Solar Capital Ltd. (NASDAQ: SLRC), today reported earnings

of $35.8 million, or $0.81 per share for the quarter ended

March 31, 2013. Net investment income for the quarter

was $25.5 million or $0.58 per share. At March 31, 2013, net

asset value (NAV) per share was $23.00, representing a 1.3%

increase from December 31, 2012.

Solar Capital Ltd. (the “Company”) also announced that its Board

of Directors has declared a second quarter dividend

of $0.60 per share payable on July 1, 2013 to

stockholders of record on June 20, 2013. The Company expects

the dividend to be paid from taxable earnings with specific tax

characteristics reported to stockholders after the end of the 2013

calendar year.

HIGHLIGHTS:

At March 31, 2013: Investment Portfolio: $1.4 billion Number of

Portfolio Companies: 40 Net Assets: $1.0 billion Net Asset Value

per share: $23.00 Portfolio Activity for the Quarter Ended

March 31, 2013: Investments made during the quarter: $75.0 million

Investments repaid and sold during the quarter: $69.3 million

Operating Results for the Quarter Ended March 31, 2013: Net

investment income: $25.5 million Net realized and unrealized gains:

$10.3 million Net increase in net assets from operations: $35.8

million Net investment income per share: $0.58

“We are pleased with our Q1 results which reflect the first

quarter of income generated from our investment in Crystal

Financial. The underlying performance and credit quality of our

overall portfolio continues to be strong,” said Michael Gross,

Chairman and CEO of Solar Capital Ltd. “Over the last couple of

years, we have steered the portfolio towards a higher proportion of

secured loans and floating rate investments in a conscious effort

to be more defensive and more broadly diversified. In the current

frothy credit markets, we are maintaining our patient and prudent

approach to making investments that we believe meet our stringent

risk-return requirements.”

Conference Call and

Webcast

The company will host an earnings conference call and audio

webcast at 10:00 a.m. (Eastern Time) on Wednesday, May 8, 2013.

All interested parties may participate in the conference call by

dialing (800) 299-9086 approximately 5-10 minutes prior to the

call. International callers should dial (617) 786-2903.

Participants should reference Solar Capital Ltd. and the

participant passcode of 94312147 when prompted. Following the call

you may access a replay of the event via audio webcast. This

conference call will be broadcast live over the Internet and can be

accessed by all interested parties through Solar Capital’s

website, www.solarcapltd.com. Additionally, a replay dial-in

will be available until May 22, 2013 and can be accessed

by dialing (888) 286-8010 and using the passcode 66486071.

International callers should dial (617) 801-6888. To listen to the

live call, please go to the Company's website at least 15 minutes

prior to the start of the call to register and download any

necessary audio software. For those who are not able to listen to

the live broadcast, a replay will be available shortly after the

call on the Solar Capital website.

Portfolio and Investment

Activity

During the quarter ended March 31, 2013, we invested

$75.0 million across 3 portfolio companies. Investments sold

or repaid during the quarter ended March 31, 2013 totaled

$69.3 million.

At March 31, 2013, our portfolio consisted of 40 portfolio

companies and was invested in 22 industries. At the end of this

same period, the fair value weighted average yield on our portfolio

of debt investments was 13.3%.

At March 31, 2013, 98% of our portfolio was performing

measured at fair value with one investment, Rug Doctor Inc., on

non-accrual status.

Solar Capital Ltd. and its predecessor companies have invested

approximately $3.0 billion in 85 portfolio companies. Over the same

period, Solar Capital Ltd. has completed transactions with more

than 70 different financial sponsors.

Crystal Capital Financial Holdings

LLC

On December 28, 2012, we completed the acquisition of

Crystal Capital Financial Holdings LLC (“Crystal Financial”), a

commercial finance company focused on providing asset-based and

other secured financing solutions.

At the time of closing on December 28, 2012, Crystal

Financial had 25 loans outstanding to 22 different borrowers with a

total par value of approximately $400 million. As of March 31,

2013, Crystal Financial had 26 loans outstanding to 21 different

borrowers with a total par value of approximately $411.4 million.

