The RMR Group Inc. Announces Second Quarter Fiscal 2024 Financial Results May 7, 2024 Exhibit 99.2

2 Dividend RMR has declared a quarterly dividend on its Class A Common Stock and Class B-1 Common Stock of $0.45 per share, representing a 12.5% increase over last quarter's cash distribution of $0.40, to shareholders of record as of the close of business on April 22, 2024. This dividend will be paid on or about May 16, 2024. Conference Call A conference call to discuss RMR’s fiscal second quarter results will be held on Wednesday, May 8, 2024 at 1:00 p.m. Eastern Time. The conference call may be accessed by dialing (844) 481-2945 or (412) 317-1868 (if calling from outside the U.S. and Canada); a pass code is not required. A replay will be available for one week by dialing (877) 344-7529; the replay pass code is 3292097. A live audio webcast of the conference call will also be available in a listen-only mode on RMR’s website, at www.rmrgroup.com. The archived webcast will be available for replay on RMR’s website after the call. The transcription, recording and retransmission in any way are strictly prohibited without the prior written consent of RMR. About The RMR Group The RMR Group is a leading U.S. alternative asset management company, unique for its focus on commercial real estate (CRE) and related businesses. RMR’s vertical integration is supported by over 1,100 real estate professionals in more than 35 offices nationwide who manage over $41 billion in assets under management and leverage more than 35 years of institutional experience in buying, selling, financing and operating CRE. RMR benefits from a scalable platform, a deep and experienced management team and a diversity of direct real estate strategies across its clients. RMR is headquartered in Newton, MA and was founded in 1986. For more information, please visit www.rmrgroup.com. "This quarter, RMR increased management and advisory services revenue by 7% sequentially and generated net income of $5.9 million, net income per share of $0.34, adjusted net income per share of $0.39, Distributable Earnings per share of $0.51 and Adjusted EBITDA of $22.7 million. Our results, which were largely in line with guidance, reflect both a focus on cost management as well as ensuring we are investing in our platform so we can take advantage of attractive market opportunities as they arise. Our financial position remains strong with nearly $200 million of cash and no corporate debt. Looking ahead, we remain focused on assisting our clients on the execution of their financial and strategic priorities, driving growth within our residential platform and utilizing our balance sheet to capitalize on opportunities to expand RMR’s private capital assets under management.” Adam Portnoy, President and Chief Executive Officer THE RMR GROUP INC. ANNOUNCES SECOND QUARTER FISCAL 2024 FINANCIAL RESULTS Newton, MA (May 7, 2024). The RMR Group Inc. (Nasdaq: RMR) today announced its financial results for the fiscal quarter ended March 31, 2024.

3 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: executing RMR's Managed Equity REITs' strategic plans and related benefits; commercial real estate market conditions; and RMR's liquidity and its position to capitalize on additional growth opportunities in the current market environment. Forward-looking statements reflect RMR’s current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause RMR's actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward-looking statements. Some of the risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: The dependence of RMR's revenues on a limited number of clients; the variability of its revenues; risks related to supply chain constraints, commodity pricing and inflation, including inflation impacting wages and employee benefits; changing market conditions, practices and trends, which may adversely impact its clients and the fees RMR receives from them; potential terminations of the management agreements with its clients; increases in or sustained high market interest rates, which may significantly reduce RMR's revenues or impede its growth; RMR's dependence on the growth and performance of its clients; its ability to obtain or create new clients for its business and other circumstances beyond RMR's control; the ability of RMR's clients to operate their businesses profitably, optimize their capital structures and to grow and increase their market capitalizations and total shareholder returns; RMR's ability to successfully provide management services to its clients; RMR's ability to maintain or increase the distributions RMR pays to its shareholders; RMR's ability to successfully pursue and execute capital allocation and new business strategies; RMR's ability to prudently invest in its business to enhance its operations, services and competitive positioning; and RMR's ability to successfully integrate acquired businesses and realize the expected returns on its investments; risk that cost savings and synergies anticipated to be realized by the acquisition of MPC Partners Holding LLC may not be fully realized or may take longer to realize than expected; changes to RMR's operating leverage or client diversity; litigation risks; risks related to acquisitions, dispositions and other activities by or among its clients; allegations, even if untrue, of any conflicts of interest arising from RMR's management activities; its ability to retain the services of its managing directors and other key personnel; RMR's and its clients’ risks associated with RMR's and its clients' costs of compliance with laws and regulations, including securities regulations, exchange listing standards and other laws and regulations affecting public companies; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in RMR's periodic filings. The information contained in RMR’s filings with the Securities and Exchange Commission (SEC), including under the caption “Risk Factors” in its periodic reports, or incorporated therein, identifies important factors that could cause differences from the forward-looking statements in this presentation. RMR’s filings with the SEC are available on the SEC’s website at www.sec.gov. You should not place undue reliance on forward-looking statements. Except as required by law, RMR does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. Investor Relations Contact Kevin Barry, Senior Director (617) 796-8230 WARNING REGARDING FORWARD-LOOKING STATEMENTS Corporate Headquarters Two Newton Place 255 Washington Street, Suite 300 Newton, Massachusetts 02458

Second Quarter Fiscal 2024 Financial Results

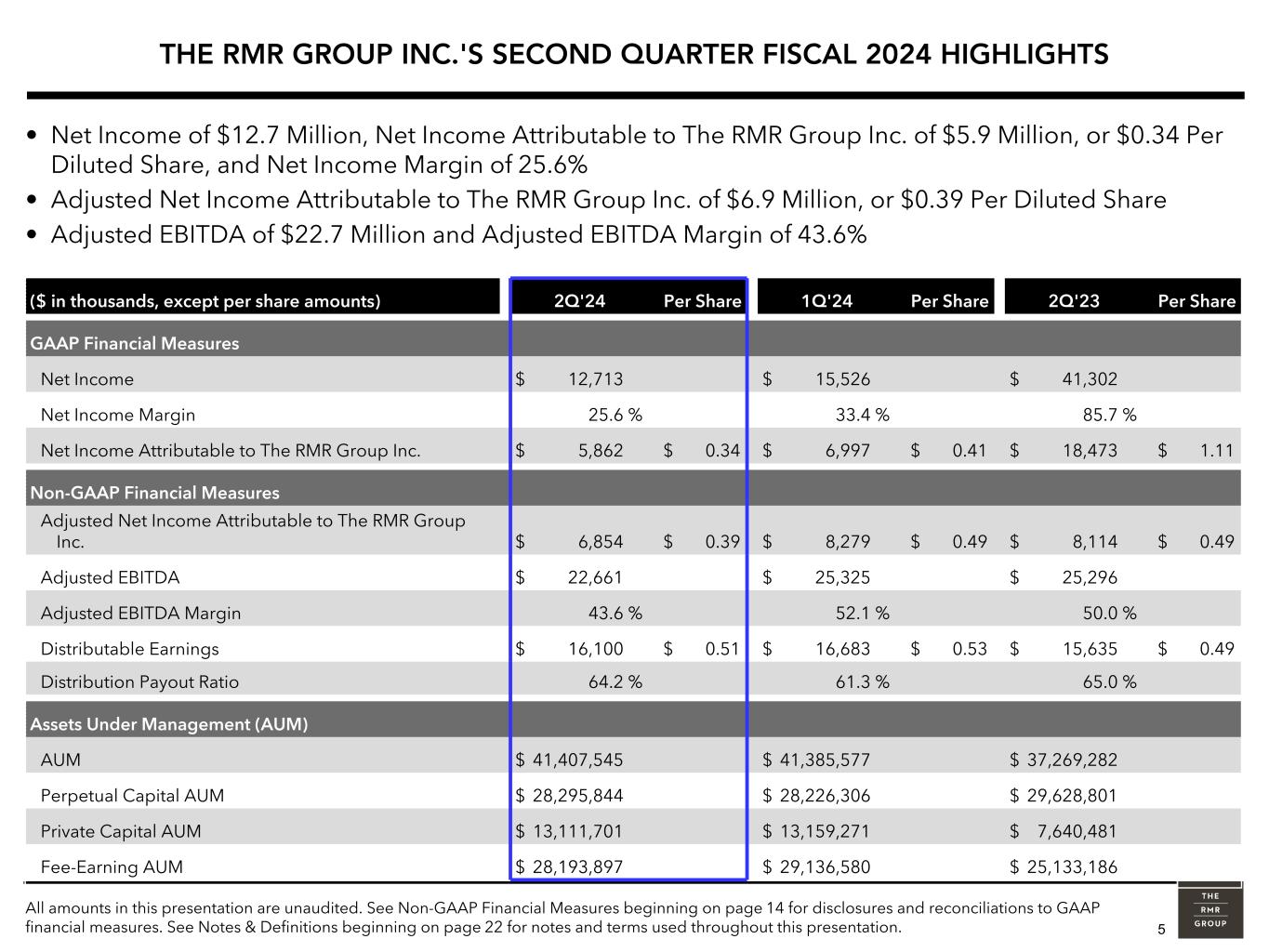

5 THE RMR GROUP INC.'S SECOND QUARTER FISCAL 2024 HIGHLIGHTS All amounts in this presentation are unaudited. See Non-GAAP Financial Measures beginning on page 14 for disclosures and reconciliations to GAAP financial measures. See Notes & Definitions beginning on page 22 for notes and terms used throughout this presentation. • Net Income of $12.7 Million, Net Income Attributable to The RMR Group Inc. of $5.9 Million, or $0.34 Per Diluted Share, and Net Income Margin of 25.6% • Adjusted Net Income Attributable to The RMR Group Inc. of $6.9 Million, or $0.39 Per Diluted Share • Adjusted EBITDA of $22.7 Million and Adjusted EBITDA Margin of 43.6% ($ in thousands, except per share amounts) 2Q'24 Per Share 1Q'24 Per Share 2Q'23 Per Share GAAP Financial Measures Net Income $ 12,713 $ 15,526 $ 41,302 Net Income Margin 25.6 % 33.4 % 85.7 % Net Income Attributable to The RMR Group Inc. $ 5,862 $ 0.34 $ 6,997 $ 0.41 $ 18,473 $ 1.11 Non-GAAP Financial Measures Adjusted Net Income Attributable to The RMR Group Inc. $ 6,854 $ 0.39 $ 8,279 $ 0.49 $ 8,114 $ 0.49 Adjusted EBITDA $ 22,661 $ 25,325 $ 25,296 Adjusted EBITDA Margin 43.6 % 52.1 % 50.0 % Distributable Earnings $ 16,100 $ 0.51 $ 16,683 $ 0.53 $ 15,635 $ 0.49 Distribution Payout Ratio 64.2 % 61.3 % 65.0 % Assets Under Management (AUM) AUM $ 41,407,545 $ 41,385,577 $ 37,269,282 Perpetual Capital AUM $ 28,295,844 $ 28,226,306 $ 29,628,801 Private Capital AUM $ 13,111,701 $ 13,159,271 $ 7,640,481 Fee-Earning AUM $ 28,193,897 $ 29,136,580 $ 25,133,186

