Total revenue of $18.3 million and diluted

earnings per share (EPS) of $0.20

Maintains full-year revenue guidance of $66 to

$69 million (+10-15%) and EPS guidance of $0.66 to $0.68

Simulations Plus, Inc. (NASDAQ: SLP) (“Simulations Plus”), a

leading provider of modeling and simulation software and services

for pharmaceutical safety and efficacy, today reported financial

results for its second quarter fiscal 2024, ended February 29,

2024.

Second Quarter 2024 Financial Highlights (compared to second

quarter 2023)

- Total revenue increased 16% to $18.3 million

- Software revenue increased 11% to $11.6 million, representing

63% of total revenue

- Services revenue increased 27% to $6.7 million, representing

37% of total revenue

- Gross profit increased to $13.2 million; gross margin was

72%

- Adjusted EBITDA of $7.1 million, representing 39% of total

revenue

- Net income of $4.0 million and diluted earnings per share (EPS)

of $0.20 versus net income of $4.2 million and diluted EPS of

$0.20

Six Months 2024 Financial Highlights (compared to six months

2023)

- Total revenue increased 18% to $32.8 million

- Software revenue increased 16% to $19.2 million

- Services revenue increased 22% to $13.6 million

- Gross profit increased 3% to $23.1 million; gross margin was

70%

- Adjusted EBITDA of $10.5 million, representing 32% of total

revenue

- Net income of $6.0 million and diluted EPS of $0.29 versus net

income of $5.4 million and diluted EPS of $0.26

Management Commentary

“Our second quarter results reflected strong performance in both

our software and services segments,” said Shawn O’Connor, Chief

Executive Officer of Simulations Plus. “Total revenue increased

16%, driven by higher software revenues in our Clinical

Pharmacology & Pharmacometrics (CPP) business unit and the

Cheminformatics business unit, whose ADMET Predictor®

platform continued to gain adoption and added another new

Artificial Intelligence (AI) biotech customer in the second

quarter. Services revenue growth was primarily driven by higher

revenues in our Quantitative Systems Pharmacology (QSP) and

Physiologically Based Pharmacokinetics (PBPK) business units.

“Since the beginning of calendar 2024, we have seen encouraging

signs in biotech funding with notable strength from biotech

companies that have candidates undergoing clinical trials.

Regarding large pharmaceutical companies, funding continues to vary

depending on their near-term direction and business outlook, but

the overall market is healthier compared to a year ago. For the

balance of 2024, we remain cautiously optimistic that demand for

our comprehensive suite of modeling and simulation software

products and services will continue to gain momentum as the funding

environment improves.

“During the quarter, we also launched our corporate development

initiative to intensify our focus on strategic investments and

partnerships in early-state technology companies. While strategic

acquisitions to complement organic growth remain a priority, we

believe there are hidden gems among early-stage companies

developing high-potential technologies. We believe that our ability

to identify and evaluate commercial applications for emerging

technologies will complement our own R&D efforts and position

Simulations Plus at the forefront of innovation.

“Our strong performance in the first half of the year, combined

with market improvement, puts us on track to achieve our guidance

for fiscal 2024. We entered the third quarter with a healthy

pipeline and a solid balance sheet, and we are confident that

Simulations Plus is firmly positioned to advance its critical role

in drug development workflow. Our unwavering focus remains on

delivering disciplined growth and achieving long-term returns for

our shareholders.”

Fiscal 2024 Guidance

Fiscal 2024 Guidance

Annual Increase

Revenue

$66M - $69M

10 - 15%

Software mix

55 - 60%

—

Services mix

40 - 45%

—

Diluted earnings per share

$0.66 - $0.68

35 - 39%

Quarterly Dividend

The Company’s Board of Directors declared a cash dividend of

$0.06 per share of the Company’s common stock, payable on May 6,

2024, to shareholders of record as of April 29, 2024. The

declaration of any future dividends will be determined by the Board

of Directors each quarter and will depend on earnings, financial

condition, capital requirements, and other factors.

Environmental, Social, and Governance

We focus our Environmental, Social, and Governance (ESG) efforts

where we can have the most positive impact. To learn more about our

latest initiatives and priorities, please visit our website to read

our 2023 ESG update.

