Stitch Fix, Inc. (NASDAQ:SFIX), the leading online personal styling

service, has released its financial results for the third quarter

of fiscal year 2019 ended April 27, 2019, and posted a letter

to its shareholders on its investor relations website.

Third quarter highlights

- Active clients of 3.1 million, an increase of 17% year over

year

- Net revenue of $408.9 million, an increase of 29% year over

year

- Net income of $7.0 million and adjusted EBITDA of $(0.3)

million

- Diluted earnings per share of $0.07

“Q3 was another strong quarter for us,

delivering net revenue of $408.9 million, exceeding our guidance

and representing 29% year-over-year growth,” said Stitch Fix

founder and CEO Katrina Lake. “We grew our active clients to 3.1

million, an increase of 17% year over year. At the same time, we

continue to drive engagement with our existing client base, growing

revenue per active client 8% year over year. These results

demonstrate our ability to attract new clients and to serve our

existing clients well. The continued strength of our Women’s

category and the growth of our Men’s category give us even more

confidence in our ability to scale new categories and geographies.

As I look forward, I’m excited about the opportunities ahead to

delight even more clients around the world.”

Please visit the Stitch Fix investor relations

website at https://investors.stitchfix.com to view the

financial results included in the letter to shareholders. The

Company intends to continue to make future announcements of

material financial and other information through its investor

relations website. The Company will also, from time to time,

disclose this information through press releases, filings with the

Securities and Exchange Commission, conference calls, or webcasts,

as required by applicable law.

Conference Call and Webcast

Information

Katrina Lake, Founder and Chief Executive

Officer of Stitch Fix, Paul Yee, Chief Financial Officer of Stitch

Fix, and Mike Smith, President and Chief Operating Officer of

Stitch Fix, will host a conference call at 2:00 p.m. Pacific Time

today to discuss the Company’s financial results and outlook. A

live webcast will be accessible on Stitch Fix’s investor relations

website at investors.stitchfix.com. Interested parties can also

access the call by dialing (800) 458-4121 in the U.S. or (323)

794-2093 internationally, and entering conference code 3401344.

A telephonic replay will be available through Wednesday, June

12, 2019, at (888) 203-1112 or (719) 457-0820, passcode 3401344. An

archive of the webcast conference call will be available shortly

after the call ends at https://investors.stitchfix.com.

About Stitch Fix, Inc.

Stitch Fix is reinventing the shopping

experience by delivering one-to-one personalization to our clients,

through the combination of data science and human judgment. Stitch

Fix was founded in 2011 by CEO Katrina Lake. Since our founding,

we’ve helped millions of men, women, and kids discover and buy what

they love through personalized shipments of apparel, shoes, and

accessories, hand-selected by Stitch Fix stylists and delivered to

our clients’ homes.

Forward-Looking Statements

This press release and related conference call

and webcast contain forward-looking statements within the meaning

of the federal securities laws. All statements other than

statements of historical fact could be deemed forward looking,

including but not limited to statements regarding our future

financial performance, including our guidance on financial results

for the fourth quarter and full year of fiscal 2019; market trends,

growth, and opportunity; profitability; competition; the timing and

success of expansions to our offering and penetration of our target

markets, such as the launch of our offering in the United Kingdom;

