Losses 20.712.111.332.853.999.3Income Tax Expense 68.738.734.2107.3176.8332.5Net Income 4.34.34.38.617.317.3Preferred Stock Dividends 64.334.329.898.7159.5315.2Net Income to Common Performance Metrics 0.95%0.53%0.44%0.74%0.55%1.04%Return on Average Assets 1.33%1.09%0.86%1.21%0.93%1.55%PPNR12 / Average Assets 65%71%71%68%70%59%Efficiency Ratio13 9.17%5.06%4.35%7.15%5.73%11.33%Return on Average Common Equity $1.33$0.70$0.59$2.02$3.13$6.18Earnings Per Share 2022Non-GAAP Adjustments11 ($M) 349.5Non-Interest Revenue 248.5Gain on Sale of BDCF 101.0Non-interest Revenue, Adjusted 727.5Non-Interest Expense 29.6Transaction Costs 9.8Restructuring Expenses 8.0Charitable Contribution 680.1Non-Interest Expense, Adjusted

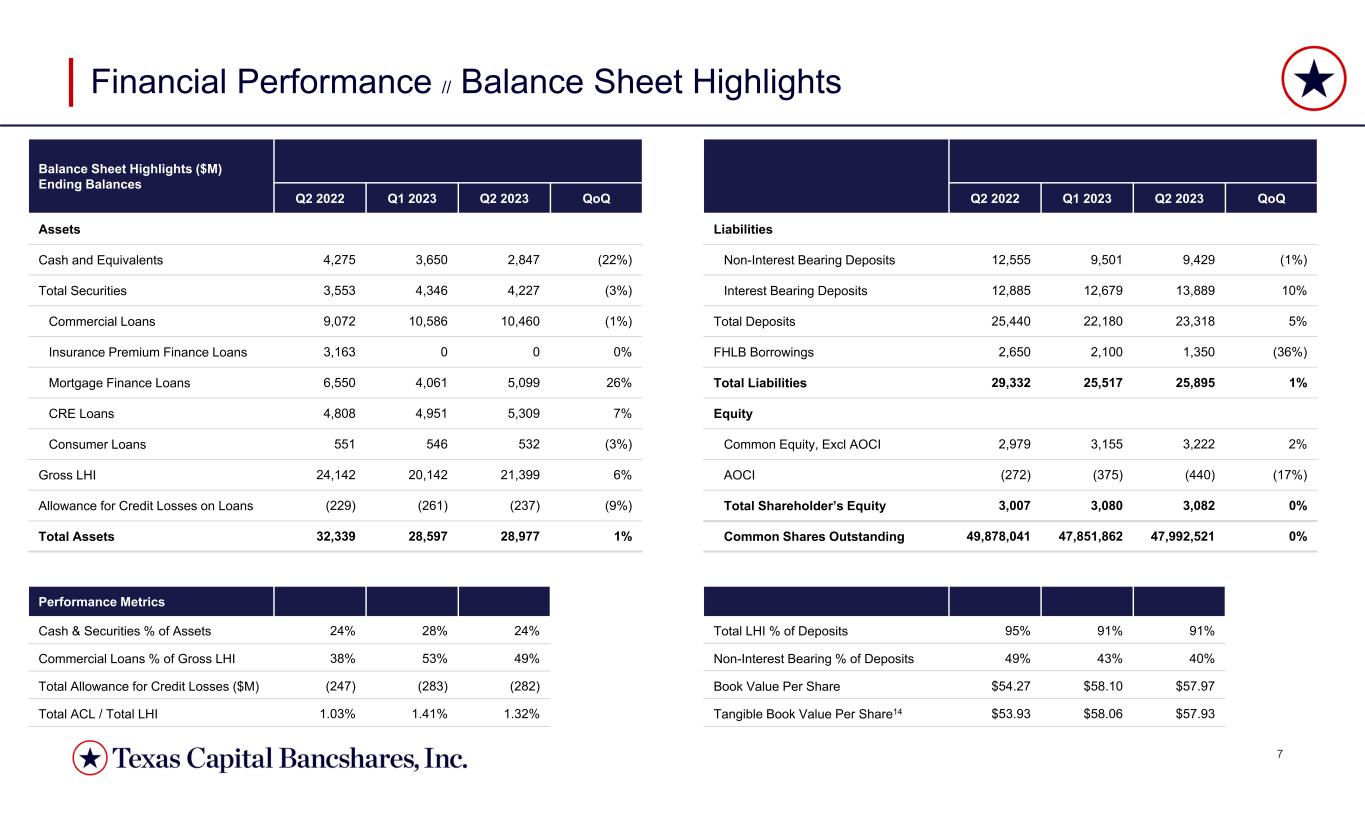

7 Balance Sheet Highlights ($M) Ending Balances QoQQ2 2023Q1 2023Q2 2022 Assets (22%)2,8473,6504,275Cash and Equivalents (3%)4,2274,3463,553Total Securities (1%)10,46010,5869,072Commercial Loans 0%003,163Insurance Premium Finance Loans 26%5,0994,0616,550Mortgage Finance Loans 7%5,3094,9514,808CRE Loans (3%)532546551Consumer Loans 6%21,39920,14224,142Gross LHI (9%)(237)(261)(229)Allowance for Credit Losses on Loans 1%28,97728,59732,339Total Assets Financial Performance // Balance Sheet Highlights Performance Metrics 24%28%24%Cash & Securities % of Assets 49%53%38%Commercial Loans % of Gross LHI (282)(283)(247)Total Allowance for Credit Losses ($M) 1.32%1.41%1.03%Total ACL / Total LHI QoQQ2 2023Q1 2023Q2 2022 Liabilities (1%)9,4299,50112,555Non-Interest Bearing Deposits 10%13,88912,67912,885Interest Bearing Deposits 5%23,31822,18025,440Total Deposits (36%)1,3502,1002,650FHLB Borrowings 1%25,89525,51729,332Total Liabilities Equity 2%3,2223,1552,979Common Equity, Excl AOCI (17%)(440)(375)(272)AOCI 0%3,0823,0803,007Total Shareholder’s Equity 0%47,992,521 47,851,862 49,878,041 Common Shares Outstanding 91%91%95%Total LHI % of Deposits 40%43%49%Non-Interest Bearing % of Deposits $57.97$58.10$54.27Book Value Per Share $57.93$58.06$53.93Tangible Book Value Per Share14

