Southern Missouri Bancorp, Inc. (“Company”) (NASDAQ: SMBC), the

parent corporation of Southern Bank (“Bank”), today announced

preliminary net income for the first quarter of fiscal 2022 of

$12.7 million, an increase of $2.8 million, or 27.6%, as compared

to the same period of the prior fiscal year. The increase was

attributable to an increase in net interest income and a negative

provision for credit losses in the current period, as compared to a

charge in the year ago period, partially offset by increases in

noninterest expense and provision for income taxes, and a decrease

in noninterest income. Preliminary net income was $1.43 per fully

diluted common share for the first quarter of fiscal 2022, an

increase of $.34 as compared to the $1.09 per fully diluted common

share reported for the same period of the prior fiscal year.

Highlights for the first

quarter of fiscal

2022:

- Annualized return on average assets was 1.87%, while annualized

return on average common equity was 17.7%, as compared to 1.57% and

15.6%, respectively, in the same quarter a year ago, and 2.01% and

19.8%, respectively, in the fourth quarter of fiscal 2021, the

linked quarter.

- Earnings per common share (diluted) were $1.43, up $.34, or

31.2%, as compared to the same quarter a year ago, and down $.10,

or 6.5%, from the fourth quarter of fiscal 2021, the linked

quarter.

- The Company recorded a negative provision for credit losses

totaling $305,000, consisting of a negative provision for credit

losses (PCL) attributable to its outstanding loan balances of

$679,000, partially offset by a PCL attributable to off-balance

sheet credit exposures of $374,000. In the same quarter a year ago,

PCL attributable to outstanding loan balances totaled $774,000, and

PCL attributable to off-balance sheet credit exposures totaled

$226,000, for a total charge to earnings of $1.0 million.

Nonperforming assets were $8.4 million, or 0.31% of total assets,

at September 30, 2021, as compared to $8.1 million, or 0.30% of

total assets, at June 30, 2021, and $11.3 million, or 0.44% of

total assets, at September 30, 2020.

- Net loans increased $49.2 million during the quarter, despite

balances of SBA Paycheck Protection Program (PPP) loans declining

by $36.6 million. Deposit balances increased by $40.9 million in

the quarter. Certificate of deposit balances continued to decline,

but at a more moderate pace, while nonmaturity balances

increased.

- Net interest margin for the quarter was 4.01%, as compared to

3.73% reported for the year ago period, and 3.74% reported for the

fourth quarter of fiscal 2021, the linked quarter. Net interest

income was increased significantly by accelerated accretion of

deferred origination fees on PPP loans as those loans were repaid

through SBA forgiveness. Discount accretion on acquired loan

portfolios was modestly decreased in the current quarter as

compared to the year ago period, but increased modestly as compared

to the linked period. Average cash balances remained elevated

compared to the year-ago period, but were reduced as compared to

the linked quarter.

- Noninterest income was down 8.6% for the quarter, as compared

to the year ago period, and down 7.0% as compared to the fourth

quarter of fiscal 2021, the linked quarter. Gains on sale of

residential loans originated for sale into the secondary market

were lower than in the year ago and linked quarters, and servicing

income was lower as compared to the year ago and linked quarters on

fewer originations and the inclusion in the linked quarter of

recognition of an improved valuation of mortgage servicing

rights.

- Noninterest expense was up 7.2% for the quarter, as compared to

the year ago period, and up 0.2% from the fourth quarter of fiscal

2021, the linked quarter.

Dividend Declared:

The Board of Directors, on October 19, 2021, declared a

quarterly cash dividend on common stock of $0.20, payable November

30, 2021, to stockholders of record at the close of business on

November 15, 2021, marking the 110th consecutive quarterly dividend

since the inception of the Company. The Board of Directors and

management believe the payment of a quarterly cash dividend

enhances stockholder value and demonstrates our commitment to and

confidence in our future prospects.

Conference Call:

The Company will host a conference call to review the

information provided in this press release on Tuesday, October 26,

2021, at 9:30 a.m., central time. The call will be available live

to interested parties by calling 1-844-200-6205 in the United

States (all other locations: 1-929-526-1599). Participants should

use participant access code 857442. Telephone playback will be

available beginning one hour following the conclusion of the call

through November 8, 2021. The playback may be accessed in the

United States by dialing 1-866-813-9403 (Canada: 1-226-828-7578, UK

local: 0204-525-0658, and all other locations: +44-204-525-0658),

and using the conference passcode 735311.

