Sterling Bancorp, Inc. (NASDAQ: SBT) (“Sterling” or the

“Company”), the holding company of Sterling Bank and Trust, F.S.B.

(the “Bank”), today reported its unaudited financial results for

the second quarter ended June 30, 2024.

Second Quarter 2024

Highlights

- Net income of $1.3 million, or $0.03 per diluted

share

- Net interest margin of 2.44%

- Nonperforming loans of $12.2 million, 0.97% of total loans

and 0.51% of total assets

- Provision for (recovery of) credit losses of $(2.1) million;

ratio of allowance for credit losses to total loans of

2.18%

- Non-interest expense of $14.9 million

- Shareholders’ equity of $328.9 million

- Company’s consolidated and Bank’s leverage ratio of 14.26%

and 13.80%, respectively

- Total deposits of $2.0 billion

- Total gross loans of $1.3 billion

The Company reported net income of $1.3 million, or $0.03 per

diluted share, for the quarter ended June 30, 2024, compared to a

net loss of $(0.2) million, or $(0.00) per diluted share, for the

quarter ended March 31, 2024.

“Our focus remains fixed on protecting book value and Sterling’s

financial position while we continue to explore opportunities to

prudently reposition the Company and increase net income. The

margin compression experienced by Sterling is generally consistent

with what is being felt in much of the community banking industry.

Additionally, our substantial level of liquidity continues to exert

some downward pressure on earnings. Credit quality remains strong

as do our capital ratios. The capital markets have seen some

welcome signs of life and recent activity continues to encourage us

to maintain the course of action that we are on. Deposit levels

remain essentially flat which is our preferred position at this

time. While the residential portfolio continues to decline through

prepayments and amortization, we are seeing some growth in our

commercial portfolio as several very attractive opportunities have

come to fruition,” said Thomas M. O’Brien, Chairman, President, and

Chief Executive Officer.

Balance Sheet

Total Assets – Total assets were $2.4 billion at June 30,

2024, a decrease of $39.8 million, or 2%, from March 31, 2024.

Cash and due from banks decreased $46.4 million, or 7%, to

$599.8 million at June 30, 2024 compared to $646.2 million at March

31, 2024. Debt securities increased $47.1 million, or 12%, to

$441.9 million at June 30, 2024. All debt securities are available

for sale, have a relatively short duration and are considered part

of our liquid assets.

Total gross loans of $1.3 billion at June 30, 2024 decreased

$39.0 million, or 3%, from March 31, 2024. Residential real estate

loans were $972.3 million, a decrease of $68.1 million from March

31, 2024. Commercial real estate loans were $277.3 million, an

increase of $32.7 million from March 31, 2024.

Total Deposits – Total deposits were $2.0 billion at June

30, 2024, an increase of $7.6 million from March 31, 2024. Money

market, savings and NOW deposits were $1.1 billion, an increase of

$3.9 million from March 31, 2024. Time deposits were $905.2

million, an increase of $4.2 million from March 31, 2024.

Noninterest-bearing deposits were $32.2 million at June 30, 2024

compared to $32.7 million at March 31, 2024. Total estimated

uninsured deposits to total deposits were approximately 22% at June

30, 2024, March 31, 2024 and December 31, 2023. Our current

strategy is to continue to offer competitive interest rates on our

deposit products to maintain our existing customer deposit base and

maintain our liquidity.

Federal Home Loan Bank Borrowings – In May 2024 the

Company repaid with existing cash $50.0 million of a long-term

fixed rate borrowing that the Federal Home Loan Bank called, as

expected.

Capital – Total shareholders’ equity was $328.9 million

at June 30, 2024, an increase of $1.6 million compared to $327.3

million at March 31, 2024.

At June 30, 2024, the consolidated Company’s and Bank’s leverage

ratios were 14.26% and 13.80%, respectively. Both the Company and

the Bank are required to maintain a Tier 1 leverage ratio of

greater than 9.0% to have satisfied the minimum regulatory capital

requirements as well as the capital ratio requirements to be

considered well capitalized for regulatory purposes.

