Roma Financial Corporation Announces Second Quarter 2012 Earnings

August 06 2012 - 2:00PM

Roma Financial Corporation (Nasdaq:ROMA) (the "Company"), the

holding company of Roma Bank and RomAsia Bank, announced today its

results of operations for the three and six months ended June 30,

2012. Net income attributable to Roma Financial Corporation for the

three and six months ended June 30, 2012 was $0.9 million and $2.3

million, respectively, or $.03 and $.08 per common and diluted

share, compared to $1.4 million and $3.2 million, or $.05 and $.11

per common and diluted share, for the same period of the prior

year.

At June 30, 2012, the Company's consolidated assets were $1.85

billion, compared to $1.89 billion at both December 31, 2011, and

June 30, 2011. Loans, before the allowance for loan losses and

excluding loan originations sold, increased $26.2 million (2.7%) to

$994.0 million since the end of 2011 and $65.0 million (7.9%) over

June 30, 2011. Deposits decreased 4.0% to $1.53 billion from

$1.58 billion at December 31, 2011 and $1.57 billion at June 30,

2011. Stockholders' equity ended the quarter at $219.1

million, compared to $218.0 million at December 31, 2011.

"Unprecedented low interest rates continue to constrict yields

on loans and investments, and in concert with high liquidity and

tepid commercial loan demand, caused a decline in interest income

in both the comparative three and six month periods. To

minimize the impact of low rates on net interest margins,

management has tightly controlled rates on deposit accounts thereby

purposefully limiting the inflow of deposits and encouraging the

outward migration of higher costing deposits. We are in a very

liquid position and our strategy is to forego the temptation of

locking in unattractive higher yielding longer term investments,

which might benefit earnings in the short term, but pose a threat

to our earnings potential and capital when the inevitable increase

in rates occurs," commented Peter A. Inverso, President and

CEO.

"Our banks continue to make residential and commercial loans

available and our portfolios continue to establish new highs. Our

loan portfolios should surpass the billion dollar threshold during

the third quarter. Additionally, we are making good progress

in lowering our non-performing loan levels," said

Inverso.

"We have experienced significant growth in non-interest income

from premiums on loans originated for sale by our residential loan

origination group and mortgage servicing fee income. This

improvement has helped abate higher expenses associated with

problem loan resolutions and acquired collateral dispositions,"

added Inverso.

"The strain on the banking industry from regulatory and economic

forces is considerable, but our Company will doggedly pursue its

mission of serving the banking needs of our communities," concluded

Inverso.

Shares of the Company began trading on July 12, 2006, on the

NASDAQ Global Select Market under the symbol "ROMA."

Roma Financial Corporation (Nasdaq:ROMA) is the holding company

of Roma Bank, a community bank headquartered in Robbinsville, New

Jersey, and RomAsia Bank headquartered in South Brunswick, New

Jersey. Roma Bank has been serving families, businesses and

the communities of Central New Jersey for over 91 years with a

complete line of financial products and services, and today Roma

Bank operates branch locations in Mercer, Burlington, Camden and

Ocean counties in New Jersey. Visit Roma online at

www.romabank.com, or RomAsia Bank at www.romasiabank.com. RomAsia

Bank has two branch locations in Middlesex County, New Jersey.

Forward Looking Statements

The foregoing material contains forward-looking statements

concerning the financial condition, results of operations and

business of the Company. We caution that such statements are

subject to a number of uncertainties and actual results could

differ materially, and, therefore, readers should not place undue

reliance on any forward-looking statements. The Company does

not undertake, and specifically disclaims, any obligation to

publicly release the results of any revisions that may be made to

any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements.

CONTACT: Peter A. Inverso, President & CEO

609 223-8310

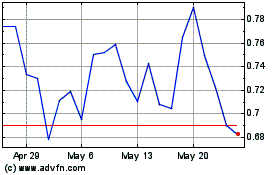

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Oct 2024 to Nov 2024

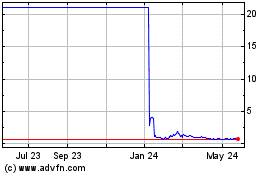

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Nov 2023 to Nov 2024