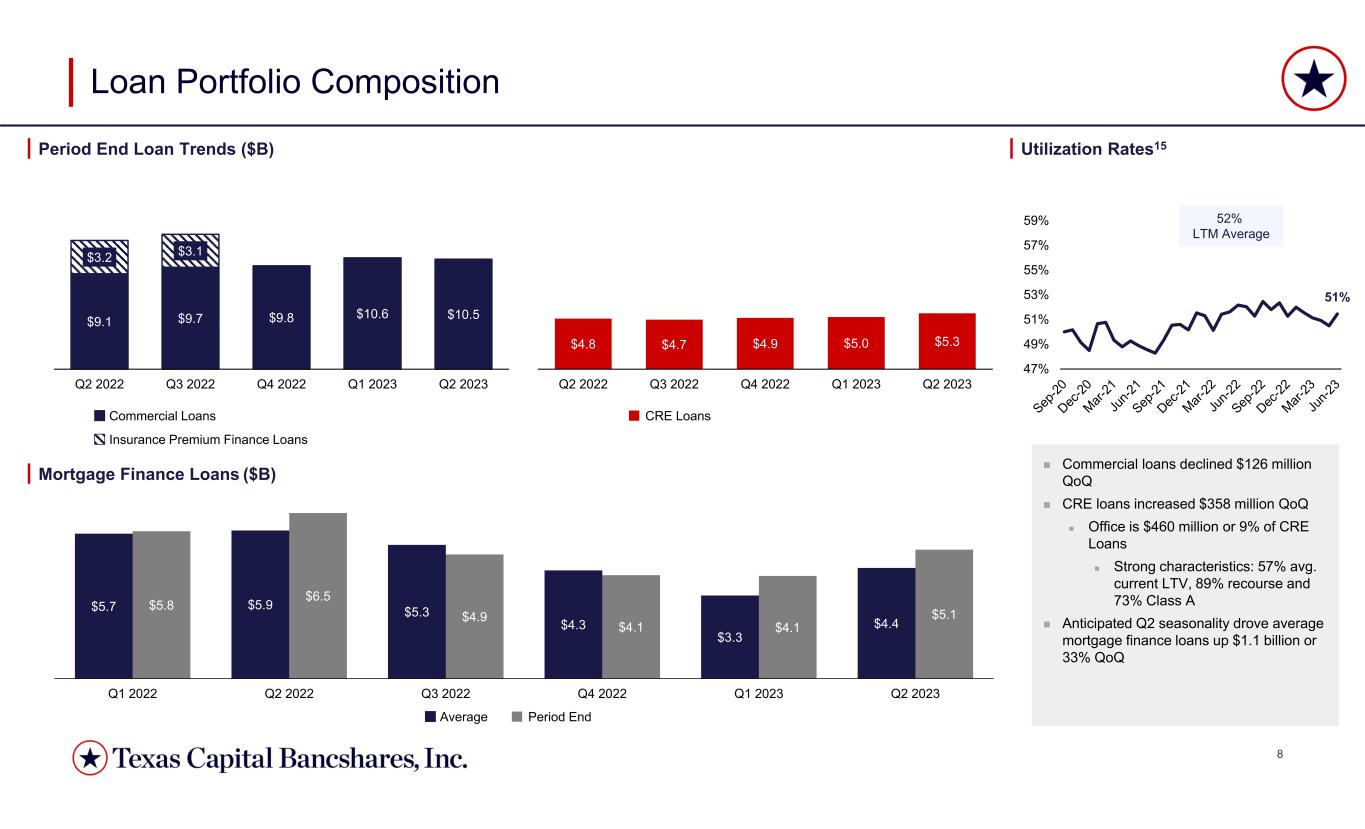

8 $5.7 $5.9 $5.3 $4.3 $3.3 $4.4 $5.8 $6.5 $4.9 $4.1 $4.1 $5.1 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $4.8 $4.7 $4.9 $5.0 $5.3 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Loan Portfolio Composition Period End Loan Trends ($B) Utilization Rates15 Commercial Loans Insurance Premium Finance Loans CRE Loans $9.1 $9.7 $9.8 $10.6 $10.5 $3.2 $3.1 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Commercial loans declined $126 million QoQ CRE loans increased $358 million QoQ Office is $460 million or 9% of CRE Loans Strong characteristics: 57% avg. current LTV, 89% recourse and 73% Class A Anticipated Q2 seasonality drove average mortgage finance loans up $1.1 billion or 33% QoQ Mortgage Finance Loans ($B) 51% 47% 49% 51% 53% 55% 57% 59% 52% LTM Average Average Period End