Asset Quality and Provision for (Recovery of) Credit

Losses – A provision for (recovery of) credit losses of $(2.1)

million was recorded for the second quarter of 2024 compared to a

provision for credit losses of $41 thousand for the first quarter

of 2024. In the second quarter of 2024, the recovery of credit

losses related to loans of $(2.1) million was primarily the result

of a reduction in the allowance for credit losses on our

residential loans due to a decline in this portfolio and lower

future loss rates on one of our residential loan products. A

recovery of credit losses related to loans of $(0.1) million was

recorded in the first quarter of 2024. A provision for credit

losses on unfunded commitments was recorded for the three months

ended June 30, 2024 and March 31, 2024 of $0.1 million and $0.2

million, respectively. The allowance for credit losses at June 30,

2024 was $27.6 million, or 2.18% of total loans, compared to $29.3

million, or 2.24% of total loans, at March 31, 2024.

Net charge offs (recoveries) during the second quarter of 2024

and first quarter of 2024 were $(0.4) million and $0,

respectively.

Nonperforming loans, comprised primarily of nonaccrual

residential real estate loans, totaled $12.2 million, or 0.51% of

total assets at June 30, 2024, compared to $9.3 million, or 0.39%

of total assets at March 31, 2024. Nonperforming loans at June 30,

2024 included a $1.1 million matured commercial real estate loan,

which was extended subsequent to the end of the quarter and is

included in loans 90 days past due and still accruing.

Results of Operations

Net Interest Income and Net Interest Margin – Net

interest income for the second quarter of 2024 was $14.4 million

compared to $14.9 million for the first quarter of 2024. The net

interest margin was 2.44% and 2.52% for the second and first

quarter of 2024, respectively. The decrease in net interest income

during the second quarter of 2024 compared to the prior quarter was

primarily due to a $1.3 million increase in interest expense on our

average balance of interest-bearing deposits since the rate paid

during the second quarter of 2024 increased 22 basis points. This

decrease was partially offset by a $0.9 million increase in

interest income earned on our average balance of investment

securities and other interest-earnings assets. Interest income on

loans declined $0.3 million in the second quarter of 2024 as

compared to the prior quarter as a decline in the average loan

portfolio balance of $58.7 million, or 4%, was offset in part by

the 18 basis point increase in the yield on the average loan

portfolio. The increase in the yield was due primarily to

residential mortgage rates resetting in the higher interest rate

environment.

Non-Interest Income – Non-interest income for the second

quarter of 2024 and first quarter of 2024 was $0.4 million and $0.2

million, respectively, an increase of $0.2 million, primarily due

to funds received from the Federal Home Loan Bank based on the

performance of loans previously sold to them.

Non-Interest Expense – Non-interest expense of $14.9

million for the second quarter of 2024 reflected a decrease of $0.5

million, or 3%, compared to $15.4 million for the first quarter of

2024. This decrease was primarily due to a $0.3 million decrease in

salaries and employee benefits. In the prior quarter, we completed

staff reductions in various support positions which resulted in a

decline of $0.2 million in salaries and employee benefits expense

compared to the first quarter of 2024. Also, favorably impacting

the first quarter of 2024 was a reversal of a liability for

deferred compensation. In addition, the U.S. Department of Justice

advised the Company in May 2024 that it had closed all of its

investigations focused on the Bank’s former Advantage Loan Program.

Accordingly, we no longer expect to incur any future costs to

cooperate with these completed government investigations or in

connection with claims for the advancement or reimbursement of

legal fees to third parties due to such investigations.

Income Tax Expense (Benefit)– For the three months ended

June 30, 2024, the Company recorded an income tax expense of $0.6

million, or an effective tax rate of 33.0%, compared to an income

tax (benefit) of $(0.1) million, or an effective tax rate of 34.3%,

for the three months ended March 31, 2024. Our effective tax rate

varies from the statutory rate primarily due to the impact of

non-deductible compensation related expenses.

Mr. O’Brien said, “The year is progressing quickly and we

believe there are some hopeful signs of easing inflation,

moderating interest rates, and lessening financial stress in the

economy. The Company will continue to move forward and explore its

opportunities. We believe this is the most prudent course of action

given our unique circumstances and the current market

dynamics.”

