0001844862

false

0001844862

2023-08-08

2023-08-08

0001844862

us-gaap:CommonStockMember

2023-08-08

2023-08-08

0001844862

us-gaap:WarrantMember

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 8, 2023

Solid

Power, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-40284 |

|

86-1888095 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

486

S. Pierce Avenue, Suite E

Louisville, Colorado |

|

80027 |

| (Address of principal executive offices) |

|

(Zip code) |

(303) 219-0720

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, par value $0.0001 per share |

|

SLDP |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 |

|

SLDPW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§ 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 8, 2023,

Solid Power, Inc. (the “Company”) issued a press release announcing its financial and operational results for

the second quarter ended June 30, 2023. A copy of the press release is furnished with this report as Exhibit 99.1.

Such exhibit and the information

set forth therein will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 |

Financial Statements and Exhibits. |

See the Exhibit index below, which is incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: August 8, 2023

| |

SOLID POWER, INC. |

| |

|

|

| |

By: |

/s/ James Liebscher |

| |

|

Name: James Liebscher |

| |

|

Title: Chief Legal Officer and Secretary |

Exhibit 99.1

SECOND QUARTER 2023 RESULTS REFLECT CONTINUED

STRONG EXECUTION

| - | Business, operational and financial update call scheduled for 5:00 p.m. ET today |

LOUISVILLE,

Colo., August 8, 2023 – Solid Power, Inc. (Nasdaq: SLDP), a leading developer of solid-state battery

technology, today announced its financial results for the second quarter ended June 30, 2023.

Recent

Business Highlights

| · | SP2 commenced electrolyte powder production in April and is meeting internal performance and quality

targets. |

| · | Electrolyte sampling yielded positive feedback from industry leaders. |

| · | Began large-scale production of EV cells, keeping the company on track for 2023 delivery of A-sample EV

cells to partners. |

| · | Appointed John Van Scoter as President and Chief Executive Officer. |

“Solid Power has made tremendous progress furthering its technology

and operational capabilities this year,” said John Van Scoter, President and Chief Executive Officer of Solid Power. “During

the year to date, we continued to execute on our joint development agreements and further extended our agreement with Ford. With respect

to electrolyte, the team completed the build-out of our electrolyte production line, started and began scaling up production, and is producing

electrolyte that meets our internal performance and quality metrics. Most importantly, we are receiving positive feedback from industry

leaders and believe there may be an opportunity to accelerate our timeline for future electrolyte sales.”

“On the cell development side, the team has significantly improved

20 Ah cell yields and recently began scaling EV cell production. We expect to deliver EV cells to BMW for testing in their demo car program

over the coming quarters. We look forward to seeing our technology demonstrated in a full-sized BMW demo vehicle. Our operational focus

now shifts to optimizing production processes, improving cell performance, and delivering EV cells to our partners,” Van Scoter

said.

“Having spoken with our key stakeholders, I believe Solid

Power has opportunities to further build upon its leadership position,” Van Scoter continued. “As CEO, I have identified

near-term priorities to expand our geographic reach, mature our supply chain capabilities and elevate our investor communications as we

execute towards commercialization. I firmly believe that Solid Power’s capital light business model and leading-edge technologies

position the company to be a leader in transformative battery technologies and deliver long-term value for our partners, employees, and

shareholders.”

Second Quarter 2023 Financial

Highlights

Second quarter

2023 revenue was $4.9 million, an increase of $2.3 million compared to the second quarter of 2022, as a result of continued execution

under the company’s joint development agreements. First half 2023 revenue was $8.7 million, up $3.9 million from the first half

of 2022.

As expected,

operating expenses were higher in the second quarter and first half of 2023 compared with the same periods in 2022. This increase was

driven by accelerated investments in product development and the scaling of operations. Second quarter 2023 operating loss was $22.2 million

and net loss was $12.2 million, or $0.07 per share.

Balance Sheet and Liquidity

Solid Power’s

liquidity position remained strong, with June 30, 2023 total liquidity totaling $443.4 million, as shown below.

| ($ in thousands) | |

June 30, 2023 | | |

December 31, 2022 | |

| Cash and cash equivalents | |

$ | 28,439 | | |

$ | 50,123 | |

| Marketable securities | |

| 192,694 | | |

| 272,957 | |

| Long-term investments | |

| 222,255 | | |

| 172,974 | |

| Total liquidity | |

$ | 443,388 | | |

$ | 496,054 | |

The Company’s cash, cash equivalents and

investments are held at leading global banks and are invested in grade A corporate and government securities with an average maturity

of 15 months.

Second quarter

and first half 2023 capital expenditures totaled $9.6 million and $21.2 million, respectively, primarily representing investments in the

Company’s new electrolyte production facility.