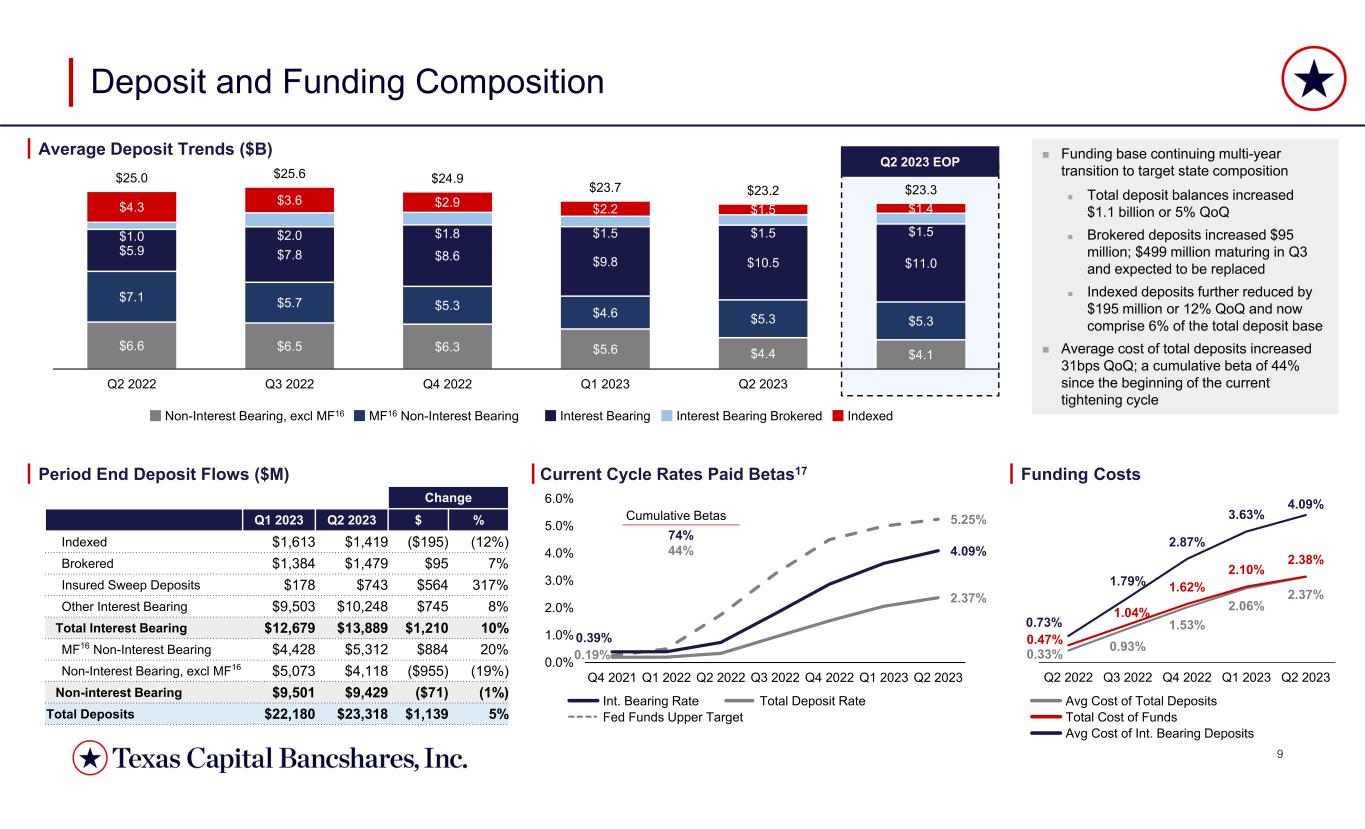

9 0.33% 0.93% 1.53% 2.06% 2.37% 0.47% 1.04% 1.62% 2.10% 2.38% 0.73% 1.79% 2.87% 3.63% 4.09% Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q2 2023 EOP $6.6 $6.5 $6.3 $5.6 $4.4 $4.1 $7.1 $5.7 $5.3 $4.6 $5.3 $5.3 $5.9 $7.8 $8.6 $9.8 $10.5 $11.0 $1.0 $2.0 $1.8 $1.5 $1.5 $1.5 $4.3 $3.6 $2.9 $2.2 $1.5 $1.4 $25.0 $25.6 $24.9 $23.7 $23.2 $23.3 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Deposit and Funding Composition Funding base continuing multi-year transition to target state composition Total deposit balances increased $1.1 billion or 5% QoQ Brokered deposits increased $95 million; $499 million maturing in Q3 and expected to be replaced Indexed deposits further reduced by $195 million or 12% QoQ and now comprise 6% of the total deposit base Average cost of total deposits increased 31bps QoQ; a cumulative beta of 44% since the beginning of the current tightening cycle Average Deposit Trends ($B) Period End Deposit Flows ($M) Funding CostsCurrent Cycle Rates Paid Betas17 Non-Interest Bearing, excl MF16 MF16 Non-Interest Bearing Interest Bearing Interest Bearing Brokered Indexed Change %$Q2 2023Q1 2023 (12%)($195)$1,419$1,613Indexed 7%$95$1,479$1,384Brokered 317%$564$743$178Insured Sweep Deposits 8%$745$10,248$9,503Other Interest Bearing 10%$1,210$13,889$12,679Total Interest Bearing 20%$884$5,312$4,428MF16 Non-Interest Bearing (19%)($955)$4,118$5,073Non-Interest Bearing, excl MF16 (1%)($71)$9,429$9,501Non-interest Bearing 5%$1,139$23,318$22,180Total Deposits Int. Bearing Rate Total Deposit Rate Fed Funds Upper Target Total Cost of Funds Avg Cost of Int. Bearing Deposits Avg Cost of Total Deposits 5.25% 0.39% 4.09% 0.19% 2.37% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Cumulative Betas 74% 44%

