Sprout Social, Inc. (“Sprout Social”, the “Company”) (Nasdaq: SPT),

an industry-leading provider of cloud-based social media management

software, today announced financial results for its third quarter

ended September 30, 2024.

“The Sprout team delivered a solid third quarter,

driving 20% revenue growth and 31% growth in cRPO as we executed

our strategy across key company metrics. Sprout continues to focus

on product leadership and expanding our competitive position within

the Enterprise segment as these customers leverage the power of

Social to drive their digital strategies,” said Ryan Barretto,

CEO.

Third Quarter 2024 Financial

Highlights

Revenue

- Revenue was $102.6 million, up 20% compared to the third

quarter of 2023.

- Total remaining performance obligations (RPO) of $311.5 million

as of September 30, 2024, up 36% year-over-year.

- Current remaining performance obligations (cRPO) of $220.7

million as of September 30, 2024, up 31% year-over-year.

Operating Income (Loss)

- GAAP operating loss was ($16.9) million, compared to ($24.2)

million in the third quarter of 2023.

- Non-GAAP operating income (loss) was $7.5 million, compared to

($0.6) million in the third quarter of 2023.

Net Loss

- GAAP net loss was ($17.1) million, compared to ($23.0) million

in the third quarter of 2023.

- Non-GAAP net income (loss) was $7.3 million, compared to ($0.6)

million in the third quarter of 2023.

- GAAP net loss per share was ($0.30) based on 57.2 million

weighted-average shares of common stock outstanding, compared to

($0.41) based on 55.8 million weighted-average shares of common

stock outstanding in the third quarter of 2023.

- Non-GAAP net income (loss) per share was $0.13 based on 57.2

million weighted-average shares of common stock outstanding,

compared to ($0.01) based on 55.8 million weighted-average shares

of common stock outstanding in the third quarter of 2023.

Cash

- Cash and equivalents and marketable securities totaled $91.5

million as of September 30, 2024, compared to $93.2 million as of

June 30, 2024.

- Net cash generated by (used in) operating activities was $9.0

million, compared to ($5.5) million in the third quarter of

2023.

- Non-GAAP free cash flow was $9.3 million, compared to ($3.4)

million in the third quarter of 2023.

See “Use of Non-GAAP Financial Measures” below for

definitions of Non-GAAP operating income (loss), Non-GAAP net

income (loss), Non-GAAP net income (loss) per share, non-GAAP free

cash flow, dollar-based net retention rate and dollar-based net

retention rate excluding small-and-medium-sized business customers

and the financial tables that accompany this release for

reconciliations of our non-GAAP measures to their closest

comparable GAAP measures. See “Customer Metrics” below for how

Sprout Social defines the number of customers contributing over

$10,000 in ARR and the number of customers contributing over

$50,000 in ARR.

Customer Metrics

- Grew number of customers contributing over $10,000 in ARR to

9,119 customers as of September 30, 2024, up 12% compared to

September 30, 2023.

- Grew number of customers contributing over $50,000 in ARR to

1,610 customers as of September 30, 2024, up 29% compared to

September 30, 2023.

Recent Customer Highlights

- During the third quarter, we had the opportunity to grow with

new and existing customers like: Zoom, Honda, Campbell’s, Church

and Dwight, AGI, Valvoline Global, Valvoline Instant Oil Change,

the United States Coast Guard, Mattress Firm, Constellation Energy

Corp, Banco de Oro, and Scrub Daddy.

Recent Business Highlights

Sprout Social recently:

- Named Mike Wolff as Chief Revenue Officer to oversee Sprout’s

global Sales, Success and Partnerships organization. He will focus

on the continued global growth and expansion of Sprout’s innovative

offerings. (link)

- Named #1 in 94 Reports in G2’s 2024 Fall Reports, expanding its

leadership across global markets and business segments (link)

- Launched new Salesforce integration using Agentforce to assist

service reps (link)

- Unveiled latest product innovations to streamline marketers’

work, accelerate business insights with AI, and simplify social

customer service (link)

- Joined the AWS Marketplace to help customers simplify the

procurement process, streamline billing, and gain faster time to

value (link)

Fourth Quarter and 2024 Financial

Outlook

For the fourth quarter of 2024, the Company

currently expects:

- Total revenue between $106.3 million and $107.1 million.

- Non-GAAP operating income to be between $8.7 million and $9.5

million.

- Non-GAAP net income per share of between $0.15 and $0.16 based

on approximately 57.6 million weighted-average shares of common

stock outstanding.

For the full year 2024, the Company currently

expects:

- Total revenue to be between $405.1 million and $405.9

million.

- Non-GAAP operating income between $27.5 million and $28.3

million, including an estimated benefit from the deferred

commission accounting change, which will affect all future

periods.

