The Simply Good Foods Company (Nasdaq: SMPL) (“Simply Good Foods,”

or the “Company”), a developer, marketer and seller of branded

nutritional foods and snacking products, today reported financial

results for the fourteen and fifty-three weeks ended August 31,

2024. The acquisition of Only What You Need, Inc. ("OWYN") was

completed on June 13, 2024; therefore, the Company's fourth quarter

and full fiscal year 2024 results include approximately eleven

weeks of OWYN performance. The reference to "legacy" Simply Good

Foods in this press release encompasses Simply Good Foods' business

excluding OWYN.

Fourth Quarter

Summary:(1)

- Net sales of

$375.7 million versus

$320.4 million

- Net income of

$29.3 million versus

$36.6 million

- Earnings per diluted share

(“EPS”) of $0.29 versus

$0.36

- Adjusted Diluted

EPS(2) of

$0.50 versus

$0.45

- Adjusted

EBITDA(3) $77.5 million

versus $67.3 million

Full Fiscal Year

2025(3,4) Outlook:

- Net sales expected to

increase 8.5% to 10.5%

- OWYN full fiscal year 2025 Net Sales expected to be in

the $135-145 million range

- Adjusted

EBITDA(3) expected to increase 4%

to 6%

- The fifty-third week in the

fiscal 2024 comparison year is about a 2-percentage point headwind

to both Net Sales and Adjusted EBITDA growth in full year fiscal

2025 and is incorporated in the outlook above

- Assuming a comparable full

year of OWYN results are included in fiscal 2024, as well as the

exclusion of the fifty-third week in fiscal 2024, fiscal 2025 is

expected to be in line with the Company's long-term algorithm; net

sales growth in the 4-6% range and Adjusted EBITDA growth slightly

greater than the net sales increase

"In fiscal 2024, the Simply Good Foods team

delivered on our strategic initiatives driving solid retail

takeaway gains that resulted in full year volume driven legacy(5)

net sales growth of about 5% and an increase of Adjusted EBITDA of

nearly 10%," said Geoff Tanner, President and Chief Executive

Officer of the Company. "OWYN marketplace momentum was strong and

the brand's fourth quarter net sales and earnings contribution to

the Company's overall results was at the high end of our estimates.

Fourth quarter legacy(5) net sales increased 8.1%, including the

benefit of the extra week, and combined with solid cost controls,

resulted in strong gross margin and total Company Adjusted EBITDA

growth of 15%."

"In fiscal 2025, we will build on our existing

capabilities to strengthen the position of our brands in the

marketplace. We are increasing Quest chips capacity and anticipate

that chips retail inventory levels will be back at normal levels by

the end of the first quarter. This should position us for solid

chips growth in the upcoming new year, new you season. While early,

Quest bake shop products are doing well and in February we will

launch the new Quest "Overload" bar, supported with strong

advertising and marketing, that should improve our marketplace

trends in this segment. Atkins revitalization plans are progressing

as planned and the launch of core bar and shake innovation is

tracking well. OWYN results continue to be strong, and the

integration is proceeding as planned. We will continue to invest in

our business and are committed to our vision of being a leader in

the nutritional snacking category with brands that are well

positioned to win over the near and long-term," Tanner

concluded.

Fourth Quarter 2024

Results(1)

Net sales increased $55.3 million, or 17.2%, to

$375.7 million. The OWYN acquisition closed on June 13, 2024, and

was a 9.1 percentage point contribution to net sales growth. Legacy

net sales increased 8.1%, including the extra week that was about a

7.7 percentage point benefit. Legacy North America net sales

increased 8.8% driven by Quest, and the international business

declined 12.3% compared to fourth quarter 2023.

Total Simply Good Foods fourth quarter retail

takeaway(6) in the combined measured and unmeasured channels

increased 8% driven by strong OWYN point-of-sales growth of about

80%. Legacy retail takeaway growth slightly moderated to

approximately 4%, primarily due to temporary Quest chips capacity

constraints.

Gross profit was $146.0 million for the fourth

quarter of fiscal 2024, an increase of $25.5 million from the year

ago period. The increase in gross profit was driven by lower legacy

business ingredient and packaging costs, the inclusion of OWYN, and

the extra week in the fiscal year. This was partially offset by a

non-cash $3.2 million inventory purchase accounting step-up

adjustment related to the OWYN acquisition. As a result, gross

margin was 38.8%, a 120 basis points increase versus last year. The

non-cash inventory purchase accounting step-up adversely affected

gross margin by 90 basis points.

In the fourth quarter of fiscal 2024, the

Company reported net income of $29.3 million compared to $36.6

million for the comparable period of fiscal 2023. Higher operating

profit was offset by costs related to the OWYN acquisition.

Operating expenses of $98.1 million increased

$33.4 million versus the comparable period of fiscal 2023. Selling

and marketing expenses increased $10.0 million to $40.8 million

primarily due to increased investments in marketing growth

initiatives and the inclusion of OWYN. General and administrative

("G&A") expenses of $41.3 million increased $11.8 million

compared to the year ago period primarily due to higher

employee-related costs, stock-based compensation, corporate

expenses and the inclusion of OWYN. Excluding stock-based

compensation of $5.2 million, executive transition costs of $3.2

million, as well as integration and other non-recurring costs of

$0.7 million, fourth quarter fiscal year 2024 G&A increased

$8.7 million to $32.2 million.