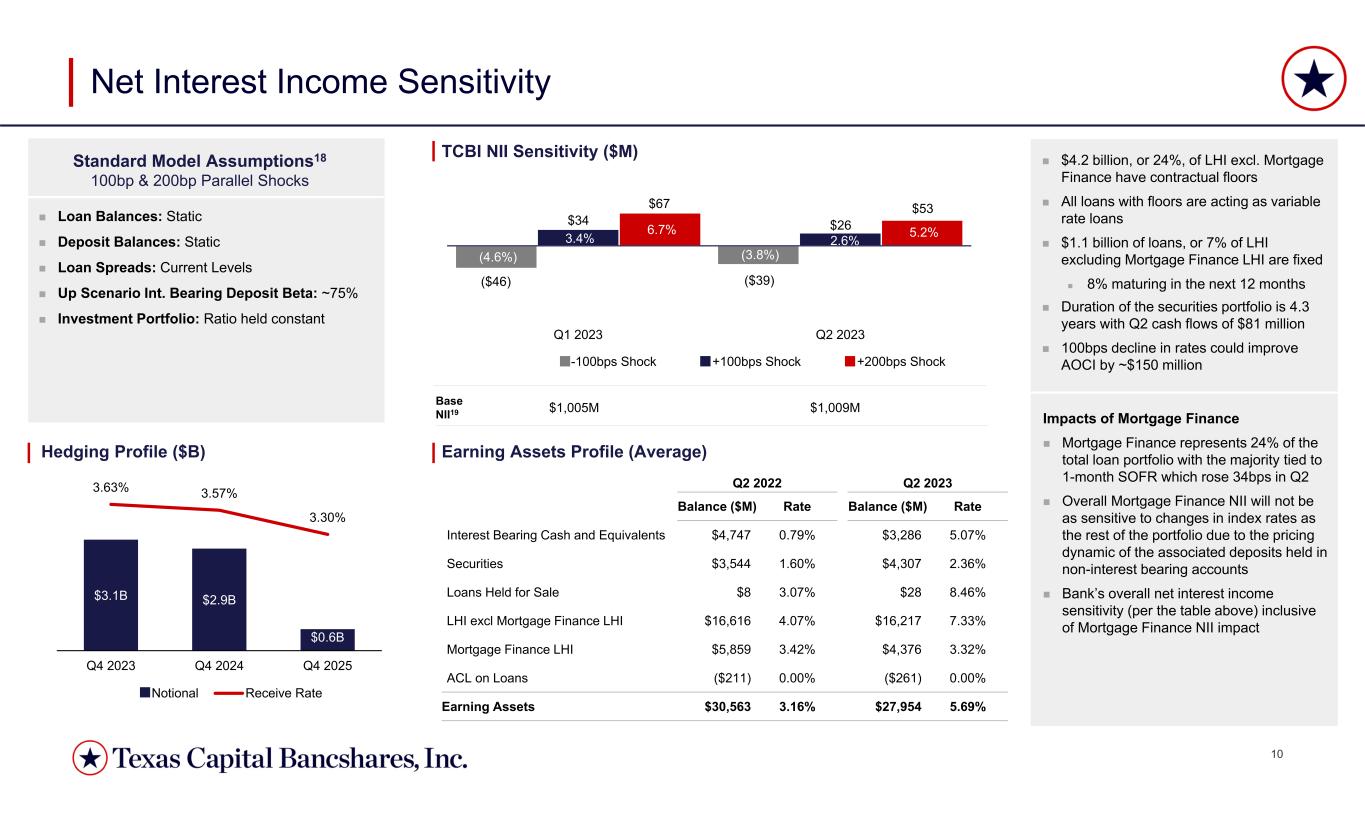

10 (4.6%) (3.8%) 3.4% 2.6% 6.7% 5.2% (15.0%) (10.0%) (5.0%) 0.0% 5.0% 10.0% 15.0% Q1 2023 Q2 2023 -100bps Shock +100bps Shock +200bps Shock $3.1B $2.9B $0.6B 3.63% 3.57% 3.30% Q4 2023 Q4 2024 Q4 2025 Notional Receive Rate Net Interest Income Sensitivity Standard Model Assumptions18 100bp & 200bp Parallel Shocks Loan Balances: Static Deposit Balances: Static Loan Spreads: Current Levels Up Scenario Int. Bearing Deposit Beta: ~75% Investment Portfolio: Ratio held constant Hedging Profile ($B) TCBI NII Sensitivity ($M) $1,009M$1,005MBase NII19 $67 $34 ($46) $53 $26 ($39) Earning Assets Profile (Average) Q2 2023Q2 2022 RateBalance ($M)RateBalance ($M) 5.07%$3,2860.79%$4,747Interest Bearing Cash and Equivalents 2.36%$4,3071.60%$3,544Securities 8.46%$283.07%$8Loans Held for Sale 7.33%$16,2174.07%$16,616LHI excl Mortgage Finance LHI 3.32%$4,3763.42%$5,859Mortgage Finance LHI 0.00%($261)0.00%($211)ACL on Loans 5.69%$27,9543.16%$30,563Earning Assets $4.2 billion, or 24%, of LHI excl. Mortgage Finance have contractual floors All loans with floors are acting as variable rate loans $1.1 billion of loans, or 7% of LHI excluding Mortgage Finance LHI are fixed 8% maturing in the next 12 months Duration of the securities portfolio is 4.3 years with Q2 cash flows of $81 million 100bps decline in rates could improve AOCI by ~$150 million Impacts of Mortgage Finance Mortgage Finance represents 24% of the total loan portfolio with the majority tied to 1-month SOFR which rose 34bps in Q2 Overall Mortgage Finance NII will not be as sensitive to changes in index rates as the rest of the portfolio due to the pricing dynamic of the associated deposits held in non-interest bearing accounts Bank’s overall net interest income sensitivity (per the table above) inclusive of Mortgage Finance NII impact

11 $205.5 $239.1 $247.6 $235.3 $232.0 2.68% 3.05% 3.26% 3.33% 3.29% Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Net Interest Income Net Interest Margin Q2-2023 Earnings Overview Net Interest Margin ($M)Net Interest Income ($M) Non-Interest Income ($M) Fee Income Detail ($M) Non-Interest Expense ($M) 17%14%11%10%11%% of Adj Revenue11 Non-Interest Income Gain on Sale of Insur. Prem. Finance11 $26.2 $25.3 $29.2 $37.4 $46.0 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $248.5 $6.1 $5.0 $5.2 Deposit Service Charges Investment Banking and Trading Wealth Management $4.1 $3.4 $3.7 $11.1 $18.8 $27.5 Q2 2022 Q2 2023Q1 2023 $103.4 $115.1 $100.9 $128.7 $113.0 $60.9 $65.2 $81.4 $65.3 $68.6 $16.7 $30.8 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Salaries & Benefits Non-Recurring Items11Other NIE $164.3 $197.0 $213.1 $194.0 63% 58% 47% 66% 37% 34% 39% 34% 8% 14% 62% 38% $181.6 $235.3 $26.1 $8.8 $0.6 ($18.7) ($17.3) ($2.8) $232.0 Q1 2023 Loan Volume Loan Yield Loan Fees Investment Securities & Cash Deposits Borrowings Q2 2023

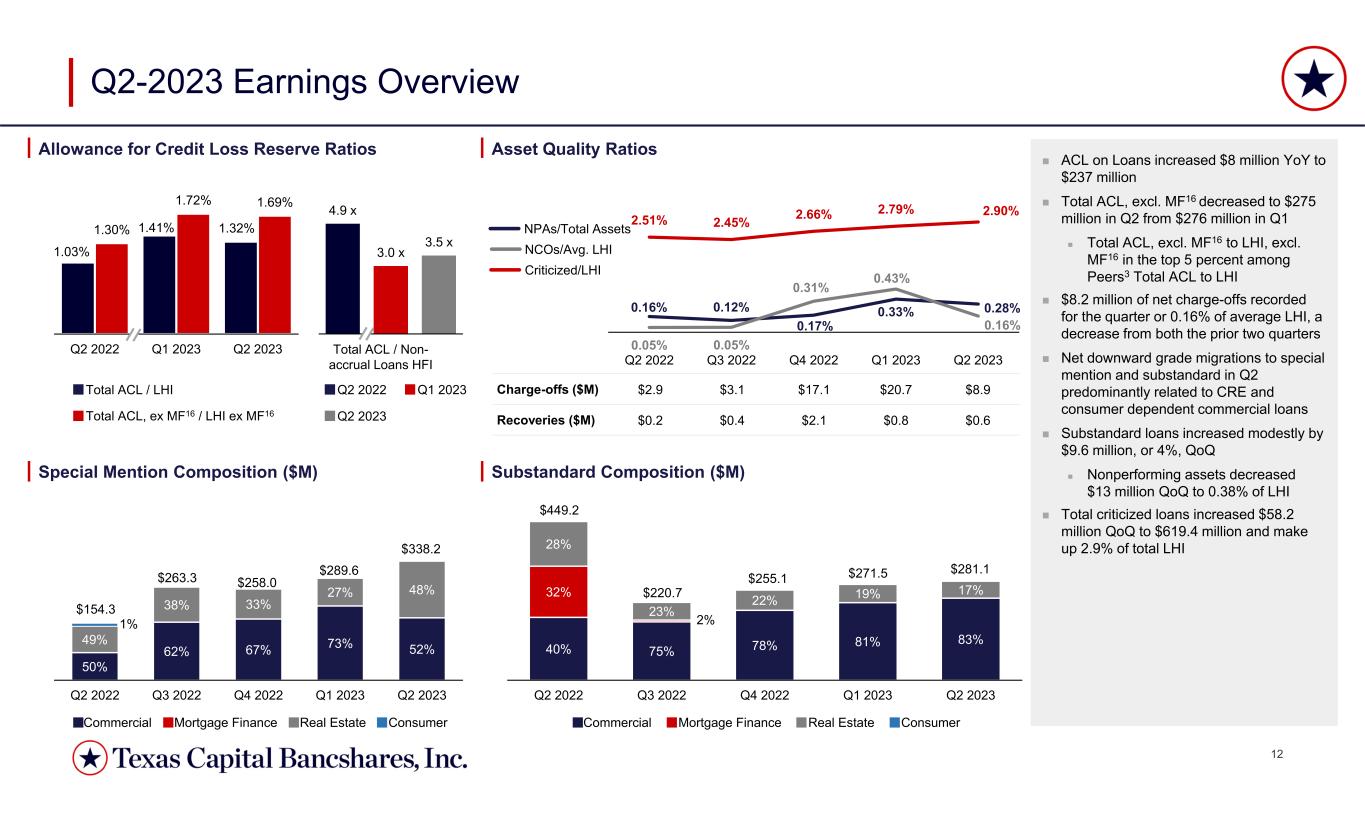

12 1.03% 1.41% 1.32% 1.30% 1.72% 1.69% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45% 0.50% 0.55% 0.60% 0.65% 0.70% 0.75% 0.80% 0.85% 0.90% 0.95% 1.00% 1.05% 1.10% 1.15% 1.20% 1.25% 1.30% 1.35% 1.40% 1.45% 1.50% 1.55% 1.60% 1.65% 1.70% 1.75% 1.80% 1.85% Q2 2022 Q1 2023 Q2 2023 0.16% 0.12% 0.17% 0.33% 0.28% 0.05% 0.05% 0.31% 0.43% 0.16% 2.51% 2.45% 2.66% 2.79% 2.90% Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q2-2023 Earnings Overview Allowance for Credit Loss Reserve Ratios Asset Quality Ratios Special Mention Composition ($M) Substandard Composition ($M) 50% 62% 67% 73% 52% 49% 38% 33% 27% 48% Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Commercial Mortgage Finance Real Estate Consumer 1% $154.3 $263.3 $258.0 $289.6 $338.2 40% 75% 78% 81% 83% 32% 2% 28% 23% 22% 19% 17% Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Commercial Mortgage Finance Real Estate Consumer $449.2 $220.7 $255.1 $271.5 $281.1 $8.9$20.7$17.1$3.1$2.9Charge-offs ($M) $0.6$0.8$2.1$0.4$0.2Recoveries ($M) NPAs/Total Assets Criticized/LHI NCOs/Avg. LHI Q2 2022 Q1 2023 Q2 2023 4.9 x 3.0 x 3.5 x – 1.0 x 2.0 x 3.0 x 4.0 x 5.0 x 6.0 x 7.0 x 8.0 x Q2 2022 Q1 2023 Q2 2023 Total ACL / Non- accrual Loans HFI ACL on Loans increased $8 million YoY to $237 million Total ACL, excl. MF16 decreased to $275 million in Q2 from $276 million in Q1 Total ACL, excl. MF16 to LHI, excl. MF16 in the top 5 percent among Peers3 Total ACL to LHI $8.2 million of net charge-offs recorded for the quarter or 0.16% of average LHI, a decrease from both the prior two quarters Net downward grade migrations to special mention and substandard in Q2 predominantly related to CRE and consumer dependent commercial loans Substandard loans increased modestly by $9.6 million, or 4%, QoQ Nonperforming assets decreased $13 million QoQ to 0.38% of LHI Total criticized loans increased $58.2 million QoQ to $619.4 million and make up 2.9% of total LHI Total ACL / LHI Total ACL, ex MF16 / LHI ex MF16

13 2023 Target 10.46% 11.08% 13.00% 12.42% 12.18% 12.00% 1.45% 1.51% 1.67% 1.61% 1.54% 2.51% 2.66% 3.03% 2.83% 2.71% 14.42% 15.25% 17.70% 16.86% 16.43% Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 2023 Target $53.93 $51.48 $56.45 $58.06 $57.93 $54.27 $51.82 $56.48 $58.10 $57.97 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 8.32% 8.45% 9.69% 9.72% 9.60% 8.37% 8.50% 9.70% 9.72% 9.60% Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q2-2023 Earnings Overview Total regulatory capital remains exceptionally strong Total capital ratio of 16.43%, in the top decile of the peer group3, and CET1 ratio of 12.18% in Q2 2023 Tangible common equity / tangible assets6 finished the quarter at 9.60%, an important characteristic of our financially resilient business model and a key metric as we manage the balance sheet through- cycle Tangible common equity / tangible assets6 in top decile of peer group3 Tangible book value per share14 declined $0.13 as net income available to common stockholders of $64.3 million was offset by a decline in AOCI of $65.5 million AOCI per share of $9.17 Regulatory Capital Levels Tangible Common Equity / Tangible Assets6 Tangible Book Value per Share14 Period End AOCI ($M) ($440.3)($374.8)($418.9)($435.4)($272.2) AOCI per Share ($9.17)($7.83)($8.59)($8.73)($5.46) Tangible Common Equity / Tangible Assets6 Common Equity / Total Assets Peer3 Tangible Common Equity / Tangible Assets6 7.13%7.09%6.78%7.22% Tangible Book Value per Share14 Book Value per Share CET1 Tier 2 CapitalTier 1 Capital

