TenX Keane Acquisition (Nasdaq: TENKU, TENK, TENKR) (the “TenX”), a

publicly traded special purpose acquisition company, today

announced that on August 2, 2024, at the extraordinary general

meeting, its shareholders voted to approve the previously announced

business combination with the wholly owned oncology subsidiary of

Citius Pharmaceuticals, Inc. (“Citius Pharma”) (Nasdaq: CTXR), a

late-stage biopharmaceutical company dedicated to the development

and commercialization of first-in-class critical care products. The

newly combined public company will continue to trade on the Nasdaq

stock exchange and is to be renamed Citius Oncology, Inc. (“Citius

Oncology”).

The transaction has been unanimously approved by

the Board of Directors of TenX, Citius Pharma, and Citius Pharma’s

oncology subsidiary. Subject to certain contractual as well as

customary closing conditions, the merger is expected to be

completed in the coming weeks.

The transaction is expected to provide Citius

Oncology with improved access to the public equity markets, support

the commercialization of LYMPHIR, if approved, and position the

company to explore additional targeted oncology opportunities.

About the Merger

Pursuant to the business combination agreement,

TenX will acquire Citius Pharma’s wholly owned subsidiary via a

merger, with the newly combined publicly traded company to be named

Citius Oncology, Inc. In the transaction, all shares of Citius

Pharma’s wholly owned subsidiary will be converted into the right

to receive common stock of the new public company, Citius Oncology.

As a result, upon closing, Citius Pharma will hold approximately

65.6 million shares of common stock of Citius Oncology which will

represent approximately 90% of the new public company. As part of

the transaction, Citius Pharma will contribute up to $10 million in

cash to Citius Oncology. An additional 12.75 million existing

options will be assumed by Citius Oncology from Citius Pharma’s

subsidiary.

The description of the transaction contained

herein is only a summary and is qualified in its entirety by

reference to the business combination agreement, a copy of which

has been filed by TenX in a Current Report on Form 8-K, filed with

the U.S. Securities and Exchange Commission on October 24,

2023.

Advisors

Newbridge Securities Corporation is acting as

exclusive financial advisor to TenX and Maxim Group LLC is acting

as exclusive financial advisor to Citius Pharma. The Crone Law

Group, P.C., Han Kun Law Offices, Ogier are acting as U.S., PRC,

and Cayman legal advisors to TenX, respectively. Wyrick Robbins

Yates & Ponton LLP is acting as legal advisor to Citius Pharma

and Citius Oncology.

About TenX Keane

Acquisition

TenX Keane Acquisition is a blank check company,

also commonly referred to as a special purpose acquisition company

(SPAC) formed for the purpose of effecting a merger, share

exchange, asset acquisition, share purchase, reorganization, or

similar business combination with one or more businesses or

entities. TenX is led by Xiaofeng Yuan, Chairman and Chief

Executive Officer, and Taylor Zhang, Chief Financial Officer, who

are growth-oriented executives with a long track record of value

creation across industries.

About Citius Oncology, Inc.

Citius Oncology will serve as a platform to

develop and commercialize novel targeted oncology therapies. The

company is seeking approval from the U.S. Food and Drug

Administration (FDA) of LYMPHIR™ for an orphan indication in the

treatment of persistent or recurrent cutaneous T-cell lymphoma

(CTCL), a rare form of non-Hodgkin lymphoma. Management estimates

the initial market for LYMPHIR currently exceeds $400 million, is

growing and is underserved by existing therapies. Robust

intellectual property protections that span orphan drug

designation, complex technology, trade secrets and pending patents

for immuno-oncology use as a combination therapy with checkpoint

inhibitors would further support Citius Oncology’s competitive

positioning.

About LYMPHIR™

(denileukin diftitox-cxdl)

LYMPHIR is a specially engineered IL-2-

diphtheria toxin fusion protein made using recombinant DNA

technology. It works by targeting cells that have IL-2 receptors

with a toxin derived from diphtheria bacteria. Once inside the

cell, this toxin stops the cell from making proteins, which leads

to cell death. LYMPHIR has two main effects. It directly kills

tumor cells by binding to the IL-2 receptors and internalizing the

diphtheria toxin directly into the tumor cells, causing them to

die. Additionally, it boosts the body’s immune response by

transiently reducing the number of regulatory T-cells (Tregs) that

suppress the immune system, thereby enhancing the body’s ability to

fight the tumor. If approved, LYMPHIR would be unique as the only

IL-2 receptor targeted CTCL therapy, offering a novel option to

patients cycling through multiple treatments.

