Sunrun (Nasdaq: RUN), the nation’s leading provider of clean energy

as a subscription service, today announced financial results for

the quarter ended June 30, 2024.

“In the second quarter we again set new records for both storage

installation and attachment rates, further differentiating Sunrun

in the industry, beating the high-end of our storage installation

guidance and delivering solid quarter-over-quarter growth for solar

installation, Cash Generation and Net Subscriber Value,”

said Mary Powell, Sunrun’s Chief Executive

Officer. “Our primary focus is on expanding our

differentiation, launching additional products and services to

expand customer lifetime values, and remaining a disciplined,

margin-focused leader in the sector to drive meaningful Cash

Generation.”

“The team is executing on our margin-focused and

disciplined-growth strategy, which is producing strong results. We

expect positive Cash Generation in Q3, are on track for our

annualized run-rate target of $200 to $500 million in Q4, and are

excited to introduce our 2025 Cash Generation guidance of $350 to

$600 million,” said Danny Abajian, Sunrun’s Chief Financial

Officer. “We continue to execute well in the capital

markets and believe our sponsor quality and record of strong asset

performance continue to differentiate us in the market.”

Second Quarter Updates

- Storage Attachment Rates Reach 54%: Storage attachment rates on

installations reached 54% in Q2, up from 18% in the same period a

year ago, with 264.5 Megawatt hours installed during the quarter.

Sunrun has now installed more than 116,000 solar and storage

systems, representing nearly 1.8 Gigawatt hours of stored energy

capacity.

- Accelerating Momentum in New Homes Business: Sunrun is pleased

to welcome industry leaders Matt Brost and Ellen Struck to its new

homes division. Brost and Struck most recently worked at SunPower,

where they led the largest new home solar business in the country,

and together bring more than four decades of experience in the

energy and solar industries. With this strategic investment, Sunrun

plans to accelerate the growth of solar and storage installations

on new construction and capitalize on our strong, market-leading

platform across multiple segments.

- Sunrun and Tesla Electric Partner to Support Texas Power Grid:

The program, which has enrolled more than 150 Sunrun customers,

will dispatch stored solar energy from at-home batteries to rapidly

increase available electricity reserves on the Texas power grid

during times of high consumption. Customers will be compensated for

their participation while also retaining a portion of the stored

energy in their batteries to provide back-up power to their homes

in the event of a power outage. Sunrun will also earn incremental

recurring revenue for the program.

- Sunrun Customers Power Through Outages Caused By Hurricane

Beryl: During prolonged power outages in the aftermath of Hurricane

Beryl, more than 1,600 Sunrun customers in the greater Houston area

were able to keep their homes energized with more than 70,000 hours

of backup energy provided by their solar-plus-storage systems.

- First Vehicle-To-Home Grid Support Launched in Maryland: In

partnership with Maryland’s largest utility, Baltimore Gas and

Electric Company (BGE), the program utilizes all-electric Ford

F-150 Lightning trucks to deliver power to owners’ homes during

peak demand times to support Maryland’s power grid. This program is

the first operational bidirectional electric vehicle power plant in

the United States that uses a cohort of customer vehicles and is a

significant proof of concept, with the goal to expand these

programs all around the country.

- Continued Strong Capital Markets Execution: In June, as

previously noted, Sunrun closed an $886 million securitization of

residential solar and battery systems. The two classes of

non-recourse Class A senior notes were rated A+ by Kroll with the

$443.15 million public Class A-1 note priced at a credit spread of

205 basis points. The Class A notes represented an advance rate of

approximately 72.6%. Similar to prior transactions, Sunrun raised

additional subordinated non-recourse financing which increased the

cumulative advance rate to 83%. In July 2024, Sunrun also expanded

its non-recourse warehouse lending facility by $280 to $2,630

million in commitments, matching the growing scale of Sunrun’s

business.

- Science Based Targets Initiative (SBTi) Approves Sunrun’s

Net-Zero and Emissions Reductions Targets: Sunrun’s near and

long-term greenhouse gas emissions reductions targets have been

assessed and approved by the SBTi. In addition, SBTi has verified

Sunrun’s net-zero science-based target by 2050. The SBTi is a

corporate climate action organization that enables companies and

financial institutions worldwide to play their part in combating

the climate crisis.

Key Operating Metrics

In the second quarter of 2024, Customer Additions were 26,687

including 24,984 Subscriber Additions. As of June 30, 2024, Sunrun

had 984,000 Customers, including 828,129 Subscribers. Customers

grew 13% in the second quarter of 2024 compared to the second

quarter of 2023.

Annual Recurring Revenue from Subscribers was approximately $1.5

billion as of June 30, 2024. The Average Contract Life Remaining of

Subscribers was 17.8 years as of June 30, 2024.

Subscriber Value was $49,610 in the second quarter of 2024, an

11% increase compared to the second quarter of 2023. Creation Cost

was $37,216 in the second quarter of 2024.

Net Subscriber Value was $12,394 in the second quarter of 2024.

Total Value Generated was $310 million in the second quarter of

2024. On a pro-forma basis assuming a 7.5% discount rate,

consistent with capital costs observed in Q2, Subscriber Value was

$44,291 and Net Subscriber Value was $7,075 in the second quarter

of 2024.

Gross Earning Assets as of June 30, 2024, were $15.7 billion.

