0001013934FALSE--12-31Q32023P2Y00010139342023-01-012023-09-3000010139342023-10-20xbrli:shares00010139342022-12-31iso4217:USD00010139342023-09-30iso4217:USDxbrli:shares00010139342022-07-012022-09-3000010139342023-07-012023-09-3000010139342022-01-012022-09-300001013934us-gaap:CommonStockMember2022-06-300001013934us-gaap:AdditionalPaidInCapitalMember2022-06-300001013934us-gaap:RetainedEarningsMember2022-06-300001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-3000010139342022-06-300001013934us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001013934us-gaap:RetainedEarningsMember2022-07-012022-09-300001013934us-gaap:CommonStockMember2022-07-012022-09-300001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001013934us-gaap:CommonStockMember2022-09-300001013934us-gaap:AdditionalPaidInCapitalMember2022-09-300001013934us-gaap:RetainedEarningsMember2022-09-300001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-3000010139342022-09-300001013934us-gaap:CommonStockMember2023-06-300001013934us-gaap:AdditionalPaidInCapitalMember2023-06-300001013934us-gaap:RetainedEarningsMember2023-06-300001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-3000010139342023-06-300001013934us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001013934us-gaap:RetainedEarningsMember2023-07-012023-09-300001013934us-gaap:CommonStockMember2023-07-012023-09-300001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001013934us-gaap:CommonStockMember2023-09-300001013934us-gaap:AdditionalPaidInCapitalMember2023-09-300001013934us-gaap:RetainedEarningsMember2023-09-300001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001013934us-gaap:CommonStockMember2021-12-310001013934us-gaap:AdditionalPaidInCapitalMember2021-12-310001013934us-gaap:RetainedEarningsMember2021-12-310001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100010139342021-12-310001013934us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001013934us-gaap:RetainedEarningsMember2022-01-012022-09-300001013934us-gaap:CommonStockMember2022-01-012022-09-300001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001013934us-gaap:CommonStockMember2022-12-310001013934us-gaap:AdditionalPaidInCapitalMember2022-12-310001013934us-gaap:RetainedEarningsMember2022-12-310001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001013934us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001013934us-gaap:RetainedEarningsMember2023-01-012023-09-300001013934us-gaap:CommonStockMember2023-01-012023-09-300001013934us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-30stra:segment0001013934country:US2022-12-310001013934country:US2023-09-300001013934stra:AustraliaAndNewZealandMember2022-12-310001013934stra:AustraliaAndNewZealandMember2023-09-300001013934stpr:PA2023-09-300001013934us-gaap:OtherNoncurrentAssetsMember2022-12-310001013934us-gaap:OtherNoncurrentAssetsMember2023-09-3000010139342023-03-31stra:uSHigherEducationCampus00010139342023-04-012023-06-3000010139342023-09-112023-09-1100010139342023-07-012023-07-3100010139342022-01-012022-12-310001013934stra:TuitionGrantsAndScholarshipMemberstra:USHigherEducationSegmentMember2022-07-012022-09-300001013934stra:TuitionGrantsAndScholarshipMemberstra:USHigherEducationSegmentMember2023-07-012023-09-300001013934stra:TuitionGrantsAndScholarshipMemberstra:USHigherEducationSegmentMember2022-01-012022-09-300001013934stra:TuitionGrantsAndScholarshipMemberstra:USHigherEducationSegmentMember2023-01-012023-09-300001013934stra:USHigherEducationSegmentMemberus-gaap:ServiceOtherMember2022-07-012022-09-300001013934stra:USHigherEducationSegmentMemberus-gaap:ServiceOtherMember2023-07-012023-09-300001013934stra:USHigherEducationSegmentMemberus-gaap:ServiceOtherMember2022-01-012022-09-300001013934stra:USHigherEducationSegmentMemberus-gaap:ServiceOtherMember2023-01-012023-09-300001013934stra:USHigherEducationSegmentMember2022-07-012022-09-300001013934stra:USHigherEducationSegmentMember2023-07-012023-09-300001013934stra:USHigherEducationSegmentMember2022-01-012022-09-300001013934stra:USHigherEducationSegmentMember2023-01-012023-09-300001013934stra:AustraliaNewZealandSegmentMemberstra:TuitionGrantsAndScholarshipMember2022-07-012022-09-300001013934stra:AustraliaNewZealandSegmentMemberstra:TuitionGrantsAndScholarshipMember2023-07-012023-09-300001013934stra:AustraliaNewZealandSegmentMemberstra:TuitionGrantsAndScholarshipMember2022-01-012022-09-300001013934stra:AustraliaNewZealandSegmentMemberstra:TuitionGrantsAndScholarshipMember2023-01-012023-09-300001013934stra:AustraliaNewZealandSegmentMemberus-gaap:ServiceOtherMember2022-07-012022-09-300001013934stra:AustraliaNewZealandSegmentMemberus-gaap:ServiceOtherMember2023-07-012023-09-300001013934stra:AustraliaNewZealandSegmentMemberus-gaap:ServiceOtherMember2022-01-012022-09-300001013934stra:AustraliaNewZealandSegmentMemberus-gaap:ServiceOtherMember2023-01-012023-09-300001013934stra:AustraliaNewZealandSegmentMember2022-07-012022-09-300001013934stra:AustraliaNewZealandSegmentMember2023-07-012023-09-300001013934stra:AustraliaNewZealandSegmentMember2022-01-012022-09-300001013934stra:AustraliaNewZealandSegmentMember2023-01-012023-09-300001013934stra:EducationTechnologyServicesMember2022-07-012022-09-300001013934stra:EducationTechnologyServicesMember2023-07-012023-09-300001013934stra:EducationTechnologyServicesMember2022-01-012022-09-300001013934stra:EducationTechnologyServicesMember2023-01-012023-09-30stra:coursestra:term0001013934srt:MinimumMember2023-01-012023-09-300001013934srt:MaximumMember2023-01-012023-09-300001013934srt:MinimumMemberstra:AustraliaNewZealandSegmentMember2023-01-012023-09-300001013934stra:AustraliaNewZealandSegmentMembersrt:MaximumMember2023-01-012023-09-300001013934stra:A2020RestructuringPlanMemberstra:SeveranceAndOtherEmployeeSeparationCostsMember2021-12-310001013934stra:A2020RestructuringPlanMemberstra:SeveranceAndOtherEmployeeSeparationCostsMember2022-01-012022-09-300001013934stra:A2020RestructuringPlanMemberstra:SeveranceAndOtherEmployeeSeparationCostsMember2022-09-300001013934stra:SeveranceAndOtherEmployeeSeparationCostsMember2023-07-012023-09-300001013934stra:SeveranceAndOtherEmployeeSeparationCostsMember2023-01-012023-09-300001013934stra:SeveranceAndOtherEmployeeSeparationCostsMember2022-12-310001013934stra:SeveranceAndOtherEmployeeSeparationCostsMember2023-09-300001013934stra:A2020RestructuringPlanMember2022-07-012022-09-300001013934stra:A2020RestructuringPlanMember2022-01-012022-09-300001013934stra:A2020RestructuringPlanMember2023-01-012023-09-300001013934stra:A2020RestructuringPlanMember2023-07-012023-09-300001013934stra:TaxExemptMunicipalSecuritiesMember2023-09-300001013934us-gaap:CorporateDebtSecuritiesMember2023-09-300001013934stra:TermDepositsMember2023-09-300001013934stra:TaxExemptMunicipalSecuritiesMember2022-12-310001013934us-gaap:CorporateDebtSecuritiesMember2022-12-310001013934us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001013934us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-09-300001013934us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-09-300001013934us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryBillSecuritiesMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryBillSecuritiesMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBillSecuritiesMember2023-09-300001013934us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryBillSecuritiesMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberstra:TaxExemptMunicipalSecuritiesMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberstra:TaxExemptMunicipalSecuritiesMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberstra:TaxExemptMunicipalSecuritiesMember2023-09-300001013934us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberstra:TaxExemptMunicipalSecuritiesMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001013934us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMember2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-09-300001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-09-300001013934us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001013934us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001013934us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001013934us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001013934us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMemberstra:TaxExemptMunicipalSecuritiesMember2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberstra:TaxExemptMunicipalSecuritiesMember2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberstra:TaxExemptMunicipalSecuritiesMember2022-12-310001013934us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberstra:TaxExemptMunicipalSecuritiesMember2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001013934us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMember2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001013934us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001013934us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001013934stra:DeferredPaymentsMember2021-12-310001013934stra:DeferredPaymentsMember2022-01-012022-09-300001013934stra:DeferredPaymentsMember2022-09-300001013934stra:USHigherEducationSegmentMember2022-12-310001013934stra:AustraliaNewZealandSegmentMember2022-12-310001013934stra:EducationTechnologyServicesMember2022-12-310001013934stra:USHigherEducationSegmentMember2023-09-300001013934stra:AustraliaNewZealandSegmentMember2023-09-300001013934stra:EducationTechnologyServicesMember2023-09-300001013934stra:StudentRelationshipsMember2022-12-310001013934stra:StudentRelationshipsMember2023-09-300001013934us-gaap:TradeNamesMember2022-12-310001013934us-gaap:TradeNamesMember2023-09-300001013934stra:StudentRelationshipsMember2022-01-012022-09-300001013934stra:StudentRelationshipsMember2023-01-012023-09-300001013934us-gaap:TradeNamesMember2022-07-012022-09-300001013934us-gaap:TradeNamesMember2023-07-012023-09-300001013934us-gaap:TradeNamesMember2022-01-012022-09-300001013934us-gaap:TradeNamesMember2023-01-012023-09-300001013934stra:JackWelchManagementInstituteMember2020-12-310001013934stra:JackWelchManagementInstituteMember2022-12-310001013934stra:JackWelchManagementInstituteMember2023-09-300001013934stra:JackWelchManagementInstituteMember2023-01-012023-09-300001013934srt:ScenarioForecastMember2020-01-012031-12-310001013934srt:MinimumMemberstra:LimitedPartnershipsMember2023-09-30xbrli:pure0001013934srt:MaximumMemberstra:LimitedPartnershipsMember2023-09-300001013934stra:AmendedCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2020-11-030001013934stra:AmendmentToTheCreditFacilitySubfacilityForBorrowingsInForeignCurrenciesMemberus-gaap:RevolvingCreditFacilityMember2020-11-030001013934stra:AmendedCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2020-11-032020-11-030001013934us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2020-11-032020-11-030001013934us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2020-11-032020-11-030001013934srt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2020-11-032020-11-030001013934srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2020-11-032020-11-030001013934us-gaap:RevolvingCreditFacilityMember2023-09-012023-09-300001013934us-gaap:RevolvingCreditFacilityMember2022-12-310001013934us-gaap:RevolvingCreditFacilityMember2023-09-300001013934currency:AUDus-gaap:RevolvingCreditFacilityMember2022-12-310001013934currency:AUDus-gaap:RevolvingCreditFacilityMember2023-09-300001013934us-gaap:RevolvingCreditFacilityMember2022-01-012022-09-300001013934us-gaap:RevolvingCreditFacilityMember2023-01-012023-09-300001013934stra:InstructionalandSupportCostMember2022-07-012022-09-300001013934stra:InstructionalandSupportCostMember2023-07-012023-09-300001013934stra:InstructionalandSupportCostMember2022-01-012022-09-300001013934stra:InstructionalandSupportCostMember2023-01-012023-09-300001013934us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-300001013934us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001013934us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-300001013934us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001013934us-gaap:RestructuringChargesMember2022-07-012022-09-300001013934us-gaap:RestructuringChargesMember2023-07-012023-09-300001013934us-gaap:RestructuringChargesMember2022-01-012022-09-300001013934us-gaap:RestructuringChargesMember2023-01-012023-09-300001013934us-gaap:OperatingSegmentsMemberstra:USHigherEducationSegmentMember2022-07-012022-09-300001013934us-gaap:OperatingSegmentsMemberstra:USHigherEducationSegmentMember2023-07-012023-09-300001013934us-gaap:OperatingSegmentsMemberstra:USHigherEducationSegmentMember2022-01-012022-09-300001013934us-gaap:OperatingSegmentsMemberstra:USHigherEducationSegmentMember2023-01-012023-09-300001013934us-gaap:OperatingSegmentsMemberstra:AustraliaNewZealandSegmentMember2022-07-012022-09-300001013934us-gaap:OperatingSegmentsMemberstra:AustraliaNewZealandSegmentMember2023-07-012023-09-300001013934us-gaap:OperatingSegmentsMemberstra:AustraliaNewZealandSegmentMember2022-01-012022-09-300001013934us-gaap:OperatingSegmentsMemberstra:AustraliaNewZealandSegmentMember2023-01-012023-09-300001013934us-gaap:OperatingSegmentsMemberstra:EducationTechnologyServicesMember2022-07-012022-09-300001013934us-gaap:OperatingSegmentsMemberstra:EducationTechnologyServicesMember2023-07-012023-09-300001013934us-gaap:OperatingSegmentsMemberstra:EducationTechnologyServicesMember2022-01-012022-09-300001013934us-gaap:OperatingSegmentsMemberstra:EducationTechnologyServicesMember2023-01-012023-09-300001013934us-gaap:MaterialReconcilingItemsMember2022-07-012022-09-300001013934us-gaap:MaterialReconcilingItemsMember2023-07-012023-09-300001013934us-gaap:MaterialReconcilingItemsMember2022-01-012022-09-300001013934us-gaap:MaterialReconcilingItemsMember2023-01-012023-09-3000010139342021-04-20stra:borrowerDefenseApplication00010139342022-06-22stra:educational_institution

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ Quarterly Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

For the quarterly period ended September 30, 2023

or

☐ Transition Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File No. 0-21039

Strategic Education, Inc.

(Exact name of registrant as specified in this charter)

| | | | | | | | | | | |

| Maryland | | 52-1975978 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

| 2303 Dulles Station Boulevard | | |

| Herndon, | VA | | 20171 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (703) 561-1600

Securities Registered Pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

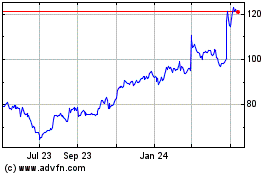

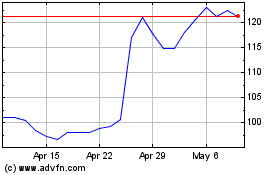

| Common Stock, $0.01 par value | | STRA | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 20, 2023, there were outstanding 24,415,845 shares of Common Stock, par value $0.01 per share, of the Registrant.

STRATEGIC EDUCATION, INC.

INDEX

FORM 10-Q

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| | | | | | | | | | | |

| December 31, 2022 | | September 30, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 213,667 | | | $ | 167,707 | |

| Marketable securities | 9,156 | | | 28,960 | |

| Tuition receivable, net | 62,953 | | | 97,429 | |

| | | |

| Income taxes receivable | — | | | 7,850 | |

| Other current assets | 43,285 | | | 48,689 | |

| Total current assets | 329,061 | | | 350,635 | |

| Property and equipment, net | 132,845 | | | 117,872 | |

| Right-of-use lease assets | 125,248 | | | 110,789 | |

| Marketable securities, non-current | 13,123 | | | 1,914 | |

| Intangible assets, net | 260,541 | | | 249,514 | |

| Goodwill | 1,251,277 | | | 1,228,431 | |

| Other assets | 49,652 | | | 54,945 | |

| Total assets | $ | 2,161,747 | | | $ | 2,114,100 | |

| | | |

| LIABILITIES & STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 90,588 | | | $ | 102,122 | |

| Income taxes payable | 6,989 | | | — | |

| Contract liabilities | 88,488 | | | 140,248 | |

| Lease liabilities | 23,879 | | | 23,121 | |

| Total current liabilities | 209,944 | | | 265,491 | |

| Long-term debt | 101,396 | | | 61,247 | |

| Deferred income tax liabilities | 34,605 | | | 28,254 | |

| Lease liabilities, non-current | 134,006 | | | 121,395 | |

| Other long-term liabilities | 46,006 | | | 42,959 | |

| Total liabilities | 525,957 | | | 519,346 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

Common stock, par value $0.01; 32,000,000 shares authorized; 24,402,891 and 24,419,092 shares issued and outstanding at December 31, 2022 and September 30, 2023, respectively | 244 | | | 244 | |

| Additional paid-in capital | 1,510,924 | | | 1,513,023 | |

| Accumulated other comprehensive loss | (35,068) | | | (62,878) | |

| Retained earnings | 159,690 | | | 144,365 | |

| Total stockholders’ equity | 1,635,790 | | | 1,594,754 | |

| Total liabilities and stockholders’ equity | $ | 2,161,747 | | | $ | 2,114,100 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Revenues | $ | 263,123 | | | $ | 285,936 | | | $ | 795,542 | | | $ | 830,222 | |

| Costs and expenses: | | | | | | | |

| Instructional and support costs | 153,162 | | | 155,735 | | | 445,154 | | | 470,152 | |

| General and administration | 97,753 | | | 97,598 | | | 289,259 | | | 292,066 | |

| Amortization of intangible assets | 3,522 | | | 3,382 | | | 10,954 | | | 10,364 | |

| Merger and integration costs | 269 | | | 330 | | | 933 | | | 1,335 | |

| Restructuring costs | 610 | | | 3,262 | | | 6,129 | | | 15,208 | |

| Total costs and expenses | 255,316 | | | 260,307 | | | 752,429 | | | 789,125 | |

| Income from operations | 7,807 | | | 25,629 | | | 43,113 | | | 41,097 | |

| Other income (expense) | (262) | | | 842 | | | (1,133) | | | 4,411 | |

| Income before income taxes | 7,545 | | | 26,471 | | | 41,980 | | | 45,508 | |

| Provision for income taxes | 1,453 | | | 8,012 | | | 13,639 | | | 14,846 | |

| Net income | $ | 6,092 | | | $ | 18,459 | | | $ | 28,341 | | | $ | 30,662 | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.26 | | | $ | 0.79 | | | $ | 1.19 | | | $ | 1.31 | |

| Diluted | $ | 0.25 | | | $ | 0.77 | | | $ | 1.18 | | | $ | 1.28 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 23,550 | | | 23,365 | | | 23,765 | | | 23,415 | |

| Diluted | 23,902 | | | 23,870 | | | 24,026 | | | 23,952 | |

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Net income | $ | 6,092 | | | $ | 18,459 | | | $ | 28,341 | | | $ | 30,662 | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustment | (38,171) | | | (11,891) | | | (74,677) | | | (28,053) | |

| Unrealized gains (losses) on marketable securities, net of tax | (189) | | | 97 | | | (895) | | | 243 | |

| Comprehensive income (loss) | $ | (32,268) | | | $ | 6,665 | | | $ | (47,231) | | | $ | 2,852 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2022 |

| Common Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income (Loss) | | Total |

| Shares | | Par Value | | | | |

| Balance at June 30, 2022 | 24,637,268 | | | $ | 246 | | | $ | 1,513,509 | | | $ | 166,175 | | | $ | (28,009) | | | $ | 1,651,921 | |

| Stock-based compensation | — | | | — | | | 5,605 | | | 7 | | | — | | | 5,612 | |

| Issuance of restricted stock, net | (4,138) | | | 1 | | | (91) | | | — | | | — | | | (90) | |

| Repurchase of common stock | (178,753) | | | (2) | | | (11,121) | | | (821) | | | — | | | (11,944) | |

Common stock dividends ($0.60 per share) | — | | | — | | | — | | | (14,749) | | | — | | | (14,749) | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | (38,171) | | | (38,171) | |

| Unrealized losses on marketable securities, net of tax | — | | | — | | | — | | | — | | | (189) | | | (189) | |

| Net income | — | | | — | | | — | | | 6,092 | | | — | | | 6,092 | |

| Balance at September 30, 2022 | 24,454,377 | | | $ | 245 | | | $ | 1,507,902 | | | $ | 156,704 | | | $ | (66,369) | | | $ | 1,598,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2023 |

| Common Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income (Loss) | | Total |

| Shares | | Par Value | | | | |

| Balance at June 30, 2023 | 24,465,671 | | | $ | 245 | | | $ | 1,509,077 | | | $ | 140,368 | | | $ | (51,084) | | | $ | 1,598,606 | |

| Stock-based compensation | — | | | — | | | 3,905 | | | 172 | | | — | | | 4,077 | |

| Exercise of stock options, net | 1,382 | | | — | | | 71 | | | — | | | — | | | 71 | |

| Issuance of restricted stock, net | (47,961) | | | (1) | | | (30) | | | — | | | — | | | (31) | |

Common stock dividends ($0.60 per share) | — | | | — | | | — | | | (14,634) | | | — | | | (14,634) | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | (11,891) | | | (11,891) | |

| Unrealized gains on marketable securities, net of tax | — | | | — | | | — | | | — | | | 97 | | | 97 | |

| Net income | — | | | — | | | — | | | 18,459 | | | — | | | 18,459 | |

| Balance at September 30, 2023 | 24,419,092 | | | $ | 244 | | | $ | 1,513,023 | | | $ | 144,365 | | | $ | (62,878) | | | $ | 1,594,754 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the nine months ended September 30, 2022 |

| Common Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income (Loss) | | Total |

| Shares | | Par Value | | | | |

| Balance at December 31, 2021 | 24,592,098 | | | $ | 246 | | | $ | 1,529,969 | | | $ | 174,572 | | | $ | 9,203 | | | $ | 1,713,990 | |

| Stock-based compensation | — | | | — | | | 16,202 | | | 7 | | | — | | | 16,209 | |

| Issuance of restricted stock, net | 434,068 | | | 5 | | | (2,873) | | | — | | | — | | | (2,868) | |

| Repurchase of common stock | (571,789) | | | (6) | | | (35,396) | | | (1,514) | | | — | | | (36,916) | |

Common stock dividends ($1.80 per share) | — | | | — | | | — | | | (44,702) | | | — | | | (44,702) | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | (74,677) | | | (74,677) | |

| Unrealized losses on marketable securities, net of tax | — | | | — | | | — | | | — | | | (895) | | | (895) | |

| Net income | — | | | — | | | — | | | 28,341 | | | — | | | 28,341 | |

| Balance at September 30, 2022 | 24,454,377 | | | $ | 245 | | | $ | 1,507,902 | | | $ | 156,704 | | | $ | (66,369) | | | $ | 1,598,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the nine months ended September 30, 2023 |

| Common Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income (Loss) | | Total |

| Shares | | Par Value | | | | |

| Balance at December 31, 2022 | 24,402,891 | | | $ | 244 | | | $ | 1,510,924 | | | $ | 159,690 | | | $ | (35,068) | | | $ | 1,635,790 | |

| Stock-based compensation | — | | | — | | | 15,030 | | | 172 | | | — | | | 15,202 | |

| Exercise of stock options, net | 2,704 | | | — | | | 126 | | | — | | — | | | 126 | |

| Issuance of restricted stock, net | 142,570 | | | 1 | | | (5,051) | | | — | | — | | | (5,050) | |

| Repurchase of common stock | (129,073) | | | (1) | | | (8,006) | | | (2,006) | | | — | | | (10,013) | |

Common stock dividends ($1.80 per share) | — | | | — | | | — | | | (44,153) | | | — | | | (44,153) | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | (28,053) | | | (28,053) | |

| Unrealized gains on marketable securities, net of tax | — | | | — | | | — | | | — | | | 243 | | | 243 | |

| Net income | — | | | — | | | — | | | 30,662 | | | — | | | 30,662 | |

| Balance at September 30, 2023 | 24,419,092 | | | $ | 244 | | | $ | 1,513,023 | | | $ | 144,365 | | | $ | (62,878) | | | $ | 1,594,754 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

STRATEGIC EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | |

| For the nine months ended September 30, |

| 2022 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 28,341 | | | $ | 30,662 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Gain on sale of property and equipment | — | | | (2,136) | |

| Amortization of deferred financing costs | 414 | | | 416 | |

| Amortization of investment discount/premium | 29 | | | (40) | |

| Depreciation and amortization | 49,193 | | | 44,881 | |

| Deferred income taxes | (9,213) | | | (5,947) | |

| Stock-based compensation | 16,209 | | | 15,202 | |

| Impairment of right-of-use lease assets | 1,185 | | | 5,135 | |

| Changes in assets and liabilities: | | | |

| Tuition receivable, net | (33,320) | | | (35,113) | |

| Other assets | 417 | | | (12,456) | |

| Accounts payable and accrued expenses | 6,768 | | | 11,119 | |

| Income taxes payable and income taxes receivable | 4,498 | | | (14,669) | |

| Contract liabilities | 65,437 | | | 52,836 | |

| Other liabilities | (5,226) | | | (2,717) | |

| Net cash provided by operating activities | 124,732 | | | 87,173 | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (32,508) | | | (27,318) | |

| Purchases of marketable securities | — | | | (16,904) | |

| Proceeds from marketable securities | 2,600 | | | 8,175 | |

| Proceeds from sale of property and equipment | — | | | 5,890 | |

| Proceeds from other investments | — | | | 457 | |

| Other investments | (223) | | | (314) | |

| Cash paid for acquisition, net of cash acquired | (193) | | | (448) | |

| Net cash used in investing activities | (30,324) | | | (30,462) | |

| | | |

| Cash flows from financing activities: | | | |

| Common dividends paid | (44,600) | | | (44,139) | |

| Payments on long-term debt | — | | | (40,000) | |

| Net payments for stock awards | (2,973) | | | (4,925) | |

| Repurchase of common stock | (36,916) | | | (9,999) | |

| Net cash used in financing activities | (84,489) | | | (99,063) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (10,729) | | | (3,657) | |

| Net decrease in cash, cash equivalents, and restricted cash | (810) | | | (46,009) | |

| Cash, cash equivalents, and restricted cash — beginning of period | 279,212 | | | 227,454 | |

| Cash, cash equivalents, and restricted cash — end of period | $ | 278,402 | | | $ | 181,445 | |

| Non-cash transactions: | | | |

| Non-cash additions to property and equipment | $ | 1,910 | | | $ | 2,110 | |

| Right-of-use lease assets obtained in exchange for operating lease liabilities | $ | 4,278 | | | $ | 8,329 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

STRATEGIC EDUCATION, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. Nature of Operations

Strategic Education, Inc. (“Strategic Education” or the “Company”), a Maryland corporation, is an education services company that provides access to high-quality education through campus-based and online post-secondary education offerings, as well as through programs to develop job-ready skills for high-demand markets. Strategic Education’s portfolio of companies is dedicated to closing the skills gap by placing adults on the most direct path between learning and employment.

The accompanying condensed consolidated financial statements and footnotes include the results of the Company’s three reportable segments: (1) U.S. Higher Education (“USHE”), which is primarily comprised of Strayer University and Capella University and is focused on providing flexible and affordable certificate and degree programs to working adults; (2) Education Technology Services, which is primarily focused on developing and maintaining relationships with employers to build employee education benefits programs; and (3) Australia/New Zealand, which through Torrens University and associated assets, provides certificate and degree programs in Australia and New Zealand. The Company’s reportable segments are discussed further in Note 15.

2. Significant Accounting Policies

Financial Statement Presentation

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany accounts and transactions have been eliminated in the consolidated financial statements.

All information as of September 30, 2022 and 2023, and for the three and nine months ended September 30, 2022 and 2023 is unaudited but, in the opinion of management, contains all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the condensed consolidated financial position, results of operations, and cash flows of the Company. The condensed consolidated balance sheet as of December 31, 2022 has been derived from the audited consolidated financial statements at that date. Certain year-to-date amounts have been reclassified to conform to the current period’s presentation. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) have been condensed or omitted. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022. The results of operations for the three and nine months ended September 30, 2023 are not necessarily indicative of the results to be expected for the full fiscal year.

Below is a description of the nature of the costs included in the Company’s operating expense categories.

Instructional and support costs generally contain items of expense directly attributable to activities that support students. This expense category includes salaries and benefits of faculty and academic administrators, as well as admissions and administrative personnel who support and serve student interests. Instructional and support costs also include course development costs and costs associated with delivering course content, including educational supplies, facilities, and all other physical plant and occupancy costs, with the exception of costs attributable to the corporate offices. Bad debt expense incurred on delinquent student account balances is also included in instructional and support costs.

General and administration expenses include salaries and benefits of management and employees engaged in finance, human resources, legal, regulatory compliance, marketing and other corporate functions. Also included are the costs of advertising and production of marketing materials. General and administration expense also includes the facilities occupancy and other related costs attributable to such functions.

Amortization of intangible assets consists of amortization and depreciation expense related to intangible assets and software assets acquired through the Company’s acquisition of Torrens University and associated assets in Australia and New Zealand (“ANZ”).

Merger and integration costs include integration expenses associated with the Company’s merger with Capella Education Company and the Company’s acquisition of ANZ.

Restructuring costs include severance and other personnel-related expenses from voluntary and involuntary employee terminations, right-of-use lease and fixed asset impairment charges, gains on sale of real estate and early termination of leased facilities, and other costs associated with the Company’s restructuring activities. See Note 4 for additional information.

Foreign Currency Translation and Transaction Gains and Losses

The United States Dollar (“USD”) is the functional currency of the Company and its subsidiaries operating in the United States. The financial statements of its foreign subsidiaries are maintained in their functional currencies. The functional currency of each of the foreign subsidiaries is the currency of the economic environment in which the subsidiary primarily does business. Financial statements of foreign subsidiaries are translated into USD using the exchange rates applicable to the dates of the financial statements. Assets and liabilities are translated into USD using the period-end spot foreign exchange rates. Income and expenses are translated at the weighted-average exchange rates in effect during the period. Equity accounts are translated at historical exchange rates. The effects of these translation adjustments are reported as a component of accumulated other comprehensive income (loss) within shareholders’ equity.

For any transaction that is in a currency different from the entity’s functional currency, the Company records a net gain or loss based on the difference between the exchange rate at the transaction date and the exchange rate at the transaction settlement date (or rate at period end, if unsettled), in the unaudited condensed consolidated statements of income.

Restricted Cash

In the United States, a significant portion of the Company’s revenues are funded by various federal and state government programs. The Company generally does not receive funds from these programs prior to the start of the corresponding academic term. The Company may be required to return certain funds for students who withdraw from a U.S. higher education institution during the academic term. The Company had approximately $1.4 million and $2.1 million of these unpaid obligations as of December 31, 2022 and September 30, 2023, respectively. In Australia and New Zealand, advance tuition payments from international students are required to be restricted until a student commences his or her course. In addition, a portion of tuition prepayments from students enrolled in a vocational education and training program are held in trust by a third party law firm to adhere to tuition protection requirements. As of December 31, 2022 and September 30, 2023, the Company had approximately $11.9 million and $11.2 million, respectively, of restricted cash related to these requirements in Australia and New Zealand. These balances are recorded as restricted cash and included in other current assets in the unaudited condensed consolidated balance sheets.

As part of conducting operations in Pennsylvania, the Company is required to maintain a “minimum protective endowment” of at least $0.5 million in an interest-bearing account as long as the Company operates its campuses in the state. The Company holds these funds in an interest-bearing account, which is included in other assets.

The following table illustrates the reconciliation of cash, cash equivalents, and restricted cash shown in the unaudited condensed consolidated statements of cash flows as of September 30, 2022 and 2023 (in thousands):

| | | | | | | | | | | |

| As of September 30, |

| 2022 | | 2023 |

| Cash and cash equivalents | $ | 262,757 | | | $ | 167,707 | |

| Restricted cash included in other current assets | 15,145 | | | 13,238 | |

| Restricted cash included in other assets | 500 | | | 500 | |

| Total cash, cash equivalents, and restricted cash shown in the statement of cash flows | $ | 278,402 | | | $ | 181,445 | |

Marketable Securities

Investments in marketable securities are carried at either amortized cost or fair value. Investments in marketable securities that the Company has the positive intent and ability to hold to maturity are carried at amortized cost and classified as held-to-maturity. Investments in marketable securities that are not classified as held-to-maturity are carried at fair value and classified as either trading or available-for-sale. Management determines the appropriate designation of marketable securities at the time of purchase and reevaluates such designation as of each balance sheet date. All of the Company’s marketable securities are designated as either held-to-maturity or available-for-sale.

The Company’s available-for-sale marketable securities consist of tax-exempt municipal securities and corporate debt securities, which are carried at fair value as determined by quoted market prices or other inputs either directly or indirectly observable in the marketplace for identical or similar assets, with unrealized gains and losses, net of tax, recognized as a component of accumulated

other comprehensive income (loss) within shareholders’ equity. Management reviews the fair value of the portfolio at least quarterly, and evaluates individual securities with fair value below amortized cost at the balance sheet date for impairment. In order to determine whether there is an impairment, management evaluates whether the Company intends to sell the impaired security and whether it is more likely than not that the Company will be required to sell the security before recovering its amortized cost basis.

If management intends to sell an impaired debt security, or it is more likely than not the Company will be required to sell the security prior to recovering its amortized cost basis, an impairment is deemed to have occurred. The amount of an impairment related to a credit loss, or securities that management intends to sell before recovery, is recognized in earnings. The amount of an impairment on debt securities related to other factors is recorded consistent with changes in the fair value of all other available-for-sale securities as a component of accumulated other comprehensive income (loss) within shareholders’ equity.

The cost of securities sold is based on the specific identification method. Amortization of premiums, accretion of discounts, interest, dividend income and realized gains and losses are included in other income. The contractual maturity date of available-for-sale securities is based on the days remaining to the effective maturity. The Company classifies marketable securities as either current or non-current assets based on management’s intent with regard to usage of those funds, which is dependent upon the security’s maturity date and liquidity considerations based on current market conditions. If management intends to hold the securities for longer than one year as of the balance sheet date, they are classified as non-current.

Tuition Receivable and Allowance for Credit Losses

The Company records tuition receivable and contract liabilities for its students upon the start of the academic term or program. Tuition receivables are not collateralized; however, credit risk is minimized as a result of the diverse nature of the Company’s student bases and through the participation of the majority of the students in federally funded financial aid programs. An allowance for credit losses is established based upon historical collection rates by age of receivable and adjusted for reasonable expectations of future collection performance, net of estimated recoveries. These collection rates incorporate historical performance based on a student’s current enrollment status, likelihood of future enrollment, degree mix trends and changes in the overall economic environment. In the event that current collection trends differ from historical trends, an adjustment is made to the allowance for credit losses and bad debt expense.

The Company’s tuition receivable and allowance for credit losses were as follows as of December 31, 2022 and September 30, 2023 (in thousands):

| | | | | | | | | | | |

| December 31, 2022 | | September 30, 2023 |

| Tuition receivable | $ | 110,066 | | | $ | 145,775 | |

| Allowance for credit losses | (47,113) | | | (48,346) | |

| Tuition receivable, net | $ | 62,953 | | | $ | 97,429 | |

Approximately $2.7 million and $2.6 million of tuition receivable, net, are included in other assets as of December 31, 2022 and September 30, 2023, respectively, because these amounts are expected to be collected after 12 months.

The following table illustrates changes in the Company’s allowance for credit losses for the three and nine months ended September 30, 2022 and 2023 (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Allowance for credit losses, beginning of period | $ | 43,507 | | | $ | 45,877 | | | $ | 48,783 | | | $ | 47,113 | |

| Additions charged to expense | 11,895 | | | 14,880 | | | 27,899 | | | 37,138 | |

| Write-offs, net of recoveries | (10,462) | | | (12,411) | | | (31,742) | | | (35,905) | |

| Allowance for credit losses, end of period | $ | 44,940 | | | $ | 48,346 | | | $ | 44,940 | | | $ | 48,346 | |

Assets Held for Sale

The Company classifies assets and liabilities as held for sale (“disposal group”) when management, having the authority to approve the action, commits to a plan to sell the disposal group, the sale is probable to be completed within one year, and the disposal group is available for immediate sale in its present condition. The Company also considers whether an active program to locate a buyer has been initiated, whether the disposal group is marketed actively for sale at a price that is reasonable in relation to its current fair value, and whether actions required to complete the plan indicate that it is unlikely that significant changes to the

plan will be made or that the plan will be withdrawn. The Company initially measures a disposal group that is classified as held for sale at the lower of its carrying amount or fair value less costs to sell. Any loss resulting from this measurement is recognized in the period in which the held for sale criteria are met. Gains are not recognized until the date of sale. Assets are not depreciated or amortized while they are classified as held for sale. Upon determining that a disposal group meets the criteria to be classified as held for sale, the Company reports the assets and liabilities of the disposal group as assets held for sale and liabilities held for sale in its unaudited condensed consolidated balance sheets.

Over the last several years, the Company has been evaluating its owned and leased real estate portfolio to identify underutilized facilities to either downsize or exit. One facility identified to be marketed for sale was an owned U.S. Higher Education campus consisting of land, buildings, and building improvements. The Company determined that it met all of the criteria to classify these assets as held for sale as of March 31, 2023. No loss was recorded as the carrying amount of the net assets was less than the fair value less costs to sell. Fair value was determined based upon the anticipated sales price of these assets.

During the second quarter of 2023, the Company sold the long-lived assets related to the owned U.S. Higher Education campus noted above and recognized a $2.1 million gain on sale, which is included in Restructuring costs on the unaudited condensed consolidated statements of income.

Goodwill and Intangible Assets

Goodwill represents the excess of the purchase price of an acquired business over the amount assigned to the assets acquired and liabilities assumed in a business combination. Indefinite-lived intangible assets, which include trade names, are recorded at fair value on their acquisition date. An indefinite life was assigned to the trade names because they have the continued ability to generate cash flows indefinitely.

Goodwill and the indefinite-lived intangible assets are assessed at least annually for impairment on the first day of the fourth quarter, or more frequently if events occur or circumstances change between annual tests that would more likely than not reduce the fair value of the respective reporting unit or indefinite-lived intangible asset below its carrying amount. The Company identifies its reporting units by assessing whether the components of its operating segments constitute businesses for which discrete financial information is available, and management regularly reviews the operating results of those components.

Finite-lived intangible assets that are acquired in business combinations are recorded at fair value on their acquisition dates and are amortized on a straight-line basis over the estimated useful life of the asset. Finite-lived intangible assets consist of student relationships.

The Company reviews its finite-lived intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If such assets are not recoverable, a potential impairment loss is recognized to the extent the carrying amount of the assets exceeds the fair value of the assets.

Authorized Stock

The Company has authorized 32,000,000 shares of common stock, par value $0.01, of which 24,402,891 and 24,419,092 shares were issued and outstanding as of December 31, 2022 and September 30, 2023, respectively. The Company also has authorized 8,000,000 shares of preferred stock, none of which is issued or outstanding. Before any preferred stock may be issued in the future, the Board of Directors would need to establish the preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends, qualifications, and the terms or conditions of the redemption of the preferred stock.

In July 2023, the Company’s Board of Directors declared a regular, quarterly cash dividend of $0.60 per share of common stock. The dividend was paid on September 11, 2023.

Net Income Per Share

Basic earnings per share is computed by dividing net income by the weighted average number of shares of common stock outstanding during the periods. Diluted earnings per share reflects the potential dilution that could occur assuming conversion or exercise of all dilutive unexercised stock options, restricted stock, and restricted stock units (“stock awards”). The dilutive effect of stock awards was determined using the treasury stock method. Under the treasury stock method, all of the following are assumed to be used to repurchase shares of the Company’s common stock: (1) the proceeds received from the exercise of stock options, and (2) the amount of compensation cost associated with the stock awards for future service not yet recognized by the Company. Stock awards are excluded from the computation of diluted earnings per share when their effect would be anti-dilutive.

Set forth below is a reconciliation of shares used to calculate basic and diluted earnings per share for the three and nine months ended September 30, 2022 and 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Weighted average shares outstanding used to compute basic earnings per share | 23,550 | | | 23,365 | | | 23,765 | | | 23,415 | |

| Incremental shares issuable upon the assumed exercise of stock options | 3 | | | 3 | | | 3 | | | 4 | |

| Unvested restricted stock and restricted stock units | 349 | | | 502 | | | 258 | | | 533 | |

| Shares used to compute diluted earnings per share | 23,902 | | | 23,870 | | | 24,026 | | | 23,952 | |

| | | | | | | |

| Anti-dilutive shares excluded from the diluted earnings per share calculation | 11 | | | 276 | | | 149 | | | 219 | |

Comprehensive Income (Loss)

Comprehensive income (loss) includes net income and all changes in the Company’s equity during a period from non-owner sources, which for the Company consists of unrealized gains and losses on available-for-sale marketable securities, net of tax, and foreign currency translation adjustments. As of December 31, 2022 and September 30, 2023, the balance of accumulated other comprehensive loss was $35.1 million, net of tax of $0.1 million, and $62.9 million, net of tax of $0.1 million, respectively. There were no reclassifications out of accumulated other comprehensive income (loss) to net income for the three and nine months ended September 30, 2022 and 2023.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of expenses during the period reported. The most significant management estimates include allowances for credit losses, useful lives of property and equipment and intangible assets, incremental borrowing rates, potential sublease income and vacancy periods, accrued expenses, forfeiture rates and the likelihood of achieving performance criteria for stock-based awards, value of free courses earned by students that will be redeemed in the future, valuation of goodwill and intangible assets, and the provision for income taxes. Actual results could differ from those estimates.

Recently Issued Accounting Standards Not Yet Adopted

Accounting Standards Updates recently issued by the FASB but not yet effective are not expected to have a material effect on the Company’s consolidated financial statements.

3. Revenue Recognition

The Company’s revenues primarily consist of tuition revenue arising from educational services provided in the form of classroom instruction and online courses. Tuition revenue is deferred and recognized ratably over the period of instruction, which varies depending on the course format and chosen program of study. Strayer University’s educational programs and Capella University’s GuidedPath classes typically are offered on a quarterly basis, and such periods coincide with the Company’s quarterly financial reporting periods, while Capella University’s FlexPath courses are delivered over a twelve-week subscription period. Torrens University offers the majority of its education programs on a trimester system having three primary academic terms, which all occur within the calendar year.

The following table presents the Company’s revenues from contracts with customers disaggregated by material revenue category for the three and nine months ended September 30, 2022 and 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| U.S. Higher Education Segment | | | | | | | |

| Tuition, net of discounts, grants and scholarships | $ | 177,678 | | | $ | 192,850 | | | $ | 546,407 | | | $ | 575,725 | |

Other(1) | 7,821 | | | 8,978 | | | 24,884 | | | 25,677 | |

| Total U.S. Higher Education Segment | 185,499 | | | 201,828 | | | 571,291 | | | 601,402 | |

| Australia/New Zealand Segment | | | | | | | |

| Tuition, net of discounts, grants and scholarships | 60,238 | | | 61,667 | | | 173,621 | | | 165,855 | |

Other(1) | 939 | | | 1,597 | | | 3,611 | | | 4,384 | |

| Total Australia/New Zealand Segment | 61,177 | | | 63,264 | | | 177,232 | | | 170,239 | |

Education Technology Services Segment(2) | 16,447 | | | 20,844 | | | 47,019 | | | 58,581 | |

| Consolidated revenue | $ | 263,123 | | | $ | 285,936 | | | $ | 795,542 | | | $ | 830,222 | |

_________________________________________

(1)Other revenue is primarily comprised of academic fees, sales of course materials, placement fees and other non-tuition revenue streams.

(2)Education Technology Services revenue is primarily derived from tuition revenue.

Revenues are recognized when control of the promised goods or services is transferred to customers in an amount that reflects the consideration the Company expects to be entitled to receive in exchange for those goods and services. The Company applies the five-step revenue model under ASC 606 to determine when revenue is earned and recognized.

Arrangements with students may have multiple performance obligations. For such arrangements, the Company allocates net tuition revenue to each performance obligation based on its relative standalone selling price. The Company generally determines standalone selling prices based on the prices charged to customers and observable market prices. The standalone selling price of material rights to receive free classes or scholarships in the future is estimated based on class tuition prices or amounts of scholarships, and likelihood of redemption based on historical student attendance and completion behavior.

At the start of each academic term or program, a contract liability is recorded for academic services to be provided, and a tuition receivable is recorded for the portion of the tuition not paid in advance. Any cash received prior to the start of an academic term or program is recorded as a contract liability. Some students may be eligible for scholarship awards, the estimated value of which will be realized in the future and is deducted from revenue when earned, based on historical student attendance and completion behavior. Contract liabilities are recorded as a current or long-term liability in the unaudited condensed consolidated balance sheets based on when the benefit is expected to be realized.

Course materials are available to enable students to access electronically all required materials for courses in which they enroll during the quarter. Revenue derived from course materials is recognized ratably over the duration of the course as the Company provides the student with continuous access to these materials during the term. For sales of certain other course materials, the Company is considered the agent in the transaction, and as such, the Company recognizes revenue net of amounts owed to the vendor at the time of sale. Revenues also include certain academic fees recognized within the quarter of instruction, and certificate revenue and licensing revenue, which are recognized as the services are provided.

Contract Liabilities – Graduation Fund

Strayer University offers the Graduation Fund, which allows undergraduate students to earn tuition credits that are redeemable in the final year of a student’s course of study if he or she successfully remains in the program. Students registering in credit-bearing courses in any undergraduate degree program receive one free course for every three courses that the student successfully completes. To be eligible, students must meet all of Strayer University’s admission requirements and must be enrolled in a bachelor’s degree program. Students who have more than one consecutive term of non-attendance lose any Graduation Fund credits earned to date, but may earn and accumulate new credits if the student is reinstated or readmitted by Strayer University in the future.

Revenue from students participating in the Graduation Fund is recorded in accordance with ASC 606. The Company defers the value of the related performance obligation associated with the credits estimated to be redeemed in the future based on the underlying revenue transactions that result in progress by the student toward earning the benefit. The Company’s estimate of the benefits that will be redeemed in the future is based on its historical experience of student persistence toward completion of a course of study within this program and similar programs. Each quarter, the Company assesses its assumptions underlying these

estimates, and to date, any adjustments to the estimates have not been material. The amount estimated to be redeemed in the next 12 months is $19.4 million and is included as a current contract liability in the unaudited condensed consolidated balance sheets. The remainder is expected to be redeemed within two to four years.

The table below presents activity in the contract liability related to the Graduation Fund (in thousands):

| | | | | | | | | | | |

| For the nine months ended September 30, |

| 2022 | | 2023 |

| Balance at beginning of period | $ | 52,024 | | | $ | 46,842 | |

| Revenue deferred | 12,647 | | | 14,543 | |

| Benefit redeemed | (16,295) | | | (16,931) | |

| Balance at end of period | $ | 48,376 | | | $ | 44,454 | |

Unbilled Receivables – Student Tuition

Academic materials may be shipped to certain new undergraduate students in advance of the term of enrollment. Under ASC 606, the materials represent a performance obligation to which the Company allocates revenue based on the fair value of the materials relative to the total fair value of all performance obligations in the arrangement with the student. When control of the materials passes to the student in advance of the term of enrollment, an unbilled receivable and related revenue are recorded.

Costs to Obtain a Contract

Certain commissions earned by third party international agents are considered incremental and recoverable costs of obtaining a contract with customers in the Australia/New Zealand segment. These costs are deferred and then amortized over the period of benefit which ranges from one year to two years.

4. Restructuring and Related Charges

In the third quarter of 2020, the Company began implementing a restructuring plan in an effort to reduce the ongoing operating costs of the Company to align with changes in enrollment following the COVID-19 pandemic. Under this plan, the Company incurred severance and other employee separation costs related to voluntary and involuntary employee terminations.

The following details the changes in the Company’s severance and other employee separation costs restructuring liabilities related to the 2020 restructuring plan during the nine months ended September 30, 2022 (in thousands):

| | | | | |

| 2020

Restructuring Plan |

| Balance at December 31, 2021 | $ | 1,612 | |

| Restructuring and other charges | 1,241 | |

| Payments | (2,853) | |

| Balance at September 30, 2022 | $ | — | |

The final severance payments under the 2020 restructuring plan were made in the third quarter of 2022.

The Company also incurs severance and other employee separation costs related to voluntary and involuntary employee terminations that are not tied to a formal restructuring plan. During the three and nine months ended September 30, 2023, the Company incurred $2.9 million and $11.3 million of severance and other employee separation charges related to the elimination of certain positions. These severance and other employee separation charges are included in Restructuring costs on the unaudited condensed consolidated statements of income.

The following details the changes in the Company's severance and other employee separation costs restructuring liabilities during the nine months ended September 30, 2023 (in thousands):

| | | | | |

| Severance Restructuring Liability |

| Balance at December 31, 2022 | $ | — | |

| Restructuring and other charges | 11,256 | |

| Payments | (8,731) | |

Balance at September 30, 2023(1) | $ | 2,525 | |

____________________________________

(1)Restructuring liabilities are included in accounts payable and accrued expenses.

The Company has also been evaluating its owned and leased real estate portfolio, which has resulted in the consolidation and sale of underutilized facilities. The Company recorded approximately $0.1 million and $1.2 million of right-of-use lease asset charges during the three and nine months ended September 30, 2022, respectively, and approximately $5.1 million during the nine months ended September 30, 2023, related to facilities that were consolidated during the period. The Company also recorded fixed asset impairment charges of approximately $0.1 million and $2.5 million during the three and nine months ended September 30, 2022, respectively, and approximately $0.1 million and $0.4 million during the three and nine months ended September 30, 2023, respectively. During the nine months ended September 30, 2023, the Company recorded a $2.1 million gain from the sale of property and equipment of an owned campus that was previously closed. These right-of-use lease asset and fixed asset impairment charges and gains on the sale of property and equipment are included in Restructuring costs on the unaudited condensed consolidated statements of income.

5. Marketable Securities

The following is a summary of available-for-sale and held-to-maturity securities as of September 30, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Amortized Cost | | Gross Unrealized Gain | | Gross Unrealized (Losses) | | Estimated Fair Value |

| Available-for-sale securities: | | | | | | | |

| Tax-exempt municipal securities | $ | 11,654 | | | $ | 1 | | | $ | (263) | | | $ | 11,392 | |

| Corporate debt securities | 3,204 | | | — | | | (122) | | | 3,082 | |

| Total available-for sale securities | $ | 14,858 | | | $ | 1 | | | $ | (385) | | | $ | 14,474 | |

| | | | | | | |

| Held-to-maturity securities: | | | | | | | |

| Term deposits | $ | 16,400 | | | $ | — | | | $ | — | | | $ | 16,400 | |

The following is a summary of available-for-sale securities as of December 31, 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Amortized Cost | | Gross Unrealized Gain | | Gross Unrealized (Losses) | | Estimated Fair Value |

| Available-for-sale securities: | | | | | | | |

| Tax-exempt municipal securities | $ | 15,852 | | | $ | 2 | | | $ | (507) | | | $ | 15,347 | |

| Corporate debt securities | 7,140 | | | — | | | (208) | | | 6,932 | |

| Total | $ | 22,992 | | | $ | 2 | | | $ | (715) | | | $ | 22,279 | |

The Company had no held-to-maturity securities as of December 31, 2022.

The unrealized gains and losses on the Company’s investments in corporate debt and municipal securities as of December 31, 2022 and September 30, 2023 were caused by changes in market values primarily due to interest rate changes. As of September 30, 2023, the fair value of the Company’s securities which were in an unrealized loss position for a period longer than twelve months was $13.5 million. The Company does not intend to sell these securities, and it is not more likely than not that the Company will be required to sell these securities prior to the recovery of their amortized cost basis, which may be at maturity. As such, no impairment charges were recorded during the three and nine months ended September 30, 2022 and 2023. The Company has no allowance for credit losses related to its available-for-sale or held-to-maturity securities as all investments are in investment grade securities.

The following table summarizes the maturities of the Company’s marketable securities as of December 31, 2022 and September 30, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2022 | | September 30, 2023 |

| Available-for-sale securities | | Held-to-maturity securities | | Available-for-sale securities | | Held-to-maturity securities |

| Due within one year | $ | 9,156 | | | $ | — | | | $ | 12,560 | | | $ | 16,400 | |

| Due after one year through three years | 13,123 | | | — | | | 1,914 | | | — | |

| Total | $ | 22,279 | | | $ | — | | | $ | 14,474 | | | $ | 16,400 | |

The following table summarizes the proceeds from the maturities and sales of available-for-sale securities for the three and nine months ended September 30, 2022 and 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Maturities of marketable securities | $ | 500 | | | $ | 3,215 | | | $ | 2,600 | | | $ | 8,175 | |

| Sales of marketable securities | — | | | — | | | — | | | — | |

| Total | $ | 500 | | | $ | 3,215 | | | $ | 2,600 | | | $ | 8,175 | |

The Company did not record any gross realized gains or losses in net income during the three and nine months ended September 30, 2022 and September 30, 2023.

6. Fair Value Measurement

Assets measured at fair value on a recurring basis consist of the following as of September 30, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Measurements at Reporting Date Using |

| September 30, 2023 | | Quoted Prices in

Active Markets

for Identical

Assets/Liabilities

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

| Assets: | | | | | | | |

| Money market funds | $ | 78,308 | | | $ | 78,308 | | | $ | — | | | $ | — | |

| U.S. treasury bills | 14,915 | | | 14,915 | | | — | | | — | |

Available-for-sale securities: | | | | | | | |

| Tax-exempt municipal securities | 11,392 | | | — | | | 11,392 | | | — | |

| Corporate debt securities | 3,082 | | | — | | | 3,082 | | | — | |

| Total assets at fair value on a recurring basis | $ | 107,697 | | | $ | 93,223 | | | $ | 14,474 | | | $ | — | |

Assets and liabilities measured at fair value on a recurring basis consist of the following as of December 31, 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Measurements at Reporting Date Using |

| December 31, 2022 | | Quoted Prices in

Active Markets

for Identical

Assets/Liabilities

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

| Assets: | | | | | | | |

| Money market funds | $ | 217 | | | $ | 217 | | | $ | — | | | $ | — | |

Available-for-sale securities: | | | | | | | |

| Tax-exempt municipal securities | 15,347 | | | — | | | 15,347 | | | — | |

| Corporate debt securities | 6,932 | | | — | | | 6,932 | | | — | |

| Total assets at fair value on a recurring basis | $ | 22,496 | | | $ | 217 | | | $ | 22,279 | | | $ | — | |

The Company measures the above items on a recurring basis at fair value as follows:

•Money market funds and U.S. treasury bills – Classified in Level 1 is excess cash the Company holds in money market funds and U.S. treasury bills, which are included in cash and cash equivalents in the accompanying unaudited condensed consolidated balance sheets. The Company records any net unrealized gains and losses for changes in fair value as a component of accumulated other comprehensive income (loss) in stockholders’ equity. The Company’s cash and cash equivalents and held-to-maturity securities held at December 31, 2022 and September 30, 2023 approximate fair value and are not disclosed in the above tables because of the short-term nature of the financial instruments.

•Available-for-sale securities – Classified in Level 2 and valued using readily available pricing sources for comparable instruments utilizing observable inputs from active markets. The Company does not hold securities in inactive markets.

The Company did not change its valuation techniques associated with recurring fair value measurements from prior periods and did not transfer assets or liabilities between levels of the fair value hierarchy during the nine months ended September 30, 2022 and 2023.

The Company acquired certain assets and entered into deferred payment arrangements with the sellers in transactions that occurred in 2011. The deferred payments were classified within Level 3 as there was no liquid market for similarly priced instruments and were valued using discounted cash flow models that encompassed significant unobservable inputs. The assumptions used to prepare the discounted cash flows included estimates for interest rates, enrollment growth, retention rates, and pricing strategies. The final payment related to the deferred payment arrangements was made in the first quarter of 2022.

Changes in the fair value of the Company’s Level 3 liabilities during the nine months ended September 30, 2022 are as follows (in thousands):

| | | | | |

| As of September 30, 2022 |

| Balance as of the beginning of period | $ | 658 | |

| Amounts paid | (658) | |

| Other adjustments to fair value | — | |

| Balance at end of period | $ | — | |

7. Goodwill and Intangible Assets

Goodwill

The following table presents changes in the carrying value of goodwill by segment for the nine months ended September 30, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | U.S. Higher Education | | Australia /

New Zealand | | Education Technology Services | | Total |

| Balance as of December 31, 2022 | $ | 632,075 | | | $ | 519,202 | | | $ | 100,000 | | | $ | 1,251,277 | |

| Additions | — | | | — | | | — | | | — | |

| Impairments | — | | | — | | | — | | | — | |

| Currency translation adjustments | — | | | (22,846) | | | — | | | (22,846) | |

| Adjustments to prior acquisitions | — | | | — | | | — | | | — | |

| Balance as of September 30, 2023 | $ | 632,075 | | | $ | 496,356 | | | $ | 100,000 | | | $ | 1,228,431 | |

The Company assesses goodwill at least annually for impairment during the fourth quarter, or more frequently if events occur or circumstances change between annual tests that would more likely than not reduce the fair value of the respective reporting unit below its carrying amount. No events or circumstances occurred in the three and nine months ended September 30, 2023 to indicate an impairment to goodwill at any of its segments. There were no impairment charges related to goodwill recorded during the three and nine months ended September 30, 2022 and 2023.

Intangible Assets

The following table represents the balance of the Company’s intangible assets as of December 31, 2022 and September 30, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 | | September 30, 2023 |

| | Gross Carrying Amount | | Accumulated Amortization | | Net | | Gross Carrying Amount | | Accumulated Amortization | | Net |

| Subject to amortization | | | | | | | | | | | |

| Student relationships | $ | 200,185 | | | $ | (191,125) | | | $ | 9,060 | | | $ | 200,095 | | | $ | (199,155) | | | $ | 940 | |

| Not subject to amortization | | | | | | | | | | | |

| Trade names | 251,481 | | | — | | | 251,481 | | | 248,574 | | | — | | | 248,574 | |

| Total | $ | 451,666 | | | $ | (191,125) | | | $ | 260,541 | | | $ | 448,669 | | | $ | (199,155) | | | $ | 249,514 | |

The Company’s finite-lived intangible assets are comprised of student relationships, which are being amortized on a straight-line basis over a three-year useful life. Straight-line amortization expense for finite-lived intangible assets reflects the pattern in which the economic benefits of the assets are consumed over their estimated useful lives. Amortization expense related to finite-lived intangible assets was $8.5 million and $8.0 million for the nine months ended September 30, 2022 and 2023, respectively.

Indefinite-lived intangible assets not subject to amortization consist of trade names. The Company assigned an indefinite useful life to its trade name intangible assets, as it is believed these assets have the ability to generate cash flows indefinitely. In addition, there are no legal, regulatory, contractual, economic, or other factors to limit the useful life of the trade name intangibles.

The Company assesses indefinite-lived intangible assets at least annually for impairment during the fourth quarter, or more frequently if events occur or circumstances change between annual tests that would more likely than not reduce the fair value of the respective indefinite-lived intangible asset below its carrying amount. No events or circumstances occurred in the three and nine months ended September 30, 2023 to indicate an impairment to indefinite-lived intangible assets. There were no impairment charges related to indefinite-lived intangible assets recorded during the three and nine months ended September 30, 2022 and 2023.

8. Other Current Assets

Other current assets consist of the following as of December 31, 2022 and September 30, 2023 (in thousands):