Balance Sheet Summary:

The Company experienced balance sheet growth in the first three

months of fiscal 2022, with total assets of $2.7 billion at

September 30, 2021, reflecting an increase of $38.0 million, or

1.4%, as compared to June 30, 2021. Growth primarily reflected an

increase in net loans receivable, partially offset by a decrease in

cash and cash equivalents.

Cash equivalents and time deposits were a combined $112.4

million at September 30, 2021, a decrease of $12.2 million, or

9.8%, as compared to June 30, 2021. The decrease was primarily a

result of loan growth outpacing deposit growth during the period.

AFS securities were $209.4 million at September 30, 2021, an

increase of $2.4 million, or 1.2%, as compared to June 30,

2021.

Loans, net of the allowance for credit losses (ACL), were $2.2

billion at September 30, 2021, an increase of $49.2 million, or

2.2%, as compared to June 30, 2021. Gross loans increased by $48.6

million, while the ACL attributable to outstanding loan balances

decreased $679,000, reflecting our negative PCL and no net charge

offs during the period. The increase in loan balances in the

portfolio was primarily attributable to increases in residential

and commercial real estate loans, partially offset by decreases in

construction loan balances and commercial loans. Residential real

estate loans increased due to growth in multifamily and 1- to

4-family residential lending. Commercial loan balances decreased

primarily as a result of forgiveness of PPP loans, but this was

partially offset by increases in agricultural operating lines and

commercial and industrial loans. After declining by $36.6 million

during the period, unpaid PPP loan balances were $26.4 million at

September 30, 2021, while unrecognized deferred fee income on those

loans was approximately $1.3 million. Management expects

forgiveness payments to continue over the next few quarters. Loans

anticipated to fund in the next 90 days totaled $181.1 million at

September 30, 2021, as compared to $141.5 million at June 30, 2021,

and $122.7 million at September 30, 2020.

Nonperforming loans were $6.1 million, or 0.27% of gross loans,

at September 30, 2021, as compared to $5.9 million, or 0.26% of

gross loans at June 30, 2021. Nonperforming assets were $8.4

million, or 0.31% of total assets, at September 30, 2021, as

compared to $8.1 million, or 0.30% of total assets, at June 30,

2021.

Our ACL at September 30, 2021, totaled $32.5 million,

representing 1.43% of gross loans and 530.6% of nonperforming

loans, as compared to an ACL of $33.2 million, representing 1.49%

of gross loans and 566.1% of nonperforming loans at June 30, 2021.

The ACL at September 30, 2021, also represented 1.44% of gross

loans excluding PPP loans. The Company has estimated its credit

losses as of September 30, 2021, under ASC 320-20, and management

believes the allowance for credit losses as of that date is

adequate based on that estimate; however, there remains significant

uncertainty regarding the possible length of time before economic

activity fully recovers from the COVID-19 pandemic, including

uncertainty regarding the effectiveness of recent efforts by the

U.S. government and Federal Reserve to respond to the pandemic and

its economic impact. From late June to early July, public health

authorities in our market area began reporting significant

increases in COVID-19 cases and hospitalizations, although these

have abated since mid to late August. Management considered the

potential impact of the pandemic on its consumer and business

borrowers, particularly those business borrowers most affected by

efforts to contain the pandemic, most notably including our

borrowers in the hotel industry.

Provisions of the CARES Act and subsequent legislation allow

financial institutions the option to temporarily suspend certain

requirements under U.S. GAAP related to troubled debt

restructurings (TDRs) for certain loans that were otherwise current

and performing prior to the COVID-19 pandemic, but for which

borrowers experienced or expected difficulties due to the impact of

the pandemic. Initially, the Company generally granted deferrals

under this program for three-month periods, while interest-only

modifications were generally for six-month periods. Some borrowers

were granted additional periods of deferral or interest-only

modifications. The Company did not account for these loans as TDRs.

As of September 30, 2021, no loans remained on COVID-related

payment deferrals, and four loans with balances of approximately

$23.7 million remained on interest-only payment modifications.

These figures are relatively unchanged since June 30, 2021, and

down significantly from one year prior. For these borrowers whose

payment terms have not returned to the original terms under their

loan agreement, the Company has classified the credit as a “special

mention” status credit. While management considers progress made by

our borrowers in responding to the pandemic to be relatively

strong, and the performance of our loan portfolio to be encouraging

to date, we cannot predict with certainty the difficulties to be

faced in coming months. Should markets where our borrowers operate

experience continued high levels of COVID-19 cases, or a

resurgence, business activity or employee attendance could be

negatively impacted, or borrowers could be required by local

authorities to restrict activity.