- Non-GAAP net income per share between $0.46 and $0.47 based on

approximately 57.0 million weighted-average shares of common stock

outstanding.

The Company’s fourth quarter and 2024 financial

outlook is based on a number of assumptions that are subject to

change and many of which are outside the Company’s control. If

actual results vary from these assumptions, the Company’s

expectations may change. There can be no assurance that the Company

will achieve these results.

The Company does not provide guidance for

operating loss, the most directly comparable GAAP measure to

non-GAAP operating income, net loss per share, the most directly

comparable GAAP measure to non-GAAP net income per share, or

operating margin, the most directly comparable GAAP measure to

Non-GAAP operating margin, and similarly cannot provide a

reconciliation between its forecasted non-GAAP operating income,

non-GAAP net income per share and non-GAAP operating margin and

these comparable GAAP measures without unreasonable effort due to

the unavailability of reliable estimates for certain items. These

items are not within the Company’s control and may vary greatly

between periods and could significantly impact future financial

results.

Conference Call Information

The financial results and business highlights will

be discussed on a conference call and webcast scheduled at 4:00

p.m. Central Time (5:00 p.m. Eastern Time) today, November 7, 2024.

Online registration for this event conference call can be found at

https://registrations.events/direct/Q4I1913184. The live webcast of

the conference call can be accessed from Sprout Social’s investor

relations website at http://investors.sproutsocial.com.

Following completion of the events, a webcast

replay will also be available at

http://investors.sproutsocial.com for 12 months.

About Sprout Social

Sprout Social is a global leader in social media

management and analytics software. Sprout’s unified platform puts

powerful social data into the hands of approximately 30,000 brands

so they can make strategic decisions that drive business growth and

innovation. With a full suite of social media management solutions,

Sprout offers comprehensive publishing and engagement

functionality, customer care, connected workflows and AI-powered

business intelligence. Sprout’s award-winning software operates

across all major social media networks and digital platforms. For

more information about Sprout Social (NASDAQ: SPT), visit

sproutsocial.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. In some cases, you can identify

forward-looking statements by terms such as “anticipate,”

“believe,” “can,” “continue,” “could,” “estimate,” “expect,”

“explore,” “intend,” “long-term model,” “may,” “medium to longer

term goals,” “might” “outlook,” “plan,” “potential,” “predict,”

“project,” “should,” “strategy,” “target,” “will,” “would,” or the

negative of these terms, and similar expressions intended to

identify forward-looking statements. However, not all

forward-looking statements contain these identifying words. These

statements may relate to our market size and growth strategy, our

estimated and projected costs, margins, revenue, expenditures and

customer and financial growth rates, our Q4 2024 and full year 2024

financial outlook, our plans and objectives for future operations,

growth, initiatives or strategies. By their nature, these

statements are subject to numerous uncertainties and risks,

including factors beyond our control, that could cause actual

results, performance or achievement to differ materially and

adversely from those anticipated or implied in the forward-looking

statements. These assumptions, uncertainties and risks include

that, among others: we may not be able to sustain our revenue and

customer growth rate in the future; price increases have and may

continue to negatively impact demand for our products, customer

acquisition and retention and reduce the total number of customers

or customer additions; our business would be harmed by any

significant interruptions, delays or outages in services from our

platform, our API providers, or certain social media platforms; if

we are unable to attract potential customers through unpaid

channels, convert this traffic to free trials or convert free

trials to paid subscriptions, our business and results of

operations may be adversely affected; we may be unable to

successfully enter new markets, manage our international expansion

and comply with any applicable international laws and regulations;

we may be unable to integrate acquired businesses or technologies

successfully or achieve the expected benefits of such acquisitions

and investments; unstable market and economic conditions, such as

recession risks, effects of inflation, labor shortages, supply

chain issues, high interest rates, and the impacts of current and

potential future bank failures and impacts of ongoing overseas

conflicts, have and could continue to adversely impact our business

and that of our existing and prospective customers, which may

result in reduced demand for our products; we may not be able to

generate sufficient cash to service our indebtedness; covenants in

our credit agreement may restrict our operations, and if we do not

effectively manage our business to comply with these covenants, our

financial condition could be adversely impacted; any

cybersecurity-related attack, significant data breach or disruption

of the information technology systems or networks on which we rely

could negatively affect our business; changing regulations relating

to privacy, information security and data protection could increase

our costs, affect or limit how we collect and use personal

information and harm our brand; and risks related to ongoing legal

proceedings. Additional risks and uncertainties that could cause

actual outcomes and results to differ materially from those

contemplated by the forward-looking statements are included under

the caption “Risk Factors” and elsewhere in our filings with the

Securities and Exchange Commission (the “SEC”), including our

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the SEC on February 23, 2024, as well as any future

reports that we file with the SEC. Moreover, you should interpret

many of the risks identified in those reports as being heightened

as a result of the current instability in market and economic

conditions. Forward-looking statements speak only as of the date

the statements are made and are based on information available to

Sprout Social at the time those statements are made and/or

management's good faith belief as of that time with respect to

future events. Sprout Social assumes no obligation to update

forward-looking statements to reflect events or circumstances after

the date they were made, except as required by law.