In the fourth quarter of fiscal 2024, the

Company incurred costs related to the OWYN acquisition of $11.8

million.

Net interest income and interest expense was

$8.0 million, an increase of $1.6 million versus the fourth quarter

of fiscal 2023. The interest expense component increase versus the

year ago period is primarily driven by a higher debt balance due to

the OWYN acquisition.

Adjusted EBITDA(3), a non-GAAP financial measure

used by the Company that makes certain adjustments to net income

calculated under GAAP, was $77.5 million versus $67.3 million in

the year ago period.

In the fourth quarter of fiscal 2024, the

Company reported earnings per diluted share (“Diluted EPS”) of

$0.29 versus $0.36 in the year ago period. The number of diluted

weighted average total shares outstanding in the fourth quarter of

fiscal 2024 were approximately 101.4 million versus

100.9 million in the year ago period.

Adjusted Diluted EPS(2), a non-GAAP financial

measure used by the Company that makes certain adjustments to

Diluted EPS calculated under GAAP, was $0.50 versus $0.45 in the

year ago period.

Fifty-Three Weeks Ended

August 31, 2024 vs.

Fifty-Two Weeks Ended August 26,

2023(1)

- Net sales were

$1,331.3 million versus

$1,242.7 million

- Net income of

$139.3 million versus

$133.6 million

- Earnings per diluted share

(“EPS”) of $1.38 versus

$1.32

- Adjusted Diluted

EPS(2) of

$1.83 versus

$1.63

- Adjusted

EBITDA(3) of

$269.1 million versus

$245.6 million

Net sales increased $88.6 million, or 7.1%, to

$1,331.3 million. The OWYN acquisition closed on June 13, 2024, and

was a 2.4 percentage point contribution to net sales growth. Legacy

net sales increased 4.8%, including the fifty-third week that was

slightly less than a 2 percentage point benefit. Legacy North

America net sales increased 4.9% driven by Quest and the

international business declined 1.2%.

Gross profit was $511.6 million for the

fifty-three weeks ended August 31, 2024, an increase of $58.1

million from the year ago period. The increase in gross profit was

driven by lower legacy business ingredient and packaging costs,

partially offset by a non-cash $3.2 million inventory purchase

accounting step-up adjustment related to the OWYN acquisition. As a

result, gross margin was 38.4%, a 190 basis point increase versus

last year. The non-cash inventory purchase accounting step-up

adversely affected gross margin by 20 basis points.

Net income was $139.3 million compared to

$133.6 million for the comparable period of 2023. The increase

was due to higher operating profit, including the benefit of the

fifty-third week, partially offset by costs related to the OWYN

acquisition.

Operating expenses of $305.1 million

increased $56.6 million versus the comparable period of fiscal

2023. Selling and marketing expenses increased $24.4 million

to $143.9 million primarily due to increased investments in

marketing growth initiatives and the inclusion of OWYN. G&A

expenses of $129.7 million increased $18.1 million compared to the

year ago period primarily due to higher employee-related costs,

stock-based compensation, corporate expenses and the inclusion of

OWYN. Excluding stock-based compensation of $18.4 million,

executive transition costs of $3.9 million, as well as integration

costs and other non-recurring costs of $0.3 million, full fiscal

year 2024 G&A increased $14.9 million to $107.1 million.

For the fifty-three weeks ended August 31, 2024,

the Company incurred costs related to the OWYN acquisition of $14.5

million.

Net interest income and interest expense was

$21.7 million, a decline of $7.2 million versus last year. The

interest expense component decline was due to a lower term loan

debt balance leading up to the June 13, 2024 close of the OWYN

acquisition versus the year ago period.

Adjusted EBITDA(3), a non-GAAP financial measure

used by the Company that makes certain adjustments to net income

calculated under GAAP, was $269.1 million versus $245.6 million in

the year ago period.

For the full fiscal year 2024, the Company

reported Diluted EPS of $1.38 versus $1.32 in the year ago period.

The diluted weighted average total shares outstanding for the

fifty-three weeks ended August 31, 2024 was approximately 101.3

million versus 100.9 million in the year ago period.

Adjusted Diluted EPS(2), a non-GAAP financial

measure used by the Company that makes certain adjustments to

Diluted EPS calculated under GAAP, was $1.83 versus $1.63 in the

year ago period.

Balance Sheet and Cash Flow

Full fiscal year 2024 cash provided by operating

activities was $215.7 million, an increase of about 26% versus the

year ago period.

On June 13, 2024, the Company completed the OWYN

Acquisition. Simply Good Foods funded the cash purchase price of

$280.0 million, excluding post-closing purchase price adjustments

and before transaction related fees, through a combination of cash

on its balance sheet and an incremental borrowing of $250.0 million

under its outstanding credit facility. The incremental $250.0

million term loan and the then outstanding $240.0 million term loan

balance have an interest rate of SOFR plus a credit spread

adjustment equal to 0.10% for one-month SOFR, 0.15% for up to three

month SOFR and 0.25% for up to six-month SOFR, subject to a floor

of 0.50%, plus 2.50% margin. The incremental portion of the term

loan was priced to lenders at par.

