FALSE000087423800008742382024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 6, 2024

| | | | | | | | | | | | | | |

|

| STERLING INFRASTRUCTURE, INC. |

(Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 001-31993 | | 25-1655321 |

(State or other jurisdiction of incorporation

or organization) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

1800 Hughes Landing Blvd. The Woodlands, Texas | | | | 77380 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | |

Registrant’s telephone number, including area code: (281) 214-0777 |

| | | | |

|

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Common Stock, $0.01 par value per share | STRL | The NASDAQ Stock Market LLC |

| (Title of Class) | (Trading Symbol) | (Name of each exchange on which registered) |

| | |

|

| | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| | | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

| | | | | |

| |

| |

On May 6, 2024, Sterling Infrastructure, Inc. (the “Company”) issued a press release announcing financial results for the three months ended March 31, 2024 and providing an update on full year 2024 guidance. The press release is being furnished with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference. The information provided in this Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act, nor shall it be incorporated by reference in any filing made by the Company pursuant to the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), other than to the extent that such filing incorporates by reference any or all of such information by express reference thereto. |

Item 7.01 Regulation FD Disclosure.

| | | | | |

| |

| |

On May 7, 2024, the Company will host a conference call to discuss the first quarter 2024 results as well as corporate developments. The slides to be used during the conference call are being furnished with this Current Report on Form 8-K as Exhibit 99.2 and are incorporated herein by reference.

The information provided in this Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act, nor shall it be incorporated by reference in any filing made by the Company pursuant to the Exchange Act or the Securities Act, other than to the extent that such filing incorporates by reference any or all of such information by express reference thereto. |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| SIGNATURES |

|

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | | | | | | | |

| | STERLING INFRASTRUCTURE, INC. |

| | | |

| Date: | May 6, 2024 | By: | /s/ Ronald A. Ballschmiede |

| | | Ronald A. Ballschmiede |

| | | Chief Financial Officer |

NEWS RELEASE

For Immediate Release:

May 6, 2024

Sterling Reports Record First Quarter 2024 Results

THE WOODLANDS, TX – May 6, 2024 – Sterling Infrastructure, Inc. (NasdaqGS: STRL) (“Sterling” or the “Company”) today announced financial results for the first quarter 2024.

The financial comparisons herein are to the prior year quarter, unless otherwise noted.

First Quarter 2024 Results

•Revenues of $440.4 million, an increase of 9%

•Gross margin of 17.5%, an increase from 15.3%

•Net Income of $31.0 million, or $1.00 per diluted share, an increase of 58% and 56%, respectively

•EBITDA(1) of $55.7 million, an increase of 21%

•Cash flows from operations totaled $49.6 million for the first quarter

•Cash and Cash Equivalents totaled $480.4 million at March 31, 2024

•Backlog at March 31, 2024 was $2.35 billion

•Combined backlog(2) at March 31, 2024 was $2.42 billion

CEO Remarks and Outlook

“We had a great start to the year, growing revenue 9%, driving gross margins to a new first quarter high of 17.5%, and delivering EPS of $1.00. This was achieved despite the challenging weather in January and February. Had the weather cooperated, the quarter would have been even better,” stated Joe Cutillo, Sterling’s Chief Executive Officer. “We closed the first quarter with backlog of over $2.35 billion, a 45% increase from first quarter 2023 levels, providing strong visibility for the remainder of the year and into 2025. Awards in the quarter of $642 million represent a 1.8x book-to-burn ratio and reflect strength in the data center and aviation markets. Cash flow from operations was $50 million and our balance sheet remains in great shape. We are working diligently to find the right deals that would grow the company and enhance our service offering.”