All loans were floating rate with the largest loan outstanding

totaling $39.3 million. The average loan size was $15.8 million and

none of the loans were on non-accrual status. Crystal Financial’s

credit facility, which is non-recourse to Solar Capital Ltd., had

approximately $158.4 million of borrowings outstanding at March 31,

2013.

Results of Operations for the Three

Months Ended March 31, 2013 compared to the Three Months Ended

March 31, 2012.

Investment Income

For the quarters ended March 31, 2013 and 2012, gross investment

income totaled $46.1 million and $36.3 million, respectively. The

increase in gross investment income for the three months ended

March 31, 2013 as compared to the three months ended March 31, 2012

was primarily due to an increase in the average size of the

income-producing portfolio.

Expenses

Operating expenses totaled $20.6 million and $15.0 million,

respectively, for the quarters ended March 31, 2013 and 2012. The

increase in operating expenses for the three months ended March 31,

2013 as compared to the three months ended March 31, 2012 was

primarily due to significant growth in our portfolio of assets and

our business in general.

Net Investment Income

The Company’s net investment income totaled $25.5 million and

$21.1 million, or $0.58 and $0.58 per average share, for the three

months ended March 31, 2013 and 2012, respectively.

Net Realized Gain

Net realized gain for the three months ended March 31, 2013

and 2012 totaled $0.7 million and $9.2 million, respectively. Net

realized gain for the three months ended March 31, 2013 was

primarily related to sales of selected assets. The net realized

gain for the three months ended March 31, 2012 was primarily

related to the exit of our equity investment in National Specialty

Alloys.

Net Change in Unrealized Gain

For the three months ended March 31, 2013 and 2012, net

change in unrealized gain on the Company’s assets and liabilities

totaled $9.6 million and $15.9 million, respectively. Net

unrealized gain for the three months ended March 31, 2013 was

primarily attributable to net improvements in capital market

conditions. During the three months ended March 31, 2012,

unrealized gain was primarily attributable to general market

improvements, modest yield tightening and overall positive net

changes in general portfolio company fundamentals.

Net Increase in Net Assets Resulting From Operations

For the three months ended March 31, 2013 and 2012, the

Company had a net increase in net assets resulting from operations

of $35.8 million and $46.2 million, respectively. For the three

months ended March 31, 2013 and 2012, basic and diluted

earnings per average share were $0.81 and $1.26, respectively.

Liquidity and Capital Resources

As of March 31, 2013, we had a total of $446.2 million of

unused borrowing capacity under our revolving credit facilities,

subject to borrowing base limits.

On January 11, 2013, the Company closed a follow-on public

equity offering of 6.3 million shares of common stock at

$24.40 per share raising approximately $146.9 million in net

proceeds. The primary uses of the funds raised are for investments

in portfolio companies, reductions in revolving debt outstanding

and for other general corporate purposes.

Financial Statements and

Tables

SOLAR CAPITAL LTD.

CONSOLIDATED STATEMENTS OF ASSETS AND LIABILITIES (in

thousands, except share amounts)

March 31, 2013

(unaudited)