Total liabilities were $2.4 billion at September 30, 2021, an

increase of $28.2 million, or 1.2%, as compared to June 30,

2021.

Deposits were $2.4 billion at September 30, 2021, an increase of

$40.9 million, or 1.8%, as compared to June 30, 2021. This increase

primarily reflected an increase in non-interest bearing transaction

accounts, interest-bearing transaction accounts, and savings

accounts, partially offset by a decrease in certificates of

deposit. The increase was net of a $9.6 million decrease in public

unit funds, which totaled $316.8 million at September 30, 2021,

while brokered deposits were unchanged, and included time deposits

of $5.0 million and nonmaturity deposits of $20.1 million.

Customers have held unusually high balances on deposit during the

uncertain environment of recent periods, but the Company expects

that some of the higher-than-normal balances may dissipate over the

course of calendar year 2022. The average loan-to-deposit ratio for

the first quarter of fiscal 2022 was 96.4%, as compared to 99.1%

for the same period of the prior fiscal year.

FHLB advances were $46.5 million at September 30, 2021, a

decrease of $11.0 million, or 19.1%, as compared to June 30, 2021,

as the Company utilized cash to repay maturing term advances.

The Company’s stockholders’ equity was $293.3 million at

September 30, 2021, an increase of $9.8 million, or 3.5%, as

compared to June 30, 2021. The increase was attributable primarily

to earnings retained after cash dividends paid, partially offset by

repurchases of the Company’s common stock. During the first quarter

of fiscal 2022, the Company repurchased 26,607 common shares for

$1.2 million, at an average price of $44.15.

Quarterly Income Statement Summary:

The Company’s net interest income for the three-month period

ended September 30, 2021, was $25.6 million, an increase of $3.6

million, or 16.2%, as compared to the same period of the prior

fiscal year. The increase was attributable to an 8.2% increase in

the average balance of interest-earning assets, combined with an

increase in net interest margin to 4.01% in the current three-month

period, from 3.73% in the same period a year ago. As a material

amount of PPP loans were forgiven, and therefore repaid ahead of

their scheduled maturity, the Company recognized accelerated

accretion of interest income from deferred origination fees on

these loans. In the current quarter, this component of interest

income totaled $2.2 million, adding 34 basis points to the net

interest margin, with no comparable item in the year ago period. In

the linked quarter, ended June 30, 2021, accelerated accretion of

deferred origination fees on PPP loans totaled $1.3 million, adding

20 basis points to the net interest margin. Accretion of deferred

origination fees on these loans will decline in future periods.

Loan discount accretion and deposit premium amortization related

to the Company’s August 2014 acquisition of Peoples Bank of the

Ozarks, the June 2017 acquisition of Capaha Bank, the February 2018

acquisition of Southern Missouri Bank of Marshfield, the Gideon

Acquisition, and the Central Federal Acquisition resulted in

$376,000 in net interest income for the three-month period ended

September 30, 2021, as compared to $339,000 in net interest income

for the same period a year ago. The Company generally expects this

component of net interest income to decline over time, although

volatility may occur to the extent we have periodic resolutions of

specific loans. Combined, this component of net interest income

contributed six basis points to net interest margin in the

three-month period ended September 30, 2021, as compared to a

contribution of six basis points in the same period of the prior

fiscal year, and a seven basis point contribution in the linked

quarter, ended June 30, 2021, when net interest margin was

3.74%.

The Company recorded a negative provision for credit losses of

$305,000 for the three-month period ended September 30, 2021, as

compared to a provision for credit losses of $1.0 million in the

same period of the prior fiscal year. The negative provision in the

current period was due to a $679,000 reduction in the Company’s

required ACL on outstanding loan balances, partially offset by a

$374,000 increase in the Company’s required ACL for off-balance

sheet credit exposure. The Company assesses that the economic

outlook has remained relatively steady as compared to the quarter

ended June 30, 2021, though uncertainty remains as noted in our

discussion of the ACL, above. As a percentage of average loans

outstanding, the negative provision for credit losses in the

current three-month period represented a recovery of 0.05%

(annualized), while the Company recorded no net charge offs during

the period. During the same period of the prior fiscal year, the

provision represented a charge of 0.19% (annualized), while the

Company recorded net charge offs of 0.03% (annualized).

