Announced clear regulatory pathway to

Accelerated Approval from U.S. Food and Drug Administration (FDA)

for isaralgagene civaparvovec in Fabry disease, using data from

ongoing Phase 1/2 STAAR study, avoiding requirement for additional

registrational study and accelerating estimated time to potential

approval by approximately three years.

Pfizer plans to present detailed data from

Phase 3 AFFINE trial evaluating giroctocogene fitelparvovec, an

investigational Hemophilia A gene therapy that Sangamo has

co-developed with and licensed to Pfizer, via a platform

presentation at the 66th American Society for Hematology (ASH)

Annual Meeting and Exposition.

Received $50 million in upfront license fees

and milestone payments in connection with previously announced

global epigenetic regulation and capsid delivery license agreement

with Genentech to develop novel genomic medicines for

neurodegenerative diseases, and eligible to earn up to $1.9 billion

in additional milestone payments, plus tiered royalties on net

sales.

Submitted investigational new drug (IND)

application to FDA for ST-503 for the treatment of intractable pain

due to idiopathic small fiber neuropathy (iSFN), a type of chronic

neuropathic pain.

Sangamo Therapeutics, Inc. (Nasdaq: SGMO), a genomic medicine

company, today reported business highlights and third quarter 2024

financial results.

“This is a pivotal time for Sangamo as we build upon our recent

strong momentum with news of a clear regulatory pathway to

Accelerated Approval in the U.S. for ST-920 in Fabry disease,

accelerating time to potential approval by approximately three

years,” said Sandy Macrae, Chief Executive Officer of Sangamo

Therapeutics. “Alongside Pfizer’s Hemophilia A program activities,

and against a backdrop of our recent epigenetic regulation and

capsid license agreement with Genentech, these developments create

a strong foundation for our core neurology pipeline, which

continues to advance. We were thrilled to submit our first

neurology IND application this quarter for ST-503 for the treatment

of intractable pain due to idiopathic small fiber neuropathy and

expect to be in the clinic in mid-2025. We are proud of our

scientific and strategic execution so far this year and are

continuing to work diligently to secure additional funding to

further advance our wholly owned neurology programs, capsid

delivery technology and next-generation genome engineering

capabilities.”

Recent Business Highlights

Corporate Updates

- Announced in August a global epigenetic regulation and capsid

delivery license agreement with Genentech to develop novel genomic

medicines for neurodegenerative diseases.

- Received $50.0 million from Genentech in upfront license fees

and milestone payments.

- Eligible to earn up to $1.9 billion from Genentech in

additional development and commercial milestones spread across

multiple potential products under the agreement and tiered

royalties on net sales of such products, subject to certain

specified reductions.

Clinical Programs

Fabry Disease

- Announced in October the outcome of a successful interaction

with the FDA, providing a clear regulatory pathway to Accelerated

Approval for isaralgagene civaparvovec, or ST-920, an

investigational gene therapy for the treatment of Fabry

disease.

- The FDA has agreed in a Type B interaction that data from the

ongoing Phase 1/2 STAAR study can serve as the primary basis for

approval under the Accelerated Approval Program, using estimated

glomerular filtration rate (eGFR) slope as an intermediate clinical

endpoint.

- Sangamo engaged with the FDA on alternative pathways to

potential approval following analysis of clinical data from the

Phase 1/2 STAAR study showing encouraging safety and efficacy data,

including promising preliminary evidence of improved kidney

function. In the 18 male and female patients treated with

isaralgagene civaparvovec with more than one year of follow-up

data, a statistically significant positive mean annualized eGFR

slope was observed.

- Based on these latest data, the FDA agreed that eGFR slope at

52 weeks can serve as an intermediate clinical endpoint to support

a potential Accelerated Approval. The FDA also advised that eGFR

slope at 104 weeks may be assessed to verify clinical benefit.

- The complete dataset to support an Accelerated Approval pathway

will be available in the first half of 2025. This approach unlocks

a potential Biologics License Application (BLA) submission in the

second half of 2025, three years ahead of previous estimates, and

avoids the requirement for an additional, costly registrational

study to establish clinical efficacy.

- Dosing was completed in the Phase 1/2 STAAR study in April

2024, with a total of 33 patients dosed. The longest treated

patient recently achieved four years of follow-up.

- The 18th and final patient who started the study on Enzyme

Replacement Therapy (ERT), was successfully withdrawn from ERT in

September 2024, and all 18 patients remain off ERT as of

today.