December 31, 2012

Assets Investments at fair value: Companies

less than 5% owned (cost: $869,415 and $856,134, respectively) $

840,361 $ 831,306 Companies 5% to 25% owned (cost: $173,743 and

$167,564, respectively) 172,983 165,406 Companies more than 25%

owned (cost: $406,222 and $408,373, respectively) 408,054

398,810 Total investments (cost: $1,449,380

and $1,432,071, respectively) 1,421,398 1,395,522 Cash 11,645

14,133 Foreign currency (cost: $920 and $899, respectively) 884 906

Interest and dividends receivable 22,130 15,147 Deferred offering

costs 423 450 Deferred financing costs 4,133 4,228 Derivatives 16

17 Receivable for investments sold 655 — Prepaid expenses and other

assets 1,427 —

Total assets

1,462,711 1,430,403

Liabilities

Revolving credit facilities 128,793 264,452 Unsecured senior notes

100,000 100,000 Senior secured notes 75,000 75,000 Term loan 50,000

50,000 Dividends payable 26,984 23,217 Payable for investments

purchased 29,604 21,756 Management fee payable 7,134 6,612

Performance-based incentive fee payable 6,380 6,050 Interest

payable 3,431 2,406 Administrative services fee payable 316 1,058

Other liabilities and accrued expenses 556

1,579

Total liabilities 428,198

552,130

Net Assets Common stock, par value $0.01 per

share, 200,000,000 and 200,000,000 common shares authorized,

respectively, and 44,973,532 and 38,694,060 shares issued and

outstanding, respectively 450 387 Paid-in capital in excess of par

1,125,634 978,279 Distributions in excess of net investment income

(6,127 ) (4,662 ) Accumulated net realized loss (54,942 ) (55,631 )

Net unrealized depreciation (30,502

)

(40,100 )

Total net assets $ 1,034,513 $

878,273

Net Asset Value Per Share $ 23.00 $

22.70

SOLAR CAPITAL

LTD. CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

(in thousands, except share amounts) Three months

endedMarch 31, 2013 Three months endedMarch

31, 2012 INVESTMENT INCOME: Interest and

dividends: Companies more than 25% owned $ 10,474 $ 1,082 Companies

5% to 25% owned 7,060 — Companies less than 5% owned 28,563

35,227 Total investment income 46,097

36,309

EXPENSES: Management fees 7,134

5,278 Performance-based incentive fees 6,380 5,275 Interest and

other credit facility expenses 4,823 2,695 Administrative services

expense 727 696 Other general and administrative expenses

1,514 1,009 Total operating expenses 20,578

14,953 Income tax expense — 257 Total

expenses 20,578 15,210 Net investment

income 25,519 21,099

REALIZED AND UNREALIZED GAIN (LOSS)

ON

INVESTMENTS, FOREIGN

CURRENCIES AND DERIVATIVES:

Net realized gain (loss) on investments: Companies more than 25%

owned $ 472 $ 11,002 Companies 5% to 25% owned — — Companies less

than 5% owned 228 (725 ) Net realized gain on

investments 700 10,277 Net realized loss on foreign currencies and

derivatives: (11 ) (326 ) Total net realized gain

before income taxes 689 9,951 Income

tax expense — 785 Net realized gain

689 9,166 Net change in unrealized gain

on investments 8,568 18,834 Net change in unrealized gain (loss) on

foreign currencies andderivatives 1,030 (2,941

) Net change in unrealized gain 9,598 15,893

Net realized and unrealized gain on investments, foreign

currencies and derivatives 10,287 25,029

NET INCREASE IN NET ASSETS RESULTING

FROM OPERATIONS

$ 35,806 $ 46,158

EARNINGS PER SHARE $ 0.81

$ 1.26

About Solar Capital Ltd.

Solar Capital Ltd. is a closed-end investment company that has

elected to be treated as a business development company under the

Investment Company Act of 1940. The Company invests primarily in

leveraged, middle market companies in the form of senior secured

loans, mezzanine loans, and equity securities.

Forward-Looking

Statements

Statements included herein may constitute “forward-looking

statements,” which relate to future events or our future

performance or financial condition. These statements are not

guarantees of future performance, conditions or results and involve

a number of risks and uncertainties. Actual results may differ

materially from those in the forward-looking statements as a result

of a number of factors, including those described from time to time

in our filings with the Securities and Exchange Commission. Solar

Capital Ltd. undertakes no duty to update any forward-looking

statements made herein.

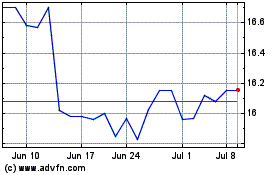

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

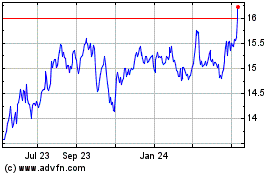

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Jul 2023 to Jul 2024