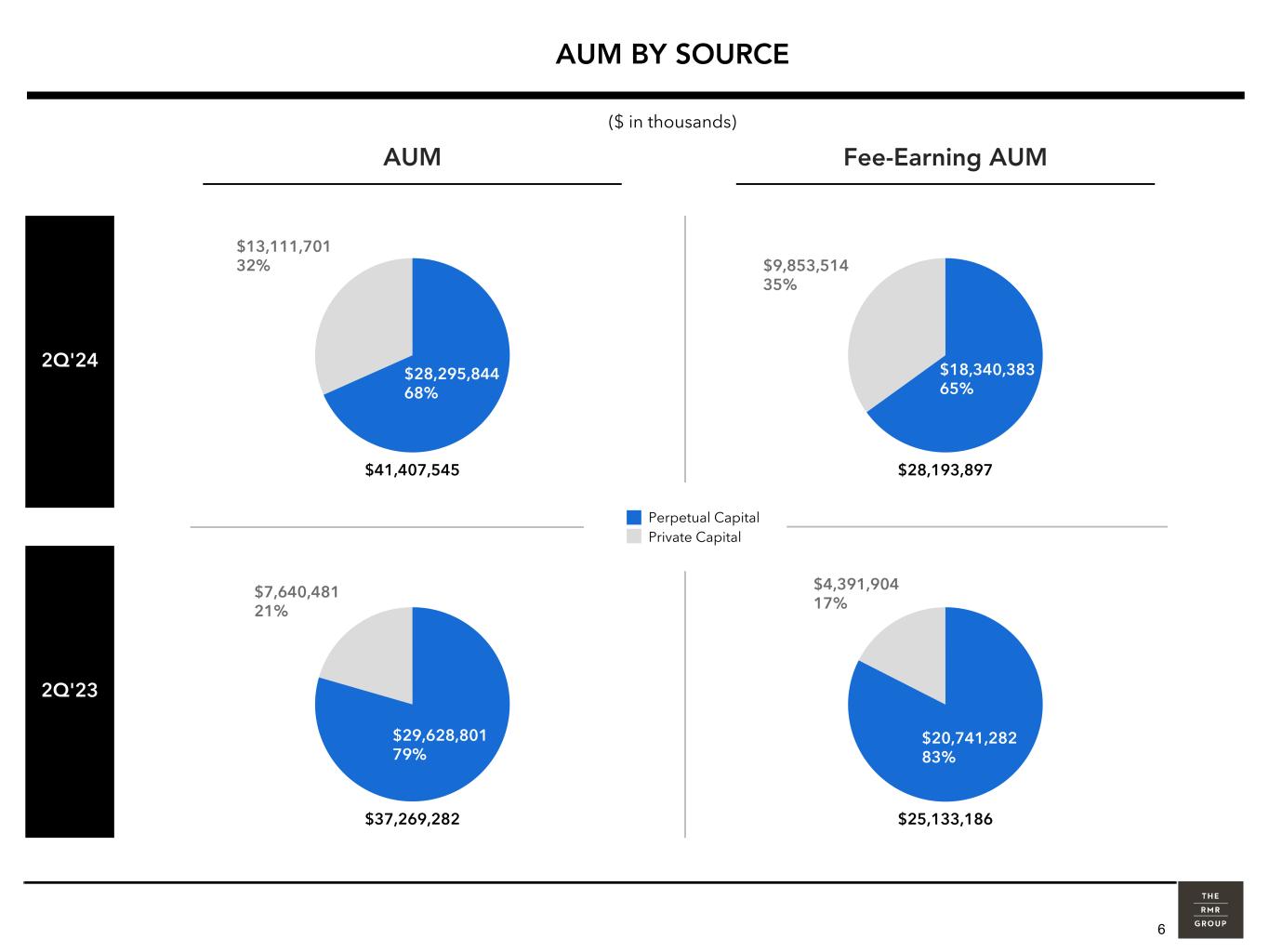

6 Managed Public Real Estate Capital Managed Private Real Estate Capital $28,295,844 68% $13,111,701 32% $41,407,545 $29,628,801 79% $7,640,481 21% $37,269,282 AUM AUM BY SOURCE ($ in thousands) 2Q'24 2Q'23 Fee-Earning AUM $18,340,383 65% $9,853,514 35% $28,193,897 $20,741,282 83% $4,391,904 17% $25,133,186 Perpetual Capital Private Capital

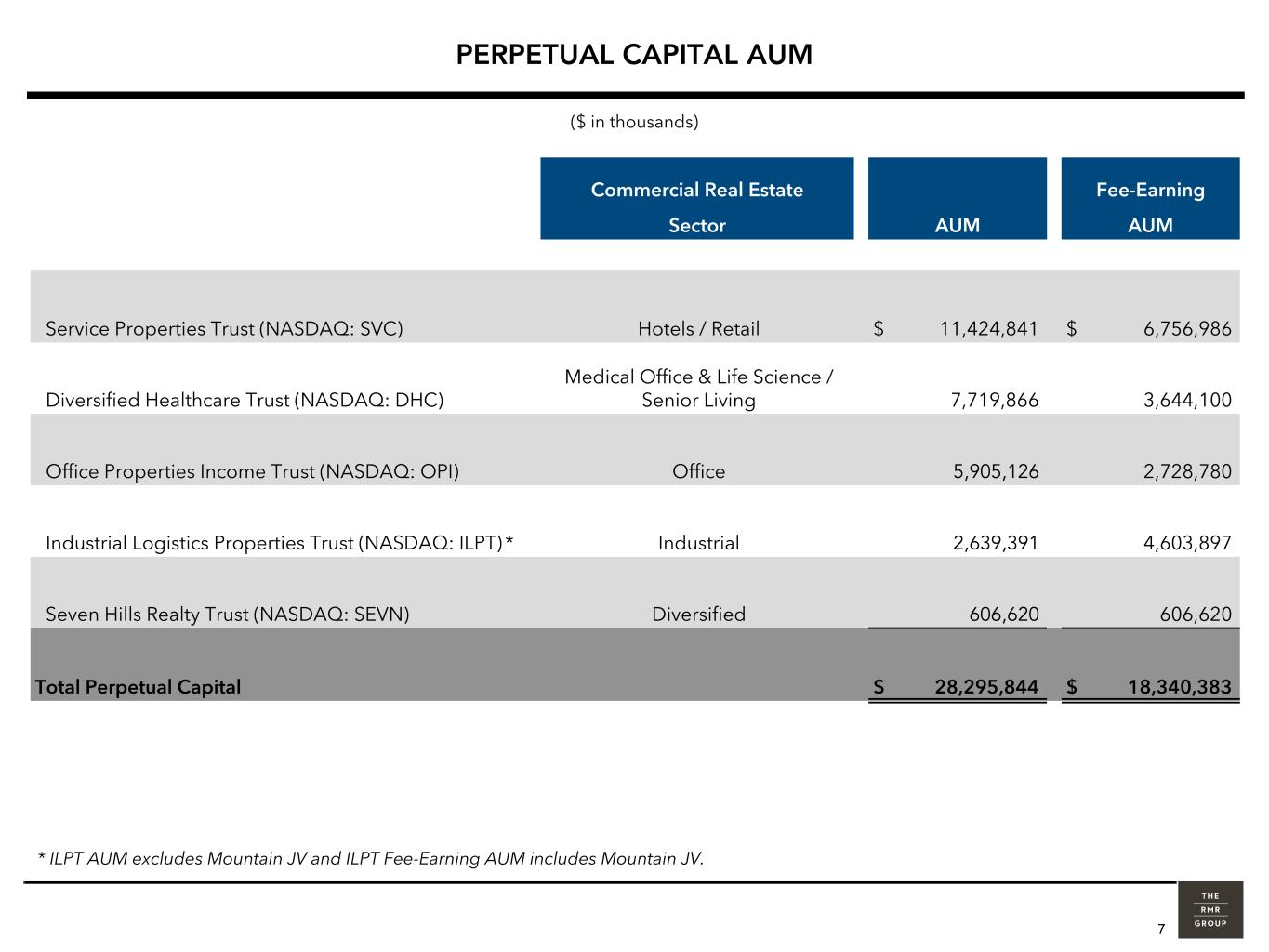

7 PERPETUAL CAPITAL AUM Commercial Real Estate Fee-Earning Sector AUM AUM Service Properties Trust (NASDAQ: SVC) Hotels / Retail $ 11,424,841 $ 6,756,986 Diversified Healthcare Trust (NASDAQ: DHC) Medical Office & Life Science / Senior Living 7,719,866 3,644,100 Office Properties Income Trust (NASDAQ: OPI) Office 5,905,126 2,728,780 Industrial Logistics Properties Trust (NASDAQ: ILPT) * Industrial 2,639,391 4,603,897 Seven Hills Realty Trust (NASDAQ: SEVN) Diversified 606,620 606,620 Total Perpetual Capital $ 28,295,844 $ 18,340,383 ($ in thousands) * ILPT AUM excludes Mountain JV and ILPT Fee-Earning AUM includes Mountain JV.

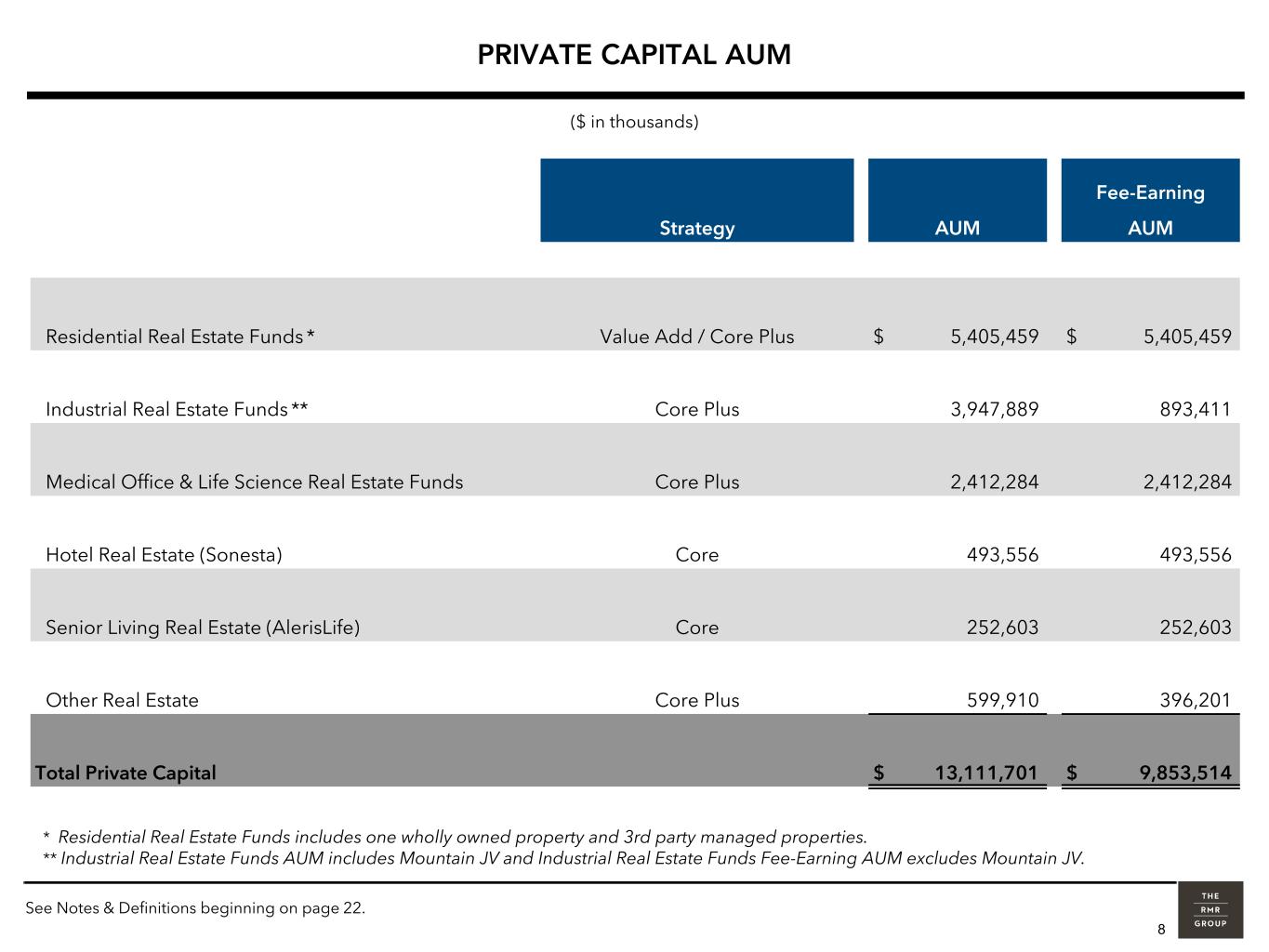

8 PRIVATE CAPITAL AUM Fee-Earning Strategy AUM AUM Residential Real Estate Funds * Value Add / Core Plus $ 5,405,459 $ 5,405,459 Industrial Real Estate Funds ** Core Plus 3,947,889 893,411 Medical Office & Life Science Real Estate Funds Core Plus 2,412,284 2,412,284 Hotel Real Estate (Sonesta) Core 493,556 493,556 Senior Living Real Estate (AlerisLife) Core 252,603 252,603 Other Real Estate Core Plus 599,910 396,201 Total Private Capital $ 13,111,701 $ 9,853,514 * Residential Real Estate Funds includes one wholly owned property and 3rd party managed properties. ** Industrial Real Estate Funds AUM includes Mountain JV and Industrial Real Estate Funds Fee-Earning AUM excludes Mountain JV. ($ in thousands) See Notes & Definitions beginning on page 22.