- Sangamo has begun to execute BLA readiness activities for

isaralgagene civaparvovec, while continuing to advance ongoing

business development discussions with potential collaboration

partners.

Hemophilia A

- Pfizer will be presenting detailed data from the Phase 3 AFFINE

trial of giroctocogene fitelparvovec, an investigational gene

therapy that Sangamo has co-developed with and licensed to Pfizer

for the treatment of adults with moderately severe to severe

hemophilia A, in an oral presentation at the 66th ASH Annual

Meeting and Exposition on December 9, 2024.

- The ASH abstract confirmed that the AFFINE trial met its

primary endpoint of non-inferiority and superiority, with a

statistically significant decrease in total annualized bleeding

rate (ABR) from Week 12 through at least 15 months of follow up

post-infusion compared with routine Factor VIII (FVIII) replacement

prophylaxis treatment (mean total ABR estimates, 1.24 vs

4.73).

- Key secondary endpoints as defined by the trial protocol – the

percentage of participants with FVIII activity >5% (chromogenic

assay) at 15 months and ABR for treated bleeds – were met, and also

demonstrated superiority compared to prophylaxis. At Month 15, 84%

of participants had FVIII activity >5%, with 82.8% of

participants continuing to maintain FVIII activity >5% at

2-years post-infusion.

- Treated ABR during Week 12 through ≥15 months post-infusion was

significantly reduced compared to prophylaxis (mean treated ABR

estimates, 0.07 vs. 4.08), demonstrating superiority.

- In the AFFINE trial, giroctocogene fitelparvovec was generally

well tolerated with no study discontinuations.

- Pfizer is discussing these data with regulatory

authorities.

- Sangamo is eligible to earn from Pfizer up to $220.0 million in

milestone payments upon the achievement of certain regulatory and

commercial milestones for giroctocogene fitelparvovec and product

sales royalties of 14% - 20% if giroctocogene fitelparvovec is

approved and commercialized, subject to certain reductions.

Neurology Pipeline

Chronic Neuropathic Pain

- Submitted IND application to the FDA for ST-503, an

investigational epigenetic regulator for the treatment of

intractable pain due to iSFN, a type of chronic neuropathic

pain.

- Assuming clearance of this IND by the FDA, we expect to start

the Phase 1/2 study in the middle of 2025.

- Published a manuscript in bioRxiv titled, “Potent and selective

repression of SCN9A by engineered zinc finger repressors (ZFRs) for

the treatment of neuropathic pain” demonstrating that ZFRs can

selectively and potently reduce the expression of Nav1.7 sodium

channels in sensory neurons in animal models, following a single

intrathecal administration of ST-503.

Prion Disease

- Clinical trial authorization (CTA) enabling activities continue

to advance for Sangamo’s program to treat prion disease, leveraging

our novel neurotropic AAV capsid known as STAC-BBB, that has

demonstrated industry-leading blood brain barrier penetration in

nonhuman primates (NHPs) following intravenous administration.

- Presented updated data at Prion 2024 Conference in October

2024, showing the potency of Sangamo’s ZFR in a disease mouse model

at multiple dose levels. The ZFR significantly reduced expression

of prion mRNA and protein in the brain, extended mouse survival and

limited the formation of toxic prion aggregates.

- Additionally, we presented NHP data at the Prion 2024

Conference, showing that a single intravenous administration of the

prion ZFR, delivered via STAC-BBB, resulted in potent and

widespread repression of the prion gene in transduced neurons.

- A CTA submission is expected in the fourth quarter of

2025.

Novel Adeno-Associated Virus (AAV) Capsid Delivery

Technology

- We continue to engage in business development discussions with

new potential collaborators for STAC-BBB for use in delivering

intravenously administered genomic medicines for certain specified

neurological diseases.

Third Quarter 2024 Financial Results

Consolidated net income available for common stockholders for

the third quarter ended September 30, 2024 was $10.7 million, or

$0.04 per share on a fully diluted basis, compared to a net loss of

$104.2 million, or $0.59 per share, for the same period in

2023.

Revenues

Revenues for the third quarter ended September 30, 2024 were

$49.4 million, compared to $9.4 million for the same period in

2023.

The increase of $40.0 million in revenues was primarily

attributed to $49.2 million in revenue relating to our

collaboration agreement with Genentech, Inc. This increase was

partially offset by a decrease of $5.5 million in revenue relating

to our collaboration agreement with Kite Pharma, Inc. which expired

pursuant to its terms in April 2024, and a decrease of $3.7 million

in revenue relating to our other license agreements.

GAAP and Non-GAAP Operating Expenses

Three Months Ended Nine Months Ended September

30, September 30, (In millions)

2024

2023

2024

2023

Research and development

$

27.7

$

57.1

$

87.8

$

183.4

General and administrative

11.1

13.9

34.9

48.1

Impairment of long-lived assets

-

44.8

5.5

65.2

Impairment of goodwill and indefinite-lived intangible assets

-

-

-

89.5

Total operating expenses

38.8

115.8

128.2

386.2

Impairment of long-lived assets

-

(44.8

)

(5.5

)

(65.2

)

Impairment of goodwill and indefinite-lived intangible assets

-

-

-

(89.5

)

Depreciation and amortization

(1.3

)

(5.5

)

(3.9

)

(13.2

)

Stock-based compensation expense

(3.3

)

(6.2

)

(9.1

)

(21.3

)

Non-GAAP operating expenses

$

34.2

$

59.3

$

109.7

$

197.0

Total operating expenses on a GAAP basis for the third quarter

ended September 30, 2024 were $38.8 million compared to $115.8

million for the same period in 2023. Non-GAAP operating expenses,

which exclude impairment charges, depreciation and amortization and

stock-based compensation expense as shown in the reconciliation

table above, for the third quarter ended September 30, 2024 were

$34.2 million, compared to $59.3 million for the same period in

2023.

The decrease in total operating expenses on a non-GAAP basis was

primarily attributable to a decrease in preclinical and clinical

expenses due to deferral and reprioritization of certain research

and development programs, lower compensation and other personnel

costs mainly due to lower headcount as a result of restructuring of

operations and a corresponding reductions in workforce announced

during 2023, a decrease in external professional services costs,

and a decrease in facilities and infrastructure related

expenses.

Cash and Cash Equivalents

Cash and cash equivalents as of September 30, 2024 were $39.2

million, compared to cash, cash equivalents and marketable

securities of $81.0 million as of December 31, 2023. We believe

that our available cash and cash equivalents as of September 30,

2024, together with the $10.0 million milestone payment we received

from Genentech, will be sufficient to fund our planned operations

into the first quarter of 2025.

Financial Guidance for 2024

- On a GAAP basis, we expect total operating expenses in the

range of approximately $150 million to $170 million in 2024, which

includes non-cash stock-based compensation expense, impairment

expense, and depreciation and amortization.

- We expect non-GAAP total operating expenses, excluding

estimated non-cash stock-based compensation expense of

approximately $13 million, impairment expense of approximately $6

million, and depreciation and amortization of approximately $6

million, in the range of approximately $125 million to $145 million

in 2024.

Upcoming Events

Sangamo plans to participate in the following event:

- Jefferies London Healthcare Conference, November 19-21,

2024

Access links for available webcasts for investor conferences

will be available on the Sangamo website in the Investors and Media

section under Events. Available materials will be found on the

Sangamo website after the event under Presentations.

Conference Call

The Sangamo management team will hold a corporate call to

further discuss program advancements and financial updates on

Tuesday, November 12, at 4:30pm Eastern Time.

Participants should register for, and access, the call using

this link. While not required, it is recommended you join 10

minutes prior to the event start. Once registered, participants

will be given the option to either dial into the call with the

number and unique passcode provided or to use the dial-out option

to connect their phone instantly.

An updated corporate presentation is available in the Investors

and Media section under Presentations.

The link to access the live webcast can also be found on the

Sangamo website in the Investors and Media section under Events. A

replay will be available following the conference call, accessible

at the same link.

About Sangamo Therapeutics

Sangamo Therapeutics is a genomic medicine company dedicated to

translating ground-breaking science into medicines that transform

the lives of patients and families afflicted with serious

neurological diseases who do not have adequate or any treatment

options. Sangamo believes that its zinc finger epigenetic

regulators are ideally suited to potentially address devastating

neurological disorders and that its capsid discovery platform can

expand delivery beyond currently available intrathecal delivery

capsids, including in the central nervous system. Sangamo’s

pipeline also includes multiple partnered programs and programs

with opportunities for partnership and investment. To learn more,

visit www.sangamo.com and connect with us on LinkedIn and X.

Forward-Looking Statements

This press release contains forward-looking statements regarding

our current expectations. These forward-looking statements include,

without limitation, statements relating to: the impact of business

development and clinical advancements on Sangamo’s cash runway and

ability to continue to operate as a going concern, the therapeutic

and commercial potential of Sangamo’s product candidates, including

the durability of therapeutic effects, the therapeutic and

commercial potential of technologies used by Sangamo in its product

candidates, including its gene therapy technologies and zinc finger

platform, the potential of its adeno-associated virus capsid

delivery platform, the potential for isaralgagene civaparvovec to

qualify for the FDA’s Accelerated Approval program, including the

adequacy of data generated in the Phase 1/2 STAAR study to support

any such approval; expectations concerning the availability of

additional data to support a potential BLA submission for

isaralgagene civaparvovec, and the timing of such submission; the

potential to accelerate the expected timeline to approval; the

anticipated advancement of isaralgagene civaparvovec to

registration, including Sangamo’s plans to seek a potential

collaboration partner; Sangamo’s ability to realize the expected

benefits of the license agreement with Genentech, including the

potential for Sangamo to receive development and commercial

milestone payments and royalties, Sangamo’s ability to establish

and maintain collaborations and strategic partnerships and realize

the expected benefits of such arrangements, including its ability

to find a collaboration partner for its Fabry disease program and

additional collaborations with respect to Sangamo’s STAC-BBB capsid

delivery platform and epigenetic regulation capabilities, and

Pfizer’s continued advancements of the giroctocogene fitelparvovec

program, including the potential for Pfizer to complete clinical

development, regulatory interactions, manufacturing and global

commercialization of any resulting products, anticipated revenues

from existing and new collaborations and the timing thereof, the

anticipated plans and timelines of Sangamo and its collaborators in

conducting our ongoing and potential future clinical trials and

presenting clinical data from such clinical trials, the anticipated

advancement of Sangamo’s product candidates to late-stage

development, advancement of Sangamo’s preclinical neurology

programs, including announcement of such data, and anticipated CTA

submission, Sangamo’s estimates regarding the sufficiency of its

cash resources and its expenses, capital requirements and need for

substantial additional financing, Sangamo’s 2024 financial guidance

related to GAAP and non-GAAP total operating expenses, impairments

and stock-based compensation, plans to participate in industry and

investor conferences, Sangamo’s efforts and ability to secure

additional funding, including plans to seek partners for certain of

Sangamo’s programs and the discussions related thereto, and other

statements that are not historical fact. These statements are not

guarantees of future performance and are subject to certain risks

and uncertainties that are difficult to predict. Factors that could

cause actual results to differ include, but are not limited to,

risks and uncertainties related to Sangamo’s lack of capital

resources and need for substantial additional funding to execute

its operating plan and to continue to operate as a going concern,

including the risk that Sangamo will be unable to obtain funding or

partnerships or additional collaboration partners necessary to

advance its preclinical and clinical programs and to otherwise

operate as a going concern, in which case Sangamo may be required

to cease operations entirely, liquidate all or a portion of its

assets and/or seek protection under the U.S. Bankruptcy Code, the

potential for Genentech to breach or terminate its agreement with

Sangamo; and the potential for Sangamo to fail to realize its

expected benefits from the Genentech agreement, including but not

limited to further validating the importance of the zinc finger

platform to support the development of therapeutics for

neurodegenerative diseases; Sangamo’s ability to execute its

restructurings as currently contemplated; the uncertain and costly

research and development process, including the risk that

preclinical results may not be indicative of results in any future

clinical trials; the effects of macroeconomic factors or financial

challenges, including as a result of the ongoing overseas

conflicts, current or potential future bank failures, inflation and

high interest rates, on the global business environment, healthcare

systems and business and operations of Sangamo and its

collaborators, including the initiation and operation of clinical

trials; the impacts of clinical trial delays, pauses and holds on

clinical trial timelines and commercialization of product

candidates; the uncertain timing and unpredictable nature of

clinical trial results, including the risk that therapeutic effects

in the Phase 3 AFFINE trial will not be durable in patients as well

as the risk that the therapeutic effects observed in the latest

preliminary clinical data from the Phase 1/2 STAAR study will not

be durable in patients and that final clinical trial data from the

study will not validate the safety and efficacy of isaralgagene

civaparvovec, including that the 52-week data from the Phase 1/2

STAAR study will not support a BLA submission and/or that the

104-week data from such study will not verify the clinical benefit

of isaralgagene civaparvovec or support FDA approval, and that the

patients withdrawn from ERT will remain off ERT; the unpredictable

regulatory approval process for product candidates across multiple

regulatory authorities; reliance on results of early clinical

trials, which results are not necessarily predictive of future

clinical trial results, including the results of any registrational

trial of Sangamo’s product candidates; the potential for

technological developments that obviate technologies used by

Sangamo; Sangamo’s reliance on collaborators and its potential

inability to secure additional collaborations, and Sangamo’s

ability to achieve expected future operating results.

All forward-looking statements about our future plans and

expectations, including our financial guidance, are subject to our

ability to secure adequate additional funding. There can be no

assurance that Sangamo and its collaborators will be able to

develop commercially viable products or that Sangamo will earn any

milestone or royalty payments under its collaboration agreements.

Actual results may differ materially from those projected in these

forward-looking statements due to the risks and uncertainties

described above and other risks and uncertainties that exist in the

operations and business environments of Sangamo and its

collaborators. These risks and uncertainties are described more

fully in Sangamo’s Securities and Exchange Commission, or SEC,

filings and reports, including in Sangamo’s Annual Report on Form

10-K for the year ended December 31, 2023, as supplemented by

Sangamo’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024, and subsequent filings and reports that Sangamo

makes from time to time with the SEC. Forward-looking statements

contained in this announcement are made as of this date, and

Sangamo undertakes no duty to update such information except as

required under applicable law.

Non-GAAP Financial Measures

To supplement our financial results and guidance presented in

accordance with GAAP, we present non-GAAP operating expenses, which

excludes depreciation and amortization, stock-based compensation

expense and impairment of goodwill, indefinite-lived intangible

assets and long-lived assets from GAAP operating expenses. We

believe that this non-GAAP financial measure, when considered

together with our financial information prepared in accordance with

GAAP, can enhance investors’ and analysts’ ability to meaningfully

compare our results from period to period and to our

forward-looking guidance, and to identify operating trends in our

business. We have excluded depreciation and amortization, and

stock-based compensation expense because they are non-cash expenses

that may vary significantly from period to period as a result of

changes not directly or immediately related to the operational

performance for the periods presented, and we have excluded

impairment of goodwill, indefinite-lived intangible assets and

long-lived assets to facilitate a more meaningful evaluation of our

current operating performance and comparisons to our operating

performance in other periods. This non-GAAP financial measure is in

addition to, not a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP. We

encourage investors to carefully consider our results under GAAP,

as well as our supplemental non-GAAP financial information, to more

fully understand our business.

SELECTED CONSOLIDATED FINANCIAL DATA (Unaudited; in

thousands, except per share amounts)

Statement of

Operations Data: Three months ended Nine months

ended September 30, September 30,

2024

2023

2024

2023

Revenues

$

49,412

$

9,398

$

50,249

$

174,190

Operating expenses: Research and development

27,732

57,089

87,846

183,351

General and administrative

11,049

13,918

34,861

48,068

Impairment of long-lived assets

-

44,799

5,521

65,232

Impairment of goodwill and indefinite-lived intangible assets

-

-

-

89,485

Total operating expenses

38,781

115,806

128,228

386,136

Income (loss) from operations

10,631

(106,408

)

(77,979

)

(211,946

)

Interest and other income, net

129

3,515

3,694

9,610

Income (loss) before income taxes

10,760

(102,893

)

(74,285

)

(202,336

)

Income tax expense (benefit)

88

1,270

260

(4,800

)

Net income (loss)

10,672

(104,163

)

(74,545

)

(197,536

)

Net income allocated to participating securities

1,287

-

-

-

Net income (loss) available to common stockholders

$

9,385

$

(104,163

)

$

(74,545

)

$

(197,536

)

Net income (loss) per share Basic

$

0.05

$

(0.59

)

$

(0.37

)

$

(1.14

)

Diluted

$

0.04

$

(0.59

)

$

(0.37

)

$

(1.14

)

Shares used in computing net income (loss) per share Basic

208,345

177,171

198,849

173,375

Diluted

214,325

177,171

198,849

173,375

Selected Balance Sheet Data:

September 30, 2024

December 31, 2023 Cash,

cash equivalents, and marketable securities

$

39,201

$

81,002

Total assets

$

111,263

$

165,320

Total stockholders' equity

$

39,134

$

82,887

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112955936/en/

Investor Relations & Media Inquiries Louise Wilkie

ir@sangamo.com media@sangamo.com

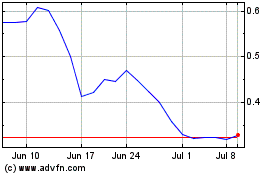

Sangamo Therapeutics (NASDAQ:SGMO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sangamo Therapeutics (NASDAQ:SGMO)

Historical Stock Chart

From Jan 2024 to Jan 2025