- Revenue and earnings at the high-end of Q4 guidance

- Revenue of $753 million in Q4’24, up 12% from Q4’23

- Q4 growth driven by strong AI-related demand and improved

broader market dynamics

Teradyne, Inc. (NASDAQ:TER):

Q4'24

Q4'23

Q3'24

FY 2024

FY 2023

Revenue (mil)

$

753

$

671

$

737

$

2,820

$

2,676

GAAP EPS

$

0.90

$

0.72

$

0.89

$

3.32

$

2.73

Non-GAAP EPS

$

0.95

$

0.79

$

0.90

$

3.22

$

2.93

Teradyne, Inc. (NASDAQ: TER) reported revenue of $753 million

for the fourth quarter of 2024 of which $561 million was in

Semiconductor Test and $98 million in Robotics. GAAP net income for

the fourth quarter of 2024 was $146.3 million or $0.90 per diluted

share. On a non-GAAP basis, Teradyne’s net income in the fourth

quarter of 2024 was $155.0 million, or $0.95 per diluted share,

which excluded acquired intangible asset amortization,

restructuring and other charges, amortization on our investment in

Technoprobe, pension mark-to-market, and included the related tax

impact on non-GAAP adjustments.

“Our Q4 results were toward the high end of our guidance range,

driven by demand in our Semi Test business. For the quarter, AI

compute and related memory remained strong while Mobile and

Auto/Industrial exceeded our expectations,” said Teradyne CEO, Greg

Smith. “In 2025, we expect year-over-year revenue acceleration with

improving conditions in our test businesses. We expect the secular

growth opportunities in AI compute and memory to remain, and we

will continue to invest into these areas. Additionally, we plan to

strategically realign our Robotics business to enhance customer

experience and drive operational efficiency. Over the mid-term, we

expect that this realignment will support our growth and

profitability objectives.”

Guidance for the first quarter of 2025 is revenue of $660

million to $700 million, with GAAP net income of $0.48 to $0.59 per

diluted share and non-GAAP net income of $0.58 to $0.68 per diluted

share. Non-GAAP guidance excludes acquired intangible asset

amortization, amortization on our investment in Technoprobe,

restructuring and other costs, as well as the related tax impact on

non-GAAP adjustments.

Note that the Semiconductor Test segment revenue includes the

results of the Integrated Systems Test ("IST") component, with

product lines for system level and hard disk drive testing, that

was previously included in our System Test segment results. IST

contributed $19 million to Semiconductor Test in the fourth

quarter.

Webcast

A conference call to discuss the fourth quarter results, along

with management’s business outlook, will follow at 8:30 a.m. ET,

Thursday, January 30, 2025. Interested investors should access the

webcast at www.teradyne.com and click on "Investors" at least five

minutes before the call begins. Presentation materials will be

available starting at 8:30 a.m. ET. A replay will be available on

the Teradyne website at www.teradyne.com/investors.