For the fourteen and fifty-three weeks ended

August 31, 2024, the Company repaid $90.0 million and $135.0

million, respectively, of its term loan debt, and at the end of the

year, the outstanding principal balance was $400.0 million.

As of August 31, 2024, the Company had cash

of $132.5 million and a trailing twelve-month Net Debt to Adjusted

EBITDA ratio of 1.0x(7).

Outlook(4)

While early, retail takeaway is off to a good

start and the Company expects to deliver on its fiscal year 2025

plans. The Company continues to execute against its strategic

initiatives and is making investments in the business that

management expects will strengthen its brands in the marketplace.

OWYN integration work is well underway and progressing as

planned.

The Company expects strong Quest and OWYN net

sales and retail takeaway growth in fiscal year 2025 driven by

greater velocity, increased distribution, innovation and marketing

investments. The Company is pleased with the progress of the Atkins

revitalization plan and remains focused on the ongoing plan in

fiscal 2025, particularly packaging and reformulation. In addition,

as discussed last quarter, the Company will also focus on

optimizing and improving the ROI of Atkins' brand investments in

fiscal 2025. The Company anticipates this will affect Atkins fiscal

2025 net sales and retail takeaway but believes this is necessary

to ensure the brand remains a sustainable and profitable business

over the long-term.

As discussed last quarter, in fiscal 2025, the

Company expects input cost inflation. Solid productivity and cost

savings initiatives are in place that are expected to partially

offset these higher costs, however, given the unprecedented

increase in the cost of select inputs the Company anticipates gross

margin compression in fiscal 2025.

Therefore, the Company anticipates the following

in fiscal 2025:

- Net Sales expected to increase 8.5%

to 10.5%

- OWYN full fiscal year 2025 Net Sales expected to be in the

$135-145 million range

- Adjusted EBITDA(3) expected to

increase 4% to 6%

- The fifty-third week in fiscal 2024

comparison year is about a 2-percentage point headwind to both Net

Sales and Adjusted EBITDA growth in full year fiscal 2025 and

incorporated in the outlook above

- Assuming a comparable full year of

OWYN results are included in fiscal 2024, as well as the exclusion

of the fifty-third week in fiscal 2024, fiscal 2025 is expected to

be in line with the Company's long-term algorithm; net sales growth

in the 4-6% range and Adjusted EBITDA growth slightly greater than

the net sales increase

___________________________________(1) All

comparisons for the fourth quarter ended August 31, 2024,

versus the fourth quarter ended August 26, 2023.(2) Adjusted

Diluted Earnings Per Share is a non-GAAP financial measure. The

Company excludes acquisition-related costs, such as business

transaction costs, integration expense and depreciation and

amortization expense in calculating Adjusted Diluted Earnings Per

Share. Please refer to “Reconciliation of Adjusted Diluted Earnings

Per Share” in this press release for an explanation and

reconciliation of this non-GAAP financial measure.(3) Adjusted

Earnings Before Interest, Taxes, Depreciation and Amortization

("EBITDA") is a non-GAAP financial measure. Please refer to

“Reconciliation of EBITDA and Adjusted EBITDA” in this press

release for an explanation and reconciliation of this non-GAAP

financial measure.(4) The Company does not provide a

forward-looking reconciliation of Adjusted Diluted Earnings Per

Share to Earnings Per Share or Adjusted EBITDA to Net Income, the

most directly comparable GAAP financial measures, expected for

2025, because we are unable to provide such a reconciliation

without unreasonable effort due to the unavailability of reliable

estimates for certain components of consolidated net income and the

respective reconciliations, and the inherent difficulty of

predicting what the changes in these components will be throughout

the fiscal year. As these items may vary greatly between periods,

we are unable to address the probable significance of the

unavailable information, which could significantly affect our

future financial results.(5) Legacy Simply Good Foods refers to

performance of the combined Quest and Atkins brands(6) Combined

Quest, Atkins, and OWYN IRI MULO + C-store and Company unmeasured

channel estimate for the 14-weeks ending September 1, 2024, vs. the

comparable year ago period.(7) Net Debt to Adjusted EBITDA is a

non-GAAP financial measure which Simply Good Foods defines as the

total debt outstanding under our credit agreement with Barclays

Bank PLC and other parties ("Credit Agreement"), reduced by cash

and cash equivalents, and divided by the Company's full fiscal year

2024 Adjusted EBITDA, as previously defined. The Company does not

provide a forward-looking reconciliation of Net Debt to Adjusted

EBITDA to Net Debt to Consolidated Net Income, the most directly

comparable GAAP financial measures, expected for 2025, because we

are unable to provide such a reconciliation without unreasonable

effort due to the unavailability of reliable estimates for certain

components of consolidated net income and the respective

reconciliations, and the inherent difficulty of predicting what the

changes in these components will be throughout the fiscal year. As

these items may vary greatly between periods, we are unable to

address the probable significance of the unavailable information,

which could significantly affect our future financial results.

Conference Call and Webcast

InformationThe Company will host a conference call with

members of the executive management team to discuss these results

today, Thursday, October 24, 2024, at 6:30 a.m. Mountain time

(8:30 a.m. Eastern time). Investors interested in

participating in the live call can dial 877-407-0792 from the U.S.

and International callers can dial 201-689-8263. In addition, the

call and accompanying presentation slides will be broadcast live

over the Internet hosted at the “Investor Relations” section of the

Company's website at http://www.thesimplygoodfoodscompany.com. A

telephone replay will be available approximately two hours after

the call concludes and will be available through October 31, 2024,

by dialing 844-512-2921 from the U.S., or 412-317-6671 from

international locations, and entering confirmation code

13749310.

About The Simply Good Foods

CompanyThe Simply Good Foods Company (Nasdaq: SMPL),

headquartered in Denver, Colorado, is a consumer packaged food and

beverage company that is bringing nutritious snacking with

ambitious goals to raise the bar on what food can be with trusted

brands and innovative products. Our product portfolio consists

primarily of protein bars, ready-to-drink (RTD) shakes, sweet and

salty snacks, and confectionery products marketed under the Atkins,

Quest, and OWYN brands. We are a company that aims to lead the

nutritious snacking movement and is poised to expand our healthy

lifestyle platform through innovation, organic growth, and

investment opportunities in the snacking space. To learn more,

visit http://www.thesimplygoodfoodscompany.com.

Investor ContactMark PogharianVice President,

Investor Relations, Treasury and Business Development The Simply

Good Foods Company (720)

768-2681mpogharian@simplygoodfoodsco.com

Forward Looking Statements

Certain statements made herein are not

historical facts but are forward-looking statements for purposes of

the safe harbor provisions under The Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally are

accompanied by or include words such as “will”, “expect”, “intends”

or other similar words, phrases or expressions. These statements

relate to future events or our future financial or operational

performance and involve known and unknown risks, uncertainties and

other factors that could cause our actual results, levels of

activity, performance or achievement to differ materially from

those expressed or implied by these forward-looking statements. We

caution you that these forward-looking statements are not

guarantees of future performance and involve risks, uncertainties

and assumptions that are difficult to predict. You should not place

undue reliance on forward-looking statements. These statements

reflect our current views with respect to future events, are based

on assumptions and are subject to risks and uncertainties. These

risks and uncertainties relate to, among other things, our ability

to achieve our estimates of OWYN’s net sales and Adjusted EBITDA

and our anticipated synergies from the OWYN Acquisition, our net

leverage ratio post-acquisition, our Adjusted EPS post-acquisition,

our ability to maintain OWYN personnel and effectively integrate

OWYN, our operations being dependent on changes in consumer

preferences and purchasing habits regarding our products, a global

supply chain and effects of supply chain constraints and

inflationary pressure on us and our contract manufacturers, our

ability to continue to operate at a profit or to maintain our

margins, the effect pandemics or other global disruptions on our

business, financial condition and results of operations, the

sufficiency of our sources of liquidity and capital, our ability to

maintain current operation levels and implement our growth

strategies, our ability to maintain and gain market acceptance for

our products or new products, our ability to capitalize on

attractive opportunities, our ability to respond to competition and

changes in the economy including changes regarding inflation and

increasing ingredient and packaging costs and labor challenges at

our contract manufacturers and third party logistics providers, the

amounts of or changes with respect to certain anticipated raw

materials and other costs, difficulties and delays in achieving the

synergies and cost savings in connection with acquisitions, changes

in the business environment in which we operate including general

financial, economic, capital market, regulatory and geopolitical

conditions affecting us and the industry in which we operate, our

ability to maintain adequate product inventory levels to timely

supply customer orders, changes in taxes, tariffs, duties,

governmental laws and regulations, the availability of or

competition for other brands, assets or other opportunities for

investment by us or to expand our business, competitive product and

pricing activity, difficulties of managing growth profitably, the

loss of one or more members of our management team, potential for

increased costs and harm to our business resulting from

unauthorized access of the information technology systems we use in

our business, expansion of our wellness platform and other risks

and uncertainties indicated in the Company’s Form 10-K, Form 10-Q,

and Form 8-K reports (including all amendments to those reports)

filed with the U.S. Securities and Exchange Commission from time to

time. In addition, forward-looking statements provide the Company’s

expectations, plans or forecasts of future events and views as of

the date of this communication. Except as required by law, the

Company undertakes no obligation to update such statements to

reflect events or circumstances arising after such date and

cautions investors not to place undue reliance on any such

forward-looking statements. These forward-looking statements should

not be relied upon as representing the Company’s assessments as of

any date subsequent to the date of this communication.

|

|

|

The Simply Good Foods Company and

SubsidiariesConsolidated Balance

Sheets(Unaudited, dollars in thousands, except share and

per share data) |

|

|

| |

|

August 31, 2024 |

|

August 26, 2023 |

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash |

|

$ |

132,530 |

|

|

$ |

87,715 |

|

|

Accounts receivable, net |

|

|

150,721 |

|

|

|

145,078 |

|

|

Inventories |

|

|

142,107 |

|

|

|

116,591 |

|

|

Prepaid expenses |

|

|

5,730 |

|

|

|

6,294 |

|

|

Other current assets |

|

|

9,192 |

|

|

|

15,974 |

|

|

Total current assets |

|

|

440,280 |

|

|

|

371,652 |

|

| |

|

|

|

|

| Long-term assets: |

|

|

|

|

|

Property and equipment, net |

|

|

24,830 |

|

|

|

24,861 |

|

|

Intangible assets, net |

|

|

1,336,466 |

|

|

|

1,108,119 |

|

|

Goodwill |

|

|

591,687 |

|

|

|

543,134 |

|

|

Other long-term assets |

|

|

42,881 |

|

|

|

49,318 |

|

|

Total assets |

|

$ |

2,436,144 |

|

|

$ |

2,097,084 |

|

| |

|

|

|

|

| Liabilities and stockholders’

equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

58,559 |

|

|

$ |

52,712 |

|

|

Accrued interest |

|

|

265 |

|

|

|

1,940 |

|

|

Accrued expenses and other current liabilities |

|

|

49,791 |

|

|

|

35,062 |

|

|

Current maturities of long-term debt |

|

|

— |

|

|

|

143 |

|

|

Total current liabilities |

|

|

108,615 |

|

|

|

89,857 |

|

| |

|

|

|

|

| Long-term liabilities: |

|

|

|

|

|

Long-term debt, less current maturities |

|

|

397,485 |

|

|

|

281,649 |

|

|

Deferred income taxes |

|

|

166,012 |

|

|

|

116,133 |

|

|

Other long-term liabilities |

|

|

36,546 |

|

|

|

38,346 |

|

|

Total liabilities |

|

|

708,658 |

|

|

|

525,985 |

|

| See commitments and

contingencies (Note 11) |

|

|

|

|

| |

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

Preferred stock, $0.01 par value, 100,000,000 shares authorized,

none issued |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value, 600,000,000 shares authorized,

102,515,315 and 101,929,868 issued at August 31, 2024 and August

26, 2023, respectively |

|

|

1,025 |

|

|

|

1,019 |

|

|

Treasury stock, 2,365,100 shares and 2,365,100 shares at cost at

August 31, 2024 and August 26, 2023, respectively |

|

|

(78,451 |

) |

|

|

(78,451 |

) |

|

Additional paid-in-capital |

|

|

1,319,686 |

|

|

|

1,303,168 |

|

|

Retained earnings |

|

|

487,265 |

|

|

|

347,956 |

|

|

Accumulated other comprehensive loss |

|

|

(2,039 |

) |

|

|

(2,593 |

) |

|

Total stockholders’ equity |

|

|

1,727,486 |

|

|

|

1,571,099 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

2,436,144 |

|

|

$ |

2,097,084 |

|

|

|

|

The Simply Good Foods Company and

SubsidiariesConsolidated Statements of Income and

Comprehensive Income(Unaudited, dollars in thousands,

except share and per share data) |

|

|

|

|

|

14-Weeks Ended |

|

13-Weeks Ended |

|

53-Weeks Ended |

|

52-Weeks Ended |

|

|

|

August 31, 2024 |

|

August 26, 2023 |

|

August 31, 2024 |

|

August 26, 2023 |

|

Net sales |

|

$ |

375,687 |

|

|

$ |

320,418 |

|

|

$ |

1,331,321 |

|

|

$ |

1,242,672 |

|

| Cost of goods sold |

|

|

229,735 |

|

|

|

199,968 |

|

|

|

819,755 |

|

|

|

789,252 |

|

| Gross profit |

|

|

145,952 |

|

|

|

120,450 |

|

|

|

511,566 |

|

|

|

453,420 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling and marketing |