The Company’s noninterest income for the three-month period

ended September 30, 2021, was $4.5 million, a decrease of $426,000,

or 8.6%, as compared to the same period of the prior fiscal year.

In the current period, decreases in gains realized on the sale of

residential real estate loans originated for that purpose and loan

servicing income were partially offset by increases in deposit

account service charges, bank card interchange income, and other

income. Origination of residential real estate loans for sale on

the secondary market was down 69% as compared to the year ago

period, as both refinancing and purchase activity declined,

resulting in a decrease in both gains on sale of these loans and

recognition of new mortgage servicing rights. Approximately

one-fifth of the decline was due to the Company’s decision to

retain for its portfolio some mortgage loans that were fully

underwritten and documented for sale on the secondary market, due

to its liquidity position. Deposit service charges increased

primarily due to an increase in NSF activity as compared to the

year ago period. Bank card interchange income increased due to a

12.3% increase in the number of bank card transactions and a 17.7%

increase in bank card dollar volume, as compared to the same

quarter a year ago. Other income increased as the Company recorded

a $137,000 net gain on the sale of multiple properties acquired as

bank facilities via acquisition, but no longer utilized for that

purpose.

Noninterest expense for the three-month period ended September

30, 2021, was $14.2 million, an increase of $1.0 million, or 7.2%,

as compared to the same period of the prior fiscal year. The

increase was attributable primarily to compensation and benefits,

occupancy expenses, data processing charges, and advertising. The

increase in compensation and benefits as compared to the prior year

period primarily reflected standard increases in compensation and

benefits over the prior year. Occupancy expenses increased due in

part to remodeled or relocated facilities, an additional location,

new ATM and ITM installations, and other equipment purchases. The

increase in data processing charges reflects a change from a

below-trend expense level in the year-ago period due to timing

differences. The increase in advertising expense reflects a return

to planned levels of expenditures following reduced activity in the

year-ago period. The efficiency ratio for the three-month period

ended September 30, 2021, was 47.2%, as compared to 49.1% in the

same period of the prior fiscal year, with the improvement

attributable primarily to the current period’s increases in net

interest income, while the increase in noninterest expenses was

relatively contained.

The income tax provision for the three-month period ended

September 30, 2021, was $3.5 million, an increase of $741,000, or

27.0% as compared to the same period of the prior fiscal year. This

was a result of higher pre-tax income, while the effective tax rate

was little changed at 21.5%, as compared to 21.6% in the same

period a year ago.

Forward-Looking Information:

Except for the historical information contained herein, the

matters discussed in this press release may be deemed to be

forward-looking statements that are subject to known and unknown

risks, uncertainties, and other factors that could cause the actual

results to differ materially from the forward-looking statements,

including: potential adverse impacts to the economic conditions in

the Company’s local market areas, other markets where the Company

has lending relationships, or other aspects of the Company’s

business operations or financial markets, generally, resulting from

the ongoing COVID-19 pandemic and any governmental or societal

responses thereto; expected cost savings, synergies and other

benefits from our merger and acquisition activities might not be

realized to the extent anticipated, within the anticipated time

frames, or at all, and costs or difficulties relating to

integration matters, including but not limited to customer and

employee retention, might be greater than expected; the strength of

the United States economy in general and the strength of the local

economies in which we conduct operations; fluctuations in interest

rates and in real estate values; monetary and fiscal policies of

the FRB and the U.S. Government and other governmental initiatives

affecting the financial services industry; the risks of lending and

investing activities, including changes in the level and direction

of loan delinquencies and write-offs and changes in estimates of

the adequacy of the allowance for credit losses; our ability to

access cost-effective funding; the timely development of and

acceptance of our new products and services and the perceived

overall value of these products and services by users, including

the features, pricing and quality compared to competitors' products

and services; fluctuations in real estate values and both

residential and commercial real estate markets, as well as

agricultural business conditions; demand for loans and deposits;

legislative or regulatory changes that adversely affect our

business; changes in accounting principles, policies, or

guidelines; results of regulatory examinations, including the

possibility that a regulator may, among other things, require an

increase in our reserve for loan losses or write-down of assets;

the impact of technological changes; and our success at managing

the risks involved in the foregoing. Any forward-looking statements

are based upon management’s beliefs and assumptions at the time

they are made. We undertake no obligation to publicly update or

revise any forward-looking statements or to update the reasons why

actual results could differ from those contained in such

statements, whether as a result of new information, future events

or otherwise. In light of these risks, uncertainties and

assumptions, the forward-looking statements discussed might not

occur, and you should not put undue reliance on any forward-looking

statements.