Non-GAAP Results

In addition to disclosing results that are determined in

accordance with GAAP, Teradyne also discloses non-GAAP results of

operations that exclude certain income items and charges. These

results are provided as a complement to results provided in

accordance with GAAP. Non-GAAP income from operations and non-GAAP

net income exclude acquired intangible assets amortization,

restructuring and other, pension actuarial gains and losses, stock

compensation modification expense, gains and losses on foreign

exchange options in connection with acquisitions and divestitures,

gain on sale of business, legal settlement, discrete income tax

adjustments, and includes the related tax impact on non-GAAP

adjustments. GAAP requires that these items be included in

determining income from operations and net income. Non-GAAP income

from operations, non-GAAP net income, non-GAAP income from

operations as a percentage of revenue, non-GAAP net income as a

percentage of revenue, and non-GAAP net income per share are

non-GAAP performance measures presented to provide meaningful

supplemental information regarding Teradyne’s baseline performance

before gains, losses or other charges that may not be indicative of

Teradyne’s current core business or future outlook. These non-GAAP

performance measures are used to make operational decisions, to

determine employee compensation, to forecast future operational

results, and for comparison with Teradyne’s business plan,

historical operating results and the operating results of

Teradyne’s competitors. Non-GAAP diluted shares include the impact

of Teradyne’s call option on its shares. Management believes each

of these non-GAAP performance measures provides useful supplemental

information for investors, allowing greater transparency to the

information used by management in its operational decision making

and in the review of Teradyne’s financial and operational

performance, as well as facilitating meaningful comparisons of

Teradyne’s results in the current period compared with those in

prior and future periods. A reconciliation of each available GAAP

to non-GAAP financial measure discussed in this press release is

contained in the attached exhibits and on the Teradyne website at

www.teradyne.com by clicking on “Investor Relations” and then

selecting “Financials” and the “GAAP to Non-GAAP Reconciliation”

link. The non-GAAP performance measures discussed in this press

release may not be comparable to similarly titled measures used by

other companies. The presentation of non-GAAP measures is not meant

to be considered in isolation, as a substitute for, or superior to,

financial measures or information provided in accordance with

GAAP.

About Teradyne

Teradyne (NASDAQ:TER) designs, develops, and manufactures

automated test equipment and advanced robotics systems. Its test

solutions for semiconductors and electronics products enable

Teradyne’s customers to consistently deliver on their quality

standards. Its advanced robotics business includes collaborative

robots and mobile robots that support manufacturing and warehouse

operations for companies of all sizes. For more information, visit

teradyne.com. Teradyne® is a registered trademark of Teradyne,

Inc., in the U.S. and other countries.

Safe Harbor Statement

This release contains forward-looking statements including

statements regarding Teradyne’s future business prospects,

financial performance or position and results of operations. You

can identify forward-looking statements by their use of

forward-looking words such as “anticipate,” “expect,” “plan,”

“could,” “may,” “will,” “believe,” “estimate,” “goal” or other

comparable terms. Forward-looking statements in this press release

address various matters, including statements regarding Teradyne’s

financial guidance. Investors are cautioned that such

forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from the

forward-looking statements due to known and unknown risks,

uncertainties, assumptions, and other factors. Such factors

include, but are not limited to, macroeconomic factors and

slowdowns or downturns in economic conditions generally and in the

markets in which Teradyne operates; decreased or delayed product

demand from one or more significant customers; a slowdown or

inability in the development, delivery and acceptance of new

products; the ability to grow the Robotics business; the impact of

increased research and development spending; the impact of

epidemics or pandemics such as COVID-19; the impact of a supply

shortage on our supply chain and contract manufacturers; the

consummation and success of any mergers or acquisitions; unexpected

cash needs; the business judgment of the board of directors that a

declaration of a dividend or the repurchase of common stock is not

in Teradyne’s best interests; changes to U.S. or global tax

regulations or guidance; the impact of any tariffs or export

controls imposed by the U.S. or China; the impact of U.S.

Department of Commerce or other government agency regulations

relating to Huawei, HiSilicon and other customers or potential

customers; the impact of U.S. Department Commerce export control

regulations for certain U.S. products and technology sold to

military end users or for military end-use in China; the impact of

the current conflicts in Israel; the impact of regulations

published by the U.S. Department of Commerce relating to

semiconductors and semiconductor manufacturing equipment destined

for certain end uses in China.

The risks included above are not exhaustive. For a more detailed

description of the risk factors associated with Teradyne, please

refer to Teradyne’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023. Many of these factors are macroeconomic in

nature and are, therefore, beyond Teradyne’s control. We caution

readers not to place undue reliance on any forward-looking

statements included in this press release which speak only as to

the date of this press release. Teradyne specifically disclaims any

obligation to update any forward-looking information contained in

this press release or with respect to the announcements described

herein.

