Current Report Filing (8-k)

August 28 2019 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 26, 2019

|

SILVERSUN TECHNOLOGIES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

001-38063

|

|

16-1633636

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

120 Eagle Rock Ave

East Hanover, NJ 07936

(Address of Principal Executive Offices)

(973) 396-1720

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common shares (par value $0.00001 per share)

|

SSNT

|

NASDAQ

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On August 26, 2019 (the “Closing Date”), SWK Technologies, Inc. (“SWK”), a wholly-owned subsidiary of SilverSun Technologies, Inc. (the “Company”), entered into and closed that certain Asset Purchase Agreement (the “Asset Purchase Agreement”) by and among the Company, SPS Commerce, Inc., as buyer (“Buyer” or “SPS”), and SWK, as seller (the “Seller”), pursuant to which the Buyer has agreed to acquire from the Seller certain assets related to the MAPADOC business.

In consideration for the Acquired Assets (as defined in the Asset Purchase Agreement), at closing, SPS: (i) paid Seller $10,350,000 in cash (the “Initial Cash Payment”); and (ii) delivered $1,150,000 to an escrow account (the “Escrowed Property”) pursuant to the terms and conditions of that certain Escrow Agreement dated August [26], 2019 (the “Escrow Agreement”), for an aggregate consideration of $11,500,000 (the “Purchase Price”). Pursuant to the terms and conditions of that certain Escrow Agreement entered into in connection with the Asset Purchase Agreement, portions of the Escrowed Property will be released at six months and at twelve months following the date of closing of the Asset Purchase Agreement, to the extent that no indemnity claims against the Escrowed Property have been filed by the Buyer.

The above description of the Asset Purchase Agreement and the Escrow Agreement do not purport to be complete and are qualified in their entirety by reference to such documents filed as Exhibit 10.1 and Exhibit 10.2 hereto, respectively.

Item 1.02 Termination of a Material Definitive Agreement.

As previously disclosed, on September 11, 2018, SWK entered into a Revolving Demand Note (the “JPM Revolving Demand Note”) by and between SWK and JPMorgan Chase Bank (“JPM Lender”), a commercial lender. On August 26, 2019, all amounts owed to JPM Lender under the JPM Revolving Demand Note were paid and the JPM Revolving Demand Note terminated and is of no further force or effect. The JPM Lender had agreed to loan SWK up to a principal amount of two million dollars. The interest rate on the JPM Revolving Demand Note was a variable rate, equal to the “Adjusted LIBOR Rate”, plus two and one quarter percent (2.25%) per annum. The JPM Revolving Demand Note was secured by all of SWK’s assets pursuant to a security agreement and was also collateralized by substantially all of the assets of the Company.

Item 8.01 Other Events.

On August 27, 2019, the Company issued a press release regarding the Asset Purchase Agreement described above under Item 1.01 of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1*

|

|

Asset Purchase Agreement, dated August 26, 2019, by and among SilverSun Technologies, Inc. SWK Technologies, Inc., and SPS Commerce, Inc.

|

|

10.2*

|

|

Form of Escrow Agreement, dated August 26, 2019, by and among SWK Technologies, Inc., SPS Commerce, Inc. and Wells Fargo Bank, National Association

|

|

99.1*

|

|

Press Release, dated August 27, 2019

|

*filed herewith

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

SILVERSUN TECHNOLOGIES, INC.

|

|

|

|

|

|

Date: August 27, 2019

|

By:

|

/s/ Mark Meller

|

|

|

|

Mark Meller

|

|

|

|

President and Chief Executive Officer

|

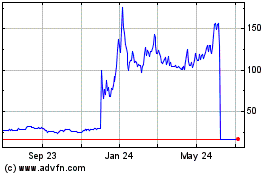

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Aug 2024 to Sep 2024

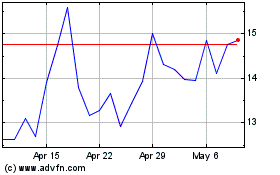

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Sep 2023 to Sep 2024