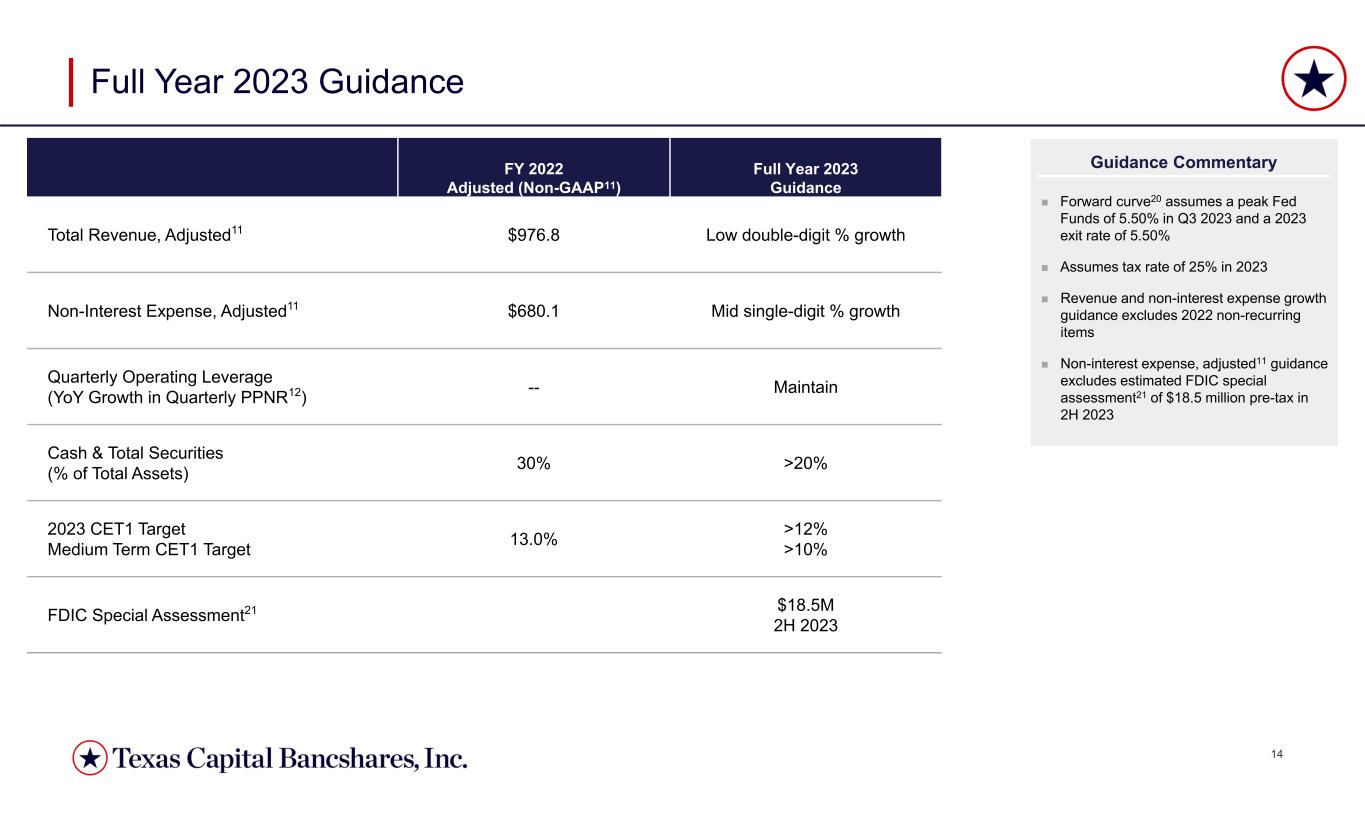

14 Full Year 2023 Guidance FY 2022 Adjusted (Non-GAAP11) Low double-digit % growth$976.8 Total Revenue, Adjusted11 Mid single-digit % growth$680.1Non-Interest Expense, Adjusted11 Maintain--Quarterly Operating Leverage (YoY Growth in Quarterly PPNR12) >20%30%Cash & Total Securities (% of Total Assets) >12% >10%13.0%2023 CET1 Target Medium Term CET1 Target $18.5M 2H 2023FDIC Special Assessment21 Full Year 2023 Guidance Forward curve20 assumes a peak Fed Funds of 5.50% in Q3 2023 and a 2023 exit rate of 5.50% Assumes tax rate of 25% in 2023 Revenue and non-interest expense growth guidance excludes 2022 non-recurring items Non-interest expense, adjusted11 guidance excludes estimated FDIC special assessment21 of $18.5 million pre-tax in 2H 2023 Guidance Commentary

