Seanergy Maritime Holdings Corp. (“Seanergy” or the “Company”)

(NASDAQ: SHIP) today announced that it has mailed a letter from

Stamatis Tsantanis, Seanergy’s Chairman and Chief Executive

Officer, to shareholders in connection with the Company’s upcoming

2024 Annual Meeting of Shareholders.

The letter highlights the Company’s:

- Transformation over the last four

years into a prominent pure-play Capesize shipping company with

attractive competitive positioning and an improved balance sheet,

poised to capitalize on tailwinds in the Capesize market;

- Comprehensive strategic plan that

has enabled Seanergy to grow its business, deliver record financial

results and increase returns to shareholders; and

- Highly qualified directors who each

brings a deep understanding of the industry. Their continued

oversight is critical for us to build on our momentum and execute

our strategic plans.

The Seanergy Board of Directors continues to

unanimously recommend that shareholders vote on the

WHITE proxy card “FOR” Seanergy’s

nominees and “AGAINST” the proposals made by

Economou, and discard any other proxy card you may receive from

Economou. Additional information, including details on how to vote,

can be found at www.VoteSeanergy.com.

The full text of the letter follows:

October 8, 2024

Dear Fellow Seanergy

Shareholders,

I am reaching out to you directly because we

need your vote on the WHITE proxy card in

connection with our upcoming Annual Meeting of Shareholders. Your

vote is incredibly important not only to Seanergy, all of our

employees and the customers that rely on our shipping services, but

also to protect the value of YOUR investment in our Company.

Over the last four years in particular, we have

transformed Seanergy into a prominent pure-play Capesize

shipping company with a distinct competitive edge and a robust

financial foundation. Our decisive actions have strategically

positioned the Company to fully capitalize on the growing

opportunities within the Capesize market and have enhanced our

ability to deliver sustained value to our

shareholders.

Seanergy has significant momentum that reflects

key decisions made by the Board and management team. Starting in

2021, we took bold and decisive actions, executing a

comprehensive strategic plan that redefined our business.

We expanded our Capesize fleet, fortified our balance sheet and

smoothly transitioned into a fully independent, broadly owned

public company, all while prioritizing returns to our shareholders.

These efforts are also translating into a dramatically improved

cash flow profile that has been a catalyst for a significant

increase in our share price and dividends. We are well positioned

to continue our growth trajectory and create long-term value for

our investors.

Our shareholders are now benefitting from our

focused strategy, as well as our strong execution, which has

enabled us to grow our business, deliver record financial results

and increase returns to shareholders. Specifically, we have been

focused on:

- Investing in our

fleet: We have been growing our fleet efficiently through

well-timed, low-cost acquisitions of high-quality vessels, levered

conservatively that resulted in sustainable cash break-even

rates. We have invested over $350 million into the growth

of our fleet since 2020, which now stands at 19 Capesize

vessels or 3.4 million DWT. Furthermore, we are committed

to enhancing the competitiveness of our fleet and improving returns

through innovative initiatives, in collaboration with our

charterers and other industry stakeholders, to invest in

energy-efficient technologies that reduce our environmental

footprint. Our long-standing sustainability and ESG

efforts have been recognized with multiple awards.

- Delivering record

profitability and cash flow generation: In the first half

of 2024, we delivered net revenues of $81.4

million and net income of $24.3 million,

executing consistently on our strategic decision to position

Seanergy as a leading dry bulk shipping company

with a pure-play Capesize fleet. We also generated

significant cash flows to fund our growth and

capital returns.

- Reducing our debt:

Through a thoughtful and prudent approach to capital allocation, we

have streamlined our capital structure and reduced our leverage.

These actions have enabled us to grow strategically while returning

capital to shareholders. At the same time, we ensured that we have

the requisite financial flexibility to navigate long-term

shipping market cycles in our historically volatile dry

bulk market.

- Increasing our returns to

shareholders: We have prioritized rewarding our

shareholders through compelling dividends and securities

repurchases. Since 2021 we have repurchased $42.9 million in

securities, while from the initiation of our dividend strategy in

2022, we have paid 11 consecutive quarterly dividends and 3 special

dividends, totaling $34.7 million. In light of our strong

performance and our commitment to creating value, we recently

updated our dividend policy to return approximately 50% of

our net operating cash flow (after debt and reserves) to

shareholders through dividends.

By advancing this strategy, we have delivered

peer-leading total shareholder returns of over 130% over

the last year.i

Our Highly Qualified Director

Nominees

Our success to date has been driven by the

expertise of our highly qualified Board and the dedicated execution

by my colleagues on the management team. Our directors are actively

engaged in shaping our strategic direction, ensuring the delivery

of strong results, and providing the critical experience and

insights required to effectively oversee a shipping company in

today's market landscape.

Turning specifically to the two independent

directors who are up for election this year – Mr. Dimitrios

Anagnostopoulos and Mr. Ioannis Kartsonas – each brings a

deep understanding of shipping, finance, investments, commodities

markets, management and capital allocation. These skills are

crucial to our business and our ongoing value creation strategy.

Their leadership, knowledge and commitment are exactly what

Seanergy needs to thrive as a public dry bulk shipping

company. It is truly a privilege to work alongside them

and benefit from their perspectives.

To Capture the Opportunities Ahead, We

Need Your Vote

Seanergy, along with all our shareholders, is

already benefiting from the decisive actions taken by our Board and

management team.

To continue to build on our momentum and

effectively execute our strategic plans, your support is essential

– we need your vote on the WHITE proxy card. Our

Board unanimously recommends that you vote

“FOR” Seanergy’s

nominees and “AGAINST” the

proposals made by Economou, and discard any other proxy card you

may receive from Economou.

I am incredibly optimistic about the future of

Seanergy. To demonstrate my commitment, I have personally invested

approximately $1.2 million in Seanergy shares and stock options

since 2023 and have not sold a single share. I am confident that

Seanergy is well-positioned to continue delivering leading,

sustainable shareholder returns through the cycles and into the

future. Your vote

“FOR” Seanergy

will help ensure we stay on this path of success.

Thank you for your continued support.

Sincerely,

Stamatis Tsantanis

YOUR VOTE IS IMPORTANT!

We urge you to vote

"FOR" Seanergy’s

highly qualified director nominees – Mr. Dimitrios Anagnostopoulos

and Mr. Ioannis Kartsonas – and

"AGAINST"

Economou’s proposals on the WHITE proxy card

TODAY.

Please follow the instructions on your proxy card

or voting instruction form and vote by 11:59 PM ET on November 3,

2024.

Learn more about our plans to continue creating

value for shareholders and how to vote at www.VoteSeanergy.com.

|

|

|

If you have any questions or require any assistance with voting

your shares, please contact our proxy solicitor, MacKenzie

Partners, at U.S. & Canada Toll-Free: +1-800-322-2885

Greece Toll-Free: +1-800-000-0260 Elsewhere Call Collect (Toll):

+1-212-929-5500OrEmail: Seanergy@MacKenziePartners.com You may

receive solicitation materials from Economou. The Board unanimously

recommends shareholders disregard and do not return any proxy

materials from Economou. |

|

|

|

|

|

|

|

|

About Seanergy Maritime Holdings

Corp.

Seanergy Maritime Holdings Corp. is a prominent

pure-play Capesize shipping company publicly listed in the U.S.

Seanergy provides marine dry bulk transportation services through a

modern fleet of Capesize vessels. The Company’s operating fleet

consists of 19 vessels (1 Newcastlemax and 18 Capesize) with an

average age of approximately 13.4 years and an aggregate cargo

carrying capacity of approximately 3,417,608 dwt.

The Company is incorporated in the Republic of

the Marshall Islands and has executive offices in Glyfada, Greece.

The Company's common shares trade on the Nasdaq Capital Market

under the symbol “SHIP”.

Please visit our Company website at:

www.seanergymaritime.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events, including with respect

to the declaration of dividends, market trends and shareholder

returns. Words such as “may”, “should”, “expects”, “intends”,

“plans”, “believes”, “anticipates”, “hopes”, “estimates” and

variations of such words and similar expressions are intended to

identify forward-looking statements. These statements involve known

and unknown risks and are based upon a number of assumptions and

estimates, which are inherently subject to significant

uncertainties and contingencies, many of which are beyond the

control of the Company. Actual results may differ materially from

those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially

include, but are not limited to, the Company’s operating or

financial results; the Company’s liquidity, including its ability

to service its indebtedness; competitive factors in the market in

which the Company operates; shipping industry trends, including

charter rates, vessel values and factors affecting vessel supply

and demand; future, pending or recent acquisitions and

dispositions, business strategy, impacts of litigation, areas of

possible expansion or contraction, and expected capital spending or

operating expenses; risks associated with operations outside the

United States; broader market impacts arising from trade disputes

or war (or threatened war) or international hostilities, such as

between Israel and Hamas or Iran and between Russia and Ukraine;

risks associated with the length and severity of pandemics

(including COVID-19), including their effects on demand for dry

bulk products and the transportation thereof; and other factors

listed from time to time in the Company’s filings with the SEC,

including its most recent annual report on Form 20-F. The Company’s

filings can be obtained free of charge on the SEC’s website at

www.sec.gov. Except to the extent required by law, the Company

expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Company’s

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

For further information please

contact:

Investors

Seanergy Investor RelationsTel: +30 213 0181

522E-mail: ir@seanergy.gr

Capital Link, Inc.Paul Lampoutis230 Park Avenue

Suite 1536New York, NY 10169Tel: +1 212-661-7566Email:

seanergy@capitallink.com

Media

Joele Frank, Wilkinson Brimmer KatcherAaron

Palash / Maggie Carangelo / Spencer HoffmanTel: +1

212-355-4449Email: Seanergy-Media@joelefrank.com

________________________i As of September 26,

2024. Total shareholder returns defined as the compound total

return, with dividends reinvested on the ex-date.

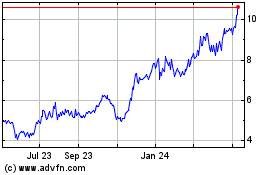

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Dec 2024 to Jan 2025

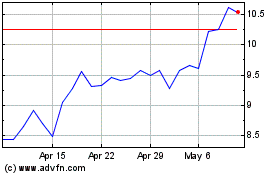

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Jan 2024 to Jan 2025