TERADYNE, INC. REPORT FOR FOURTH FISCAL

QUARTER OF 2024

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

Quarter Ended

Year Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net revenues

$

752,884

$

737,298

$

670,600

$

2,819,880

$

2,676,298

Cost of revenues (exclusive of acquired

intangible assets amortization shown separately below) (1)

305,597

300,784

291,055

1,170,953

1,139,550

Gross profit

447,287

436,514

379,545

1,648,927

1,536,748

Operating expenses:

Selling and administrative (2)

155,739

157,649

142,336

617,047

577,315

Engineering and development

128,387

117,474

102,207

460,876

418,089

Acquired intangible assets

amortization

4,656

4,748

4,651

18,764

18,999

Restructuring and other (3)

4,554

4,578

6,027

15,571

21,277

Loss (gain) on sale of business (4)

367

—

—

(57,119

)

—

Operating expenses

293,703

284,449

255,221

1,055,139

1,035,680

Income from operations

153,584

152,065

124,324

593,788

501,068

Interest and other (income) expense

(5)

(4,213

)

(6,919

)

(15,482

)

(15,298

)

(24,504

)

Income before income taxes and equity in

net earnings of affiliate

157,797

158,984

139,806

609,086

525,572

Income tax provision

5,408

12,260

22,752

59,503

76,820

Income before equity in net earnings of

affiliate

152,389

146,724

117,054

549,583

448,752

Equity in net earnings of affiliate

(6,136

)

(1,075

)

—

(7,211

)

—

Net income

$

146,253

$

145,649

$

117,054

$

542,372

$

448,752

Net income per

common share:

Basic

$

0.90

$

0.89

$

0.77

$

3.41

$

2.91

Diluted

$

0.90

$

0.89

$

0.72

$

3.32

$

2.73

Weighted average common shares - basic

162,478

163,002

152,812

159,083

154,310

Weighted average common shares - diluted

(6)

163,184

164,253

162,106

163,314

164,304

Cash dividend declared per common

share

$

0.12

$

0.12

$

0.11

$

0.48

$

0.44

(1)

Cost of revenues includes:

Quarter Ended

Year Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Provision for excess and obsolete

inventory

$

3,406

$

6,078

$

5,289

$

18,921

$

28,358

Legal settlement

—

3,600

—

3,600

—

Sale of previously written down

inventory

(441

)

(472

)

(1,115

)

(2,227

)

(5,161

)

$

2,965

$

9,206

$

4,174

$

20,294

$

23,197

(2)

For the twelve months ended December 31,

2024, selling and administrative expenses included an equity charge

of $1.7 million for the modification of Teradyne executives'

retirement agreements. For the twelve months ended December 31,

2023, selling and administrative expenses included an equity charge

of $5.9 million for the modification of Teradyne’s retired CEO’s

outstanding equity awards in connection with his February 1, 2023,

retirement.

(3)

Restructuring and other consists of:

Quarter Ended

Year Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Lease terminations

$

1,284

$

—

$

—

$

1,284

$

—

Employee severance

378

1,280

2,892

5,234

14,727

Acquisition and divestiture related

expenses

—

—

3,132

2,214

3,132

Contract termination

—

—

—

—

1,511

Other

2,892

3,298

3

6,840

1,907

$

4,554

$

4,578

$

6,027

$

15,572

$

21,277

(4)

On May 27, 2024, Teradyne sold Teradyne's

Device Interface Solution ("DIS") business, a component of the

Semiconductor Test segment, to Technoprobe S.p.A. ("Technoprobe"),

for $85.0 million, net of cash and cash equivalents sold and a

working capital adjustment.

(5)

Interest and other includes:

Quarter Ended

Year Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Pension actuarial losses (gains)

$

(1,842

)

$

(2,262

)

$

2,575

$

(4,355

)

$

2,703

Loss (gain) on foreign exchange option

—

—

(7,464

)

9,765

(7,464

)

(6)

Under GAAP, when calculating diluted

earnings per share, convertible debt must be assumed to have

converted if the effect on EPS would be dilutive. Diluted shares

assume the conversion of the convertible debt as the effect would

be dilutive. Accordingly, for the quarter ended December 31, 2023,

0.2 million shares have been included in diluted shares. For the

twelve months ended December 31, 2023, 0.6 million shares have been

included in diluted shares. For the quarters ended September 29,

2024, and December 31, 2023, diluted shares included 0.5 million,

and 8.6 million shares, respectively, from the convertible note

hedge transaction. For the twelve months ended December 31, 2024,

and December 31, 2023, diluted shares included 3.6 million and 8.9

million shares, respectively, from the convertible note hedge

transaction.