Webcast and Conference Call Details

Shawn O’Connor, chief executive officer, and Will Frederick,

chief financial and operations officer, will host a conference call

and webcast today at 5 p.m. Eastern Time to discuss the details of

the Company’s performance for the quarter and certain

forward-looking information. The call may be accessed by

registering here or by calling 1-877-451-6152 (domestic) or

1-201-389-0879 (international) or by clicking on this Call me™ link

to request a return call. The webcast will be available on our

website under Conference Calls & Presentations. A replay of the

webcast will be available on the website approximately one hour

following the call.

Non-GAAP Definitions

Adjusted EBITDA

Adjusted EBITDA is defined as earnings (loss) before interest,

taxes, depreciation and amortization, stock-based compensation,

(gain) loss on currency exchange, any acquisition- or

financial-transaction-related expenses, and any asset impairment

charges. Currency exchange excluded represents the exchange rate

fluctuations on the foreign currency denominated transactions. The

impact of transactions in foreign currency represents the effect of

converting revenue and expenses occurring in a currency other than

the functional currency. The Company believes that the non-GAAP

financial measures presented facilitate an understanding of

operating performance and provide a meaningful comparison of its

results between periods. The Company’s management uses non-GAAP

financial measures to, among other things, evaluate its ongoing

operations in relation to historical results, for internal planning

and forecasting purposes and in the calculation of

performance-based compensation. Adjusted EBITDA represents a

measure that we believe is customarily used by investors and

analysts to evaluate the financial performance of companies in

addition to the GAAP measures that we present. Our management also

believes that Adjusted EBITDA is useful in evaluating our core

operating results. However, Adjusted EBITDA is not a measure of

financial performance under accounting principles generally

accepted in the United States of America and should not be

considered an alternative to net income or operating income as an

indicator of our operating performance or to net cash provided by

operating activities as a measure of our liquidity. The Company’s

Adjusted EBITDA measure may not provide information that is

directly comparable to that provided by other companies in its

industry, as other companies in its industry may calculate non-GAAP

financial results differently, particularly related to

nonrecurring, unusual items.

Adjusted Diluted EPS

Adjusted diluted EPS is calculated based on net income excluding

the impact of any acquisition- or financial-transaction-related

expenses, any asset impairment charges, and tax provisions /

benefits related to the previous items. The Company excludes the

above items because they are outside of the Company’s normal

operations and/or, in certain cases, are difficult to forecast

accurately for future periods.

The Company believes that the use of non-GAAP measures helps

investors to gain a better understanding of the Company’s core

operating results and future prospects, consistent with how

management measures and forecasts the Company’s performance,

especially when comparing such results to previous periods or

forecasts.

About Simulations Plus

Serving clients worldwide for more than 25 years, Simulations

Plus is a leading provider in the biosimulation market providing

software and consulting services supporting drug discovery,

development, research, and regulatory submissions. We offer

solutions that bridge artificial intelligence (AI)/machine

learning, physiologically based pharmacokinetics, quantitative

systems pharmacology/toxicology, and population PK/PD modeling

approaches. Our technology is licensed and applied by major

pharmaceutical, biotechnology, and regulatory agencies worldwide.

For more information, visit our website at

www.simulations-plus.com. Follow us on LinkedIn | X | YouTube.

Forward-Looking Statements

Except for historical information, the matters discussed in this

press release are forward-looking statements that involve risks and

uncertainties. Words like “believe,” “expect,” and “anticipate”

mean that these are our best estimates as of this writing, but

there can be no assurances that expected or anticipated results or

events will actually take place, so our actual future results could

differ significantly from those statements. Factors that could

cause or contribute to such differences include, but are not

limited to: our ability to successfully integrate the Immunetrics

business with our own, as well as expenses we may incur in

connection therewith, our ability to maintain our competitive

advantages, acceptance of new software and improved versions of our

existing software by our customers, the general economics of the

pharmaceutical industry, our ability to finance growth, our ability

to continue to attract and retain highly qualified technical staff,

market conditions, macroeconomic factors, and a sustainable market.

Further information on our risk factors is contained in our

quarterly and annual reports and filed with the U.S. Securities and

Exchange Commission.