Use of Non-GAAP Financial

Measures

We have provided in this press release certain

financial information that has not been prepared in accordance with

generally accepted accounting principles in the United States

(“GAAP”). Our management uses these non-GAAP financial measures

internally in analyzing our financial results and believes that use

of these non-GAAP financial measures is useful to investors as an

additional tool to evaluate ongoing operating results and trends

and in comparing our financial results with other companies in our

industry, many of which present similar non-GAAP financial

measures. Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable financial

measures prepared in accordance with GAAP and should be read only

in conjunction with our consolidated financial statements prepared

in accordance with GAAP. A reconciliation of our historical

non-GAAP financial measures to the most directly comparable GAAP

measures has been provided in the financial statement tables

included in this press release, and investors are encouraged to

review these reconciliations.

Non-GAAP gross profit. We define

non-GAAP gross profit as GAAP gross profit, excluding stock-based

compensation expense and amortization expense associated with the

acquired developed technology from our acquisition of Tagger Media,

Inc. (the “Tagger acquisition”). We believe non-GAAP gross profit

provides our management and investors consistency and comparability

with our past financial performance and facilitates

period-to-period comparisons of operations, as it eliminates the

effect of stock-based compensation and amortization expense, which

are often unrelated to overall operating performance. In 2023, we

revised our definition of non-GAAP gross profit to exclude

amortization expense associated with the acquired developed

technology from the Tagger acquisition.

Non-GAAP gross margin. We define

non-GAAP gross margin as non-GAAP gross profit as a percentage of

revenue.

Non-GAAP operating income (loss).

We define non-GAAP operating income (loss) as GAAP loss from

operations, excluding stock-based compensation expense,

acquisition-related expenses and amortization expense associated

with the acquired intangible assets from the Tagger acquisition. We

believe non-GAAP operating income (loss) provides our management

and investors consistency and comparability with our past financial

performance and facilitates period-to-period comparisons of

operations, as it eliminates the effect of stock-based

compensation, acquisition-related expenses and amortization

expense, which are often unrelated to overall operating

performance. In 2023, we revised our definition of non-GAAP

operating income (loss) to exclude acquisition-related expenses in

connection with the Tagger acquisition and amortization expense

associated with the acquired intangible assets from the Tagger

acquisition.

Non-GAAP operating margin. We

define non-GAAP operating margin as non-GAAP operating income

(loss) as a percentage of revenue.

Non-GAAP net income (loss). We

define non-GAAP net income (loss) as GAAP net loss, excluding

stock-based compensation expense, acquisition-related expenses,

amortization expense associated with the acquired intangible assets

from the Tagger acquisition and tax benefits due to changes in

valuation allowances from business acquisitions. We believe

non-GAAP net income (loss) provides our management and investors

consistency and comparability with our past financial performance

and facilitates period-to-period comparisons of operations, as this

non-GAAP financial measure eliminates the effect of stock-based

compensation, acquisition-related expenses, amortization expense

and tax benefits due to changes in valuation allowances from

business acquisitions, which are often unrelated to overall

operating performance. In 2023, we revised our definition of

non-GAAP net income (loss) to exclude acquisition-related expenses

in connection with the Tagger acquisition, amortization expense

associated with the acquired intangible assets from the Tagger

acquisition and tax benefits recognized from changes in the

valuation allowance associated with our acquisition of Tagger.

Non-GAAP net income (loss) per

share. We define non-GAAP net income (loss) per share as

GAAP net loss per share attributable to common shareholders, basic

and diluted, excluding stock-based compensation expense,

acquisition-related expenses, amortization expense associated with

the acquired intangible assets from the Tagger acquisition and tax

benefits due to changes in valuation allowances from business

acquisitions. We believe non-GAAP net income (loss) per share

provides our management and investors consistency and comparability

with our past financial performance and facilitates

period-to-period comparisons of operations, as this non-GAAP

financial measure eliminates the effect of stock-based

compensation, acquisition-related expenses, amortization expense

and tax benefits due to changes in valuation allowances from

business acquisitions, which are often unrelated to overall

operating performance. In 2023, we revised our definition of

non-GAAP net income (loss) per share to exclude acquisition-related

expenses in connection with the Tagger acquisition, amortization

expense associated with the acquired intangible assets from the

Tagger acquisition and tax benefits recognized from changes in the

valuation allowance associated with our acquisition of Tagger.

