As filed with the Securities and Exchange Commission on August 7, 2024

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Smith Micro Software, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 7372 | | 33-0029027 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

5800 Corporate Drive

Pittsburgh, PA 15237

(412) 837-5300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William W. Smith, Jr.

Chief Executive Officer

Smith Micro Software, Inc.

120 Vantis Drive, Suite 350

Aliso Viejo, CA 92656

(949) 362-5800

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

| | | | | | | | |

| Brian Novosel, Esq. | | Jonathan H. Talcott |

| Jennifer Minter, Esq. | | Michael K. Bradshaw, Jr. |

| Buchanan Ingersoll & Rooney PC | | Nelson Mullins Riley & Scarborough LLP |

| Union Trust Building | | 101 Constitution Avenue NW, Suite 900 |

| 501 Grant Street, Suite 200 | | Washington, DC 20001 |

| Pittsburgh, PA 15219 | | (202) 689-2800 |

| (412) 562-8800 | | |

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities pursuant to this prospectus until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated August 7, 2024

PRELIMINARY PROSPECTUS

Up to Shares of Common Stock

Up to Common Warrants to Purchase up to Shares of Common Stock

Up to Pre-Funded Warrants to Purchase up to Shares of Common Stock

Up to Placement Agent Warrants to Purchase up to Shares of Common Stock

Up to Shares of Common Stock Underlying the Common Warrants, Pre-Funded Warrants and Placement Agent Warrants

We are offering up to shares of our common stock, par value $0.001 per share (the “Common Stock”) together with up to common warrants to purchase up to shares of Common Stock (the “Common Warrants”). Each share of our Common Stock or a pre-funded warrant in lieu thereof, is being sold together with a Common Warrant to purchase share of our Common Stock. The shares of Common Stock and Common Warrants are immediately separable and will be issued separately in this offering in this offering but must be purchased together in this offering. The assumed combined public offering price for each share of Common Stock and accompanying Common Warrant is $ , which is equal to the closing price of our Common Stock on the Nasdaq Capital Market on _____ __, 2024. Each Common Warrant will have an exercise price per share of $ , will be exercisable at any time beginning on ____ __, 2024 and will expire on ____ __, 20__.

Because a purchaser’s purchase of shares of Common Stock in this offering could otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or at the election of the purchaser, 9.99%) of our outstanding Common Stock immediately following consummation of this offering, we are offering to the purchasers pre-funded warrants to purchase up to shares of Common Stock (the “Pre-Funded Warrants”) in lieu of shares of Common Stock. Each Pre-Funded Warrant will be exercisable for one share of our Common Stock. The purchase price of each Pre-Funded Warrant is $ , which is equal to the price per share at which the shares of Common Stock are being sold to the public in this offering, minus $0.001 per share, and the exercise price of each Pre-Funded Warrant will be $0.001 per share. For each Pre-Funded Warrant that we sell, the number of shares of our Common Stock offered will be decreased on a one-for-one basis. This offering also relates to the shares of Common Stock issuable upon exercise of the Common Warrants (the “Common Warrant Shares”) and the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants (the “Pre-Funded Warrant Shares”).

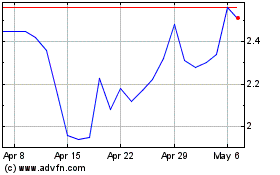

Our Common Stock is listed for trading on the Nasdaq Capital Market under the symbol “SMSI”. The last reported sale price of our Common Stock on the Nasdaq Capital Market on August 6, 2024 was $1.735 per share. All share, Common Warrant and Pre-Funded Warrant numbers are based on an assumed combined public offering price of $ per share and the accompanying Common Warrant and $ per pre-funded warrant and the accompanying Common Warrant, based on the closing price of the Company’s Common Stock on _____ __, 2024 as reported on the Nasdaq Capital Market. The actual combined public offering price per share of Common Stock and accompanying Common Warrant, and per Pre-Funded Warrant and accompanying Common Warrant, will be fixed for the duration of this offering and will be determined between us and purchasers based on market conditions at the time of pricing, and may be at a discount to the then current market price of our Common Stock. The recent market price used throughout this prospectus may not be indicative of the actual combined public offering price. The actual combined public offering price may be based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general condition of the securities markets at the time of this offering. There is no established public trading market for the Common Warrants or Pre-Funded Warrants, and we do not expect a market for the Common Warrants or the Pre-Funded Warrants to develop. We do not intend to list the Common Warrants or Pre-Funded Warrants on the Nasdaq Capital Market, any other national securities exchange or any other trading system. Without an active trading market, the liquidity of the Common Warrants and the Pre-Funded Warrants will be limited.

We have engaged Roth Capital Partners, LLC (the “placement agent” or “Roth”) to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered in this offering. The placement agent is not purchasing or selling any of the securities we are offering, and the placement agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. There is no required minimum number of securities that must be sold as a condition to completion of this offering, and there are no arrangements to place the funds in an escrow, trust, or similar account. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund if we do not sell all of the securities offered hereby. This offering will terminate on _____ __, 2024, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one closing for all the securities purchased in this offering. We have agreed to pay the placement agent the placement agent fees as set forth in the table below, which assumes we sell all of the securities offered by this prospectus.

We are a “smaller reporting company” as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and as such are subject to reduced public company reporting requirements for this prospectus and future filings.

| | | | | | | | | | | | | | | | | |

| Per Share of Common Stock and Accompanying Common Warrant | | Per Pre- Funded Warrant and Accompanying Common Warrant | | Total |

Public Offering price | $ | | $ | | $ |

Placement Agent fees(1) | $ | | $ | | $ |

Proceeds to Smith Micro Software, Inc., before expenses | $ | | $ | | $ |

__________________

(1)Does not include additional items of compensation payable to the placement agent, which includes a warrant to purchase seven percent (7.0%) of the aggregate number of shares of Common Stock and Pre-Funded Warrants issued in this offering, with an exercise price equal to no less than 125% of the combined public offering price per share sold in this offering, and reimbursement for certain accountable expenses incurred by them. See “Plan of Distribution.”