CONDENSED CONSOLIDATED BALANCE SHEETS (In

thousands)

December 31, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

553,354

$

757,571

Marketable securities

46,312

62,154

Accounts receivable, net

471,426

422,124

Inventories, net

298,492

309,974

Prepayments

429,086

548,970

Other current assets

17,727

37,992

Current assets held for sale

—

23,250

Total current assets

1,816,397

2,162,035

Property, plant and equipment, net

508,171

445,492

Operating lease right-of-use assets,

net

70,185

73,417

Marketable securities

124,121

117,434

Deferred tax assets

222,438

175,775

Retirement plans assets

11,994

11,504

Equity method investment

494,494

—

Other assets

49,620

38,580

Acquired intangible assets, net

15,927

35,404

Goodwill

395,367

415,652

Assets held for sale

—

11,531

Total assets

$

3,708,714

$

3,486,824

Liabilities

Accounts payable

$

134,792

$

180,131

Accrued employees’ compensation and

withholdings

204,991

191,750

Deferred revenue and customer advances

107,710

99,804

Other accrued liabilities

90,777

114,712

Operating lease liabilities

18,699

17,522

Income taxes payable

67,610

48,653

Current liabilities held for sale

—

7,379

Total current liabilities

624,579

659,951

Retirement plans liabilities

133,338

132,090

Long-term deferred revenue and customer

advances

40,505

37,282

Long-term other accrued liabilities

7,442

19,998

Deferred tax liabilities

1,038

183

Long-term operating lease liabilities

57,922

65,092

Long-term income taxes payable

24,596

44,331

Liabilities held for sale

—

2,000

Total liabilities

889,420

960,927

Shareholders’ equity

2,819,294

2,525,897

Total liabilities and shareholders’

equity

$

3,708,714

$

3,486,824

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands)

Quarter Ended

Twelve Months Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Cash flows from operating activities:

Net income

$

146,253

$

117,054

$

542,372

$

448,752

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

26,497

23,260

100,977

92,118

Stock-based compensation

14,855

12,443

60,122

57,682

Equity in net earnings of affiliate

6,136

—

7,211

—

Amortization

4,631

4,685

18,764

18,768

Provision for excess and obsolete

inventory

3,406

5,289

18,922

28,358

Loss (gain) on sale of business

367

—

(57,119

)

—

Deferred taxes

(20,099

)

(13,616

)

(46,360

)

(37,642

)

Retirement plan actuarial losses

(gains)

(1,842

)

2,575

(4,355

)

2,703

Losses (gains) on investments

(83

)

(11,756

)

10,056

(14,915

)

Other

2,751

(811

)

(2,290

)

(955

)

Changes in operating assets and

liabilities

Accounts receivable

12,607

40,786

(52,659

)

70,977

Inventories

(2,420

)

(1,068

)

8,707

5,327

Prepayments and other assets

58,016

20,881

119,454

(43,101

)

Accounts payable and other liabilities

9,279

42,783

(54,386

)

46,782

Deferred revenue and customer advances

8,552

(7,693

)

12,176

(57,210

)

Retirement plans contributions

(1,645

)

(1,794

)

(5,814

)

(5,492

)

Income taxes

15,296

15,762

(3,602

)

(26,921

)

Net cash provided by operating

activities

282,557

248,780

672,176

585,231

Cash flows from investing activities:

Purchases of property, plant and

equipment

(57,385

)

(44,336

)

(198,095

)

(159,642

)

Purchases of marketable securities

(10,700

)

(24,120

)

(45,796

)

(161,906

)

Purchases of investments in businesses

(5,000

)

—

(532,060

)

—

Issuance of convertible loan

—

—

—

(5,000

)

Proceeds from maturities of marketable

securities

5,190

13,595

38,353

85,042

Proceeds from sales of marketable

securities

436

24,438

24,035

61,401

Proceeds from the sale of a business, net

of cash and cash equivalents sold

—

—

90,348

—

Proceeds from life insurance

—

—

873

460

Net cash used for investing activities

(67,459

)