Non-GAAP free cash flow. We

define non-GAAP free cash flow as net cash provided by (used in)

operating activities less expenditures for property and equipment,

acquisition-related costs and interest. Non-GAAP free cash flow

does not reflect our future contractual obligations or represent

the total increase or decrease in our cash balance for a given

period. We believe non-GAAP free cash flow is a useful indicator of

liquidity that provides information to management and investors

about the amount of cash used in our core operations that, after

expenditures for property and equipment, acquisition-related costs

and interest, is not available for strategic initiatives. In 2023,

we revised our definition of non-GAAP free cash flow to exclude

payments related to acquisition-related costs associated with the

Tagger acquisition (which are not applicable for the periods

presented) and cash paid for interest on our revolving line of

credit.

Non-GAAP free cash flow margin.

We define non-GAAP free cash flow margin as non-GAAP free cash flow

as a percentage of revenue.

Non-GAAP sales and marketing expenses,

non-GAAP research and development expenses and non-GAAP general and

administrative expenses. Non-GAAP sales and marketing

expenses, non-GAAP research and development expenses and non-GAAP

general and administrative expenses are defined as sales and

marketing expenses, research and development expenses and general

and administrative expenses, respectively, less stock-based

compensation expense and acquisition-related expenses. We believe

these non-GAAP measures provide our management and investors with

insight into day-to-day operating expenses given that these

measures eliminate the effect of stock-based compensation and

acquisition-related expenses. In 2023, we revised our definition of

non-GAAP general and administrative expenses to exclude

acquisition-related expenses in connection with the Tagger

acquisition and amortization expense associated with the acquired

intangible assets from the Tagger acquisition.

Key Business Metrics

Annual recurring revenue (“ARR”).

We define ARR as the annualized revenue run-rate of subscription

agreements from all customers as of the last date of the specified

period. We believe ARR is an indicator of the scale of our entire

platform while mitigating fluctuations due to seasonality and

contract term.

Remaining performance obligations

(“RPO”). RPO, or remaining performance obligations,

represents contracted revenue that has not yet been recognized, and

includes deferred revenue and amounts that will be invoiced and

recognized in future periods.

Current remaining performance obligations

(“cRPO”). cRPO, or current RPO, represents contracted

revenue that has not yet been recognized, and includes deferred

revenue and amounts that will be invoiced and recognized in the

next 12 months.

Number of customers. We define a

customer as a unique account, multiple accounts containing a common

non-personal email domain, or multiple accounts governed by a

single agreement or entity. We believe that the number of customers

using our platform is an indicator of our market penetration.

Number of customers contributing more than

$10,000 in ARR. We define number of customers contributing

more than $10,000 in ARR as those on a paid subscription plan that

had more than $10,000 in ARR as of a period end. We view the number

of customers that contribute more than $10,000 in ARR as a measure

of our ability to scale with our customers and attract larger

organizations. We define a customer as a unique account, multiple

accounts containing a common non-personal email domain, or multiple

accounts governed by a single agreement or entity. We believe this

represents potential for future growth, including expanding within

our current customer base.

Number of customers contributing more than

$50,000 in ARR. We define number of customers contributing

more than $50,000 in ARR as those on a paid subscription plan that

had more than $50,000 in ARR as of a period end. We view the number

of customers that contribute more than $50,000 in ARR as a measure

of our ability to scale with large customers and attract

sophisticated organizations. We define a customer as a unique

account, multiple accounts containing a common non-personal email

domain, or multiple accounts governed by a single agreement or

entity. We believe this represents potential for future growth,

including expanding within our current customer base.

Dollar-based net retention rate.

We calculate dollar-based net retention rate by dividing the ARR

from our customers as of December 31st in the reported year by the

ARR from those same customers as of December 31st in the previous

year. This calculation is net of upsells, contraction, cancellation

or expansion during the period but excludes ARR from new customers.

We use dollar-based net retention to evaluate the long-term value

of our customer relationships, because we believe this metric

reflects our ability to retain and expand subscription revenue

generated from our existing customers.

Dollar-based net retention rate excluding

SMB customers. We calculate dollar-based net retention

rate excluding SMB customers by dividing the ARR from all customers

excluding ARR from customers that we have identified or that

self-identified as having less than 50 employees as of December

31st in the reported year by the ARR from those same customers as

of December 31st of the previous year. This calculation is net of

upsells, contraction, cancellation or expansion during the period

but excludes ARR from new customers. We used dollar-based net

retention excluding SMB customers to evaluate the long-term value

of our larger customer relationships, because we believe this

metric reflects our ability to retain and expand subscription

revenue generated from our existing customers.