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE RISKS AND UNCERTAINTIES IN THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 12 OF THIS PROSPECTUS AND IN THE OTHER DOCUMENTS THAT ARE INCORPORATED BY REFERENCE BEFORE PURCHASING ANY OF THE SECURITIES OFFERED BY THIS PROSPECTUS. We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The delivery to the purchasers of the shares of Common Stock, Pre-Funded Warrants, and Common Warrants in this offering is expected to be made on or about _____ __, 2024, subject to satisfaction of certain customary closing conditions.

Roth Capital Partners

The date of this prospectus is August 7, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the SEC. You should rely only on the information contained in this prospectus or any related prospectus supplement. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus is accurate only on the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date. Other than as required under the federal securities laws, we undertake no obligation to publicly update or revise such information, whether as a result of new information, future events or any other reason. This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

This prospectus and the information incorporated by reference herein and therein contains references to trademarks, trade names and service marks belonging to us or other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable owner will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. All trademarks, trade names, and service marks included or incorporated by reference into this prospectus are the property of their respective owners.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the federal securities laws. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “will,” “should,” “may,” “plan,” “assume” and other expressions that predict or indicate future events and trends and that do not relate to historical matters. You should not unduly rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. These statements are not guarantees of future performance and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, our actual results could differ materially from those expressed or implied in any forward-looking statements as a result of various factors. Such factors include, but are not limited to, the following:

•our customer concentration, given that the majority of our sales currently depend on a few large client relationships;

•our ability to establish and maintain strategic relationships with our customers and mobile device manufacturers, their ability to attract customers, and their willingness to promote our products;

•our ability and/or customers’ ability to distribute our mobile software applications to their end users through third party mobile software application stores, which we do not control;

•our dependency upon effective operation with operating systems, devices, networks and standards that we do not control and on our continued relationships with mobile operating system providers, device manufacturers and mobile software application stores on commercially reasonable terms or at all;

•our ability to hire and retain key personnel;

•the possibility of security and privacy breaches in our systems and in the third-party software and/or systems that we use, damaging client relations and inhibiting our ability to grow;

•interruptions or delays in the services we provide from our data center hosting facilities that could harm our business;

•the existence of undetected software defects in our products and our failure to resolve detected defects in a timely manner;

•our ability to remain a going concern;

•our ability to raise additional capital and the risk of such capital not being available to us at commercially reasonable terms or at all;

•our ability to be profitable;

•changes in our operating income due to shifts in our sales mix and variability in our operating expenses;

•our current client concentration within the vertical wireless carrier market, and the potential impact to our business resulting from changes within this vertical market, or failure to penetrate new markets;

•rapid technological evolution and resulting changes in demand for our products from our key customers and their end users;

•intense competition in our industry and the core vertical markets in which we operate, and our ability to successfully compete;

•the risks inherent with international operations;

•the impact of evolving information security and data privacy laws on our business and industry;

•the impact of governmental regulations on our business and industry;

•our ability to protect our intellectual property and our ability to operate our business without infringing on the rights of others;

•the risk of being delisted from Nasdaq if we fail to meet any of its applicable listing requirements;

•our ability to assimilate acquisitions without diverting management attention and impacting current operations;

•failure to realize the expected benefits of prior acquisitions;

•the availability of third-party intellectual property and licenses needed for our operations on commercially reasonable terms, or at all; and

•the difficulty of predicting our quarterly revenues and operating results and the chance of such revenues and results falling below analyst or investor expectations, which could cause the price of our Common Stock to fall.

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results to be materially different from the anticipated future results, performance or achievements expressed or implied by any forward-looking statements, including the factors described under the heading “Risk Factors” in this prospectus, under similar headings in the documents incorporated by reference into this prospectus, and the risk factors and cautionary statements described in other documents that we file from time to time with the SEC, specifically under the heading “Item 1A: Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K for the year ended December 31, 2023 that was filed with the SEC on February 26, 2024, and any of our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. You should evaluate all forward-looking statements made in this prospectus, including the documents we incorporate by reference, in the context of these risks, uncertainties and other factors.

All forward-looking statements in this prospectus, including the documents we incorporate by reference, apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this prospectus. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and you are cautioned not to unduly rely upon these statements.

PROSPECTUS SUMMARY

This summary highlights, and is qualified in its entirety by, the more detailed information and financial statements included elsewhere or incorporated by reference in this prospectus. This summary does not contain all of the information that may be important to you in making your investment decision. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 12, and the financial statements and other information incorporated by reference into this prospectus. In this prospectus, except as otherwise indicated, the terms “Smith Micro,” “the Company,” “we,” “us,” or “our” in this prospectus refer to Smith Micro Software, Inc., a Delaware corporation, and its wholly-owned subsidiaries. Our Company

Smith Micro provides software solutions that simplify and enhance the mobile experience to some of the leading wireless service providers around the globe. From enabling the Digital Family Lifestyle™ to providing powerful voice messaging capabilities, we strive to enrich today’s connected lifestyles while creating new opportunities to engage consumers via smartphones and consumer Internet of Things (“IoT”) devices. Our portfolio includes a wide range of products for creating, sharing, and monetizing rich content, such as visual voice messaging, retail content display optimization and performance analytics on any product set.

We continue to innovate and evolve our business to respond to industry trends and maximize opportunities in growing and evolving markets, such as digital lifestyle services and online safety, “Big Data” analytics, automotive telematics, and the consumer IoT marketplace. The key to our longevity, however, is not simply technological innovation, but our focus on understanding our customers’ needs and delivering value.

We currently provide white label Family Safety applications to two Tier 1 wireless carriers in the United States, and believe that we remain strategically positioned to offer our market-leading family safety platform to the majority of U.S. mobile subscribers. We believe that we have an opportunity to increase the respective subscriber bases, and in turn, grow the revenues associated with these Tier 1 carriers. Further, we executed new, multi-year Family Safety agreements with a Tier 1 carrier in Europe in the fourth quarter of 2023 and a U.S.-based carrier in the first quarter of 2024. The new Family Safety solution with the U.S. based carrier launched on our SafePath Global platform during the second quarter of 2024, and associated marketing activities for that product have begun. Additionally, the Family Safety product for the Tier 1 European carrier is anticipated to launch in the next few months.

Business Segments

We currently have one reportable operating segment: Wireless.