(30,423

)

(622,342

)

(179,645

)

Cash flows from financing activities:

Repurchase of common stock

(143,521

)

(50,749

)

(198,574

)

(397,241

)

Dividend payments

(19,487

)

(16,797

)

(76,423

)

(67,878

)

Payments related to net settlement of

employee stock compensation awards

(267

)

(202

)

(14,100

)

(20,788

)

Payments of borrowings on revolving credit

facility

—

—

(185,000

)

—

Payments of convertible debt principal

—

(23,529

)

—

(50,264

)

Proceeds from borrowings on revolving

credit facility

—

—

185,000

—

Issuance of common stock under stock

purchase and stock option plans

65

175

37,330

34,259

Net cash used for financing activities

(163,210

)

(91,102

)

(251,767

)

(501,912

)

Effects of exchange rate changes on cash

and cash equivalents

(8,570

)

(6,645

)

(2,284

)

(876

)

Increase (decrease) in cash and cash

equivalents

43,318

120,610

(204,217

)

(97,202

)

Cash and cash equivalents at beginning of

period

510,036

636,961

757,571

854,773

Cash and cash equivalents at end of

period

$

553,354

$

757,571

$

553,354

$

757,571

GAAP to Non-GAAP Earnings

Reconciliation

(In millions, except per share

amounts)

Quarter Ended

December 31, 2024

% of Net Revenues

September 29, 2024

% of Net Revenues

December 31, 2023

% of Net Revenues

Net revenues

$

752.9

$

737.3

$

670.6

Gross profit - GAAP

447.3

59.4

%

436.5

59.2

%

379.5

56.6

%

Legal settlement (1)

—

—

3.6

0.5

%

—

—

Gross profit - non-GAAP

447.3

59.4

%

440.1

59.7

%

379.5

56.6

%

Income from operations - GAAP

153.6

20.4

%

152.1

20.6

%

124.3

18.5

%

Acquired intangible assets

amortization

4.7

0.6

%

4.7

0.6

%

4.7

0.7

%

Restructuring and other (2)

4.6

0.6

%

4.6

0.6

%

6.0

0.9

%

Legal settlement (1)

—

—

3.6

0.5

%

—

—

Loss (Gain) on sale of business (3)

0.4

0.0

%

—

—

—

—

Income from operations - non-GAAP

$

163.2

21.7

%

$

165.0

22.4

%

$

135.0

20.1

%

Net Income per Common

Share

Net Income per Common

Share

Net Income per Common

Share

December 31, 2024

% of Net Revenues

Basic

Diluted

September 29, 2024

% of Net Revenues

Basic

Diluted

December 31, 2023

% of Net Revenues

Basic

Diluted

Net income - GAAP

$

146.3

19.4

%

$

0.90

$

0.90

$

145.6

19.7

%

$

0.89

$

0.89

$

117.1

17.5

%

$

0.77

$

0.72

Amortization of equity method

investment

8.0

1.1

%

0.05

0.05

2.4

0.3

%

0.01

0.01

—

—

—

—

Acquired intangible assets

amortization

4.7

0.6

%

0.03

0.03

4.7

0.6

%

0.03

0.03

4.7

0.7

%

0.03

0.03

Restructuring and other (2)

4.6

0.6

%

0.03

0.03

4.6

0.6

%

0.03

0.03

6.0

0.9

%

0.04

0.04

Loss (gain) on sale of business (3)

0.4

0.1

%

0.00

0.00

—

—

—

—

—

—

—

—

Legal settlement (1)

—

—

—

—

3.6

0.5

%

0.02

0.02

—

—

—

—

Loss (gain) on foreign exchange option

—

—

—

—

—

—

—

—

(7.5

)

-1.1

%

—

(0.05

)

Pension mark-to-market adjustment (4)

(1.8

)

-0.2

%

(0.01

)

(0.01

)

(2.3

)

-0.3

%

(0.01

)

(0.01

)