our ability to leverage our engineering and data science

capabilities to drive efficiencies in our business and enhance our

ability to personalize; our plans related to client acquisition,

including any impact on our costs and margins and our ability to

determine optimal marketing and advertising methods; and our

ability to successfully acquire, engage, and retain clients. These

statements involve substantial risks and uncertainties, including

risks and uncertainties related to our ability to generate

sufficient net revenue to offset our costs; the growth of our

market and consumer behavior; our ability to acquire, engage, and

retain clients; our ability to provide offerings and services that

achieve market acceptance; our data science and technology,

stylists, operations, marketing initiatives, and other key

strategic areas; risks related to international operations; and

other risks described in the filings we make with the Securities

and Exchange Commission (“SEC”). Further information on these and

other factors that could cause our financial results, performance,

and achievements to differ materially from any results,

performance, or achievements anticipated, expressed, or implied by

these forward-looking statements is included in filings we make

with the SEC from time to time, including in the section titled

“Risk Factors” in our Quarterly Report on Form 10-Q for the fiscal

quarter ended January 26, 2019. These documents are available

on the SEC Filings section of the Investor Relations section of our

website at: http://investors.stitchfix.com. We undertake no

obligation to update any forward-looking statements made in this

press release to reflect events or circumstances after the date of

this press release or to reflect new information or the occurrence

of unanticipated events, except as required by law. The achievement

or success of the matters covered by such forward-looking

statements involves known and unknown risks, uncertainties, and

assumptions. If any such risks or uncertainties materialize or if

any of the assumptions prove incorrect, our results could differ

materially from the results expressed or implied by the

forward-looking statements we make. You should not rely upon

forward-looking statements as predictions of future events.

Forward-looking statements represent our management’s beliefs and

assumptions only as of the date such statements are made.

|

|

|

Stitch Fix, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(Unaudited) |

|

(In thousands, except share and per share amounts) |

|

|

| |

April 27, 2019 |

|

July 28, 2018 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

143,829 |

|

|

$ |

297,516 |

|

|

Restricted cash |

250 |

|

|

250 |

|

|

Short-term investments |

147,779 |

|

|

— |

|

|

Inventory, net |

110,100 |

|

|

85,092 |

|

|

Prepaid expenses and other current assets |

40,639 |

|

|

34,148 |

|

| Total current assets |

442,597 |

|

|

417,006 |

|

|

Long-term investments |

62,919 |

|

|

— |

|

|

Property and equipment, net |

52,715 |

|

|

34,169 |

|

|

Deferred tax assets |

17,436 |

|

|

14,107 |

|

|

Restricted cash, net of current portion |

12,600 |

|

|

12,600 |

|

|

Other long-term assets |

3,215 |

|

|

3,703 |

|

| Total assets |

$ |

591,482 |

|

|

$ |

481,585 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

99,727 |

|

|

$ |

79,782 |

|

|

Accrued liabilities |

66,039 |

|

|

43,037 |

|

|

Gift card liability |

7,660 |

|

|

6,814 |

|

|

Deferred revenue |

12,962 |

|

|

8,870 |

|

|

Other current liabilities |

2,664 |

|

|

3,729 |

|

| Total current liabilities |

189,052 |

|

|

142,232 |

|

|

Deferred rent, net of current portion |

16,811 |

|

|

15,288 |

|

|

Other long-term liabilities |

10,484 |

|

|

8,993 |

|

| Total liabilities |

216,347 |

|

|

166,513 |

|

| Stockholders’ equity: |

|

|

|

|

Class A common stock, $0.00002 par value |

1 |

|

|

1 |

|

|

Class B common stock, $0.00002 par value |

1 |

|

|

1 |

|

|

Additional paid-in capital |

265,547 |

|

|

235,312 |

|

|

Accumulated other comprehensive income |

91 |

|

|

— |

|

|

Retained earnings |

109,495 |

|

|

79,758 |

|

| Total stockholders’