Conference Call and Webcast

Management will host a conference call on Wednesday, July 24,

2024 at 11:00 a.m. Eastern Time to discuss the Company’s unaudited

financial results for the quarter ended June 30, 2024. The

conference call number for U.S. participants is (833) 535-2201 and

the conference call number for participants outside the United

States is (412) 902-6744. Additionally, interested parties can

listen to a live webcast of the call in the “Investor Relations”

section of the Company’s website at www.sterlingbank.com. An

archived version of the webcast will be available in the same

location shortly after the live call has ended.

A replay of the conference call may be accessed through July 31,

2024 by U.S. callers dialing (877) 344-7529 and international

callers dialing (412) 317-0088, using conference ID number

2233158.

About Sterling Bancorp, Inc.

Sterling Bancorp, Inc. is a unitary thrift holding company. Its

wholly owned subsidiary, Sterling Bank and Trust, F.S.B., has

primary branch operations in the San Francisco and Los Angeles,

California metropolitan areas and New York City. Sterling also has

an operations center and a branch in Southfield, Michigan. Sterling

offers a range of loan products as well as retail and business

banking services. For additional information, please visit the

Company’s website at http://www.sterlingbank.com.

Forward-Looking Statements

This Press Release contains certain statements that are, or may

be deemed to be, “forward-looking statements” regarding the

Company’s plans, expectations, thoughts, beliefs, estimates, goals

and outlook for the future. These forward-looking statements

reflect our current views with respect to, among other things,

future events and our financial performance, including any

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions. These statements are often, but not always,

made through the use of words or phrases such as “may,” “might,”

“should,” “could,” “believe,” “expect,” “continue,” “will,”

“estimate,” “intend,” “plan,” “anticipate,” and “would” or the

negative versions of those words or other comparable words or

phrases of a future or forward-looking nature, though the absence

of these words does not mean a statement is not forward-looking.

All statements other than statements of historical facts, including

but not limited to statements regarding the economy and financial

markets, government investigations, credit quality, the regulatory

scheme governing our industry, competition in our industry,

interest rates, our liquidity, our business and our governance, are

forward-looking statements. We have based the forward-looking

statements in this Press Release primarily on our current

expectations and projections about future events and trends that we

believe may affect our business, financial condition, results of

operations, prospects, business strategy and financial needs. These

forward-looking statements are not historical facts, and they are

based on current expectations, estimates and projections about our

industry, management's beliefs and certain assumptions made by

management, many of which, by their nature, are inherently

uncertain and beyond our control. There can be no assurance that

future developments will be those that have been anticipated. We

may not actually achieve the plans, intentions or expectations

disclosed in our forward-looking statements. Our statements should

not be read to indicate that we have conducted an exhaustive

inquiry into, or review of, all potentially available relevant

information. Accordingly, we caution you that any such

forward-looking statements are not guarantees of future performance

and are subject to risks, assumptions, estimates and uncertainties

that are difficult to predict. The risks, uncertainties and other

factors detailed from time to time in our public filings, including

those included in the disclosures under the headings “Cautionary

Note Regarding Forward-Looking Statements” and “Risk Factors” in

our Annual Report on Form 10-K filed with the Securities and

Exchange Commission on March 14, 2024, subsequent periodic reports

and future periodic reports, could affect future results and

events, causing those results and events to differ materially from

those views expressed or implied in the Company’s forward-looking

statements. These risks are not exhaustive. Other sections of this

Press Release and our filings with the Securities and Exchange

Commission include additional factors that could adversely impact

our business and financial performance. Moreover, we operate in a

very competitive and rapidly changing environment. New risks and

uncertainties emerge from time to time, and it is not possible for

us to predict all risks and uncertainties that could have an impact

on the forward-looking statements contained in this Press Release.

Should one or more of the foregoing risks materialize, or should

underlying assumptions prove incorrect, actual results or outcomes

may vary materially from those projected in, or implied by, such

forward-looking statements. Accordingly, you should not place undue

reliance on any such forward-looking statements. The Company

disclaims any obligation to update, revise, or correct any

forward-looking statements based on the occurrence of future

events, the receipt of new information or otherwise.