Southern Missouri Bancorp,

Inc.UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary Balance Sheet

Data as of: |

|

Sep. 30, |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

|

(dollars in thousands, except per share data) |

|

2021 |

|

2021 |

|

2021 |

|

2020 |

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash equivalents and time

deposits |

|

$ |

112,382 |

|

$ |

124,571 |

|

$ |

237,873 |

|

$ |

150,496 |

|

$ |

42,850 |

|

| Available for sale (AFS)

securities |

|

|

209,409 |

|

|

207,020 |

|

|

190,409 |

|

|

181,146 |

|

|

175,528 |

|

| FHLB/FRB membership stock |

|

|

10,456 |

|

|

10,904 |

|

|

11,181 |

|

|

11,004 |

|

|

11,956 |

|

| Loans receivable, gross |

|

|

2,282,021 |

|

|

2,233,466 |

|

|

2,170,112 |

|

|

2,156,870 |

|

|

2,185,547 |

|

|

Allowance for credit losses |

|

|

32,543 |

|

|

33,222 |

|

|

35,227 |

|

|

35,471 |

|

|

35,084 |

|

| Loans receivable, net |

|

|

2,249,478 |

|

|

2,200,244 |

|

|

2,134,885 |

|

|

2,121,399 |

|

|

2,150,463 |

|

| Bank-owned life insurance |

|

|

44,099 |

|

|

43,817 |

|

|

43,539 |

|

|

43,268 |

|

|

43,644 |

|

| Intangible assets |

|

|

20,868 |

|

|

21,218 |

|

|

21,168 |

|

|

21,453 |

|

|

21,582 |

|

| Premises and equipment |

|

|

65,253 |

|

|

64,077 |

|

|

63,908 |

|

|

63,970 |

|

|

64,430 |

|

| Other assets |

|

|

26,596 |

|

|

28,679 |

|

|

29,094 |

|

|

30,262 |

|

|

30,281 |

|

|

Total assets |

|

$ |

2,738,541 |

|

$ |

2,700,530 |

|

$ |

2,732,057 |

|

$ |

2,622,998 |

|

$ |

2,540,734 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

1,985,316 |

|

$ |

1,972,384 |

|

$ |

1,981,345 |

|

$ |

1,927,351 |

|

$ |

1,861,051 |

|

| Noninterest-bearing

deposits |

|

|

386,379 |

|

|

358,419 |

|

|

387,416 |

|

|

337,736 |

|

|

307,023 |

|

| FHLB advances |

|

|

46,522 |

|

|

57,529 |

|

|

62,781 |

|

|

63,286 |

|

|

85,637 |

|

| Other liabilities |

|

|

11,796 |

|

|

13,532 |

|

|

12,358 |

|

|

11,743 |

|

|

11,880 |

|

| Subordinated debt |

|

|

15,268 |

|

|

15,243 |

|

|

15,218 |

|

|

15,193 |

|

|

15,168 |

|

|

Total liabilities |

|

|

2,445,281 |

|

|

2,417,107 |

|

|

2,459,118 |

|

|

2,355,309 |

|

|

2,280,759 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

293,260 |

|

|

283,423 |

|

|

272,939 |

|

|

267,689 |

|

|

259,975 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,738,541 |

|

$ |

2,700,530 |

|

$ |

2,732,057 |

|

$ |

2,622,998 |

|

$ |

2,540,734 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity to assets ratio |

|

|

10.71 |

% |

|

10.50 |

% |

|

9.99 |

% |

|

10.21 |

% |

|

10.23 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding |

|

|

8,878,591 |

|

|

8,905,265 |

|

|

8,959,296 |

|

|

9,035,232 |

|

|

9,126,625 |

|

|

Less: Restricted common shares not vested |

|

|

31,845 |

|

|

31,845 |

|

|

31,845 |

|

|

25,410 |

|

|

27,260 |

|

| Common shares for book value

determination |

|

|

8,846,746 |

|

|

8,873,420 |

|

|

8,927,451 |

|

|

9,009,822 |

|

|

9,099,365 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per common

share |

|

$ |

33.15 |

|

$ |

31.94 |

|

$ |

30.57 |

|

$ |

29.71 |

|

$ |

28.57 |

|

| Closing market price |

|

|

44.89 |

|

|

44.96 |

|

|

39.42 |

|

|

30.44 |

|

|

23.58 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming asset

data as of: |

|

Sep. 30, |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

|

(dollars in thousands) |

|

2021 |

|

2021 |

|

2021 |

|

2020 |

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonaccrual loans |

|

$ |

6,133 |

|

$ |

5,869 |

|

$ |

6,757 |

|

$ |

8,330 |

|

$ |

8,775 |

|

| Accruing loans 90 days or more

past due |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Total nonperforming loans |

