SoFi’s New Robo-Advisor Platform Expands Everyday Investors’ Access to Diversified Asset Classes

November 12 2024 - 9:15AM

Business Wire

SoFi Partners with BlackRock Inc. to Offer

Retail Investors Access to Sophisticated Portfolios and Increased

Selection

Today, SoFi (SOFI), a member-centric, one-stop shop for digital

financial services that helps members borrow, save, spend, invest

and protect their money, announced the launch of a new robo-advisor

platform, expanding on the company’s current automated investment

offering. SoFi is now one of the few automated investment platforms

to provide access to alternative asset classes alongside

traditional and sustainability-focused funds. These offerings,

built in partnership with the world’s largest asset manager,

BlackRock Inc. (BLK), expose investors without significant

financial resources, or a wealth manager, to new strategies and

funds, some of which would otherwise require a seven-figure

investment minimum.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241112139875/en/

The new robo offering comes on the heels of SoFi’s early 2024

launch of alternative investment funds. With more than 8 in 10

(81%1) of people expressing interest in alternative investments,

SoFi is addressing a broader market need with a low-fee,

personalized approach to investment strategies, all available on a

platform that’s both intuitive and educational.

"Our new robo platform bolsters our commitment to empowering the

everyday investor,” said Anthony Noto, CEO of SoFi. “We launched

one of the broadest offerings of alternative assets available from

an online brokerage. Since then, we’ve been focused on how we can

continue to scale our platform to meet the needs of more members,

regardless of where they are on their financial journey. SoFi Robo

Investing marks yet another milestone as we continue to deliver on

our mission to build a one-stop financial platform that helps our

members unlock their long term goals in a meaningful way.”

SoFi’s Robo Investing product offers the benefits of always-on

automation plus expert-curated portfolios for 0.25% annual advisor

fee and allows members to adjust taxable and non-taxable portfolios

to meet their unique needs. Members can now select from three

portfolio themes: “Classic,” which offers a balanced,

low-cost mix of stock and bonds; “Classic with

Alternatives,” which is one of the first to offer access to

alternative asset classes (e.g., real estate and multi-strategy

funds); and “Sustainable,” which offers a well-diversified

mix of stocks and bond funds with favorable environmental, social,

and governance practices.

“The combination of these elements – high-value, automated

investment opportunities – developed and personalized by financial

experts – all paired with our members’ 1-1 access to CFPs – is what

makes the whole package incredibly valuable when it comes to

helping our members make progress toward achieving their long term

goals,” said Brian Walsh, PhD, CFP® and Head of Advice &

Planning at SoFi. “As always, we’ve packaged this offering into a

fully digital experience – that’s clear, yet customizable – to

empower our members to take control of their financial

futures.”

To try robo investing, simply visit sofi.com/invest/automated/

or download the app and open an account. Current SoFi Invest

members will transition to the new experience in the coming months

and can find more information and updates through SoFi’s online

help center.

About SoFi

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for

digital financial services on a mission to help people achieve

financial independence to realize their ambitions. The company’s

full suite of financial products and services helps 9.4 million

SoFi members borrow, save, spend, invest, and protect their money

better by giving them fast access to the tools they need to get

their money right, all in one app. SoFi also equips members with

the resources they need to get ahead – like credentialed financial

planners, exclusive experiences and events, and a thriving

community – on their path to financial independence.

SoFi innovates across three business segments: Lending,

Financial Services – which includes SoFi Checking and Savings, SoFi

Invest, SoFi Credit Card, SoFi Protect, and SoFi Insights – and

Technology Platform, which offers the only end-to-end vertically

integrated financial technology stack. SoFi Bank, N.A., an

affiliate of SoFi, is a nationally chartered bank, regulated by the

OCC and FDIC and SoFi is a bank holding company regulated by the

Federal Reserve. The company is also the naming rights partner of

SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles

Rams. For more information, visit SoFi.com or download our iOS and

Android apps.

Advisory services are offered by SoFi Wealth LLC, an

SEC-registered investment adviser. Information about SoFi Wealth’s

advisory operations, services, and fees is set forth in SoFi

Wealth’s current Form ADV Part 2 (Brochure), a copy of which is

available upon request and at www.adviserinfo.sec.gov.

0.25% fee is based on your account value. The wrap program fee

may cost more or less than purchasing brokerage, custodial, and

recordkeeping services separately. Brokerage costs are billed

separately. Please see SoFi.com/legal/wrapbrochure for more

information.

SOFI-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112139875/en/

Media Contact Meghan Brown pr@sofi.org

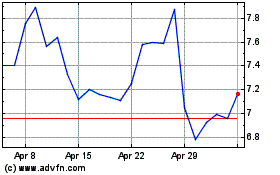

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Jan 2025 to Feb 2025

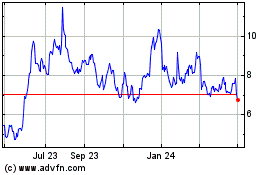

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Feb 2024 to Feb 2025