Net Earning Assets were $5.7 billion, which included $1,042 million

in Total Cash, as of June 30, 2024.

Cash Generation was $217 million in the second quarter. The

strong Cash Generation achievement was inclusive of a recoupment of

the ITC-related working capital investments made in Q1.

Storage Capacity Installed was 264.5 Megawatt hours in the

second quarter of 2024. This represents a 152% year over year

increase from the 104.8 Megawatt hours of Storage Capacity

Installed in the second quarter of 2023.

Solar Energy Capacity Installed was 192.3 Megawatts in the

second quarter of 2024. Solar Energy Capacity Installed for

Subscribers was 182.1 Megawatts in the second quarter of 2024.

Networked Solar Energy Capacity was 7,058 Megawatts as of June

30, 2024. Networked Solar Energy Capacity for Subscribers was 5,984

Megawatts as of June 30, 2024. Networked Storage Capacity was 1.8

Gigawatt hours as of June 30, 2024.

The solar energy systems we deployed in Q2 are expected to

offset the emission of 3.8 million metric tons of CO2 over the next

thirty years. Over the last twelve months ended June 30, 2024,

Sunrun’s systems are estimated to have offset 3.9 million metric

tons of CO2.

Outlook

Management is reiterating guidance for Cash Generation of $50

million to $125 million in Q4 ($200 million to $500 million

annualized). Cash Generation is expected to be positive in Q3.

Management is introducing Cash Generation guidance of $350

million to $600 million for the full-year 2025.

Storage Capacity Installed is expected to be in a range of 1,030

to 1,100 Megawatt hours for the full-year 2024, and increase from

the prior range of 800 to 1,000 Megawatt hours. This range

represents approximately 80% to 93% growth year over year.

Storage Capacity Installed is expected to be in a range of 275

to 300 Megawatt hours in the third quarter of 2024. This range

represents approximately 64% growth year over year.

Solar Energy Capacity Installed is expected to decline

approximately 15% for the full-year 2024, in-line with the low-end

of the prior guidance range. Year-over-year growth is expected to

be positive in Q4.

Solar Energy Capacity Installed is expected to be in a range of

220 to 230 Megawatts in the third quarter of 2024. This range

represents approximately 14% to 20% sequential growth from Q2.

Second Quarter 2024 GAAP Results

Total revenue was $523.9 million in the second quarter of 2024,

down $66.3 million, or 11%, from the second quarter of 2023.

Customer agreements and incentives revenue was $387.8 million, an

increase of $85.7 million, or 28%, compared to the second quarter

of 2023. Solar energy systems and product sales revenue was $136.0

million, a decrease of $152.0 million, or 53%, compared to the

second quarter of 2023. The increasing mix of Subscribers results

in less upfront revenue recognition, as revenue is recognized over

the life of the Customer Agreement which is typically 20 or 25

years.

Total cost of revenue was $428.8 million, a decrease of 20%

year-over-year. Total operating expenses were $651.9 million, a

decrease of 18% year-over-year.

Net income attributable to common stockholders was $139.1

million, or $0.63 per basic share and $0.55 per diluted share, in

the second quarter of 2024.

Financing Activities

As of August 6, 2024, closed transactions and executed term

sheets provide us with expected tax equity to fund approximately

313 Megawatts of Solar Energy Capacity Installed for Subscribers

beyond what was deployed through June 30, 2024. Sunrun also had

$1,089 million available in its non-recourse senior revolving

warehouse facility at the end of Q2, pro-forma to reflect a recent

upsize, to fund over 373 Megawatts of Solar Energy Capacity

Installed for Subscribers.

Conference Call Information

Sunrun is hosting a conference call for analysts and investors

to discuss its second quarter 2024 results and business outlook at

1:30 p.m. Pacific Time today, August 6, 2024. A live audio webcast

of the conference call along with supplemental financial

information will be accessible via the “Investor Relations” section

of Sunrun’s website at https://investors.sunrun.com. The conference

call can also be accessed live over the phone by dialing (877)

407-5989 (toll free) or (201) 689-8434 (toll). An audio replay will

be available following the call on the Sunrun Investor Relations

website for approximately one month.

About Sunrun

Sunrun Inc. (Nasdaq: RUN) revolutionized the solar industry in

2007 by removing financial barriers and democratizing access to

locally-generated, renewable energy. Today, Sunrun is the nation’s

leading provider of clean energy as a subscription service,

offering residential solar and storage with no upfront costs.

Sunrun’s innovative products and solutions can connect homes to the

cleanest energy on earth, providing them with energy security,

predictability, and peace of mind. Sunrun also manages energy

services that benefit communities, utilities, and the electric grid

while enhancing customer value. Discover more at www.sunrun.com

Non-GAAP Information

This press release includes references to certain non-GAAP

financial measures, such as non-GAAP net (loss) income and non-GAAP

net (loss) income per share. We believe that these non-GAAP

financial measures, when reviewed in conjunction with GAAP

financial measures, can provide meaningful supplemental information

for investors regarding the performance of our business and

facilitate a meaningful evaluation of current period performance on

a comparable basis with prior periods. Our management uses these

non-GAAP financial measures in order to have comparable financial

results to analyze changes in our underlying business from quarter

to quarter. These non-GAAP financial measures should be considered

as a supplement to, and not as a substitute for or superior to the

GAAP financial measures presented in this press release and our

financial statements and other publicly filed reports. Non-GAAP

measures as presented herein may not be comparable to similarly

titled measures used by other companies.