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Unaudited)

Three Months Ended

Six Months Ended

(in thousands, except per common share

amounts)

February 29, 2024

February 28, 2023

February 29, 2024

February 28, 2023

Revenues

Software

$

11,614

$

10,487

$

19,203

$

16,561

Services

6,691

5,263

13,602

11,153

Total revenues

18,305

15,750

32,805

27,714

Cost of revenues

Software

1,348

843

2,339

1,728

Services

3,736

1,777

7,397

3,563

Total cost of revenues

5,084

2,620

9,736

5,291

Gross profit

13,221

13,130

23,069

22,423

Operating expenses

Research and development

1,312

1,317

2,529

2,483

Sales and marketing

1,949

1,730

3,938

3,215

General and administrative

5,518

6,049

11,200

11,813

Total operating expenses

8,779

9,096

17,667

17,511

Income from operations

4,442

4,034

5,402

4,912

Other income

810

1,034

2,256

1,774

Income before income taxes

5,252

5,068

7,658

6,686

Provision for income taxes

(1,223

)

(894

)

(1,684

)

(1,267

)

Net income

$

4,029

$

4,174

$

5,974

$

5,419

Earnings per share

Basic

$

0.20

$

0.21

$

0.30

$

0.27

Diluted

$

0.20

$

0.20

$

0.29

$

0.26

Weighted-average common shares

outstanding

Basic

19,975

20,112

19,961

20,200

Diluted

20,315

20,529

20,288

20,657

Other comprehensive (loss) income, net

of tax

Foreign currency translation

adjustments

(15

)

(23

)

(69

)

30

Comprehensive income

$

4,014

$

4,151

$

5,905

$

5,449

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(Audited)

(in thousands, except share and per share

amounts)

February 29, 2024

August 31, 2023

ASSETS

Current assets

Cash and cash equivalents

$

37,031

$

57,523

Accounts receivable, net of allowance for

credit losses of $30 and $46

13,114

10,201

Prepaid income taxes

1,364

804

Prepaid expenses and other current

assets

4,975

3,904

Short-term investments

71,473

57,940

Total current assets

127,957

130,372

Long-term assets

Capitalized computer software development

costs, net of accumulated amortization of $17,962 and $17,199

12,333

11,335

Property and equipment, net

843

671

Operating lease right-of-use assets

1,062

1,247

Intellectual property, net of accumulated

amortization of $10,117 and $9,301

7,873

8,689

Other intangible assets, net of

accumulated amortization of $2,606 and $2,107

12,935

12,825

Goodwill

19,099

19,099

Long-term investments

9,024

—

Deferred tax assets

2,323

1,438

Other assets

524

425

Total assets

$

193,973

$

186,101

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

360

$

144

Accrued compensation

3,184

4,392

Accrued expenses

2,992

659

Contracts payable

5,110

3,250

Operating lease liability - current

portion

425

442

Deferred revenue

2,457

3,100

Total current liabilities

14,528

11,987

Long-term liabilities

Operating lease liability

607

755

Contracts payable – net of current

portion

1,800

3,330

Total liabilities

16,935

16,072

Commitments and contingencies

—

—

Shareholders' equity

Preferred stock, $0.001 par value -

10,000,000 shares authorized; no shares issued and outstanding

$

—

$

—

Common stock, $0.001 par value and

additional paid-in capital —50,000,000 shares authorized;

19,983,703 and 19,937,961 shares issued and outstanding

148,472

144,974

Retained earnings

28,776

25,196

Accumulated other comprehensive loss

(210

)

(141

)

Total shareholders' equity

177,038

170,029

Total liabilities and shareholders'

equity

$

193,973

$

186,101

SIMULATIONS PLUS, INC.