In 2011 and 2013, the FDA granted orphan drug

designation to LYMPHIR for the treatment of peripheral T-cell

lymphoma (PTCL) and CTCL, respectively. In 2021, denileukin

diftitox received regulatory approval in Japan for the treatment of

CTCL and PTCL. Subsequently in 2021, Citius Pharma acquired an

exclusive license with rights to develop and commercialize LYMPHIR

in all markets except for Japan and certain parts of Asia. The FDA

is reviewing a Biologics License Application (BLA) for LYMPHIR and

has set August 13, 2024, as the PDUFA target action date.

Additional value-creating opportunities in larger markets include

potential indications in peripheral T-cell lymphoma or as a

combination therapy with CAR-T and PD-1 inhibitors, and in markets

outside the U.S. Currently, two investigator-initiated trials are

underway to explore LYMPHIR’s potential as an immuno-oncology

combination therapy.

About Citius Pharmaceuticals,

Inc.

Citius Pharma is a late-stage biopharmaceutical

company dedicated to the development and commercialization of

first-in-class critical care products. The Company's diversified

pipeline includes two late-stage product candidates. In May 2024,

Citius Pharma announced positive topline data of Mino-Lok®, its

antibiotic lock solution to salvage catheters in patients with

catheter-related bloodstream infections. Following the expected

merger of Citius Oncology and TenX, Citius Pharma would hold

approximately 90% of Citius Oncology, a standalone publicly traded

company, with LYMPHIR as its primary asset. In addition, Citius

Pharma completed enrollment in its Phase 2b trial of CITI-002

(Halo-Lido), a topical formulation for the relief of hemorrhoids.

For more information, please visit www.citiuspharma.com.

Forward-Looking Statements

This press release may contain "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such statements are made based on our expectations and beliefs

concerning future events impacting TenX. You can identify these

statements by the fact that they use words such as "will,"

"anticipate," "estimate," "expect," "plan," "should," and "may" and

other words and terms of similar meaning or use of future dates.

Forward-looking statements are based on management's current

expectations and are subject to risks and uncertainties that could

negatively affect our business, operating results, financial

condition and stock price. Factors that could cause actual results

to differ materially from those currently anticipated are: the

planned transaction between TenX Keane Acquisition and Citius

Pharma to form Citius Oncology may not be completed for failure to

meet closing conditions or other reasons; the anticipated benefits

of the transaction may not be realized fully, if at all, or may

take longer to realize than expected; the FDA may not approve

LYMPHIR; risks relating to the results of research and development

activities, including those from our existing and any new pipeline

assets; the need for substantial additional funds; the ability to

commercialize products if approved by the FDA; the dependence on

third-party suppliers; the estimated markets for product candidates

and the acceptance thereof by any market; the ability of product

candidates to impact the quality of life of target patient

populations; the ability to obtain, perform under and maintain

financing and strategic agreements and relationships; uncertainties

relating to preclinical and clinical testing; the early stage of

products under development; market and other conditions; risks

related to our growth strategy; patent and intellectual property

matters; our ability to identify, acquire, close and integrate

product candidates and companies successfully and on a timely

basis; government regulation; competition; as well as other risks

described in our SEC filings. These may be further impacted by any

future public health risks or geopolitical events. Accordingly,

these forward-looking statements do not constitute guarantees of

future performance, and you are cautioned not to place undue

reliance on these forward-looking statements. Risks regarding our

business are described in detail in our Securities and Exchange

Commission (“SEC”) filings which are available on the SEC’s website

at www.sec.gov, including in our Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the SEC on April 16, 2024,

and updated by our subsequent filings with the SEC. These

forward-looking statements speak only as of the date hereof, and we

expressly disclaim any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in our expectations or any

changes in events, conditions or circumstances on which any such

statement is based, except as required by law.

Investor Contact:

Taylor Zhangtarget@TenXkeane.com

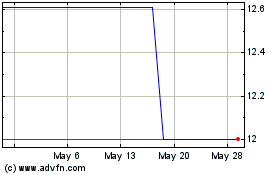

TenX Keane Acquisition (NASDAQ:TENKU)

Historical Stock Chart

From Nov 2024 to Dec 2024

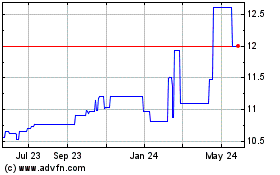

TenX Keane Acquisition (NASDAQ:TENKU)

Historical Stock Chart

From Dec 2023 to Dec 2024