While we no longer believe that ARR and number of

customers are key performance indicators of Sprout Social’s

business, these metrics are necessary for an understanding of how

we define number of customers contributing over $10,000 in ARR and

number of customers contributing over $50,000 in ARR. For this

purpose, we define ARR as the annualized revenue run-rate of

subscription agreements from all customers as of the last date of

the specified period and we define a customer as a unique account,

multiple accounts containing a common non-personal email domain, or

multiple accounts governed by a single agreement or entity.

Availability of Information on Sprout

Social’s Website and Social Media Profiles

Investors and others should note that Sprout

Social routinely announces material information to investors and

the marketplace using SEC filings, press releases, public

conference calls, webcasts and the Sprout Social Investors website.

We also intend to use the social media profiles listed below as a

means of disclosing information about us to our customers,

investors and the public. While not all of the information that the

Company posts to the Sprout Social Investors website or to social

media profiles is of a material nature, some information could be

deemed to be material. Accordingly, the Company encourages

investors, the media, and others interested in Sprout Social to

review the information that it shares at the Investors link located

at the bottom of the page on www.sproutsocial.com and to regularly

follow our social media profiles. Users may automatically receive

email alerts and other information about Sprout Social when

enrolling an email address by visiting “Email Alerts” in the

“Shareholder Services” section of Sprout Social's Investor website

at https://investors.sproutsocial.com/.

Social Media Profiles:

www.twitter.com/SproutSocialwww.twitter.com/SproutSocialIRwww.facebook.com/SproutSocialIncwww.linkedin.com/company/sprout-social-inc-/www.instagram.com/sproutsocial

Contact

Media: Layla Revis Email:

pr@sproutsocial.com Phone: (866) 878-3231

Investors: Alex Kurtz Twitter:

@SproutSocialIR Email: investors@sproutsocial.comPhone: (312)