“The trends across each of our business segments remain strong. In E-Infrastructure Solutions, we expanded operating margins by 294 basis points and grew operating profit by 12% as we continue to shift toward large, mission critical projects. E-Infrastructure revenue declined 10%, driven predominantly by weather impacts across the east coast and the timing of scheduled project starts. We continue to expect high single to low double-digit revenue growth in the E-Infrastructure segment in 2024. E-Infrastructure awards of $332 million reflect continued strength in the data center market. Transportation Solutions had another excellent quarter, with revenue growth of 34% and operating profit growth of 53%. We are seeing broad-based demand across our Transportation Solutions footprint and end markets. Building Solutions revenue grew 23% and operating profit grew 70%, reflecting strength in our residential slab business and excellent performance at the recently acquired Professional Plumbers Group (PPG). Our commercial business declined in the quarter, which was in line with our expectations,” continued Mr. Cutillo.

“We believe 2024 will be another excellent year for Sterling. With the strong first quarter results along with our backlog position, we are trending toward the high end of our guidance for the year. We are maintaining our full year revenue and EBITDA guidance and are raising our net income and diluted EPS guidance to reflect lowered net interest expense and

(1) See the “Non-GAAP Measures” and “EBITDA Reconciliation” sections below for more information.

(2) Combined Backlog includes Unsigned Awards of $67.6 million and $303.2 million at March 31, 2024 and December 31, 2023, respectively.

tax rate expectations for the year. Based on the high end of our 2024 guidance, our revenue would grow 12%, our net income would increase 23% and our EBITDA would improve 16%,” Mr. Cutillo concluded.

Full Year 2024 Guidance

•Revenue of $2.125 billion to $2.215 billion

•Net Income of $160 million to $170 million

•Diluted EPS of $5.00 to $5.30

•EBITDA(1) of $285 million to $300 million

Conference Call

Sterling’s management will hold a conference call to discuss these results and recent corporate developments on Tuesday, May 7, 2024 at 9:00 a.m. ET/8:00 a.m. CT. Interested parties may participate in the call by dialing (800) 836-8184. Please call in 10 minutes before the conference call is scheduled to begin and ask for the Sterling Infrastructure call. To coincide with the conference call, Sterling will post a slide presentation at www.strlco.com on the Events & Presentations section of the Investor Relations tab. Following management’s opening remarks, there will be a question and answer session.

To listen to a simultaneous webcast of the call, please go to the Company’s website at www.strlco.com at least 15 minutes early to download and install any necessary audio software. If you are unable to listen live, the conference call webcast will be archived on the Company’s website for 30 days.

About Sterling

Sterling operates through a variety of subsidiaries within three segments specializing in E-Infrastructure, Transportation and Building Solutions in the United States, primarily across the Southern, Northeastern, Mid-Atlantic and Rocky Mountain regions and the Pacific Islands. E-Infrastructure Solutions provides advanced, large-scale site development services for manufacturing, data centers, e-commerce distribution centers, warehousing, power generation and more. Transportation Solutions includes infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, rail and storm drainage systems. Building Solutions includes residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs, other concrete work, and plumbing services for new single-family residential builds. From strategy to operations, we are committed to sustainability by operating responsibly to safeguard and improve society’s quality of life. Caring for our people and our communities, our customers and our investors – that is The Sterling Way.

Joe Cutillo, CEO, “We build and service the infrastructure that enables our economy to run,

our people to move and our country to grow.”

(1) See the “Non-GAAP Measures” and “EBITDA Guidance Reconciliation” sections below for more information.

Important Information for Investors and Stockholders

Non-GAAP Measures

This press release contains “Non-GAAP” financial measures as defined under Regulation G of the amended U.S. Securities Exchange Act of 1934. The Company reports financial results in accordance with U.S. generally accepted accounting principles (“GAAP”), but the Company believes that certain Non-GAAP financial measures provide useful supplemental information to investors regarding the underlying business trends and performance of the Company’s ongoing operations and are useful for period-over-period comparisons of those operations.

Non-GAAP measures may include adjusted net income, adjusted EPS, EBITDA and adjusted EBITDA, in each case excluding the impacts of certain identified items. The excluded items represent items that the Company does not consider to be representative of its normal operations. The Company believes that these measures are useful for investors to review, because they provide a consistent measure of the underlying financial results of the Company’s ongoing business and, in the Company’s view, allow for a supplemental comparison against historical results and expectations for future performance. Furthermore, the Company uses each of these to measure the performance of the Company’s operations for budgeting and forecasting, as well as for determining employee incentive compensation. However, Non-GAAP measures should not be considered as substitutes for net income, EPS, or other data prepared and reported in accordance with GAAP and should be viewed in addition to the Company’s reported results prepared in accordance with GAAP.

