false--09-30Q100009247172025http://fasb.org/us-gaap/2024#ProductMemberhttp://fasb.org/us-gaap/2024#ProductMemberhttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherComprehensiveIncomeLossDerivativeExcludedComponentIncreaseDecreaseAdjustmentsAfterTaxhttp://fasb.org/us-gaap/2024#OtherComprehensiveIncomeLossDerivativeExcludedComponentIncreaseDecreaseAdjustmentsAfterTax0000924717us-gaap:CustomerRelationshipsMember2024-12-310000924717us-gaap:OperatingSegmentsMembersrdx:InVitroDiagnosticsMember2024-10-012024-12-310000924717us-gaap:AdditionalPaidInCapitalMember2024-09-300000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMember2024-09-300000924717srdx:ResearchDevelopmentAndOtherMember2023-10-012023-12-310000924717us-gaap:PatentsMember2024-09-3000009247172023-12-310000924717srdx:PerformanceCoatingsMembersrdx:MedicalDeviceMemberus-gaap:OperatingSegmentsMemberus-gaap:RoyaltyMember2023-10-012023-12-310000924717us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012023-12-310000924717srdx:EmbolitechLLCMember2024-10-012024-12-310000924717us-gaap:CommonStockMember2023-12-310000924717us-gaap:OperatingSegmentsMember2024-10-012024-12-310000924717srdx:AbbottAgreementMembersrdx:MilestonePaymentMember2023-04-012023-06-300000924717srdx:AbbottAgreementMember2024-10-012024-12-310000924717srdx:MidcapCreditAgreementMembersrdx:TrancheOneMembersrdx:SecuredTermLoanFacilitiesMember2022-10-140000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrdx:TrancheOneMembersrdx:SecuredTermLoanFacilitiesMember2024-10-012024-12-310000924717us-gaap:DevelopedTechnologyRightsMember2024-12-310000924717srdx:CommercialPaperAndCorporateBondSecuritiesMember2024-12-310000924717us-gaap:FiniteLivedIntangibleAssetsMember2024-09-300000924717us-gaap:OperatingSegmentsMember2023-10-012023-12-310000924717srdx:CommercialPaperAndCorporateBondSecuritiesMember2024-09-300000924717srdx:OperatingLeaseRightOfUseAssetsMember2024-12-310000924717us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000924717us-gaap:ProductMember2024-10-012024-12-310000924717srdx:GtcrMergerAgreementMember2024-10-012024-12-310000924717srdx:AbbottAgreementMembersrdx:MilestonePaymentMember2018-10-012019-09-300000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrdx:TrancheOneMembersrdx:SecuredTermLoanFacilitiesMember2024-09-300000924717us-gaap:CommonStockMember2024-10-012024-12-310000924717us-gaap:RestrictedStockUnitsRSUMember2023-10-012023-12-310000924717us-gaap:OperatingSegmentsMembersrdx:InVitroDiagnosticsMemberus-gaap:ProductMember2024-10-012024-12-310000924717us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-10-012024-12-310000924717us-gaap:InterestRateSwapMember2024-12-310000924717us-gaap:OperatingSegmentsMembersrdx:MedicalDeviceMemberus-gaap:LicenseMember2023-10-012023-12-310000924717us-gaap:CommonStockMember2023-09-3000009247172023-10-012023-12-310000924717srdx:AbbottAgreementMember2024-12-310000924717srdx:EmbolitechLLCMemberus-gaap:InProcessResearchAndDevelopmentMember2019-10-012020-09-300000924717srdx:EmbolitechLLCMemberus-gaap:InProcessResearchAndDevelopmentMember2021-10-012022-09-300000924717srdx:EmployeeStockPurchasePlanMember2024-10-012024-12-310000924717us-gaap:OperatingSegmentsMembersrdx:InVitroDiagnosticsMemberus-gaap:ProductMember2023-10-012023-12-310000924717srt:MinimumMembersrdx:GtcrMergerAgreementMember2024-05-282024-05-280000924717us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AvailableforsaleSecuritiesMember2024-12-310000924717srdx:VetexMedicalLimitedMembersrt:ScenarioForecastMember2027-07-012027-09-300000924717srdx:ResearchDevelopmentAndOtherMembersrdx:MedicalDeviceMemberus-gaap:OperatingSegmentsMember2023-10-012023-12-310000924717us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AvailableforsaleSecuritiesMember2024-12-310000924717us-gaap:CustomerRelationshipsMember2024-09-300000924717us-gaap:TrademarksAndTradeNamesMember2024-09-300000924717srdx:ResearchDevelopmentAndOtherMember2024-10-012024-12-310000924717us-gaap:RetainedEarningsMember2023-09-300000924717srdx:MidcapCreditAgreementMembersrdx:SecuredTermLoanFacilitiesMember2022-10-142022-10-140000924717srdx:GtcrMergerAgreementMembersrt:MaximumMember2024-05-282024-05-280000924717srdx:VetexMedicalLimitedMember2024-10-012024-12-310000924717us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300000924717us-gaap:CostOfSalesMember2024-10-012024-12-310000924717srdx:BceParentLlcAndBceMergerSubIncMembersrdx:GtcrMergerAgreementMember2024-05-280000924717us-gaap:CostOfSalesMember2023-10-012023-12-310000924717us-gaap:RevolvingCreditFacilityMembersrdx:YearTwoMembersrdx:MidcapCreditAgreementMember2022-10-142022-10-140000924717us-gaap:OperatingSegmentsMembersrdx:MedicalDeviceMember2024-10-012024-12-310000924717us-gaap:RestrictedStockMember2023-10-012023-12-310000924717us-gaap:OperatingSegmentsMembersrdx:MedicalDeviceMemberus-gaap:ProductMember2023-10-012023-12-310000924717srdx:EmployeeStockPurchasePlanMember2023-10-012023-12-310000924717srdx:ResearchDevelopmentAndOtherMembersrdx:MedicalDeviceMemberus-gaap:OperatingSegmentsMember2024-10-012024-12-310000924717us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AvailableforsaleSecuritiesMember2024-09-300000924717srdx:EmbolitechLLCMemberus-gaap:InProcessResearchAndDevelopmentMember2022-10-012024-09-300000924717us-gaap:AdditionalPaidInCapitalMember2023-09-300000924717us-gaap:OperatingSegmentsMembersrdx:MedicalDeviceMember2023-10-012023-12-310000924717us-gaap:OtherNoncurrentAssetsMember2024-12-310000924717srdx:EmbolitechLLCMemberus-gaap:InProcessResearchAndDevelopmentMember2017-10-012018-09-300000924717us-gaap:AdditionalPaidInCapitalMember2024-12-310000924717us-gaap:AdditionalPaidInCapitalMember2024-10-012024-12-310000924717srdx:VetexMedicalLimitedMember2020-10-012021-09-300000924717us-gaap:TrademarksAndTradeNamesMember2024-12-310000924717us-gaap:DevelopedTechnologyRightsMember2024-09-300000924717us-gaap:RevolvingCreditFacilityMembersrdx:MidcapCreditAgreementMember2022-10-140000924717us