528-9166

|

|

|

Sprout Social, Inc. |

|

Consolidated Statements of Operations

(Unaudited) |

|

(in thousands, except share and per share

data) |

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

2024 |

|

2023 |

|

Revenue |

|

|

|

|

Subscription |

$ 101,813 |

|

$ 84,802 |

|

Professional services and other |

825 |

|

730 |

|

Total revenue |

102,638 |

|

85,532 |

|

Cost of revenue(1) |

|

|

|

|

Subscription |

22,928 |

|

19,874 |

|

Professional services and other |

304 |

|

324 |

|

Total cost of revenue |

23,232 |

|

20,198 |

|

Gross profit |

79,406 |

|

65,334 |

|

Operating expenses |

|

|

|

|

Research and development(1) |

26,272 |

|

20,057 |

|

Sales and marketing(1) |

47,499 |

|

44,499 |

|

General and administrative(1) |

22,514 |

|

24,982 |

|

Total operating expenses |

96,285 |

|

89,538 |

|

Loss from operations |

(16,879) |

|

(24,204) |

|

Interest expense |

(851) |

|

(1,147) |

|

Interest income |

1,007 |

|

1,651 |

|

Other expense, net |

(110) |

|

(293) |

|

Loss before income taxes |

(16,833) |

|

(23,993) |

|

Income tax expense (benefit) |

254 |

|

(980) |

|

Net loss |

$ (17,087) |

|

$ (23,013) |

|

Net loss per share attributable to common shareholders, basic and

diluted |

$ (0.30) |

|

$ (0.41) |

|

Weighted-average shares outstanding used to compute net loss per

share, basic and diluted |

57,179,710 |

|

55,831,230 |

|

|

|

|

|

|

(1) Includes stock-based compensation expense as follows: |

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

2024 |

|

2023 |

|

Cost of revenue |

$ 1,059 |

|

$ 971 |

|

Research and development |

7,493 |

|

5,020 |

|

Sales and marketing |

8,962 |

|

8,570 |

|

General and administrative |

5,672 |

|

4,452 |

|

Total stock-based compensation expense |

$ 23,186 |

|

$ 19,013 |

|

Sprout Social, Inc. |

|

Consolidated Statements of Operations

(Unaudited) |

|

(in thousands, except share and per share

data) |

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

Revenue |

|

|

|

|

Subscription |

$ 296,100 |

|

$ 238,234 |

|

Professional services and other |

2,718 |

|

1,825 |

|

Total revenue |

298,818 |

|

240,059 |

|

Cost of revenue(1) |

|

|

|

|

Subscription |

67,211 |

|

54,479 |

|

Professional services and other |

851 |

|

828 |

|

Total cost of revenue |

68,062 |

|

55,307 |

|

Gross profit |

230,756 |

|

184,752 |

|

Operating expenses |

|

|

|

|

Research and development(1) |

75,167 |

|

56,889 |

|

Sales and marketing(1) |

138,233 |

|

120,711 |

|

General and administrative(1) |

64,035 |

|

58,206 |

|

Total operating expenses |

277,435 |

|

235,806 |

|

Loss from operations |

(46,679) |

|

(51,054) |

|

Interest expense |

(2,869) |

|

(1,210) |

|

Interest income |

3,095 |

|

5,811 |

|

Other expense, net |

(773) |

|

(650) |

|

Loss before income taxes |

(47,226) |

|

(47,103) |

|

Income tax expense (benefit) |

328 |

|

(753) |

|

Net loss |

$ (47,554) |

|

$ (46,350) |

|

Net loss per share attributable to common shareholders, basic and

diluted |

$ (0.84) |

|

$ (0.83) |

|

Weighted-average shares outstanding used to compute net loss per

share, basic and diluted |

56,742,498 |

|

55,508,195 |

|

|

|

|

|

|

(1) Includes stock-based compensation expense as follows: |

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

Cost of revenue |

$ 2,890 |

|

$ 2,329 |

|

Research and development |

18,979 |

|

12,949 |

|

Sales and marketing |

24,527 |

|

22,346 |

|

General and administrative |

15,454 |

|

11,421 |

|

Total stock-based compensation expense |

$ 61,850 |

|

$ 49,045 |

|

Sprout Social, Inc. |

|

Consolidated Balance Sheets (Unaudited) |

|

(in thousands, except share and per share

data) |

|

|

|

|

|

September 30, 2024 |

|

December 31, 2023 |

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ 82,886 |

|

$ 49,760 |

|

Marketable securities |

8,625 |

|

44,645 |

|

Accounts receivable, net of allowances of $2,220 and $2,177 at

September 30, 2024 and December 31, 2023, respectively |

54,361 |

|

63,489 |

|

Deferred Commissions |

17,662 |

|

27,725 |

|

Prepaid expenses and other assets |

14,984 |

|

10,324 |

|

Total current assets |

178,518 |

|

195,943 |

|

Marketable securities, noncurrent |

- |

|

3,699 |

|

Property and equipment, net |

10,773 |

|

11,407 |

|

Deferred commissions, net of current portion |

45,772 |

|

26,240 |

|

Operating lease, right-of-use asset |

8,003 |

|

8,729 |

|

Goodwill |

121,315 |

|

121,404 |

|

Intangible assets, net |

23,388 |

|

28,065 |

|

Other assets, net |

1,060 |

|

1,098 |

|

Total assets |

$ 388,829 |

|

$ 396,585 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

$ 7,536 |

|

$ 6,933 |

|

Deferred revenue |

149,172 |

|

140,536 |

|

Operating lease liability |

3,913 |

|

3,948 |

|

Accrued wages and payroll related benefits |

15,669 |

|

18,362 |

|

Accrued expenses and other |

10,227 |

|

11,260 |

|

Total current liabilities |

186,517 |

|

181,039 |

|

Revolving credit facility |

30,000 |

|

55,000 |

|

Deferred revenue, net of current portion |

1,040 |

|

920 |

|

Operating lease liability, net of current portion |

12,835 |

|

15,083 |

|

Other non-current liabilities |

351 |

|

351 |

|

Total liabilities |

230,743 |

|

252,393 |

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

|

|

|

Class A common stock, par value $0.0001 per share; 1,000,000,000

shares authorized; 53,810,286 and 50,878,170 shares issued and

outstanding, respectively, at September 30, 2024; 52,133,594 and

49,241,563 shares issued and outstanding, respectively, at December

31, 2023 |

4 |

|

4 |

|

Class B common stock, par value $0.0001 per share; 25,000,000

shares authorized; 6,727,582 and 6,520,638 shares issued and

outstanding, respectively, at September 30, 2024; 7,201,140 and

6,994,196 shares issued and outstanding, respectively, at December

31, 2023 |

1 |

|

1 |

|

Additional paid-in capital |

535,154 |

|

471,789 |

|

Treasury stock, at cost |

(37,113) |

|

(35,113) |

|

Accumulated other comprehensive loss |

6 |

|

(77) |

|

Accumulated deficit |

(339,966) |

|

(292,412) |

|

Total stockholders’ equity |

158,086 |

|

144,192 |

|

Total liabilities and stockholders’ equity |

$ 388,829 |

|

$ 396,585 |

|

Sprout Social, Inc. |

|

Consolidated Statements of Cash Flows

(Unaudited) |

|

(in thousands) |

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

2024 |

|

2023 |

|

Cash flows from operating activities |

|

|

|

|

Net loss |

$ (17,087) |

|

$ (23,013) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities |

|

|

|

|

Depreciation and amortization of property, equipment and

software |

960 |

|

790 |

|

Amortization of line of credit issuance costs |

52 |

|

34 |

|

Amortization of premium (accretion of discount) on marketable

securities |

(58) |

|

(844) |

|

Amortization of acquired intangible assets |

1,553 |

|

1,199 |

|

Amortization of deferred commissions |

4,238 |

|

6,893 |

|

Amortization of right-of-use operating lease asset |

475 |

|

405 |

|

Stock-based compensation expense |

23,186 |

|

19,013 |

|

Provision for accounts receivable allowances |

732 |

|

723 |

|

Tax benefit related to release of valuation allowance |

- |

|

(1,134) |

|

Changes in operating assets and liabilities, excluding impact from

business acquisition |

|

|

|

|

Accounts receivable |

3,521 |

|

(551) |

|

Prepaid expenses and other current assets |

(10) |

|

598 |

|

Deferred commissions |

(7,286) |

|

(9,458) |

|

Accounts payable and accrued expenses |

(1,313) |

|

(2,756) |

|

Deferred revenue |

949 |

|

3,503 |

|

Lease liabilities |

(960) |

|

(920) |

|

Net cash provided by (used in) operating activities |

8,952 |

|

(5,518) |

|

Cash flows from investing activities |

|

|

|

|

Expenditures for property and equipment |

(477) |

|

(800) |

|

Payments for business acquisition, net of cash acquired |

- |

|

(139,347) |

|

Proceeds from maturity of marketable securities |

3,800 |

|

38,712 |

|

Net cash provided by (used in) investing activities |

3,323 |

|

(101,435) |

|

Cash flows from financing activities |

|

|

|

|

Borrowings from line of credit |

- |

|

75,000 |

|

Repayments of line of credit |

(10,000) |

|

- |

|

Payments for line of credit issuance costs |

- |

|

(823) |

|

Proceeds from exercise of stock options |

2 |

|

- |

|

Employee taxes paid related to the net share settlement of

stock-based awards |

(252) |

|

(474) |

|

Net cash (used in) provided by financing activities |

(10,250) |

|

73,703 |

|

Net increase (decrease) in cash, cash equivalents, and restricted

cash |

2,025 |

|

(33,250) |

|

Cash, cash equivalents, and restricted cash |

|

|

|

|

Beginning of period |

84,830 |

|

77,211 |

|

End of period |

$ 86,855 |

|

$ 43,961 |

|

Sprout Social, Inc. |

|

Consolidated Statements of Cash Flows

(Unaudited) |

|

(in thousands) |

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

Cash flows from operating activities |

|

|

|

|

Net loss |

$ (47,554) |

|

$ (46,350) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities |

|

|

|

|

Depreciation and amortization of property, equipment and

software |

2,826 |

|

2,302 |

|

Amortization of line of credit issuance costs |

155 |

|

34 |

|

Amortization of premium (accretion of discount) on marketable

securities |

(383) |

|

(2,733) |

|

Amortization of acquired intangible assets |

4,677 |

|

1,937 |

|

Amortization of deferred commissions |

11,649 |

|

19,064 |

|

Amortization of right-of-use operating lease asset |

1,360 |

|

1,128 |

|

Stock-based compensation expense |

61,850 |

|

49,045 |

|

Provision for accounts receivable allowances |

1,473 |

|

1,583 |

|

Tax benefit related to release of valuation allowance |

- |

|

(1,134) |

|