|

|

40,832 |

|

|

|

30,839 |

|

|

|

143,929 |

|

|

|

119,489 |

|

|

General and administrative |

|

|

41,273 |

|

|

|

29,481 |

|

|

|

129,699 |

|

|

|

111,566 |

|

|

Depreciation and amortization |

|

|

4,206 |

|

|

|

4,381 |

|

|

|

16,917 |

|

|

|

17,416 |

|

|

Business transaction costs |

|

|

11,821 |

|

|

|

— |

|

|

|

14,524 |

|

|

|

— |

|

| Total operating expenses |

|

|

98,132 |

|

|

|

64,701 |

|

|

|

305,069 |

|

|

|

248,471 |

|

| |

|

|

|

|

|

|

|

|

| Income from operations |

|

|

47,820 |

|

|

|

55,749 |

|

|

|

206,497 |

|

|

|

204,949 |

|

| |

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

1,412 |

|

|

|

484 |

|

|

|

4,307 |

|

|

|

1,144 |

|

|

Interest expense |

|

|

(9,371 |

) |

|

|

(6,867 |

) |

|

|

(26,029 |

) |

|

|

(30,068 |

) |

|

Gain (loss) on foreign currency transactions |

|

|

76 |

|

|

|

(418 |

) |

|

|

267 |

|

|

|

(344 |

) |

|

Other income (expense) |

|

|

900 |

|

|

|

1 |

|

|

|

1,008 |

|

|

|

11 |

|

| Total other income

(expense) |

|

|

(6,983 |

) |

|

|

(6,800 |

) |

|

|

(20,447 |

) |

|

|

(29,257 |

) |

| |

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

|

40,837 |

|

|

|

48,949 |

|

|

|

186,050 |

|

|

|

175,692 |

|

| Income tax expense |

|

|

11,546 |

|

|

|

12,307 |

|

|

|

46,741 |

|

|

|

42,117 |

|

| Net income |

|

$ |

29,291 |

|

|

$ |

36,642 |

|

|

$ |

139,309 |

|

|

$ |

133,575 |

|

| |

|

|

|

|

|

|

|

|

| Other comprehensive

income: |

|

|

|

|

|

|

|

|

|

Foreign currency translation, net of reclassification

adjustments |

|

|

202 |

|

|

|

(211 |

) |

|

|

554 |

|

|

|

(642 |

) |

| Comprehensive income |

|

$ |

29,493 |

|

|

$ |

36,431 |

|

|

$ |

139,863 |

|

|

$ |

132,933 |

|

| |

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.29 |

|

|

$ |

0.37 |

|

|

$ |

1.39 |

|

|

$ |

1.34 |

|

|

Diluted |

|

$ |

0.29 |

|

|

$ |

0.36 |

|

|

$ |

1.38 |

|

|

$ |

1.32 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

100,144,460 |

|

|

|

99,556,078 |

|

|

|

99,929,196 |

|

|

|

99,442,046 |

|

|

Diluted |

|

|

101,355,223 |

|

|

|

100,943,710 |

|

|

|

101,281,888 |

|

|

|

100,880,079 |

|

|

|

|

The Simply Good Foods Company and

SubsidiariesConsolidated Statements of Cash

Flows(Unaudited, dollars in thousands) |

|

|

| |

|

53-Weeks Ended |

|

52-Weeks Ended |

| |

|

August 31, 2024 |

|

August 26, 2023 |

| Operating activities |

|

|

|

|

|

Net income |

|

$ |

139,309 |

|

|

$ |

133,575 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

20,993 |

|

|

|

20,253 |

|

|

Amortization of deferred financing costs and debt discount |

|

|

2,037 |

|

|

|

2,763 |

|

|

Stock compensation expense |

|

|

18,421 |

|

|

|

14,480 |

|

|

Estimated credit (recoveries) losses |

|

|

(150 |

) |

|

|

315 |

|

|

Unrealized (gain) loss on foreign currency transactions |

|

|

(267 |

) |

|

|

344 |

|

|

Deferred income taxes |

|

|

8,366 |

|

|

|

10,590 |

|

|

Amortization of operating lease right-of-use asset |

|

|

6,991 |

|

|

|

6,729 |

|

|

Other |

|

|

988 |

|

|

|

567 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable, net |

|

|

9,129 |

|

|

|

(13,374 |

) |

|

Inventories |

|

|

13,726 |

|

|

|

8,169 |

|

|

Prepaid expenses |

|

|

1,164 |

|

|

|

(1,306 |

) |

|

Other current assets |

|

|

4,957 |

|

|

|

6,837 |

|

|

Accounts payable |

|

|

(15,450 |

) |

|

|

(9,510 |

) |

|

Accrued interest |

|

|

(1,675 |

) |

|

|

1,780 |

|

|

Accrued expenses and other current liabilities |

|

|

12,730 |

|

|

|

(5,223 |

) |

|

Other assets and liabilities |

|

|

(5,565 |

) |

|

|

(5,872 |

) |

| Net cash provided by operating

activities |

|

|

215,704 |

|

|

|

171,117 |

|

| Investing activities |

|

|

|

|

|

Purchases of property and equipment |

|

|

(5,743 |

) |

|

|

(11,585 |

) |

|

Acquisition of business, net of cash acquired |

|

|

(280,409 |

) |

|

|

— |

|

|

Investments in intangible assets and other assets |

|

|

(730 |

) |

|

|

(603 |

) |

| Net cash used in investing

activities |

|

|

(286,882 |

) |

|

|

(12,188 |

) |

| Financing activities |

|

|

|

|

|

Proceeds from option exercises |

|

|

4,293 |

|

|

|

5,247 |

|

|

Tax payments related to issuance of restricted stock units |

|

|

(5,048 |

) |

|

|

(2,859 |

) |

|

Repurchase of common stock |

|

|

— |

|

|

|

(16,448 |

) |

|

Payments on finance lease obligations |

|

|

(145 |

) |

|

|

(278 |

) |

|

Principal payments of long-term debt |

|

|

(135,000 |

) |

|

|

(121,500 |

) |

|

Proceeds from issuance of long-term debt |

|

|

250,000 |

|

|

|

— |

|

|

Cash received on repayment of note receivable |

|

|

3,000 |

|

|

|

— |

|

|

Deferred financing costs |

|

|

(1,199 |

) |

|

|

(2,694 |

) |

| Net cash provided by (used in)

financing activities |

|

|

115,901 |

|

|

|

(138,532 |

) |

| Net increase (decrease) in

cash |

|

|

44,723 |

|

|

|

20,397 |

|

| Effect of exchange rate on

cash |

|

|

92 |

|

|

|

(176 |

) |

| Cash at beginning of

period |

|

|

87,715 |

|

|

|

67,494 |

|

| Cash at end of period |

|

$ |

132,530 |

|

|

$ |

87,715 |

|

| |

Reconciliation of

EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA.