|

|

6,133 |

|

|

5,869 |

|

|

6,757 |

|

|

8,330 |

|

|

8,775 |

|

| Other real estate owned

(OREO) |

|

|

2,240 |

|

|

2,227 |

|

|

2,651 |

|

|

2,707 |

|

|

2,466 |

|

| Personal property

repossessed |

|

|

8 |

|

|

23 |

|

|

— |

|

|

44 |

|

|

9 |

|

|

Total nonperforming assets |

|

$ |

8,381 |

|

$ |

8,119 |

|

$ |

9,408 |

|

$ |

11,081 |

|

$ |

11,250 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total nonperforming assets to

total assets |

|

|

0.31 |

% |

|

0.30 |

% |

|

0.34 |

% |

|

0.42 |

% |

|

0.44 |

% |

| Total nonperforming loans to

gross loans |

|

|

0.27 |

% |

|

0.26 |

% |

|

0.31 |

% |

|

0.39 |

% |

|

0.40 |

% |

| Allowance for loan losses to

nonperforming loans |

|

|

530.62 |

% |

|

566.06 |

% |

|

521.34 |

% |

|

425.82 |

% |

|

399.82 |

% |

| Allowance for loan losses to

gross loans |

|

|

1.43 |

% |

|

1.49 |

% |

|

1.62 |

% |

|

1.64 |

% |

|

1.61 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performing troubled debt

restructurings (1) |

|

$ |

3,585 |

|

$ |

3,241 |

|

$ |

7,092 |

|

$ |

7,897 |

|

$ |

7,923 |

|

(1) Nonperforming troubled debt restructurings

are included with nonaccrual loans or accruing loans 90 days or

more past due.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three-month period ended |

| Quarterly Summary

Income Statement Data: |

|

Sep. 30, |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

| (dollars in thousands, except

per share data) |

|

2021 |

|

2021 |

|

2021 |

|

2020 |

|

2020 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents |

|

$ |

60 |

|

|

$ |

67 |

|

|

$ |

70 |

|

|

$ |

48 |

|

$ |

41 |

|

AFS securities and membership stock |

|

|

1,106 |

|

|

|

1,126 |

|

|

|

1,025 |

|

|

|

997 |

|

|

1,024 |

|

Loans receivable |

|

|

27,694 |

|

|

|

26,339 |

|

|

|

26,005 |

|

|

|

26,826 |

|

|

25,907 |

|

Total interest income |

|

|

28,860 |

|

|

|

27,532 |

|

|

|

27,100 |

|

|

|

27,871 |

|

|

26,972 |

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

2,816 |

|

|

|

3,141 |

|

|

|

3,494 |

|

|

|

3,863 |

|

|

4,390 |

|

FHLB advances |

|

|

276 |

|

|

|

314 |

|

|

|

325 |

|

|

|

347 |

|

|

380 |

|

Subordinated debt |

|

|

130 |

|

|

|

131 |

|

|

|

132 |

|

|

|

134 |

|

|

138 |

|

Total interest expense |

|

|

3,222 |

|

|

|

3,586 |

|

|

|

3,951 |

|

|

|

4,344 |

|

|

4,908 |

| Net interest income |

|

|

25,638 |

|

|

|

23,946 |

|

|

|

23,149 |

|

|

|

23,527 |

|

|

22,064 |

| Provision for credit

losses |

|

|

(305 |

) |

|

|

(2,615 |

) |

|

|

(409 |

) |

|

|

1,000 |

|

|

1,000 |

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposit account charges and related fees |

