Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

May 19 2022 - 4:02PM

Edgar (US Regulatory)

| Prospectus Supplement No. 4 | |

Filed Pursuant to Rule 424(b)(3) |

| (to Prospectus dated April 20, 2022) | |

Registration No. 333-260828 |

SCIENCE 37 HOLDINGS, INC.

103,576,231 Shares of Common Stock

This Prospectus Supplement

No. 4 (this “prospectus supplement”) updates, amends and supplements the prospectus of Science 37 Holdings, Inc. (the “Company,”

“we,” “us,” and “our”), dated April 20, 2022 (as previously updated, amended and supplemented, the

“Prospectus”), which forms a part of our Registration Statement on Form S-1, as amended (Registration No. 333-260828).

Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement

is being filed to supplement, modify or supersede certain information contained in the Prospectus. Any statement in the Prospectus that

is modified or superseded is not deemed to constitute a part of the Prospectus, except as modified or superseded by this prospectus supplement.

Except to the extent that the information in this prospectus supplement modifies or supersedes the information contained in the Prospectus,

this prospectus supplement should be read, and will be delivered, with the Prospectus. This prospectus supplement is not complete without,

and may not be utilized except in connection with, the Prospectus.

Our common stock is listed

on The Nasdaq Stock Market, LLC, or Nasdaq, under the symbol “SNCE”. On May 18, 2022, the closing sale price of our common

stock as reported on the Nasdaq was $2.91.

We are an “emerging

growth company” under applicable Securities and Exchange Commission rules and, as such, have elected to comply with reduced public

company disclosure requirements for the Prospectus and future filings.

Our business and investment

in our common stock involve significant risks. These risks are described in the section titled “Risk Factors” beginning on

page 4 of the Prospectus and under similar headings in any further amendments or supplements to the Prospectus.

Neither the Securities

and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement or the Prospectus. Any representation to the contrary is a criminal offense.

The date of this

prospectus supplement is May 19, 2022.

ABOUT THIS PROSPECTUS SUPPLEMENT

We are filing this prospectus

supplement to amend and update the “Principal Stockholders” and “Selling Securityholders” tables and the applicable

footnotes of the Prospectus to reflect a distribution of shares of common stock from LifeSci Holdings, LLC (the “Sponsor”),

one of the registered holders previously identified in the Prospectus, to the additional registered holders named herein (the “Transferees”).

This prospectus supplement is not increasing the number of shares being offered under the Prospectus, but only reflecting the transfer

of shares of common stock previously registered and providing certain information about the Transferees and the securities they may offer

pursuant to the Prospectus. The information set forth below has been provided by or on behalf of the registered holders listed below as

of April 26, 2022.

PRINCIPAL STOCKHOLDERS

The information in the table that appears under the caption “Principal

Stockholders” on pages 100 through 102 of the Prospectus is modified by (i) removing the Sponsor from the subsection of 5%

Holders, (ii) decreasing the number of shares of common stock beneficially owned by the Sponsor and its affiliates and (iii) updating

the number of shares of common stock currently owned by the 5% Holders and directors and executive officers. Beneficial ownership is determined

according to the rules of the SEC, which generally provides that a person has beneficial ownership of a security if he, she or it possesses

sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable

within 60 days. The beneficial ownership percentages set forth below are based on 115,881,097 shares of common stock issued and outstanding

as of May 6, 2022.

| Name and Address of Beneficial Owner | |

Number of Shares | | |

% of

Ownership | |

| 5% Holders |

| Entities affiliated with Redmile Group, LLC(1) | |

| 19,808,234 | | |

| 17.1 | |

| Pharmaceutical Product Development, LLC(2) | |

| 17,379,797 | | |

| 15.0 | |

| Entities affiliated with Lux Capital(3) | |

| 12,249,889 | | |

| 10.6 | |

| Directors and Executive Officers |

| David Coman(4) | |

| 3,209,784 | | |

| 2.8 | |

| Mike Zaranek(5) | |

| 629,017 | | |

| * | |

| Darcy Forman(6) | |

| 201,837 | | |

| * | |

| Jonathan Cotliar(7) | |

| 709,461 | | |

| * | |

| Steven Geffon(8) | |

| 571,835 | | |

| * | |

| Christine Pellizzari | |

| — | | |

| — | |

| John W. Hubbard(9) | |

| 229,528 | | |

| * | |

| Neil Tiwari(10) | |

| 27,575 | | |

| * | |

| Robert Faulkner(11) | |

| 41,363 | | |

| * | |

| Adam Goulburn(12) | |

| 30,056 | | |

| * | |

| Bhooshitha B. De Silva | |

| — | | |

| — | |

| Emily Rollins(13) | |

| 27,575 | | |

| * | |

| All directors and executive officers as a group (12 individuals)(14) | |

| 5,110,586 | | |

| 4.9 | % |

| | |

| | | |

| | |

* Less than one percent

| (1) | Based on information included in a Schedule 13D filed on October 18, 2021. Consists of (a) 3,829,013

shares of common stock held by RAF, L.P., (b) 3,110,595 shares of common stock held by Redmile Capital Offshore II Master Fund, Ltd.,

(c) 7,252,571 shares of common stock held by Redmile Private Investments II, L.P., (d) 616,055 shares of common stock held by Redmile

Strategic Master Fund, LP, and (e) 5,000,000 shares of common stock held by RedCo II Master Fund, L.P. Redmile Group, LLC is the investment

manager/adviser to each of the private investment vehicles listed in items (a) through (e) (collectively, the “Redmile Funds”)

and, in such capacity, exercises voting and investment power over all of the securities held by the Redmile Funds and may be deemed to

share beneficial ownership over these securities. Jeremy C. Green serves as the managing member of Redmile Group, LLC and, as a result,

may be deemed to share beneficial ownership over these securities. Redmile Group, LLC and Mr. Green each disclaim beneficial ownership

of these securities. The address of the Redmile Funds, Mr. Green and Robert Faulkner, a representative

on the Issuer’s board of directors, is c/o Redmile Group, LLC, One Letterman Dr., Building D, Suite D3-300, San Francisco, CA 94129. |

| (2) | Based on information included in a Schedule 13D filed on December 12, 2021. Wildcat Acquisition Holdings

(UK) Limited (“Wildcat”) is the sole member of Pharmaceutical Product Development, LLC; Jaguar Holding Company II (“Jaguar

II”) is the sole shareholder of Wildcat; Jaguar Holding Company I, LLC (“Jaguar “) is the sole shareholder of Jaguar

II; Eagle Holding Company II, LLC (“Eagle II”) is the sole member of Jaguar I; PPD, Inc. (“PPD”) is the sole member

of Eagle II; Thermo Fisher Scientific Powder US Holdings Corp. (“Powder Holdings”) is the sole shareholder of PPD; and Thermo

Fisher Scientific Inc. (“Thermo Fisher”), a Delaware corporation, is the ultimate parent entity of Powder Holdings. By virtue

of such relationships, each may be deemed to have beneficial ownership over such securities, and each disclaims beneficial ownership over

such securities. The principal office of Wildcat is 11 Granta Park, Cambridge CB21 6GQ, United Kingdom, the principal office of each of

PPD, Eagle II, Jaguar I, Jaguar II and Pharma LLC is 929 North Front Street, Wilmington, North Carolina 28401 and the principal office

of each of Thermo Fisher and Powder Holdings is 168 Third Avenue, Waltham, Massachusetts 02451. |

| (3) | Based on information included in a Schedule 13D/A filed on April 7, 2022. Consists of (a) 8,743,999

shares of common stock held by Lux Ventures IV, L.P. and (b) 3,505,890 shares of common stock held by Lux Co-Invest Opportunities, L.P.

Lux Venture Partners IV, LLC is the general partner of Lux Ventures IV, L.P. and exercises voting and dispositive power over the shares

held by Lux Ventures IV, L.P. Lux Co-Invest Partners, LLC is the general partner of Lux Co-Invest Opportunities, L.P. and exercises voting

and dispositive power over the shares held by Lux Co-Invest Opportunities, L.P. Peter Hebert and Joshua Wolfe are the individual managers

of Lux Venture Partners IV, LLC and Lux Co-Invest Partners, LLC and may be deemed to share voting and dispositive power over the shares

held by each of Lux Ventures IV, L.P. and Lux Co-Invest Opportunities, L.P., Lux Capital Management, LLC, as the investment manager for

each of Lux Venture Partners IV, LLC and Lux Co-Invest Partners, LLC, may be deemed to share voting and dispositive power over the shares

held by each of Lux Ventures IV, L.P. and Lux Co-Invest Opportunities, L.P. Each of Lux Capital Management, LLC, Lux Venture Partners

IV, LLC, Lux Co-Invest Partners, LLC, Peter Hebert and Joshua Wolfe disclaim beneficial ownership over these securities. The address of

the entities and individuals listed above is c/o Lux Capital Management, LLC, 920 Broadway, 11th Floor, New York, NY 10010. |

| (4) | Represents 981,437 shares of common stock and 2,228,347 options to purchase shares of common stock that

are exercisable as of or within 60 days of May 6, 2022. |

| (5) | Represents 629,017 options to purchase shares of common stock that are exercisable as of or within 60

days of May 6, 2022. |

| (6) | Represents 42,547 shares of common stock and 158,840 options to purchase shares of common stock that are

exercisable as of or within 60 days of May 6, 2022. |

| (7) | Represents 686,768 shares of common stock and 22,693 options to purchase shares of common stock that are

exercisable as of or within 60 days of May 6, 2022. |

| (8) | Represents 571,835 options to purchase shares of common stock that are exercisable as of or within 60

days of May 6, 2022. |

| (9) | Represents 229,528 options to purchase shares of common stock that are exercisable as of or within 60

days of May 6, 2022. |

| (10) | Represents 27,575 options to purchase shares of common stock that are exercisable within 60 days of May

6, 2022. |

| (11) | Represents 41,363 options to purchase shares of common stock that are exercisable within 60 days of May

6, 2022. |

| (12) | Represents 2,481 shares of common stock and 27,575 options to purchase shares of common stock that are

exercisable within 60 days of May 6, 2022. |

| (13) | Represents 27,575 options to purchase shares of common stock that are exercisable within 60 days of May

6, 2022. |

| (14) | Represents 1,713,233 shares of common stock and 3,964,348 options to purchase shares of common stock that

are exercisable as of or within 60 days of May 6, 2022. |

SELLING SECURITYHOLDERS

The information in the table

that appears under the caption “Selling Securityholders” on pages 103 through 107 of the Prospectus is modified by (i) decreasing

the number of shares of common stock beneficially owned by the “LifeSci Entities” (which includes the Sponsor and certain

of its affiliates) and (ii) adding the Transferees as Selling Securityholders. The beneficial ownership percentages set forth below are

based on 115,881,097 shares of common stock issued and outstanding as of May 6, 2022.

| | |

Shares Beneficially Owned Prior to Offering | | |

| | |

Shares Beneficially Owned After the Offering | |

| Names and Addresses of Beneficial Owner | |

Number of Shares | | |

Number of Shares of Common Stock Being Offered | | |

Number of Shares | | |

Percentage of Outstanding Common Stock Beneficially Owned | |

| LifeSci Entities(1) | |

| 1,945,897 | | |

| 1,945,897 | | |

| — | | |

| — | |

| Stephanie Gajdjis | |

| 10,000 | | |

| 10,000 | | |

| — | | |

| — | |

| Matthew Joseph Margiotta | |

| 50,000 | | |

| 50,000 | | |

| — | | |

| — | |

| Bob Spivak | |

| 50,000 | | |

| 50,000 | | |

| — | | |

| — | |

| Patrick Dolezal | |

| 50,000 | | |

| 50,000 | | |

| — | | |

| — | |

| Samuel Slutsky | |

| 100,000 | | |

| 100,000 | | |

| — | | |

| — | |

| Adam Evertts | |

| 50,000 | | |

| 50,000 | | |

| — | | |

| — | |

| Paul Yook | |

| 100,000 | | |

| 100,000 | | |

| — | | |

| — | |

| David Dobkin(2) | |

| 500,000 | | |

| 500,000 | | |

| — | | |

| — | |

| Dobkin GST Trust | |

| 139,403 | | |

| 139,403 | | |

| — | | |

| — | |

| Yehuda Michael Rice(3) | |

| 1,934,542 | | |

| 1,934,542 | | |

| — | | |

| — | |

| Andrew McDonald(4) | |

| 1,934,542 | | |

| 1,934,542 | | |

| — | | |

| — | |

| (1) | Consists of (a) 1 share of common stock owned by the Sponsor and (b) 1,945,896 shares of common stock

owned by LifeSci Ventures Partners II, LP.Michael Rice and Andrew McDonald are the managing members of the Sponsor and the general partners

of LifeSci Ventures Partners II, LP. The address for these entities and individuals is c/o Science 37 Holdings, Inc., 800 Park Offices

Drive, Suite 3606, Research Triangle Park, North Carolina, 27709. |

| (2) | Mr. Dobkin was the Chief Financial Officer and served on the board of directors of the Company prior to

the Closing (as defined below). On October 6, 2021, we consummated the business combination, or the Business Combination, contemplated

by the Agreement and Plan of Merger, dated May 6, 2021, by and among LSAQ, LifeSci Acquisition II Merger Sub, Inc., a Delaware corporation

and wholly-owned subsidiary of LSAQ (“Merger Sub”), and Science 37, Inc., a Delaware corporation (“Legacy Science 37”)

(the “Merger Agreement”). Pursuant to the Merger Agreement, Merger Sub was merged with and into Legacy Science 37, with Legacy

Science 37 surviving the merger as a wholly owned subsidiary of LSAQ (the “Business Combination”). Upon the closing of the

Business Combination (the “Closing”), we changed our name to Science 37 Holdings, Inc. |

| (3) | Mr. Rice was our Chief Operating Officer and served on our board of directors prior to the Closing. |

| (4) | Mr. McDonald was our Chief Executive Officer and served on our board of directors prior to the Closing. |

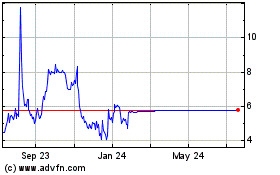

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From Jul 2023 to Jul 2024