Changes in operating assets and liabilities, excluding impact from

business acquisition |

|

|

|

|

Accounts receivable |

7,655 |

|

(7,747) |

|

Prepaid expenses and other current assets |

(4,723) |

|

(3,535) |

|

Deferred commissions |

(21,118) |

|

(26,018) |

|

Accounts payable and accrued expenses |

(1,526) |

|

247 |

|

Deferred revenue |

8,755 |

|

23,867 |

|

Lease liabilities |

(2,917) |

|

(2,630) |

|

Net cash provided by operating activities |

22,179 |

|

9,060 |

|

Cash flows from investing activities |

|

|

|

|

Expenditures for property and equipment |

(2,062) |

|

(1,444) |

|

Payments for business acquisition, net of cash acquired |

(1,409) |

|

(145,779) |

|

Purchases of marketable securities |

- |

|

(63,085) |

|

Proceeds from maturity of marketable securities |

40,185 |

|

85,964 |

|

Proceeds from sale of marketable securities |

- |

|

5,538 |

|

Net cash provided by (used in) investing activities |

36,714 |

|

(118,806) |

|

Cash flows from financing activities |

|

|

|

|

Borrowings from line of credit |

- |

|

75,000 |

|

Repayments of line of credit |

(25,000) |

|

- |

|

Payments for line of credit issuance costs |

- |

|

(823) |

|

Proceeds from exercise of stock options |

29 |

|

29 |

|

Proceeds from employee stock purchase plan |

1,238 |

|

1,427 |

|

Employee taxes paid related to the net share settlement of

stock-based awards |

(2,000) |

|

(1,843) |

|

Net cash (used in) provided by financing activities |

(25,733) |

|

73,790 |

|

Net increase (decrease) in cash, cash equivalents, and restricted

cash |

33,160 |

|

(35,956) |

|

Cash, cash equivalents, and restricted cash |

|

|

|

|

Beginning of period |

53,695 |

|

79,917 |

|

End of period |

$ 86,855 |

|

$ 43,961 |

The following schedule reflects our non-GAAP

financial measures and reconciles our non-GAAP financial measures

to the related GAAP financial measures (in thousands, except per

share data):

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Reconciliation of Non-GAAP gross profit |

|

|

|

|

|

|

|

|

Gross profit |

$ 79,406 |

|

$ 65,334 |

|

$ 230,756 |

|

$ 184,752 |

|

Stock-based compensation expense |

1,059 |

|

971 |

|

2,890 |

|

2,329 |

|

Amortization of acquired developed technology |

705 |

|

470 |

|

2,115 |

|

470 |

|

Non-GAAP gross profit |

$ 81,170 |

|

$ 66,775 |

|

$ 235,761 |

|

$ 187,551 |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP operating income

(loss) |

|

|

|

|

|

|

|

Loss from operations |

$ (16,879) |

|

$ (24,204) |

|

$ (46,679) |

|

$ (51,054) |

|

Stock-based compensation expense |

23,186 |

|

19,013 |

|

61,850 |

|

49,045 |

|

Acquisition-related expenses |

- |

|

3,755 |

|

- |

|

4,221 |

|

Amortization of acquired intangible assets |

1,213 |

|

809 |

|

3,639 |

|

809 |

|

Non-GAAP operating income (loss) |

$ 7,520 |

|

$ (627) |

|

$ 18,810 |

|

$ 3,021 |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP net income (loss) |

|

|

|

|

|

|

|

|

Net loss |

$ (17,087) |

|

$ (23,013) |

|

$ (47,554) |

|

$ (46,350) |

|

Stock-based compensation expense |

23,186 |

|

19,013 |

|

61,850 |

|

49,045 |

|

Acquisition-related expenses |

- |

|

3,755 |

|

- |

|

4,221 |

|

Amortization of acquired intangible assets |

1,213 |

|

809 |

|

3,639 |

|

809 |

|

Tax benefit due to change in valuation allowance from business

acquisition |

- |

|

(1,134) |

|

- |

|

(1,134) |

|

Non-GAAP net income (loss) |

$ 7,312 |

|

$ (570) |

|

$ 17,935 |

|

$ 6,591 |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP net income (loss) per

share |

|

|

|

|

|

|

|

Net loss per share attributable to common shareholders, basic and

diluted |

$ (0.30) |

|

$ (0.41) |

|

$ (0.84) |

|

$ (0.83) |

|

Stock-based compensation expense |

0.41 |

|

0.34 |

|

1.10 |

|

0.88 |

|

Acquisition-related expenses |

- |

|

0.07 |

|

- |

|

0.08 |

|

Amortization of acquired intangible assets |

0.02 |

|

0.01 |

|

0.06 |

|

0.01 |

|

Tax benefit due to change in valuation allowance from business

acquisition |

- |

|

(0.02) |

|

- |

|

(0.02) |

|

Non-GAAP net income (loss) per share |

$0.13 |

|

$(0.01) |

|

$ 0.32 |

|

$ 0.12 |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP free cash flow |

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

$ 8,952 |

|

$ (5,518) |

|

$ 22,179 |

|

$ 9,060 |

|

Expenditures for property and equipment |

(477) |

|

(800) |

|

(2,062) |

|

(1,444) |

|

Acquisition-related costs |

- |

|

2,906 |

|

- |

|

2,906 |

|

Interest paid on credit facility |

836 |

|

- |

|

3,014 |

|

- |

|

Non-GAAP free cash flow |

$ 9,311 |

|

$ (3,412) |

|

$ 23,131 |

|

$ 10,522 |

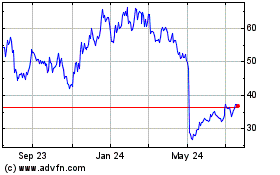

Sprout Social (NASDAQ:SPT)

Historical Stock Chart

From Oct 2024 to Nov 2024

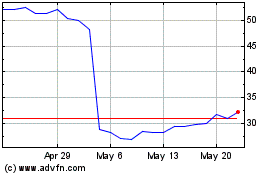

Sprout Social (NASDAQ:SPT)

Historical Stock Chart

From Nov 2023 to Nov 2024