|

|

1,561 |

|

|

|

1,279 |

|

|

|

1,275 |

|

|

|

1,360 |

|

|

1,339 |

|

Bank card interchange income |

|

|

951 |

|

|

|

1,243 |

|

|

|

1,004 |

|

|

|

836 |

|

|

830 |

|

Loan late charges |

|

|

107 |

|

|

|

189 |

|

|

|

118 |

|

|

|

138 |

|

|

141 |

|

Loan servicing fees |

|

|

154 |

|

|

|

559 |

|

|

|

217 |

|

|

|

368 |

|

|

310 |

|

Other loan fees |

|

|

451 |

|

|

|

302 |

|

|

|

266 |

|

|

|

305 |

|

|

327 |

|

Net realized gains on sale of loans |

|

|

369 |

|

|

|

531 |

|

|

|

853 |

|

|

|

1,390 |

|

|

1,206 |

|

Net realized gains on AFS securities |

|

|

— |

|

|

|

— |

|

|

|

90 |

|

|

|

— |

|

|

— |

|

Earnings on bank owned life insurance |

|

|

281 |

|

|

|

277 |

|

|

|

270 |

|

|

|

974 |

|

|

280 |

|

Other noninterest income |

|

|

641 |

|

|

|

477 |

|

|

|

431 |

|

|

|

349 |

|

|

508 |

|

Total noninterest income |

|

|

4,515 |

|

|

|

4,857 |

|

|

|

4,524 |

|

|

|

5,720 |

|

|

4,941 |

| Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

8,199 |

|

|

|

8,007 |

|

|

|

7,739 |

|

|

|

7,545 |

|

|

7,720 |

|

Occupancy and equipment, net |

|

|

2,113 |

|

|

|

2,053 |

|

|

|

1,990 |

|

|

|

1,866 |

|

|

1,970 |

|

Data processing expense |

|

|

1,269 |

|

|

|

1,322 |

|

|

|

1,253 |

|

|

|

1,175 |

|

|

1,062 |

|

Telecommunications expense |

|

|

320 |

|

|

|

321 |

|

|

|

317 |

|

|

|

308 |

|

|

315 |

|

Deposit insurance premiums |

|

|

178 |

|

|

|

173 |

|

|

|

174 |

|

|

|

218 |

|

|

201 |

|

Legal and professional fees |

|

|

234 |

|

|

|

403 |

|

|

|

256 |

|

|

|

236 |

|

|

198 |

|

Advertising |

|

|

329 |

|

|

|

391 |

|

|

|

240 |

|

|

|

219 |

|

|

230 |

|

Postage and office supplies |

|

|

195 |

|

|

|

211 |

|

|

|

198 |

|

|

|

195 |

|

|

193 |

|

Intangible amortization |

|

|

338 |

|

|

|

338 |

|

|

|

338 |

|

|

|

338 |

|

|

380 |

|

Foreclosed property expenses |

|

|

31 |

|

|

|

6 |

|

|

|

48 |

|

|

|

38 |

|

|

50 |

|

Other noninterest expense |

|

|

1,018 |

|

|

|

975 |

|

|

|

975 |

|

|

|

908 |

|

|

953 |

|

Total noninterest expense |

|

|

14,224 |

|

|

|

14,200 |

|

|

|

13,528 |

|

|

|

13,046 |

|

|

13,272 |

|

Net income before income taxes |

|

|

16,234 |

|

|

|

17,218 |

|

|

|

14,554 |

|

|

|

15,201 |

|

|

12,733 |

| Income taxes |

|

|

3,488 |

|

|

|

3,529 |

|

|

|

3,096 |

|

|

|

3,153 |

|

|

2,747 |

|

Net income |

|

|

12,746 |

|

|

|

13,689 |

|

|

|

11,458 |

|

|

|

12,048 |

|

|

9,986 |

| Less: Distributed and

undistributed earnings allocated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to participating securities |

|

|

46 |

|

|

|

49 |

|

|

|

41 |

|

|

|

34 |

|

|

30 |

|

Net income available to common shareholders |

|

$ |

12,700 |

|

|

$ |

13,640 |

|

|

$ |

11,417 |

|

|

$ |

12,014 |

|

$ |

9,956 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common

share |

|

$ |

1.43 |

|

|

$ |

1.53 |

|

|

$ |

1.27 |

|

|

$ |

1.33 |

|

$ |

1.09 |

| Diluted earnings per common

share |

|

|

1.43 |

|

|

|

1.53 |

|

|

|

1.27 |

|

|

|

1.32 |

|

|

1.09 |

| Dividends per common

share |

|

|

0.20 |

|

|

|

0.16 |

|

|

|

0.16 |

|

|

|

0.15 |

|

|

0.15 |

| Average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

8,867,000 |

|

|

|

8,895,000 |

|

|

|

8,972,000 |

|

|

|

9,064,000 |

|

|

9,100,000 |

|

Diluted |

|

|

8,874,000 |

|

|

|

8,902,000 |

|

|

|

8,976,000 |

|

|

|

9,067,000 |

|

|

9,102,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three-month period ended |