The wireless industry continues to undergo rapid change on all fronts as connected devices, mobile applications, and digital content are consumed by users who want information, high-speed wireless connectivity and entertainment, anytime, anywhere. While most of us think about being “connected” in terms of computers, tablets and smartphones, the consumer IoT market is creating a world where almost anything can be connected to the wireless Internet. Wearable devices such as smartwatches, fitness trackers, pet trackers and GPS locators, as well as smart home devices, are now commonplace, enabling people, pets, and things to be connected to the “Internet of Everything.” These devices have created an entire ecosystem of over-the-top (“OTT”) apps that provide products over the Internet to bypass traditional distribution methods, while expanding how communication service providers can provide value to mobile consumers.

Although there are numerous business opportunities associated with pervasive connectivity, there are also numerous challenges, including:

•The average age by which most children use smartphones and other connected devices continues to decrease. As such, parents and guardians must be proactive in managing and combating digital lifestyle issues such as excessive screen time, cyberbullying, and online safety;

•As IoT use cases continue to proliferate and scale, management complexity, security and interoperability must be addressed efficiently and correctly;

•Mobile network operators (“MNO”) are being marginalized by messaging applications, and face growing competitive pressure from cable multiple system operators (“MSO”) and others deploying Wi-Fi networks to attract mobile users;

•Enterprises face increasing pressure to mobilize workforces, operations, and customer engagement, but lack the expertise and technologies needed to leverage mobile technology securely and cost-effectively;

•The ubiquity and convenience of e-commerce has created the need for consumer-facing brands to reimagine brick-and-mortar retail experiences; and

•The change in dynamics of work, school and home life has led to an increased use of mobile devices for work, education and entertainment which has given rise to a new set of challenges and issues.

Products

To address these challenges, Smith Micro offers the following solutions:

SafePath® – Comprised of SafePath Family™, SafePath IoT™, SafePath Home™, SafePath Premium™, SafePath Drive™, SafePathOS™ and SafePath Global™, the SafePath product suite provides comprehensive and easy-to-use tools to protect family digital lifestyles and manage connected devices both inside and outside the home. As a carrier-grade, white-label platform, SafePath empowers MNO and cable operators to bring to market full-featured, on-brand family safety solutions that provide in-demand services to mobile subscribers. These solutions include location tracking, parental controls, driver safety functionality, and enhanced AI/machine learning to optimize and customize families’ online experience, provide cyberbullying protection, social media intelligence, and public safety notifications for parents or guardians. Delivered to end-users as value-added services, SafePath-based solutions activate new revenue streams for MNOs while helping to increase brand affinity and reduce subscriber churn. In 2024, we launched SafePath Global™, a new deployment and launch model that will allow MNOs to rapidly deliver SafePath to their users with faster time-to-market, minimal reliance on MNO’s resources, and easy customer onboarding, and plan to deploy and launch SafePath Premium™, an upgrade to our SafePath Family™ offering that will expand the product’s online protection and digital parenting tools, and to continue our development of SafePathOS™, a software-only solution designed to be pre-installed and configured on mobile devices to enable MNOs to offer a kids phone with the features and protections of our SafePath digital family software solution out of the box.

ViewSpot® – Our retail display management platform provides wireless carriers and retailers with a way to bring powerful on-screen, interactive demos to life. These engaging in-store demo experiences deliver consistent, secure, and targeted content that can be centrally managed and updated via ViewSpot Studio. With the feature set provided by the ViewSpot platform, wireless carriers and other smartphone retailers can easily customize and optimize the content loops displayed on demo devices so that it resonates with in-store shoppers. Interactive demos created in ViewSpot can be experienced on Android smart devices.

CommSuite® – The CommSuite premium messaging platform helps mobile service providers deliver a next-generation voicemail experience to mobile subscribers, while monetizing a legacy cost-center. CommSuite Visual Voicemail (“VVM”) and Premium Visual Voicemail (“PVVM”) quickly and easily allows users to manage voice messages just like email or SMS with reply, forwarding and social sharing options. CommSuite also enables multi-language Voice-to-Text (“VTT”) transcription messaging, which facilitates convenient message consumption for users by reading versus listening. The CommSuite platform is available to both postpaid premium subscribers as well as prepaid subscribers and is installed on millions of Android handsets in the United States.

Marketing and Sales Strategy

Because of our broad product portfolio, deep integration and product development experience and flexible business models we can quickly bring to market innovative solutions that support our customers’ needs, which creates new revenue opportunities and differentiates their products and services from their competitors.

Our marketing and sales strategy is as follows:

Leverage Operator Relationships. We continue to capitalize on our strong relationships with the world’s leading MNOs and MSOs. These customers serve as our primary distribution channel, providing access to hundreds of millions of end-users around the world.

Focus on High-Growth Markets. We continue to focus on providing digital lifestyle solutions, analytics/Big Data solutions, premium messaging services, and visual retail content management solutions.

Expand our Customer Base. In addition to growing our business with current customers, we look to add new MNO and MSO customers worldwide, as well as to expand into new partnerships as we extend the reach of our product platforms within the connected lifestyle ecosystem.

Key Revenue Contributors

In our business, we market and sell our products primarily to large MNOs and MSOs, so there are a limited number of actual and potential customers for our current products, resulting in significant customer concentration. With the launch of SafePath Global, we plan to expand our customer reach more easily to smaller MNOs and MSOs.

One of the Company’s U.S. Tier 1 carrier customers terminated its family safety contract with Smith Micro, effective June 30, 2023, and elected to continue to receive services under the contract for a transitional period through November 30, 2023. The revenues associated with that customer contract were approximately 36% of our total revenues for 2023. We do not anticipate any further revenue from this contract in 2024.

Customer Service and Technical Support

We provide technical support and customer service through our online knowledge base, email, and live chat. Our operator customers generally provide their own primary customer support functions and rely on us for support to their technical support personnel.

Product Development

The software industry, particularly the wireless market, is characterized by rapid and frequent changes in technology and user needs. We work closely with industry groups and customers, both current and potential, to help us anticipate changes in technology and determine future customer needs. Software functionality depends upon the capabilities of the related hardware. Accordingly, we maintain engineering relationships with various hardware manufacturers, and we develop our software in tandem with their product development. Our engineering relationships with manufacturers, as well as with our major customers, are central to our product development efforts. We remain focused on the development and expansion of our technology, particularly in the wireless space.

Competition

The markets in which we operate are highly competitive and subject to rapid changes in technology. These conditions create new opportunities for Smith Micro, as well as for our competitors, and we expect new competitors to continue to enter the market. We not only compete with other software vendors for new customer contracts, in an increasingly competitive and fast-moving market we also compete to acquire technology and qualified personnel.

We believe that the principal competitive factors affecting the mobile software market include domain expertise, product features, usability, quality, price, customer service, speed to market and effective sales and marketing efforts. Although we believe that our products currently compete favorably with respect to these factors, there can be no assurance that we can maintain our competitive position against current and potential competitors. We also believe that the market for our software products has been and will continue to be characterized by significant price competition. A material reduction in the price we obtain for our products would negatively affect our profitability.

Many of our existing and potential customers have the resources to develop products internally that would compete directly with our product offerings. As such, these customers may opt to discontinue the purchase of our

products in the future. Our future performance is therefore substantially dependent upon the extent to which existing customers elect to purchase software from us rather than designing and developing their own software.

Proprietary Rights and Licenses

We protect our intellectual property through a combination of patents, copyrights, trademarks, trade secrets, intellectual property laws, confidentiality procedures and contractual provisions. We have United States and foreign patents and pending patent applications that relate to various aspects of our products and technology. We have also registered, and applied for the registration of, U.S. and international trademarks, service marks, domain names, and copyrights. We will continue to apply for such protections in the future as we deem necessary to protect our intellectual property. We seek to avoid unauthorized use and disclosure of our proprietary intellectual property by requiring employees and third parties with access to our proprietary information to execute confidentiality agreements with us and by restricting access to our source code.

Our customers license our products and/or access our offerings pursuant to written agreements. Our customer agreements contain restrictions on reverse engineering, duplication, disclosure, and transfer of licensed software, and restrictions on access and use of software as a service (“SaaS”).

Despite our efforts to protect our proprietary technology and our intellectual property rights, unauthorized parties may attempt to copy or obtain and use our technology to develop products and technology with the same functionality as our products and technology. Policing unauthorized use of our technology and intellectual property rights is difficult, and we may not be able to detect unauthorized use of our intellectual property rights or take effective steps to enforce our intellectual property rights.

Human Capital Resources

As of July 31, 2024, we had a total of 218 employees within the following departments: 154 in engineering and operations, 42 in sales and marketing, and 22 in management and administration. We are not subject to any collective bargaining agreement, and we believe that our relationships with our employees are good. We believe that our strength and competitive advantage is our people. We value the skills, strengths, and perspectives of our diverse team and foster a participatory workplace that enables people to get involved in making decisions. The Company provides various training and development opportunities to foster an environment in which employees are encouraged to be creative thinkers who are driven, focused, and interested and able to advance their knowledge and skills in ever-changing technology.

Recent Developments

Reverse Stock Split

On April 3, 2024, our stockholders and special committee of the Board of Directors approved a 1-for-8 reverse stock split of our outstanding shares of Common Stock, which became effective as of 11:59 pm Eastern time on April 10, 2024 (the “Reverse Stock Split”). As a result of the Reverse Stock Split, every eight (8) shares of Common Stock, whether issued and outstanding or held by the Company as treasury stock, were automatically combined into one (1) issued and outstanding share of Common Stock. No fractional shares were issued in connection with the Reverse Stock Split. Rather, each fractional share of Common Stock that would have otherwise been issued as a result of the Reverse Stock Split was rounded up to the nearest whole share of Common Stock. All equity awards outstanding and Common Stock reserved for issuance under the Company’s equity incentive plans, employee stock purchase plan and warrants outstanding immediately prior to the Reverse Stock Split were appropriately adjusted by dividing the number of affected shares of Common Stock by eight (8) and, as applicable, multiplying the exercise price by eight (8), as a result of the Reverse Stock Split.

All share and per share numbers, option numbers, warrant numbers, and other derivative security numbers and exercise prices appearing in this prospectus have been adjusted to give effect to the Reverse Stock Split in this filing, however, the Company’s annual, periodic and current reports, and all other information and documents incorporated by reference into this prospectus that were filed prior to April 11, 2024, do not give effect to the Reverse Stock Split.

May 2024 Offering & Private Placement

On May 10, 2024, we entered into a securities purchase agreement (the “May 2024 Purchase Agreement”) with certain institutional and accredited investors (the “May 2024 Purchasers”) relating to the registered direct offering and sale of an aggregate of 1,065,000 shares of the Company’s Common Stock at an offering price of $2.15 per share of Common Stock and pre-funded warrants (the “May 2024 Pre-Funded Warrants”) to purchase up to 845,000 shares of Common Stock at an offering price of $2.149 per underlying share (the “May 2024 Registered Direct Offering”). The May 2024 Pre-Funded Warrants have an exercise price of $0.001 per share and can be exercised at any time after their original issuance until such May 2024 Pre-Funded Warrants are exercised in full. The shares of Common Stock and May 2024 Pre-Funded Warrants (including the shares of Common Stock underlying the warrants) were offered by the Company pursuant to a prospectus supplement dated May 10, 2024, and accompanying prospectus dated May 12, 2022, in connection with a takedown from the Company’s shelf registration statement on Form S-3 (File No. 333-264667), which was declared effective by the SEC on May 12, 2022.

In a concurrent private placement, the Company also sold unregistered warrants (the “May 2024 Common Warrants”) to the May 2024 Purchasers to purchase up to an aggregate of 1,910,000 shares of Common Stock (the “May 2024 Private Placement”). Each unregistered May 2024 Common Warrant has an exercise price of $2.34 per share, is exercisable at any time beginning November 14, 2024 and will expire November 14, 2029. Both the May 2024 Registered Direct Offering and the May 2024 Private Placement closed on May 14, 2024.

Roth acted as the exclusive placement agent for the May 2024 Registered Direct Offering and the May 2024 Private Placement pursuant to a placement agency agreement (the “May 2024 Placement Agency Agreement”) dated May 10, 2024, by and between the Company and Roth, and a related engagement letter with Roth. Pursuant to the May 2024 Placement Agency Agreement, on May 14, 2024 the Company issued to Roth warrants to purchase up to 133,700 shares of Common Stock (the “May 2024 Placement Agent Warrants”), which represent 7.0% of the aggregate number of shares of Common Stock and May 2024 Pre-Funded Warrants sold in the May 2024 Registered Direct Offering. The May 2024 Placement Agent Warrants have substantially the same terms as the May 2024 Common Warrants, except that the May 2024 Placement Agent Warrants have an exercise price equal to $2.86 and expire November 16, 2026.

The shares of Common Stock underlying the May 2024 Common Warrants and the May 2024 Placement Agent Warrants (collectively referred to herein as the “May 2024 Warrants”) were registered on a resale registration statement on Form S-1 (File No. 333-280542) that was declared effective by the SEC on July 10, 2024.

Risks of Investing

Investing in our securities involves substantial risks. Potential investors are urged to read and consider the risk factors relating to an investment in our securities set forth under “Risk Factors” in this prospectus as well as other information we include in this prospectus.

Corporate Information

The Company was incorporated in California in November 1983 and reincorporated in Delaware in June 1995. Our principal executive offices are located at 5800 Corporate Drive, Pittsburgh, Pennsylvania 15237 and our telephone number is (412) 837-5300. Our website address is www.smithmicro.com, and we make our filings with the SEC available on the Investor Relations page of our website. Our Common Stock is traded on the Nasdaq Capital Market under the symbol “SMSI.”

THE OFFERING

| | | | | | | | |

Issuer | | Smith Micro Software, Inc. |

| | |

Common Stock Offered by Us: | | Up to shares of our Common Stock. The assumed combined public offering price for each share of Common Stock and accompanying Common Warrant is $ . We are also registering up to shares of Common Stock issuable upon exercise of the Common Warrants, Pre-Funded Warrants and Placement Agent Warrants (as later defined herein) pursuant to this prospectus. |

| | |

Pre-Funded Warrants Offered by Us: | | We are also offering to those purchasers, if any, whose purchase of the Common Stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or at the election of the purchaser, 9.99%) of our outstanding Common Stock immediately following consummation of this offering, the opportunity to purchase, if they so choose, Pre-Funded Warrants in lieu of the Common Stock that would otherwise result in ownership in excess of 4.99% (or 9.99% as applicable) of our Common Stock. The purchase price of each Pre-Funded Warrant and accompanying Common Warrant will equal the price per share of Common Stock and accompanying Common Warrant being sold to the public in this offering, minus $0.001, and the exercise price of each Pre-Funded Warrant will be $0.001 per share. Each Pre-Funded Warrant will be immediately exercisable and may be exercised at any time until exercised in full. There is no expiration date for the Pre-Funded Warrants. There is no established trading market for the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to apply for a listing for the Pre-Funded Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited. |

| | |

Common Warrants Offered by Us: | | Each share of our Common Stock and each Pre-Funded Warrant to purchase one share of our Common Stock is being sold together with a Common Warrant to purchase share of our Common Stock. Each Common Warrant will have an exercise price of $ per share, will be exercisable at any time beginning on _____ __, 2024 and will expire on _____ __, 20__. The shares of Common Stock and Pre-Funded Warrants, and the accompanying Common Warrants, as the case may be, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Common Warrants. Because we will issue a Common Warrant for each share of Common Stock and for each Pre-Funded Warrant sold in this offering, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of the shares of our Common Stock and Pre-Funded Warrants sold. |

| | |

Shares of Common Stock Outstanding Prior to this Offering(1): | | 11,035,130 shares as of July 31, 2024 |

| | |

| | | | | | | | |

Shares of Common Stock Outstanding After this Offering: | | shares, assuming no sale of any Pre-Funded Warrants and no exercise of the Common Warrants being offered in this offering. To the extent that Pre-Funded Warrants are sold, the number of shares of Common Stock sold in this offering will be reduced on a one-for-one basis. |

| | |

Use of Proceeds: | | We estimate that the net proceeds of this offering based upon an assumed combined public offering price of $ per share and accompanying Common Warrant, which was the closing price of our Common Stock on the Nasdaq Capital Market on _____ __, 2024, after deducting the estimated placement agent fees and estimated offering expenses payable by us, will be approximately $ million, assuming no exercise of the Common Warrants. We will receive additional proceeds from the Common Warrants and Placement Agent Warrants and minimal proceeds from Pre-Funded Warrants (collectively, the “Warrants”) to the extent such Warrants are exercisable for cash once exercisable. We intend to use the net proceeds from this offering for general corporate purposes and working capital purposes. See “Use of Proceeds.” |

| | |

Lock-Up Agreements: | | Subject to certain exceptions, the Company has agreed not to (i) issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of Common Stock or any securities convertible into or exercisable or exchangeable for our Common Stock; or (ii) file any registration statement (other than the registration statement relating to this offering or a registration statement on Form S-8) with respect to the registration of shares of Common Stock pursuant to any company equity incentive plan) with the SEC relating to the offering of any shares of our Common Stock or any securities convertible into or exercisable or exchangeable for shares of our Common Stock, for a period of days following the date of the closing of this offering. In addition, each of our directors and officers have agreed with the placement agent, subject to certain exceptions, not to sell, transfer, or dispose of, directly or indirectly, any of our Common Stock or securities convertible or exchangeable for our Common Stock for a period of days following the date of the closing of this offering. |

| | |

Dividend Policy: | | We currently intend to retain any future earnings and do not anticipate paying cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend upon our financial condition, operating results, capital requirements, any contractual restrictions and such other factors as our board of directors may deem appropriate. |

| | |

Risk Factors: | | Investing in our securities involves significant risks. See “Risk Factors” on page 12 of this prospectus and under similar headings in the documents incorporated by reference into this prospectus for a discussion of the factors you should carefully consider before deciding to invest in our securities. |

| | |

Nasdaq Capital Market Symbol: | | SMSI We do not intend to apply for the listing of the Warrants on any national securities exchange or other trading system. Without an active trading market, the liquidity of the Warrants will be limited. |

| | |

Transfer Agent and Registrar: | | Computershare Trust Company, N.A. |

__________________

(1)The number of shares of Common Stock to be outstanding immediately after this offering is based on 11,035,130 shares of Common Stock issued and outstanding as of July 31, 2024, and exclude the following, all as of July 31, 2024:

•8,848 shares of our Common Stock related to stock options issuable upon exercise, with a weighted-average exercise price of $26.89 per share;

•845,000 shares of our Common Stock issuable upon the exercise of the May 2024 Pre-Funded Warrants;

•2,465,060 shares of our Common Stock issuable upon the exercise of outstanding warrants with exercise prices ranging from $2.06 to $21.20 per share; and

•up to an aggregate of 2,611,345 shares of our Common Stock reserved for future grant or issuance under our Amended and Restated Omnibus Equity Incentive Plan (the “Incentive Plan”), and our Employee Stock Purchase Plan (the “ESPP”).

Unless otherwise indicated, all information contained in this prospectus reflects the Reverse Stock Split and assumes (i) no exercise of the outstanding options or warrants described above, (ii) no exercise of the Common Warrants to be sold in this offering or the placement agent warrants to purchase up to shares at an exercise price of $ per share to be issued as compensation to the placement agent in connection with this offering (the “Placement Agent Warrants”), and (iii) the exercise for cash of all Pre-Funded Warrants issued in this offering.

RISK FACTORS

Investing in our securities involves risk. Before making an investment decision, you should carefully consider the following discussion of risks and uncertainties affecting us and our securities as well as the risks described in our most recent Annual Report on Form 10-K and any updates to our risk factors in our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by reference into this prospectus, in light of your particular investment objectives and financial circumstances. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. The risks and uncertainties we discuss in this prospectus and in the documents incorporated by reference herein are those that we currently believe may materially affect our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may materially and adversely affect our business, financial condition and results of operations. See also the section of this prospectus titled “Where You Can Find More Information.”

Risks Related To This Offering

This is a best efforts offering, meaning no minimum amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans, including our near-term business plans, nor will investors in this offering receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus.

The placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our business goals and continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term and may need to raise additional funds to complete such short-term operations. Such additional capital may not be available or available on terms acceptable to us, or at all.

There is no required minimum number of securities that must be sold as a condition to completion of this offering, and we have not, nor will we, establish an escrow account in connection with this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth herein. Because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in us, but we are unable to fulfill our objectives due to a lack of interest in this offering. Further, because there is no escrow account in operation and no minimum investment amount, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. Investor funds will not be returned under any circumstances whether during or after the offering.

Management will have broad discretion in how we use the proceeds from this offering.

Our management will have broad discretion with respect to the use of proceeds of this offering, including for any of the purposes described in the section of this prospectus entitled “Use of Proceeds.” You will be relying on the judgment of our management regarding the application of the proceeds of this offering, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used in ways you would agree with. The results and effectiveness of the use of proceeds are uncertain, and we could spend the proceeds in ways that you do not agree with or that do not improve our results of operations or enhance the value of our Common Stock. Our failure to apply these funds effectively could harm our business and cause the price of our Common Stock to decline.

If the price of our Common Stock fluctuates significantly, your investment could lose value.

Although our Common Stock is listed on the Nasdaq Capital Market, we cannot assure you that an active public market will continue for our Common Stock. If an active public market for our Common Stock does not continue, the trading price and liquidity of our Common Stock will be materially and adversely affected. If there is a thin trading market or “float” for our stock, the market price for our Common Stock may fluctuate significantly more than the stock market as a whole. Without a large float, our Common Stock would be less liquid than the stock of companies with broader public ownership and, as a result, the trading prices of our Common Stock may be more volatile. In addition, in the absence of an active public trading market, investors may be unable to liquidate their investment in us.

Furthermore, the stock market is subject to significant price and volume fluctuations, and the price of our Common Stock could fluctuate widely in response to several factors, including:

•our quarterly or annual operating results;

•changes in our earnings estimates;

•investment recommendations by securities analysts following our business or our industry;

•additions or departures of key personnel;

•success of competitors;

•changes in the business, earnings estimates or market perceptions of our competitors;

•our failure to achieve operating results consistent with securities analysts’ projections;

•changes in industry, general market or economic conditions; and

•announcements of legislative or regulatory changes.

Broad market and industry factors may materially harm the market price of our securities irrespective of our operating performance. The stock market in general, and Nasdaq in particular, has experienced price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of the particular companies affected. The trading prices and valuations of these stocks, and of our Common Stock, may not be predictable.

A loss of investor confidence in the market for our stock or the stocks of other companies which investors perceive to be similar to us could depress our stock price regardless of our business, prospects, financial condition or results of operations. A decline in the market price of our Common Stock also could adversely affect our ability to issue additional securities and our ability to obtain additional financing in the future.

The stock market has experienced extreme price and volume fluctuations in recent years that have significantly affected the quoted prices of the securities of many companies, including companies in our industry. The changes often appear to occur without regard to specific operating performance. The price of our Common Stock could fluctuate based upon factors that have little or nothing to do with our company and these fluctuations could materially reduce our stock price.

We do not anticipate paying dividends in the foreseeable future.

We do not currently pay dividends and do not anticipate paying any dividends for the foreseeable future. Any future determination to pay dividends will be made at the discretion of our board of directors, subject to compliance with applicable laws and covenants under any future credit facility, which may restrict or limit our ability to pay dividends. Payment of dividends will depend on our financial condition, operating results, capital requirements, general business conditions and other factors that our board of directors may deem relevant at that time. Unless and until we declare and pay dividends, any return on your investment will only occur if our share price appreciates.

If you purchase our securities in this offering, you may incur immediate and substantial dilution in the book value of your shares of Common Stock.

You may suffer immediate and substantial dilution in the net tangible book value of the Common Stock you purchase in this offering. Based on the assumed public offering price of $ per share and accompanying Common Warrant, the last reported price of our Common Stock on the Nasdaq Capital Market on _____ __, 2024, we estimate our as adjusted net tangible book value per share of Common Stock after this offering will be $ . As a result, purchasers of securities in this offering will experience an immediate decrease of $ per share in net tangible book value of our Common Stock. See the section of this prospectus titled “Dilution” for a more detailed description of these factors.

Except as otherwise provided in the Warrants, holders of Warrants issued in this offering will have no rights as stockholders of our shares of Common Stock until such holders exercise their Warrants.

The Warrants offered in this offering do not confer any rights of Common Stock ownership on their holders, such as voting rights, but rather merely represent the right to acquire Common Stock at a fixed price. Specifically, a holder of a Pre-Funded Warrant may exercise the right to acquire Common Stock and pay a nominal exercise price of $0.001 at any time, a holder of a Common Warrant may exercise the right to acquire Common Stock and pay an exercise price of $ beginning on _____ __, 2024, and a holder of a Placement Agent Warrant may exercise the right to acquire Common Stock and pay an exercise price of $ beginning on _____ __, 2024. Upon exercise of the Warrants, as applicable, the holders thereof will be entitled to exercise the rights of a holder of shares of Common Stock only as to matters for which the record date occurs after the exercise date.

There is no public market for the Warrants being offered in this offering.

There is no established public trading market for the Warrants being sold in this offering. We will not list the Warrants on any securities exchange or nationally recognized trading system, including the Nasdaq Capital Market. Therefore, we do not expect a market to ever develop for the Warrants. Without an active trading market, the liquidity of the Warrants will be limited.

Resales of our shares of Common Stock in the public market by our stockholders as a result of this offering may cause the market price of our Common Stock to fall.

We are registering shares of Common Stock, as well as shares of Common Stock, in the aggregate, issuable upon the exercise of the Warrants. Sales of substantial amounts of our shares of Common Stock in the public market, or the perception that such sales might occur, could adversely affect the market price of our shares of Common Stock. The issuance of new shares of Common Stock could result in resales of our shares of Common Stock by our current stockholders concerned about the potential ownership dilution of their holdings. Furthermore, in the future, we may issue additional shares of Common Stock or other equity or debt securities exercisable or convertible into shares of Common Stock. Any such issuance could result in substantial dilution to our existing stockholders and could cause our stock price to decline.

Risks Related to Our Common Stock and the Securities Market

If securities or industry analysts do not publish research or reports, or if they publish negative, adverse, or misleading research or reports, regarding us, our business or our market, our Common Stock price and trading volume could decline.

The trading market for our Common Stock is influenced by the research and reports that securities or industry analysts publish about us, our business, or our market. We do not currently have a significant number of firms providing research coverage on the Company, and may never obtain significant research coverage by securities or industry analysts. If no or few securities or industry analysts provide coverage of us, our Common Stock price could be negatively impacted. In the event we obtain significant securities or industry analyst coverage and such coverage is negative, or adverse or misleading regarding us, our business model, our intellectual property, our stock performance or our market, or if our operating results fail to meet the expectations of analysts, our Common Stock price would likely decline. If one or more of these analysts cease coverage of us or fail to publish reports on us

regularly, we could lose visibility in the financial markets, which in turn could cause our Common Stock price or trading volume to decline.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our securities.

In 2020, the SEC implemented Regulation Best Interest requiring that “a broker, dealer, or a natural person who is an associated person of a broker or dealer, when making a recommendation of any securities transaction or investment strategy involving securities (including account recommendations) to a retail customer, shall act in the best interest of the retail customer at the time the recommendation is made, without placing the financial or other interest of the broker, dealer, or natural person who is an associated person of a broker or dealer making the recommendation ahead of the interest of the retail customer.” This is a significantly higher standard for broker-dealers to recommend securities to retail customers than before under prior FINRA suitability rules. FINRA suitability rules do still apply to institutional investors and require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending securities to their customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information, and, for retail customers, determine that the investment is in the customer’s “best interest,” and meet other SEC requirements. Both SEC Regulation Best Interest and FINRA’s suitability requirements may make it more difficult for broker-dealers to recommend that their customers buy speculative, low-priced securities. They may affect investing in our Common Stock, which may have the effect of reducing the level of trading activity in our securities. As a result, fewer broker-dealers may be willing to make a market in Common Stock, reducing a stockholder’s ability to resell shares of our Common Stock.

Our charter documents, Delaware law, and our commercial contracts may contain provisions that may discourage an acquisition of us by others and may prevent attempts by our stockholders to replace or remove our current management.

Provisions in our charter documents, as well as provisions of the Delaware General Corporation Law (“DGCL”), could have an impact on the trading price of our Common Stock by making it more difficult for a third party to acquire us at a price favorable to our stockholders. For example, our charter documents include provisions: classifying our board of directors such that only approximately one-third of the directors are elected each year; prohibiting the use of cumulative voting for the election of directors; authorizing the issuance of “blank check” preferred stock, the terms of which may be established and shares of which may be issued by our board of directors without stockholder approval to defend against a takeover attempt; and establishing advance notice requirements for nominations for election to our Board of Directors or for proposing matters that can be acted upon at stockholder meetings.

In addition, these provisions may frustrate or prevent any attempts by our stockholders to replace or remove our board of directors or current management. We are subject to Section 203 of the DGCL, which generally prohibits a Delaware corporation from engaging in any of a broad range of business combinations with an interested stockholder for a period of three years following the date on which the stockholder became an interested stockholder, unless such transactions are approved by our board of directors. This provision could have the effect of delaying or preventing a change of control, whether or not it is desired by or beneficial to our stockholders, which could also affect the price that some investors are willing to pay for our Common Stock.

Finally, commercial contracts that we enter into with our vendors and customers in the course of our business operations may contain provisions with respect to changes in control that could provide for termination rights or otherwise have a negative impact on our business or results of operations if a stockholder were to acquire a significant percentage of our outstanding stock.

The issuance of additional stock in connection with acquisitions or otherwise will dilute all other stockholdings.

We are not restricted from issuing additional shares of our Common Stock, or from issuing securities that are convertible into or exchangeable for, or that represent the right to receive, Common Stock. As of July 31, 2024, we had an aggregate of 100.0 million shares of Common Stock authorized and of that approximately 82.8 million shares that are not issued, outstanding or reserved for issuance (for purposes of warrant exercise or under the Company’s

current Incentive Plan). We may issue all of these shares without any action or approval by our stockholders. We may expand our business through complementary or strategic business combinations or acquisitions of other companies and assets, and we may issue shares of Common Stock in connection with those transactions. The market price of our Common Stock could decline as a result of our issuance of a large number of shares of Common Stock, particularly if the per share consideration we receive for the stock we issue is less than the per share book value of our Common Stock or if we are not expected to be able to generate earnings with the proceeds of the issuance that are as great as the earnings per share we are generating before we issue the additional shares. In addition, any shares issued in connection with these activities, the exercise of warrants or stock options or otherwise would dilute the percentage ownership held by our investors. We cannot predict the size of future issuances or the effect, if any, that they may have on the market price of our Common Stock.

We have a history of losses, may not be able to achieve profitability going forward, and may not be able to raise additional capital necessary to continue as a going concern.

We have experienced losses since 2021 and, at December 31, 2023 and 2022, had an accumulated deficit of approximately $305.9 million and $281.6 million, respectively. We may incur additional losses in the future.