Non-GAAP net (loss) income is defined as GAAP net (loss) income

adjusted by the non-cash goodwill impairment charge. Management

believes the exclusion of this non-cash and non-recurring item

provides useful supplemental information to investors and

facilitates the analysis of its operating results and comparison of

operating results across reporting periods.

Forward Looking Statements

This communication contains forward-looking statements related

to Sunrun (the “Company”) within the meaning of Section 27A of the

Securities Act of 1933, and Section 21E of the Securities Exchange

Act of 1934 and the Private Securities Litigation Reform Act of

1995. Such forward-looking statements include, but are not limited

to, statements related to: the Company’s financial and operating

guidance and expectations; the Company’s business plan, trajectory,

expectations, market leadership, competitive advantages,

operational and financial results and metrics (and the assumptions

related to the calculation of such metrics); the Company’s momentum

in its business strategies including its ESG efforts, expectations

regarding market share, total addressable market, customer value

proposition, market penetration, financing activities, financing

capacity, product mix, and ability to manage cash flow and

liquidity; the growth of the solar industry; the Company’s

financing activities and expectations to refinance, amend, and/or

extend any financing facilities; trends or potential trends within

the solar industry, our business, customer base, and market; the

Company’s ability to derive value from the anticipated benefits of

partnerships, new technologies, and pilot programs, including

contract renewal and repowering programs; anticipated demand,

market acceptance, and market adoption of the Company’s offerings,

including new products, services, and technologies; the Company’s

strategy to be a storage-first company; the ability to increase

margins based on a shift in product focus; expectations regarding

the growth of home electrification, electric vehicles, virtual

power plants, and distributed energy resources; the Company’s

ability to manage suppliers, inventory, and workforce; supply

chains and regulatory impacts affecting supply chains; the

Company’s leadership team and talent development; the legislative

and regulatory environment of the solar industry and the potential

impacts of proposed, amended, and newly adopted legislation and

regulation on the solar industry and our business; the ongoing

expectations regarding the Company’s storage and energy services

businesses and anticipated emissions reductions due to utilization

of the Company’s solar energy systems; and factors outside of the

Company’s control such as macroeconomic trends, bank failures,

public health emergencies, natural disasters, acts of war,

terrorism, geopolitical conflict, or armed conflict / invasion, and

the impacts of climate change. These statements are not guarantees

of future performance; they reflect the Company’s current views

with respect to future events and are based on assumptions and

estimates and are subject to known and unknown risks, uncertainties

and other factors that may cause actual results, performance or

achievements to be materially different from expectations or

results projected or implied by forward-looking statements. The

risks and uncertainties that could cause the Company’s results to

differ materially from those expressed or implied by such

forward-looking statements include: the Company’s continued ability

to manage costs and compete effectively; the availability of

additional financing on acceptable terms; worldwide economic

conditions, including slow or negative growth rates and inflation;

volatile or rising interest rates; changes in policies and

regulations, including net metering, interconnection limits, and

fixed fees, or caps and licensing restrictions and the impact of

these changes on the solar industry and our business; the Company’s

ability to attract and retain the Company’s business partners;

supply chain risks and associated costs; realizing the anticipated

benefits of past or future investments, partnerships, strategic

transactions, or acquisitions, and integrating those acquisitions;

the Company’s leadership team and ability to attract and retain key

employees; changes in the retail prices of traditional utility

generated electricity; the availability of rebates, tax credits and

other incentives; the availability of solar panels, batteries, and

other components and raw materials; the Company’s business plan and

the Company’s ability to effectively manage the Company’s growth

and labor constraints; the Company’s ability to meet the covenants

in the Company’s investment funds and debt facilities; factors

impacting the home electrification and solar industry generally,

and such other risks and uncertainties identified in the reports

that we file with the U.S. Securities and Exchange Commission from

time to time. All forward-looking statements used herein are based

on information available to us as of the date hereof, and we assume

no obligation to update publicly these forward-looking statements

for any reason, except as required by law.

Citations to industry and market statistics used herein may be

found in our Investor Presentation, available via the “Investor

Relations” section of Sunrun’s website at

https://investors.sunrun.com.