Trended Financial

Information*

(Unaudited)

(in millions except earnings per share

amounts)

FY 2022

FY 2023

FY 2024

FY 2022

FY 2023

FY 2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Full Year

Full Year

YTD

Revenue

Software

$

7.4

$

9.8

$

9.6

$

5.9

$

6.1

$

10.5

$

10.6

$

9.3

$

7.6

$

11.6

$

32.7

$

36.5

$

19.2

Services

5.0

5.0

5.3

5.8

5.9

5.3

5.6

6.3

6.9

6.7

21.2

23.1

13.6

Total

$

12.4

$

14.8

$

15.0

$

11.7

$

12.0

$

15.8

$

16.2

$

15.6

$

14.5

$

18.3

$

53.9

$

59.6

$

32.8

Gross

Margin

Software

90.0

%

92.0

%

92.4

%

86.1

%

85.4

%

92.0

%

91.5

%

89.4

%

86.9

%

88.4

%

90.6

%

90.1

%

87.8

%

Services

60.0

%

59.3

%

65.6

%

68.2

%

69.7

%

66.2

%

63.4

%

62.1

%

47.0

%

44.2

%

63.5

%

65.3

%

45.6

%

Total

77.8

%

80.9

%

82.9

%

77.2

%

77.7

%

83.4

%

81.8

%

78.4

%

67.9

%

72.2

%

79.9

%

80.5

%

70.3

%

Income from operations

$

3.8

$

5.5

$

4.9

$

0.7

$

0.9

$

4.0

$

4.1

$

(0.3

)

$

1.0

$

4.4

$

14.9

$

8.7

$

5.4

Operating Margin

30.6

%

37.0

%

33.1

%

5.9

%

7.3

%

25.6

%

25.2

%

-1.8

%

6.6

%

24.3

%

27.7

%

14.6

%

16.5

%

Net Income

$

3.0

$

4.4

$

4.1

$

1.0

$

1.2

$

4.2

$

4.0

$

0.5

$

1.9

$

4.0

$

12.5

$

10.0

$

6.0

Diluted Earnings Per Share

$

0.15

$

0.21

$

0.20

$

0.05

$

0.06

$

0.20

$

0.20

$

0.03

$

0.10

$

0.20

$

0.60

$

0.49

$

0.29

Adjusted EBITDA

$

5.3

$

7.2

$

6.5

$

2.5

$

3.0

$

6.2

$

6.5

$

4.9

$

3.4

$

7.1

$

21.5

$

20.6

$

10.5

Adjusted Diluted EPS

$

0.15

$

0.21

$

0.20

$

0.06

$

0.07

$

0.21

$

0.21

$

0.18

$

0.10

$

0.20

$

0.61

$

0.67

$

0.10

Cash Flow from Operations

$

3.6

$

2.6

$

3.8

$

7.9

$

4.7

$

5.5

$

8.5

$

3.1

$

0.2

$

5.8

$

17.9

$

21.9

$

6.0

Revenue Breakdown

by Region

Americas

$

8.5

$

9.7

$

11.2

$

8.4

$

8.5

$

10.6

$

10.8

$

11.0

$

10.9

$

12.5

$

37.7

$

40.8

$

23.4

EMEA

3.0

3.7

1.9

1.7

2.1

3.6

3.4

2.6

2.3

4.7

10.4

11.7

7.0

Asia Pacific

0.9

1.4

1.9

1.6

1.3

1.5

2.1

2.1

1.3

1.2

5.8

7.0

2.5

Total

$

12.4

$

14.8

$

15.0

$

11.7

$

12.0

$

15.8

$

16.2

$

15.6

$

14.5

$

18.3

$

53.9

$

59.6

$

32.8

Software

Performance Metrics

Average Revenue per Customer (in

thousands)

Commercial

$

71

$

101

$

95

$

65

$

68

$

110

$

97

$

88

$

79

$

113

Services

Performance Metrics

Backlog (in millions)

$

15.4

$

17.0

$

16.7

$

15.9

$

15.8

$

15.4

$

15.7

$

19.5

$

18.9

$

18.0

*Numbers may not add due to rounding

SIMULATIONS PLUS, INC.

