UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

SHINECO,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

52-2175898 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

T1,

South Tower, Jiazhaoye Square

Chaoyang

District, Beijing, People’s Republic of China, 100022

(Address

of Principal Executive Offices) (Zip Code)

2024

Equity Incentive Plan

(Full

title of the plans)

Vcorp

Services, LLC

1013

Centre Road, Suite 403-B

Wilmington,

DE 19805

New

Castle County

(Name

and address of agent for service)

845-425-0077

(Telephone

number, including area code, of agent for service)

Copies

to:

Jennifer

Zhan

Chief

Executive Officer

Shineco,

Inc.

T1,

South Tower, Jiazhaoye Square

Chaoyang District,

Beijing, People’s Republic of China 100022

+86

10-87227366 |

|

Huan

Lou, Esq.

David Manno, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

(212)

930-9700 |

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

This

registration statement on Form S-8 (the “Registration Statement”) is filed by Shineco, Inc. (the “Registrant”)

to register securities issuable pursuant to its 2024 Equity Incentive Plan. The securities registered hereby consist of 1,000,000 new

common stock, US$0.001 par value per share of the Registrant (the “Common Stock”), which represent the number of Common

Stock available for issuance under the 2024 Equity Incentive Plan. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended

(the “Securities Act”), this Registration Statement also covers an indeterminate number of additional shares which

may be offered and issued to prevent dilution from share splits, share subdivisions, share dividends, bonus issues of shares or similar

transactions as provided in the 2024 Equity Incentive Plan. Any Common Stock covered by an award granted under the 2024 Equity Incentive

Plan (or portion of an award) that terminates, expires, lapses or repurchased for any reason will be deemed not to have been issued for

purposes of determining the maximum aggregate number of Common Stock that may be issued under the 2024 Equity Incentive Plan.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

| Item

1. |

Plan

Information. |

The

Company will provide each recipient of a grant under the 2024 Equity Incentive Plan (the “Recipients”) with documents

that contain information related to the 2024 Equity Incentive Plan (the “Plan”), and other information including,

but not limited to, the disclosure required by Item 1 of Form S-8, which information is not required to be and is not being filed as

a part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. The

foregoing information and the documents incorporated by reference in response to Item 3 of Part II of this Registration Statement, taken

together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. A Section 10(a) prospectus will

be given to each Recipient who receives shares of Common Stock covered by this Registration Statement, in accordance with Rule 428(b)(1)

under the Securities Act.

| Item

2. |

Registrant

Information and Employee Plan Annual Information. |

Upon

written or oral request, any of the documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents

are incorporated by reference in this Section 10(a) Prospectus) and other documents required to be delivered to eligible employees, non-employee

directors and consultants pursuant to Rule 428(b) are available without charge by contacting:

Jennifer

Zhan

Chief

Executive Officer

Shineco,

Inc.

T1,

South Tower, Jiazhaoye Square

Chaoyang

District, Beijing, People’s Republic of China, 100022

(+86)

10-87227366

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference. |

The

SEC allows us to incorporate by reference the information we file with them under certain conditions, which means that we can disclose

important information to you by referring you to those documents. The information incorporated by reference is considered to be a part

of this prospectus and any information that we file subsequent to this prospectus with the SEC will automatically update and supersede

this information. The documents we are incorporating by reference are as follows:

| |

(a) |

our

Annual Report for the fiscal year ended June 30, 2023, on Form 10-K filed on September 28, 2023; |

| |

|

|

| |

(b) |

our

Quarterly Reports on Form 10-Q for the fiscal quarters ended September 30, 2023, December 31, 2023 and March 31, 2024, filed on November 14, 2023, February 8, 2024 and May 15, 2024, respectively; and |

| |

|

|

| |

(c) |

our

Current Reports on Form 8-K filed on June 30, 2023, July 24, 2023, September 21, 2023, November 17, 2023, December 1, 2023, December 21, 2023, December 27, 2023, December 28, 2023, January 4, 2024, February 5, 2024, February 16, 2024, March 12, 2024, and April 30, 2024; and |

| |

|

|

| |

(d) |

the

description of the common stock, $0.001 par value per share, contained in our registration statement on Form 8-A filed with the Commission

on May 13, 2016 pursuant to Section 12(b) of the Exchange Act and all amendments or reports filed by us for the purpose of updating

those descriptions. |

All

documents filed by us pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the initial filing date of this prospectus,

through the date declared effective, until the termination of the offering of securities contemplated by this prospectus shall be deemed

to be incorporated by reference into this prospectus. These documents that we file later with the SEC and that are incorporated by reference

in this prospectus will automatically update information contained in this prospectus or that was previously incorporated by reference

into this prospectus. You will be deemed to have notice of all information incorporated by reference in this prospectus as if that information

was included in this prospectus.

| Item

4. |

Description

of Securities. |

Not

applicable.

| Item

5. |

Interests

of Named Experts and Counsel. |

Not

applicable.

| Item

6. |

Indemnification

of Directors and Officers. |

Section

102 of the Delaware General Corporation Law allows a corporation to eliminate the personal liability of directors of a corporation to

the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except where the director breached

the duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment

of a dividend or approved a stock repurchase in violation of the Delaware General Corporation Law, or obtained an improper personal benefit.

Under

Section 145 of the General Corporation Law of the State of Delaware, we can indemnify our directors and officers against liabilities

they may incur in such capacities, including liabilities under the Securities Act. Our certificate of incorporation provides that, pursuant

to Delaware law, our directors shall not be liable for monetary damages for breach of the directors’ fiduciary duty of care to

us and our stockholders. This provision in the certificate of incorporation does not eliminate the duty of care, and in appropriate circumstances

equitable remedies such as injunctive or other forms of non-monetary relief will remain available under Delaware law. In addition, each

director will continue to be subject to liability for breach of the director’s duty of loyalty to us or our stockholders, for acts

or omissions not in good faith or involving intentional misconduct or knowing violations of the law, for actions leading to improper

personal benefit to the director, and for payment of dividends or approval of stock repurchases or redemptions that are unlawful under

Delaware law. The provision also does not affect a director’s responsibilities under any other law, such as the federal securities

laws or state or federal environmental laws.

Section

174 of the Delaware General Corporation Law provides, among other things, that a director who willfully or negligently approves of an

unlawful payment of dividends or an unlawful stock purchase or redemption may be held liable for such actions. A director who was either

absent when the unlawful actions were approved or dissented at the time, may avoid liability by causing his or her dissent to such actions

to be entered in the books containing minutes of the meetings of our board of directors at the time such action occurred or immediately

after such absent director receives notice of the unlawful acts.

Our

amended and restated bylaws provide for the indemnification of our directors and officers to the fullest extent permitted by the Delaware

General Corporation Law. Our amended and restated bylaws further provide that our board of directors has discretion to indemnify our

agents and employees. We are required to advance, prior to the final disposition of any proceeding, promptly on request, all expenses

incurred by any director or executive officer in connection with that proceeding on receipt of an undertaking by or on behalf of that

director or executive officer to repay those amounts if it should be determined ultimately that he or she is not entitled to be indemnified

under the bylaws or otherwise. We are not, however, required to advance any expenses in connection with any proceeding if our board determines,

pursuant to Delaware law, that the claimant has not met the standards of conduct which make it permissible under the Delaware General

Corporation Law for the corporation to indemnify the claimant for the amount claimed.

As

of the date of this prospectus, we have not entered into any indemnification agreement with our directors or officers, and our directors

and officers are not covered by directors’ and officers’ liability insurance policies.

| Item

7. |

Exemption

from Registration Claimed. |

Not

applicable.

EXHIBIT

INDEX

| (a) |

The

undersigned registrant hereby undertakes: |

| |

(1) |

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

(i) |

To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| |

(ii) |

To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end

of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b)

if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set

forth in the “Calculation of Registration Fee” table in the effective registration statement. |

| |

|

|

| |

(iii) |

To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

provided,

however, Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-1,

Form S-3, Form SF-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange

Act of 1934 that are incorporated by reference in the registration statement, or, as to a registration statement on Form S-3, Form SF-3

or Form F-3, is contained in a form of prospectus filed pursuant to § 230.424(b) of this chapter that is part of the registration

statement.

| |

(2) |

That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. |

| |

(3) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| |

(4) |

That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required

by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier

of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the

offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date

an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the

registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in

any such document immediately prior to such effective date; or

| |

(5) |

That,

for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller

to the purchaser and will be considered to offer or sell such securities to such purchaser: |

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

That for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report

pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee

benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in the City of Beijing, on June 13, 2024.

| |

SHINECO,

INC. |

| |

|

|

| |

By: |

/s/

Jennifer Zhan |

| |

|

Jennifer

Zhan |

| |

|

Chief

Executive Officer |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Jennifer

Zhan as his/hers true and lawful attorneys-in-fact and agents, with full power of substitution, for him/her in any and all capacities,

to sign any or all amendments to this Registration Statement on Form S-8 (including post-effective amendments), and to file the same,

with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said

attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done

in connection therewith, as fully for all intents and purposes as he might or could do in person, hereby and about the premises hereby

ratifying and confirming all that said attorneys-in-fact and agent, proxy and agent, or her substitute, may lawfully do or cause to be

done by virtue hereof

Pursuant

to the requirements of the Securities Act of 1933, as amended, the following persons in the capacities and on the dates indicated have

signed this Registration Statement below.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Jennifer Zhan |

|

Chief

Executive Officer |

|

June

13, 2024 |

| Jennifer

Zhan |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Sai (Sam) Wang |

|

Chief

Financial Officer and Director |

|

June

13, 2024 |

| Sai

(Sam) Wang |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Xiqiao Liu |

|

Director

and Chief Operating Officer |

|

June

13, 2024 |

| Xiqiao

Liu |

|

|

|

|

| |

|

|

|

|

| /s/

Mike Zhao |

|

Chairman

of the Board |

|

June

13, 2024 |

| Mike

Zhao |

|

|

|

|

| |

|

|

|

|

| /s/

Jin Liu |

|

Director |

|

June

13, 2024 |

| Jin

Liu |

|

|

|

|

| |

|

|

|

|

| /s/

Aamir Ali Quraishi |

|

Director |

|

June

13, 2024 |

| Aamir

Ali Quraishi |

|

|

|

|

| |

|

|

|

|

| /s/

Hu Li |

|

Director |

|

June

13, 2024 |

| Hu

Li |

|

|

|

|

Exhibit

4.1

SHINECO,

INC.

2024

SHARE INCENTIVE PLAN

This

2024 Equity Incentive Plan (the “Plan”) is intended as an incentive, to retain in the employment of and as directors,

officers, consultants, advisors and employees to Shineco, Inc., a Delaware corporation (the “Company”), and any Subsidiary

of the Company, within the meaning of Section 424(f) of the United States Internal Revenue Code of 1986, as amended (the “Code”),

persons of training, experience and ability, to attract new directors, officers, consultants, advisors and employees whose services are

considered valuable, to encourage the sense of proprietorship and to stimulate the active interest of such persons in the development

and financial success of the Company and its Subsidiaries.

It

is further intended that certain options granted pursuant to the Plan shall constitute incentive stock options within the meaning of

Section 422 of the Code (the “Incentive Options”) while certain other options granted pursuant to the Plan shall be

nonqualified stock options (the “Nonqualified Options”). Incentive Options and Nonqualified Options are hereinafter

referred to collectively as “Options.”

The

Company intends that the Plan meet the requirements of Rule 16b-3 (“Rule 16b-3”) promulgated under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and that transactions of the type specified in subparagraphs

(c) to (f) inclusive of Rule 16b-3 by officers and directors of the Company pursuant to the Plan will be exempt from the operation of

Section 16(b) of the Exchange Act. In all cases, the terms, provisions, conditions and limitations of the Plan shall be construed and

interpreted consistent with the Company’s intent as stated in this Section 1.

| |

2. |

Administration

of the Plan. |

The

authority to manage the operation of and administer the Plan shall be vested in the Board of Directors of the Company (the “Board”)

or the Compensation Committee (the “Committee”) as delegated by the Board. The Board or Committee if so delegated

by the Board shall be hereinafter referred to as the “Administrator.” To qualify as the Administrator, the Committee shall

consist of and maintain two or more directors who are (i) “Independent Directors” (as such term is defined under the rules

of the NASDAQ Stock Market) and (ii) “Non-Employee Directors” (as such term is defined in Rule 16b-3), which shall serve

at the pleasure of the Board. The Administrator subject to Sections 3, 5 and 6 hereof, shall have full power and authority to designate

recipients of Options and restricted stock (“Restricted Stock”), and to determine the terms and conditions of the

respective Option and Restricted Stock agreements (which need not be identical) and to interpret the provisions and supervise the administration

of the Plan. The Administrator shall have the authority, without limitation, to designate which Options granted under the Plan shall

be Incentive Options and which shall be Nonqualified Options. To the extent any Option does not qualify as an Incentive Option, it shall

constitute a separate Nonqualified Option.

Subject

to the provisions of the Plan, the Administrator shall interpret the Plan and all Options and Restricted Stock (the “Securities”)

granted under the Plan, shall make such rules as it deems necessary for the proper administration of the Plan, shall make all other determinations

necessary or advisable for the administration of the Plan and shall correct any defects or supply any omission or reconcile any inconsistency

in the Plan or in any Securities granted under the Plan in the manner and to the extent that the Administrator deems desirable to carry

into effect the Plan or any Securities. The act or determination of a majority of the Administrator shall be the act or determination

of the Administrator and any decision reduced to writing and signed by all of the members of the Administrator shall be fully effective

as if it had been made by a majority of the Administrator at a meeting duly held for such purpose. Subject to the provisions of the Plan,

any action taken or determination made by the Administrator pursuant to this and the other Sections of the Plan shall be conclusive on

all parties.

In

the event that for any reason the Committee is unable to act or if the Committee at the time of any grant, award or other acquisition

under the Plan does not consist of two or more Non-Employee Directors, or if there shall be no such Committee, or if the Board otherwise

determines to administer the Plan, then the Plan shall be administered by the Board and any such grant, award or other acquisition may

be approved or ratified in any other manner contemplated by subparagraph (d) of Rule 16b-3.

| |

3. |

Designation

of Optionees and Grantees. |

The

persons eligible for participation in the Plan as recipients of Options (the “Optionees”) or Restricted Stock (the

“Grantees” and together with Optionees, the “Participants”) shall include directors, officers and

employees of, and consultants and advisors to, the Company or any Subsidiary; provided that Incentive Options may only be granted to

employees of the Company and any Subsidiary. In selecting Participants, and in determining the number of shares to be covered by each

Option or award of Restricted Stock granted to Participants, the Administrator may consider any factors it deems relevant, including,

without limitation, the office or position held by the Participant or the Participant’s relationship to the Company, the Participant’s

degree of responsibility for and contribution to the growth and success of the Company or any Subsidiary, the Participant’s length

of service, promotions and potential. A Participant who has been granted an Option or Restricted Stock hereunder may be granted an additional

Option or Options, or Restricted Stock if the Administrator shall so determine.

| |

4. |

Stock

Reserved for the Plan. |

Subject

to adjustment as provided in Section 8 hereof, a maximum of 10,000,000 shares of the Company’s common stock, par value $0.001 per

share (the “Common Stock”), shall be subject to the Plan. The shares of Common Stock subject to the Plan shall consist

of unissued shares, treasury shares or previously issued shares held by any Subsidiary of the Company, and such number of shares of Common

Stock shall be and is hereby reserved for such purpose. Any of such shares of Common Stock that may remain unissued and that are not

subject to outstanding Options at the termination of the Plan shall cease to be reserved for the purposes of the Plan, but until termination

of the Plan the Company shall at all times reserve a sufficient number of shares of Common Stock to meet the requirements of the Plan.

Should any Securities expire or be canceled prior to its exercise, satisfaction of conditions or vesting in full, as applicable, or should

the number of shares of Common Stock to be delivered upon the exercise or vesting in full of an Option or award of Restricted Stock be

reduced for any reason, the shares of Common Stock theretofore subject to such Option or Restricted Stock, as applicable, may be subject

to future Options or Restricted Stock under the Plan.

| |

5. |

Terms

and Conditions of Options. |

Options

granted under the Plan shall be subject to the following conditions and shall contain such additional terms and conditions, not inconsistent

with the terms of the Plan, as the Administrator shall deem desirable:

(a)

Option Price. The purchase price of each share of Common Stock purchasable under an Incentive Option shall be determined by the

Administrator at the time of grant, but shall not be less than 100% of the Fair Market Value (as defined below) of such share of Common

Stock on the date the Option is granted; provided, however, that with respect to an Optionee who, at the time such Incentive

Option is granted, owns (within the meaning of Section 424(d) of the Code) more than 10% of the total combined voting power of all classes

of stock of the Company or of any Subsidiary, the purchase price per share of Common Stock shall be at least 110% of the Fair Market

Value per share of Common Stock on the date of grant. The purchase price of each share of Common Stock purchasable under a Nonqualified

Option shall not be less than 100% of the Fair Market Value of such share of Common Stock on the date the Option is granted. The exercise

price for each Option shall be subject to adjustment as provided in Section 8 below. “Fair Market Value” means the

closing price on the final trading day immediately prior to the grant date of the Common Stock on the NASDAQ Capital Market or other

principal securities exchange on which shares of Common Stock are listed (if the shares of Common Stock are so listed), or, if not so

listed, the mean between the closing bid and asked prices of publicly traded shares of Common Stock in the over the counter market, or,

if such bid and asked prices shall not be available, as reported by any nationally recognized quotation service selected by the Company,

or as determined by the Administrator in a manner consistent with the provisions of the Code. Anything in this Section 5(a) to the contrary

notwithstanding, in no event shall the purchase price of a share of Common Stock be less than the minimum price permitted under the rules

and policies of any national securities exchange on which the shares of Common Stock are listed.

(b)

Option Term. The term of each Option shall be fixed by the Administrator, but no Option shall be exercisable more than ten years

after the date such Option is granted and in the case of an Incentive Option granted to an Optionee who, at the time such Incentive Option

is granted, owns (within the meaning of Section 424(d) of the Code) more than 10% of the total combined voting power of all classes of

stock of the Company or of any Subsidiary, no such Incentive Option shall be exercisable more than five years after the date such Incentive

Option is granted.

(c)

Exercisability. Subject to Section 5(j) hereof, Options shall be exercisable at such time or times and subject to such terms and

conditions as shall be determined by the Administrator at the time of grant; provided, however, that in the absence of

any Option vesting periods designated by the Administrator at the time of grant, Options shall vest and become exercisable as to one-third

of the total number of shares subject to the Option on each of the first, second and third anniversaries of the date of grant; and provided

further that no Options shall be exercisable until such time as any vesting limitation required by Section 16 of the Exchange Act, and

related rules, shall be satisfied if such limitation shall be required for continued validity of the exemption provided under Rule 16b-3(d)(3).

Upon

the occurrence of a “Change in Control” (as hereinafter defined), the Administrator may accelerate the vesting and exercisability

of outstanding Options, in whole or in part, as determined by the Administrator in its sole discretion. In its sole discretion, the Administrator

may also determine that, upon the occurrence of a Change in Control, each outstanding Option shall terminate within a specified number

of days after notice to the Optionee thereunder, and each such Optionee shall receive, with respect to each share of Common Stock subject

to such Option, an amount equal to the excess of the Fair Market Value of such shares immediately prior to such Change in Control over

the exercise price per share of such Option; such amount shall be payable in cash, in one or more kinds of property (including the property,

if any, payable in the transaction) or a combination thereof, as the Administrator shall determine in its sole discretion.

For

purposes of the Plan, unless otherwise defined in an employment agreement between the Company and the relevant Optionee, a Change in

Control shall be deemed to have occurred if:

(i)

a tender offer (or series of related offers) shall be made and consummated for the ownership of 50% or more of the outstanding voting

securities of the Company, unless as a result of such tender offer more than 50% of the outstanding voting securities of the surviving

or resulting corporation shall be owned in the aggregate by the stockholders of the Company (as of the time immediately prior to the

commencement of such offer), any employee benefit plan of the Company or its Subsidiaries, and their affiliates;

(ii)

the Company shall be merged or consolidated with another corporation, unless as a result of such merger or consolidation more than 50%

of the outstanding voting securities of the surviving or resulting corporation shall be owned in the aggregate by the stockholders of

the Company (as of the time immediately prior to such transaction), any employee benefit plan of the Company or its Subsidiaries, and

their affiliates;

(iii)

the Company shall sell substantially all of its assets to another corporation that is not wholly owned by the Company, unless as a result

of such sale more than 50% of such assets shall be owned in the aggregate by the stockholders of the Company (as of the time immediately

prior to such transaction), any employee benefit plan of the Company or its Subsidiaries and their affiliates; or

(iv)

a Person (as defined below) shall acquire 50% or more of the outstanding voting securities of the Company (whether directly, indirectly,

beneficially or of record), unless as a result of such acquisition more than 50% of the outstanding voting securities of the surviving

or resulting corporation shall be owned in the aggregate by the stockholders of the Company (as of the time immediately prior to the

first acquisition of such securities by such Person), any employee benefit plan of the Company or its Subsidiaries, and their affiliates.

Notwithstanding

the foregoing, if Change of Control is defined in an employment agreement between the Company and the relevant Optionee, then, with respect

to such Optionee, Change of Control shall have the meaning ascribed to it in such employment agreement.

For

purposes of this Section 5(c), ownership of voting securities shall take into account and shall include ownership as determined by applying

the provisions of Rule 13d-3(d)(I)(i) (as in effect on the date hereof) under the Exchange Act. In addition, for such purposes, “Person”

shall have the meaning given in Section 3(a)(9) of the Exchange Act, as modified and used in Sections 13(d) and 14(d) thereof; provided,

however, that a Person shall not include (A) the Company or any of its Subsidiaries; (B) a trustee or other fiduciary holding

securities under an employee benefit plan of the Company or any of its Subsidiaries; (C) an underwriter temporarily holding securities

pursuant to an offering of such securities; or (D) a corporation owned, directly or indirectly, by the stockholders of the Company in

substantially the same proportion as their ownership of stock of the Company.

(d)

Method of Exercise. Options to the extent then exercisable may be exercised in whole or in part at any time during the option

period, by giving written notice to the Company specifying the number of shares of Common Stock to be purchased, accompanied by payment

in full of the purchase price, in cash, or by check or such other instrument as may be acceptable to the Administrator. As determined

by the Administrator, in its sole discretion, at or after grant, payment in full or in part may be made at the election of the Optionee

(i) in the form of Common Stock owned by the Optionee (based on the Fair Market Value of the Common Stock which is not the subject of

any pledge or security interest, (ii) in the form of shares of Common Stock withheld by the Company from the shares of Common Stock otherwise

to be received with such withheld shares of Common Stock having a Fair Market Value equal to the exercise price of the Option, or (iii)

by a combination of the foregoing, such Fair Market Value determined by applying the principles set forth in Section 5(a), provided that

the combined value of all cash and cash equivalents and the Fair Market Value of any shares surrendered to the Company is at least equal

to such exercise price and except with respect to (ii) above, such method of payment will not cause a disqualifying disposition of all

or a portion of the Common Stock received upon exercise of an Incentive Option. An Optionee shall have the right to dividends and other

rights of a stockholder with respect to shares of Common Stock purchased upon exercise of an Option at such time as the Optionee (i)

has given written notice of exercise and has paid in full for such shares, and (ii) has satisfied such conditions that may be imposed

by the Company with respect to the withholding of taxes.

(e)

Non-transferability of Options. Options are not transferable and may be exercised solely by the Optionee during his lifetime or

after his death by the person or persons entitled thereto under his will or the laws of descent and distribution. The Administrator,

in its sole discretion, may permit a transfer of a Nonqualified Option to (i) a trust for the benefit of the Optionee, (ii) a member

of the Optionee’s immediate family (or a trust for his or her benefit) or (iii) pursuant to a domestic relations order. Any attempt

to transfer, assign, pledge or otherwise dispose of, or to subject to execution, attachment or similar process, any Option contrary to

the provisions hereof shall be void and ineffective and shall give no right to the purported transferee.

(f)

Termination by Death. Unless otherwise determined by the Administrator, if any Optionee’s employment with or service to

the Company or any Subsidiary terminates by reason of death, the Option may thereafter be exercised, to the extent then exercisable (or

on such accelerated basis as the Administrator shall determine at or after grant), by the legal representative of the estate or by the

legatee of the Optionee under the will of the Optionee, for a period of one (1) year after the date of such death (or, if later, such

time as the Option may be exercised pursuant to Section 14(d) hereof) or until the expiration of the stated term of such Option as provided

under the Plan, whichever period is shorter.

(g)

Termination by Reason of Disability. Unless otherwise determined by the Administrator, if any Optionee’s employment with

or service to the Company or any Subsidiary terminates by reason of Disability (as defined below), then any Option held by such Optionee

may thereafter be exercised, to the extent it was exercisable at the time of termination due to Disability (or on such accelerated basis

as the Administrator shall determine at or after grant), but may not be exercised after ninety (90) days after the date of such termination

of employment or service (or, if later, such time as the Option may be exercised pursuant to Section 14(d) hereof) or the expiration

of the stated term of such Option, whichever period is shorter; provided, however, that, if the Optionee dies within such

ninety (90) day period, any unexercised Option held by such Optionee shall thereafter be exercisable to the extent to which it was exercisable

at the time of death for a period of one (1) year after the date of such death (or, if later, such time as the Option may be exercised

pursuant to Section 14(d) hereof) or for the stated term of such Option, whichever period is shorter. “Disability” shall

mean an Optionee’s total and permanent disability; provided, that if Disability is defined in an employment agreement between

the Company and the relevant Optionee, then, with respect to such Optionee, Disability shall have the meaning ascribed to it in such

employment agreement

(h)

Termination by Reason of Retirement. Unless otherwise determined by the Administrator, if any Optionee’s employment with

or service to the Company or any Subsidiary terminates by reason of Normal or Early Retirement (as such terms are defined below), any

Option held by such Optionee may thereafter be exercised to the extent it was exercisable at the time of such Retirement (or on such

accelerated basis as the Administrator shall determine at or after grant), but may not be exercised after ninety (90) days after the

date of such termination of employment or service (or, if later, such time as the Option may be exercised pursuant to Section 14(d) hereof)

or the expiration of the stated term of such Option, whichever date is earlier; provided, however, that, if the Optionee

dies within such ninety (90) day period, any unexercised Option held by such Optionee shall thereafter be exercisable, to the extent

to which it was exercisable at the time of death, for a period of one (1) year after the date of such death (or, if later, such time

as the Option may be exercised pursuant to Section 14(d) hereof) or for the stated term of such Option, whichever period is shorter.

For

purposes of this paragraph (h), “Normal Retirement” shall mean retirement from active employment with the Company

or any Subsidiary on or after the normal retirement date specified in the applicable Company or Subsidiary pension plan or if no such

pension plan, age 65, and “Early Retirement” shall mean retirement from active employment with the Company or any

Subsidiary pursuant to the early retirement provisions of the applicable Company or Subsidiary pension plan or if no such pension plan,

age 55.

(i)

Other Terminations. Unless otherwise determined by the Administrator upon grant, if any Optionee’s employment with or service

to the Company or any Subsidiary is terminated by such Optionee for any reason other than death, Disability, Normal or Early Retirement

or Good Reason (as defined below), the Option shall thereupon terminate, except that the portion of any Option that was exercisable on

the date of such termination of employment or service may be exercised for the lesser of ninety (90) days after the date of termination

(or, if later, such time as the Option may be exercised pursuant to Section 14(d) hereof) or the balance of such Option’s term,

which ever period is shorter. The transfer of an Optionee from the employ of or service to the Company to the employ of or service to

a Subsidiary, or vice versa, or from one Subsidiary to another, shall not be deemed to constitute a termination of employment or service

for purposes of the Plan.

(i)

In the event that the Optionee’s employment or service with the Company or any Subsidiary is terminated by the Company or such

Subsidiary for “cause” any unexercised portion of any Option shall immediately terminate in its entirety. For purposes hereof,

unless otherwise defined in an employment agreement between the Company and the relevant Optionee, “Cause” shall exist upon

a good-faith determination by the Board, following a hearing before the Board at which an Optionee was represented by counsel and given

an opportunity to be heard, that such Optionee has been accused of fraud, dishonesty or act detrimental to the interests of the Company

or any Subsidiary of Company or that such Optionee has been accused of or convicted of an act of willful and material embezzlement or

fraud against the Company or of a felony under any state or federal statute; provided, however, that it is specifically

understood that “Cause” shall not include any act of commission or omission in the good-faith exercise of such Optionee’s

business judgment as a director, officer or employee of the Company, as the case may be, or upon the advice of counsel to the Company.

Notwithstanding the foregoing, if Cause is defined in an employment agreement between the Company and the relevant Optionee, then, with

respect to such Optionee, Cause shall have the meaning ascribed to it in such employment agreement.

(ii)

In the event that an Optionee is removed as a director, officer or employee by the Company at any time other than for “Cause”

or resigns as a director, officer or employee for “Good Reason” the Option granted to such Optionee may be exercised by the

Optionee, to the extent the Option was exercisable on the date such Optionee ceases to be a director, officer or employee. Such Option

may be exercised at any time within one (1) year after the date the Optionee ceases to be a director, officer or employee (or, if later,

such time as the Option may be exercised pursuant to Section 14(d) hereof), or the date on which the Option otherwise expires by its

terms; whichever period is shorter, at which time the Option shall terminate; provided, however, if the Optionee dies before

the Options terminate and are no longer exercisable, the terms and provisions of Section 5(f) shall control. For purposes of this Section

5(i), and unless otherwise defined in an employment agreement between the Company and the relevant Optionee, Good Reason shall exist

upon the occurrence of the following:

| |

(A) |

the

assignment to Optionee of any duties inconsistent with the position in the Company that Optionee held immediately prior to the assignment; |

| |

|

|

| |

(B) |

a

Change of Control resulting in a significant adverse alteration in the status or conditions of Optionee’s participation with

the Company or other nature of Optionee’s responsibilities from those in effect prior to such Change of Control, including

any significant alteration in Optionee’s responsibilities immediately prior to such Change in Control; and |

| |

|

|

| |

(C) |

the

failure by the Company to continue to provide Optionee with benefits substantially similar to those enjoyed by Optionee prior to

such failure. |

Notwithstanding

the foregoing, if Good Reason is defined in an employment agreement between the Company and the relevant Optionee, then, with respect

to such Optionee, Good Reason shall have the meaning ascribed to it in such employment agreement.

(j)

Limit on Value of Incentive Option. The aggregate Fair Market Value, determined as of the date the Incentive Option is granted,

of Common Stock for which Incentive Options are exercisable for the first time by any Optionee during any calendar year under the Plan

(and/or any other stock option plans of the Company or any Subsidiary) shall not exceed $100,000. Should it be determined that an Incentive

Stock Option granted under the Plan exceeds such maximum for any reason other than a failure in good faith to value the Stock subject

to such option, the excess portion of such option shall be considered a Nonqualified Option. To the extent the employee holds two (2)

or more such Options which become exercisable for the first time in the same calendar year, the foregoing limitation on the exercisability

of such Option as Incentive Stock Options under the Federal tax laws shall be applied on the basis of the order in which such Options

are granted. If, for any reason, an entire Option does not qualify as an Incentive Stock Option by reason of exceeding such maximum,

such Option shall be considered a Nonqualified Option.

| |

6. |

Terms

and Conditions of Restricted Stock. |

Restricted

Stock may be granted under this Plan aside from, or in association with, any other award and shall be subject to the following conditions

and shall contain such additional terms and conditions (including provisions relating to the acceleration of vesting of Restricted Stock

upon a Change of Control), not inconsistent with the terms of the Plan, as the Administrator shall deem desirable:

(a)

Grantee rights. A Grantee shall have no rights to an award of Restricted Stock unless and until Grantee accepts the award within

the period prescribed by the Administrator and, if the Administrator shall deem desirable, makes payment to the Company in cash, or by

check or such other instrument as may be acceptable to the Administrator. After acceptance and issuance of a certificate or certificates,

as provided for below, the Grantee shall have the rights of a stockholder with respect to Restricted Stock subject to the non-transferability

and forfeiture restrictions described in Section 6(d) below.

(b)

Issuance of Certificates. The Company shall issue in the Grantee’s name a certificate or certificates for the shares of

Common Stock associated with the award promptly after the Grantee accepts such award.

(c)

Delivery of Certificates. Unless otherwise provided, any certificate or certificates issued evidencing shares of Restricted Stock

shall not be delivered to the Grantee until such shares are free of any restrictions specified by the Administrator at the time of grant.

(d)

Forfeitability, Non-transferability of Restricted Stock. Shares of Restricted Stock are forfeitable until the terms of the Restricted

Stock grant have been satisfied. Shares of Restricted Stock are not transferable until the date on which the Administrator has specified

such restrictions have lapsed. Unless otherwise provided by the Administrator at or after grant, distributions in the form of dividends

or otherwise of additional shares or property in respect of shares of Restricted Stock shall be subject to the same restrictions as such

shares of Restricted Stock.

(e)

Change of Control. Upon the occurrence of a Change in Control as defined in Section 5(c), the Administrator may accelerate the

vesting of outstanding Restricted Stock, in whole or in part, as determined by the Administrator, in its sole discretion.

(f)

Termination of Employment. Unless otherwise determined by the Administrator at or after grant, in the event the Grantee ceases

to be an employee or otherwise associated with the Company for any other reason, all shares of Restricted Stock theretofore awarded to

him which are still subject to restrictions shall be forfeited and the Company shall have the right to complete the blank stock power.

The Administrator may provide (on or after grant) that restrictions or forfeiture conditions relating to shares of Restricted Stock will

be waived in whole or in part in the event of termination resulting from specified causes, and the Administrator may in other cases waive

in whole or in part restrictions or forfeiture conditions relating to Restricted Stock.

No

Securities shall be granted pursuant to the Plan on or after the date which is ten years from the effective date of the Plan, but Options

and awards of Restricted Stock theretofore granted may extend beyond that date.

| |

8. |

Capital

Change of the Company. |

In

the event of any merger, reorganization, consolidation, recapitalization, stock dividend, or other change in corporate structure affecting

the Common Stock of the Company, the Administrator shall make an appropriate and equitable adjustment in the number and kind of shares

reserved for issuance under the Plan and (A) in the number and option price of shares subject to outstanding Options granted under the

Plan, to the end that after such event each Optionee’s proportionate interest shall be maintained (to the extent possible) as immediately

before the occurrence of such event. The Administrator shall, to the extent feasible, make such other adjustments as may be required

under the tax laws so that any Incentive Options previously granted shall not be deemed modified within the meaning of Section 424(h)

of the Code. Appropriate adjustments shall also be made in the case of outstanding Restricted Stock granted under the Plan.

The

adjustments described above will be made only to the extent consistent with continued qualification of the Option under Section 422 of

the Code (in the case of an Incentive Option) and Section 409A of the Code.

| |

9. |

Purchase

for Investment/Conditions. |

Unless

the Options and shares covered by the Plan have been registered under the Securities Act of 1933, as amended (the “Securities

Act”), or the Company has determined that such registration is unnecessary, each person exercising or receiving Securities

under the Plan may be required by the Company to give a representation in writing that he is acquiring the securities for his own account

for investment and not with a view to, or for sale in connection with, the distribution of any part thereof. The Administrator may impose

any additional or further restrictions on awards of Securities as shall be determined by the Administrator at the time of award.

(a)

The Company may make such provisions as it may deem appropriate, consistent with applicable law, in connection with any Securities granted

under the Plan with respect to the withholding of any taxes (including income or employment taxes) or any other tax matters.

(b)

If any Grantee, in connection with the acquisition of Restricted Stock, makes the election permitted under Section 83(b) of the Code

(that is, an election to include in gross income in the year of transfer the amounts specified in Section 83(b)), such Grantee shall

notify the Company of the election with the Internal Revenue Service pursuant to regulations issued under the authority of Code Section

83(b).

(c)

If any Grantee shall make any disposition of shares of Common Stock issued pursuant to the exercise of an Incentive Option under the

circumstances described in Section 421(b) of the Code (relating to certain disqualifying dispositions), such Grantee shall notify the

Company of such disposition within ten (10) days hereof.

| |

11. |

Effective

Date of Plan. |

The

Plan shall be effective on February 1, 2024 when the Plan was approved by majority vote of the Company’s stockholders on February

1, 2024.

| |

12. |

Amendment

and Termination. |

The

Board may amend, suspend, or terminate the Plan, except that no amendment shall be made that would impair the rights of any Participant

under Securities theretofore granted without the Participant’s consent, and except that no amendment shall be made which, without

the approval of the stockholders of the Company would:

(a)

materially increase the number of shares that may be issued under the Plan, except as is provided in Section 8;

(b)

materially increase the benefits accruing to the Participants under the Plan;

(c)

materially modify the requirements as to eligibility for participation in the Plan;

(d)

decrease the exercise price of an Incentive Option to less than 100% of the Fair Market Value per share of Common Stock on the date of

grant thereof or the exercise price of a Nonqualified Option to less than 100% of the Fair Market Value per share of Common Stock on

the date of grant thereof;

(e)

extend the term of any Option beyond that provided for in Section 5(b);

(f)

except as otherwise provided in Sections 5(d) and 8 hereof, reduce the exercise price of outstanding Options or effect repricing through

cancellations and re-grants of new Options;

(g)

increase the number of shares of Common Stock to be issued or issuable under the Plan to an amount that is equal to or in excess of 19.99%

of the number of shares of Common Stock outstanding before the issuance of the stock or securities; or

(h)

otherwise require stockholder approval pursuant to the rules and regulations of the NASDAQ Stock Market.

Subject

to the forgoing, the Administrator may amend the terms of any Option theretofore granted, prospectively or retrospectively, but no such

amendment shall impair the rights of any Optionee without the Optionee’s consent.

It

is the intention of the Board that the Plan comply strictly with the provisions of Section 409A of the Code and Treasury Regulations

and other Internal Revenue Service guidance promulgated thereunder (the “Section 409A Rules”) and the Administrator

shall exercise its discretion in granting awards hereunder (and the terms of such awards), accordingly. The Plan and any grant of an

award hereunder may be amended from time to time (without, in the case of an award, the consent of the Participant) as may be necessary

or appropriate to comply with the Section 409A Rules.

| |

13. |

Government

Regulations. |

The

Plan, and the grant and exercise or conversion, as applicable, of Securities hereunder, and the obligation of the Company to issue and

deliver shares under such Securities shall be subject to all applicable laws, rules and regulations, and to such approvals by any governmental

agencies, national securities exchanges and interdealer quotation systems as may be required.

(a)

Certificates. All certificates for shares of Common Stock delivered under the Plan shall be subject to such stop transfer orders

and other restrictions as the Administrator may deem advisable under the rules, regulations and other requirements of the Securities

and Exchange Commission, or other securities commission having jurisdiction, any applicable Federal or state securities law, any stock

exchange or interdealer quotation system upon which the Common Stock is then listed or traded and the Administrator may cause a legend

or legends to be placed on any such certificates to make appropriate reference to such restrictions.

(b)

Employment Matters. Neither the adoption of the Plan nor any grant or award under the Plan shall confer upon any Participant who

is an employee of the Company or any Subsidiary any right to continued employment or, in the case of a Participant who is a director,

continued service as a director, with the Company or a Subsidiary, as the case may be, nor shall it interfere in any way with the right

of the Company or any Subsidiary to terminate the employment of any of its employees, the service of any of its directors or the retention

of any of its consultants or advisors at any time.