As of June 30, 2024, we had cash and cash equivalents of $5.6 million. There are no assurances that we will be able to raise additional capital or on terms favorable to us. Our recurring losses from operations and projected future cash flow requirements raise substantial doubt about our ability to continue as a going concern without sufficient capital resources and we have included explanatory information in the notes to our financial statements for the year ended December 31, 2023, with respect to this uncertainty, and the report of our independent registered public accounting firm dated February 26, 2024 with respect to our audited financial statements for the year ended December 31, 2023 included an emphasis of matter for this as well. Our consolidated financial statements do not include any adjustments that might result from the outcome of this going concern uncertainty and have been prepared under the assumption that we will continue to operate as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

Our ability to continue as a going concern is dependent on our available cash, how well we manage that cash, and our operating requirements. If we are unable to raise additional capital when needed, we could be forced to curtail operations or take other actions such as, implementing additional restructuring and cost reductions, disposing of one or more product lines and/or, selling or licensing intellectual property. If we are unable to continue as a going concern, we may be forced to liquidate our assets, which would have an adverse impact on our business and developmental activities. In such a scenario, the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements.

USE OF PROCEEDS

We estimate that the net proceeds we will receive from the sale of our securities in this offering, assuming all the securities we are offering are sold, after deducting placement agent fees and other estimated offering expenses payable by us, and assuming no sale of any Pre-Funded Warrants and no exercise of the Common Warrants or Placement Agent Warrants being issued in this offering, will be approximately $ , based on an assumed combined public offering price of $ per share and accompanying Common Warrant, which was the closing price for our Common Stock on the Nasdaq Capital Market on _____ __, 2024. If the Common Warrants are exercised in full for cash, the estimated net proceeds will increase to $ . We cannot predict when, or if, the Common Warrants or Placement Agent Warrants will be exercised. It is possible that the Common Warrants and Placement Agent Warrants may expire and may never be exercised for cash.

However, because this is a best efforts offering and there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, the placement agent fees and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth on the cover page of this prospectus, and we may not sell any or all of the securities we are offering. As a result, we may receive significantly less in net proceeds.

We currently intend to use any proceeds from the sale of our securities in this offering for general corporate purposes and working capital. Our expected use of net proceeds from this offering represents our current intentions

based upon our present plans and business condition. The amounts and timing of our actual use of net proceeds will vary depending on numerous factors, including the amount of cash generated or used by our operations. We may temporarily invest the net proceeds in short-term, interest-bearing instruments or other investment-grade securities. We have not determined the amount of net proceeds to be used specifically for such purposes. As a result, management will have broad discretion in the application of the net proceeds, and investors will be relying on our judgment regarding the application of the net proceeds.

DIVIDEND POLICY

We currently intend to retain any future earnings and do not anticipate paying cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend upon our financial condition, operating results, capital requirements, any contractual restrictions and such other factors as our board of directors may deem appropriate.

DILUTION

If you invest in our securities in this offering, your ownership interest may be diluted immediately depending on the difference between the effective public offering price per share of our Common Stock (assuming the exercise for cash of all Pre-Funded Warrants issued in this offering) and the as adjusted net tangible book value per share of our Common Stock immediately after this offering (assuming the exercise for cash of all Pre-Funded Warrants issued in this offering).

Our historical net tangible book value as of June 30, 2024, was $5.6 million, or $0.53 per share of Common Stock, based on 10,625,467 shares of Common Stock outstanding as of that date.

After giving effect to the sale of million shares of Common Stock, or up to Pre-Funded Warrants in lieu of shares of Common Stock (and the full exercise of those warrants), issued by us and after deducting the estimated fees and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2024, would have been $ million, or $ per share. This represents an immediate increase in net tangible book value of $ per share to existing stockholders and immediate dilution of $ per share to the investors in this offering, as illustrated by the following table (which assumes no exercise of the Common Warrants or Placement Agent Warrants).

| | | | | | | | | | | |

Assumed combined public offering price per share and accompanying common warrant | | | $ |

Net tangible book value per share of Common Stock at June 30, 2024 | $ | | 0.53 | |

Pro forma increase in net tangible book value per share attributable to investors participating in this offering | $ | | |

As adjusted net tangible book value per share after giving effect to this offering | | | $ |

Dilution per share to investors participating in this offering | | | $ |

A $0.10 increase in the assumed combined public offering price per share and accompanying Common Warrant would increase the as adjusted net tangible book value by $ per share and result in dilution to investors participating in this offering of $ per share, and a $0.10 decrease in the assumed combined public offering price per share and accompanying Common Warrant would decrease the as adjusted net tangible book value by $ per share and result in dilution to investors participating in this offering by $ per share, in each case assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and assuming no Pre-Funded Warrants are sold in this offering, no exercise of the Common Warrants being offered in this offering, that no value is attributed to such Common Warrants and that such Common Warrants are classified as and accounted for as equity, and after deducting placement agent fees and estimated expenses payable by us.

We may also increase the number of shares being offered by us. An increase of 500,000 shares being offered by us in this offering would increase our as adjusted net tangible book value per share by approximately $ and our as adjusted net tangible book value per share would be $ , representing a decrease in as adjusted net tangible book value per share to investors participating in this offering of $ . A decrease of 500,000 shares offered by us in

this offering would decrease our as adjusted net tangible book value per share by approximately $ resulting in an as adjusted net tangible book value per share of $ and a decrease in as adjusted net tangible book value per share to investors participating in this offering of $ per share. The foregoing calculations assume that the combined public offering price remains the same, and are after deducting placement agent fees and estimated expenses payable by us.

The table and discussion above are based on 10,625,467 shares of Common Stock issued and outstanding as of June 30, 2024, and exclude the following, all as of June 30, 2024:

•8,848 shares of our Common Stock related to stock options issuable upon exercise, with a weighted-average exercise price of $26.89 per share;

•845,000 shares of our Common Stock issuable upon the exercise of the May 2024 Pre-Funded Warrants;

•2,465,060 shares of our Common Stock issuable upon the exercise of outstanding warrants with exercise prices ranging from $2.06 to $21.20 per share; and

•up to an aggregate of 3,113,598 shares of our Common Stock reserved for future grant or issuance under our Amended and Restated Omnibus Equity Incentive Plan (the “Incentive Plan”), and our Employee Stock Purchase Plan (the “ESPP”).