2.6

0.4

%

0.02

0.02

Exclude discrete tax adjustments

(8.0

)

-1.1

%

(0.05

)

(0.05

)

(8.9

)

-1.2

%

(0.05

)

(0.05

)

3.3

0.5

%

0.02

0.02

Non-GAAP tax adjustments

0.9

0.1

%

0.01

0.01

(2.1

)

-0.3

%

(0.01

)

(0.01

)

1.0

0.1

%

0.01

0.01

Net income - non-GAAP

$

155.0

20.6

%

$

0.95

$

0.95

$

147.6

20.0

%

$

0.91

$

0.90

$

127.2

19.0

%

$

0.83

$

0.79

GAAP and non-GAAP weighted average common

shares - basic

162.5

163.0

152.8

GAAP weighted average common shares -

diluted (6)

163.2

164.3

162.1

Exclude dilutive shares related to

convertible note transaction

—

—

(0.2

)

Non-GAAP weighted average common shares -

diluted

163.2

164.3

161.9

(1)

For the quarter ended September 29, 2024,

legal settlement includes charges for a settlement following a

judgment against the Company for infringement of expired

patents.

(2)

Restructuring and other consists of:

Quarter Ended

December 31, 2024

September 29, 2024

December 31, 2023

Lease terminations

$

1.3

$

—

$

—

Employee severance

0.4

1.3

2.9

Acquisition and divestiture related

expenses

—

—

3.1

Other

2.9

3.3

—

$

4.6

$

4.6

$

6.0

(3)

On May 27, 2024, Teradyne sold DIS, a

component of the Semiconductor Test segment, to Technoprobe, for

$85.0 million, net of cash and cash equivalents sold and a working

capital adjustment.

(4)

For the quarters ended December 31, 2024,

September 29, 2024, and December 31, 2023, adjustments to exclude

actuarial gains and losses, respectively, recognized under GAAP in

accordance with Teradyne’s mark-to-market pension accounting.

(5)

For the quarters ended September 29, 2024,

and December 31, 2023, non-GAAP weighted average diluted common

shares included 0.5 million and 8.6 million shares, respectively,

from the convertible note hedge transaction.

Twelve Months Ended

December 31, 2024

% of Net Revenues

December 31, 2023

% of Net Revenues

Net Revenues

$

2,819.9

$

2,676.3

Gross profit - GAAP

1,648.9

58.5

%

1,536.7

57.4

%

Legal settlement (1)

3.6

0.1

%

—

—

Gross profit - non-GAAP

1,652.5

58.6

%

1,536.7

57.4

%

Income from operations - GAAP

593.8

21.1

%

501.1

18.7

%

Acquired intangible assets

amortization

18.8

0.7

%

19.0

0.7

%

Restructuring and other (2)

15.6

0.6

%

21.3

0.8

%

Legal settlement (1)

3.6

0.1

%

—

—

Equity modification charge (3)

1.7

0.1

%

5.9

0.2

%

Loss (gain) on sale of business (4)

(57.1

)

-2.0

%

—

—

Income from operations - non-GAAP

$

576.3

20.4

%

$

547.3

20.4

%

Net Income per Common

Share

Net Income per Common

Share

December 31, 2024

% of Net Revenues

Basic

Diluted

December 31, 2023

% of Net Revenues

Basic

Diluted

Net income - GAAP

$

542.4

19.2

%

$

3.39

$

3.32

$

448.8

16.8

%

$

2.91

$

2.73

Acquired intangible assets

amortization

18.8

0.7

%

0.12

0.11

19.0

0.7

%

0.12

0.12

Restructuring and other (2)

15.6

0.6

%

0.10

0.10

21.8

0.8

%

0.14

0.13

Amortization of equity method

investment

10.4

0.4

%

0.07

0.06

—

—

—

—

Loss (gain) on foreign exchange option

9.8

0.3

%

0.06

0.06

(7.5

)

-0.3

%

(0.05

)

(0.05

)

Legal settlement (1)

3.6

0.1

%

0.02

0.02

—

—

—

—

Equity modification charge (3)