2023 Outlook

Solid Power’s

2023 outlook and goals remained unchanged. Through the date of this release, the following milestones have been completed:

| · | Initiated production from Solid Power’s SP2 electrolyte production

facility. |

| · | Began delivering electrolyte to potential customers for sampling

and feedback, which is ongoing. |

Solid Power

remains committed to delivering on the following key objectives:

| · | Scaling electrolyte production from SP2. |

| · | Delivering EV cells to our joint development partners and entering

the automotive qualification process. |

| · | Continuing to improve key cell performance metrics, including energy

density, pressure, cycle life, low temperature operations and safety. |

As Solid

Power executes on its milestones, the Company continues to expect that in 2023, cash used in operations will be between $70 million and

$80 million and capital expenditures will range from $50 million to $60 million. Total cash investment is expected to range between $120

million and $140 million.

2023 revenue

is expected to be in the range of $15 million to $20 million.

Webcast and Conference Call

Solid Power will host a conference call at 3:00

p.m. MT (5:00 p.m. ET) today, August 8, 2023. Participating on the call will be David Jansen, Chairperson of the Board,

John Van Scoter, President and Chief Executive Officer, and Kevin Paprzycki, Chief Financial Officer.

Interested investors and other parties can listen

to a webcast of the live conference call through Solid Power’s Investor Relations website at ir.solidpowerbattery.com.

The conference call can be accessed live over

the phone by dialing +1-844-826-3035 (domestic) or +1-412-317-5195 (international).

A recording of the conference call will be available

approximately three hours after the completion of the call at ir.solidpowerbattery.com or by dialing +1-844-512-2921 (domestic)

or +1-412-317-6671 (international). The pin number for the replay is 10180212. The replay will be available until 9:59 p.m. MT (11:59

p.m. ET) on August 22, 2023.

About Solid Power, Inc.

Solid Power is developing

solid-state battery technology to enable the next generation of batteries for the fast-growing EV and other markets. Solid Power’s

core technology is its electrolyte material, which Solid Power believes can enable extended driving range, longer battery life, improved

safety, and lower cost compared to traditional lithium-ion. Solid Power’s business model – selling its electrolyte to cell

manufacturers and licensing its cell designs and manufacturing processes – distinguishes the company from many of its competitors

who plan to be commercial battery manufacturers. Ultimately, Solid Power endeavors to be a leading producer and distributor of sulfide-based

solid electrolyte material for powering both EVs and other applications. For more information, visit http://www.solidpowerbattery.com/.

Forward Looking Statements

All statements other

than statements of present or historical fact contained herein are “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including Solid Power’s

or its management team’s expectations, objectives, beliefs, intentions or strategies regarding the future. When used herein, the

words “could,” “should,” “will,” “may,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” “plan,” “outlook,”

“seek,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although

not all forward-looking statements contain such identifying words. These statements include our financial guidance for 2023, future financial

performance and our strategy, expansion plans, market opportunity, future operations, future operating results, estimated revenues, losses,

projected costs, prospects, and plans and objectives of management. These forward-looking statements are based on management’s current

expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future

events. Except as otherwise required by applicable law, Solid Power disclaims any duty to update any forward-looking statements, all of

which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Readers are

cautioned not to put undue reliance on forward-looking statements and Solid Power cautions you that these forward-looking statements are

subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Solid

Power, including the following factors: (i) risks relating to the uncertainty of the success of our research and development efforts,

including our ability to achieve the technological objectives or results that our partners require, and to commercialize our technology

in advance of competing technologies; (ii) risks relating to the non-exclusive nature of our original equipment manufacturers and

joint development agreement relationships; (iii) our ability to negotiate and execute supply agreements with our partners on commercially

reasonable terms; (iv) rollout of our business plan and the timing of expected business milestones; (v) delays in the construction

and operation of production facilities; (vi) our ability to protect our intellectual property, including in jurisdictions outside

of the United States; (vii) broad market adoption of EVs and other technologies where we are able to deploy our cell technology and

electrolyte material, if developed successfully; (viii) our success in retaining or recruiting, or changes required in, our officers,

key employees, including technicians and engineers, or directors; (ix) risks and potential disruptions related to management and

board of directors transitions; (x) changes in applicable laws or regulations; (xi) risks related to technology systems and

security breaches; (xii) the possibility that we may be adversely affected by other economic, business or competitive factors, including

supply chain interruptions, and may not be able to manage other risks and uncertainties; (xiii) risks relating to our status as a

research and development stage company with a history of financial losses, and an expectation to incur significant expenses and continuing

losses for the foreseeable future; (xiv) the termination or reduction of government clean energy and electric vehicle incentives;

and (xv) changes in domestic and foreign business, market, financial, political and legal conditions. Additional information concerning

these and other factors that may impact the operations and projections discussed herein can be found in the “Risk Factors”

sections of Solid Power’s Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q

for the quarter ended March 31, 2023 and other documents filed by Solid Power from time to time with the SEC, all of which are available

on the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained in the forward-looking statements. Solid Power gives no assurance

that it will achieve its expectations.