EBITDA and Adjusted EBITDA are non-GAAP financial measures commonly

used in our industry and should not be construed as alternatives to

net income as an indicator of operating performance or as

alternatives to cash flow provided by operating activities as a

measure of liquidity (each as determined in accordance with GAAP).

Simply Good Foods defines EBITDA as net income or loss before

interest income, interest expense, income tax expense, depreciation

and amortization, and Adjusted EBITDA as further adjusted to

exclude the following items: stock-based compensation expense,

executive transition costs, business transaction costs, inventory

step-up, integration costs, term loan transaction fees, and other

non-core expenses. The Company believes that EBITDA and Adjusted

EBITDA, when used in conjunction with net income, are useful to

provide additional information to investors. Management of the

Company uses EBITDA and Adjusted EBITDA to supplement net income

because these measures reflect operating results of the on-going

operations, eliminate items that are not directly attributable to

the Company’s underlying operating performance, enhance the overall

understanding of past financial performance and future prospects,

and allow for greater transparency with respect to the key metrics

the Company’s management uses in its financial and operational

decision making. The Company also believes that EBITDA and Adjusted

EBITDA are frequently used by securities analysts, investors and

other interested parties in the evaluation of companies in its

industry. EBITDA and Adjusted EBITDA may not be comparable to other

similarly titled captions of other companies due to differences in

the non-GAAP calculation.

The following unaudited table provides a

reconciliation of EBITDA and Adjusted EBITDA to its most directly

comparable GAAP measure, which is net income, for the fourteen and

fifty-three weeks ended August 31, 2024 and thirteen and fifty-two

weeks ended August 26, 2023:

| (In

thousands) |

|

14-Weeks Ended |

|

13-Weeks Ended |

|

53-Weeks Ended |

|

52-Weeks Ended |

| |

August 31, 2024 |

|

August 26, 2023 |

|

August 31, 2024 |

|

August 26, 2023 |

|

Net income |

|

$ |

29,291 |

|

|

$ |

36,642 |

|

|

$ |

139,309 |

|

|

$ |

133,575 |

|

| Interest income |

|

|

(1,412 |

) |

|

|

(484 |

) |

|

|

(4,307 |

) |

|

|

(1,144 |

) |

| Interest expense |

|

|

9,371 |

|

|

|

6,867 |

|

|

|

26,029 |

|

|

|

30,068 |

|

| Income tax expense |

|

|

11,546 |

|

|

|

12,307 |

|

|

|

46,741 |

|

|

|

42,117 |

|

| Depreciation and

amortization |

|

|

5,122 |

|

|

|

5,209 |

|

|

|

20,993 |

|

|

|

20,253 |

|

| EBITDA |

|

|

53,918 |

|

|

|

60,541 |

|

|

|

228,765 |

|

|

|

224,869 |

|

|

Stock-based compensation expense |

|

|

5,212 |

|

|

|

4,024 |

|

|

|

18,421 |

|

|

|

14,480 |

|

|

Executive transition costs |

|

|

3,150 |

|

|

|

2,232 |

|

|

|

3,871 |

|

|

|

3,390 |

|

|

Business transaction costs |

|

|

11,821 |

|

|

|

— |

|

|

|

14,524 |

|

|

|

— |

|

|

Inventory step-up |

|

|

3,226 |

|

|

|

— |

|

|

|

3,226 |

|

|

|

— |

|

|

Integration of OWYN |

|

|

588 |

|

|

|

— |

|

|

|

588 |

|

|

|

— |

|

|

Term loan transaction fees |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,423 |

|

|

Other (1) |

|

|

(464 |

) |

|

|

457 |

|

|

|

(265 |

) |

|

|

393 |

|

| Adjusted EBITDA |

|

$ |

77,451 |

|

|

$ |

67,254 |

|

|

$ |

269,130 |

|

|

$ |

245,555 |

|

|

|

|

(1) Other items consist principally of exchange impact of foreign

currency transactions and other expenses. |

|

|

Reconciliation of Adjusted Diluted

Earnings Per Share

Adjusted Diluted Earnings per

Share. Adjusted Diluted Earnings per Share is a non-GAAP

financial measure commonly used in our industry and should not be

construed as an alternative to diluted earnings per share as an

indicator of operating performance. Simply Good Foods defines

Adjusted Diluted Earnings Per Share as diluted earnings per share

before depreciation and amortization, stock-based compensation

expense, executive transition costs, business transaction costs,

inventory step-up, integration costs, term loan transaction fees,

and other non-core expenses, on a theoretical tax effected basis of

such adjustments. The tax effect of such adjustments to Adjusted

Diluted Earnings Per Share is calculated by applying an overall

assumed statutory tax rate to each gross adjustment as shown in the

reconciliation to Adjusted EBITDA, as previously defined. The

assumed statutory tax rate reflects a normalized effective tax rate

estimated based on assumptions regarding the Company's statutory

and effective tax rate for each respective reporting period,

including the current and deferred tax effects of each adjustment,

and is adjusted for the effects of tax reform, if any. The Company

consistently applies the overall assumed statutory tax rate to

periods throughout each fiscal year and reassesses the overall

assumed statutory rate on annual basis. The Company believes that

the inclusion of these supplementary adjustments in presenting

Adjusted Diluted Earnings per Share, when used in conjunction with

diluted earnings per share, are appropriate to provide additional

information to investors, reflects more accurately operating

results of the on-going operations, enhances the overall

understanding of past financial performance and future prospects

and allows for greater transparency with respect to the key metrics

the Company uses in its financial and operational decision making.

The Company also believes that Adjusted Diluted Earnings per Share

is frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in its industry.

Adjusted Diluted Earnings per Share may not be comparable to other

similarly titled captions of other companies due to differences in

the non-GAAP calculation.

The following unaudited tables below provide a

reconciliation of Adjusted Diluted Earnings Per Share to its most

directly comparable GAAP measure, which is diluted earnings per

share, for the fourteen and fifty-three weeks ended August 31, 2024

and the fifty-two weeks ended August 26, 2023:

| |

|

14-Weeks Ended |

|

13-Weeks Ended |

|

53-Weeks Ended |

|

52-Weeks Ended |

| |

|

August 31, 2024 |

|

August 26, 2023 |

|

August 31, 2024 |

|

August 26, 2023 |

|

Diluted earnings per share |

|

$ |

0.29 |

|

|

$ |

0.36 |

|

|

$ |

1.38 |

|

|

$ |

1.32 |

|

| |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

0.05 |

|

|

|

0.05 |

|

|

|

0.21 |

|

|

|

0.20 |

|

| Stock-based compensation

expense |

|

|

0.05 |

|

|

|

0.04 |

|

|

|

0.18 |

|

|

|

0.14 |

|

| Executive transition

costs |

|

|

0.03 |

|

|

|

0.02 |

|

|

|

0.04 |

|

|

|

0.03 |

|

| Business transaction

costs |

|

|

0.12 |

|

|

|

— |

|

|

|

0.14 |

|

|

|

— |

|

| Inventory step-up |

|

|

0.03 |

|

|

|

— |

|

|

|

0.03 |

|

|

|

— |

|

| Integration of OWYN |

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

| Term loan transaction

fees |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.02 |

|

| Tax effects of adjustments

(2) |

|

|

(0.07 |

) |

|

|

(0.03 |

) |

|

|

(0.15 |

) |

|

|

(0.09 |

) |

| Rounding (5) |

|

|

(0.01 |

) |

|

|

0.01 |

|

|

|

(0.01 |

) |

|

|

0.01 |

|

| Adjusted diluted earnings per

share |

|

$ |

0.50 |

|

|

$ |

0.45 |

|

|

$ |

1.83 |

|

|

$ |

1.63 |

|

|

|

|

(2) This line item reflects the aggregate tax effect of all non-tax

adjustments reflected in the preceding line items of the table. The

tax effect of each adjustment is computed (i) by dividing the gross

amount of the adjustment, as shown in the Adjusted EBITDA

reconciliation, by the number of diluted weighted average shares

outstanding for the applicable fiscal period and (ii) applying an

overall assumed statutory tax rate of 25% for the fourteen and

fifty-three weeks ended August 31, 2024, as well as the thirteen

and fifty-two weeks ended August 26, 2023. |

|

|

|

(5) Adjusted Diluted Earnings Per Share amounts are computed

independently for each quarter. Therefore, the sum of the quarterly

Adjusted Diluted Earnings Per Share amounts may not equal the year

to date Adjusted Diluted Earnings Per Share amounts due to

rounding. |

|

|

Reconciliation of Net Debt to Adjusted

EBITDA

Net Debt to Adjusted EBITDA.

Net Debt to Adjusted EBITDA is a non-GAAP financial measure which

Simply Good Foods defines as the total debt outstanding under our

credit agreement with Barclays Bank PLC and other parties (“Credit

Agreement”), reduced by cash and cash equivalents, and divided by

the trailing twelve months of Adjusted EBITDA, as previously

defined.

The following unaudited table below provides a

reconciliation of Net Debt to Adjusted EBITDA as of August 31,

2024:

| (In

thousands) |

|

August 31, 2024 |

|

Net Debt: |

|

|

|

Total debt outstanding under the Credit Agreement |

|

$ |

400,000 |

|

|

Less: cash and cash equivalents |

|

|

(132,530 |

) |

|

Net Debt as of August 31, 2024 |

|

$ |

267,470 |

|

| |

|

|

| Adjusted EBITDA |

|

$ |

269,130 |

|

| |

|

|

|

|

| Net Debt to Adjusted

EBITDA |

|

|

1.0 |

x |

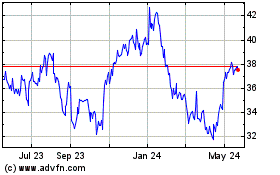

Simply Good Foods (NASDAQ:SMPL)

Historical Stock Chart

From Dec 2024 to Jan 2025

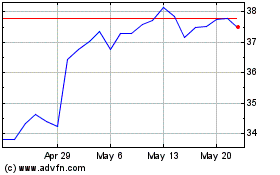

Simply Good Foods (NASDAQ:SMPL)

Historical Stock Chart

From Jan 2024 to Jan 2025