Syros Announces Pricing of $45.0 million Underwritten Offering of Common Stock and Pre-Funded Warrants

December 19 2023 - 7:27AM

Business Wire

Syros Pharmaceuticals (NASDAQ: SYRS), a biopharmaceutical

company committed to advancing new standards of care for the

frontline treatment of hematologic malignancies, announced today

that it has priced an underwritten offering of 4,939,591 shares of

common stock at an offering price of $4.42 per share, and, in lieu

of common stock to investors who so choose, pre-funded warrants to

purchase 5,242,588 shares of its common stock at an offering price

of $4.419 per pre-funded warrant, which would result in total gross

proceeds of approximately $45.0 million, before underwriting

discounts and commissions and offering expenses payable by Syros.

All shares and pre-funded warrants are being offered by Syros.

Closing of the offering is expected to occur on or about December

21, 2023, subject to customary closing conditions.

The financing included new and existing investors, including

Bain Capital Life Sciences, Syros co-founder and founding investor

Flagship Pioneering, Adage Capital Partners LP, Invus, Samsara

BioCapital, Deep Track Capital, Blue Owl Healthcare Opportunities,

DAFNA Capital Management LLC, as well as a life sciences-focused

investment fund.

TD Cowen and Piper Sandler & Co. are acting as joint

book-running managers for the offering.

The offering is being made pursuant to a shelf registration

statement that was filed with the Securities and Exchange

Commission (“SEC”) on April 6, 2023 and declared effective by the

SEC on April 28, 2023. The offering will be made only by means of

the prospectus and prospectus supplement that form a part of the

registration statement.

The final terms of the offering will be disclosed in a

prospectus supplement to be filed with the SEC. Copies of the

prospectus supplement and the accompanying prospectus relating to

this offering, when available, can be obtained from Cowen and

Company, LLC, 599 Lexington Avenue, New York, NY 10022, by

telephone at (833) 297-2926, or by email at

Prospectus_ECM@cowen.com or from Piper Sandler & Co.,

Attention: Prospectus Department, 800 Nicollet Mall, J12S03,

Minneapolis, MN 55402, by telephone at 800-747-3924, or by email:

prospectus@psc.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Syros Pharmaceuticals

Syros is committed to developing new standards of care for the

frontline treatment of patients with hematologic malignancies.

Driven by the motivation to help patients with blood disorders that

have largely eluded other targeted approaches, Syros is developing

tamibarotene, an oral selective RARα agonist in frontline patients

with higher-risk myelodysplastic syndrome and acute myeloid

leukemia with RARA gene overexpression.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of The Private Securities Litigation Reform Act of

1995, including without limitation statements regarding the

consummation of the offering as well as the gross proceeds from the

offering and the anticipated uses of such proceeds. The words,

without limitation, ‘‘anticipate,’’ ‘‘believe,’’ ‘‘continue,’’

‘‘could,’’ ‘‘estimate,’’ ‘‘expect,’’ “hope,” ‘‘intend,’’ ‘‘may,’’

‘‘plan,’’ ‘‘potential,’’ ‘‘predict,’’ ‘‘project,’’ ‘‘target,’’

‘‘should,’’ ‘‘would,’’ and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Actual

results or events could differ materially from the plans,

intentions and expectations disclosed in these forward-looking

statements as a result of various important factors including,

without limitation, risks and uncertainties related to the

satisfaction of customary closing conditions related to the

offering and the impact of general economic, industry or political

conditions in the United States or internationally. There can be no

assurance that Syros will be able to complete the offering on the

anticipated terms, or at all. Additional risks and uncertainties

relating to the offering, Syros and its business can be found under

the caption “Risk Factors” in Syros’ Annual Report on Form 10-K for

the year ended December 31, 2022 and Quarterly Reports on Form 10-Q

for the quarters ended March 31, 2023, June 30, 2023 and September

30, 2023, each of which is on file with the Securities and Exchange

Commission; and risks described in other filings that Syros makes

with the Securities and Exchange Commission in the future.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231218719088/en/

Syros Contact: Karen Hunady Director of Corporate

Communications & Investor Relations 1-857-327-7321 khunady@syros.com

Investor Contact: Hannah Deresiewicz Stern Investor

Relations, Inc. 212-362-1200 hannah.deresiewicz@sternir.com

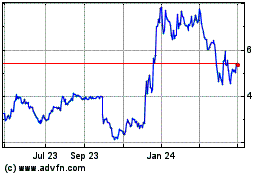

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Dec 2024 to Jan 2025

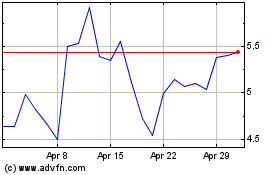

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Jan 2024 to Jan 2025