Contact Information

Kevin Paprzycki

Chief Financial Officer

1 (800) 799-7380

investors@solidpowerbattery.com

Website:

www.solidpowerbattery.com

Solid Power, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except par value and

number of shares)

| | |

As of | |

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 28,439 | | |

$ | 50,123 | |

| Marketable securities | |

| 192,694 | | |

| 272,957 | |

| Contract receivables | |

| 5,224 | | |

| 1,840 | |

| Prepaid expenses and other current assets | |

| 3,494 | | |

| 2,888 | |

| Total current assets | |

| 229,851 | | |

| 327,808 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 95,076 | | |

| 82,761 | |

| Right-of-use operating lease asset, net | |

| 7,444 | | |

| 7,725 | |

| Right-of-use financing lease asset, net | |

| 938 | | |

| 922 | |

| Other assets | |

| 1,087 | | |

| 1,148 | |

| Long-term investments | |

| 222,255 | | |

| 172,974 | |

| Intangible assets, net | |

| 1,360 | | |

| 1,108 | |

| | |

| | | |

| | |

| Total assets | |

$ | 558,011 | | |

$ | 594,446 | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and other accrued liabilities | |

$ | 8,065 | | |

$ | 11,326 | |

| Current portion of long-term debt | |

| - | | |

| 7 | |

| Deferred revenue | |

| 18 | | |

| 4,050 | |

| Accrued compensation | |

| 4,080 | | |

| 4,528 | |

| Operating lease liabilities, short-term | |

| 586 | | |

| 549 | |

| Financing lease liability, short-term | |

| 308 | | |

| 273 | |

| Total current liabilities | |

| 13,057 | | |

| 20,733 | |

| | |

| | | |

| | |

| Warrant liabilities | |

| 6,791 | | |

| 9,117 | |

| Operating lease liabilities, long-term | |

| 8,317 | | |

| 8,622 | |

| Financing lease liabilities, long-term | |

| 535 | | |

| 602 | |

| | |

| | | |

| | |

| Total liabilities | |

$ | 28,700 | | |

$ | 39,074 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common Stock, $0.0001 par value; 2,000,000,000 shares authorized; 178,326,890 and 176,007,184 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| 18 | | |

| 18 | |

| Additional paid-in capital | |

| 583,034 | | |

| 577,603 | |

| Accumulated deficit | |

| (50,369 | ) | |

| (19,090 | ) |

| Accumulated other comprehensive loss | |

| (3,372 | ) | |

| (3,159 | ) |

| | |

| | | |

| | |

| Total stockholders' equity | |

| 529,311 | | |

| 555,372 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 558,011 | | |

$ | 594,446 | |

Solid Power, Inc.

Condensed Consolidated Statements

of Operations (Unaudited)

(in thousands, except number of shares

and per-share amounts)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue | |

$ | 4,906 | | |

$ | 2,582 | | |

$ | 8,698 | | |

$ | 4,778 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Direct costs | |

| 6,897 | | |

| 2,987 | | |

| 13,171 | | |

| 5,017 | |

| Research and development | |

| 14,508 | | |

| 8,440 | | |

| 26,156 | | |

| 15,101 | |

| Selling, general and administrative | |

| 5,673 | | |

| 5,851 | | |

| 12,862 | | |

| 10,670 | |

| Total operating expenses | |

| 27,078 | | |

| 17,278 | | |

| 52,189 | | |

| 30,788 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (22,172 | ) | |

| (14,696 | ) | |

| (43,491 | ) | |

| (26,010 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Nonoperating income and expense | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 4,993 | | |

| 931 | | |

| 9,827 | | |

| 1,171 | |

| Change in fair value of warrant liabilities | |

| 4,987 | | |

| 27,473 | | |

| 2,325 | | |

| 28,183 | |

| Interest expense | |

| (13 | ) | |

| (5 | ) | |

| (26 | ) | |

| (10 | ) |

| Total

nonoperating income and expense | |

| 9,967 | | |

| 28,399 | | |

| 12,126 | | |

| 29,344 | |

| | |

| | | |

| | | |

| | | |

| | |

| Pretax income (loss) | |

| (12,205 | ) | |

| 13,703 | | |

| (31,365 | ) | |

| 3,334 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit | |

| - | | |

| 36 | | |

| - | | |

| 13 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

$ | (12,205 | ) | |

$ | 13,667 | | |

$ | (31,365 | ) | |

$ | 3,321 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted earnings (loss) per

share | |

$ | (0.07 | ) | |

$ | 0.08 | | |

$ | (0.18 | ) | |

$ | 0.02 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding - basic | |

| 178,063,573 | | |

| 174,128,230 | | |

| 177,502,037 | | |

| 173,266,760 | |

| Weighted average shares outstanding - diluted | |

| 178,063,573 | | |

| 174,703,533 | | |

| 177,502,037 | | |

| 173,566,001 | |

Solid Power, Inc.