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000924717srdx:OperatingLeaseRightOfUseAssetsMember2024-09-300000924717srdx:ResearchDevelopmentAndOtherMemberus-gaap:OperatingSegmentsMembersrdx:InVitroDiagnosticsMember2023-10-012023-12-310000924717srdx:ResearchDevelopmentAndOtherMemberus-gaap:OperatingSegmentsMembersrdx:InVitroDiagnosticsMember2024-10-012024-12-310000924717srdx:AbbottAgreementMembersrdx:MilestonePaymentMember2019-10-012020-09-300000924717us-gaap:ResearchAndDevelopmentExpenseMember2023-10-012023-12-310000924717srdx:GtcrMergerAgreementMember2024-05-280000924717us-gaap:RoyaltyMember2024-10-012024-12-310000924717us-gaap:RetainedEarningsMember2023-12-3100009247172025-01-2700009247172024-10-012024-12-310000924717us-gaap:CommonStockMember2024-09-300000924717us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2024-09-300000924717srdx:MedicalDeviceMember2024-10-012024-12-310000924717us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-10-012023-12-310000924717us-gaap:RetainedEarningsMember2023-10-012023-12-310000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMembersrdx:MidcapCreditAgreementMembersrdx:SecuredTermLoanFacilitiesMember2022-10-140000924717us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000924717us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000924717us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AvailableforsaleSecuritiesMember2024-09-300000924717srdx:PerformanceCoatingsMembersrdx:MedicalDeviceMemberus-gaap:OperatingSegmentsMemberus-gaap:RoyaltyMember2024-10-012024-12-310000924717us-gaap:OtherNoncurrentAssetsMember2024-09-300000924717us-gaap:RoyaltyMember2023-10-012023-12-310000924717us-gaap:OperatingSegmentsMembersrdx:InVitroDiagnosticsMember2023-10-012023-12-310000924717us-gaap:RestrictedStockMember2024-10-012024-12-310000924717srdx:InVitroDiagnosticsMember2024-09-3000009247172024-12-310000924717srdx:MedicalDeviceMember2024-12-310000924717srdx:MidcapCreditAgreementMembersrdx:TrancheOneMembersrdx:SecuredTermLoanFacilitiesMember2022-10-142022-10-1400009247172023-09-300000924717srdx:AbbottAgreementMembersrdx:MilestonePaymentMember2020-10-012021-09-300000924717us-gaap:FairValueMeasurementsRecurringMember2024-12-310000924717us-gaap:EmployeeStockOptionMember2023-10-012023-12-310000924717us-gaap:CorporateNonSegmentMember2024-10-012024-12-310000924717us-gaap:ResearchAndDevelopmentExpenseMember2024-10-012024-12-310000924717us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000924717us-gaap:RetainedEarningsMember2024-12-310000924717us-gaap:FairValueMeasurementsRecurringMember2024-09-300000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrdx:MidcapCreditAgreementMember2022-10-142022-10-140000924717srdx:MidcapCreditAgreementMembersrdx:SecuredTermLoanFacilitiesMembersrdx:TrancheTwoMember2022-10-140000924717us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000924717us-gaap:InterestRateSwapMember2024-09-300000924717srdx:MidcapCreditAgreementMembersrdx:YearThreeToMaturityMembersrdx:SecuredTermLoanFacilitiesMember2022-10-142022-10-140000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMembersrdx:MidcapCreditAgreementMember2022-10-140000924717us-gaap:AdditionalPaidInCapitalMember2023-12-310000924717srdx:MedicalDeviceMember2024-09-300000924717srdx:EmbolitechLLCMemberus-gaap:InProcessResearchAndDevelopmentMember2020-10-012021-09-300000924717us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2024-09-300000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMember2024-12-310000924717us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-09-300000924717us-gaap:CorporateNonSegmentMember2023-10-012023-12-310000924717us-gaap:CommonStockMember2024-12-310000924717srdx:EmbolitechLLCMemberus-gaap:InProcessResearchAndDevelopmentMember2022-10-012023-09-300000924717us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-10-012024-12-310000924717us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2024-12-310000924717us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000924717us-gaap:CommonStockMember2023-10-012023-12-310000924717srdx:AbbottAgreementMembersrdx:UpfrontPaymentMember2017-10-012018-09-300000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMember2024-10-012024-12-310000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrdx:TrancheOneMembersrdx:SecuredTermLoanFacilitiesMember2024-12-310000924717us-gaap:FiniteLivedIntangibleAssetsMember2024-12-310000924717us-gaap:RetainedEarningsMember2024-10-012024-12-310000924717us-gaap:PatentsMember2024-12-310000924717us-gaap:RetainedEarningsMember2024-09-300000924717us-gaap:RevolvingCreditFacilityMembersrdx:MidcapCreditAgreementMembersrdx:TrancheOneMember2022-10-140000924717us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2024-12-310000924717srt:MaximumMember2024-10-012024-12-310000924717us-gaap:OperatingSegmentsMembersrdx:MedicalDeviceMemberus-gaap:ProductMember2024-10-012024-12-310000924717srdx:InVitroDiagnosticsMember2024-12-3100009247172024-09-300000924717us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrdx:MidcapCreditAgreementMember2024-10-012024-12-310000924717srdx:MedicalDeviceMemberus-gaap:OperatingSegmentsMemberus-gaap:LicenseMember2024-10-012024-12-310000924717srt:MaximumMember2023-10-012023-12-310000924717us-gaap:AdditionalPaidInCapitalMember2023-10-012023-12-310000924717srdx:MidcapCreditAgreementMembersrdx:SecuredTermLoanFacilitiesMember2022-10-140000924717srdx:EmbolitechLLCMemberus-gaap:InProcessResearchAndDevelopmentMember2024-10-012024-12-310000924717us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-09-300000924717us-gaap:ProductMember2023-10-012023-12-310000924717srdx:MidcapRevolvingCreditFacilityMembersrdx:MidcapCreditAgreementMembersrdx:MidcapEventOfDefaultMembersrdx:SecuredTermLoanFacilitiesMember2022-10-142022-10-140000924717us-gaap:RevolvingCreditFacilityMembersrdx:MidcapCreditAgreementMember2022-10-142022-10-140000924717us-gaap:RestrictedStockUnitsRSUMember2024-10-012024-12-31xbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 0-23837

