75 Percent of Retailers Rank E-Commerce Sales as a Top Priority, Displacing Stores for First Time

January 18 2016 - 8:00AM

SPS Commerce, Inc. (Nasdaq:SPSC), a leader in retail cloud

services, today unveiled the fourth annual Retail Insight industry

benchmark report. The benchmark survey noted the optimism and

challenges facing today’s retailers, distributors, suppliers and

logistics firms as they tackle growing customer expectations. Two

key trends emerged from this year’s report: e-commerce and stores

have switched places as the top growth driver, and suppliers are

not keeping up with the omnichannel retail demands of the digital

consumer and their retail customers.

"This year’s benchmark survey confirms that retailers are

accelerating their digital retail transformation, and see this as a

source of competitive advantage," said Peter Zaballos, vice

president of marketing and product at SPS Commerce. "For the first

time in four years, we see retailers pursuing suppliers that can

provide critical omnichannel capabilities of rapid fulfillment,

rich item and inventory information and drop-ship capabilities to

fuel their growth plans. Executive mandates for digital retail

transformation are guiding 52 percent of retailers to expedite

their initiatives. We expect 2016 to be a year of rapid change and

innovation."

The Retail Insight benchmark study of members of the SPS Retail

Network revealed the following:

- Retailers rank growing e-commerce sales as their top priority

(75 percent) followed by improving the in-store experience (53

percent).

- Distributors (80 percent) and logistics providers (41 percent)

are focused on rapid fulfillment above all else.

- Suppliers (80 percent) place streamlined fulfillment as their

top priority, yet 45 percent lag in omnichannel strategy and

execution with only 18 percent claiming even moderate success.

- Retailers cite more or improved item attributes as their top

desire from vendors in 2016 (69 percent), while distributors need

vendors to provide visibility to available inventory (75

percent).

- Legacy systems (59 percent) and cultures adverse to change (38

percent) are key inhibitors to retailers’ omnichannel

progress.

- Retailers rate their visibility to available inventory from

supplier warehouses as critically low (21 percent) and in-store

visibility at insufficient levels (75 percent) to meet consumer

demand.

"For the last three years, the survey has shown omnichannel

retail evolving from a quest for consistent customer facing

experience to a scramble for faster fulfillment,” said Nikki Baird,

managing partner at Retail Systems Research (RSR). “Retailers need

to have the ability to take an order no matter where demand is

generated, or where the inventory to meet that demand is located,

and get it to the customer as quickly as possible. Over the past

year, we saw the ecosystem take a deep breath as it absorbed the

depth of change required to achieve these omnichannel goals.”

The complimentary Retail Insight: Fulfilling Consumer

Demand report and infographic are available from SPS Commerce.

Hear more highlights from the report presented by RSR and SPS at

the upcoming webinar on Feb. 25, 2016, at 3 p.m. EST.

About the Fourth Annual SPS Retail Benchmark

SurveyThe Retail Insights: Consumer Expectations Transform

the Industry report quantifies the state of the retail industry,

identifies investment priorities for 2016, and outlines the

execution of omnichannel strategies to reach today's consumer. The

survey and market analysis is developed in partnership with Retail

Systems Research (RSR), who surveyed hundreds of retail

practitioners in September 2015.

About SPS CommerceSPS Commerce perfects the

power of trading partner relationships with the industry's most

broadly adopted, retail cloud services platform. As a leader in

cloud-based supply chain management solutions, we provide proven

integrations and comprehensive retail performance analytics to

thousands of customers worldwide. SPS Commerce has achieved 59

consecutive quarters of revenue growth and is headquartered in

Minneapolis. For additional information, please contact SPS

Commerce at 866-245-8100 or visit www.spscommerce.com.

SPS COMMERCE, SPS, and RETAIL UNIVERSE are marks of SPS

Commerce, Inc. and Registered in the U.S. Patent and Trademark

Office. 1=INFINITY logo, AS THE NETWORK GROWS, SO DOES YOUR

OPPORTUNITY, INFINITE RETAIL POWER, RETAIL UNIVERSE, RSX, SPS logo,

and others are further marks of SPS Commerce, Inc. These marks may

be registered or otherwise protected in other countries.

Contact:

Kay Rindels

SPS Commerce

866-245-8100

krindels@spscommerce.com

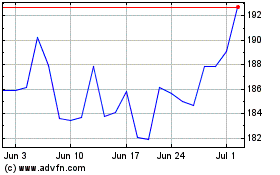

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Nov 2024 to Dec 2024

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Dec 2023 to Dec 2024