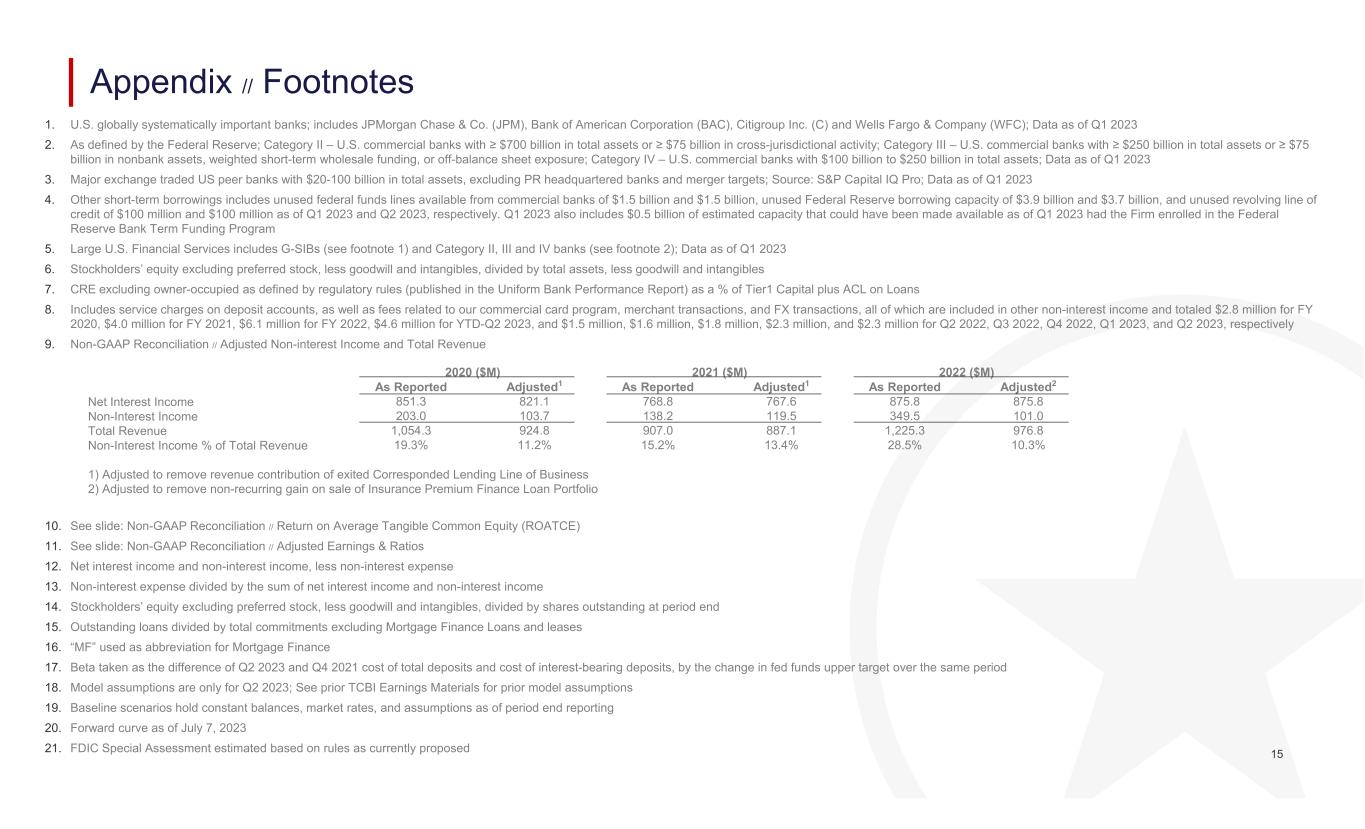

15 1. U.S. globally systematically important banks; includes JPMorgan Chase & Co. (JPM), Bank of American Corporation (BAC), Citigroup Inc. (C) and Wells Fargo & Company (WFC); Data as of Q1 2023 2. As defined by the Federal Reserve; Category II – U.S. commercial banks with ≥ $700 billion in total assets or ≥ $75 billion in cross-jurisdictional activity; Category III – U.S. commercial banks with ≥ $250 billion in total assets or ≥ $75 billion in nonbank assets, weighted short-term wholesale funding, or off-balance sheet exposure; Category IV – U.S. commercial banks with $100 billion to $250 billion in total assets; Data as of Q1 2023 3. Major exchange traded US peer banks with $20-100 billion in total assets, excluding PR headquartered banks and merger targets; Source: S&P Capital IQ Pro; Data as of Q1 2023 4. Other short-term borrowings includes unused federal funds lines available from commercial banks of $1.5 billion and $1.5 billion, unused Federal Reserve borrowing capacity of $3.9 billion and $3.7 billion, and unused revolving line of credit of $100 million and $100 million as of Q1 2023 and Q2 2023, respectively. Q1 2023 also includes $0.5 billion of estimated capacity that could have been made available as of Q1 2023 had the Firm enrolled in the Federal Reserve Bank Term Funding Program 5. Large U.S. Financial Services includes G-SIBs (see footnote 1) and Category II, III and IV banks (see footnote 2); Data as of Q1 2023 6. Stockholders’ equity excluding preferred stock, less goodwill and intangibles, divided by total assets, less goodwill and intangibles 7. CRE excluding owner-occupied as defined by regulatory rules (published in the Uniform Bank Performance Report) as a % of Tier1 Capital plus ACL on Loans 8. Includes service charges on deposit accounts, as well as fees related to our commercial card program, merchant transactions, and FX transactions, all of which are included in other non-interest income and totaled $2.8 million for FY 2020, $4.0 million for FY 2021, $6.1 million for FY 2022, $4.6 million for YTD-Q2 2023, and $1.5 million, $1.6 million, $1.8 million, $2.3 million, and $2.3 million for Q2 2022, Q3 2022, Q4 2022, Q1 2023, and Q2 2023, respectively 9. Non-GAAP Reconciliation // Adjusted Non-interest Income and Total Revenue 10. See slide: Non-GAAP Reconciliation // Return on Average Tangible Common Equity (ROATCE) 11. See slide: Non-GAAP Reconciliation // Adjusted Earnings & Ratios 12. Net interest income and non-interest income, less non-interest expense 13. Non-interest expense divided by the sum of net interest income and non-interest income 14. Stockholders’ equity excluding preferred stock, less goodwill and intangibles, divided by shares outstanding at period end 15. Outstanding loans divided by total commitments excluding Mortgage Finance Loans and leases 16. “MF” used as abbreviation for Mortgage Finance 17. Beta taken as the difference of Q2 2023 and Q4 2021 cost of total deposits and cost of interest-bearing deposits, by the change in fed funds upper target over the same period 18. Model assumptions are only for Q2 2023; See prior TCBI Earnings Materials for prior model assumptions 19. Baseline scenarios hold constant balances, market rates, and assumptions as of period end reporting 20. Forward curve as of July 7, 2023 21. FDIC Special Assessment estimated based on rules as currently proposed Appendix // Footnotes 2022 ($M)2021 ($M)2020 ($M) Adjusted2As ReportedAdjusted1As ReportedAdjusted1As Reported 875.8875.8767.6768.8821.1851.3Net Interest Income 101.0349.5119.5138.2103.7203.0Non-Interest Income 976.81,225.3887.1907.0924.81,054.3Total Revenue 10.3%28.5%13.4%15.2%11.2%19.3%Non-Interest Income % of Total Revenue 1) Adjusted to remove revenue contribution of exited Corresponded Lending Line of Business 2) Adjusted to remove non-recurring gain on sale of Insurance Premium Finance Loan Portfolio

