Synchronoss Technologies, Inc.

(“Synchronoss” or the “Company”) (Nasdaq: SNCR), a

global leader and innovator in personal Cloud platforms, today

announced the retirement of its outstanding Series B Perpetual

Non-Convertible Preferred Stock (the “Series B Preferred”) and

$19.7 million of its outstanding 8.375% Senior Notes due 2026

(“Senior Notes”) funded by a new $75.0 million term loan with

alternative credit manager AS Birch Grove. This financing is

intended to serve as the first step in a larger strategic plan

designed to significantly enhance the Company’s financial position,

capital structure, cash generation capabilities, and operational

flexibility.

Once complete, the Company expects these actions

to reduce its total outstanding net debt, inclusive of its retired

Series B Preferred, by approximately $7.3 million in addition to

creating nearly $10.6 million in projected pre-tax cost savings

over the life of the term loan.

With the proceeds of the financing, Synchronoss

intends to repurchase the remaining 60,826 shares of its

outstanding Series B Preferred held by a subsidiary of B. Riley

Financial, Inc. (Nasdaq: RILY) (“B. Riley”). The Company has agreed

to repurchase the Series B Preferred for an aggregate purchase

price of $52.6 million (the “Series B Repurchase”). In addition to

eliminating the $60.8 million liquidation preference of the Series

B Preferred, this Series B Repurchase also reduces cost of capital

from 14% to SOFR+550 basis points per annum, resulting in annual

pre-tax cost savings of over $2.0 million.

Additionally, with the remaining proceeds from

the term loan, Synchronoss intends to repurchase approximately

$19.7 million in principal of its 8.375% Senior Notes due 2026

(“Senior Notes”) from an affiliate of B. Riley for a total purchase

price of $16.5 million, to pay transaction fees and expenses

associated with the financing, and for general corporate

purposes.

Synchronoss believes that these measures

collectively strengthen the capital structure of the Company and

they are expected to be additive to the steps previously taken to

position the Company to generate material free cash flows in 2024

and beyond.

Jeff Miller, CEO of Synchronoss Technologies

Inc., stated, “Today’s announcement marks another major step in our

ongoing evolution as we transform the business into a sustainably

profitable and increasingly cash generative enterprise. Our ability

to secure this financing from our new lending partner AS Birch

Grove reflects the strong financial health of our Company and

enables us to materially enhance our balance sheet through our

combined capital structure improvements. We are also grateful to B.

Riley for their strategic support over the past three years as our

largest shareholder, which has been integral to our transformation

strategy, and we look forward to their continued support.”

Scott Cragg, Partner at AS Birch Grove, added,

“We are excited to partner with Synchronoss and are impressed by

the Company’s successful transformation into a pure-play global

Cloud solutions provider. We are pleased to support the continued

evolution of the Company’s industry-leading platform and execution

of growth opportunities with both existing and future

customers.”

TD Cowen acted as Exclusive Financial Advisor to

Synchronoss. Gunderson Dettmer Stough Villeneuve Franklin &

Hachigian, LLP served as legal counsel to Synchronoss. Cahill

Gordon & Reindel LLP served as legal counsel to AS Birch

Grove.

About AS Birch GroveAS Birch

Grove manages approximately $8 billion in assets across

Multi-Strategy Credit, CLOs and Private Credit strategies. The firm

was formed in 2021 through the merger of American Securities credit

business and Birch Grove Capital. Birch Grove’s private credit

funds focus on providing solution capital to middle market

companies in transition and maintain a flexible mandate with the

ability to support a wide variety of capital structures to enable

customized solutions for businesses. For more information, please

visit www.asbirchgrove.com.

About SynchronossSynchronoss

Technologies (Nasdaq: SNCR), a global leader in personal Cloud

solutions, empowers service providers to establish secure and

meaningful connections with their subscribers. Synchronoss’ SaaS

Cloud platform simplifies onboarding processes and fosters

subscriber engagement, resulting in enhanced revenue streams,

reduced expenses, and faster time-to-market. Millions of

subscribers trust Synchronoss to safeguard their most cherished

memories and important digital content. Explore how Synchronoss’

Cloud-focused solutions redefine the way you connect with your

digital world at www.synchronoss.com.

Forward-Looking StatementsThis

press release includes statements concerning Synchronoss and its

future expectations, plans and prospects that constitute

“forward-looking statements” within the meaning of federal

securities law. These forward-looking statements reflect the

Company’s current views with respect to, among other things, the

closing of the repurchases of Series B Preferred and Senior Notes,

the use of proceeds from the term loan, the costs savings and

future benefits of the financing and repurchases and the Company’s

financial performance. These statements are often, though not

always made through the use of words or phrases such as “may,”

“might,” “should,” “could,” “predict,” “will,” “seek,” “estimate,”

“project,” “projection,” “annualized,” “strive,” “goal,” “target,”

“outlook,” “aim,” “expect,” “plan,” “anticipate,” “intends,”

“believes,” “potential” or “continue” or other similar expressions

are intended to identify forward-looking statements. These

forward-looking statements are not historical facts and are based

on current expectations and projections about future events and

financial trends that management believes may affect its business,

financial condition and results of operations, any of which, by

their nature, are uncertain and beyond Synchronoss’ control.

Accordingly, any such forward looking statements are not guarantees

of future performance and are subject to risks, assumptions,

estimates and uncertainties that are difficult to predict. Although

Synchronoss believes that the expectations reflected in these

forward looking statements are reasonable as of the date made,

actual results may prove to be materially different from the

results expressed or implied by the forward looking statements.

Except as otherwise indicated, these forward-looking statements

speak only as of the date of this press release and are subject to

a number of risks, uncertainties and assumptions including, without

limitation, risks relating to the satisfaction of the customary

closing conditions related to the repurchases of Series B Preferred

and Senior Notes, the Company’s ability to sustain or increase

revenue from its larger customers and generate revenue from new

customers, the Company’s expectations regarding expenses and

revenue, the sufficiency of the Company’s cash resources, the

impact of legal proceedings involving the Company, including the

litigation by the Securities and Exchange Commission (the “SEC”)

against certain former employees of the Company described in the

Company’s most recent SEC filings, and other risks and factors that

are described in the “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations”

sections of the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, which is on file with the SEC and

available on the SEC’s website at www.sec.gov. Additional factors

may be described in those sections of the Company’s Quarterly

Report on Form 10-Q for the quarter ended June 30, 2024, expected

to be filed with the SEC in the third quarter of 2024. The Company

does not undertake any obligation to update any forward-looking

statements contained in this press release as a result of new

information, future events or otherwise.

Media Relations

Contact:Domenick

CileaSpringboarddcilea@springboardpr.com

Investor Relations Contact:Tom

Colton and Alec WilsonGateway Group, Inc.SNCR@gateway-grp.com

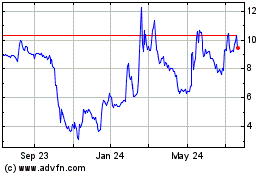

Synchronoss Technologies (NASDAQ:SNCR)

Historical Stock Chart

From Nov 2024 to Dec 2024

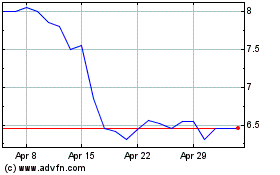

Synchronoss Technologies (NASDAQ:SNCR)

Historical Stock Chart

From Dec 2023 to Dec 2024