Surmodics, Inc.

(Exact name of registrant as specified in its charter)

|

|

Minnesota |

41-1356149 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

9924 West 74th Street, Eden Prairie, Minnesota 55344

(Address of principal executive offices) (Zip Code)

(952) 500-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $0.05 par value |

|

SRDX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

|

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the registrant’s Common Stock, $0.05 par value per share, as of January 27, 2025 was 14,295,998

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Surmodics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

2024 |

|

|

2024 |

|

(In thousands, except per share data) |

(Unaudited) |

|

ASSETS |

|

|

|

|

|

Current Assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

30,145 |

|

|

$ |

36,115 |

|

Available-for-sale securities |

|

— |

|

|

|

3,997 |

|

Accounts receivable, net of allowances of $220 and $144 as of

December 31, 2024 and September 30, 2024, respectively |

|

12,559 |

|

|

|

13,292 |

|

Contract assets |

|

9,879 |

|

|

|

9,872 |

|

Inventories |

|

15,261 |

|

|

|

15,168 |

|

Prepaids and other |

|

4,005 |

|

|

|

2,860 |

|

Total Current Assets |

|

71,849 |

|

|

|

81,304 |

|

Property and equipment, net |

|

23,805 |

|

|

|

24,956 |

|

Intangible assets, net |

|

21,271 |

|

|

|

23,569 |

|

Goodwill |

|

42,408 |

|

|

|

44,640 |

|

Other assets |

|

4,407 |

|

|

|

4,093 |

|

Total Assets |

$ |

163,740 |

|

|

$ |

178,562 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

Accounts payable |

$ |

2,561 |

|

|

$ |

2,786 |

|

Accrued liabilities: |

|

|

|

|

|

Compensation |

|

4,882 |

|

|

|

11,099 |

|

Accrued other |

|

3,582 |

|

|

|

3,795 |

|

Deferred revenue |

|

266 |

|

|

|

1,619 |

|

Income tax payable |

|

1,894 |

|

|

|

1,244 |

|

Total Current Liabilities |

|

13,185 |

|

|

|

20,543 |

|

Long-term debt, net |

|

29,591 |

|

|

|

29,554 |

|

Deferred income taxes |

|

1,595 |

|

|

|

1,785 |

|

Other long-term liabilities |

|

7,600 |

|

|

|

7,783 |

|

Total Liabilities |

|

51,971 |

|

|

|

59,665 |

|

Commitments and Contingencies (Note 11) |

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

Series A Preferred stock — $.05 par value, 450 shares authorized; no shares issued and outstanding |

|

— |

|

|

|

— |

|

Common stock — $.05 par value, 45,000 shares authorized; 14,294 and 14,325 shares

issued and outstanding as of December 31, 2024 and September 30, 2024, respectively |

|

715 |

|

|

|

716 |

|

Additional paid-in capital |

|

45,135 |

|

|

|

44,594 |

|

Accumulated other comprehensive loss |

|

(6,143 |

) |

|

|

(2,126 |

) |

Retained earnings |

|

72,062 |

|

|

|

75,713 |

|

Total Stockholders’ Equity |

|

111,769 |

|

|

|

118,897 |

|

Total Liabilities and Stockholders’ Equity |

$ |

163,740 |

|

|

$ |

178,562 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Surmodics, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

2024 |

|

|

2023 |

|

(In thousands, except per share data) |

(Unaudited) |

|

Revenue: |

|

|

|

|

|

Product sales |

$ |

16,548 |

|

|

$ |

18,827 |

|

Royalties and license fees |

|

10,634 |

|

|

|

9,179 |

|

Research, development and other |

|

2,740 |

|

|

|

2,546 |

|

Total revenue |

|

29,922 |

|

|

|

30,552 |

|

Operating costs and expenses: |

|

|

|

|

|

Product costs |

|

7,425 |

|

|

|

8,803 |

|

Research and development |

|

8,941 |

|

|

|

8,664 |

|

Selling, general and administrative |

|

15,174 |

|

|

|

12,537 |

|

Acquired intangible asset amortization |

|

863 |

|

|

|

870 |

|

Total operating costs and expenses |

|

32,403 |

|

|

|

30,874 |

|

Operating (loss) income |

|

(2,481 |

) |

|

|

(322 |

) |

Other expense, net: |

|

|

|

|

|

Interest expense, net |

|

(882 |

) |

|

|

(896 |

) |

Foreign exchange gain (loss) |

|

32 |

|

|

|

(45 |

) |

Investment income, net |

|

387 |

|

|

|

539 |

|

Other expense, net |

|

(463 |

) |

|

|

(402 |

) |

(Loss) income before income taxes |

|

(2,944 |

) |

|

|

(724 |

) |

Income tax expense |

|

(707 |

) |

|

|

(62 |

) |

Net (loss) income |

$ |

(3,651 |

) |

|

$ |

(786 |

) |

|

|

|

|

|

|

Basic net (loss) income per share |

$ |

(0.26 |

) |

|

$ |

(0.06 |

) |

Diluted net (loss) income per share |

$ |

(0.26 |

) |

|

$ |

(0.06 |

) |

|

|

|

|

|

|

Weighted average number of shares outstanding: |

|

|

|

|

|

Basic |

|

14,231 |

|

|

|

14,102 |

|

Diluted |

|

14,231 |

|

|

|

14,102 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Surmodics, Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive (Loss) Income

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

2024 |

|

|

2023 |

|

(In thousands) |

(Unaudited) |

|

Net (loss) income |

$ |

(3,651 |

) |

|

$ |

(786 |

) |

Other comprehensive (loss) income: |

|

|

|

|

|

Derivative instruments: |

|

|

|

|

|

Unrealized net gain (loss) |

|

506 |

|

|

|

(620 |

) |

Net gain reclassified to earnings |

|

(29 |

) |

|

|

(62 |

) |

Net changes related to available-for-sale securities, net of tax |

|

— |

|

|

|

(8 |

) |

Foreign currency translation adjustments |

|

(4,494 |

) |

|

|

2,797 |

|

Other comprehensive (loss) income |

|

(4,017 |

) |

|

|

2,107 |

|

Comprehensive (loss) income |

$ |

(7,668 |

) |

|

$ |

1,321 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Surmodics, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2024 and 2023 |

|

|

(Unaudited) |

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

Other |

|

|

|

|

|

Total |

|

|

Common Stock |

|

|

Paid-In |

|

|

Comprehensive |

|

|

Retained |

|

|

Stockholders’ |

|

(In thousands) |

Shares |

|

|

Amount |

|

|

Capital |

|

|

Loss |

|

|

Earnings |

|

|

Equity |

|

Balance at September 30, 2024 |

|

14,325 |

|

|

$ |

716 |

|

|

$ |

44,594 |

|

|

$ |

(2,126 |

) |

|

$ |

75,713 |

|

|

$ |

118,897 |

|

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,651 |

) |

|

|

(3,651 |

) |

Other comprehensive loss, net of tax |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,017 |