Sterling Bancorp, Inc.

Consolidated Financial

Highlights (Unaudited)

At and for the Three Months

Ended

June 30,

March 31,

June 30,

(dollars in thousands, except per share data)

2024

2024

2023

Net income (loss)

$

1,316

$

(197

)

$

2,539

Income (loss) per share, diluted

$

0.03

$

(0.00

)

$

0.05

Net interest income

$

14,395

$

14,934

$

16,184

Net interest margin

2.44

%

2.52

%

2.64

%

Non-interest income

$

412

$

199

$

1,911

Non-interest expense

$

14,923

$

15,392

$

17,341

Loans, net of allowance for credit losses

$

1,236,687

$

1,274,022

$

1,449,709

Total deposits

$

2,013,465

$

2,005,855

$

2,041,491

Asset Quality Nonperforming loans

$

12,213

$

9,348

$

2,095

Allowance for credit losses to total loans

2.18

%

2.24

%

2.43

%

Allowance for credit losses to total nonaccrual loans

249

%

314

%

1753

%

Nonaccrual loans to total loans

0.87

%

0.71

%

0.14

%

Nonperforming loans to total loans

0.97

%

0.72

%

0.14

%

Nonperforming loans to total assets

0.51

%

0.39

%

0.08

%

Net charge offs (recoveries) to average loans during the period

(0.03

)%

0.00

%

(0.03

)%

Provision for (recovery of) credit losses

$

(2,079

)

$

41

$

(2,902

)

Net charge offs (recoveries)

$

(440

)

$

(0

)

$

(402

)

Performance Ratios Return on average assets

0.22

%

(0.03

)%

0.41

%

Return on average shareholders' equity

1.62

%

(0.24

)%

3.24

%

Efficiency ratio (1)

100.78

%

101.71

%

95.83

%

Yield on average interest-earning assets

5.75

%

5.61

%

5.15

%

Cost of average interest-bearing liabilities

3.91

%

3.66

%

2.99

%

Net interest spread

1.84

%

1.95

%

2.16

%

Leverage Capital Ratios(2) Consolidated

14.26

%

14.10

%

13.44

%

Bank

13.80

%

13.58

%

12.91

%

(1) Efficiency ratio is computed as the ratio of

non-interest expense divided by the sum of net interest income and

non-interest income. (2) Leverage capital ratio is Tier 1 (core)

capital to average total assets. June 30, 2024 capital ratios are

estimated.

Sterling Bancorp, Inc. Condensed Consolidated

Balance Sheets (Unaudited)

June 30,

March 31,

%

December 31,

%

June 30,

%

(dollars in thousands)

2024

2024

change

2023

change

2023

change

Assets Cash and due from banks

$

599,774

$

646,168

(7

)%

$

577,967

4

%

$

655,391

(8

)%

Interest-bearing time deposits with other banks

5,232

5,229

0

%

5,226

0

%

934

N/M

Debt securities available for sale

441,930

394,852

12

%

419,213

5

%

334,508

32

%

Equity securities

4,637

4,656

(0

)%

4,703

(1

)%

4,640

(0

)%

Loans, net of allowance for credit losses of $27,556, $29,257,

$29,404 and $36,153

1,236,687

1,274,022

(3

)%

1,319,568

(6

)%

1,449,709

(15

)%

Accrued interest receivable

8,835

9,195

(4

)%

8,509

4

%

7,489

18

%

Mortgage servicing rights, net

1,392

1,485

(6

)%

1,542

(10

)%

1,658

(16

)%

Leasehold improvements and equipment, net

4,961

5,206

(5

)%

5,430

(9

)%

5,850

(15

)%

Operating lease right-of-use assets

11,481

12,358

(7

)%

11,454

0

%

13,025

(12

)%

Federal Home Loan Bank stock, at cost

18,423

18,923

(3

)%

18,923

(3

)%

20,288

(9

)%

Federal Reserve Bank stock, at cost

9,139

9,096

0

%

9,048

1

%

—

N/M

Company-owned life insurance

8,818

8,764

1

%

8,711

1

%

8,605

2

%

Deferred tax asset, net

17,923

18,240

(2

)%

16,959

6

%

18,538

(3

)%

Other assets

5,507

6,361

(13

)%

8,750

(37

)%

11,375

(52

)%

Total assets

$

2,374,739

$

2,414,555

(2

)%

$

2,416,003

(2

)%

$

2,532,010

(6

)%

Liabilities Noninterest-bearing deposits

$

32,167

$

32,680

(2

)%

$

35,245

(9

)%

$

44,799

(28

)%

Interest-bearing deposits

1,981,298

1,973,175

0

%

1,968,741

1

%

1,996,692

(1

)%

Total deposits

2,013,465

2,005,855

0

%

2,003,986

0

%

2,041,491

(1

)%

Federal Home Loan Bank borrowings

—

50,000

(100

)%

50,000

(100

)%

50,000

(100

)%

Subordinated notes, net

—

—

N/M

—

N/M

65,234

(100

)%

Operating lease liabilities

12,504

13,407

(7

)%

12,537

(0

)%

14,176

(12

)%

Other liabilities

19,900

18,027

10

%

21,757

(9

)%

43,433

(54

)%

Total liabilities

2,045,869

2,087,289

(2

)%

2,088,280

(2

)%

2,214,334

(8

)%

Shareholders’ Equity Preferred stock, authorized

10,000,000 shares; no shares issued and outstanding

—

—

—

—

—

—

—

Common stock, no par value, authorized shares 500,000,000; shares

issued and outstanding 52,371,509, 52,046,683, 52,070,361 and

52,081,886

84,323

84,323

0

%

84,323

0

%

84,323

0

%

Additional paid-in capital

17,592

17,173

2

%

16,660

6

%

15,098

17

%

Retained earnings

243,083

241,767

1

%

241,964

0

%

236,587

3

%

Accumulated other comprehensive loss

(16,128

)

(15,997

)

(1

)%

(15,224

)

(6

)%

(18,332

)

12

%

Total shareholders’ equity

328,870

327,266

0

%

327,723

0

%

317,676

4

%

Total liabilities and shareholders’ equity

$

2,374,739

$

2,414,555

(2

)%

$

2,416,003

(2

)%

$

2,532,010

(6

)%

N/M - Not Meaningful

Sterling Bancorp, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

Three Months Ended

Six Months Ended

(dollars in thousands, except per share amounts)

June 30,

2024

March 31,

2024

%

change

June 30,

2023

%

change

June 30,

2024

June 30,

2023

%

change

Interest income Interest and fees on loans

$

20,620

$

20,969

(2

)%

$

21,892

(6

)%

$

41,589

$

44,052

(6

)%

Interest and dividends on investment securities and restrictedstock

4,758

4,018

18

%

2,666

78

%

8,776

5,122

71

%

Interest on interest-bearing cash deposits

8,486

8,295

2

%

7,002

21

%

16,781

11,809

42

%

Total interest income

33,864

33,282

2

%

31,560

7

%

67,146

60,983

10

%

Interest expense Interest on deposits

19,350

18,100

7

%

13,337

45

%

37,450

23,146

62

%

Interest on Federal Home Loan Bank borrowings

119

248

(52

)%

248

(52

)%

367

493

(26

)%

Interest on Subordinated Notes

—

—

N/M

1,791

(100

)%

—

3,484

(100

)%

Total interest expense

19,469

18,348

6

%

15,376

27

%

37,817

27,123

39

%

Net interest income

14,395

14,934

(4

)%

16,184

(11

)%

29,329

33,860

(13

)%

Provision for (recovery of) credit losses

(2,079

)

41

N/M

(2,902

)

28

%

(2,038

)

(2,228

)

9

%

Net interest income after provision for (recovery of) credit losses

16,474

14,893

11

%

19,086

(14

)%

31,367

36,088

(13

)%

Non-interest income Service charges and fees

92

87

6

%

78

18

%

179

172

4

%

Loss on sale of investment securities

—

—

N/M

—

N/M

—

(2

)

100

%

Gain on sale of loans held for sale

—

—

N/M

1,720

(100

)%

—

1,695

(100

)%

Unrealized loss on equity securities

(19

)

(47

)

60

%

(71

)

73

%

(66

)

—

N/M

Net servicing income

46

75

(39

)%

102

(55

)%

121

161

(25

)%

Income earned on company-owned life insurance

84

83

1

%

81

4

%

167

161

4

%

Other

209

1

N/M

1

N/M

210

2

N/M

Total non-interest income

412

199

N/M

1,911

(78

)%

611

2,189

(72

)%

Non-interest expense Salaries and employee benefits

8,196

8,460

(3

)%

9,274

(12

)%

16,656

18,684

(11

)%

Occupancy and equipment

2,005

2,084

(4

)%

2,051

(2

)%

4,089

4,163

(2

)%

Professional fees

2,147

2,182

(2

)%

3,521

(39

)%

4,329

6,742

(36

)%

FDIC insurance

262

262

0

%

263

(0

)%

524

520

1

%

Data processing

742

733

1

%

754

(2

)%

1,475

1,492

(1

)%

Other

1,571

1,671

(6

)%

1,478

6

%

3,242

3,577

(9

)%

Total non-interest expense

14,923

15,392

(3

)%

17,341

(14

)%

30,315

35,178

(14

)%

Income (loss) before income taxes

1,963

(300

)

N/M

3,656

(46

)%

1,663

3,099

(46

)%

Income tax expense (benefit)

647

(103

)

N/M

1,117

(42

)%

544

1,063

(49

)%

Net income (loss)

$

1,316

$

(197

)

N/M

$

2,539

(48

)%

$

1,119

$

2,036

(45

)%

Income (loss) per share, basic and diluted

$

0.03

$

(0.00

)

$

0.05

$

0.02

$

0.04

Weighted average common shares outstanding: Basic

50,920,703

50,843,106

50,672,461

50,881,905

50,559,092

Diluted

51,349,764

50,843,106

50,778,213

51,326,379

50,705,998

N/M - Not Meaningful

Sterling Bancorp, Inc.

Yield Analysis and Net Interest Income (Unaudited)

Three Months Ended June 30, 2024 March 31,

2024 June 30, 2023 Average Average

Average Average Average Average

(dollars in thousands) Balance Interest

Yield/Rate Balance Interest Yield/Rate

Balance Interest Yield/Rate

Interest-earning assets Loans(1) Residential real estate and

other consumer

$

1,006,040

$

17,007

6.76

%

$

1,064,200

$

17,197

6.46

%

$

1,277,408

$

18,250

5.71

%

Commercial real estate

252,380

3,252

5.15

%

246,423

3,213

5.22

%

224,836

2,787

4.96

%

Construction

4,997

130

10.41

%

7,246

242

13.36

%

31,819

820

10.31

%

Commercial and industrial

10,855

231

8.51

%

15,087

317

8.40

%

2,255

35

6.21

%

Total loans

1,274,272

20,620

6.47

%

1,332,956

20,969

6.29

%

1,536,318

21,892

5.70

%

Securities, includes restricted stock(2)

464,404

4,758

4.10

%

437,712

4,018

3.67

%

375,094

2,666

2.84

%

Other interest-earning assets

618,846

8,486

5.49

%

601,791

8,295

5.51

%

541,887

7,002

5.17

%

Total interest-earning assets

2,357,522

33,864

5.75

%

2,372,459

33,282

5.61

%

2,453,299

31,560

5.15

%

Noninterest-earning assets Cash and due from banks

3,391

4,643

4,233

Other assets

29,717

29,521

27,645

Total assets

$

2,390,630

$

2,406,623

$

2,485,177

Interest-bearing liabilities Money market, savings and NOW

$

1,062,347

$

9,827

3.71

%

$

1,074,937

$

9,655

3.60

%

$

980,359

$

6,270

2.57

%

Time deposits

911,466

9,523

4.19

%

884,115

8,445

3.83

%

969,938

7,067

2.92

%

Total interest-bearing deposits

1,973,813

19,350

3.93

%

1,959,052

18,100

3.71

%

1,950,297

13,337

2.74

%

FHLB borrowings

24,176

119

1.95

%

50,000

248

1.96

%

50,000

248

1.96

%

Subordinated notes, net

-

-

0.00

%

-

-

0.00

%

65,245

1,791

10.86

%

Total borrowings

24,176

119

1.95

%

50,000

248

1.96

%

115,245

2,039

7.00

%

Total interest-bearing liabilities

1,997,989

19,469

3.91

%

2,009,052

18,348

3.66

%

2,065,542

15,376

2.99

%

Noninterest-bearing liabilities Demand deposits

31,930

35,348

44,005

Other liabilities

33,361

34,924

61,487

Shareholders' equity

327,350

327,299

314,143

Total liabilities and shareholders' equity

$

2,390,630

$

2,406,623

$

2,485,177

Net interest income and spread(2)

$

14,395

1.84

%

$

14,934

1.95

%

$

16,184

2.16

%

Net interest margin(2)

2.44

%

2.52

%

2.64

%

(1) Nonaccrual loans are included in the respective average

loan balances. Income, if any, on such loans is recognized on a

cash basis. (2) Interest income does not include taxable

equivalence adjustments.

Six Months Ended June 30,

2024 June 30, 2023 Average Average

Average Average (dollars in thousands)

Balance Interest Yield/Rate Balance

Interest Yield/Rate Interest-earning assets

Loans(1) Residential real estate and other consumer

$

1,035,121

$

34,204

6.61

%

$

1,321,858

$

36,764

5.56

%

Commercial real estate

249,402

6,465

5.18

%

224,383

5,383

4.80

%

Construction

6,122

372

12.15

%

36,601

1,854

10.13

%

Commercial and industrial

12,971

548

8.45

%

1,821

51

5.60

%

Total loans

1,303,616

41,589

6.38

%

1,584,663

44,052

5.56

%

Securities, includes restricted stock(2)

451,059

8,776

3.89

%

370,744

5,122

2.76

%

Other interest-earning assets

610,318

16,781

5.50

%

477,186

11,809

4.95

%

Total interest-earning assets

2,364,993

67,146

5.68

%

2,432,593

60,983

5.01

%

Noninterest-earning assets Cash and due from banks

4,018

4,353

Other assets

29,616

27,349

Total assets

$

2,398,627

$

2,464,295

Interest-bearing liabilities Money market, savings and NOW

$

1,068,642

$

19,482

3.66

%

$

990,874

$

10,884

2.22

%

Time deposits

897,791

17,968

4.01

%

935,605

12,262

2.64

%

Total interest-bearing deposits

1,966,433

37,450

3.82

%

1,926,479

23,146

2.42

%

FHLB borrowings

37,088

367

1.98

%

50,000

493

1.99

%

Subordinated notes, net

-

-

0.00

%

65,255

3,484

10.62

%

Total borrowings

37,088

367

1.96

%

115,255

3,977

6.86

%

Total interest-bearing liabilities

2,003,521

37,817

3.79

%

2,041,734

27,123

2.68

%

Noninterest-bearing liabilities Demand deposits

33,639

47,127

Other liabilities

34,142

61,892

Shareholders' equity

327,325

313,542

Total liabilities and shareholders' equity

$

2,398,627

$

2,464,295

Net interest income and spread(2)

$

29,329

1.89

%

$

33,860

2.33

%

Net interest margin(2)

2.48

%

2.78

%

(1) Nonaccrual loans are included in the respective average

loan balances. Income, if any, on such loans is recognized on a

cash basis. (2) Interest income does not include taxable

equivalence adjustments.