1.7

0.1

%

0.01

0.01

5.9

0.2

%

0.04

0.04

Pension mark-to-market adjustment (5)

(4.4

)

-0.2

%

(0.03

)

(0.03

)

2.7

0.1

%

0.02

0.02

Loss (gain) on sale of business (4)

(57.1

)

-2.0

%

(0.36

)

(0.35

)

—

—

—

—

Exclude discrete tax adjustments

(8.7

)

-0.3

%

(0.05

)

(0.05

)

(3.4

)

-0.1

%

(0.02

)

(0.02

)

Non-GAAP tax adjustments

(6.9

)

-0.2

%

(0.04

)

(0.04

)

(7.7

)

-0.3

%

(0.05

)

(0.05

)

Convertible share adjustment (6)

—

—

—

—

—

—

—

0.01

Net income - non-GAAP

$

525.1

18.6

%

$

3.29

$

3.22

$

479.6

17.9

%

$

3.11

$

2.93

GAAP and non-GAAP weighted average common

shares - basic

159.8

154.3

GAAP weighted average common shares -

diluted (6)

163.3

164.3

Exclude dilutive shares from convertible

note

—

(0.6

)

Non-GAAP weighted average common shares -

diluted

163.3

163.7

(1)

For the twelve months ended December 31,

2024, a legal settlement includes charges for a settlement

following a judgment against the Company for infringement of

expired patents.

(2)

Restructuring and other consists of:

Twelve Months Ended

December 31, 2024

December 31, 2023

Employee severance

$

5.2

$

14.8

Acquisition and divestiture related

expenses

2.2

3.1

Lease terminations

1.3

—

Contract termination

—

1.5

Other

6.8

1.9

$

15.6

$

21.3

(3)

For the twelve months ended December 31,

2024, selling and administrative expenses included an equity charge

of $1.7 million for the modification of Teradyne’s executives'

retirement agreements. For the twelve months ended December 31,

2023, selling and administrative expenses included an equity charge

of $5.9 million for the modification of Teradyne’s retired CEO’s

outstanding equity awards in connection with his February 1, 2023,

retirement.

(4)

On May 27, 2024, Teradyne sold DIS, a

component of the Semiconductor Test segment, to Technoprobe, for

$85.0 million, net of cash and cash equivalents sold and a working

capital adjustment.

(5)

For twelve months ended December 31, 2024,

and December 31, 2023, adjustments to exclude actuarial gains and

losses, respectively, recognized under GAAP in accordance with

Teradyne’s mark-to-market pension accounting.

(6)

For the twelve months ended December 31,

2024 and December 31, 2023, non-GAAP weighted average diluted

common shares included 3.6 million and 8.9 million shares,

respectively, from the convertible note hedge transaction.

GAAP to Non-GAAP Reconciliation of First Quarter 2025

guidance:

GAAP and non-GAAP first quarter revenue

guidance:

$660 million

to

$700 million

GAAP net income per diluted share

$

0.48

$

0.59

Exclude acquired intangible assets

amortization

0.03

0.03

Exclude restructuring and other

charges

0.03

0.03

Exclude equity method investment

amortization

0.05

0.05

Non-GAAP tax adjustments

(0.01

)

(0.01

)

Non-GAAP net income per diluted share

$

0.58

$

0.68

For press releases and other information of interest to

investors, please visit Teradyne’s homepage at

http://www.teradyne.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128031178/en/

Teradyne, Inc. Traci Tsuchiguchi 978-370-2444 Vice President of

Corporate Relations

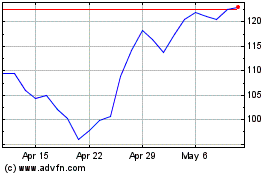

Teradyne (NASDAQ:TER)

Historical Stock Chart

From Dec 2024 to Jan 2025

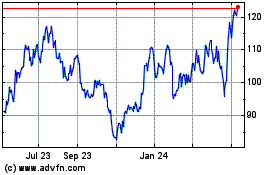

Teradyne (NASDAQ:TER)

Historical Stock Chart

From Jan 2024 to Jan 2025