) |

|

|

— |

|

|

|

(4,017 |

) |

Issuance of common stock |

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Common stock options exercised, net |

|

3 |

|

|

|

— |

|

|

|

105 |

|

|

|

— |

|

|

|

— |

|

|

|

105 |

|

Purchase of common stock to pay

employee taxes |

|

(33 |

) |

|

|

(1 |

) |

|

|

(1,307 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,308 |

) |

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

1,743 |

|

|

|

— |

|

|

|

— |

|

|

|

1,743 |

|

Balance at December 31, 2024 |

|

14,294 |

|

|

$ |

715 |

|

|

$ |

45,135 |

|

|

$ |

(6,143 |

) |

|

$ |

72,062 |

|

|

$ |

111,769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at September 30, 2023 |

|

14,155 |

|

|

$ |

708 |

|

|

$ |

36,706 |

|

|

$ |

(4,759 |

) |

|

$ |

87,255 |

|

|

$ |

119,910 |

|

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(786 |

) |

|

|

(786 |

) |

Other comprehensive income, net of tax |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,107 |

|

|

|

— |

|

|

|

2,107 |

|

Issuance of common stock |

|

102 |

|

|

|

5 |

|

|

|

(5 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Common stock options exercised, net |

|

7 |

|

|

|

— |

|

|

|

39 |

|

|

|

— |

|

|

|

— |

|

|

|

39 |

|

Purchase of common stock to pay

employee taxes |

|

(29 |

) |

|

|

(1 |

) |

|

|

(1,087 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,088 |

) |

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

1,968 |

|

|

|

— |

|

|

|

— |

|

|

|

1,968 |

|

Balance at December 31, 2023 |

|

14,235 |

|

|

$ |

712 |

|

|

$ |

37,621 |

|

|

$ |

(2,652 |

) |

|

$ |

86,469 |

|

|

$ |

122,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Surmodics, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

2024 |

|

|

2023 |

|

(In thousands) |

(Unaudited) |

|

Operating Activities: |

|

|

|

|

|

Net loss |

$ |

(3,651 |

) |

|

$ |

(786 |

) |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

2,083 |

|

|

|

2,333 |

|

Stock-based compensation |

|

1,743 |

|

|

|

1,968 |

|

Noncash lease expense |

|

208 |

|

|

|

183 |

|

Amortization of debt issuance costs |

|

76 |

|

|

|

76 |

|

Provision for credit losses |

|

76 |

|

|

|

6 |

|

Deferred taxes |

|

(68 |

) |

|

|

(97 |

) |

Other |

|

5 |

|

|

|

(123 |

) |

Change in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable and contract assets |

|

435 |

|

|

|

(3,430 |

) |

Inventories |

|

(93 |

) |

|

|

401 |

|

Prepaids and other |

|

(515 |

) |

|

|

(788 |

) |

Accounts payable |

|

(216 |

) |

|

|

(428 |

) |

Accrued liabilities |

|

(7,362 |

) |

|

|

(7,084 |

) |

Income taxes |

|

738 |

|

|

|

99 |

|

Deferred revenue |

|

(1,353 |

) |

|

|

(1,122 |

) |

Net cash (used in) provided by operating activities |

|

(7,894 |

) |

|

|

(8,792 |

) |

Investing Activities: |

|

|

|

|

|

Purchases of property and equipment |

|

(302 |

) |

|

|

(720 |

) |

Purchases of available-for-sale securities |

|

— |

|

|

|

(9,750 |

) |

Maturities of available-for-sale securities |

|

4,000 |

|

|

|

2,000 |

|

Net cash (used in) provided by investing activities |

|

3,698 |

|

|

|

(8,470 |

) |

Financing Activities: |

|

|

|

|

|

Issuance of common stock |

|

105 |

|

|

|

39 |

|

Payments for taxes related to net share settlement of equity awards |

|

(1,308 |

) |

|

|

(1,088 |

) |

Net cash (used in) provided by financing activities |

|

(1,203 |

) |

|

|

(1,049 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

(571 |

) |

|

|

247 |

|

Net change in cash and cash equivalents |

|

(5,970 |

) |

|

|

(18,064 |

) |

Cash and Cash Equivalents: |

|

|

|

|

|

Beginning of period |

|

36,115 |

|

|

|

41,419 |

|

End of period |

$ |

30,145 |

|

|

$ |

23,355 |

|

Supplemental Information: |

|

|

|

|

|

Cash paid for income taxes |

$ |

— |

|

|

$ |

— |

|

Cash paid for interest |

|

785 |

|

|

|

779 |

|

Noncash investing and financing activities: |

|

|

|

|

|

Acquisition of property and equipment |

|

141 |

|

|

|

43 |

|

Right-of-use assets obtained in exchange for operating lease liabilities |

|

— |

|

|

|

845 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Surmodics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

Period Ended December 31, 2024

(Unaudited)

1. Organization

Description of Business

Surmodics, Inc. and subsidiaries (referred to as “Surmodics,” the “Company,” “we,” “us,” “our” and other like terms) is a leading provider of performance coating technologies for intravascular medical devices and chemical and biological components for in vitro diagnostic (“IVD”) immunoassay tests and microarrays. Surmodics develops and commercializes highly differentiated vascular intervention medical devices that are designed to address unmet clinical needs and engineered to the most demanding requirements. Our key growth strategy leverages the combination of the Company’s expertise in proprietary surface modification and drug-delivery coating technologies, along with its device design, development and manufacturing capabilities. The Company’s mission is to improve the detection and treatment of disease. Surmodics is headquartered in Eden Prairie, Minnesota.

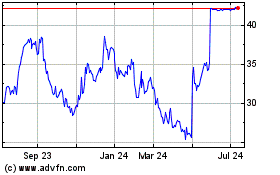

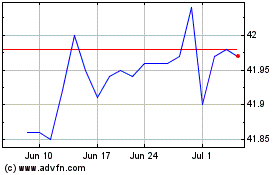

On May 28, 2024, Surmodics entered into a Merger Agreement (the “Merger Agreement”) with BCE Parent, LLC, a Delaware limited liability company (“Parent”), and BCE Merger Sub, Inc., a Minnesota corporation and a wholly owned Subsidiary of Parent (“Merger Sub”), pursuant to which Surmodics will, subject to the terms and conditions thereof, be acquired by Parent for $43.00 per share in cash through the merger of Merger Sub with and into the Company, with the Company as the surviving corporation and a wholly owned subsidiary of Parent. See Note 13 Merger Agreement for additional information.

Basis of Presentation and Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements include all accounts and wholly-owned subsidiaries and have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”). All intercompany transactions have been eliminated. The Company operates on a fiscal year ending on September 30. In accordance with the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”), the Company has omitted footnote disclosures that would substantially duplicate the disclosures contained in the audited consolidated financial statements of the Company. These unaudited condensed consolidated financial statements should be read together with the audited consolidated financial statements for the fiscal year ended September 30, 2024, and notes thereto included in our Annual Report on Form 10-K as filed with the SEC.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Ultimate results could differ from those estimates. The results of operations for the three months ended December 31, 2024 are not necessarily indicative of the results that may be expected for the entire 2025 fiscal year.

New Accounting Pronouncements

Not Yet Adopted

In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2023-07, Segment Reporting: Improvements to Reportable Segment Disclosures. This guidance requires disclosure of incremental segment information on an annual and interim basis. This amendment is effective for our fiscal year ending September 30, 2025 and interim periods within our fiscal year ending September 30, 2026. We are currently assessing the impact of this guidance on our disclosures.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes: Improvements to Income Tax Disclosures. This guidance requires consistent categories and greater disaggregation of information in the rate reconciliation and disclosures of income taxes paid by jurisdiction. This amendment is effective for our fiscal year ending September 30, 2026 and interim periods within our fiscal year ending September 30, 2027. We are currently assessing the impact of this guidance on our disclosures.

No other new accounting pronouncement issued or effective during our fiscal year ending September 30, 2025, or is expected to have, a material impact on the Company’s condensed consolidated financial statements.

2. Revenue

The following table is a disaggregation of revenue within each reportable segment.

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

(In thousands) |

2024 |

|

|

2023 |

|

Medical Device |

|

|

Product sales |

$ |

10,116 |

|

|

$ |

11,950 |

|

Royalties & license fees – performance coatings |

|

9,383 |

|

|

|

8,208 |

|

License fees – SurVeil DCB |

|

1,251 |

|

|

|

971 |

|

Research, development and other |

|

2,531 |

|

|

|

2,416 |

|

Medical Device Revenue |

|

23,281 |

|

|

|

23,545 |

|

In Vitro Diagnostics |

|

|

|

|

|

Product sales |

|

6,432 |

|

|

|

6,877 |

|

Research, development and other |

|

209 |

|

|

|

130 |

|

In Vitro Diagnostics Revenue |

|

6,641 |

|

|

|

7,007 |

|

Total Revenue |

$ |

29,922 |

|

|

$ |

30,552 |

|

Contract assets totaled $10.7 million and $10.6 million as of December 31, 2024 and September 30, 2024, respectively, and was reported in contract assets, current and other assets, noncurrent (Note 5) on the condensed consolidated balance sheets. Fluctuations in the balance of contract assets result primarily from (i) fluctuations in the sales volume of performance coating royalties and license fees earned, but not collected, at each balance sheet date due to payment timing and contractual changes in the normal course of business; and (ii) starting in fiscal 2024, sales-based profit-sharing earned, but not collected, related to a collaborative arrangement (Note 3).

Deferred revenue totaled $0.3 million and $1.6 million as of December 31, 2024 and September 30, 2024, respectively, on the condensed consolidated balance sheets and was primarily related to a collaborative arrangement (Note 3). For the three months ended December 31, 2024 and 2023, the total amount of revenue recognized that was included in the respective beginning of fiscal year balances of deferred revenue on the condensed consolidated balance sheets totaled $1.3 million and $1.0 million, respectively.

3. Collaborative Arrangement

On February 26, 2018, the Company entered into an agreement with Abbott Vascular, Inc. (“Abbott”) with respect to one of the device products in our Medical Device reportable segment, the SurVeil™ drug-coated balloon (“DCB”) for treatment of the superficial femoral artery (the “Abbott Agreement”). In June 2023, the SurVeil DCB received U.S. Food and Drug Administration (“FDA”) premarket approval (“PMA”) and may now be marketed and sold in the U.S. by Abbott.

SurVeil DCB License Fees

Under the Abbott Agreement, Surmodics is responsible for conducting all necessary clinical trials, including completion of the ongoing, five-year TRANSCEND pivotal clinical trial of the SurVeil DCB. The Company has received payments totaling $87.8 million for achievement of clinical and regulatory milestones under the Abbott Agreement, which consisted of the following: (i) a $25 million upfront fee in fiscal 2018, (ii) a $10 million milestone payment in fiscal 2019, (iii) a $10.8 million milestone payment in fiscal 2020, (iv) a $15 million milestone payment in fiscal 2021, and (v) a $27 million milestone payment in the third quarter of fiscal 2023 upon receipt of PMA for the SurVeil DCB from the FDA. There are no remaining contingent or other milestone payments under the Abbott Agreement.

License fee revenue on milestone payments received under the Abbott Agreement is recognized using the cost-to-cost method based on total costs incurred to date relative to total expected costs for the TRANSCEND pivotal clinical trial, which is expected to be competed in fiscal 2025. See Note 2 Revenue for SurVeil DCB license fee revenue recognized in our Medical Device reportable segment.

As of December 31, 2024, deferred revenue on the condensed consolidated balance sheets included $0.3 million from upfront and milestone payments received under the Abbott Agreement. This represented the Company’s remaining performance obligations and is expected to be recognized as revenue in the second quarter of fiscal 2025 as services, principally the TRANSCEND clinical trial, are completed.

SurVeil DCB Product Sales

Under the Abbott Agreement, we supply commercial units of the SurVeil DCB to Abbott, and Abbott has exclusive worldwide distribution rights. During the first quarter of fiscal 2024, we commenced shipment of commercial units of the SurVeil DCB to Abbott. We recognize revenue from the sale of commercial units of the SurVeil DCB to Abbott at the time of shipment in product sales on the condensed consolidated statements of operations. The amount of SurVeil DCB product sales revenue recognized includes (i) the contractual transfer price per unit and (ii) an estimate of Surmodics’ share of net profits resulting from product sales by Abbott to third parties pursuant to the Abbott Agreement (“estimated SurVeil DCB profit-sharing”). On a quarterly basis, Abbott (i) reports to us its third-party sales of the SurVeil DCB the quarter after those sales occur, which may occur within two years following shipment based on the product’s current shelf life; and (ii) reports to us and pays the actual amount of profit-sharing. Estimated SurVeil DCB profit-sharing represents variable consideration and is recorded in contract assets, current and other assets, noncurrent on the condensed consolidated balance sheets. We estimate variable consideration as the most-likely amount to which we expect to be entitled, and we include estimated amounts in the transaction price to the extent it is probable that a significant reversal of cumulative revenue will not occur when the uncertainty associated with the variable consideration is resolved. Significant judgment is required in estimating the amount of variable consideration to recognize when assessing factors outside of Surmodics’ influence, such as limited availability of third-party information, expected duration of time until resolution, and limited relevant past experience.

4. Fair Value Measurements

Assets and liabilities measured at fair value on a recurring basis by level of the fair value hierarchy were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

(In thousands) |

Quoted Prices in Active Markets for Identical Instruments

(Level 1) |

|

|

Significant Other

Observable Inputs

(Level 2) |

|

|

Significant

Unobservable Inputs

(Level 3) |

|

|

Total Fair Value |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents (1) |

$ |

— |

|

|

$ |

23,228 |

|

|

$ |

— |

|

|

$ |

23,228 |

|

Available-for-sale securities (1) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total assets |

$ |

— |

|

|

$ |

23,228 |

|

|

$ |

— |

|

|

$ |

23,228 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

Interest rate swap (2) |

|

— |

|

|

|

196 |

|

|

|

— |

|

|

|

196 |

|

Total liabilities |

$ |

— |

|

|

$ |

196 |

|

|

$ |

— |

|

|

$ |

196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

(In thousands) |

Quoted Prices in

Active Markets

for Identical

Instruments

(Level 1) |

|

|

Significant Other

Observable Inputs

(Level 2) |

|

|

Significant

Unobservable Inputs

(Level 3) |

|

|

Total Fair Value |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents (1) |

$ |

— |

|

|

$ |

29,334 |

|

|

$ |

— |

|

|

$ |

29,334 |

|

Available-for-sale securities (1) |

|

— |

|

|

|

3,997 |

|

|

|

— |

|

|

|

3,997 |

|

Total assets |

$ |

— |

|

|

$ |

33,331 |

|

|

$ |

— |

|

|

$ |

33,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

Interest rate swap (2) |

$ |

— |

|

|

$ |

673 |

|

|

$ |

— |

|

|

$ |

673 |

|

Total liabilities |

$ |

— |

|

|

$ |

673 |

|

|

$ |

— |

|

|

$ |

673 |

|

(1)Fair value of cash equivalents (money market funds) and available-for-sale securities (commercial paper and corporate bond securities) was based on quoted vendor prices and broker pricing where all significant inputs are observable.

(2)Fair value of interest rate swap is based on forward-looking, one-month term secured overnight financing rate (“Term SOFR”) spot rates and interest rate curves (Note 7).

5. Supplemental Balance Sheet Information

Investments — Available-for-sale Securities

The amortized cost, unrealized holding gains and losses, and fair value of available-for-sale securities were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

(In thousands) |

|

Amortized

Cost |

|

|

Unrealized

Gains |

|

|

Unrealized

Losses |

|

|

Fair

Value |

|

Commercial paper and corporate bonds |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Available-for-sale securities |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

(In thousands) |

|

Amortized

Cost |

|

|

Unrealized

Gains |

|

|

Unrealized

Losses |

|

|

Fair

Value |

|

Commercial paper and corporate bonds |

|

$ |

3,997 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

3,997 |

|

Available-for-sale securities |

|

$ |

3,997 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

3,997 |

|

Inventories

Inventories consisted of the following components:

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

(In thousands) |

2024 |

|

|

2024 |

|

Raw materials |

$ |

8,793 |

|

|

$ |

8,505 |

|

Work-in process |

|

2,268 |

|

|

|

2,476 |

|

Finished products |

|

4,200 |

|

|

|

4,187 |

|

Inventories |

$ |

15,261 |

|

|

$ |

15,168 |

|

Prepaids and Other Assets, Current

Prepaids and other current assets consisted of the following:

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

(In thousands) |

2024 |

|

|

2024 |

|

Prepaid expenses and other |

$ |

3,905 |

|

|

$ |

2,752 |

|

Irish research and development credits receivable |

|

100 |

|

|

|

108 |

|

Prepaids and other |

$ |

4,005 |

|

|

$ |

2,860 |

|

Intangible Assets

Intangible assets consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

(Dollars in thousands) |

Weighted Average Original Life (Years) |

|

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net |

|

Definite-lived intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

Customer lists and relationships |

|

9.3 |

|

|

$ |

11,066 |

|

|

$ |

(10,321 |

) |

|

$ |

745 |

|

Developed technology |

|

11.9 |

|

|

|

33,452 |

|

|

|

(14,215 |

) |

|

|

19,237 |

|

Patents and other |

|

14.9 |

|

|

|

2,338 |

|

|

|

(1,629 |

) |

|

|

709 |

|

Total definite-lived intangible assets |

|

|

|

|

46,856 |

|

|

|

(26,165 |

) |

|

|

20,691 |

|

Unamortized intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

Trademarks and trade names |

|

|

|

|

580 |

|

|

|

— |

|

|

|

580 |

|

Intangible assets, net |

|

|

|

$ |

47,436 |

|

|

$ |

(26,165 |

) |

|

$ |

21,271 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

(Dollars in thousands) |

Weighted Average Original Life (Years) |

|

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net |

|

Definite-lived intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

Customer lists and relationships |

|

9.3 |

|

|

$ |

11,870 |

|

|

$ |

(10,844 |

) |

|

$ |

1,026 |

|

Developed technology |

|

11.9 |

|

|

|

35,433 |

|

|

|

(14,222 |

) |

|

|

21,211 |

|

Patents and other |

|

14.9 |

|

|

|

2,338 |

|

|

|

(1,586 |

) |

|

|

752 |

|

Total definite-lived intangible assets |

|

|

|

|

49,641 |

|

|

|

(26,652 |

) |

|

|

22,989 |

|

Unamortized intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

Trademarks and trade names |

|

|

|

|

580 |

|

|

|

— |

|

|

|

580 |

|

Intangible assets, net |

|

|

|

$ |

50,221 |

|

|

$ |

(26,652 |

) |

|

$ |

23,569 |

|

Intangible asset amortization expense was $0.9 million for each of the three months ended December 31, 2024 and 2023 . Based on the intangible assets in service as of December 31, 2024, estimated amortization expense for future fiscal years was as follows:

|

|

|

|

(In thousands) |

|

|

Remainder of 2025 |

$ |

2,694 |

|

2026 |

|

2,741 |

|

2027 |

|

2,498 |

|

2028 |

|

2,488 |

|

2029 |

|

2,488 |

|

2030 |

|

2,262 |

|

Thereafter |

|

5,520 |

|

Definite-lived intangible assets |

$ |

20,691 |

|

Future amortization amounts presented above are estimates. Actual future amortization expense may be different as a result of future acquisitions, impairments, changes in amortization periods, foreign currency translation rates, or other factors.

Goodwill

Changes in the carrying amount of goodwill by segment were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

In Vitro

Diagnostics |

|

|

Medical

Device |

|

|

Total |

|

Goodwill as of September 30, 2024 |

$ |

8,010 |

|

|

$ |

36,630 |

|

|

$ |

44,640 |

|

Currency translation adjustment |

|

|

|

|

(2,232 |

) |

|

|

(2,232 |

) |

Goodwill as of December 31, 2024 |

$ |

8,010 |

|

|

$ |

34,398 |

|

|

$ |

42,408 |

|

Other Assets, Noncurrent

Other noncurrent assets consisted of the following:

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

(In thousands) |

2024 |

|

|

2024 |

|

Operating lease right-of-use assets |

$ |

2,820 |

|

|

$ |

3,028 |

|

Contract asset (1) |

|

803 |

|

|

|

689 |

|

Other |

|

784 |

|

|

|

376 |

|

Other assets |

$ |

4,407 |

|

|

$ |

4,093 |

|

(1)As of December 31, 2024 and September 30, 2024, the noncurrent portion of the contract asset associated with estimated SurVeil DCB profit-sharing (Note 3).