Sterling Bancorp, Inc. Loan

Composition (Unaudited)

June 30,

March 31,

%

December 31,

%

June 30,

%

(dollars in thousands)

2024

2024

change

2023

change

2023

change

Residential real estate

$

972,326

$

1,040,464

(7

)%

$

1,085,776

(10

)%

$

1,214,439

(20

)%

Commercial real estate

277,273

244,546

13

%

236,982

17

%

221,658

25

%

Construction

5,050

4,915

3

%

10,381

(51

)%

31,978

(84

)%

Commercial and industrial

9,593

13,348

(28

)%

15,832

(39

)%

17,772

(46

)%

Other consumer

1

6

(83

)%

1

0

%

15

(93

)%

Total loans held for investment

1,264,243

1,303,279

(3

)%

1,348,972

(6

)%

1,485,862

(15

)%

Less: allowance for credit losses

(27,556

)

(29,257

)

(6

)%

(29,404

)

(6

)%

(36,153

)

(24

)%

Loans, net

$

1,236,687

$

1,274,022

(3

)%

$

1,319,568

(6

)%

$

1,449,709

(15

)%

Sterling Bancorp, Inc. Allowance for Credit

Losses - Loans (Unaudited) Three Months Ended

June 30,

March 31,

December 31,

June 30,

(dollars in thousands)

2024

2024

2023

2023

Balance at beginning of period

$

29,257

$

29,404

$

34,267

$

38,565

Provision for (recovery of) credit losses

(2,141

)

(147

)

(4,927

)

(2,814

)

Charge offs

—

—

—

—

Recoveries

440

—

64

402

Balance at end of period

$

27,556

$

29,257

$

29,404

$

36,153

Sterling Bancorp, Inc. Deposit Composition

(Unaudited)

June 30,

March 31,

%

December 31,

%

June 30,

%

(dollars in thousands)

2024

2024

change

2023

change

2023

change

Noninterest-bearing deposits

$

32,167

$

32,680

(2

)%

$

35,245

(9

)%

$

44,799

(28

)%

Money Market, Savings and NOW

1,076,079

1,072,179

0

%

1,095,521

(2

)%

1,015,394

6

%

Time deposits

905,219

900,996

0

%

873,220

4

%

981,298

(8

)%

Total deposits

$

2,013,465

$

2,005,855

0

%

$

2,003,986

0

%

$

2,041,491

(1

)%

Sterling Bancorp, Inc. Credit Quality Data

(Unaudited) At and for the Three Months Ended

June 30,

March 31,

December 31,

June 30,

(dollars in thousands)

2024

2024

2023

2023

Nonaccrual loans(1) Residential real estate

$

11,049

$

9,318

$

8,942

$

2,062

Loans past due 90 days or more and still accruing interest

1,164

30

31

33

Nonperforming loans

$

12,213

$

9,348

$

8,973

$

2,095

Total loans (1)

$

1,264,243

$

1,303,279

$

1,348,972

$

1,485,862

Total assets

$

2,374,739

$

2,414,555

$

2,416,003

$

2,532,010

Allowance for credit losses to total loans

2.18

%

2.24

%

2.18

%

2.43

%

Allowance for credit losses to total nonaccrual loans

249

%

314

%

329

%

1753

%

Nonaccrual loans to total loans

0.87

%

0.71

%

0.66

%

0.14

%

Nonperforming loans to total loans

0.97

%

0.72

%

0.67

%

0.14

%

Nonperforming loans to total assets

0.51

%

0.39

%

0.37

%

0.08

%

Net charge offs (recoveries) to average loans during the period

(0.03

)%

0.00

%

0.00

%

(0.03

)%

(1) Loans are classified as held for investment and are

presented before the allowance for credit losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724713374/en/

Investor Contact: Sterling Bancorp, Inc. Karen Knott

Executive Vice President and Chief Financial Officer (248) 359-6624

kzaborney@sterlingbank.com

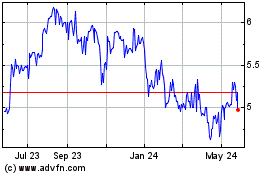

Sterling Bancorp (NASDAQ:SBT)

Historical Stock Chart

From Oct 2024 to Nov 2024

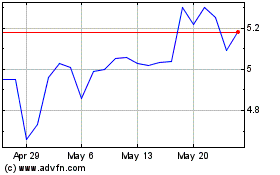

Sterling Bancorp (NASDAQ:SBT)

Historical Stock Chart

From Nov 2023 to Nov 2024