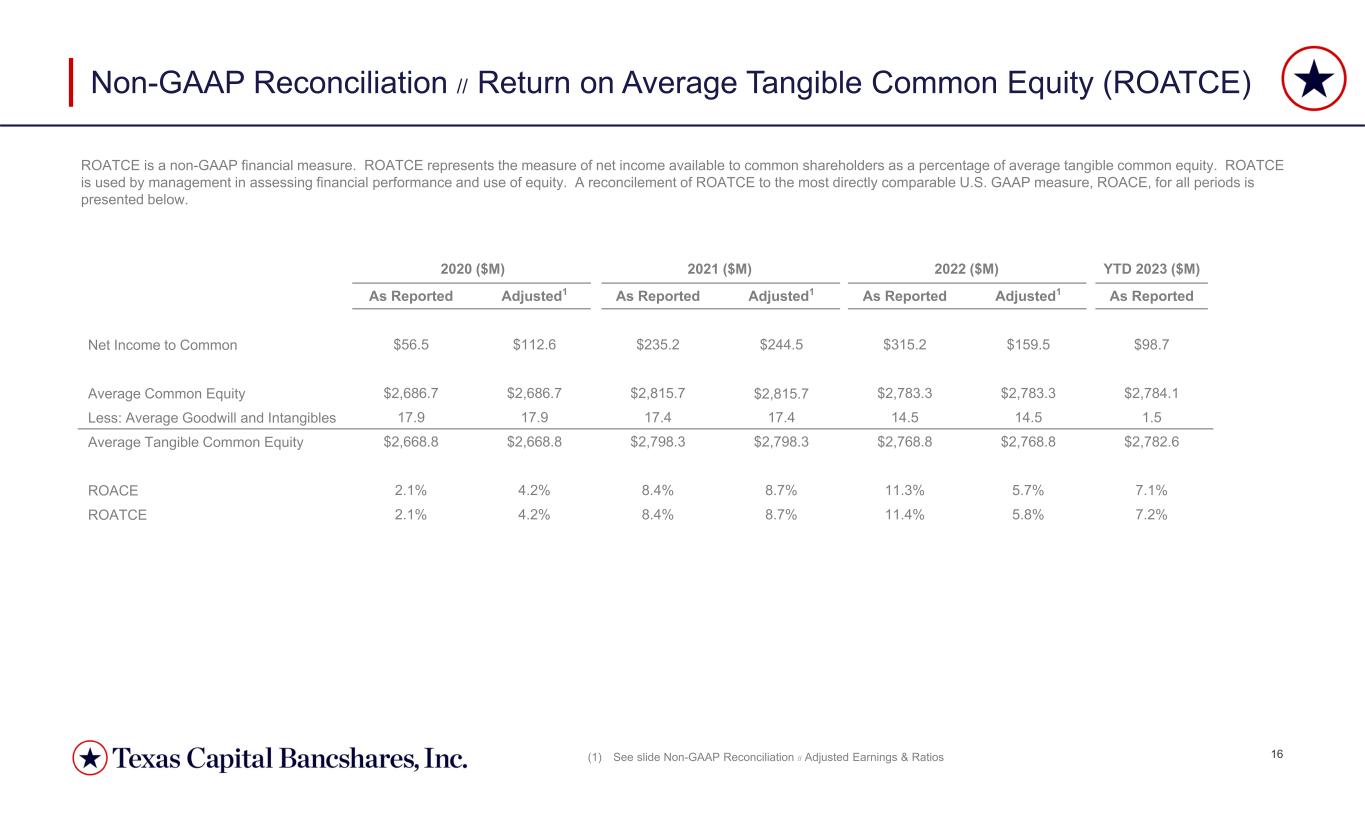

16 Non-GAAP Reconciliation // Return on Average Tangible Common Equity (ROATCE) ROATCE is a non-GAAP financial measure. ROATCE represents the measure of net income available to common shareholders as a percentage of average tangible common equity. ROATCE is used by management in assessing financial performance and use of equity. A reconcilement of ROATCE to the most directly comparable U.S. GAAP measure, ROACE, for all periods is presented below. (1) See slide Non-GAAP Reconciliation // Adjusted Earnings & Ratios YTD 2023 ($M)2022 ($M)2021 ($M)2020 ($M) As ReportedAdjusted1As ReportedAdjusted1As ReportedAdjusted1As Reported $98.7$159.5$315.2$244.5$235.2$112.6$56.5Net Income to Common $2,784.1$2,783.3$2,783.3$2,815.7$2,815.7$2,686.7$2,686.7Average Common Equity 1.514.514.517.417.417.917.9Less: Average Goodwill and Intangibles $2,782.6$2,768.8$2,768.8$2,798.3$2,798.3$2,668.8$2,668.8Average Tangible Common Equity 7.1%5.7%11.3%8.7%8.4%4.2%2.1%ROACE 7.2%5.8%11.4%8.7%8.4%4.2%2.1%ROATCE

17 Non-GAAP Reconciliation // Adjusted Earnings & Ratios Adjusted line items are non-GAAP financial measures that management believes aids in the discussion of results. A reconcilement of these adjusted items to the most directly comparable U.S. GAAP measures for all periods is presented below. Periods not presented below did not have adjustments. 202220212020Q4 2022Q3 2022($M, Except per Share) $875.8 $768.8 $851.3 $247.6 $239.1 Net Interest Income 349.5 138.2 203.0 277.7 25.3 Non-Interest Revenue Adjustments for Non-Recurring Items: (248.5)0.0 0.0 (248.5)0.0 Gain on Sale of Insur. Prem. Finance 101.0 138.2 203.0 29.2 25.3 Non-Interest Revenue, Adjusted 727.5 599.0 704.4 213.1 197.0 Non-Interest Expense Adjustments: 0.0 (12.0)(36.0)0.0 0.0 Software Write-offs (29.6)0.0 (17.8)(13.0)(16.7)Transaction Costs (9.8)0.0 (18.0)(9.8)0.0 Restructuring Expenses (8.0)0.0 0.0 (8.0)0.0 Charitable Contribution 680.1 587.0 632.6 182.3 180.4 Non-Interest Expense, Adjusted 497.8 308.1 349.9 312.2 67.4 PPNR12 296.6 320.0 421.7 94.4 84.0 PPNR12, Adjusted 66.0 (30.0)258.0 34.0 12.0 Provision for Credit Losses 99.3 84.1 25.7 60.9 13.9 Income Tax Expenses (45.4)2.7 15.6 (49.2)3.8 Tax Impact of Adjustments Above 53.9 86.8 41.3 11.8 17.7 Income Tax Expense, Adjusted 332.5 253.9 66.3 217.3 41.4 Net Income 176.8 263.2 122.4 48.6 54.3 Net Income, Adjusted 17.3 18.7 9.8 4.3 4.3 Preferred Stock Dividends 315.2 235.2 56.5 212.9 37.1 Net Income to Common 159.5 244.5 112.6 44.3 50.0 Net Income to Common, Adjusted $32,049.8 $38,140.3 $37,516.2 $30,738.4 $31,813.9 Average Assets 1.04%0.67%0.18%2.80%0.52%Return on Average Assets 0.55%0.69%0.33%0.63%0.68%Return on Average Assets, Adjusted 1.55%0.81%0.93%4.03%0.84%PPNR12 / Average Assets 0.93%0.84%1.12%1.22%1.05%PPNR12, Adjusted / Average Assets $2,783.3 $2,815.7 $2,686.7 $2,755.8 $2,745.0 Average Common Equity 11.33%8.35%2.10%30.66%5.36%Return on Average Common Equity 5.73%8.68%4.19%6.38%7.23%Return on Average Common Equity, Adjusted 51,046,742 51,140,974 50,582,979 50,282,663 50,417,884 Diluted Common Shares $6.18$4.60$1.12$4.23$0.74Earnings per Share $3.13$4.78$2.23$0.88$0.99Earnings per Share, Adjusted

v3.23.2

Document And Entity Information Document

|

Jul. 20, 2023 |

| Entity Information [Line Items] |

|

| Entity Registrant Name |

TEXAS CAPITAL BANCSHARES INC/TX

|

| Entity Emerging Growth Company |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Written Communications |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 20, 2023

|

| Entity Address, Address Line One |

2000 McKinney Avenue

|

| Entity Address, Address Line Two |

Suite 700

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

(214)

|

| Local Phone Number |

932-6600

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity File Number |

001-34657

|

| Entity Tax Identification Number |

75-2679109

|

| Entity Central Index Key |

0001077428

|

| Amendment Flag |

false

|

| Common Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

TCBI

|

| Security Exchange Name |

NASDAQ

|

| Series B Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

5.75% Non-Cumulative Perpetual Preferred Stock Series B, par value $0.01 per share

|

| Trading Symbol |

TCBIO

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |