Roma Green Finance Limited Announces Pricing of $12,300,000 Public Offering

January 09 2024 - 9:52AM

Roma Green Finance Limited (Nasdaq: ROMA) (the

“Company”), a Cayman Islands exempted company that is based in Hong

Kong, today announced the pricing of a public offering of 2,449,943

of its ordinary shares at a public offering price of $4.00 per

share for aggregate gross proceeds of approximately $9,799,772

prior to deducting underwriting discounts, commissions and other

related expenses. Additionally, in connection with the initial

public offering, a selling shareholder is selling 625,517 ordinary

shares at $4.00 per share, for total gross proceeds of $2,502,068,

before deducting underwriting discounts, commissions and other

related expenses. The Company will not receive any of the proceeds

from the sale by the selling shareholder. The ordinary shares are

expected to begin trading on the Nasdaq Capital Market tomorrow,

January 9, 2024, under the trading symbol “ROMA.” The offering is

expected to close on or about January 11, 2024, subject to

customary closing conditions.

The offering has been conducted on a firm

commitment basis. Spartan Capital Securities, LLC (“Spartan”),

acted as sole book-running manager for the offering.

The Company expects to use the net proceeds from

this offering to (i) strengthen and expand its green and

sustainable finance and climate risk advisory business in Hong Kong

and Singapore and to expand market presence in other international

markets; (ii) to enhance its industry positioning and strengthen

its business development; (iii) to strengthen its operational

efficiency; (iv) for strategic acquisition; (v) for establishing a

formal ESG academy, and (vi) for working capital and other general

corporate purposes.

A registration statement on Form F-1 relating to

the offering, as amended, was filed with the Securities and

Exchange Commission (the “SEC”) (File Number: 333-272555) and was

declared effective by the SEC on December 29, 2023. The offering is

being made only by means of a prospectus, forming a part of the

registration statement. Copies of the final prospectus relating to

the offering, when available, may be obtained from Spartan Capital

Securities, LLC; Attn: Kim Monchik, 45 Broadway, 19th Floor,

New York, NY 10006 or via email at

investmentbanking@spartancapital.com or telephone at (212)

293-0123. In addition, a copy of the prospectus relating to

the offering may be obtained via the SEC's website at

www.sec.gov.

Before you invest, you should read the

prospectus and other documents the Company has filed or will file

with the SEC for more complete information about the Company and

the offering. This press release shall not constitute an offer to

sell, or the solicitation of an offer to buy any of the Company’s

securities, nor shall such securities be offered or sold in the

United States absent registration or an applicable exemption from

registration, nor shall there be any offer, solicitation or sale of

any of the Company’s securities in any state or jurisdiction in

which such offers, solicitations or sales would be unlawful prior

to registration or qualification under the securities laws of such

state or jurisdiction.

About Roma Green Finance

Limited

The Company is based in Hong Kong and is

principally engaged in the provision of ESG, corporate governance

and risk management as well as sustainability and climate change

related advisory services. Its service offering mainly comprise the

following: (i) Sustainability Program Development, (ii) ESG

Reporting, (iii) Corporate Governance and Risk Management, (iv)

Climate Change Strategies and Solutions, (v) Environmental Audit,

(vi) ESG Rating Support and Shareholder Communication: The Company

helps clients to review and improve their ESG / sustainability

ratings with Bloomberg and other rating agencies, and (vii)

Education and Training.

Additional information about the Company is

available at http://www.romaesg.com.

Forward-Looking Statements

This press release contains forward-looking

statements regarding the Company’s current expectations. These

forward-looking statements include, without limitation, references

to the Company’s expectations regarding the closing of the public

offering and its anticipated use of net proceeds from the offering.

These statements are not guarantees of future performance and are

subject to certain risks, uncertainties and assumptions that are

difficult to predict. Factors that could cause actual results to

differ include, but are not limited to, risks and uncertainties

related to the satisfaction of customary closing conditions related

to the public offering or factors that result in changes to the

Company's anticipated use of proceeds. These and other risks and

uncertainties are described more fully in the section captioned

"Risk Factors" in the Company’s Registration Statement on Form F-1

related to the public offering (SEC File No. 333-272555).

Forward-looking statements contained in this announcement are made

as of this date, and the Company undertakes no duty to update such

information except as required under applicable law.

Contact:Roma Green Finance

LimitedTel: +852 2529 6878Email: ir@roma-international.com

Mr. Rene VanguestaineChristensenTel: + 852 6686

1376Email: rene.vanguestaine@christensencomms.com

Ms. Linda BergkampChristensenTel:

+1-480-614-3004Email: linda.bergkamp@christensencomms.com

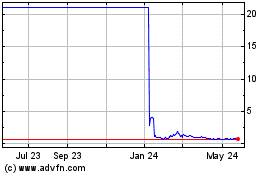

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

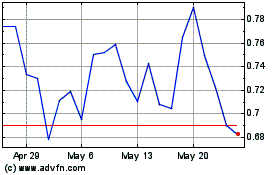

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Jan 2024 to Jan 2025