equity |

375,135 |

|

|

315,072 |

|

| Total liabilities and

stockholders’ equity |

$ |

591,482 |

|

|

$ |

481,585 |

|

|

|

|

Stitch Fix, Inc. |

|

Condensed Consolidated Statements of Operations and

Comprehensive Income |

|

(Unaudited) |

|

(In thousands, except share and per share amounts) |

|

|

| |

For the Three Months Ended |

|

For the Nine Months Ended |

| |

April 27, 2019 |

|

April 28, 2018 |

|

April 27, 2019 |

|

April 28, 2018 |

|

Revenue, net |

$ |

408,893 |

|

|

$ |

316,741 |

|

|

$ |

1,145,409 |

|

|

$ |

908,210 |

|

| Cost of goods sold |

224,445 |

|

|

178,535 |

|

|

632,644 |

|

|

513,606 |

|

|

Gross profit |

184,448 |

|

|

138,206 |

|

|

512,765 |

|

|

394,604 |

|

| Selling, general, and

administrative expenses |

189,015 |

|

|

128,454 |

|

|

491,024 |

|

|

359,696 |

|

| Operating income (loss) |

(4,567 |

) |

|

9,752 |

|

|

21,741 |

|

|

34,908 |

|

| Remeasurement of preferred

stock warrant liability |

— |

|

|

— |

|

|

— |

|

|

(10,685 |

) |

| Interest income |

(1,463 |

) |

|

(111 |

) |

|

(4,032 |

) |

|

(147 |

) |

| Other income, net |

(391 |

) |

|

(98 |

) |

|

(964 |

) |

|

(97 |

) |

| Income (loss) before income

taxes |

(2,713 |

) |

|

9,961 |

|

|

26,737 |

|

|

45,837 |

|

| Provision (benefit) for income

taxes |

(9,761 |

) |

|

474 |

|

|

(2,965 |

) |

|

19,221 |

|

| Net income |

$ |

7,048 |

|

|

$ |

9,487 |

|

|

$ |

29,702 |

|

|

$ |

26,616 |

|

| Other comprehensive income: |

|

|

|

|

|

|

|

|

Change in unrealized gain on available-for-sale securities, net of

tax |

140 |

|

|

— |

|

|

162 |

|

|

— |

|

|

Foreign currency translation |

(190 |

) |

|

— |

|

|

|

(71 |

) |

|

|

— |

|

| Total other comprehensive income

(loss), net of tax |

(50 |

) |

|

— |

|

|

|

91 |

|

|

|

— |

|

| Comprehensive income |

$ |

6,998 |

|

|

$ |

9,487 |

|

|

$ |

29,793 |

|

|

$ |

26,616 |

|

| Net income attributable to common

stockholders: |

|

|

|

|

|

|

|

|

Basic |

$ |

7,048 |

|

|

$ |

9,458 |

|

|

$ |

29,681 |

|

|

$ |

19,065 |

|

|

Diluted |

$ |

7,048 |

|

|

$ |

9,459 |

|

|

$ |

29,682 |

|

|

$ |

11,413 |

|

| Earnings per share

attributable to common stockholders: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.07 |

|

|

$ |

0.10 |

|

|

$ |

0.30 |

|

|

$ |

0.28 |

|

|

Diluted |

$ |

0.07 |

|

|

$ |

0.09 |

|

|

$ |

0.29 |

|

|

$ |

0.15 |

|

| Weighted-average shares used

to compute earnings per share attributable to common

stockholders: |

|

|

|

|

|

|

|

|

Basic |

100,301,078 |

|

|

97,055,573 |

|

|

99,619,426 |

|

|

68,596,978 |

|

|

Diluted |

103,615,159 |

|

|

101,847,521 |

|

|

103,575,702 |

|

|

74,281,211 |

|

|

|

|

Stitch Fix, Inc. |

|

Condensed Consolidated Statements of Cash

Flow |

|

(Unaudited) |

|

(In thousands) |

|

|

| |

For the Nine Months Ended |

| |

April 27, 2019 |

|

April 28, 2018 |

| Cash Flows from

Operating Activities |

|

|

|

|

Net income |

$ |

29,702 |

|

|

$ |

26,616 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

Deferred income taxes |

(3,832 |

) |

|

5,775 |

|

|

Remeasurement of preferred stock warrant liability |

— |

|

|

(10,685 |

) |

|

Inventory reserves |

2,805 |

|

|

3,928 |

|

|

Stock-based compensation expense |

23,815 |

|

|

10,277 |

|

|

Depreciation and amortization |

10,191 |

|

|

7,538 |

|

|

Loss on disposal of property and equipment |

24 |

|

|

146 |

|

|

Change in operating assets and liabilities: |

|

|

|

|

Inventory |

(27,818 |

) |

|

(18,558 |

) |

|

Prepaid expenses and other assets |

(5,969 |

) |

|

(407 |

) |

|

Accounts payable |

20,083 |

|

|

29,594 |

|

|

Accrued liabilities |

18,504 |

|

|

1,857 |

|

|

Deferred revenue |

4,288 |

|

|

3,118 |

|

|

Gift card liability |

1,251 |

|

|

1,495 |

|

|

Other liabilities |

2,164 |

|

|

802 |

|

|

Net cash provided by operating activities |

75,208 |

|

|

61,496 |

|

| Cash Flows from

Investing Activities |

|

|

|

| Purchases of property and

equipment |

(24,517 |

) |

|

(12,026 |

) |

| Purchases of securities

available-for-sale |

(233,151 |

) |

|

— |

|

| Sales of securities

available-for-sale |

2,414 |

|

|

— |

|

| Maturities of securities

available-for-sale |

21,500 |

|

|

— |

|

|

Net cash used in investing activities |

(233,754 |

) |

|

(12,026 |

) |

| Cash Flows from

Financing Activities |

|

|

|

| Proceeds from initial public

offering, net of underwriting discounts paid |

— |

|

|

129,046 |

|

| Proceeds from the exercise of

stock options, net |

9,284 |

|

|

2,074 |

|

| Payments for tax withholding

related to vesting of restricted stock units |

(4,350 |

) |

|

(402 |

) |

| Repurchase of Class B common

stock related to early exercised options |

— |

|

|

(39 |

) |

|

Net cash provided by financing activities |

4,934 |

|

|

130,679 |

|

| Net increase (decrease) in

cash, cash equivalents, and restricted cash |

(153,612 |

) |

|

180,149 |

|

| Effect of exchange rate

changes on cash |

(75 |

) |

|

— |

|

| Cash, cash equivalents, and

restricted cash at beginning of period |

310,366 |

|

|

119,958 |

|

| Cash, cash equivalents, and

restricted cash at end of period |

$ |

156,679 |

|

|

$ |

300,107 |

|

| Components of Cash,

Cash Equivalents, and Restricted Cash |

|

|

|

| Cash and cash equivalents |

$ |

143,829 |

|

|

$ |

287,257 |

|

| Restricted cash – current

portion |

250 |

|

|

— |

|

| Restricted cash – long-term

portion |

12,600 |

|

|

12,850 |

|

|

Total cash, cash equivalents, and restricted cash |

$ |

156,679 |

|

|

$ |

300,107 |

|

| Supplemental

Disclosure |

|

|

|

| Cash paid for income

taxes |

$ |

191 |

|

|

$ |

9,583 |

|

| Supplemental

Disclosure of Non-Cash Investing and Financing

Activities: |

|

|

|

| Purchases of property and

equipment included in accounts payable and accrued liabilities |

$ |

4,166 |

|

|

$ |

891 |

|

| Capitalized stock-based

compensation |

$ |

1,277 |

|

|

$ |

520 |

|

| Vesting of early exercised

options |

$ |

209 |

|

|

$ |

546 |

|

| Conversion of preferred stock

upon initial public offering |

$ |

— |

|

|

$ |

42,222 |

|

| Reclassification of preferred

stock warrant liability upon initial public offering |

$ |

— |

|

|

$ |

15,994 |

|

| Deferred offering costs paid

in prior year |

$ |

— |

|

|

$ |

1,879 |

|

| |

|

|

|

|

|

|

|

Non-GAAP Financial Measures

We report our financial results in accordance

with generally accepted accounting principles in the United States

(“GAAP”). However, management believes that certain non-GAAP

financial measures provide users of our financial information with

additional useful information in evaluating our performance.

Management believes that excluding certain items that may vary

substantially in frequency and magnitude period-to-period from net

income and earnings per share (“EPS”) provides useful supplemental

measures that assist in evaluating our ability to generate earnings

and to more readily compare these metrics between past and future

periods. Management also believes that adjusted EBITDA is

frequently used by investors and securities analysts in their

evaluations of companies, and that this supplemental measure

facilitates comparisons between companies. We believe free cash

flow is an important metric because it represents a measure of how

much cash from operations we have available for discretionary and

non-discretionary items after the deduction of capital

expenditures. These non-GAAP financial measures may be different

than similarly titled measures used by other companies. For

instance, we do not exclude stock-based compensation expense from

adjusted EBITDA or non-GAAP net income. Stock-based compensation is

an important part of how we attract and retain our employees, and

we consider it to be a real cost of running the business.

Our non-GAAP financial measures should not be

considered in isolation from, or as substitutes for, financial

information prepared in accordance with GAAP. There are several

limitations related to the use of our non-GAAP financial measures

as compared to the closest comparable GAAP measures. Some of these

limitations include:

- our non-GAAP net income and non-GAAP EPS attributable to common

stockholders – diluted measures exclude the impact of the

remeasurement of our net deferred tax assets following the adoption

of the Tax Cuts and Jobs Act (“Tax Act”);

- our non-GAAP net income, adjusted EBITDA and non-GAAP EPS

attributable to common stockholders – diluted measures exclude the

remeasurement of the preferred stock warrant liability, which is a

non-cash expense incurred in the periods prior to the completion of

our initial public offering;

- adjusted EBITDA excludes the recurring, non-cash expenses of

depreciation and amortization of property and equipment and,

although these are non-cash expenses, the assets being depreciated

and amortized may have to be replaced in the future;

- adjusted EBITDA does not reflect our tax provision, which

reduces cash available to us;

- adjusted EBITDA excludes interest income and other income, net,

as these items are not components of our core business; and

- free cash flow does not represent the total residual cash flow

available for discretionary purposes and does not reflect our

future contractual commitments.

Adjusted EBITDA

We define adjusted EBITDA as net income

excluding interest income, other income, net, provision for income

taxes, depreciation and amortization, and, when present, the

remeasurement of preferred stock warrant liability. The following

table presents a reconciliation of net income, the most comparable

GAAP financial measure, to adjusted EBITDA for each of the periods

presented:

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

(in thousands) |

|

April 27, 2019 |

|

April 28, 2018 |

|

April 27, 2019 |

|

April 28, 2018 |

| Adjusted EBITDA

reconciliation: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,048 |

|

|

$ |

9,487 |

|

|

$ |

29,702 |

|

|

$ |

26,616 |

|

| Add (deduct): |

|

|

|

|

|

|

|

|

| Interest income |

|

(1,463 |

) |

|

(111 |

) |

|

(4,032 |

) |

|

(147 |

) |

|

Other income, net |

|

(391 |

) |

|

(98 |

) |

|

(964 |

) |

|

(97 |

) |

|

Provision (benefit) for income taxes |

|

(9,761 |

) |

|

474 |

|

|

(2,965 |

) |

|

19,221 |

|

|

Depreciation and amortization |

|

4,257 |

|

|

2,650 |

|

|

11,441 |

|

|

7,538 |

|

|

Remeasurement of preferred stock warrant liability |

|

— |

|

|

— |

|

|

— |

|

|

(10,685 |

) |

| Adjusted

EBITDA |

|

$ |

(310 |

) |

|

$ |

12,402 |

|

|

$ |

33,182 |

|

|

$ |

42,446 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Income

We define non-GAAP net income as net income

excluding, when present, the remeasurement of preferred stock

warrant liability and the remeasurement of our net deferred tax

assets in relation to the adoption of the Tax Act. The following

table presents a reconciliation of net income, the most comparable

GAAP financial measure, to non-GAAP net income for each of the

periods presented:

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

(in thousands) |

|

April 27, 2019 |

|

April 28, 2018 |

|

April 27, 2019 |

|

April 28, 2018 |

| Non-GAAP net income

reconciliation: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,048 |

|

|

$ |

9,487 |

|

|

$ |

29,702 |

|

|

$ |

26,616 |

|

| Add (deduct): |

|

|

|

|

|

|

|

|

|

Remeasurement of preferred stock warrant liability |

|

— |

|

|

— |

|

|

— |

|

|

(10,685 |

) |

|

Impact of Tax Act (1) |

|

— |

|

|

— |

|

|

— |

|

|

4,730 |

|

| Non-GAAP net

income |

|

$ |

7,048 |

|

|

$ |

9,487 |

|

|

$ |

29,702 |

|

|

$ |

20,661 |

|

_____________________________(1) The U.S. government enacted

comprehensive tax legislation in December 2017. This resulted

in a net charge of $4.7 million for the nine months ended

April 28, 2018, due to the remeasurement of our net deferred

tax assets for the reduction in tax rate from 35% to 21%. The

adjustment to non-GAAP net income only includes this transitional

impact. It does not include the ongoing impacts of the lower

U.S. statutory rate on current year earnings.

Non-GAAP Earnings Per Share Attributable

to Common Stockholders – Diluted

We define non-GAAP EPS attributable to common

stockholders - diluted as EPS attributable to common stockholders -

diluted excluding, when present, the per share impact of the

remeasurement of preferred stock warrant liability and the

remeasurement of our net deferred tax assets in relation to the

adoption of the Tax Act. The following table presents a

reconciliation of EPS attributable to common stockholders –

diluted, the most comparable GAAP financial measure, to non-GAAP

EPS attributable to common stockholders – diluted for each of the

periods presented:

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

(in dollars) |

|

April 27, 2019 |

|

April 28, 2018 |

|

April 27, 2019 |

|

April 28, 2018 |

| Non-GAAP earnings per

share attributable to common stockholders –

diluted reconciliation: |

|

|

|

|

|

|

|

|

|

Earnings per share attributable to common stockholders –

diluted |

|

$ |

0.07 |

|

|

$ |

0.09 |

|

|

$ |

0.29 |

|

|

$ |

0.15 |

|

|

Per share impact of the remeasurement of preferred stock warrant

liability(1) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Per share impact of Tax Act(2) |

|

— |

|

|

— |

|

|

— |

|

|

0.07 |

|

| Non-GAAP earnings per

share attributable to common stockholders –

diluted |

|

$ |

0.07 |

|

|

$ |

0.09 |

|

|

$ |

0.29 |

|

|

$ |

0.22 |

|

_____________________________(1) For the three and nine months

ended April 28, 2018, the preferred stock warrant liability

was dilutive and included in EPS attributable to common

stockholders – diluted. Therefore, it is not an adjustment to

arrive at non-GAAP EPS attributable to common stockholders –

diluted.

(2) The U.S. government enacted comprehensive

tax legislation in December 2017. This resulted in a net

charge of $4.7 million for the nine months ended April 28,

2018, due to the remeasurement of our net deferred tax assets for

the reduction in tax rate from 35% to 21%. The adjustment to

non-GAAP EPS attributable to common stockholders –

diluted only includes this transitional impact. It does not

include the ongoing impacts of the lower U.S. statutory rate on

current year earnings.

Free Cash Flow

We define free cash flow as cash flows provided

by operating activities reduced by purchases of property and

equipment that are included in cash flows used in investing

activities. The following table presents a reconciliation of cash

flows provided by operating activities, the most comparable GAAP

financial measure, to free cash flow for each of the periods

presented:

| |

|

For the Nine Months Ended |

|

(in thousands) |

|

April 27, 2019 |

|

April 28, 2018 |

| Free cash flow

reconciliation: |

|

|

|

|

|

Cash flows provided by operating activities |

|

$ |

75,208 |

|

|

$ |

61,496 |

|

| Deduct: |

|

|

|

|

|

Purchases of property and equipment |

|

(24,517 |

) |

|

(12,026 |

) |

| Free cash

flow |

|

$ |

50,691 |

|

|

$ |

49,470 |

|

| Cash flows used in investing

activities |

|

$ |

(233,754 |

) |

|

$ |

(12,026 |

) |

| Cash flows provided by

financing activities |

|

$ |

4,934 |

|

|

$ |

130,679 |

|

| |

|

|

|

|

|

|

|

|

IR Contact:

David Pearce

ir@stitchfix.com

PR Contact:

Suzy Sammons

media@stitchfix.com

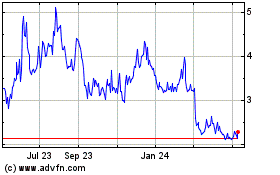

Stitch Fix (NASDAQ:SFIX)

Historical Stock Chart

From Dec 2024 to Jan 2025

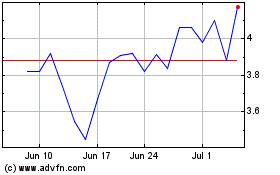

Stitch Fix (NASDAQ:SFIX)

Historical Stock Chart

From Jan 2024 to Jan 2025