Accrued Other Liabilities

Accrued other liabilities consisted of the following:

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

(In thousands) |

2024 |

|

|

2024 |

|

Accrued professional fees |

$ |

869 |

|

|

$ |

563 |

|

Accrued clinical study expense |

|

377 |

|

|

|

499 |

|

Accrued purchases |

|

828 |

|

|

|

1,023 |

|

Operating lease liabilities, current portion |

|

1,049 |

|

|

|

1,040 |

|

Other |

|

459 |

|

|

|

670 |

|

Total accrued other liabilities |

$ |

3,582 |

|

|

$ |

3,795 |

|

Other Long-term Liabilities

Other long-term liabilities consisted of the following:

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

(In thousands) |

2024 |

|

|

2024 |

|

Deferred consideration (1) |

$ |

1,669 |

|

|

$ |

1,661 |

|

Unrecognized tax benefits (2) |

|

3,263 |

|

|

|

3,176 |

|

Operating lease liabilities, less current portion |

|

2,387 |

|

|

|

2,648 |

|

Other |

|

281 |

|

|

|

298 |

|

Other long-term liabilities |

$ |

7,600 |

|

|

$ |

7,783 |

|

(1)Deferred consideration consisted of the present value of a guaranteed payment to be made in connection with the fiscal 2021 Vetex acquisition (Note 11).

(2)Unrecognized tax benefits include accrued interest and penalties, if applicable (Note 10).

6. Debt

Debt consisted of the following:

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

(In thousands) |

2024 |

|

|

2024 |

|

Revolving Credit Facility, Term SOFR + 3.00%, maturing October 1, 2027 |

$ |

5,000 |

|

|

$ |

5,000 |

|

Tranche 1 Term Loans, Term SOFR +5.75%, maturing October 1, 2027 |

|

25,000 |

|

|

|

25,000 |

|

Long-term debt, gross |

|

30,000 |

|

|

|

30,000 |

|

Less: Unamortized debt issuance costs |

|

(409 |

) |

|

|

(446 |

) |

Long-term debt, net |

$ |

29,591 |

|

|

$ |

29,554 |

|

On October 14, 2022, the Company entered into a secured revolving credit facility and secured term loan facilities pursuant to a Credit, Security and Guaranty Agreement (the “MidCap Credit Agreement”) with Mid Cap Funding IV Trust, as agent, and MidCap Financial Trust, as term loan servicer and the lenders from time to time party thereto. The MidCap Credit Agreement provides for availability under a secured revolving line of credit of up to $25.0 million (the “Revolving Credit Facility”). Availability under the Revolving Credit Facility is subject to a borrowing base.

The MidCap Credit Agreement also provided for up to $75.0 million in term loans (the “Term Loans”), consisting of a $25.0 million Tranche 1 (“Tranche 1”) and a $50.0 million Tranche 2 (“Tranche 2”), which was available until December 31, 2024. The Company did not draw any amounts under Tranche 2 and the Tranche 2 commitment expired on December 31, 2024. Upon closing, the Company borrowed $25.0 million of Tranche 1, borrowed $5.0 million on the Revolving Credit Facility, and used approximately $10.0 million of the proceeds to repay borrowings under the revolving credit facility with Bridgewater Bank. The Company intends to use the remaining proceeds to fund working capital needs and for other general corporate purposes, as permitted under the MidCap Credit Agreement.

Pursuant to the MidCap Credit Agreement, the Company provided a first priority security interest in all existing and future acquired assets, including intellectual property and real estate, owned by the Company. The MidCap Credit Agreement contains certain covenants that limit the Company’s ability to engage in certain transactions. Subject to certain limited exceptions, these covenants limit the Company’s ability to, among other things:

•create, incur, assume or permit to exist any additional indebtedness, or create, incur, allow or permit to exist any additional liens;

•enter into any amendment or other modification of certain agreements;

•effect certain changes in the Company’s business, fiscal year, management, entity name or business locations;

•liquidate or dissolve, merge with or into, or consolidate with, any other company;

•pay cash dividends on, make any other distributions in respect of, or redeem, retire or repurchase, any shares of the Company’s capital stock;

•make certain investments, other than limited permitted acquisitions; and

•enter into transactions with the Company’s affiliates.

The MidCap Credit Agreement also contains customary indemnification obligations and customary events of default, including, among other things, (i) non-payment, (ii) breach of warranty, (iii) non-performance of covenants and obligations, (iv) default on other indebtedness, (v) judgments, (vi) change of control, (vii) bankruptcy and insolvency, (viii) impairment of security, (ix) termination of a pension plan, (x) regulatory matters, and (xi) material adverse effect.

In the event of default under the MidCap Credit Agreement, the Company would be required to pay interest on principal and all other due and unpaid obligations at the current rate in effect plus 2%.

Borrowings under the MidCap Credit Agreement bear interest at Term SOFR as published by CME Group Benchmark Administration Limited plus 0.10% (“Adjusted Term SOFR”). The Revolving Credit Facility bears interest at an annual rate equal to 3.00% plus the greater of Adjusted Term SOFR or 1.50%, and the Term Loans bear interest at an annual rate equal to 5.75% plus the greater of Adjusted Term SOFR or 1.50%. The Company is required to make monthly interest payments on the Revolving Credit Facility with the entire principal payment due at maturity. The Company is required to make 48 monthly interest payments on the Term Loans beginning on November 1, 2022 (the “Interest-Only Period”). If the Company is in covenant compliance at the end of the Interest-Only Period, the Company will have the option to extend the Interest-Only Period through maturity with the entire principal payment due at maturity. If the Company is not in covenant compliance at the end of the Interest-Only Period, the Company is required to make 12 months of straight-line amortization payments with the entire principal amount due at maturity.

Subject to certain limitations, the Term Loans have a prepayment fee for payments made prior to the maturity date equal to 1.0% of the prepaid principal amount for the third year following the closing date and thereafter. In addition, if the Revolving Credit Facility is terminated in whole or in part prior to the maturity date, the Company must pay a prepayment fee equal to 1.0% of the terminated commitment amount for the third year following the closing date of the MidCap Credit Agreement and thereafter. The Company is also required to pay a full exit fee at the time of maturity or full prepayment event equal to 2.5% of the aggregate principal amount of the Term Loans made pursuant to the MidCap Credit Agreement and a partial exit fee at the time of any partial prepayment event equal to 2.5% of the amount prepaid. This exit fee is accreted over the remaining term of the Term Loans. The Company also is obligated to pay customary origination fees at the time of each funding of the Term Loans and a customary annual administrative fee based on the amount borrowed under the Term Loan, due on an annual basis. The customary fees on the Revolving Credit Facility

include (i) an origination fee based on the commitment amount, which was paid on the closing date, (ii) an annual collateral management fee of 0.50% per annum based on the outstanding balance of the Revolving Credit Facility, payable monthly in arrears and (iii) an unused line fee of 0.50% per annum based on the average unused portion of the Revolving Credit Facility, payable monthly in arrears. The Company must also maintain a minimum balance of no less than 20% of availability under the Revolving Credit Facility or a minimum balance fee applies of 0.50% per annum. Expenses recognized for fees for the Revolving Credit Facility and Term Loans are reported in interest expense, net on the condensed consolidated statements of operations.

7. Derivative Financial Instruments

As of December 31, 2024 and September 30, 2024, derivative financial instruments on the condensed consolidated balance sheets consisted of a fixed-to-variable interest rate swap to mitigate exposure to interest rate increases related to our Term Loans (“interest rate swap”). The interest rate swap has been designated as a cash flow hedge. See Note 6 Debt for further information on our financing arrangements. The net fair value of designated hedge derivatives subject to master netting arrangements reported on the condensed consolidated balance sheets was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset (Liability) |

(In thousands) |

Gross Recognized Amount |

|

|

Gross Offset Amount |

|

|

Net Amount Presented |

|

|

Cash Collateral Receivable |

|

|

Net Amount Reported |

|

|

Balance Sheet Location |

December 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest rate swap |

$ |

(196 |

) |

|

$ |

— |

|

|

$ |

(196 |

) |

|

$ |

436 |

|

|

$ |

240 |

|

|

Other assets, noncurrent |

September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest rate swap |

$ |

(673 |

) |

|

$ |

— |

|

|

$ |

(673 |

) |

|

$ |

625 |

|

|

$ |

(48 |

) |

|

Other long-term liabilities |

The pretax amounts recognized in accumulated other comprehensive loss (“AOCL”) for designated hedge derivative instruments were as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

(In thousands) |

|

2024 |

|

|

2023 |

|

Beginning unrealized net (loss) gain in AOCL |

|

$ |

(673 |

) |

|

$ |

183 |

|

Net gain (loss) recognized in other comprehensive (loss) income |

|

|

506 |

|

|

|

(620 |

) |

Net gain (loss) reclassified into interest expense |

|

|

(29 |

) |

|

|

(62 |

) |

Ending unrealized (loss) gain in AOCL |

|

$ |

(196 |

) |

|

$ |

(499 |

) |

8. Stock-based Compensation Plans

The Company has stock-based compensation plans approved by its shareholders under which it grants stock options, restricted stock awards, restricted stock units and deferred stock units to officers, directors and key employees. Stock-based compensation expense was reported as follows in the condensed consolidated statements of operations:

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

(In thousands) |

2024 |

|

|

2023 |

|

Product costs |

$ |

59 |

|

|

$ |

72 |

|

Research and development |

|

301 |

|

|

|

370 |

|

Selling, general and administrative |

|

1,383 |

|

|

|

1,526 |

|

Total |

$ |

1,743 |

|

|

$ |

1,968 |

|

As of December 31, 2024, unrecognized compensation costs related to non-vested awards totaled approximately $9.1 million, which is expected to be recognized over a weighted average period of approximately 2.0 years.

Stock Option Awards

The Company awards stock options to officers, directors and key employees and uses the Black-Scholes option pricing model to determine the fair value of stock options as of the date of each grant. Stock option grant activity was as follows:

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

2024 |

|

|

2023 |

|

Stock option grant activity: |

|

|

|

|

|

Stock options granted |

|

- |

|

|

|

250,000 |

|

Weighted average grant date fair value |

$ |

- |

|

|

$ |

15.82 |

|

Weighted average exercise price |

$ |

- |

|

|

$ |

33.64 |

|

Restricted Stock Awards

During the three months ended December 31, 2024, the Company did not award any shares of restricted stock. During the three months ended December 31, 2023, the Company awarded 98,000 shares of restricted stock to certain key employees and officers with a weighted average grant date fair value per share of $33.64. Restricted stock is valued based on the market value of the shares as of the date of grant.

Restricted Stock Unit Awards

During the three months ended December 31, 2024, the Company did not award any restricted stocks (“RSU’s”). During the three months ended December 31, 2023, the Company awarded 5,000 RSU’s to directors and key employees in foreign jurisdictions with a weighted average grant date fair value per unit of $33.64. RSUs are valued based on the market value of the shares as of the date of grant.

Employee Stock Purchase Plan

Our U.S. employees are eligible to participate in the amended 1999 Employee Stock Purchase Plan (“ESPP”) approved by our shareholders. During each of the three months ended December 31, 2024 and 2023 no shares were issued under the ESPP.

9. Net (Loss) Income Per Share Data

Basic net (loss) income per common share is calculated by dividing net (loss) income by the weighted average number of common shares outstanding during the period. Diluted net (loss) income per common share is computed by dividing net (loss) income by the weighted average number of common and common equivalent shares outstanding during the period. The Company’s potentially dilutive common shares are those that result from dilutive common stock options and non-vested stock relating to restricted stock awards and RSUs.

The calculation of diluted loss per share excluded 0.1 million or less in weighted-average shares for each of the three-month periods ended December 31, 2024 and 2023, as their effect was anti-dilutive. Basic and diluted weighted average shares outstanding were as follows:

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

(In thousands) |

2024 |

|

|

2023 |

|

Basic weighted average shares outstanding |

|

14,231 |

|

|

|

14,102 |

|

Dilutive effect of outstanding stock options, non-vested restricted stock, and non-vested restricted stock units |

|

— |

|

|

|

— |

|

Diluted weighted average shares outstanding |

|

14,231 |

|

|

|

14,102 |

|

10. Income Taxes

For interim income tax reporting, the Company estimates its full-year effective tax rate and applies it to fiscal year-to-date pretax (loss) income, excluding unusual or infrequently occurring discrete items. Tax jurisdictions with losses for which tax benefits cannot be realized are excluded. The Company reported income tax expense of $(0.7) million and $(0.1) million for the three months ended December 31, 2024 and 2023, respectively.

•Beginning in our fiscal 2023, certain research and development (“R&D”) costs are required to be capitalized and amortized over a five-year period under the Tax Cuts and Jobs Act enacted in December 2017. This change impacts the expected U.S. federal and state income tax expense and cash taxes paid and to be paid for our fiscal 2025 and 2024.

•Since September 30, 2022, we have maintained a full valuation allowance against U.S. net deferred tax assets. As a result, we are no longer recording a tax benefit associated with U.S. pretax losses and incremental deferred tax assets.

•Recurring items cause our effective tax rate to differ from the U.S. federal statutory rate of 21%, including foreign-derived intangible income (“FDII”) deductions in the U.S., U.S. federal and Irish R&D credits, Irish and U.S. state tax rates, excess tax benefits associated with stock-based compensation, and non-deductible merger-related charges (Note 13).