|

| Quarterly Average

Balance Sheet Data: |

|

Sep. 30, |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

|

(dollars in thousands) |

|

2021 |

|

2021 |

|

2021 |

|

2020 |

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing cash

equivalents |

|

$ |

83,697 |

|

$ |

158,108 |

|

$ |

171,403 |

|

$ |

40,915 |

|

$ |

19,768 |

|

| AFS securities and membership

stock |

|

|

212,564 |

|

|

206,203 |

|

|

197,984 |

|

|

184,828 |

|

|

181,535 |

|

| Loans receivable, gross |

|

|

2,262,095 |

|

|

2,193,522 |

|

|

2,146,364 |

|

|

2,177,989 |

|

|

2,162,125 |

|

|

Total interest-earning assets |

|

|

2,558,356 |

|

|

2,557,833 |

|

|

2,515,751 |

|

|

2,403,732 |

|

|

2,363,428 |

|

| Other assets |

|

|

171,505 |

|

|

166,312 |

|

|

170,475 |

|

|

170,158 |

|

|

174,574 |

|

|

Total assets |

|

$ |

2,729,861 |

|

$ |

2,724,145 |

|

$ |

2,686,226 |

|

$ |

2,573,890 |

|

$ |

2,538,002 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

1,986,023 |

|

$ |

1,985,118 |

|

$ |

1,965,191 |

|

$ |

1,886,883 |

|

$ |

1,865,636 |

|

| FHLB advances |

|

|

54,701 |

|

|

60,252 |

|

|

63,068 |

|

|

69,991 |

|

|

70,272 |

|

| Subordinated debt |

|

|

15,256 |

|

|

15,230 |

|

|

15,205 |

|

|

15,180 |

|

|

15,155 |

|

|

Total interest-bearing liabilities |

|

|

2,055,980 |

|

|

2,060,600 |

|

|

2,043,464 |

|

|

1,972,054 |

|

|

1,951,063 |

|

| Noninterest-bearing

deposits |

|

|

359,717 |

|

|

374,744 |

|

|

357,746 |

|

|

325,091 |

|

|

316,996 |

|

| Other noninterest-bearing

liabilities |

|

|

25,593 |

|

|

11,585 |

|

|

14,563 |

|

|

13,021 |

|

|

14,673 |

|

|

Total liabilities |

|

|

2,441,290 |

|

|

2,446,929 |

|

|

2,415,773 |

|

|

2,310,166 |

|

|

2,282,732 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

288,571 |

|

|

277,216 |

|

|

270,453 |

|

|

263,724 |

|

|

255,270 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,729,861 |

|

$ |

2,724,145 |

|

$ |

2,686,226 |

|

$ |

2,573,890 |

|

$ |

2,538,002 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

1.87 |

% |

|

2.01 |

% |

|

1.71 |

% |

|

1.87 |

% |

|

1.57 |

% |

| Return on average common

stockholders’ equity |

|

|

17.7 |

% |

|

19.8 |

% |

|

16.9 |

% |

|

18.3 |

% |

|

15.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

4.01 |

% |

|

3.74 |

% |

|

3.68 |

% |

|

3.92 |

% |

|

3.73 |

% |

| Net interest spread |

|

|

3.88 |

% |

|

3.61 |

% |

|

3.54 |

% |

|

3.76 |

% |

|

3.55 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio |

|

|

47.2 |

% |

|

49.3 |

% |

|

48.9 |

% |

|

44.6 |

% |

|

49.1 |

% |

Matt Funke, CFO

573-778-1800

mfunke@bankwithsouthern.com

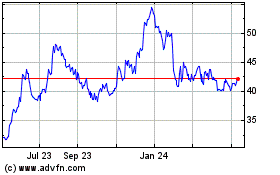

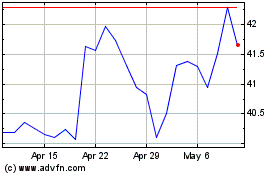

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Nov 2023 to Nov 2024