Current Report Filing (8-k)

March 16 2018 - 4:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

March 16, 2018

Date of report (Date of earliest event reported)

SPS COMMERCE,

INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34702

|

|

41-2015127

|

|

(State of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

333 South Seventh Street, Suite 1000

Minneapolis, MN

|

|

55402

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(612)

435-9400

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this

chapter). ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On March 16, 2018, SPS Commerce, Inc.

(the “Company”) entered into a cooperation agreement (the “Agreement”) with Legion Partners Holdings, LLC and certain of its affiliates (“Legion”) and Ancora Advisors, LLC and certain of its affiliates (together with

Legion, the “Investors”). The Agreement is filed as Exhibit 10.1 to this Current Report on Form

8-K.

Pursuant to the Agreement, and concurrently with the execution of the Agreement, the Company increased the size of the Company’s board of

directors (the “Board”) to ten and elected Melvin L. Keating, Michael J. McConnell and Marty M. Reaume (collectively, the “New Directors”) to the Board. Additionally, the Company agreed to, among other things, nominate the New

Directors for

re-election

at the 2018 annual meeting of stockholders (the “2018 Annual Meeting”) alongside the other continuing members of the Board.

With respect to the 2018 Annual Meeting, the Investors agreed to, among other things, vote in favor of the Company’s director nominees

and, subject to certain conditions, vote in accordance with the Board’s recommendation on all other proposals.

The Investors also

agreed to certain customary standstill provisions, effective as of the date of the Agreement through the date that is 30 calendar days prior to the stockholder nomination deadline for the Company’s 2019 annual meeting of stock (the

“Standstill Period”), prohibiting it from, among other things, (i) making certain public announcements, (ii) soliciting proxies; (iii) purchasing shares representing more than 9.9% of the outstanding common stock;

(iv) taking actions or make proposals to change or influence the Board, Company management or the direction of certain Company matters; and (v) exercising certain stockholder rights.

The Company and the Investors also made certain customary representations, agreed to mutual

non-disparagement

provisions and agreed to issue the press release attached hereto as Exhibit 99.1.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Pursuant to the Agreement, on March 16, 2018, the Company elected the New Directors to the Board, effective immediately. The New Directors

will receive the Company’s standard compensation for

non-employee

directors, as described in the Company’s proxy statement for its 2017 annual meeting of stockholders, which was filed on

March 31, 2017.

In connection with setting the size of the Board effective at the 2018 Annual Meeting at nine, the Company announced

that Michael A. Smerklo will retire from the Board at the end of his current term and not stand for reelection at the 2018 Annual Meeting.

Other than as described in Item 1.01 above, there are no arrangements or understandings between any of the New Directors and any other person

pursuant to which they were selected as directors.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d)

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SPS COMMERCE, INC.

|

|

|

|

|

|

|

Date: March 16, 2018

|

|

|

|

By:

|

|

/s/ KIMBERLY K. NELSON

|

|

|

|

|

|

|

|

Kimberly K. Nelson

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

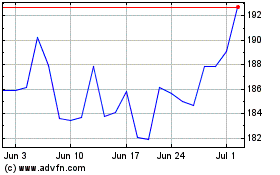

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Oct 2024 to Nov 2024

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Nov 2023 to Nov 2024