As filed with the Securities and Exchange Commission

on October 5, 2022

Registration No. 333-_____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

SHIFTPIXY, INC.

(Exact name of registrant as specified in its charter)

| Wyoming |

47-4211438 |

| (State of incorporation) |

(IRS Employer Identification No.) |

501 Brickell Key Drive, Suite 300

Miami, FL 33131

(888) 798-9100

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Scott W. Absher

Chief Executive Officer

501 Brickell Key Drive, Suite 300

Miami, FL 33131

(888) 798-9100

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Gregory Sichenzia, Esq.

Jeff Cahlon, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New York, New York 10036

(212) 930-9700

Approximate date of commencement

of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being

registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed

to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ¨

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

|

Accelerated filer ¨ |

| Non-accelerated filer x |

|

Smaller reporting company x |

| |

|

Emerging growth company x |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Exchange Act. ¨

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

| |

|

|

| The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED OCTOBER 5, 2022 |

ShiftPixy, Inc.

1,270,834 Shares of Common Stock

Pursuant to this prospectus,

the selling stockholders identified herein are offering on a resale basis an aggregate of 1,270,834 shares of common stock of ShiftPixy, Inc.,

including (i) 416,667 shares issued pursuant to the securities purchase agreement, dated September 20, 2022 (the “Purchase Agreement”),

between us and the purchaser named therein, (ii) 833,334 shares issuable upon exercise of warrants (the “Investor Warrants”)

issued to the purchaser under the Purchase Agreement, and (iii) 20,833 shares issuable upon exercise of warrants (the “Placement

Agent Warrants,” and together with the Investor Warrants, the “Warrants”) issued to the placement agent and its designees

as compensation in connection with the private placement under the Purchase Agreement (the “Private Placement”). The Investor

Warrants were issued upon closing of the Purchase Agreement on September 23, 2022, are exercisable for a period of seven years commencing

upon issuance and have an exercise price of $12.00 share. The Placement Agent Warrants are exercisable commencing March 23, 2023 and will

expire four years from the date of effectiveness of this registration statement.

We will not receive any of

the proceeds from the sale by the selling stockholders of the common stock. Upon any exercise of the Warrants by payment of cash, however,

we will receive the exercise price of the Warrants.

The selling stockholders may

sell or otherwise dispose of the common stock covered by this prospectus in a number of different ways and at varying prices. We provide

more information about how the selling stockholders may sell or otherwise dispose of the common stock covered by this prospectus in the

section entitled “Plan of Distribution” on page 15. Discounts, concessions, commissions and similar selling expenses attributable

to the sale of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses (other than

discounts, concessions, commissions and similar selling expenses) relating to the registration of the common stock with the Securities

and Exchange Commission, or the SEC.

You should carefully read

this prospectus together with the documents we incorporate by reference, before you invest in our common stock.

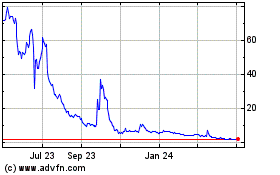

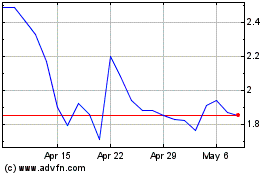

Our common stock is listed

on The Nasdaq Capital Market under the symbol “PIXY.” On October 3, 2022, the last reported sale price for our common stock

was $13.70 per share.

Investing in our

common stock involves substantial risk. Please read “Risk Factors” beginning on page 5 of this

prospectus and in the documents we incorporate by reference.

Neither the SEC nor any

state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is _____________, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we have filed with the SEC pursuant to which the selling stockholders named herein may, from time to time,

offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus. You should not assume that the information

contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any

information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference,

even though this prospectus is delivered or shares of common stock are sold or otherwise disposed of on a later date. It is important

for you to read and consider all information contained in this prospectus, including the documents incorporated by reference therein,

in making your investment decision. You should also read and consider the information in the documents to which we have referred you under

“Where You Can Find More Information” and “Information Incorporated by Reference” in this prospectus.

We have not authorized anyone

to give any information or to make any representation to you other than those contained or incorporated by reference in this prospectus. You

must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus

does not constitute an offer to sell or the solicitation of an offer to buy any of our shares of common stock other than the shares of

our common stock covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come

into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe,

any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

Unless we have indicated otherwise,

or the context otherwise requires, references in this prospectus to “ShiftPixy,” the “Company,” “we,”

“us” and “our” refer to ShiftPixy, Inc.

SUMMARY

This summary highlights

certain information appearing elsewhere in this prospectus and in the documents we incorporate by reference into this prospectus. The

summary is not complete and does not contain all of the information that you should consider before investing in our common stock. After

you read this summary, you should read and consider carefully the entire prospectus and the more detailed information and financial statements

and related notes that are incorporated by reference into this prospectus and any prospectus supplement. If you invest in our shares,

you are assuming a high degree of risk.

About Us—Business Overview

We are a human capital management

(“HCM”) platform that provides real-time business intelligence along with HR services on a fee-based “software as a

service” (“SAAS”) business model. We provide human resources, employment compliance, insurance related, payroll, and

operational employment services solutions for our business clients (“clients” or “operators”) and shift work or

“gig” opportunities for worksite employees (“WSEs” or “Shifters”). As consideration for providing

these services, we receive administrative or processing fees as a percentage of a client’s gross payroll, process and file payroll

taxes and payroll tax returns, provide workers’ compensation coverage and administration related services, and provide employee

benefits. The level of our administrative fees is dependent on the human capital management services we provide to our clients which range

from basic payroll processing to a full suite of human capital management solutions and access to human resources information systems

(“HRIS”) technology. Our primary operating business metric is gross billings, consisting of our clients’ fully burdened

payroll costs, which includes, in addition to payroll, employer taxes, benefits costs and costs associated with workers’ compensation

insurance.

Our goal is to be the best

online fully-integrated workforce solution and employer services support platform for lower-wage workers and employment opportunities.

We have built an application and desktop capable marketplace solution that allows workers (depending on the service the client elects)

to access and apply for job opportunities created by our clients and provides traditional

back-office services to our clients as well as real-time business information for our clients’ human capital needs and requirements.

We have designed our business

platform to evolve to meet the needs of a changing workforce and a changing work environment. We believe our approach and robust technology

will benefit from the demographic workplace shift away from traditional employee/employer relationships towards the increasingly flexible

work environment that is characteristic of the gig economy. We believe this change in approach began after the 2008 financial crisis and

is currently being driven by the labor shortage created by the COVID-19 economic crisis. We also believe that a significant problem underpinning

the lower wage labor crisis is the sourcing of workers and matching temporary or gig workers to short-term job opportunities.

We have built our business

on a recurring revenue model since our inception in 2015. Our initial market focus–which we have maintained—has been to monetize

a traditional staffing services business model, coupled with developed technology, to address underserved markets containing predominately

lower wage employees with high turnover, including the light industrial, food service, restaurant, and hospitality markets.

Although we expanded into

other industries during our fiscal year ended August 31, 2021 (“Fiscal 2021”), our primary focus was on clients in the

restaurant and hospitality industries, market segments traditionally characterized by high employee turnover and low pay rates. We believe

these industries will be better served by our HRIS technology platform and related mobile smartphone application that provides human resources

solutions and tracking for our clients. Our HRIS platform should provide our clients with real-time human capital business intelligence,

which we believe will result in lower operating costs, improved customer experience, and revenue growth. All our clients enter into service

agreements with us or one of our wholly-owned subsidiaries to provide these human capital management services.

We believe that our value

proposition is to provide a combination of overall net cost savings to our clients, for which they are willing to pay increased administrative

fees that offset the costs of the services we provide, as follows:

| · | Payroll tax compliance and

human capital management services; |

| · | Governmental HR compliance

such as for Patient Protection and Affordable Care Act compliance requirements; |

| · | Reduced client workers’

compensation premiums or enhanced coverage; |

| · | Access to an employee pool

of potential qualified applicants to reduce turnover costs; |

| · | Ability to fulfill temporary

worker requirements in a “tight” labor market with our intermediation (“job matching”) services; and |

| · | Reduced screening and onboarding

costs due to access to an improved pool of qualified applicants who can be onboarded through a highly advanced, efficient, and virtually

paperless technology platform. |

We believe that providing

this baseline business, coupled with our technology solution, provides a unique, value-added solution to the HR compliance, staffing,

and scheduling problems that businesses face. During and following the COVID-19 pandemic, we have instituted various growth initiatives

that are designed to accelerate our revenue growth. These initiatives include the matching of temporary job opportunities between workers

and employers under a fully compliant staffing solution through our HRIS platform. For this solution to be effective, we need to obtain

a significant number of Shifters in concentrated geographic areas to fulfill our clients’ unique staffing needs and facilitate the

client-WSE relationship. As such, during Fiscal 2021, we worked diligently to identify and create a pool of Shifters in specifically designated

geographic regions of the United States.

About this Offering

On

September 20, 2022, we entered into a securities purchase agreement with a large institutional investor (the “Purchaser”)

pursuant to which we sold to the Purchaser an aggregate of 416,667 shares of its common stock

together with warrants (the “Investor Warrants”) to purchase up to 833,334

shares of common stock in a private placement offering (the “Private Placement”). Each

share of common stock and two accompanying Investor Warrants were sold together at a combined offering price of $12.00. The Investor Warrants

are exercisable for a period of seven years commencing upon issuance at an exercise price of $12.00 per share, subject to adjustment. The

Private Placement closed on September 23, 2022. The gross proceeds to us from the private placement were approximately $5 million.

In

connection with the Purchase Agreement, we and the Purchaser entered into amendment No. 1 to warrants (the “Warrant Amendment”).

Pursuant to the Warrant Amendment, the exercise price of (i) 25,233 warrants issued on September 3, 2021, and (ii) 98,969 warrants issued

on January 28, 2022, was reduced to $0.01.

A.G.P./Alliance

Global Partners (the “Placement Agent”) acted as the exclusive placement agent in connection with the private placement pursuant

to the terms of a placement agent agreement, dated September 20, 2022, between us and the Placement Agent. Pursuant to the placement agent

agreement, we paid the Placement Agent a fee equal to 7.0% of the aggregate gross proceeds from the private placement. In addition to

the cash fee, we issued to the Placement Agent and its designees warrants to purchase up to 20,833 shares (the “Placement Agent

Warrant Shares”) of common stock (5% of the number of shares sold in the Private Placement (the “Placement Agent Warrants”)).

The Placement Agent Warrants will be exercisable for a period commencing six months from issuance, will expire four years from the effectiveness

of a registration statement for the resale of the underlying shares, and have an initial exercise price of $13.20 per share.

In

connection with the Purchase Agreement, we and the Purchaser entered into a registration rights agreement. Pursuant to the registration

rights agreement, we agreed to file a registration statement with the Securities and Exchange Commission (the “SEC”) to register

the resale by the Purchaser of the shares sold under the Purchase Agreement and the shares issuable upon exercise of the Investor Warrants

no more than 15 days after the date of closing, and to have such registration statement declared effective within 30 days of filing (or

60 days in the event of a “full review” by the SEC).

This

prospectus includes the resale of (i) 416,667 shares issued under the Purchase Agreement, (ii) 833,334 shares underlying the Investor

Warrants issued under the Purchase Agreement, and (iii) 20,833 Placement Agent Warrant Shares.

We are filing the registration

statement of which this prospectus forms a part to satisfy our obligations under the registration rights agreement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended, or the Exchange Act. Forward-looking statements give current expectations or forecasts of future events or our future financial

or operating performance. We may, in some cases, use words such as “anticipate,” “believe,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” “would” or the negative of those terms, and similar expressions

that convey uncertainty of future events or outcomes to identify these forward-looking statements.

These forward-looking statements

reflect our management’s beliefs and views with respect to future events, are based on estimates and assumptions as of the date

of this prospectus and are subject to risks and uncertainties, many of which are beyond our control, that could cause our actual results

to differ materially from those in these forward-looking statements. We discuss many of these risks in greater detail in this prospectus

under “Risk Factors” and in our Annual Report on Form 10-K filed with the SEC on December 3, 2021, as amended by

our Annual Report on Form 10-K/A filed with the SEC on February 28, 2022, as well as those described in the other documents

we file with the SEC. Moreover, new risks emerge from time to time. It is not possible for our management to predict all risks, nor can

we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results

to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place

undue reliance on these forward-looking statements.

We undertake no obligation

to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as

may be required by applicable laws or regulations.

RISK FACTORS

An investment in our securities

involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties

discussed below, as well as those under the heading “Risk Factors” contained in our Annual

Report on Form 10-K for the year ended August 31, 2021, as amended by our Annual

Report on Form 10-K/A for the year ended August 31, 2021, and in our quarterly

report for the quarterly period ended May 31, 2022, as filed with the SEC, and as incorporated by reference in this prospectus,

as the same may be amended, supplemented or superseded by the risks and uncertainties described under similar headings in the other documents

that are filed by us after the date hereof and incorporated by reference into this prospectus.

Risks Relating to Our Business

There is no guarantee

that our current cash position, expected revenue growth and anticipated financing transactions will be sufficient to fund our operations

for the next twelve months. Our sponsorship of IHC, as described below, requires significant capital deployment, entails certain risks

and may not be successful, which would likely have a material adverse effect on our future expansion, revenues, and profits.

As of May 31, 2022, we

had cash of $0.1 million and a working capital deficit of $23.1 million. We have incurred recurring losses, which has resulted in an accumulated

deficit of $179.8 million as of May 31, 2022. The recurring losses and cash used in operations are indicators of substantial doubt

as to our ability to continue as a going concern for at least one year from issuance of the audited financial statements included in our

Annual Report on Form 10-K for the fiscal year ended August 31, 2021, and in our Quarterly Reports on Form 10-Q for the quarterly

periods ended November 30, 2021, February 28, 2022, and May 31, 2022. Our plans to alleviate substantial doubt are discussed below and

elsewhere in our Annual Report on Form 10-K for the fiscal year ended August 31, 2021, and in our Quarterly Reports on Form

10-Q for the quarterly periods ended November 30, 2021, February 28, 2022, and May 31, 2022.

Historically, our principal

source of financing has come through the sale of our common stock, warrants and the issuance of convertible notes. In May 2020, we

successfully completed an underwritten public offering, raising a total of $12 million ($10.3 million net of costs), and closed an additional

$1.35 million ($1.24 million net of costs) between June 1, 2020 and July 7, 2020 pursuant to exercise of the underwriter’s

overallotment. In October 2020, we closed an additional $12 million equity offering ($10.7 million net of costs). In May 2021,

we raised approximately $12 million ($11.1 million net of costs) in connection with the sale of common stock and warrants. More recently,

in September 2021, we raised approximately $12 million ($11.1 million net of costs) in connection with the sale of common stock and

warrants, in July 2022, we raised approximately $1.3 million in connection with the exercise of warrants ($1.2 million net of costs),

and in September 2022 2022, we raised $5 million ($4.6 million net of costs) in connection with a sale of common stock and warrants. Our

plans and expectations for the next twelve months include raising additional capital to help fund expansion of our operations, including

the continued development and support of our IT and HRIS platform, as well as our activities in connection with our sponsorship of Industrial

Human Capital, Inc. (“IHC”), which is a special purpose acquisition company, or “SPAC”, for which we serve

as the financial sponsor, through our subsidiary, ShiftPixy Investments, Inc. (“Investments”). We expect to continue

to invest in our HRIS platform, ShiftPixy Labs, our sponsorship of IHC and other growth initiatives, all of which have required and will

continue to require significant cash expenditures.

We do not currently have financing

plans, but we expect to obtain additional financing in the form of public or private equity offerings over the next twelve months as described

above to extend loans to IHC in connection with the completion of its initial business combination (“IBC”), as required. There

is no assurance that IHC will be able to consummate its IBC within twelve months from the closing of the IHC IPO, which period ends on

October 22, 2022, in which case IHC would cease all operations except for the purpose of winding up, unless the shareholders approve an

extension of the time period for IHC to complete its IBC, in which case we would be required to continue to extend loans to IHC until

such time that it has completed its IBC. While IHC has filed a proxy statement proposing a meeting and vote of the shareholders on October

14, 2022, to extend the time period for IHC to complete its IBC for a period of 6 months to April 22, 2023, there is no assurance that

the shareholders will approve an extension. Assuming that the extension is approved, while we believe that IHC, after completing its IBC,

will generate significant revenues for us by virtue of entering into client services agreements (“CSAs”) and/or other contractual

relationships with us after completing the de-SPAC process, we are unable to rely with certainty on IHC to generate revenue in the future.

We expect to invest or otherwise

extend capital, through Investments, totaling up to approximately $6,164,102 in connection with our sponsorship of IHC, including $25,000

to purchase Founder Shares (previously paid on February 18, 2021), $4,639,102 to purchase private placement warrants (previously

paid on October 22, 2021) and up to $1,500,000 in working capital loans to IHC to finance transaction costs in connection with IHC’s

IBC. To date, we have not extended any such working capital loans, nor have we determined the terms upon which any such working capital

loans would be extended and/or repaid, though up to $1,500,000 of such working capital loans extended to IHC may be convertible into private

placement warrants of IHC’s post business combination entity, at a price of $1.00 per warrant at our option. If we extend working

capital loans to IHC and IHC does not consummate its IBC, such working capital loans are unlikely to be repaid. IHC has an outstanding

balance of $195,000 as of May 31, 2022, from the working capital loans.

We will lose our entire investment

in IHC if it is unable to consummate its IBC. We have withdrawn the initial public offering registration statements of Vital, TechStackery

and Firemark in order to focus on the growth and expansion of our Company and to completing IHC’s IBC. The combined value of our

equity investment in our sponsored SPACs, as carried on the consolidated balance sheet included in the financial statements accompanying

our Annual Report on Form 10-K, filed with the SEC on December 3, 2021, was $47,472,000, which we computed in accordance with

accounting principles generally accepted in the United States, and which constituted the majority of the carrying value of our total assets

as reflected on our consolidated balance sheet; however, our forfeiture of Founder Shares of Vital, TechStackery and Firemark significantly

decreased the value of our equity investment described above to $9,494,000 as we reported in our 10-Q for the period ending May 31,

2022. Further, if IHC is unable to consummate its IBC, then our Founder Shares and private placement warrants in IHC will be worthless.

Even if IHC is able to consummate its IBC, we can provide no assurance that the value of our equity investment in IHC will not decline

significantly based upon a variety of factors, including, without limitation, stockholder and general market reaction to IHC’s IBC,

redemption requests received from IHC stockholders in connection with any proposed IBC, and IHC stockholder dilution resulting from additional

capital raises or other financing transactions undertaken by IHC in connection with its IBC. We further note that on May 13, 2022,

we issued a press release announcing a special distribution of shares of common stock of IHC to all ShiftPixy shareholders of record as

of May 17, 2022. The shares in IHC are expected to be distributed to eligible ShiftPixy shareholders as soon as practicable following

the completion of the IBC, subject to a registration statement covering the IHC shares being declared effective by the SEC. In the event

of such distribution of the IHC shares, the entire remaining value of our equity investment of $9,494,000 will be reduced to zero.

We expect our investment in

our HRIS platform to continue over the next twelve months regardless of whether we enter into client services agreements with IHC’s

post business combination entity, and regardless of whether IHC is able to complete successfully the De-SPAC process, as we believe such

investments will be necessary to support our existing clients as well as our future organic growth. While we anticipate that these investments

will yield benefits to us in the future in the form of increased revenues and earnings, it is likely that such improved financial results

will be delayed or otherwise materially impacted if we are unable to enter successfully into client services agreements with IHC’s

post business combination entity on terms that are beneficial to us, or if IHC is unable to complete its IBC.

We expect to engage in additional

sales of our securities during the 2022 calendar year, either through registered public offerings or private placements, the proceeds

of which we intend to use to fund our operations and growth initiatives.

We can give no assurance that

it will be successful in implementing our business plan and obtaining financing on advantageous terms, or at all.

We will lose our entire investment in IHC

if IHC does not complete its initial business combination and our officers may have a conflict of interest in determining whether a particular

business combination target is appropriate for IHC.

On April 29, 2021, we

announced our sponsorship, through Investments, of four SPAC IPOs, but have since withdrawn the initial public offering registration statements

of three such SPACs in order to focus on the growth and expansion of our company and to completing IHC’s IBC. We purchased Founder

Shares in each SPAC, through Investments, for an aggregate purchase price of $100,000, or $25,000 per SPAC. The number of Founder Shares

issued to us was determined based on the expectation that such Founder Shares would represent 15% of the outstanding shares of each SPAC

after its initial public offering (excluding the private placement warrants described below and their underlying securities). We may be

able to make a substantial profit on our nominal investment in the Founder Shares of IHC even at a time when IHC’s public shares

have lost significant value. On the other hand, the IHC Founder Shares will be worthless if it does not complete its IBC. Accordingly, Investments

will benefit from the completion of IHC’s IBC and may be incentivized to complete an IBC of a less favorable target company or on

terms less favorable to stockholders rather than liquidate. In addition, as noted above, on May 13, 2022, we issued a press release

announcing a special distribution of shares of common stock of IHC to all ShiftPixy shareholders of record as of May 17, 2022. The

shares in IHC are expected to be distributed to eligible ShiftPixy shareholders as soon as practicable following the completion of the

IBC, subject to a registration statement covering the IHC shares being declared effective by the SEC. In the event of such distribution

of the IHC shares, the entire remaining value of our equity investment of $9,494,000 will be reduced to zero.

The registration statement

and prospectus relating to IHC’s IPO was declared effective by the SEC on October 19, 2021, and IHC units (the “IHC Units”),

consisting of one share of common stock and an accompanying warrant to purchase one share of IHC common stock, began trading on the NYSE

on October 20, 2021. The IHC IPO closed on October 22, 2021, raising gross proceeds for IHC of $115 million. In connection with

the IHC IPO, we purchased, through our wholly-owned subsidiary, 4,639,102 placement warrants at a price of $1.00 per warrant, for an aggregate

purchase price of $4,639,102. The IHC private placement warrants will be worthless if IHC does not complete an IBC. Each whole private

placement warrant is exercisable to purchase one whole share of common stock in each SPAC at $11.50 per share. Also, as previously disclosed,

on February 18, 2021, we invested an aggregate of $100,000 to purchase Founder Shares in all four of our sponsored SPACs through

Investments, though we now intend to forfeit the Founder Shares of Vital, TechStackery and Firemark.

The investment amounts set

forth above do not include loans that the Company’s wholly owned subsidiary, Investments, has extended to our four SPACs. As

of May 31, 2022, we advanced, through Investments, an aggregate of approximately $378,000 to the SPACs for payment of various expenses

in connection with the SPAC IPOs, principally consisting of SEC registration, legal and auditing fees. In addition, the Company previously

disclosed that it anticipates IHC will repay its advanced expenses when its IBC is completed. During the nine-month period ended May 31,

2022, we received approximately $183,000 from IHC, as repayment of advances provided by the sponsor with a remaining outstanding balance

of $233,000 as of May 31, 2022. The intercompany balances have been eliminated in consolidation.

In addition, we may extend

working capital loans to IHC to finance transaction costs in connection with IHC’s IBC. To date, we have not extended any such working

capital loans, nor have we determined the terms upon which any such working capital loans would be extended and/or repaid. Up to $1,500,000

of such working capital loans may be convertible into private placement warrants of IHC’s post business combination entity, at a

price of $1.00 per warrant at our option. If we extend working capital loans to IHC and IHC does not consummate its IBC, such working

capital loans are unlikely to be repaid.

We do not currently have financing

plans, but we expect to obtain additional financing in the form of public or private equity offerings as described above to purchase private

placement warrants and to extend loans to IHC in connection with its IBC.

The interests of our officers

who also serve as officers of IHC, and Mr. Absher, our Chairman and Chief Executive Officer who also serves as Chairman of the Board

of Directors of IHC, may influence their motivation in identifying and selecting a target business combination for IHC, completing IHC’s

IBC and influencing the operation of the business following IHC’s IBC.

There is no assurance that

IHC will be able to complete its IBC before October 22, 2022. While we believe that IHC, after completing its IBC, will generate

significant revenues for us by virtue of entering into CSAs and/or other contractual relationships with us after completing the De-SPAC

process, we are unable to rely with certainty on IHC to generate revenue in the future.

We expect our investment in

our HRIS platform to continue regardless of whether we enter into CSAs with the SPACs, and regardless of whether IHC is able to complete

successfully the De-SPAC process, as we believe such investments will be necessary to support our existing clients as well as our future

organic growth. While we anticipate that these investments will yield benefits to us in the future in the form of increased revenues and

earnings, it is likely that such improved financial results will be delayed or otherwise materially impacted if we are unable to enter

successfully into CSAs with IHC’s post business combination entity on terms that are beneficial to us, or if IHC is unable to complete

its IBC.

Certain of our

officers and directors have potential conflicts of interest arising from our sponsorship activities of IHC.

Our officers may not commit

their full time to our affairs, which may result in a conflict of interest in allocating their time between our operations and IHC. Mr. Absher

is engaged in an official capacity with IHC although he is not obligated to contribute any specific number of hours per week to its affairs.

Mr. Absher, our Chairman and Chief Executive Officer, also serves as Chairman of the Board of Directors of IHC. While we do not believe

that the time devoted to IHC will undermine his ability to fulfill his duties with respect to our Company, if the business affairs of

IHC requires him to devote substantial amounts of time to such affairs, it could limit his ability to devote time to our affairs which

may have a negative impact on our operations. The interests of Mr. Absher in our Company and IHC may influence his motivation in

identifying and selecting a target business combination, completing an IBC and influencing the operation of our business following IHC’s

IBC.

None of our officers or directors

(i) hold any equity interest in IHC, (ii) receive any form of compensation from IHC, or (iii) have any pecuniary interest

related to IHC separate and apart from their pecuniary interest in our Company. While Mr. Absher is an officer and director of both

our Company and IHC, and owes fiduciary duties to each entity, our Board has considered this matter and determined that no disabling conflict

of interest has arisen or is likely to arise that would prevent him from discharging his fiduciary duties on behalf of our Company. As

a result, our Board has (i) approved our sponsorship of IHC through our subsidiary, Investments, (ii) approved Mr. Absher

serving as officer and director of IHC, and (iii) approved the allocation of additional ShiftPixy resources, including financial

backing and personnel, for the purpose of supporting the activities of IHC as it pursues its IBC. Further, we do not anticipate that IHC

will enter into an IBC with a target business affiliated with us, Investments, or any of our officers or directors. To the extent

IHC were to propose a business combination with such an affiliated person or related party, such transaction would be negotiated on an

arms’ length basis and be subject to Board and shareholder approvals, as appropriate.

If we are deemed to be an investment company

under the Investment Company Act of 1940, we may be required to institute burdensome compliance requirements and our activities may be

restricted, which may make it difficult for us to conduct our operating business and our IHC sponsorship activities.

Section 3(a)(1)(A) of

the Investment Company Act 1940 (the “1940 Act”) defines as an investment company any issuer that is or holds itself out as

being, engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities. We are

and hold ourselves out to be an HCM platform that provides real-time business intelligence along with HR services on a fee-based SAAS

business model. We provide human resources, employment compliance, insurance related, payroll, and operational employment services solutions

for our clients and WSEs. In addition, we have withdrawn the initial public offering registration statements of Vital, TechStackery and

Firemark in order to focus on the growth and expansion of our company and on the completion of IHC’s IBC. We believe that these

actions, together with our ongoing operations, evidence our bona fide intent to be engaged primarily in a non-investment company business

as soon as is reasonably possible in accordance with the safe harbor provided by Rule 3a-2, as described below. Despite our bona

fide intent and other actions we have taken, there can be no assurances that we will not be deemed to be an investment company under the

1940 Act.

Section 3(a)(1)(C) of

the 1940 Act defines as an investment company any issuer that is engaged or proposes to engage in the business of investing, reinvesting,

owning, holding or trading in securities and owns or proposes to acquire investment securities having a value exceeding 40% of the value

of the issuer’s total assets (exclusive of Government securities (as defined in the 1940 Act) and cash items) on an unconsolidated

basis (the “40% Threshold”). We acquired the Founder Shares on April 22, 2021, and we believe that we exceeded the 40%

Threshold on October 19, 2021 in connection with the pricing of IHC’s IPO exclusive of Government securities and cash items.

Investments acquired 4,312,500 Founder Shares on April 22, 2021, for an aggregate purchase price of $25,000, or approximately $0.006

per share. Prior to the pricing of IHC’s IPO on October 19, 2021, there was substantial doubt as to whether the IPO would

be completed on the proposed terms, or at all, and therefore, the fair market value of the Founder Shares owned by us had significantly

less value than $10.00 per unit, the IPO price. On October 19, 2021, upon pricing of IHC’s IPO, the Founder Shares had a market

value of $21,100,000 based on the $10.00 per unit offering price. Accordingly, we believe that October 19, 2021, is the beginning

of the one-year temporary safe harbor under Rule 3a-2 promulgated under the 1940 Act, as described below.

Rule 3a-2 provides a

temporary safe harbor from application of the 1940 Act’s provisions to certain issuers that are in transition to a non-investment

company business. Specifically, Rule 3a-2 deems an issuer that meets the definition of “investment company” in Section 3(a)(1)(A) or

3(a)(1)(C) of the 1940 Act not to be an investment company for a period not to exceed one year, provided that the conditions of the

rule are satisfied. Pursuant to Rule 3a-2, the one-year period begins on the earlier of: (i) the date on which an issuer

owns securities and/or cash having a value exceeding 50% of the value of such issuer’s total assets on either a consolidated or

unconsolidated basis; or (ii) the date on which an issuer owns or proposes to acquire investment securities having a value exceeding

the 40% Threshold. Accordingly, we believe that our IHC sponsorship activities fall within the safe harbor under Rule 3a-2 of the

1940 Act, which allows a 3(a)(1)(C) investment company (as a “transient investment company”) a grace period of one year

from the date of classification, to avoid registration under the 1940 Act. The SEC’s IM Guidance Update No. 2017-03 (March 2017)

specifically states that the “purpose of Rule 3a-2 is to temporarily relieve certain issuers that are in transition to a non-investment

company business from the registration and other requirements of the 1940 Act.” In that guidance, the Staff of the SEC also acknowledged

that the “one-year period for transient investment companies should be available to issuers that have a bona fide intent to be engaged

primarily in a non-investment company business.” As provided in Rule 3a-2, during the one-year period, the issuer must undertake

activities that are consistent with an objective to no longer be an “investment company” by the end of this period. In addition,

the issuer’s board of directors must adopt a resolution that commits the issuer to undertake activities in order to achieve this

objective.

We believe that the withdrawal

of the initial public offering registration statements of Vital, TechStackery and Firemark described above, together with our ongoing

operations, evidence our bona fide intent to be engaged primarily in a non-investment company business as soon as is reasonably possible

in accordance with the safe harbor provided by Rule 3a-2. Our board of directors has adopted a resolution committing our company

to our historical operating business to provide human capital outsourcing solutions, which does not include the business of investing,

reinvesting, owning, holding, or trading in securities, and owning or proposing to acquire investment securities. The IHC IPO registration

statement and related prospectus include an exception permitting Investments to transfer its ownership in the Founder Shares at any time

to the extent that Investments determines, in good faith, that such transfer is necessary to ensure that it and/or any of its parents,

subsidiaries or affiliates are in compliance with the 1940 Act. To comply with Rule 3a-2, we intend to sell the Founder Shares or

dividend the Founder Shares to our shareholders by October 19, 2022, the end of the one-year period afforded by the safe harbor for

transient investment companies under Rule 3a-2. To this end, we have also forfeited our Founder Shares of Vital, TechStackery and

Firemark. As a result, we believe that we will not be required to register as an investment company under the 1940 Act.

In addition, as noted above,

on May 13, 2022, we issued a press release announcing a special distribution of shares of common stock of IHC to all ShiftPixy shareholders

of record as of May 17, 2022. The shares in IHC are expected to be distributed to eligible ShiftPixy shareholders as soon as practicable

following the completion of the IBC, subject to a registration statement covering the IHC shares being declared effective by the SEC.

In the event of such distribution of the IHC shares, we would no longer own such shares and would accordingly ensure that we and/or any

of our parents, subsidiaries or affiliates are in compliance with the 1940 Act.

Notwithstanding the foregoing,

the acquisition of additional investment securities, including potentially as a result of making working capital loans to IHC, could be

viewed as business activities inconsistent with this requirement.

We expect IHC to operate as

a separately managed, publicly traded entity following the completion of its IBC. We anticipate entering into one or more service agreements

with IHC post business combination that will allow its clients to participate in our HRIS platform. We believe that focusing upon the

successful completion of IHC’s IBC within the staffing industry has the potential to generate significant revenues and earnings

for us.

If we are deemed to be an

investment company under the Investment Company Act of by virtue of our IHC sponsorship activities or based upon a determination that

we exceeded the 40% Threshold prior to October 19, 2021, our future activities may be restricted, including:

| |

· |

restrictions on the nature of our investments; and |

| |

· |

restrictions on the issuance of securities, each of which may make it difficult for us to conduct our business and raise working capital. |

In addition, we may have imposed

upon us burdensome requirements, including:

| |

· |

registration as an investment company with the SEC; |

| |

· |

adoption of a specific form of corporate structure different from our current operating structure; and |

| |

· |

reporting, record keeping, voting, proxy and disclosure requirements and other rules and regulations that we are currently not subject to. |

If we were deemed to be subject

to the 1940 Act, compliance with these additional regulatory burdens would require additional expenses for which we have not allotted

funds and may hinder our ability to operate our business.

Risks Relating to This Offering

The sale of a substantial

amount of our common stock, including resale of the shares of common stock by the selling stockholders in the public market, could adversely

affect the prevailing market price of our common stock.

We are registering for resale

1,270,834 shares of common stock, including 416,667 outstanding shares and 854,167 shares issuable upon exercise of the Warrants held

by the selling stockholders. Sales of substantial amounts of our common stock in the public market, or the perception that such sales

might occur, could adversely affect the market price of our common stock. We cannot predict if and when the selling stockholders may sell

such shares in the public market.

USE OF PROCEEDS

We will not receive any of

the proceeds from any sale or other disposition of the shares of common stock covered by this prospectus. All proceeds from the sale of

the shares will be paid directly to the selling stockholder. We will receive proceeds upon the cash exercise of the Warrants, however.

Assuming full cash exercise of the Warrants at the initial exercise price, we would receive gross proceeds of approximately $10.3 million.

We currently intend to use any proceeds from Warrant exercises for general corporate purposes, including payment of outstanding accounts

payable and working capital.

To the extent the resale of

the shares of common stock underlying Warrants is registered under the Securities Act and there is a prospectus available for such registered

resale, holders of Warrants are required to pay the exercise price for the Warrants in cash. If no such registration statement and prospectus

are available six months following the applicable issuance date of the Warrants, the Warrants may be exercised through cashless exercise,

where the holder of the Warrants receives fewer shares upon exercise of its Warrants but does not pay us any cash to exercise the Warrants.

SELLING STOCKHOLDERS

The shares of common stock

being offered by the selling stockholders include (i) 416,667 shares issued under the Purchase Agreement, (ii) 833,334 shares underlying

the Investor Warrants issued under the Purchase Agreement, and (iii) 20,833 Placement Agent Warrant Shares. We are registering the shares

of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. Except as set forth below,

the selling stockholders have not had had any material relationship with us within the past three years. Except as set for the below,

none of the selling stockholders is a broker-dealer or an affiliate of a broker-dealer.

The table below lists the

selling stockholders and other information regarding the beneficial ownership of the shares of common stock by the selling stockholders.

The second column lists the number of shares of common stock beneficially owned by the selling stockholders, based on their ownership

of the shares of common stock and warrants, as of October 3, 2022, assuming exercise of any warrants held by the selling stockholders

on that date, without regard to any limitations on exercises.

The third column lists the

shares of common stock being offered by this prospectus by the selling stockholders.

In accordance with the terms

of a registration rights agreement with the purchaser under the Purchase Agreement, this prospectus generally covers the resale of the

shares of common stock issued under the Purchase Agreement or issuable upon exercise of the Warrants, determined as if the outstanding

Warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with

the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided

in the registration rights agreement, without regard to any limitations on the exercise of the Warrants. The fourth column assumes the

sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

Under the terms of the Warrants,

the selling stockholders may not exercise the Warrants to the extent such exercise would cause such selling stockholder, together with

its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding

common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the

Warrants which have not been exercised. The number of shares in the second column does not reflect this limitation. The selling stockholders

may sell all, some or none of its shares in this offering. See “Plan of Distribution.”

| Name of selling stockholder |

Number of shares of common stock owned prior to offering(1) |

Maximum number of shares of common stock to be sold pursuant to this prospectus |

Number of shares of common stock owned after offering(2) |

Percentage of outstanding common stock owned after the offering(3) |

| Armistice Capital Master Fund Ltd. (4) |

1,603,410(5) |

1,250,001(6) |

353,409 |

3.2% |

| A.G.P./Alliance Global Partners(7) |

10,562 |

7,291(8) |

3,271 |

* |

| David Bocchi(9) |

4,910 |

3,541(8) |

1,369 |

* |

| Alex Barrientos(9) |

4,976 |

3,541(8) |

1,435 |

* |

| David Birenbaum(8) |

1,504 |

1,197(8) |

307 |

* |

| George Anagnostou(9) |

2,877 |

2,006(8) |

871 |

* |

| Zachary Grodko(9) |

603 |

416(8) |

187 |

* |

| James Tang(9) |

603 |

416(8) |

187 |

* |

| Keith Donofrio(9) |

1,297 |

895(8) |

402 |

* |

| Thomas Higgins(9) |

457 |

333(8) |

124 |

* |

| Kevin Oleskewicz(9) |

1,257 |

1,197(8) |

60 |

* |

*

Less than 1%.

| (1) | Under applicable SEC rules, a person is deemed to beneficially

own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant or through the

conversion of a convertible security. Also under applicable SEC rules, a person is deemed to be the “beneficial owner” of

a security with regard to which the person directly or indirectly, has or shares (a) voting power, which includes the power to vote

or direct the voting of the security, or (b) investment power, which includes the power to dispose, or direct the disposition, of

the security, in each case, irrespective of the person’s economic interest in the security. To our knowledge, subject to community

property laws where applicable, the selling stockholders named in the table have sole voting and investment power with respect to the

common stock shown as beneficially owned by such selling stockholder, except as otherwise indicated in the footnotes to the table. |

| (2) | Represents the amount of shares

that will be held by the selling stockholder after completion of this offering based on the assumptions that (a) all common stock

registered for resale by the registration statement of which this prospectus is part will be sold and (b) no other shares of common

stock are acquired or sold by the selling stockholder prior to completion of this offering. However, the selling stockholders may sell

all, some or none of such shares offered pursuant to this prospectus and may sell other shares of common stock that they may own pursuant

to another registration statement under the Securities Act or sell some or all of their shares pursuant to an exemption from the registration

provisions of the Securities Act, including under Rule 144. |

| (3) | Based on 9,671,196 shares of common

stock outstanding as of October 3, 2022, and assumes that following the offering all of the Warrants will have been exercised (such that

10,525,363 shares of common stock will be outstanding), and all of the shares offered by the selling stockholders hereunder will have

been sold. |

|

(4) |

The shares are directly held by Armistice Capital Master Fund Ltd. (the “Master Fund”), a Cayman Islands exempted company, and may be deemed to be indirectly beneficially owned by Armistice Capital, LLC (“Armistice”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice and Steven Boyd disclaim beneficial ownership of the reported securities except to the extent of their respective pecuniary interest therein. The address of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

|

(5) |

Represents (i) 416,667 shares sold under Purchase Agreement, (ii) 833,334 shares underlying Investor Warrants, and (iii) 353,409 shares issuable upon exercise of other warrants. The warrants (including the Investor Warrants) are each subject to certain beneficial ownership limitations that prohibit the Master Fund from exercising any portion of them if, following such exercise, the Master Fund’s ownership of our common stock would exceed 4.99% of our outstanding shares of common stock. |

| (6) | Includes (i) 416,667 shares sold

under Purchase Agreement and (ii) 833,334 shares underlying Investor Warrants. The Investor Warrants are subject to certain beneficial ownership limitations that prohibit the Master Fund from exercising any portion

of them if, following such exercise, the Master Fund’s ownership of our common stock would exceed 4.99% of our outstanding shares

of common stock. |

| (7) | The selling stockholder is a broker-dealer.

The selling stockholder received the Placement Agent Warrants as compensation for acting as placement agent in the Private Placement.

The selling stockholder has also acted as underwriter or placement agent in prior offerings of the Company. |

| (8) | Represents Placement Agent Warrant

Shares. |

| (9) | The selling stockholder is an

employee of A.G.P./Alliance Global Partners, which is a registered broker-dealer that acted as our placement agent in the Private Placement. |

PLAN OF DISTRIBUTION

The selling stockholders of

the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of its securities

covered hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholders may use any one or more of the

following methods when selling securities:

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

● |

settlement of short sales; |

| |

● |

in transactions through broker-dealers that agree with the selling stockholder to sell a specified number of such securities at a stipulated price per security; |

| |

● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a combination of any such methods of sale; or |

| |

● |

any other method permitted pursuant to applicable law. |

The selling stockholders may

also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than

under this prospectus.

Broker-dealers engaged by

the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to

be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary

brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance

with FINRA IM-2440.

In connection with the sale

of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling

stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and

any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. The selling stockholders have informed the Company that they do not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the securities.

The Company is required to

pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify

the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus

effective until the earlier of (i) the date on which the securities may be resold by the selling stockholders without registration

and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to

be in compliance with the current public information under Rule 144 under the Securities

Act or any other rule of similar effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144

under the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed

brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby

may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or

qualification requirement is available and is complied with.

Under applicable rules and

regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules and

regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholder

or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them of the need to

deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under

the Securities Act).

LEGAL MATTERS

The validity of the shares

of common stock offered in this prospectus has been passed upon for us by Bailey, Stock, Harmon, Cottam, Lopez LLP, Cheyenne, Wyoming.

EXPERTS

The consolidated financial

statements of ShiftPixy, Inc. at August 31, 2021 and 2020 appearing in our Annual Report on Form 10-K for the year ended August 31, 2021, as amended by our Annual Report on Form 10-K/A for the year ended August 31, 2021, have been audited by

Marcum LLP, independent registered public accountants, as set forth in its report thereon included therein, which include an explanatory paragraph as to the Company’s ability

to continue as a going concern and which are incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance

upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC

a registration statement on Form S-3 under the Securities Act that registers the resale of the shares of our common stock covered

by this prospectus. This prospectus does not contain all of the information set forth in the registration statement and the exhibits thereto.

For further information with respect to us and our common stock, you should refer to the registration statement and the exhibits filed

as a part of the registration statement. Statements contained in or incorporated by reference into this prospectus concerning the contents

of any contract or any other document are not necessarily complete. If a contract or document has been filed as an exhibit to the registration

statement or one of our filings with the SEC that is incorporated by reference into the registration statement, we refer you to the copy

of the contract or document that has been filed. Each statement contained in or incorporated by reference into this prospectus relating

to a contract or document filed as an exhibit is qualified in all respects by the filed exhibit.

We are subject to the informational

reporting requirements of the Exchange Act. We file reports, proxy statements and other information with the SEC. Our SEC filings are

available over the Internet at the SEC’s website at http://www.sec.gov.

We make available, free of

charge, on our website at www.shiftpixy.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K and amendments to those reports and statements as soon as reasonably practicable after they are filed with the SEC. The

contents of our website are not part of this prospectus, and the reference to our website does not constitute incorporation by reference

into this prospectus of the information contained on or through that site, other than documents we file with the SEC that are specifically

incorporated by reference into this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus the information in documents we file with it, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and

information that we file later with the SEC will automatically update and supersede this information. Any statement contained in any document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other

subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference

the documents listed below and any future documents that we file with the SEC (excluding any portion of such documents that are furnished

and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing

of the registration statement of which this prospectus forms a part prior to the effectiveness of the registration statement and (ii) after

the date of this prospectus until the offering of the securities is terminated:

| ● | our Current Reports on Form 8-K

filed with the SEC on September 2,

2021, October 27,

2021, December 2,

2021, January 27,

2022, April 1,

2022, April 7,

2022, April 22,

2022, May 24,

2022, June 27,

2022, July 1,

2022, July 19,

2022 (two

filings), July 21,

2022, July 26,

2022, August 16, 2022, August 31, 2022, September 6, 2022, September 8, 2022, September 21, 2022, September 23, 2022, and October 3, 2022; and |

You may request a copy of

these filings, at no cost, by writing or telephoning us at the following address: ShiftPixy, Inc., Attention: Corporate Secretary,

501 Brickell Key Drive, Suite 300, Miami, FL 33131, phone number (888) 798-9100.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table provides

information regarding the various expenses (other than placement agent fees) payable by us in connection with the issuance and distribution

of the securities being registered hereby. All amounts shown are estimates except the SEC registration fee.

| Securities and Exchange Commission Registration Fee |

|

$ |

2,045 |

|

| Legal Fees and Expenses |

|

|

175,000 |

|

| Accounting Fees and Expenses |

|

|

10,000 |

|

| Miscellaneous |

|

|

5,000 |

|

| Total |

|

$ |

192,045 |

|

Item 15. Indemnification of Officers and Directors.

Sections 17-16-851 through

-856 of the Wyoming Statutes (the “Applicable Statutes”) provide that directors and officers of Wyoming corporations may,

under certain circumstances, be indemnified against expenses (including attorneys’ fees) and other liabilities actually and reasonably

incurred by them as a result of any suit brought against them in their capacity as a director or officer, if they acted in good faith

and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal

action or proceeding, if they had no reasonable cause to believe their conduct was unlawful. The Applicable Statutes also provide that

directors and officers may also be indemnified against expenses (including attorneys’ fees) incurred by them in connection with

a derivative suit if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of

the corporation, except that no indemnification may be made without court approval if such person was adjudged liable to the corporation.

Further,

Article V of our articles of incorporation, as amended, also provides as follows regarding our indemnification of our directors,

officers, employees and agents:

“[t]o

the fullest extent permitted by the Wyoming Business Corporation Act or any other applicable law as now in effect or as it may hereafter

be amended, no person who is or was a director of the Corporation shall be personally liable to the Corporation or its shareholders for

monetary damages for breach of fiduciary duty as a director, except for liability for (A) the amount of financial benefit received

by a director to which he or she is not entitled; (B) an intentional infliction of harm on the Corporation or the Shareholders;

(C) a violation of Section 17-16-833 of the Wyoming Business Corporation Act; or (D) an intentional violation of criminal

law. If the Wyoming Business Corporation Act is amended after the effective date of this Amendment to authorize corporate action further

eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated

or limited to the fullest extent permitted by the Wyoming Business Corporation Act, as so amended.

The

Corporation shall indemnify to the fullest extent permitted by the Wyoming Business Corporation Act, as the same may be amended and supplemented

from time to time, any and all persons whom it shall have power to indemnify under the Wyoming Business Corporation Act. The indemnification

provided for herein shall not be exclusive of any other rights to which those seeking indemnification may be entitled as a matter of

law under any Bylaw, agreement, vote of shareholders or disinterested directors of the Corporation, or otherwise, both as to action in

such indemnified person’s official capacity and as to action in another capacity while serving as a director, officer, employee,

or agent of the Corporation, and shall continue as to a person who has ceased to be a director, officer, employee, or agent of the Corporation,

and shall inure to the benefit of the heirs, executors and administrators of such person.

Any

repeal or modification of this Article V or amendment to the Wyoming Business Corporation Act shall not adversely affect any right

or protection of a director, officer, agent, or other person existing at the time of or increase the liability of any director, officer,

agent, or other person of the Corporation with respect to any acts or omissions of such director, officer, or agent occurring prior to,

such repeal, modification, or amendment.

The

Corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee

or agent of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent to another

corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against such person and incurred by

such person in any such capacity or arising out of his status as such, whether or not the Corporation would have the power to indemnify

him against liability under the provisions of this Article V.”

Further,

Article XIV of our Bylaws also provides as follows regarding our indemnification of our directors, officers, employees and agents:

“The

corporation shall indemnify any person acting on its behalf in accord with the law of Wyoming. The indemnification provided hereby shall

not be deemed exclusive of any other right to which anyone seeking indemnification thereunder may be entitled under any bylaw, agreement,

or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office. The corporation

may purchase and maintain insurance on the behalf of any Director, officer, agent, employee or former Director or officer or other person,

against any liability asserted against them and incurred by him.”

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing