RYVYL Inc. (NASDAQ: RVYL) ("RYVYL” or the "Company"), a leading

innovator of payment transaction solutions leveraging proprietary

blockchain ledger and electronic payment technology for the diverse

international markets, reported its financial results for the

quarter ended September 30, 2024.

RYVYL Co-founder and CEO Fredi

Nisan “In the third quarter of 2024, we achieved

sequential revenue growth, driven by consistently strong

international performance, which offset some challenges in U.S.

operations. Our International revenue grew a robust 96% in the

third quarter of 2024 compared to the third quarter of 2023, even

with two European software integrations postponed to Q4 2024. In

October, these two European partners started launching on the new

platforms, marking a pivotal achievement that sets the stage for

continued expansion in the region.

“In North America, momentum is also building as

our first licensing partner nears launch, and we’re rapidly

expanding our pipeline of licensing opportunities. Our recent

successes in banking-as-a-service, acquiring, and payment

processing have opened up exciting new relationships poised to

drive substantial volume well into 2025. We’re energized by RYVYL’s

accelerating growth trajectory as we head into the fourth quarter,

and we believe that 2025 will be a breakthrough year.

“Additionally, if we are able to consummate the

transactions contemplated in our recently signed memorandum of

understanding (MOU) for balance sheet restructuring, we believe

that this will reinforce our financial position and also increase

our future financial flexibility. We believe we are well-positioned

to execute on our growth plans and are confident in the tremendous

value we are creating for our customers, partners, and

shareholders.”

Third Quarter 2024 and Recent Operating

Business Development Highlights

Technology Integrations:

-

Successfully completed integration with ACI Worldwide in July,

enhancing processing speed and strengthening security.

-

Deployed new payment software with First Data, empowering RYVYL to

operate as a payment facilitator while broadening our service

capabilities.

-

Expanded our global reach by launching Visa Direct services in a

thirteenth country, increasing our footprint in key international

markets.

Product Expansion:

-

Rolled out the latest generation of our flagship payment software,

featuring an upgraded NanoKard platform that enables cashless and

secure transactions for merchants.

-

Launched Northeast Merchant Systems (NEMS) Core, specifically

optimized for high-margin processing in U.S. markets, providing

enhanced value for our clients.

Strategic Partnerships:

-

Signed a key agreement with a processing and onboarding partner in

the U.S., initially supporting 1,000 merchants with the potential

for significant expansion.

Financial Summary for the Third Quarter

Ended September 30, 2024

-

Revenue: Third quarter 2024 revenue totaled $12.6

million, driven largely by $9.8 million from RYVYL EU. This

compares to $17.5 million in revenue during the same period in

2023, of which $5.0 million was generated by RYVYL EU.

-

Processing Volume: In the third quarter of 2024,

processing volume rose 31% to $1,123 million, compared to $858

million in the third quarter of 2023. International operations

accounted for $952 million, a significant increase from $517

million the previous year, fueled by strong growth across multiple

verticals, particularly through our Independent Sales Organizations

(“ISO”) and partnership network, as well as expanded offerings in

global payments processing and banking-as-a-service. In North

America, processing volume totaled $171 million, down from $341

million in the third quarter of 2023, reflecting the impact of

shifts in a specific niche industry customer base that reduced

acquiring business volume in early 2024.

- Cost of

Revenue: Cost of revenue was $7.7 million in the third

quarter of 2024, down from $10.8 million in the third quarter of

2023. This decrease was primarily due to reduced processing

activity in North America, partially offset by higher processing

volumes in the International segment.

- Gross

Margin: Gross margin for the third quarter of 2024 was

38.5%, a slight increase from 38.2% in Q3 2023, reflecting

consistent cost management and operational efficiency.

-

Operating Expenses: Operating expenses for the

third quarter of 2024 decreased to $7.3 million, compared to $9.0

million in the third quarter of 2023. This reduction was driven by

streamlined general and administrative (G&A) costs, lower

professional fees, and more focused R&D spending, reflecting

our commitment to operational efficiency.

- Other

Expense: Other expense rose to $2.1 million in the third

quarter of 2024, up from $0.6 million in the third quarter of 2023.

This increase was mainly driven by changes in debt discount

accretion and adjustments in the fair value of derivative

liabilities.

- Adjusted

EBITDA: Adjusted EBITDA for the third quarter of 2024 was

negative $1.7 million, compared to a positive $0.05 million in the

third quarter of 2023, reflecting investments in growth initiatives

and strategic restructuring.

-

Preferred Stock Conversion: In the third quarter

of 2024, $0.2 million of preferred stock was converted to common

stock. There were no repayments of debt principal during the third

quarter.

- Cash Balances: As

of September 30, 2024, cash and restricted cash totaled $91.5

million, and unrestricted cash was $4.3 million, compared to $73.3

million and $12.2 million, respectively at December 31, 2023.

Subsequent Event – MOU to Redeem Debt

and Preferred Stock

On November 11, 2024, the Company signed a

non-binding MOU with the investor (the “Investor”) setting forth

the terms agreed to by the Company and the Investor for the full

repayment and termination of an 8% Senior Convertible Note (the

“Note) and the redemption of all shares of the Company’s Series B

Convertible Preferred Stock (the “Preferred Stock”) held by the

Investor. As of October 31, 2024, the outstanding Note principal

was $19.0 million, and the liquidation value of the Preferred Stock

was $53.5 million. Press Release - RYVYL Signs MOU with Investor to

Retire 8% Senior Convertible Note and Series B Convertible

Preferred Stock

2024 Financial Outlook

The Company has updated its guidance to reflect

the temporary delay in European software implementations, now

projecting full-year 2024 revenue between $56 million and $60

million, with processing volumes expected to exceed $4 billion.

Looking ahead, we believe that the Company is well-positioned for

revenue growth in 2025, fueled by recent successes in business

development, expanding partnerships, and growing demand for our

innovative solutions. With these strategic initiatives underway,

the Company is confident in its trajectory toward long-term growth

and value creation.

Investor Conference Call

RYVYL management will host a conference call at

4:30 p.m. Eastern Time on Thursday, November 14, 2024, to discuss

the Company's financial results for the third quarter ended

September 30, 2024, provide a corporate update and end with a

question-and-answer session. To participate, please use the

following information and submit your questions in writing prior to

the call at RYVYL@lhai.com.

Date: Thursday, November 14, 2024Time: 4:30 p.m. Eastern Time US

Dial In: 1- 877-407-4018International Dial In:

1-201-689-8471Webcast: Q3 2024 Webcast Call me: Link

Participants can use Guest dial-in #s above and

be answered by an operator OR click the Call me link for instant

telephone access to the event. The Call me link will be made active

15 minutes prior to scheduled start time.

A replay of the call will be available through

January 14, 2025, by calling 1-844-512-2921 within the United

States or 1-412-317-6671 when calling internationally and entering

access ID 13749031. An archived version of the webcast will also be

available for 90 days on the IR section of the RYVYL website or by

clicking the webcast link above. An archived version of the webcast

will also be available for 90 days on the IR section of the RYVYL

website or by clicking the webcast link above.

About RYVYL

RYVYL Inc. (NASDAQ: RVYL) was born from a

passion for empowering a new way to conduct business-to-business,

consumer-to-business, and peer-to-peer payment transactions around

the globe. By leveraging proprietary blockchain ledger and

electronic token technology for the diverse international markets,

RYVYL is a leading innovator of payment transaction solutions

reinventing the future of financial transactions. Since its

founding as GreenBox POS in 2017 in San Diego, RYVYL has developed

applications enabling an end-to-end suite of turnkey financial

products with enhanced security and data privacy, world-class

identity theft protection, and rapid speed to settlement. As a

result, the platform can log immense volumes of immutable

transactional records at the speed of the internet for first-tier

partners, merchants, and consumers around the globe.

www.ryvyl.com

Cautionary Note Regarding Forward-Looking

Statements

This press release includes information that

constitutes forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These

forward-looking statements are based on the Company’s current

beliefs, assumptions and expectations regarding future events,

which in turn are based on information currently available to the

Company. Such forward-looking statements include statements

regarding the timing of the filing of the aforementioned periodic

reports and are characterized by future or conditional words such

as "may," "will," "expect," "intend," "anticipate," “believe,"

"estimate" and "continue" or similar words. You should read

statements that contain these words carefully because they discuss

future expectations and plans, which contain projections of future

results of operations or financial condition or state other

forward-looking information.

By their nature, forward-looking statements

address matters that are subject to risks and uncertainties. A

variety of factors could cause actual events and results to differ

materially from those expressed in or contemplated by the

forward-looking statements, including the risk that the completion

and filing of the aforementioned periodic reports will take longer

than expected and that additional information may become known

prior to the expected filing of the aforementioned periodic reports

with the Securities and Exchange Commission (the “SEC”). Other risk

factors affecting the Company are discussed in detail in the

Company’s filings with the SEC. The Company undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, except to the extent required by applicable laws.

IR Contact: David Barnard, Alliance Advisors

Investor Relations, 415-433-3777, RYVYL@lhai.com

RYVYL INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(Dollars in thousands,

except share and per share data)

| |

|

September 30, 2024 |

|

|

December 31, 2023 |

|

| |

|

(Unaudited) |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current

Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,263 |

|

|

$ |

12,180 |

|

|

Restricted cash |

|

|

87,220 |

|

|

|

61,138 |

|

|

Accounts receivable, net of allowance for credit losses of $152 and

$23, respectively |

|

|

851 |

|

|

|

859 |

|

|

Cash due from gateways, net of allowance of $125 and $2,636,

respectively |

|

|

66 |

|

|

|

12,834 |

|

|

Prepaid and other current assets |

|

|

3,313 |

|

|

|

2,854 |

|

| Total current assets |

|

|

95,713 |

|

|

|

89,865 |

|

| Non-current

Assets: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

1,300 |

|

|

|

306 |

|

|

Goodwill |

|

|

20,318 |

|

|

|

26,753 |

|

|

Intangible assets, net |

|

|

3,676 |

|

|

|

5,059 |

|

|

Operating lease right-of-use assets, net |

|

|

3,627 |

|

|

|

4,279 |

|

|

Other assets |

|

|

2,677 |

|

|

|

2,403 |

|

| Total non-current assets |

|

|

31,598 |

|

|

|

38,800 |

|

| Total

assets |

|

$ |

127,311 |

|

|

$ |

128,665 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,986 |

|

|

$ |

1,819 |

|

|

Accrued liabilities |

|

|

7,569 |

|

|

|

5,755 |

|

|

Payment processing liabilities, net |

|

|

87,542 |

|

|

|

76,772 |

|

|

Current portion of operating lease liabilities |

|

|

821 |

|

|

|

692 |

|

|

Other current liabilities |

|

|

1,220 |

|

|

|

504 |

|

| Total current liabilities |

|

|

100,138 |

|

|

|

85,542 |

|

|

Long term debt, net of debt discount |

|

|

17,706 |

|

|

|

15,912 |

|

|

Operating lease liabilities, less current portion |

|

|

3,144 |

|

|

|

3,720 |

|

| Total liabilities |

|

|

120,988 |

|

|

|

105,174 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders'

Equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, Series B, par value $0.01, 5,000,000 shares

authorized; shares issued and outstanding 53,950 and 55,000 at

September 30, 2024 and December 31, 2023, respectively |

|

|

1 |

|

|

|

1 |

|

|

Common stock, par value $0.001, 100,000,000 shares authorized,

shares issued and outstanding of 6,957,875 and 5,996,948 at

September 30, 2024 and December 31, 2023, respectively |

|

|

7 |

|

|

|

6 |

|

|

Additional paid-in capital |

|

|

177,750 |

|

|

|

175,664 |

|

|

Accumulated other comprehensive income |

|

|

1,120 |

|

|

|

401 |

|

|

Accumulated deficit |

|

|

(172,555 |

) |

|

|

(152,581 |

) |

| Total stockholders'

equity |

|

|

6,323 |

|

|

|

23,491 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

127,311 |

|

|

$ |

128,665 |

|

RYVYL INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME(Dollars in thousands, except share and per

share data)(Unaudited)

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

12,606 |

|

|

$ |

17,480 |

|

|

$ |

41,280 |

|

|

$ |

43,620 |

|

| Cost of revenue |

|

|

7,749 |

|

|

|

10,800 |

|

|

|

24,643 |

|

|

|

25,703 |

|

| Gross profit |

|

|

4,857 |

|

|

|

6,680 |

|

|

|

16,637 |

|

|

|

17,917 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Advertising and marketing |

|

|

42 |

|

|

|

45 |

|

|

|

74 |

|

|

|

153 |

|

| Research and development |

|

|

815 |

|

|

|

1,315 |

|

|

|

3,027 |

|

|

|

4,434 |

|

| General and

administrative |

|

|

1,442 |

|

|

|

3,041 |

|

|

|

5,107 |

|

|

|

6,709 |

|

| Payroll and payroll taxes |

|

|

3,251 |

|

|

|

2,605 |

|

|

|

9,670 |

|

|

|

8,232 |

|

| Professional fees |

|

|

1,061 |

|

|

|

1,234 |

|

|

|

3,356 |

|

|

|

5,651 |

|

| Stock compensation

expense |

|

|

136 |

|

|

|

147 |

|

|

|

542 |

|

|

|

309 |

|

| Depreciation and

amortization |

|

|

590 |

|

|

|

657 |

|

|

|

1,826 |

|

|

|

1,899 |

|

| Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

|

6,675 |

|

|

|

- |

|

| Restructuring charges |

|

|

- |

|

|

|

- |

|

|

|

1,636 |

|

|

|

- |

|

| Total operating expenses |

|

|

7,337 |

|

|

|

9,044 |

|

|

|

31,913 |

|

|

|

27,387 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(2,480 |

) |

|

|

(2,364 |

) |

|

|

(15,276 |

) |

|

|

(9,470 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(309 |

) |

|

|

(65 |

) |

|

|

(462 |

) |

|

|

(3,310 |

) |

|

Accretion of debt discount |

|

|

(273 |

) |

|

|

(4,183 |

) |

|

|

(1,978 |

) |

|

|

(9,626 |

) |

|

Changes in fair value of derivative liability |

|

|

- |

|

|

|

6,909 |

|

|

|

14 |

|

|

|

6,580 |

|

|

Derecognition expense on conversion of convertible debt |

|

|

- |

|

|

|

(1,331 |

) |

|

|

(68 |

) |

|

|

(1,518 |

) |

|

Legal settlement expense |

|

|

(1,598 |

) |

|

|

(1,929 |

) |

|

|

(1,598 |

) |

|

|

(4,142 |

) |

|

Other income (expense) |

|

|

72 |

|

|

|

(25 |

) |

|

|

608 |

|

|

|

(1,474 |

) |

| Total other income (expense),

net |

|

|

(2,108 |

) |

|

|

(624 |

) |

|

|

(3,484 |

) |

|

|

(13,490 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before provision for

income taxes |

|

|

(4,588 |

) |

|

|

(2,988 |

) |

|

|

(18,760 |

) |

|

|

(22,960 |

) |

| Income tax provision |

|

|

586 |

|

|

|

128 |

|

|

|

1,214 |

|

|

|

138 |

|

| Net loss |

|

$ |

(5,174 |

) |

|

$ |

(3,116 |

) |

|

$ |

(19,974 |

) |

|

$ |

(23,098 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income

statement: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(5,174 |

) |

|

|

(3,116 |

) |

|

|

(19,974 |

) |

|

|

(23,098 |

) |

|

Foreign currency translation gain (loss) |

|

|

1,338 |

|

|

|

(317 |

) |

|

|

719 |

|

|

|

(389 |

) |

|

Total comprehensive loss |

|

$ |

(3,836 |

) |

|

$ |

(3,433 |

) |

|

$ |

(19,255 |

) |

|

$ |

(23,487 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.76 |

) |

|

$ |

(0.60 |

) |

|

$ |

(3.12 |

) |

|

$ |

(4.48 |

) |

| Weighted average

number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

6,812,248 |

|

|

|

5,231,588 |

|

|

|

6,408,993 |

|

|

|

5,160,499 |

|

RYVYL INC.CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS(Dollars in

thousands)(Unaudited)

| |

|

Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(19,974 |

) |

|

$ |

(23,098 |

) |

| |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

1,826 |

|

|

|

1,899 |

|

|

Noncash lease expense |

|

|

205 |

|

|

|

246 |

|

|

Stock compensation expense |

|

|

542 |

|

|

|

309 |

|

|

Accretion of debt discount |

|

|

1,978 |

|

|

|

9,626 |

|

|

Derecognition expense upon conversion of convertible debt |

|

|

68 |

|

|

|

1,518 |

|

|

Changes in fair value of derivative liability |

|

|

(14 |

) |

|

|

(6,580 |

) |

|

Impairment of goodwill |

|

|

6,675 |

|

|

|

- |

|

|

Restructuring charges |

|

|

1,636 |

|

|

|

- |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

70 |

|

|

|

457 |

|

|

Prepaid and other current assets |

|

|

(460 |

) |

|

|

6,841 |

|

|

Cash due from gateways, net |

|

|

12,706 |

|

|

|

(896 |

) |

|

Other assets |

|

|

(318 |

) |

|

|

(1,480 |

) |

|

Accounts payable |

|

|

1,166 |

|

|

|

1,962 |

|

|

Accrued and other current liabilities |

|

|

1,943 |

|

|

|

1,333 |

|

|

Accrued interest |

|

|

300 |

|

|

|

554 |

|

|

Payment processing liabilities, net |

|

|

10,770 |

|

|

|

34,893 |

|

| Net cash provided by operating

activities |

|

$ |

19,119 |

|

|

$ |

27,584 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(34 |

) |

|

|

(78 |

) |

|

Capitalized software development costs |

|

|

(1,100 |

) |

|

|

- |

|

|

Purchase of intangible assets |

|

|

(93 |

) |

|

|

- |

|

| Net cash used in investing

activities |

|

|

(1,226 |

) |

|

|

(78 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Repayments on long term debt |

|

|

(13 |

) |

|

|

(11 |

) |

|

Treasury stock purchases |

|

|

(194 |

) |

|

|

- |

|

| Net cash used in financing

activities |

|

|

(207 |

) |

|

|

(11 |

) |

| |

|

|

|

|

|

|

|

|

| Effects of exchange rates on

cash, cash equivalents, and restricted cash |

|

|

479 |

|

|

|

26 |

|

| |

|

|

|

|

|

|

|

|

| Net increase in cash, cash

equivalents, and restricted cash |

|

|

18,165 |

|

|

|

27,521 |

|

| |

|

|

|

|

|

|

|

|

| Cash, cash equivalents, and

restricted cash – beginning of period |

|

|

73,318 |

|

|

|

40,834 |

|

| |

|

|

|

|

|

|

|

|

| Cash, cash

equivalents, and restricted cash – end of

period |

|

$ |

91,483 |

|

|

$ |

68,355 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

- |

|

|

$ |

2,709 |

|

|

Income taxes |

|

$ |

759 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

| Non-cash financing and

investing activities: |

|

|

|

|

|

|

|

|

|

Convertible debt conversion to common stock |

|

$ |

200 |

|

|

$ |

300 |

|

|

Convertible debt conversion to preferred stock |

|

$ |

- |

|

|

$ |

4,297 |

|

|

Interest accrual from convertible debt converted to preferred

stock |

|

$ |

- |

|

|

$ |

2,271 |

|

|

Interest accrual from convertible debt converted to common

stock |

|

$ |

- |

|

|

$ |

3 |

|

Use of Non-GAAP Financial

Information

Adjusted earnings before interest, taxes,

depreciation, and amortization (“Adjusted EBITDA”) is a non-GAAP

measure that represents our net loss before interest expense,

amortization of debt discount, income tax expense, depreciation and

amortization, changes in the fair value of derivative liabilities,

losses on the extinguishment and derecognition expenses on the

conversion of convertible debt, non-cash stock-based compensation

expense, acquisition-related expense, non-recurring provisions for

credit losses on legacy matters, accounting fees related to the

restatement of prior period financial statements, non-recurring

costs related to the spin-off of a subsidiary, and legal costs and

settlement fees incurred in connection with non-ordinary course

litigation and other disputes.

We exclude these items in calculating Adjusted

EBITDA because we believe that the exclusion of these items will

provide for more meaningful information about our financial

performance, and do not consider the excluded items to be part of

our ongoing results of operations. Our use of Adjusted EBITDA has

limitations as an analytical tool, and you should not consider it

in isolation or as a substitute for analysis of our financial

results as reported under GAAP. Some of these limitations are: (a)

although depreciation and amortization are non-cash charges, the

assets being depreciated and amortized may have to be replaced in

the future, and Adjusted EBITDA does not reflect cash capital

expenditure requirements for such replacements or for new capital

expenditure requirements; (b) Adjusted EBITDA does not reflect

changes in, or cash requirements for, our working capital needs;

(c) Adjusted EBITDA does not reflect the potentially dilutive

impact of equity-based compensation; (d) Adjusted EBITDA does not

reflect tax payments that may represent a reduction in cash

available to us; and (e) other companies, including companies in

our industry, may calculate Adjusted EBITDA or similarly titled

measures differently, which reduces its usefulness as a comparative

measure.

Because of these and other limitations, you

should consider Adjusted EBITDA alongside our other GAAP-based

financial performance measures, net income (loss) and our other

GAAP financial results. The following table presents a

reconciliation of Adjusted EBITDA from net loss, the most directly

comparable GAAP measure, for the periods indicated:

Reconciliation of Net Loss attributable

to RYVYL, Inc., to Adjusted EBITDA for theThree

and Nine Months Ended September 30, 2024 and

2023(in thousands, except share and per share

data)(Unaudited)

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(5,174 |

) |

|

$ |

(3,116 |

) |

|

$ |

(19,974 |

) |

|

$ |

(23,098 |

) |

| Interest expense |

|

|

309 |

|

|

|

65 |

|

|

|

462 |

|

|

|

3,310 |

|

| Accretion of debt

discount |

|

|

273 |

|

|

|

4,183 |

|

|

|

1,978 |

|

|

|

9,626 |

|

| Income tax provision |

|

|

586 |

|

|

|

128 |

|

|

|

1,214 |

|

|

|

138 |

|

| Depreciation and

amortization |

|

|

590 |

|

|

|

657 |

|

|

|

1,826 |

|

|

|

1,899 |

|

| EBITDA |

|

|

(3,416 |

) |

|

|

1,917 |

|

|

|

(14,494 |

) |

|

|

(8,125 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other non-cash

adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in fair value of

derivative liability |

|

|

- |

|

|

|

(6,909 |

) |

|

|

(14 |

) |

|

|

(6,580 |

) |

| Derecognition expense on

conversion of convertible debt |

|

|

- |

|

|

|

1,331 |

|

|

|

68 |

|

|

|

1,518 |

|

| Stock compensation

expense |

|

|

136 |

|

|

|

147 |

|

|

|

542 |

|

|

|

309 |

|

| Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

|

6,675 |

|

|

|

- |

|

| Restructuring charges |

|

|

- |

|

|

|

- |

|

|

|

1,636 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Special

items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-recurring legal settlements

and ongoing matters and related legal fees |

|

|

1,598 |

|

|

|

2,197 |

|

|

|

1,598 |

|

|

|

5,308 |

|

| Carryover effects of financial

statement restatements in prior periods |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,222 |

|

| Non-recurring provision for

credit losses on legacy matters |

|

|

|

|

|

|

1,369 |

|

|

|

|

|

|

|

1,994 |

|

| Accounting fees related to the

restatement of prior period financial statements |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

237 |

|

| Non-recurring impairment of right

of use asset |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

100 |

|

| Non-recurring costs of

spin-off |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

29 |

|

| Adjusted EBITDA |

|

$ |

(1,682 |

) |

|

$ |

52 |

|

|

$ |

(3,989 |

) |

|

$ |

(3,988 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

$ |

2,480 |

) |

|

$ |

(2,364 |

) |

|

$ |

(15,276 |

) |

|

$ |

(9,470 |

) |

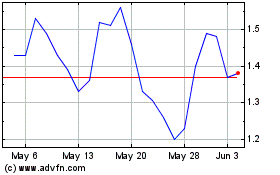

RYVYL (NASDAQ:RVYL)

Historical Stock Chart

From Nov 2024 to Dec 2024

RYVYL (NASDAQ:RVYL)

Historical Stock Chart

From Dec 2023 to Dec 2024