|

Consolidated Balance Sheets(In

Thousands) |

|

|

| |

|

June 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

| Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash |

|

$ |

707,587 |

|

$ |

678,821 |

|

Restricted cash |

|

|

334,513 |

|

|

308,869 |

|

Accounts receivable, net |

|

|

179,949 |

|

|

172,001 |

|

Inventories |

|

|

353,125 |

|

|

459,746 |

|

Prepaid expenses and other current assets |

|

|

100,978 |

|

|

262,822 |

|

Total current assets |

|

|

1,676,152 |

|

|

1,882,259 |

|

Restricted cash |

|

|

148 |

|

|

148 |

|

Solar energy systems, net |

|

|

13,856,654 |

|

|

13,028,871 |

|

Property and equipment, net |

|

|

143,128 |

|

|

149,139 |

|

Goodwill |

|

|

3,122,168 |

|

|

3,122,168 |

|

Other assets |

|

|

2,645,109 |

|

|

2,267,652 |

|

Total assets |

|

$ |

21,443,359 |

|

$ |

20,450,237 |

| Liabilities and total

equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

216,557 |

|

$ |

230,723 |

|

Distributions payable to noncontrolling interests and redeemable

noncontrolling interests |

|

|

35,067 |

|

|

35,180 |

|

Accrued expenses and other liabilities |

|

|

349,061 |

|

|

499,225 |

|

Deferred revenue, current portion |

|

|

120,006 |

|

|

128,600 |

|

Deferred grants, current portion |

|

|

8,181 |

|

|

8,199 |

|

Finance lease obligations, current portion |

|

|

26,434 |

|

|

22,053 |

|

Non-recourse debt, current portion |

|

|

250,980 |

|

|

547,870 |

|

Pass-through financing obligation, current portion |

|

|

1,458 |

|

|

16,309 |

|

Total current liabilities |

|

|

1,007,744 |

|

|

1,488,159 |

|

Deferred revenue, net of current portion |

|

|

1,141,120 |

|

|

1,067,461 |

|

Deferred grants, net of current portion |

|

|

190,949 |

|

|

195,724 |

|

Finance lease obligations, net of current portion |

|

|

80,233 |

|

|

68,753 |

|

Convertible senior notes |

|

|

652,379 |

|

|

392,867 |

|

Line of credit |

|

|

390,929 |

|

|

539,502 |

|

Non-recourse debt, net of current portion |

|

|

10,668,063 |

|

|

9,191,689 |

|

Pass-through financing obligation, net of current portion |

|

|

— |

|

|

278,333 |

|

Other liabilities |

|

|

151,876 |

|

|

190,866 |

|

Deferred tax liabilities |

|

|

111,594 |

|

|

122,870 |

|

Total liabilities |

|

|

14,394,887 |

|

|

13,536,224 |

| Redeemable noncontrolling

interests |

|

|

635,865 |

|

|

676,177 |

| Total stockholders’

equity |

|

|

5,365,745 |

|

|

5,230,228 |

| Noncontrolling interests |

|

|

1,046,862 |

|

|

1,007,608 |

|

Total equity |

|

|

6,412,607 |

|

|

6,237,836 |

|

Total liabilities, redeemable noncontrolling interests and

total equity |

|

$ |

21,443,359 |

|

$ |

20,450,237 |

|

Consolidated Statements of Operations(In

Thousands, Except Per Share Amounts) |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

Customer agreements and incentives |

|

$ |

387,825 |

|

|

$ |

302,149 |

|

|

$ |

710,792 |

|

|

$ |

548,623 |

|

|

Solar energy systems and product sales |

|

|

136,041 |

|

|

|

288,044 |

|

|

|

271,262 |

|

|

|

631,419 |

|

|

Total revenue |

|

|

523,866 |

|

|

|

590,193 |

|

|

|

982,054 |

|

|

|

1,180,042 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of customer agreements and incentives |

|

|

298,665 |

|

|

|

268,687 |

|

|

|

568,199 |

|

|

|

505,592 |

|

|

Cost of solar energy systems and product sales |

|

|

130,120 |

|

|

|

270,538 |

|

|

|

286,279 |

|

|

|

590,556 |

|

|

Sales and marketing |

|

|

151,657 |

|

|

|

194,876 |

|

|

|

303,921 |

|

|

|

397,712 |

|

|

Research and development |

|

|

10,243 |

|

|

|

4,557 |

|

|

|

22,330 |

|

|

|

9,114 |

|

|

General and administrative |

|

|

61,229 |

|

|

|

57,476 |

|

|

|

112,495 |

|

|

|

110,703 |

|

|

Total operating expenses |

|

|

651,914 |

|

|

|

796,134 |

|

|

|

1,293,224 |

|

|

|

1,613,677 |

|

| Loss from operations |

|

|

(128,048 |

) |

|

|

(205,941 |

) |

|

|

(311,170 |

) |

|

|

(433,635 |

) |

| Interest expense, net |

|

|

(207,207 |

) |

|

|

(157,177 |

) |

|

|

(399,366 |

) |

|

|

(299,875 |

) |

| Other income, net |

|

|

64,378 |

|

|

|

41,071 |

|

|

|

154,308 |

|

|

|

16,071 |

|

| Loss before income taxes |

|

|

(270,877 |

) |

|

|

(322,047 |

) |

|

|

(556,228 |

) |

|

|

(717,439 |

) |

| Income tax (benefit)

expense |

|

|

(10,949 |

) |

|

|

18,677 |

|

|

|

(13,150 |

) |

|

|

(40,942 |

) |

| Net loss |

|

|

(259,928 |

) |

|

|

(340,724 |

) |

|

|

(543,078 |

) |

|

|

(676,497 |

) |

|

Net loss attributable to noncontrolling interests and redeemable

noncontrolling interests |

|

|

(399,002 |

) |

|

|

(396,198 |

) |

|

|

(594,334 |

) |

|

|

(491,583 |

) |

|

Net income (loss) attributable to common stockholders |

|

$ |

139,074 |

|

|

$ |

55,474 |

|

|

$ |

51,256 |

|

|

$ |

(184,914 |

) |

|

Net income (loss) per share attributable to common

stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.63 |

|

|

$ |

0.26 |

|

|

$ |

0.23 |

|

|

$ |

(0.86 |

) |

|

Diluted |

|

$ |

0.55 |

|

|

$ |

0.25 |

|

|

$ |

0.23 |

|

|

$ |

(0.86 |

) |

|

Weighted average shares used to compute net income (loss) per share

attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

|

222,474 |

|

|

|

216,017 |

|

|

|

221,178 |

|

|

|

215,153 |

|

|

Diluted |

|

|

255,107 |

|

|

|

221,849 |

|

|

|

244,755 |

|

|

|

215,153 |

|

|

Consolidated Statements of Cash Flows(In

Thousands) |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Operating

activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(259,928 |

) |

|

$ |

(340,724 |

) |

|

$ |

(543,078 |

) |

|

$ |

(676,497 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization, net of amortization of deferred