(c)

Limitation of Liability. No member of the Administrator, or any officer or employee of the Company acting on behalf of the Administrator,

shall be personally liable for any action, determination or interpretation taken or made in good faith with respect to the Plan, and

all members of the Administrator and each and any officer or employee of the Company acting on their behalf shall, to the extent permitted

by law, be fully indemnified and protected by the Company in respect of any such action, determination or interpretation.

(d)

Registration of Stock. Notwithstanding any other provision in the Plan, no Option may be exercised unless and until the Common

Stock to be issued upon the exercise thereof has been registered under the Securities Act and applicable state securities laws, or are,

in the opinion of counsel to the Company, exempt from such registration in the United States. The Company shall not be under any obligation

to register under applicable federal or state securities laws any Common Stock to be issued upon the exercise of an Option granted hereunder

in order to permit the exercise of an Option and the issuance and sale of the Common Stock subject to such Option, although the Company

may in its sole discretion register such Common Stock at such time as the Company shall determine. If the Company chooses to comply with

such an exemption from registration, the Common Stock issued under the Plan may, at the direction of the Administrator, bear an appropriate

restrictive legend restricting the transfer or pledge of the Common Stock represented thereby, and the Administrator may also give appropriate

stop transfer instructions with respect to such Common Stock to the Company’s transfer agent.

| |

15. |

Non-Uniform

Determinations. |

The

Administrator’s determinations under the Plan, including, without limitation, (i) the determination of the Participants to receive

awards, (ii) the form, amount and timing of such awards, (iii) the terms and provisions of such awards and (ii) the agreements evidencing

the same, need not be uniform and may be made by it selectively among Participants who receive, or who are eligible to receive, awards

under the Plan, whether or not such Participants are similarly situated.

The

validity, construction, and effect of the Plan and any rules and regulations relating to the Plan shall be determined in accordance with

the internal laws of the State of Delaware, without giving effect to principles of conflicts of laws, and applicable federal law.

Exhibit

5.1

June

13, 2024

VIA

ELECTRONIC TRANSMISSION

Securities

and Exchange Commission

100

F Street, N.E.

Washington,

DC 20549

| |

Re: |

Shineco,

Inc. Form S-8 Registration Statement |

Ladies

and Gentlemen:

We

refer to the above-captioned registration statement on Form S-8 (the “Registration Statement”) under the Securities Act of

1933, as amended (the “Act”), filed by Shineco, Inc., a Delaware corporation (the “Company”), with the Securities

and Exchange Commission.

We

have examined the originals, photocopies, certified copies or other evidence of such records of the Company, certificates of officers

of the Company and public officials, and other documents as we have deemed relevant and necessary as a basis for the opinion hereinafter

expressed. In such examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us

as certified copies or photocopies and the authenticity of the originals of such latter documents.

Based

on our examination mentioned above, we are of the opinion that the securities being issued pursuant to the Registration Statement are

duly authorized and will be, when so issued, legally and validly issued, and fully paid and non-assessable.

We

hereby consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement. In giving the foregoing consent, we do not

hereby admit that we are in the category of persons whose consent is required under Section 7 of the Act, or the rules and regulations

of the Securities and Exchange Commission.

| |

Very

truly yours, |

| |

|

| |

/s/

Sichenzia Ross Ference Carmel LLP |

| |

Sichenzia

Ross Ference Carmel LLP |

Exhibit

23.1

|

Assentsure

PAC

UEN

– 201816648N

180B

Bencoolen Street #03-01

The

Bencoolen Singapore 189648

http://www.assentsure.com.sg |

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

consent to the incorporation by reference in this Form S-8 of our report dated September 28, 2023 relating to the consolidated financial

statements of Shineco, Inc., appearing in its Annual Report on Form 10-K for the year ended June 30, 2023. Our report contains an explanatory

paragraph regarding the Company’s ability to continue as a going concern.

/s/

Assentsure PAC

Assentsure

PAC

Singapore

June

13, 2024

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-8

(Form

Type)

SHINECO,

INC.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| Security Type | |

Security Class Title | |

Fee Calculation Rule | |

Amount Registered (1) | | |

Proposed Maximum Offering Price Per Share | | |

Proposed Maximum Aggregate Offering Price | | |

Fee Rate | | |

Amount of Registration Fee | |

| | |

| |

| |

| | |

| | |

| | |

| | |

| |

| Equity | |

Common Stock, par value $0.001 per share | |

457(c) and 457(h) | |

| 1,000,000 | (2) | |

$ | 3.13

| (3) | |

$ | 3,130,000 | | |

| 0.00014760 | | |

$ | 461.99 | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Offering Amounts | |

| | | |

| | | |

$ | 3,130,000 | | |

| | | |

$ | 461.99 | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Fee Offsets | |

| | | |

| | | |

| | | |

| | | |

| — | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Fee Due | |

| | | |

| | | |

| | | |

| | | |

$ | 461.99 | |

| (1) |

Pursuant

to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement on

Form S-8 shall also be deemed to cover such additional securities which become issuable by reason of any stock dividend, stock split,

recapitalization or any other similar transactions. |

| |

|

| (2) |

Consists

of 1,000,000 shares of common stock of Shineco, Inc., par value $0.001 per share (“Common Stock”), available for

issuance under the 2024 Equity Incentive Plan. |

| |

|

| (3) |

Estimated

solely for the purpose of calculating the registration fee under Rule 457(c) and (h) of the Securities Act on the basis of the average

of the high and low sales price per share of Common Stock on June 11, 2024, as reported on the Nasdaq Capital Market. |

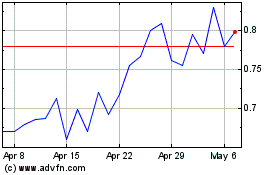

Shineco (NASDAQ:SISI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Shineco (NASDAQ:SISI)

Historical Stock Chart

From Nov 2023 to Nov 2024