Reconciliations of Non-GAAP financial measures to the most comparable GAAP measures are provided in the tables included within this press release.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that are considered forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about: our business strategy; our financial strategy; our industry outlook; our guidance; our expected margin growth; and our plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this press release, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “guidance,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this press release are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this press release are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission and elsewhere in those filings. Additional factors or risks that we currently deem immaterial, that are not presently known to us or that arise in the future could also cause our actual results to differ materially from our expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which our forward-looking statements are based are likely to change after the date the forward-looking statements are made. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

| | | | | |

Company Contact: Sterling Infrastructure, Inc. Noelle Dilts, VP Investor Relations and Corporate Strategy 281-214-0795 |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| | | | | | | |

| Revenues | $ | 440,360 | | | $ | 403,579 | | | | | |

| Cost of revenues | (363,456) | | | (341,837) | | | | | |

| Gross profit | 76,904 | | | 61,742 | | | | | |

| General and administrative expense | (27,298) | | | (23,321) | | | | | |

| Intangible asset amortization | (4,297) | | | (3,736) | | | | | |

| Acquisition related costs | (36) | | | (190) | | | | | |

| Other operating expense, net | (3,148) | | | (1,868) | | | | | |

| Operating income | 42,125 | | | 32,627 | | | | | |

| Interest income | 5,902 | | | 1,974 | | | | | |

| Interest expense | (6,664) | | | (7,528) | | | | | |

| | | | | | | |

| Income before income taxes | 41,363 | | | 27,073 | | | | | |

| Income tax expense | (7,604) | | | (7,033) | | | | | |

| Net income, including noncontrolling interests | 33,759 | | | 20,040 | | | | | |

| Less: Net income attributable to noncontrolling interests | (2,711) | | | (391) | | | | | |

| Net income attributable to Sterling common stockholders | $ | 31,048 | | | $ | 19,649 | | | | | |

| | | | | | | |

| Net income per share attributable to Sterling common stockholders: | | | | | | | |

| Basic | $ | 1.00 | | | $ | 0.64 | | | | | |

| Diluted | $ | 1.00 | | | $ | 0.64 | | | | | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 30,977 | | 30,618 | | | | |

| Diluted | 31,186 | | 30,789 | | | | |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

SEGMENT INFORMATION

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| Revenues | 2024 | | % of Revenue | | 2023 | | % of Revenue | | | | | | | | |

| E-Infrastructure Solutions | $ | 184,476 | | | 42% | | $ | 205,840 | | | 51% | | | | | | | | |

| Transportation Solutions | 148,969 | | | 34% | | 111,139 | | | 28% | | | | | | | | |

| Building Solutions | 106,915 | | | 24% | | 86,600 | | | 21% | | | | | | | | |

| Total Revenues | $ | 440,360 | | | | | $ | 403,579 | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Operating Income | | | | | | | | | | | | | | | |

| E-Infrastructure Solutions | $ | 27,169 | | | 14.7% | | $ | 24,269 | | | 11.8% | | | | | | | | |

| Transportation Solutions | 8,132 | | | 5.5% | | 5,306 | | | 4.8% | | | | | | | | |

| Building Solutions | 14,775 | | | 13.8% | | 8,701 | | | 10.0% | | | | | | | | |

| Segment Operating Income | 50,076 | | | 11.4% | | 38,276 | | | 9.5% | | | | | | | | |

| Corporate G&A Expense | (7,915) | | | | | (5,459) | | | | | | | | | | | |

| Acquisition Related Costs | (36) | | | | | (190) | | | | | | | | | | | |

| Total Operating Income | $ | 42,125 | | | 9.6% | | $ | 32,627 | | | 8.1% | | | | | | | | |

|

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 480,414 | | | $ | 471,563 | |

| Accounts receivable | 274,010 | | | 252,435 | |

| Contract assets | 88,329 | | | 88,600 | |

| Receivables from and equity in construction joint ventures | 18,222 | | | 17,506 | |

| Other current assets | 17,883 | | | 17,875 | |

| Total current assets | 878,858 | | | 847,979 | |

| Property and equipment, net | 258,802 | | | 243,648 | |

| Operating lease right-of-use assets, net | 55,169 | | | 57,235 | |

| Goodwill | 281,363 | | | 281,117 | |

| Other intangibles, net | 324,100 | | | 328,397 | |

| | | |

| Other non-current assets, net | 19,204 | | | 18,808 | |

| Total assets | $ | 1,817,496 | | | $ | 1,777,184 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 135,426 | | | $ | 145,968 | |

| Contract liabilities | 485,049 | | | 444,160 | |

| Current maturities of long-term debt | 26,469 | | | 26,520 | |

| Current portion of long-term lease obligations | 19,143 | | | 19,641 | |

| Accrued compensation | 19,831 | | | 27,758 | |

| Other current liabilities | 19,799 | | | 14,121 | |

| Total current liabilities | 705,717 | | | 678,168 | |

| Long-term debt | 308,721 | | | 314,996 | |

| Long-term lease obligations | 36,180 | | | 37,722 | |

| Members’ interest subject to mandatory redemption and undistributed earnings | 19,097 | | | 29,108 | |

| Deferred tax liability, net | 78,303 | | | 76,764 | |

| Other long-term liabilities | 17,261 | | | 16,573 | |

| Total liabilities | 1,165,279 | | | 1,153,331 | |

| Stockholders’ equity: | | | |

| Common stock | 311 | | | 309 | |

| Additional paid in capital | 288,173 | | | 293,570 | |

| | | |

| Retained earnings | 356,082 | | | 325,034 | |

| | | |

| Total Sterling stockholders’ equity | 644,566 | | | 618,913 | |

| Noncontrolling interests | 7,651 | | | 4,940 | |

| Total stockholders’ equity | 652,217 | | | 623,853 | |

| Total liabilities and stockholders’ equity | $ | 1,817,496 | | | $ | 1,777,184 | |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 33,759 | | | $ | 20,040 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 16,258 | | | 13,692 | |

| Amortization of debt issuance costs and non-cash interest | 305 | | | 422 | |

| Gain on disposal of property and equipment | (585) | | | (1,672) | |

| | | |

| | | |

| Deferred taxes | 1,517 | | | 2,728 | |

| Stock-based compensation | 4,586 | | | 3,240 | |

| | | |

| Changes in operating assets and liabilities | (6,249) | | | 10,608 | |

| Net cash provided by operating activities | 49,591 | | | 49,058 | |

| Cash flows from investing activities: | | | |

| Acquisitions, net of cash acquired | (1,016) | | | — | |

| Disposition proceeds | — | | | 14,000 | |

| Capital expenditures | (22,432) | | | (14,221) | |

| Proceeds from sale of property and equipment | 2,401 | | | 6,726 | |

| Net cash (used in) provided by investing activities | (21,047) | | | 6,505 | |

| Cash flows from financing activities: | | | |

| | | |

| Repayments of debt | (6,678) | | | (30,843) | |

| | | |

| Withholding taxes paid on net share settlement of equity awards | (13,015) | | | (4,288) | |

| | | |

| | | |

| Net cash used in financing activities | (19,693) | | | (35,131) | |

| Net change in cash, cash equivalents, and restricted cash | 8,851 | | | 20,432 | |

| Cash, cash equivalents and restricted cash at beginning of period | 471,563 | | | 185,265 | |

| Cash, cash equivalents and restricted cash at end of period | 480,414 | | | 205,697 | |

| Less: restricted cash | — | | | (3,121) | |

| | | |

| Cash and cash equivalents at end of period | $ | 480,414 | | | $ | 202,576 | |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

EBITDA RECONCILIATION

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| Net income attributable to Sterling common stockholders | $ | 31,048 | | | $ | 19,649 | | | | | |

| Depreciation and amortization | 16,258 | | | 13,692 | | | | | |

| Interest expense, net of interest income | 762 | | | 5,554 | | | | | |

| Income tax expense | 7,604 | | | 7,033 | | | | | |

EBITDA(1) | 55,672 | | | 45,928 | | | | | |

| | | | | | | |

| Acquisition related costs | 36 | | | 190 | | | | | |

Adjusted EBITDA(2) | $ | 55,708 | | | $ | 46,118 | | | | | |

| | | | | | | |

(1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest expense and taxes. |

| | | | | | | |

(2) The Company defines adjusted EBITDA as EBITDA excluding the impact of acquisition related costs. |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

EBITDA GUIDANCE RECONCILIATION

(In millions)

(Unaudited)

| | | | | | | | | | | |

| | Full Year 2024 Guidance |

| | Low | | High |

| Net income attributable to Sterling common stockholders | $ | 160 | | | $ | 170 | |

| Depreciation and amortization | 65 | | | 66 | |

| Interest expense, net of interest income | 3 | | | 4 | |

| Income tax expense | 57 | | | 60 | |

EBITDA (1) | $ | 285 | | | $ | 300 | |

| | | |

(1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense, and taxes. |

We build and service the infrastructure that enables our economy to run, our people to move, and our country to grow. Q1 2024 Earnings Call May 7, 2024

2Sterling | STRL: First Quarter 2024 DISCLOSURE: Forward-Looking Statements This presentation contains, and the officers and directors of the Company may from time to time make, statements that are considered forward- looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about: our business strategy; our financial strategy; our industry outlook; our guidance; our expected margin growth; and our plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this presentation, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” "guidance," “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this presentation are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this presentation are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission and elsewhere in those filings. Additional factors or risks that we currently deem immaterial, that are not presently known to us or that arise in the future could also cause our actual results to differ materially from our expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which our forward-looking statements are based are likely to change after the date the forward-looking statements are made. The forward- looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward- looking statements attributable to us or persons acting on our behalf. This presentation may contain the financial measures: adjusted net income, EBITDA, adjusted EBITDA, and adjusted EPS, which are not calculated in accordance with U.S. GAAP. When presented, a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measure will be provided in the Appendix to this presentation.

E-Infrastructure Solutions + Fastest growing segment in revenue growth + Provides value-added solutions to blue-chip customers in all major East Coast markets + Develops advanced, large-scale site development services for manufacturing, data centers, e-commerce distribution centers, warehousing, power generation and more Building Solutions + Serves the Nation's Top Builders in the Nation's Top Housing Markets: Texas & Arizona + Residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs, other concrete work and plumbing services for new single- family residential builds Transportation Solutions + Enhanced business mix + Provides infrastructure solutions in the Rocky Mountain States and Texas + Infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, rail and storm drainage systems Sterling | STRL: First Quarter 2024 3 WHO is Sterling? NASDAQ STRL Shares outstanding(2) 30.9M HQ The Woodlands, TX Market cap(2) $3.12B Employees ~3,000(1) Revenue(3) $2.17B Segments E-Infrastructure Solutions Building Solutions Transportation Solutions EBITDA(3) $293M Projects underway ~230(1) Total Backlog(1) $2.35B A market-leading infrastructure service provider of e-infrastructure, building and transportation solutions. A story of successful execution of a multi-year strategic business transformation; born of a vision that levers our entrepreneurial spirit. We offer a customer-centric, market-focused portfolio of goods and services geographically positioned in the right markets. (1) At March 31, 2024. (2) Shares outstanding and Market Cap as of May 3, 2024. (3) Full Year 2024 Revenue and EBITDA Mid-Point Guidance. *See EBITDA Reconciliation in the Appendix page 16.

Sterling | STRL: First Quarter 2024 4 Strategic Transformation at a Glance

+ First Quarter 2024 Results Sterling | STRL: First Quarter 2024 5

First Quarter 2024 Results Highlights + Revenues: $440.4 million + Net Income: $31.0 million + Diluted EPS: $1.00 + EBITDA(1): $55.7 million + Cash Flow from Operations(2): $49.6 million + Cash & Cash Equivalents(3): $480.4 million + Backlog(3): $2.35 billion with 15.6% margin + Combined Backlog(4): $2.42 billion with 15.5% margin Sterling | STRL: First Quarter 2024 6 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest expense and taxes. See EBITDA reconciliation on page 15. (2) Cash flow from operations for the three months ended March 31, 2024. (3) Cash & Cash Equivalents and Backlog at March 31, 2024. (4) Combined Backlog includes Unsigned Awards of $67.6 million at March 31, 2024.

Sterling | STRL: First Quarter 2024 7 Quarterly Consolidated and Segment Results ($ in millions) Q1 2024 Q1 2023 Revenues $ 440.4 $ 403.6 Gross Profit 76.9 61.7 G&A Expense (27.3) (23.3) Intangible Amortization (4.3) (3.7) Acquisition Related Costs — (0.2) Other Operating Expense, Net (3.1) (1.9) Operating Income 42.1 32.6 Interest, Net (0.8) (5.6) Income Tax Expense (7.6) (7.0) Less: Net Income Attributable to NCI (2.7) (0.4) Net income $ 31.0 $ 19.6 Diluted EPS $ 1.00 $ 0.64 EBITDA (1) $ 55.7 $ 45.9 ($ in millions) Q1 2024 Q1 2023 E-Infrastructure Solutions Revenue $ 184.5 $ 205.8 Operating Income $ 27.2 $ 24.3 Operating Margin 14.7 % 11.8 % Transportation Solutions Revenue $ 149.0 $ 111.1 Operating Income $ 8.1 $ 5.3 Operating Margin 5.5 % 4.8 % Building Solutions Revenue $ 106.9 $ 86.6 Operating Income $ 14.8 $ 8.7 Operating Margin 13.8 % 10.0 % (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest expense and taxes. See EBITDA reconciliation on page 15.

Sterling | STRL: First Quarter 2024 8 Remaining Performance Obligations (RPOs)(1) ($ in millions) March 31, 2024 December 31, 2023 E-Infrastructure Solutions RPOs $ 961.0 $ 813.7 Transportation Solutions RPOs 1,305.4 1,184.5 Building Solutions RPOs - Commercial 85.7 68.8 Total RPOs $ 2,352.1 $ 2,067.0 (1) Our remaining performance obligations do not differ from what we refer to as “Backlog,” and represent the amount of revenues we expect to recognize in the future from our contract commitments on projects.

Sterling | STRL: First Quarter 2024 9 Increased EBITDA and Cash Flow Drives Liquidity Strategy Foward Looking EBITDA Debt Coverage Ratio 1.2X 1.1X 12/31/23 3/31/24 0.0X 0.3X 0.5X 0.8X 1.0X 1.3X We expect to pursue strategic uses of our liquidity, such as strategic acquisitions, investing in capital equipment and managing leverage. Capital allocation focus • Long-term shareholder value • Complementing organic growth in existing and new markets • Strong cash flow profile provides flexibility and drives liquidity strategy Sterling is comfortable with a forward looking debt/ EBITDA coverage ratio of +/-2.5X. 5-Year Credit Facility $337M Term Loan Borrowings $75M Revolving Credit Facility (Undrawn) Key Cash Flow Considerations Q1 2024 Q1 2023 Cash flows from Operations $49.6M $49.1M Net CAPEX $20.0M $7.5M • Cash & Cash Equivalents at March 31, 2024 was $480.4 million • 2024 EBITDA guidance(1): $285M to $300M • Expected additional 2024 noncash expenses: $30M to $35M (Stock-based compensation, noncash interest expense, deferred taxes, etc.) • Scheduled term loan debt payments total $26,300, $26,300 and $6,600 for 2024, 2025, and 2026, respectively (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense and taxes. See EBITDA guidance reconciliation on page 16.

Sterling | STRL: First Quarter 2024 10 Contact Us Sterling Infrastructure, Inc. Noelle Dilts, VP IR and Corporate Strategy Tel: (281) 214-0795 noelle.dilts@strlco.com

+ Appendix Sterling | STRL: First Quarter 2024 11

Sterling | STRL: First Quarter 2024 12 2024 Modeling Considerations(1) (1) In millions except for EPS and percentages. (2) See EBITDA guidance reconciliation on page 16. Revenue $2,125 to $2,215 Gross Margin ~17.5% G&A Expense as % of Revenue (Excluding Intangible Amortization) ~5% Intangible Amortization $17 Other Operating Expense Net $17 to $19 JV Non-Controlling Interest Expense ~$10 Effective Income Tax Rate ~25% Net Income $160 to $170 Diluted EPS $5.00 to $5.30 Expected Dilutive Shares Outstanding 32.0 EBITDA(2) $285 to $300

2024 Modeling Considerations Continued* Sterling | STRL: First Quarter 2024 13 * In Millions. Non-Cash Items FY 2024 Expectations FY 2023 Depreciation $48 to $49 $42.2 Intangible Amortization $17 $15.2 Debt Issuance Cost Amortization $1 to $2 $2.0 Stock-based Compensation $14 to $16 $12.6 Deferred Taxes $15 to $17 $14.7 Other Cash Flow Items FY 2024 Expectations FY 2023 Interest expense, net of interest income $3 to $4 $15.2 CAPEX, net of disposals $55 to $60 $50.6

Sterling | STRL: First Quarter 2024 14 (1) The Company defines adjusted net income attributable to Sterling common stockholders as GAAP net income attributable to Sterling common stockholders excluding the impact of acquisition related costs. Three Months Ended March 31, 2024 2023 Net income attributable to Sterling common stockholders $ 31,048 $ 19,649 Acquisition related costs 36 190 Adjusted net income attributable to Sterling common stockholders (1) $ 31,084 $ 19,839 Net income per share attributable to Sterling common stockholders: Basic $ 1.00 $ 0.64 Diluted $ 1.00 $ 0.64 Adjusted net income per share attributable to Sterling common stockholders: Basic $ 1.00 $ 0.65 Diluted $ 1.00 $ 0.64 Weighted average common shares outstanding: Basic 30,977 30,618 Diluted 31,186 30,789 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES ADJUSTED NET INCOME RECONCILIATION (In thousands) (Unaudited)

Sterling | STRL: First Quarter 2024 15 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest expense and taxes. (2) The Company defines adjusted EBITDA as EBITDA excluding the impact of acquisition related costs. Three Months Ended March 31, 2024 2023 Net income attributable to Sterling common stockholders $ 31,048 $ 19,649 Depreciation and amortization 16,258 13,692 Interest expense, net of interest income 762 5,554 Income tax expense 7,604 7,033 EBITDA (1) 55,672 45,928 Acquisition related costs 36 190 Adjusted EBITDA (2) $ 55,708 $ 46,118 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES EBITDA RECONCILIATION (In thousands) (Unaudited)

Sterling | STRL: First Quarter 2024 16 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense and taxes. Full Year 2024 Guidance Low High Net income attributable to Sterling common stockholders $ 160 $ 170 Depreciation and amortization 65 66 Interest expense, net of interest income 3 4 Income tax expense 57 60 EBITDA (1) $ 285 $ 300 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES EBITDA GUIDANCE RECONCILIATION (In millions) (Unaudited)

THANK YOU We build and service the infrastructure that enables our economy to run, our people to move, and our country to grow.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

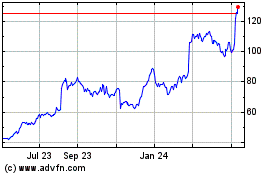

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Nov 2024 to Dec 2024

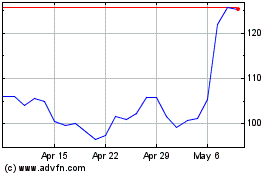

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Dec 2023 to Dec 2024