grants |

|

|

152,485 |

|

|

|

249,889 |

|

|

|

303,005 |

|

|

|

249,889 |

|

|

Deferred income taxes |

|

|

(10,948 |

) |

|

|

18,676 |

|

|

|

(13,150 |

) |

|

|

(40,937 |

) |

|

Stock-based compensation expense |

|

|

28,095 |

|

|

|

28,237 |

|

|

|

56,964 |

|

|

|

56,503 |

|

|

Interest on pass-through financing obligations |

|

|

4,081 |

|

|

|

4,894 |

|

|

|

8,837 |

|

|

|

9,756 |

|

|

Reduction in pass-through financing obligations |

|

|

(9,853 |

) |

|

|

(10,406 |

) |

|

|

(19,188 |

) |

|

|

(20,047 |

) |

|

Unrealized (loss) gain on derivatives |

|

|

(16,456 |

) |

|

|

(36,452 |

) |

|

|

(71,559 |

) |

|

|

(5,731 |

) |

|

Other noncash items |

|

|

25,184 |

|

|

|

51,318 |

|

|

|

39,823 |

|

|

|

78,684 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(12,231 |

) |

|

|

(3,317 |

) |

|

|

(13,602 |

) |

|

|

(12,702 |

) |

|

Inventories |

|

|

58,868 |

|

|

|

96,150 |

|

|

|

106,621 |

|

|

|

(7,836 |

) |

|

Prepaid expenses and other assets |

|

|

(134,946 |

) |

|

|

(141,226 |

) |

|

|

(270,624 |

) |

|

|

(250,680 |

) |

|

Accounts payable |

|

|

(68,479 |

) |

|

|

(18,404 |

) |

|

|

(8,838 |

) |

|

|

(19,832 |

) |

|

Accrued expenses and other liabilities |

|

|

4,304 |

|

|

|

(21,734 |

) |

|

|

7,699 |

|

|

|

(48,510 |

) |

|

Deferred revenue |

|

|

31,279 |

|

|

|

44,034 |

|

|

|

65,452 |

|

|

|

46,447 |

|

|

Net cash used in operating activities |

|

|

(208,545 |

) |

|

|

(202,170 |

) |

|

|

(351,638 |

) |

|

|

(641,493 |

) |

| Investing

activities: |

|

|

|

|

|

|

|

|

|

Payments for the costs of solar energy systems |

|

|

(604,531 |

) |

|

|

(692,626 |

) |

|

|

(1,143,506 |

) |

|

|

(1,198,940 |

) |

|

Purchases of property and equipment, net |

|

|

(4,274 |

) |

|

|

(7,636 |

) |

|

|

(743 |

) |

|

|

(11,632 |

) |

|

Net cash used in investing activities |

|

|

(608,805 |

) |

|

|

(700,262 |

) |

|

|

(1,144,249 |

) |

|

|

(1,210,572 |

) |

| Financing

activities: |

|

|

|

|

|

|

|

|

|

Proceeds from state tax credits, net of recapture |

|

|

5,203 |

|

|

|

— |

|

|

|

5,203 |

|

|

|

4,033 |

|

|

Proceeds from line of credit |

|

|

3,927 |

|

|

|

213,053 |

|

|

|

143,732 |

|

|

|

356,384 |

|

|

Repayment of line of credit |

|

|

— |

|

|

|

(183,500 |

) |

|

|

(292,305 |

) |

|

|

(279,736 |

) |

|

Proceeds from issuance of convertible senior notes, net of capped

call transaction |

|

|

— |

|

|

|

— |

|

|

|

444,822 |

|

|

|

— |

|

|

Repurchase of convertible senior notes |

|

|

(10,069 |

) |

|

|

— |

|

|

|

(183,784 |

) |

|

|

— |

|

|

Proceeds from issuance of non-recourse debt |

|

|

1,845,150 |

|

|

|

950,230 |

|

|

|

2,615,256 |

|

|

|

1,465,110 |

|

|

Repayment of non-recourse debt |

|

|

(1,022,193 |

) |

|

|

(287,022 |

) |

|

|

(1,453,725 |

) |

|

|

(337,990 |

) |

|

Payment of debt fees |

|

|

(35,245 |

) |

|

|

(16,388 |

) |

|

|

(83,024 |

) |

|

|

(17,121 |

) |

|

Proceeds from pass-through financing and other obligations,

net |

|

|

1,795 |

|

|

|

2,316 |

|

|

|

3,603 |

|

|

|

4,320 |

|

|

Early repayment of pass-through financing obligation |

|

|

(220,288 |

) |

|

|

— |

|

|

|

(240,288 |

) |

|

|

— |

|

|

Payment of finance lease obligations |

|

|

(7,019 |

) |

|

|

(6,283 |

) |

|

|

(13,751 |

) |

|

|

(10,760 |

) |

|

Contributions received from noncontrolling interests and redeemable

noncontrolling interests |

|

|

631,580 |

|

|

|

359,789 |

|

|

|

795,917 |

|

|

|

757,539 |

|

|

Distributions paid to noncontrolling interests and redeemable

noncontrolling interests |

|

|

(107,569 |

) |

|

|

(57,443 |

) |

|

|

(182,403 |

) |

|

|

(121,344 |

) |

|

Acquisition of noncontrolling interests |

|

|

(18,774 |

) |

|

|

(7,009 |

) |

|

|

(19,933 |

) |

|

|

(14,184 |

) |

|

Proceeds from transfer of investment tax credits |

|

|

227,691 |

|

|

|

— |

|

|

|

334,220 |

|

|

|

— |

|

|

Payments to redeemable noncontrolling interests and noncontrolling

interests of investment tax credits |

|

|

(227,691 |

) |

|

|

— |

|

|

|

(334,220 |

) |

|

|

— |

|

|

Net proceeds related to stock-based award activities |

|

|

9,921 |

|

|

|

12,541 |

|

|

|

10,977 |

|

|

|

13,869 |

|

|

Net cash provided by financing activities |

|

|

1,076,419 |

|

|

|

980,284 |

|

|

|

1,550,297 |

|

|

|

1,820,120 |

|

| Net change in cash and

restricted cash |

|

|

259,069 |

|

|

|

77,852 |

|

|

|

54,410 |

|

|

|

(31,945 |

) |

| Cash and restricted cash,

beginning of period |

|

|

783,179 |

|

|

|

843,226 |

|

|

|

987,838 |

|

|

|

953,023 |

|

| Cash and restricted cash, end

of period |

|

$ |

1,042,248 |

|

|

$ |

921,078 |

|

|

$ |

1,042,248 |

|

|

$ |

921,078 |

|

Key Operating and Financial

Metrics

The following operating metrics are used by management to

evaluate the performance of the business. Management believes these

metrics, when taken together with other information contained in

our filings with the SEC and within this press release, provide

investors with helpful information to determine the economic

performance of the business activities in a period that would

otherwise not be observable from historic GAAP measures. Management

believes that it is helpful to investors to evaluate the present

value of cash flows expected from subscribers over the full

expected relationship with such subscribers (“Subscriber Value”,

more fully defined in the definitions appendix below) in comparison

to the costs associated with adding these customers, regardless of

whether or not the costs are expensed or capitalized in the period

(“Creation Cost”, more fully defined in the definitions appendix

below). The Company also believes that Subscriber Value, Creation

Costs, and Total Value Generated are useful metrics for investors

because they present an unlevered view of all of the costs

associated with new customers in a period compared to the expected

future cash flows from these customers over a 30-year period, based

on contracted pricing terms with its customers, which is not

observable in any current or historic GAAP-derived metric.

Management believes it is useful for investors to also evaluate the

future expected cash flows from all customers that have been

deployed through the respective measurement date, less estimated

costs to maintain such systems and estimated distributions to tax

equity partners in consolidated joint venture partnership flip

structures, and distributions to project equity investors (“Gross

Earning Assets”, more fully defined in the definitions appendix

below). The Company also believes Gross Earning Assets is useful

for management and investors because it represents the remaining

future expected cash flows from existing customers, which is not a

current or historic GAAP-derived measure.

Various assumptions are made when calculating these metrics.

Both Subscriber Value and Gross Earning Assets utilize a 6% rate to

discount future cash flows to the present period. Furthermore,

these metrics assume that customers renew after the initial

contract period at a rate equal to 90% of the rate in effect at the

end of the initial contract term. For Customer Agreements with

25-year initial contract terms, a 5-year renewal period is assumed.

For a 20-year initial contract term, a 10-year renewal period is

assumed. In all instances, we assume a 30-year customer

relationship, although the customer may renew for additional years,

or purchase the system. Estimated cost of servicing assets has been

deducted and is estimated based on the service agreements

underlying each fund.

| In-period volume

metrics: |

Three Months EndedJune 30,

2024 |

|

|

Customer Additions |

|

26,687 |

|

|

Subscriber Additions |

|

24,984 |

|

|

Solar Energy Capacity Installed (in Megawatts) |

|

192.3 |

|

|

Solar Energy Capacity Installed for Subscribers (in Megawatts) |

|

182.1 |

|

|

Storage Capacity Installed (in Megawatt hours) |

|

264.5 |

|

| |

|

|

| In-period value

creation metrics: |

Three Months EndedJune 30,

2024 |

|

|

Subscriber Value Contracted Period |

$46,041 |

|

|

Subscriber Value Renewal Period |

$3,569 |

|

|

Subscriber Value |

$49,610 |

|

|

Creation Cost |

$37,216 |

|

|

Net Subscriber Value |

$12,394 |

|

|

Total Value Generated (in millions) |

$310 |

|

| |

|

|

| In-period

environmental impact metrics: |

Three Months EndedJune 30,

2024 |

|

|

Positive Environmental Impact from Customers (over trailing twelve

months, in millions of metric tons of CO2 avoidance) |

|

3.9 |

|

|

Positive Expected Lifetime Environmental Impact from Customer

Additions (in millions of metric tons of CO2 avoidance) |

|

3.8 |

|

| |

|

|

| Period-end

metrics: |

June 30, 2024 |

|

|

Customers |

|

984,000 |

|

|

Subscribers |

|

828,129 |

|

|

Households Served in Low-Income Multifamily Properties |

|

16,305 |

|

|

Networked Solar Energy Capacity (in Megawatts) |

|

7,058 |

|

|

Networked Solar Energy Capacity for Subscribers (in Megawatts) |

|

5,984 |

|

|

Networked Storage Capacity (in Megawatt hours) |

|

1,796 |

|

|

Annual Recurring Revenue (in millions) |

$1,457 |

|

|

Average Contract Life Remaining (in years) |

|

17.8 |

|

|

Gross Earning Assets Contracted Period (in millions) |

$12,051 |

|

|

Gross Earning Assets Renewal Period (in millions) |

$3,641 |

|

|

Gross Earning Assets (in millions) |

$15,692 |

|

|

Net Earning Assets (in millions) |

$5,675 |

|

Note that Sunrun updated the discount rate used to calculate

Subscriber Value and Gross Earning Assets to 6% commencing with the

first quarter 2023 reporting. Also note that figures presented

above may not sum due to rounding. For adjustments related to

Subscriber Value and Creation Cost, please see the supplemental

Creation Cost Methodology memo for each applicable period, which is

available on investors.sunrun.com.

Definitions

Deployments represent solar or storage systems,

whether sold directly to customers or subject to executed Customer

Agreements (i) for which we have confirmation that the systems are

installed, subject to final inspection, or (ii) in the case of

certain system installations by our partners, for which we have

accrued at least 80% of the expected project cost (inclusive of

acquisitions of installed systems).

Customer Agreements refer to, collectively,

solar or storage power purchase agreements and leases.

Subscriber Additions represent the number of

Deployments in the period that are subject to executed Customer

Agreements.

Customer Additions represent the number of

Deployments in the period.

Solar Energy Capacity Installed represents the

aggregate megawatt production capacity of our solar energy systems

that were recognized as Deployments in the period.

Solar Energy Capacity Installed for Subscribers

represents the aggregate megawatt production capacity of our solar

energy systems that were recognized as Deployments in the period

that are subject to executed Customer Agreements.

Storage Capacity Installed represents the

aggregate megawatt hour capacity of storage systems that were

recognized as Deployments in the period.

Creation Cost represents the sum of certain

operating expenses and capital expenditures incurred divided by

applicable Customer Additions and Subscriber Additions in the

period. Creation Cost is comprised of (i) installation costs, which

includes the increase in gross solar energy system assets and the

cost of customer agreement revenue, excluding depreciation expense

of fixed solar assets, and operating and maintenance expenses

associated with existing Subscribers, plus (ii) sales and marketing

costs, including increases to the gross capitalized costs to obtain

contracts, net of the amortization expense of the costs to obtain

contracts, plus (iii) general and administrative costs, and less

(iv) the gross profit derived from selling systems to customers

under sale agreements and Sunrun’s product distribution and lead

generation businesses. Creation Cost excludes stock based

compensation, amortization of intangibles, and research and

development expenses, along with other items the company deems to

be non-recurring or extraordinary in nature. The gross margin

derived from solar energy systems and product sales is included as

an offset to Creation Cost since these sales are ancillary to the

overall business model and lowers our overall cost of business. The

sales, marketing, general and administrative costs in Creation

Costs is inclusive of sales, marketing, general and administrative

activities related to the entire business, including solar energy

system and product sales. As such, by including the gross margin on

solar energy system and product sales as a contra cost, the value

of all activities of the Company’s segment are represented in the

Net Subscriber Value.

Subscriber Value represents the per subscriber

value of upfront and future cash flows (discounted at 6%) from

Subscriber Additions in the period, including expected payments

from customers as set forth in Customer Agreements, net proceeds

from tax equity finance partners, payments from utility incentive

and state rebate programs, contracted net grid service program cash

flows, projected future cash flows from solar energy renewable

energy credit sales, less estimated operating and maintenance costs

to service the systems and replace equipment, consistent with

estimates by independent engineers, over the initial term of the

Customer Agreements and estimated renewal period. For Customer

Agreements with 25 year initial contract terms, a 5 year renewal

period is assumed. For a 20 year initial contract term, a 10 year

renewal period is assumed. In all instances, we assume a 30-year

customer relationship, although the customer may renew for

additional years, or purchase the system.

Net Subscriber Value represents Subscriber

Value less Creation Cost.

Total Value Generated represents Net Subscriber

Value multiplied by Subscriber Additions.

Customers represent the cumulative number of

Deployments, from the company’s inception through the measurement

date.

Subscribers represent the cumulative number of

Customer Agreements for systems that have been recognized as

Deployments through the measurement date.

Networked Solar Energy Capacity represents the

aggregate megawatt production capacity of our solar energy systems

that have been recognized as Deployments, from the company’s

inception through the measurement date.

Networked Solar Energy Capacity for Subscribers

represents the aggregate megawatt production capacity of our solar

energy systems that have been recognized as Deployments, from the

company’s inception through the measurement date, that have been

subject to executed Customer Agreements.

Networked Storage Capacity represents the

aggregate megawatt hour capacity of our storage systems that have

been recognized as Deployments, from the company’s inception

through the measurement date.

Gross Earning Assets is calculated as Gross

Earning Assets Contracted Period plus Gross Earning Assets Renewal

Period.

Gross Earning Assets Contracted Period

represents the present value of the remaining net cash flows

(discounted at 6%) during the initial term of our Customer

Agreements as of the measurement date. It is calculated as the

present value of cash flows (discounted at 6%) that we would

receive from Subscribers in future periods as set forth in Customer

Agreements, after deducting expected operating and maintenance

costs, equipment replacements costs, distributions to tax equity

partners in consolidated joint venture partnership flip structures,

and distributions to project equity investors. We include cash

flows we expect to receive in future periods from tax equity

partners, government incentive and rebate programs, contracted

sales of solar renewable energy credits, and awarded net cash flows

from grid service programs with utilities or grid operators.

Gross Earning Assets Renewal Period is the

forecasted net present value we would receive upon or following the

expiration of the initial Customer Agreement term but before the

30th anniversary of the system’s activation (either in the form of

cash payments during any applicable renewal period or a system

purchase at the end of the initial term), for Subscribers as of the

measurement date. We calculate the Gross Earning Assets Renewal

Period amount at the expiration of the initial contract term

assuming either a system purchase or a renewal, forecasting only a

30-year customer relationship (although the customer may renew for

additional years, or purchase the system), at a contract rate equal

to 90% of the customer’s contractual rate in effect at the end of

the initial contract term. After the initial contract term, our

Customer Agreements typically automatically renew on an annual

basis and the rate is initially set at up to a 10% discount to

then-prevailing utility power prices.

Net Earning Assets represents Gross Earning

Assets, plus total cash, less adjusted debt and less pass-through

financing obligations, as of the same measurement date. Debt is

adjusted to exclude a pro-rata share of non-recourse debt

associated with funds with project equity structures along with

debt associated with the company’s ITC safe harboring facility.

Because estimated cash distributions to our project equity partners

are deducted from Gross Earning Assets, a proportional share of the

corresponding project level non-recourse debt is deducted from Net

Earning Assets, as such debt would be serviced from cash flows

already excluded from Gross Earning Assets.

Cash Generation is calculated using the change

in our unrestricted cash balance from our consolidated balance

sheet, less net proceeds (or plus net repayments) from all recourse

debt (inclusive of convertible debt), and less any primary equity

issuances or net proceeds derived from employee stock award

activity (or plus any stock buybacks or dividends paid to common

stockholders) as presented on the Company’s consolidated statement

of cash flows. The Company expects to continue to raise tax equity

and asset-level non-recourse debt to fund growth, and as such,

these sources of cash are included in the definition of Cash

Generation. Cash Generation also excludes long-term asset or

business divestitures and equity investments in external

non-consolidated businesses (or less dividends or distributions

received in connection with such equity investments).

Annual Recurring Revenue represents revenue

arising from Customer Agreements over the following twelve months

for Subscribers that have met initial revenue recognition criteria

as of the measurement date.

Average Contract Life Remaining represents the

average number of years remaining in the initial term of Customer

Agreements for Subscribers that have met revenue recognition

criteria as of the measurement date.

Households Served in Low-Income Multifamily

Properties represent the number of individual rental units

served in low-income multi-family properties from shared solar

energy systems deployed by Sunrun. Households are counted when the

solar energy system has interconnected with the grid, which may

differ from Deployment recognition criteria.

Positive Environmental Impact from Customers

represents the estimated reduction in carbon emissions as a result

of energy produced from our Networked Solar Energy Capacity over

the trailing twelve months. The figure is presented in millions of

metric tons of avoided carbon emissions and is calculated using the

Environmental Protection Agency’s AVERT tool. The figure is

calculated using the most recent published tool from the EPA, using

the current-year avoided emission factor for distributed resources

on a state by state basis. The environmental impact is estimated

based on the system, regardless of whether or not Sunrun continues

to own the system or any associated renewable energy credits.

Positive Expected Lifetime Environmental Impact from

Customer Additions represents the estimated reduction in

carbon emissions over thirty years as a result of energy produced

from solar energy systems that were recognized as Deployments in

the period. The figure is presented in millions of metric tons of

avoided carbon emissions and is calculated using the Environmental

Protection Agency’s AVERT tool. The figure is calculated using the

most recent published tool from the EPA, using the current-year

avoided emission factor for distributed resources on a state by

state basis, leveraging our estimated production figures for such

systems, which degrade over time, and is extrapolated for 30 years.

The environmental impact is estimated based on the system,

regardless of whether or not Sunrun continues to own the system or

any associated renewable energy credits.

Total Cash represents the total of the

restricted cash balance and unrestricted cash balance from our

consolidated balance sheet.

Investor & Analyst Contact:

Patrick JobinSVP, Deputy CFO & Investor Relations

Officerinvestors@sunrun.com

Media Contact:

Wyatt SemanekDirector, Corporate

Communicationspress@sunrun.com

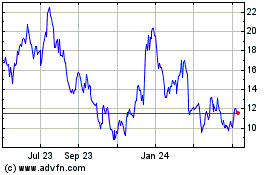

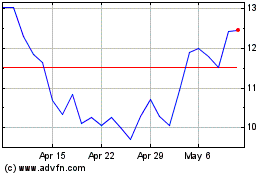

Sunrun (NASDAQ:RUN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sunrun (NASDAQ:RUN)

Historical Stock Chart

From Nov 2023 to Nov 2024