Reconciliation of Adjusted

EBITDA to Net Income*

(Unaudited)

(in millions)

FY 2022

FY 2023

FY 2024

FY 2022

FY 2023

FY 2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Full Year

Full Year

YTD

Net Income

$

3.0

$

4.4

$

4.1

$

1.0

$

1.2

$

4.2

$

4.0

$

0.5

$

1.9

$

4.0

$

12.5

$

10.0

$

6.0

Excluding:

Interest income and expense, net

(0.1

)

(0.1

)

(0.1

)

(0.4

)

(0.8

)

(1.0

)

(1.1

)

(1.3

)

(1.3

)

(1.3

)

(0.7

)

(4.1

)

(2.6

)

Provision for income taxes

0.8

1.1

0.7

(0.1

)

0.4

0.9

0.9

(0.5

)

0.5

1.2

2.6

1.7

1.7

Depreciation and amortization

0.8

1.0

0.9

0.9

0.9

0.9

0.9

1.1

1.1

1.1

3.6

3.9

2.2

Stock-based compensation

0.6

0.7

0.7

0.7

0.9

1.2

1.1

1.1

1.3

1.6

2.7

4.2

2.9

(Gain) loss on currency exchange

(0.1

)

(0.1

)

0.2

0.2

—

—

0.3

0.2

—

0.1

0.2

0.5

0.1

Impairment of other intangibles

—

—

—

—

—

—

—

0.5

—

—

—

0.5

—

Change in value of contingent

consideration

0.1

0.1

—

—

—

—

—

0.7

(0.1

)

0.4

0.3

0.7

0.3

Mergers & Acquisitions expense

—

—

—

0.3

0.3

0.1

0.4

2.5

—

—

0.3

3.3

—

Adjusted EBITDA

$

5.3

$

7.2

$

6.5

$

2.5

$

3.0

$

6.2

$

6.5

$

4.9

$

3.4

$

7.1

$

21.5

$

20.6

$

10.5

*Numbers may not add due to rounding

SIMULATIONS PLUS, INC.

Reconciliation of Adjusted

Diluted EPS to Diluted EPS*

(Unaudited)

(in millions, except Diluted EPS and

Adjusted Diluted EPS)

FY 2022

FY 2023

FY 2024

FY 2022

FY 2023

FY 2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Full Year

Full Year

YTD

Net Income (GAAP)

$

3.0

$

4.4

$

4.1

$

1.0

$

1.2

$

4.2

$

4.0

$

0.5

$

1.9

$

4.0

$

12.5

$

10.0

$

6.0

Excluding:

Mergers & Acquisitions expense

—

—

—

0.3

0.3

0.1

0.4

0.9

—

—

0.3

1.7

—

Immunetrics transaction costs

—

—

—

—

—

—

—

2.3

—

—

—

2.3

—

Cognigen trade name write-off

—

—

—

—

—

—

—

0.5

—

—

—

0.5

—

Tax effect on above adjustments

—

—

—

(0.1

)

(0.1

)

—

(0.1

)

(0.5

)

—

—

(0.1

)

(0.7

)

—

Adjusted Net income (Non-GAAP)

$

3.0

$

4.4

$

4.1

$

1.2

$

1.5

$

4.2

$

4.3

$

3.7

$

1.9

$

4.0

$

12.8

$

13.8

$

6.0

Weighted-average common shares

outstanding:

Diluted

20.7

20.7

20.8

20.9

20.8

20.5

20.4

20.4

20.3

20.3

20.7

20.5

20.3

Diluted EPS (GAAP)

$

0.15

$

0.21

$

0.20

$

0.05

$

0.06

$

0.20

$

0.20

$

0.03

$

0.10

$

0.20

$

0.60

$

0.49

$

0.29

Adjusted Diluted EPS (Non-GAAP)

$

0.15

$

0.21

$

0.20

$

0.06

$

0.07

$

0.21

$

0.21

$

0.18

$

0.10

$

0.20

$

0.61

$

0.67

$

0.29

*Numbers may not add due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240403155229/en/

Investor Relations Contacts: Lisa Fortuna Financial

Profiles 310-622-8251 slp@finprofiles.com

Renee Bouche Simulations Plus Investor Relations 661-723-7723

renee.bouche@simulations-plus.com

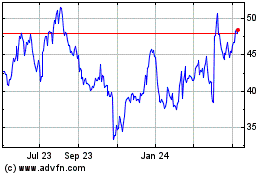

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Oct 2024 to Nov 2024

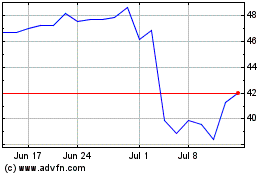

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Nov 2023 to Nov 2024