Condensed Consolidated Statements

of Cash Flows (Unaudited)

(In thousands)

| | |

For the Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities | |

| | | |

| | |

| Net income (loss) | |

$ | (31,365 | ) | |

$ | 3,321 | |

| Adjustments to reconcile net income (loss) to net cash and cash equivalents from operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 4,906 | | |

| 1,782 | |

| Amortization of right-of-use assets | |

| 372 | | |

| 16 | |

| Stock compensation expense | |

| 5,145 | | |

| 3,910 | |

| Deferred taxes | |

| - | | |

| 13 | |

| Change in fair value of warrant liabilities | |

| (2,325 | ) | |

| (28,183 | ) |

| Amortization of premiums and accretion of discounts on marketable securities | |

| (5,518 | ) | |

| - | |

| Change in operating assets and liabilities that provided (used) cash and cash equivalents: | |

| | | |

| | |

| Contract receivable | |

| (3,383 | ) | |

| (1,202 | ) |

| Prepaid expenses and other assets | |

| (188 | ) | |

| 744 | |

| Accounts payable and other accrued liabilities | |

| (297 | ) | |

| (4,261 | ) |

| Deferred revenue | |

| (4,032 | ) | |

| (286 | ) |

| Accrued expenses | |

| 649 | | |

| 1,000 | |

| Lease liabilities | |

| (268 | ) | |

| 188 | |

| Net cash and cash equivalents used in operating activities | |

| (36,304 | ) | |

| (22,958 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| (21,184 | ) | |

| (30,957 | ) |

| Purchases of marketable securities and long-term investments | |

| (174,400 | ) | |

| (212,792 | ) |

| Proceeds from sales of marketable securities | |

| 210,329 | | |

| 54,819 | |

| Purchases of intangible assets | |

| (259 | ) | |

| (228 | ) |

| Net cash and cash equivalents provided by (used in) investing activities | |

| 14,486 | | |

| (189,158 | ) |

(Continued on next page)

Solid Power, Inc.

Condensed Consolidated Statements

of Cash Flows (Unaudited)

(Continued, In thousands)

| | |

For the Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from financing activities | |

| | | |

| | |

| Payments of debt | |

| (7 | ) | |

| (71 | ) |

| Proceeds from exercise of stock options | |

| 184 | | |

| 354 | |

| Proceeds from issuance of common stock under ESPP | |

| 214 | | |

| - | |

| Receivable for exercise of stock options | |

| - | | |

| 79 | |

| Cash paid for withholding of employee taxes related to stock-based compensation | |

| (111 | ) | |

| (58 | ) |

| Payments on finance lease liability | |

| (146 | ) | |

| (20 | ) |

| Transaction costs | |

| - | | |

| (12 | ) |

| Net cash and cash equivalents provided by financing activities | |

| 134 | | |

| 272 | |

| | |

| | | |

| | |

| Net (decrease) in cash and cash equivalents | |

| (21,684 | ) | |

| (211,844 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents at beginning of period | |

| 50,123 | | |

| 513,447 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

$ | 28,439 | | |

$ | 301,603 | |

| | |

| | | |

| | |

| Supplemental information: | |

| | | |

| | |

| Cash paid for interest | |

| 26 | | |

| 5 | |

| Accrued capital expenditures | |

| 3,591 | | |

| 8,146 | |

v3.23.2

Cover

|

Aug. 08, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity File Number |

001-40284

|

| Entity Registrant Name |

Solid

Power, Inc.

|

| Entity Central Index Key |

0001844862

|

| Entity Tax Identification Number |

86-1888095

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

486

S. Pierce Avenue

|

| Entity Address, Address Line Two |

Suite E

|

| Entity Address, City or Town |

Louisville

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80027

|

| City Area Code |

303

|

| Local Phone Number |

219-0720

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

SLDP

|

| Security Exchange Name |

NASDAQ

|

| Warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50

|

| Trading Symbol |

SLDPW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

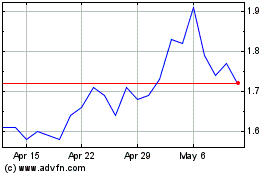

Solid Power (NASDAQ:SLDP)

Historical Stock Chart

From May 2024 to Jun 2024

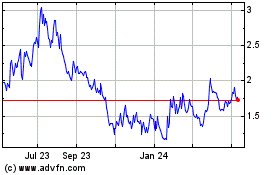

Solid Power (NASDAQ:SLDP)

Historical Stock Chart

From Jun 2023 to Jun 2024