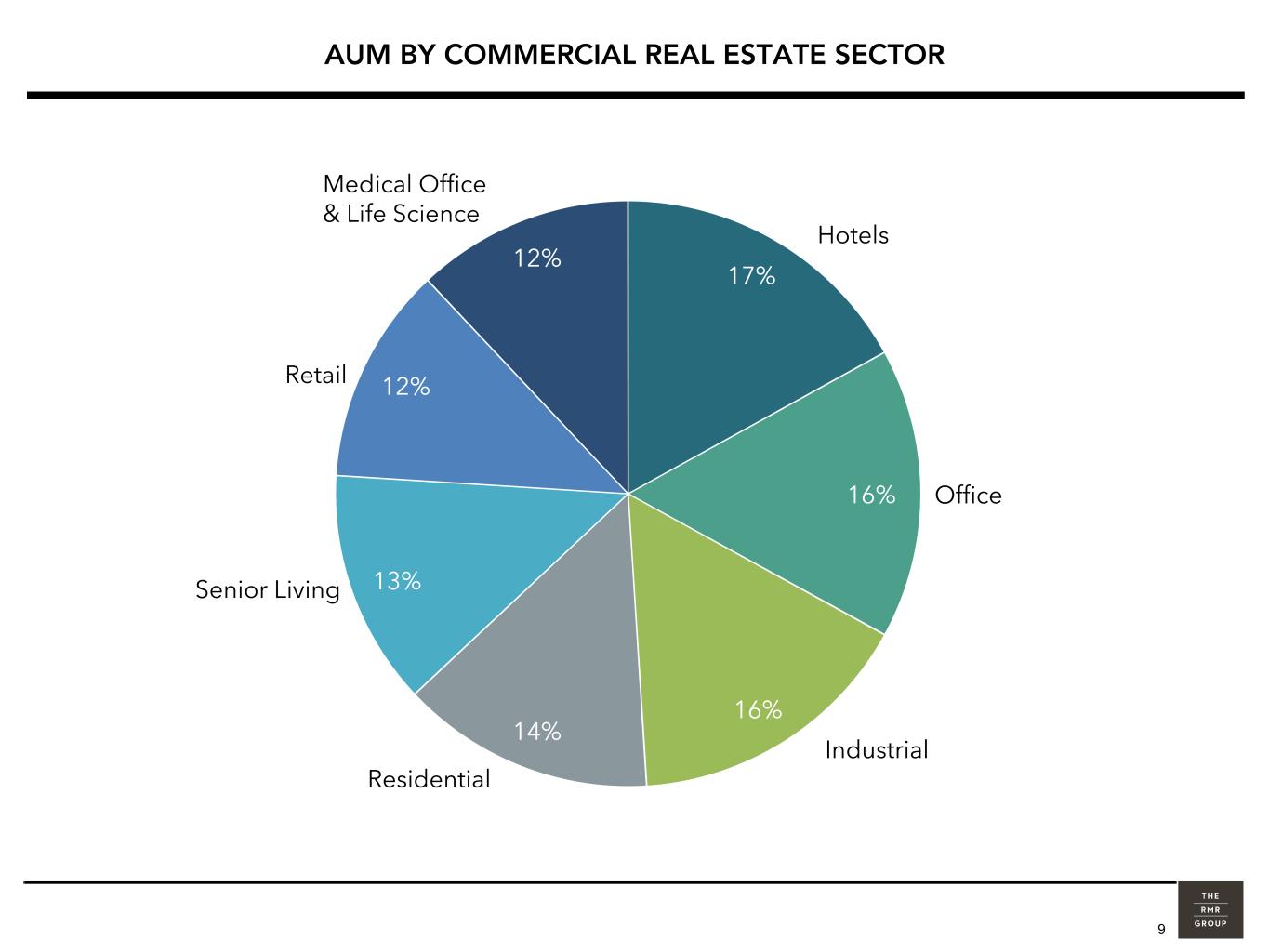

9 AUM BY COMMERCIAL REAL ESTATE SECTOR Hotels Office Industrial Residential Senior Living Retail Medical Office & Life Science 17% 16% 16% 14% 13% 12% 12%

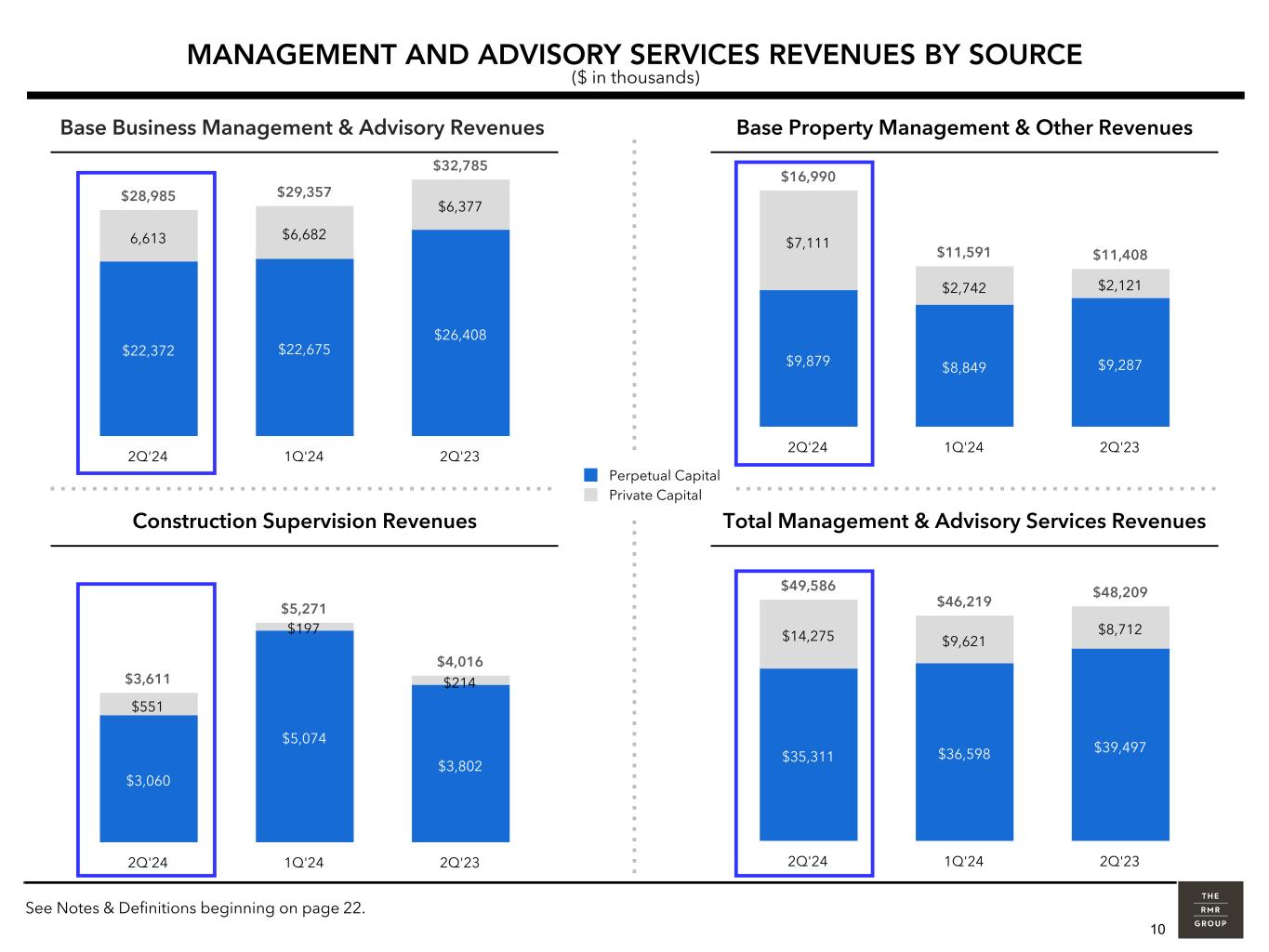

10 $49,586 $46,219 $48,209 $35,311 $36,598 $39,497 $14,275 $9,621 $8,712 2Q'24 1Q'24 2Q'23 $28,985 $29,357 $32,785 $22,372 $22,675 $26,408 6,613 $6,682 $6,377 2Q'24 1Q'24 2Q'23 $16,990 $11,591 $11,408 $9,879 $8,849 $9,287 $7,111 $2,742 $2,121 2Q'24 1Q'24 2Q'23 $3,611 $5,271 $4,016 $3,060 $5,074 $3,802 $551 $197 $214 2Q'24 1Q'24 2Q'23 Managed Public Real Estate Capital Managed Private Real Estate Capital MANAGEMENT AND ADVISORY SERVICES REVENUES BY SOURCE See Notes & Definitions beginning on page 22. ($ in thousands) Base Business Management & Advisory Revenues Base Property Management & Other Revenues Construction Supervision Revenues Total Management & Advisory Services Revenues Perpetual Capital Private Capital

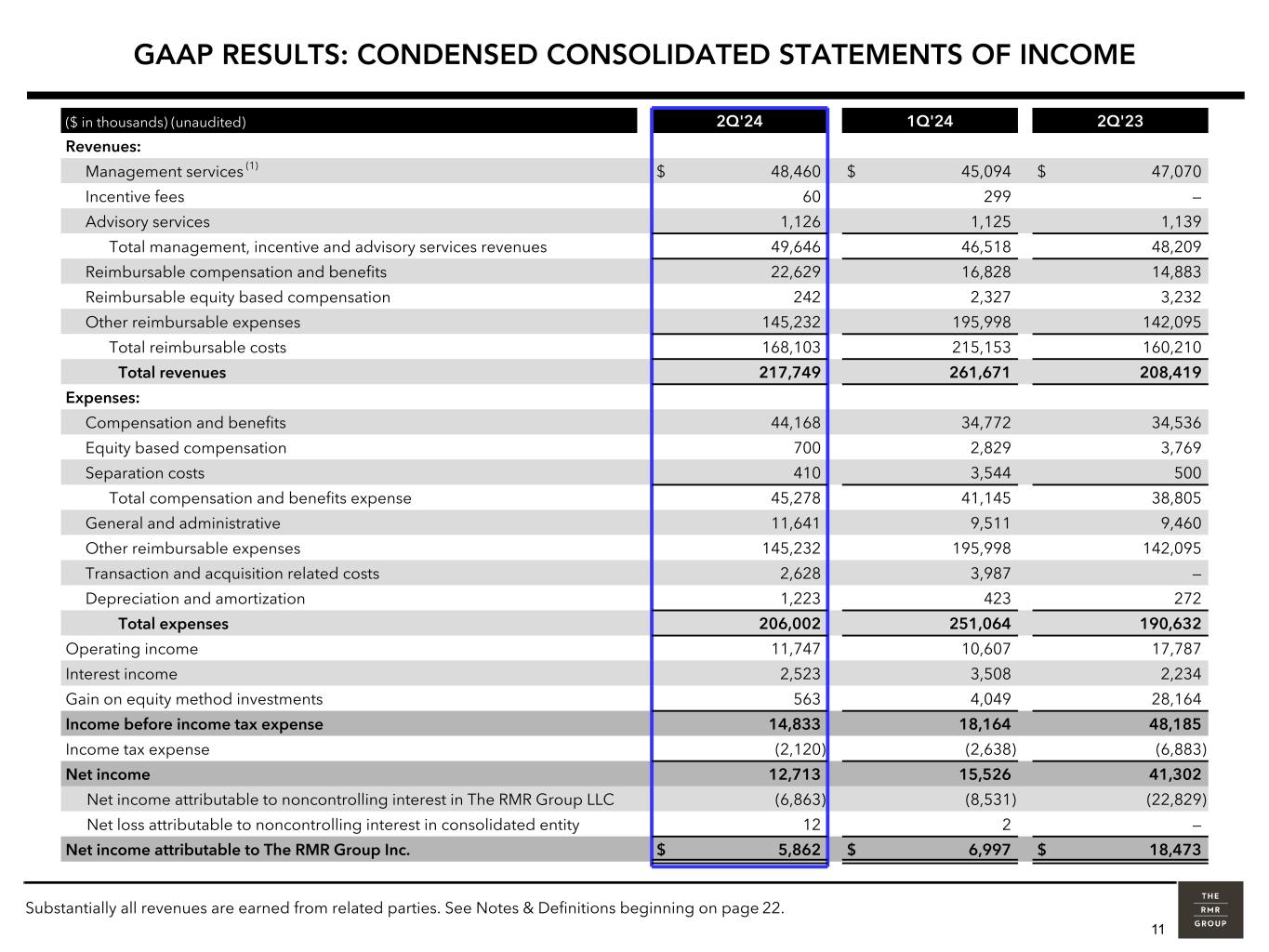

11 GAAP RESULTS: CONDENSED CONSOLIDATED STATEMENTS OF INCOME ($ in thousands) (unaudited) 2Q'24 1Q'24 2Q'23 Revenues: Management services (1) $ 48,460 $ 45,094 $ 47,070 Incentive fees 60 299 — Advisory services 1,126 1,125 1,139 Total management, incentive and advisory services revenues 49,646 46,518 48,209 Reimbursable compensation and benefits 22,629 16,828 14,883 Reimbursable equity based compensation 242 2,327 3,232 Other reimbursable expenses 145,232 195,998 142,095 Total reimbursable costs 168,103 215,153 160,210 Total revenues 217,749 261,671 208,419 Expenses: Compensation and benefits 44,168 34,772 34,536 Equity based compensation 700 2,829 3,769 Separation costs 410 3,544 500 Total compensation and benefits expense 45,278 41,145 38,805 General and administrative 11,641 9,511 9,460 Other reimbursable expenses 145,232 195,998 142,095 Transaction and acquisition related costs 2,628 3,987 — Depreciation and amortization 1,223 423 272 Total expenses 206,002 251,064 190,632 Operating income 11,747 10,607 17,787 Interest income 2,523 3,508 2,234 Gain on equity method investments 563 4,049 28,164 Income before income tax expense 14,833 18,164 48,185 Income tax expense (2,120) (2,638) (6,883) Net income 12,713 15,526 41,302 Net income attributable to noncontrolling interest in The RMR Group LLC (6,863) (8,531) (22,829) Net loss attributable to noncontrolling interest in consolidated entity 12 2 — Net income attributable to The RMR Group Inc. $ 5,862 $ 6,997 $ 18,473 Substantially all revenues are earned from related parties. See Notes & Definitions beginning on page 22.

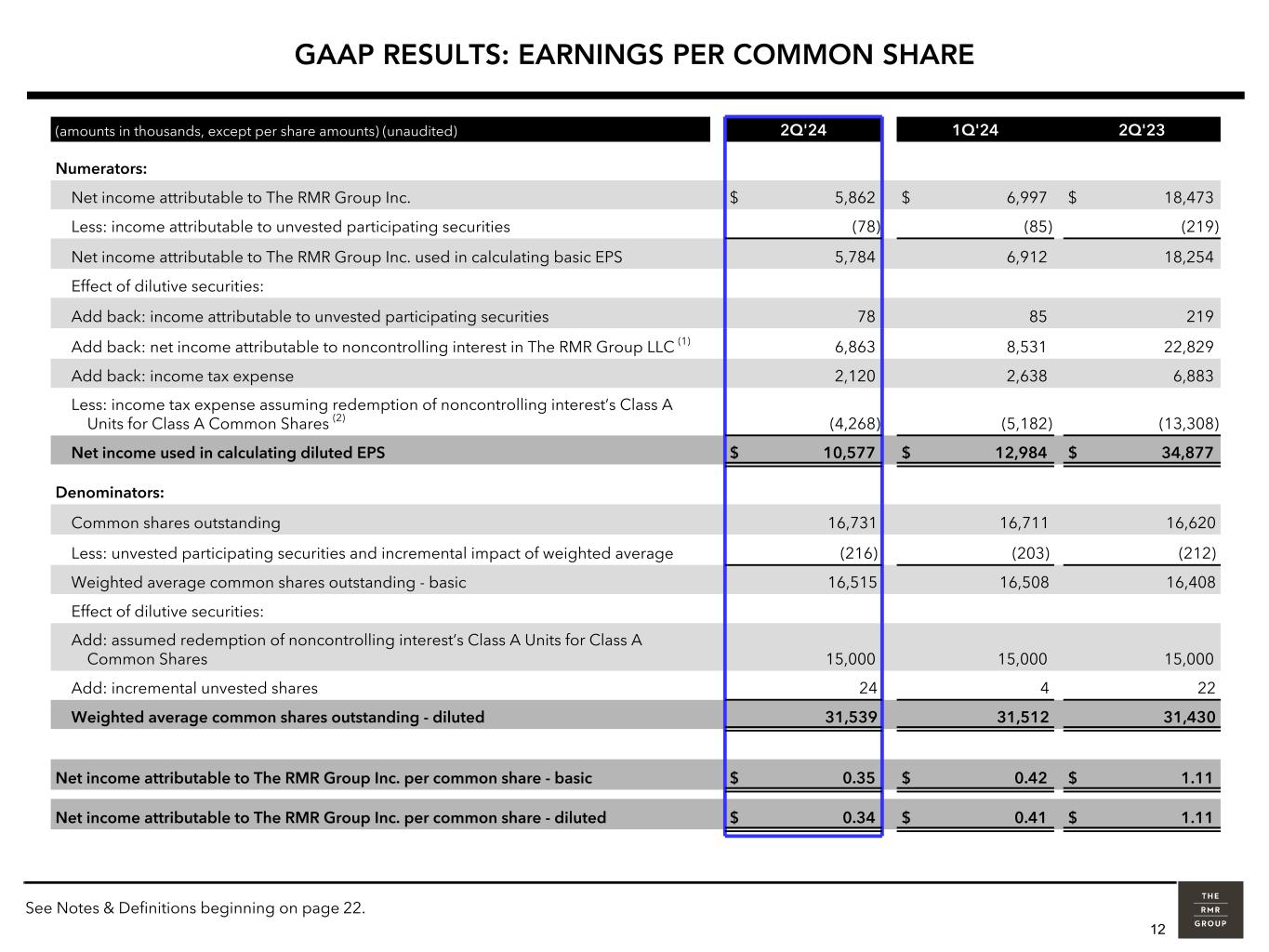

12 GAAP RESULTS: EARNINGS PER COMMON SHARE (amounts in thousands, except per share amounts) (unaudited) 2Q'24 1Q'24 2Q'23 Numerators: Net income attributable to The RMR Group Inc. $ 5,862 $ 6,997 $ 18,473 Less: income attributable to unvested participating securities (78) (85) (219) Net income attributable to The RMR Group Inc. used in calculating basic EPS 5,784 6,912 18,254 Effect of dilutive securities: Add back: income attributable to unvested participating securities 78 85 219 Add back: net income attributable to noncontrolling interest in The RMR Group LLC (1) 6,863 8,531 22,829 Add back: income tax expense 2,120 2,638 6,883 Less: income tax expense assuming redemption of noncontrolling interest’s Class A Units for Class A Common Shares (2) (4,268) (5,182) (13,308) Net income used in calculating diluted EPS $ 10,577 $ 12,984 $ 34,877 Denominators: Common shares outstanding 16,731 16,711 16,620 Less: unvested participating securities and incremental impact of weighted average (216) (203) (212) Weighted average common shares outstanding - basic 16,515 16,508 16,408 Effect of dilutive securities: Add: assumed redemption of noncontrolling interest’s Class A Units for Class A Common Shares 15,000 15,000 15,000 Add: incremental unvested shares 24 4 22 Weighted average common shares outstanding - diluted 31,539 31,512 31,430 Net income attributable to The RMR Group Inc. per common share - basic $ 0.35 $ 0.42 $ 1.11 Net income attributable to The RMR Group Inc. per common share - diluted $ 0.34 $ 0.41 $ 1.11 See Notes & Definitions beginning on page 22.

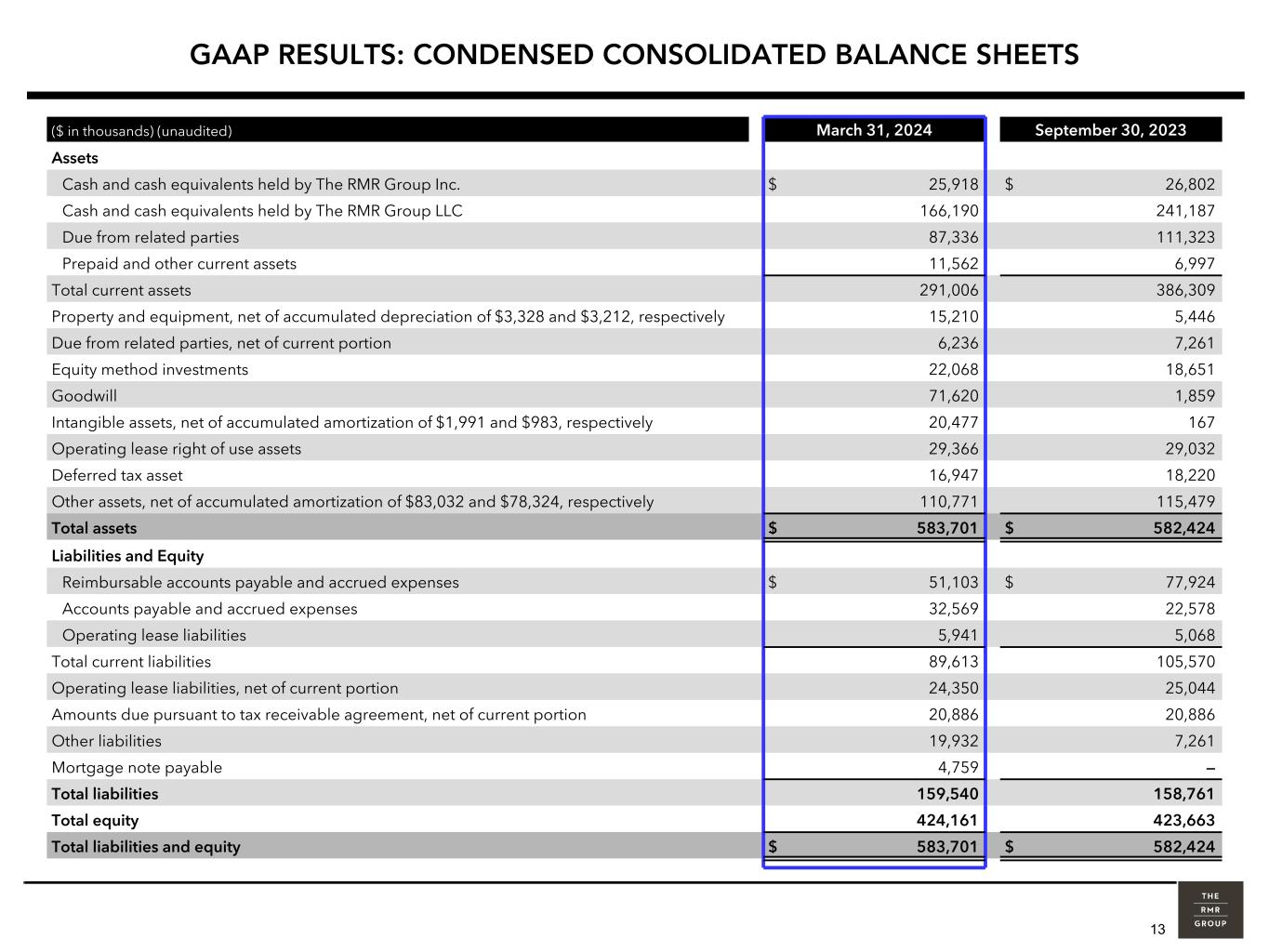

13 GAAP RESULTS: CONDENSED CONSOLIDATED BALANCE SHEETS ($ in thousands) (unaudited) March 31, 2024 September 30, 2023 Assets Cash and cash equivalents held by The RMR Group Inc. $ 25,918 $ 26,802 Cash and cash equivalents held by The RMR Group LLC 166,190 241,187 Due from related parties 87,336 111,323 Prepaid and other current assets 11,562 6,997 Total current assets 291,006 386,309 Property and equipment, net of accumulated depreciation of $3,328 and $3,212, respectively 15,210 5,446 Due from related parties, net of current portion 6,236 7,261 Equity method investments 22,068 18,651 Goodwill 71,620 1,859 Intangible assets, net of accumulated amortization of $1,991 and $983, respectively 20,477 167 Operating lease right of use assets 29,366 29,032 Deferred tax asset 16,947 18,220 Other assets, net of accumulated amortization of $83,032 and $78,324, respectively 110,771 115,479 Total assets $ 583,701 $ 582,424 Liabilities and Equity Reimbursable accounts payable and accrued expenses $ 51,103 $ 77,924 Accounts payable and accrued expenses 32,569 22,578 Operating lease liabilities 5,941 5,068 Total current liabilities 89,613 105,570 Operating lease liabilities, net of current portion 24,350 25,044 Amounts due pursuant to tax receivable agreement, net of current portion 20,886 20,886 Other liabilities 19,932 7,261 Mortgage note payable 4,759 — Total liabilities 159,540 158,761 Total equity 424,161 423,663 Total liabilities and equity $ 583,701 $ 582,424

14 Non-GAAP Financial Measures

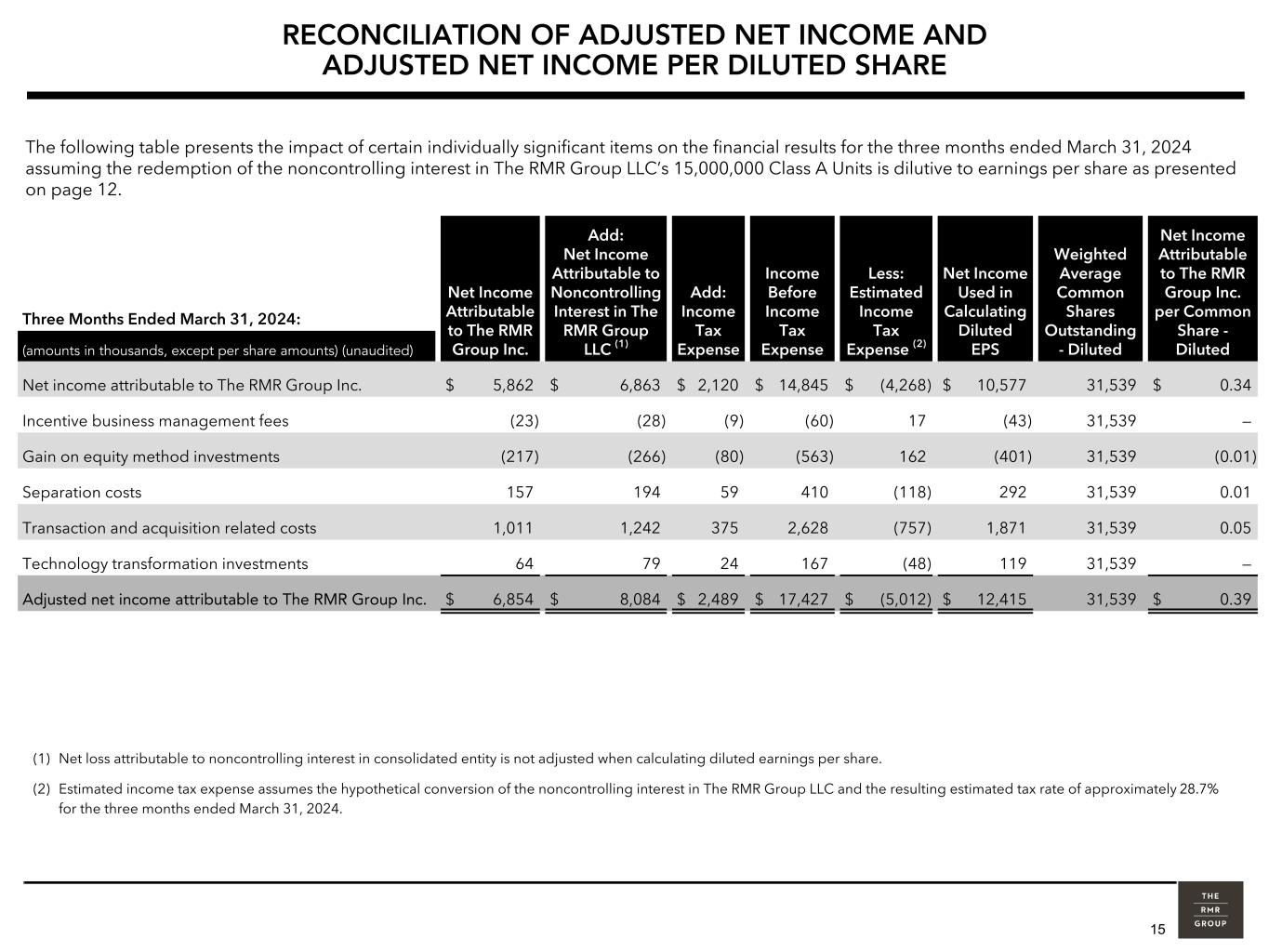

15 RECONCILIATION OF ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE The following table presents the impact of certain individually significant items on the financial results for the three months ended March 31, 2024 assuming the redemption of the noncontrolling interest in The RMR Group LLC’s 15,000,000 Class A Units is dilutive to earnings per share as presented on page 12. (1) Net loss attributable to noncontrolling interest in consolidated entity is not adjusted when calculating diluted earnings per share. (2) Estimated income tax expense assumes the hypothetical conversion of the noncontrolling interest in The RMR Group LLC and the resulting estimated tax rate of approximately 28.7% for the three months ended March 31, 2024. Three Months Ended March 31, 2024: Net Income Attributable to The RMR Group Inc. Add: Net Income Attributable to Noncontrolling Interest in The RMR Group LLC (1) Add: Income Tax Expense Income Before Income Tax Expense Less: Estimated Income Tax Expense (2) Net Income Used in Calculating Diluted EPS Weighted Average Common Shares Outstanding - Diluted Net Income Attributable to The RMR Group Inc. per Common Share - Diluted(amounts in thousands, except per share amounts) (unaudited) Net income attributable to The RMR Group Inc. $ 5,862 $ 6,863 $ 2,120 $ 14,845 $ (4,268) $ 10,577 31,539 $ 0.34 Incentive business management fees (23) (28) (9) (60) 17 (43) 31,539 — Gain on equity method investments (217) (266) (80) (563) 162 (401) 31,539 (0.01) Separation costs 157 194 59 410 (118) 292 31,539 0.01 Transaction and acquisition related costs 1,011 1,242 375 2,628 (757) 1,871 31,539 0.05 Technology transformation investments 64 79 24 167 (48) 119 31,539 — Adjusted net income attributable to The RMR Group Inc. $ 6,854 $ 8,084 $ 2,489 $ 17,427 $ (5,012) $ 12,415 31,539 $ 0.39

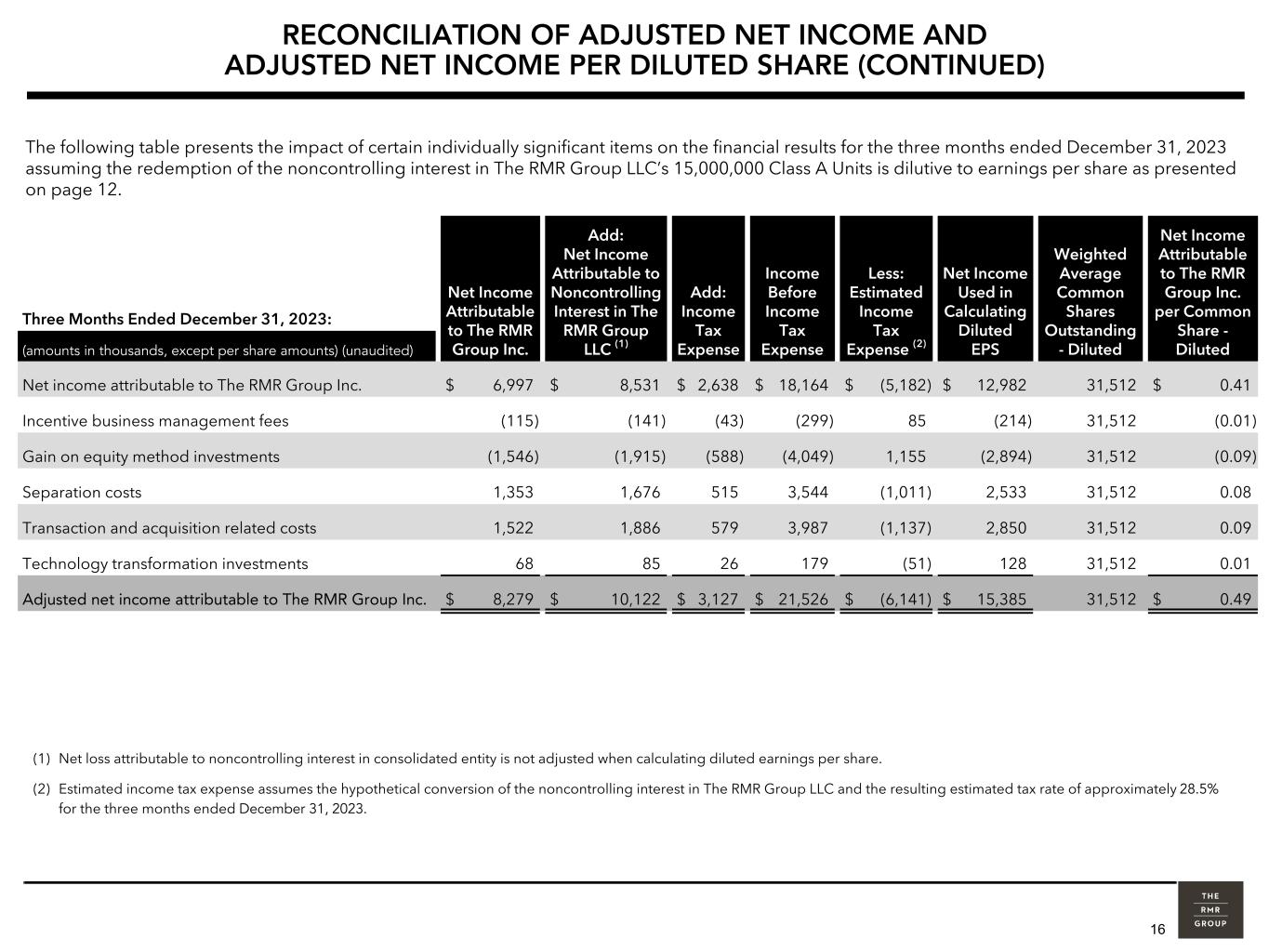

16 RECONCILIATION OF ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE (CONTINUED) The following table presents the impact of certain individually significant items on the financial results for the three months ended December 31, 2023 assuming the redemption of the noncontrolling interest in The RMR Group LLC’s 15,000,000 Class A Units is dilutive to earnings per share as presented on page 12. (1) Net loss attributable to noncontrolling interest in consolidated entity is not adjusted when calculating diluted earnings per share. (2) Estimated income tax expense assumes the hypothetical conversion of the noncontrolling interest in The RMR Group LLC and the resulting estimated tax rate of approximately 28.5% for the three months ended December 31, 2023. Three Months Ended December 31, 2023: Net Income Attributable to The RMR Group Inc. Add: Net Income Attributable to Noncontrolling Interest in The RMR Group LLC (1) Add: Income Tax Expense Income Before Income Tax Expense Less: Estimated Income Tax Expense (2) Net Income Used in Calculating Diluted EPS Weighted Average Common Shares Outstanding - Diluted Net Income Attributable to The RMR Group Inc. per Common Share - Diluted(amounts in thousands, except per share amounts) (unaudited) Net income attributable to The RMR Group Inc. $ 6,997 $ 8,531 $ 2,638 $ 18,164 $ (5,182) $ 12,982 31,512 $ 0.41 Incentive business management fees (115) (141) (43) (299) 85 (214) 31,512 (0.01) Gain on equity method investments (1,546) (1,915) (588) (4,049) 1,155 (2,894) 31,512 (0.09) Separation costs 1,353 1,676 515 3,544 (1,011) 2,533 31,512 0.08 Transaction and acquisition related costs 1,522 1,886 579 3,987 (1,137) 2,850 31,512 0.09 Technology transformation investments 68 85 26 179 (51) 128 31,512 0.01 Adjusted net income attributable to The RMR Group Inc. $ 8,279 $ 10,122 $ 3,127 $ 21,526 $ (6,141) $ 15,385 31,512 $ 0.49

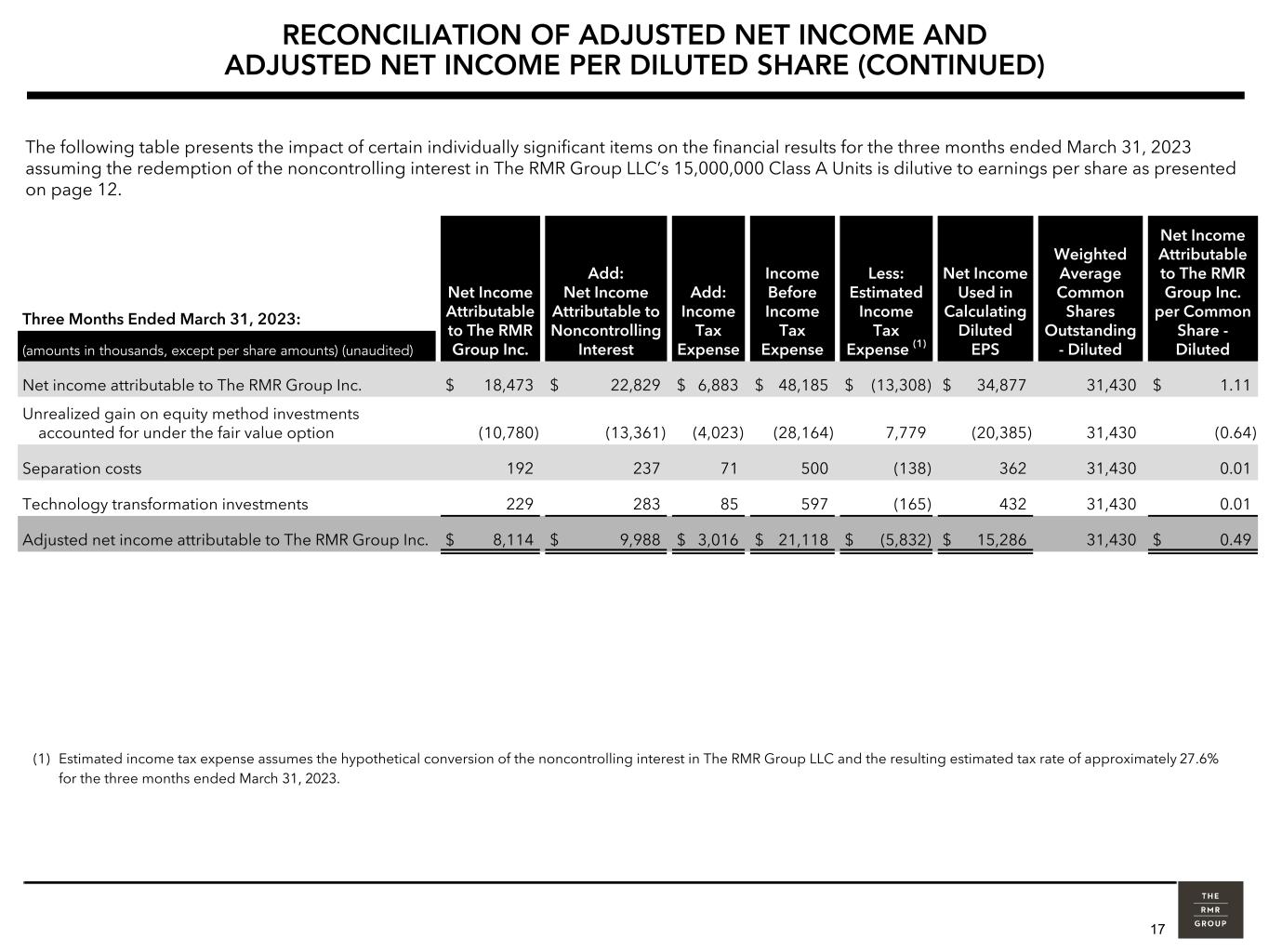

17 RECONCILIATION OF ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE (CONTINUED) The following table presents the impact of certain individually significant items on the financial results for the three months ended March 31, 2023 assuming the redemption of the noncontrolling interest in The RMR Group LLC’s 15,000,000 Class A Units is dilutive to earnings per share as presented on page 12. Three Months Ended March 31, 2023: Net Income Attributable to The RMR Group Inc. Add: Net Income Attributable to Noncontrolling Interest Add: Income Tax Expense Income Before Income Tax Expense Less: Estimated Income Tax Expense (1) Net Income Used in Calculating Diluted EPS Weighted Average Common Shares Outstanding - Diluted Net Income Attributable to The RMR Group Inc. per Common Share - Diluted(amounts in thousands, except per share amounts) (unaudited) Net income attributable to The RMR Group Inc. $ 18,473 $ 22,829 $ 6,883 $ 48,185 $ (13,308) $ 34,877 31,430 $ 1.11 Unrealized gain on equity method investments accounted for under the fair value option (10,780) (13,361) (4,023) (28,164) 7,779 (20,385) 31,430 (0.64) Separation costs 192 237 71 500 (138) 362 31,430 0.01 Technology transformation investments 229 283 85 597 (165) 432 31,430 0.01 Adjusted net income attributable to The RMR Group Inc. $ 8,114 $ 9,988 $ 3,016 $ 21,118 $ (5,832) $ 15,286 31,430 $ 0.49 (1) Estimated income tax expense assumes the hypothetical conversion of the noncontrolling interest in The RMR Group LLC and the resulting estimated tax rate of approximately 27.6% for the three months ended March 31, 2023.

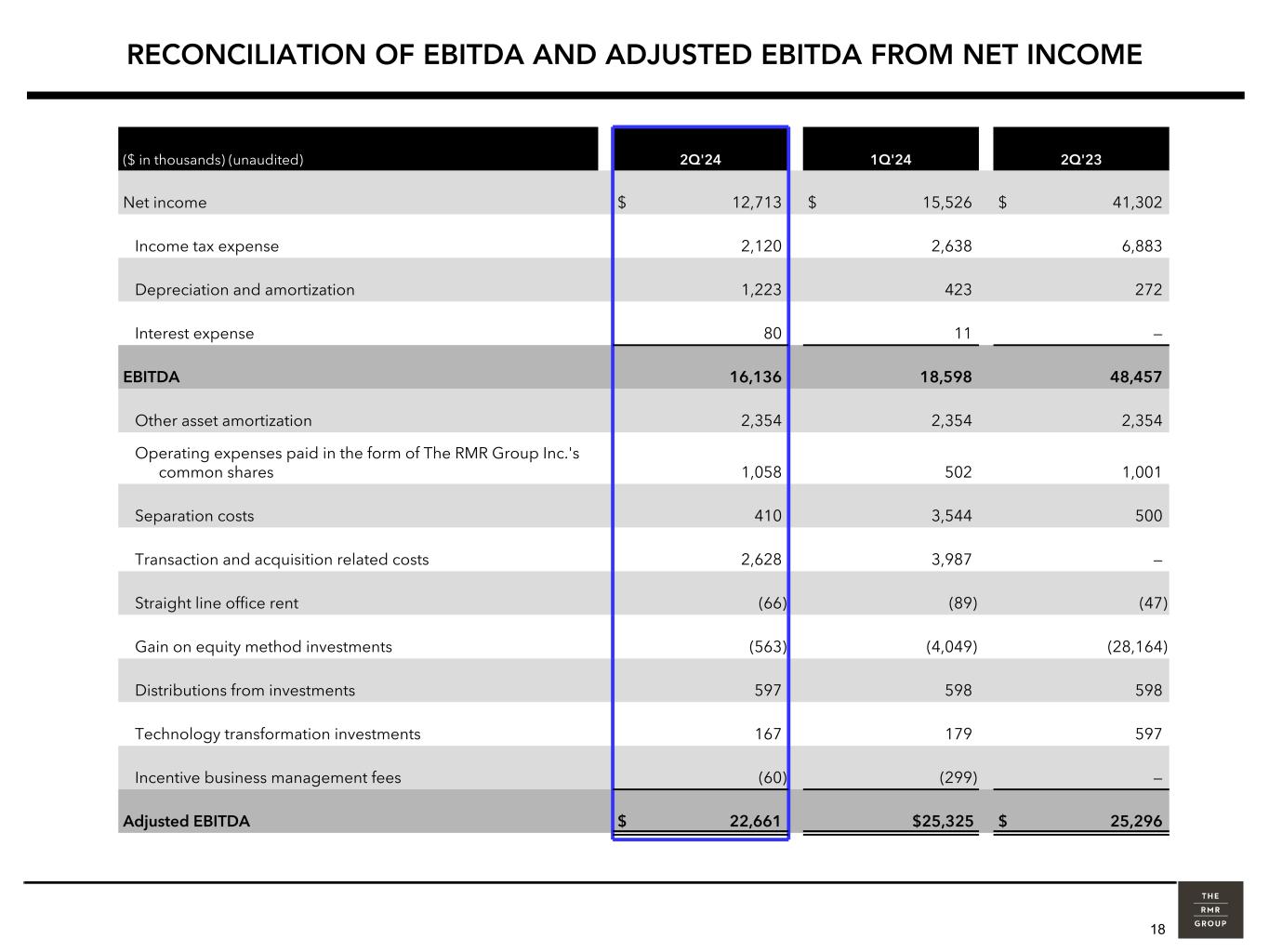

18 RECONCILIATION OF EBITDA AND ADJUSTED EBITDA FROM NET INCOME ($ in thousands) (unaudited) 2Q'24 1Q'24 2Q'23 Net income $ 12,713 $ 15,526 $ 41,302 Income tax expense 2,120 2,638 6,883 Depreciation and amortization 1,223 423 272 Interest expense 80 11 — EBITDA 16,136 18,598 48,457 Other asset amortization 2,354 2,354 2,354 Operating expenses paid in the form of The RMR Group Inc.'s common shares 1,058 502 1,001 Separation costs 410 3,544 500 Transaction and acquisition related costs 2,628 3,987 — Straight line office rent (66) (89) (47) Gain on equity method investments (563) (4,049) (28,164) Distributions from investments 597 598 598 Technology transformation investments 167 179 597 Incentive business management fees (60) (299) — Adjusted EBITDA $ 22,661 $25,325 $ 25,296

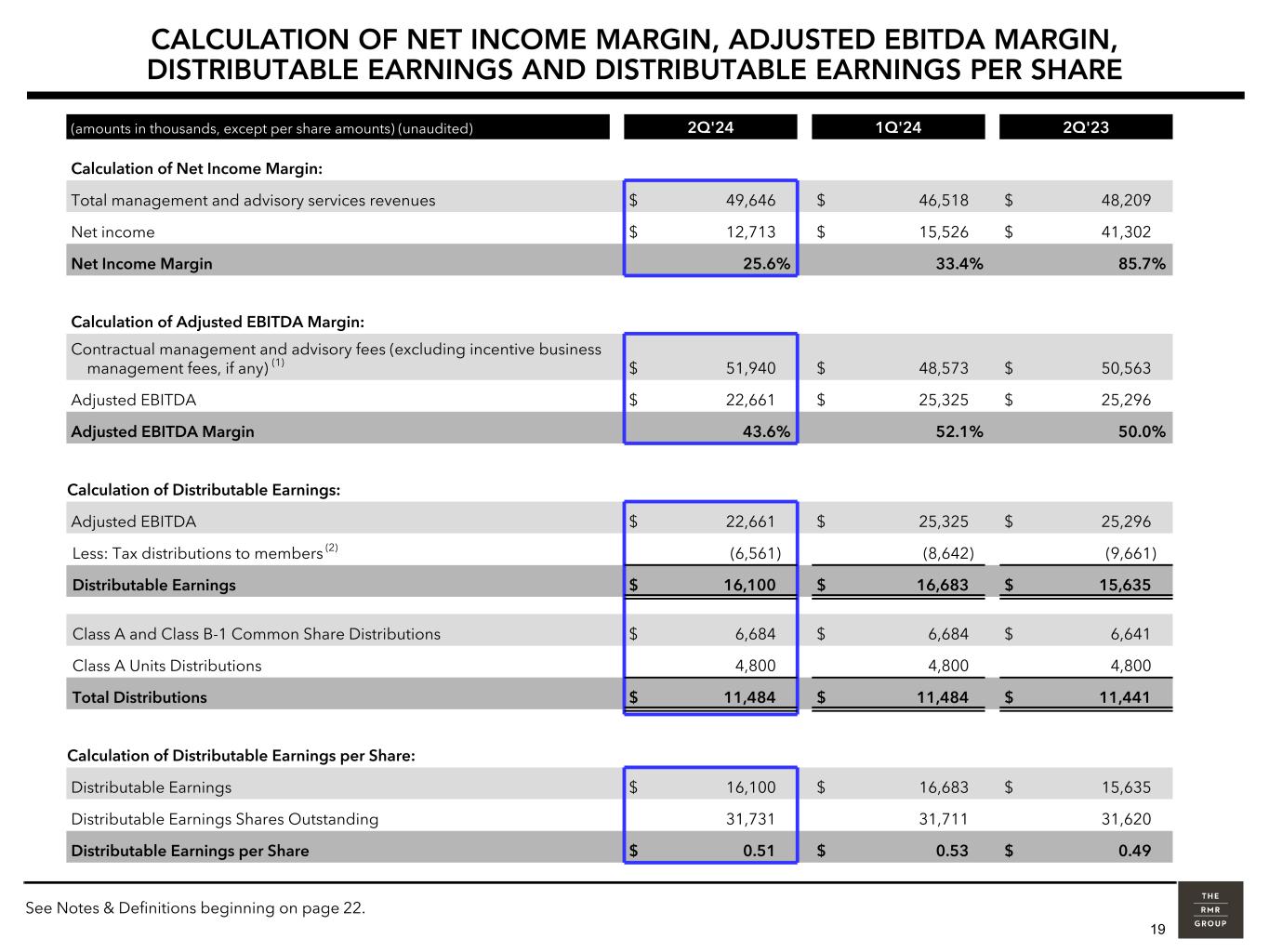

19 CALCULATION OF NET INCOME MARGIN, ADJUSTED EBITDA MARGIN, DISTRIBUTABLE EARNINGS AND DISTRIBUTABLE EARNINGS PER SHARE (amounts in thousands, except per share amounts) (unaudited) 2Q'24 1Q'24 2Q'23 Calculation of Net Income Margin: Total management and advisory services revenues $ 49,646 $ 46,518 $ 48,209 Net income $ 12,713 $ 15,526 $ 41,302 Net Income Margin 25.6% 33.4% 85.7% Calculation of Adjusted EBITDA Margin: Contractual management and advisory fees (excluding incentive business management fees, if any) (1) $ 51,940 $ 48,573 $ 50,563 Adjusted EBITDA $ 22,661 $ 25,325 $ 25,296 Adjusted EBITDA Margin 43.6% 52.1% 50.0% Calculation of Distributable Earnings: Adjusted EBITDA $ 22,661 $ 25,325 $ 25,296 Less: Tax distributions to members (2) (6,561) (8,642) (9,661) Distributable Earnings $ 16,100 $ 16,683 $ 15,635 Class A and Class B-1 Common Share Distributions $ 6,684 $ 6,684 $ 6,641 Class A Units Distributions 4,800 4,800 4,800 Total Distributions $ 11,484 $ 11,484 $ 11,441 Calculation of Distributable Earnings per Share: Distributable Earnings $ 16,100 $ 16,683 $ 15,635 Distributable Earnings Shares Outstanding 31,731 31,711 31,620 Distributable Earnings per Share $ 0.51 $ 0.53 $ 0.49 See Notes & Definitions beginning on page 22.

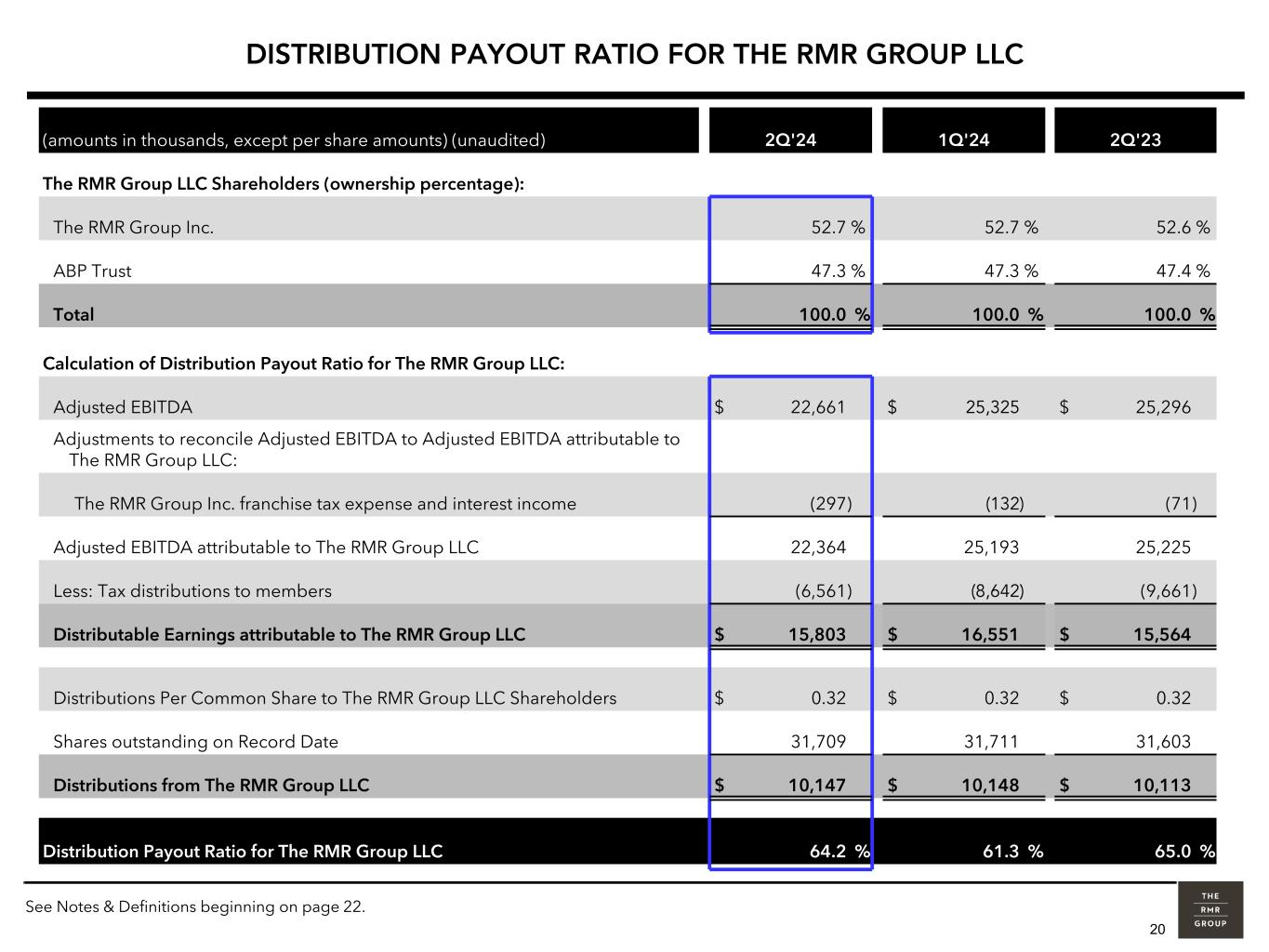

20 DISTRIBUTION PAYOUT RATIO FOR THE RMR GROUP LLC (amounts in thousands, except per share amounts) (unaudited) 2Q'24 1Q'24 2Q'23 The RMR Group LLC Shareholders (ownership percentage): The RMR Group Inc. 52.7 % 52.7 % 52.6 % ABP Trust 47.3 % 47.3 % 47.4 % Total 100.0 % 100.0 % 100.0 % Calculation of Distribution Payout Ratio for The RMR Group LLC: Adjusted EBITDA $ 22,661 $ 25,325 $ 25,296 Adjustments to reconcile Adjusted EBITDA to Adjusted EBITDA attributable to The RMR Group LLC: The RMR Group Inc. franchise tax expense and interest income (297) (132) (71) Adjusted EBITDA attributable to The RMR Group LLC 22,364 25,193 25,225 Less: Tax distributions to members (6,561) (8,642) (9,661) Distributable Earnings attributable to The RMR Group LLC $ 15,803 $ 16,551 $ 15,564 Distributions Per Common Share to The RMR Group LLC Shareholders $ 0.32 $ 0.32 $ 0.32 Shares outstanding on Record Date 31,709 31,711 31,603 Distributions from The RMR Group LLC $ 10,147 $ 10,148 $ 10,113 Distribution Payout Ratio for The RMR Group LLC 64.2 % 61.3 % 65.0 % See Notes & Definitions beginning on page 22.

21 RMR presents certain “non-GAAP financial measures” within the meaning of the applicable rules of the SEC, including Adjusted Net Income Attributable to The RMR Group Inc., Adjusted Net Income Attributable to The RMR Group Inc. per diluted share, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and Distributable Earnings. The GAAP financial measure that is most directly comparable to Adjusted Net Income Attributable to The RMR Group Inc. is net income attributable to The RMR Group Inc. The GAAP financial measure that is most directly comparable to Adjusted Net Income Attributable to The RMR Group Inc. per diluted share is net income attributable to The RMR Group Inc. per diluted share. The GAAP financial measure that is most directly comparable to EBITDA, Adjusted EBITDA and Distributable Earnings is net income and the GAAP financial measure that is most directly comparable to Adjusted EBITDA Margin is Net Income Margin, which represents net income divided by total management and advisory services revenues. These non-GAAP financial measures do not represent net income, net income attributable to The RMR Group Inc., net income attributable to The RMR Group Inc. per diluted share or cash generated by operating activities determined in accordance with GAAP, and should not be considered alternatives to net income, net income attributable to The RMR Group Inc., net income attributable to The RMR Group Inc. per diluted share or net income margin determined in accordance with GAAP, as indicators of RMR’s financial performance or as measures of its liquidity. Other asset management businesses may calculate these non-GAAP measures differently than RMR does. • Adjusted Net Income Attributable to The RMR Group Inc. RMR calculates Adjusted Net Income Attributable to The RMR Group Inc. and Adjusted Net Income Attributable to The RMR Group Inc. per diluted share as net income attributable to The RMR Group Inc. and net income attributable to The RMR Group Inc. per diluted share, respectively, excluding the effects of certain individually significant items occurring or impacting its financial results during the quarter that are not expected to be regularly occurring, relate to a special project or initiatives or relate to gains or losses. RMR provides Adjusted Net Income Attributable to The RMR Group Inc. and Adjusted Net Income Attributable to The RMR Group Inc. per diluted share for supplemental informational purposes in order to enhance the understanding of RMR’s condensed consolidated statements of income and to facilitate a comparison of RMR’s current operating performance with its historical operating performance. • Distributable Earnings is calculated as Adjusted EBITDA less tax distributions to members and is considered to be an appropriate measure of RMR’s operating performance, along with net income attributable to The RMR Group Inc. RMR believes that Distributable Earnings provides useful information to investors because by excluding amounts payable for tax obligations, it increases comparability between periods and more accurately reflects earnings that may be available for distribution to shareholders. Distributable Earnings is among the factors RMR’s Board of Directors considers when determining shareholder dividends. • Distributable Earnings Per Share calculations are based on end of period shares outstanding and includes 15,000,000 Redeemable Class A Units of RMR LLC which are paired with RMR Inc's. Class B-2 common shares outstanding; actual dividends are paid to shareholders as of the applicable record date. • EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are supplemental measures used to assess operating performance, along with net income, net income attributable to The RMR Group Inc. and net income margin. RMR believes that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin provide useful information to investors because by excluding the effects of certain amounts, such as non-cash items or non-recurring gains and losses, EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin may facilitate a comparison of current operating performance with RMR’s historical operating performance and with the performance of other asset management businesses. RMR also believes that providing Adjusted EBITDA Margin may help investors assess RMR’s performance of its business by providing the margin that Adjusted EBITDA represents to its contractual management and advisory fees (excluding incentive business management fees, if any). NON-GAAP FINANCIAL MEASURES

22 Notes & Definitions

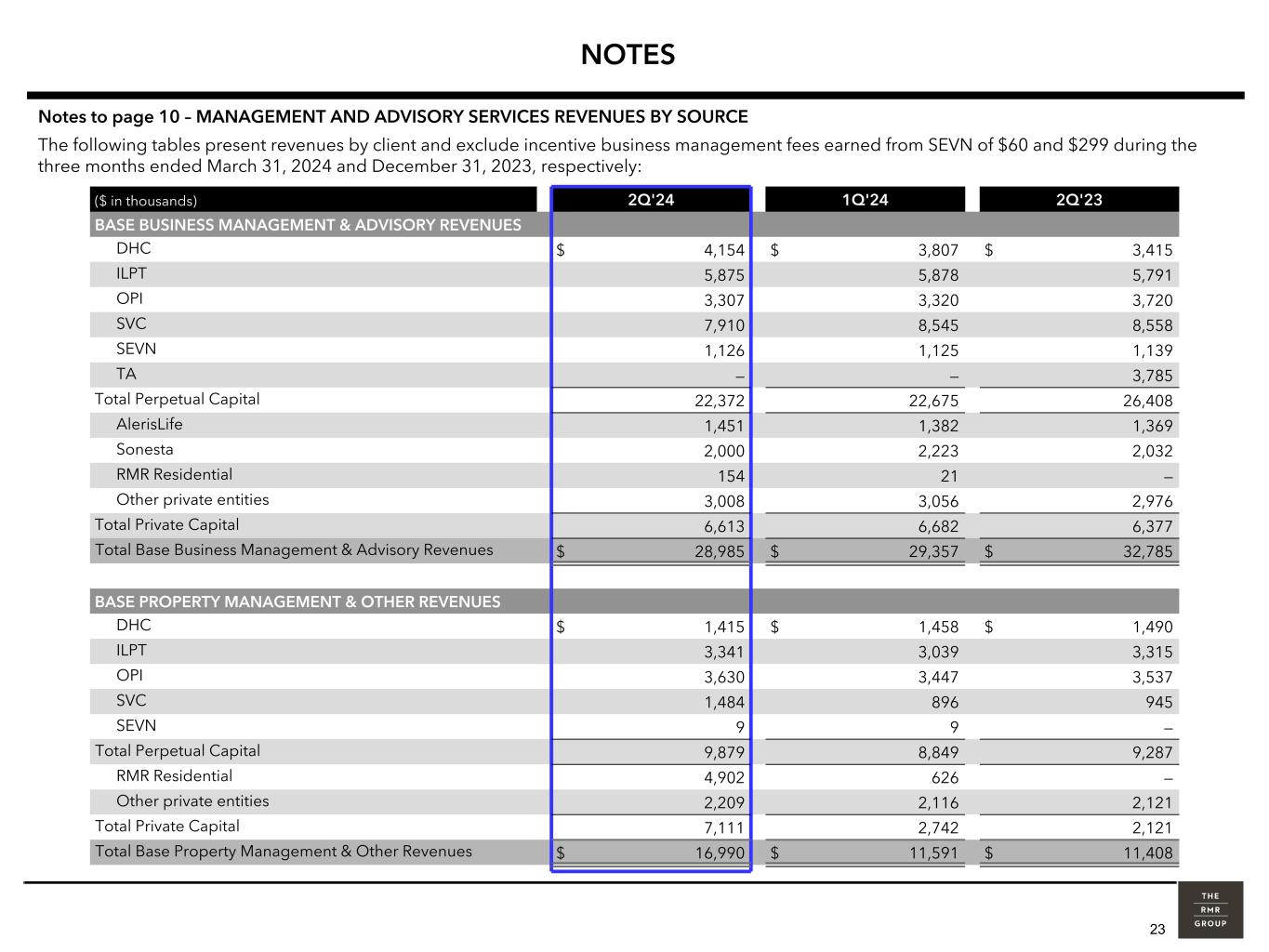

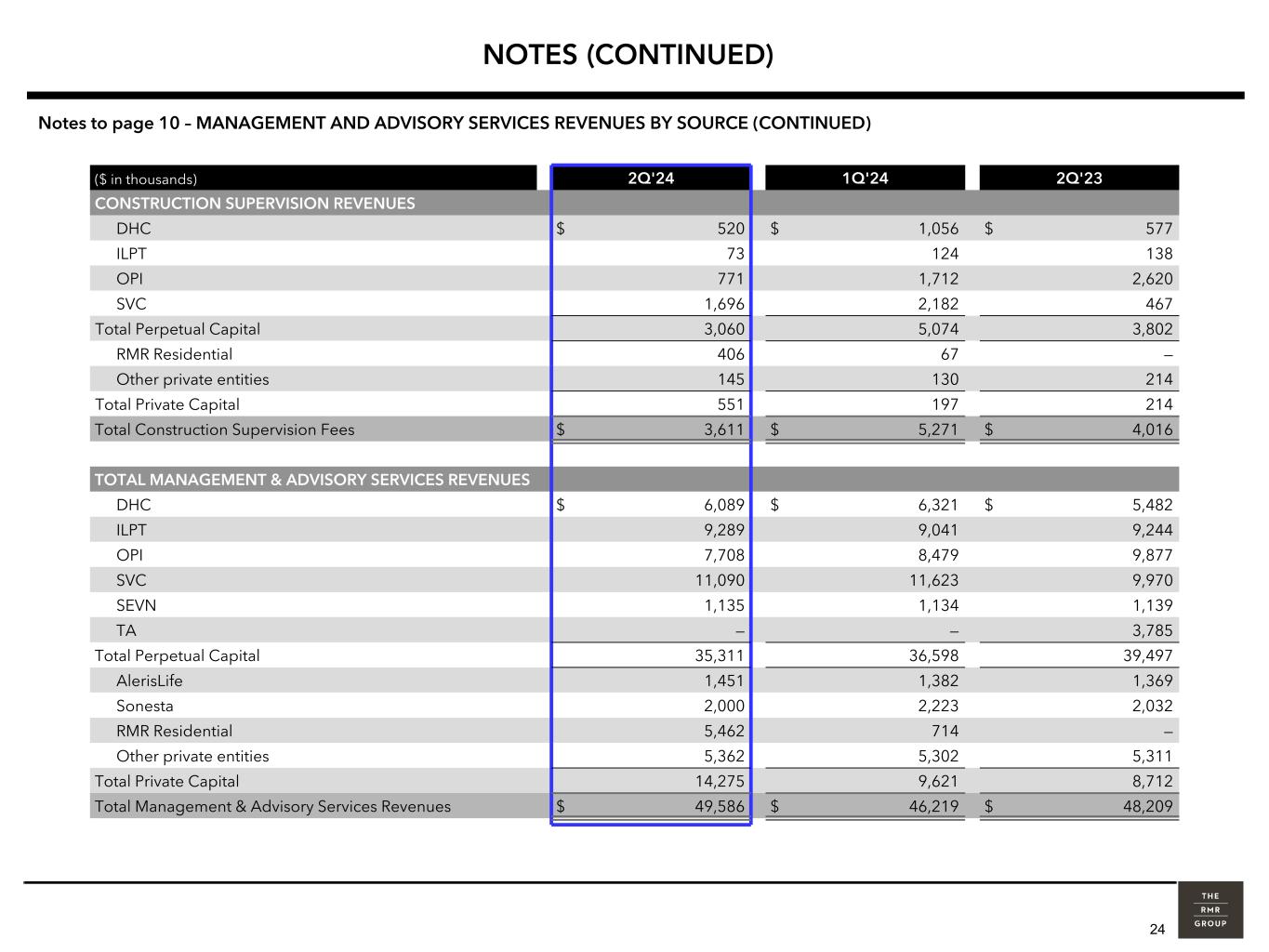

23 NOTES Notes to page 10 – MANAGEMENT AND ADVISORY SERVICES REVENUES BY SOURCE The following tables present revenues by client and exclude incentive business management fees earned from SEVN of $60 and $299 during the three months ended March 31, 2024 and December 31, 2023, respectively: ($ in thousands) 2Q'24 1Q'24 2Q'23 BASE BUSINESS MANAGEMENT & ADVISORY REVENUES DHC $ 4,154 $ 3,807 $ 3,415 ILPT 5,875 5,878 5,791 OPI 3,307 3,320 3,720 SVC 7,910 8,545 8,558 SEVN 1,126 1,125 1,139 TA — — 3,785 Total Perpetual Capital 22,372 22,675 26,408 AlerisLife 1,451 1,382 1,369 Sonesta 2,000 2,223 2,032 RMR Residential 154 21 — Other private entities 3,008 3,056 2,976 Total Private Capital 6,613 6,682 6,377 Total Base Business Management & Advisory Revenues $ 28,985 $ 29,357 $ 32,785 BASE PROPERTY MANAGEMENT & OTHER REVENUES DHC $ 1,415 $ 1,458 $ 1,490 ILPT 3,341 3,039 3,315 OPI 3,630 3,447 3,537 SVC 1,484 896 945 SEVN 9 9 — Total Perpetual Capital 9,879 8,849 9,287 RMR Residential 4,902 626 — Other private entities 2,209 2,116 2,121 Total Private Capital 7,111 2,742 2,121 Total Base Property Management & Other Revenues $ 16,990 $ 11,591 $ 11,408

24 NOTES (CONTINUED) Notes to page 10 – MANAGEMENT AND ADVISORY SERVICES REVENUES BY SOURCE (CONTINUED) ($ in thousands) 2Q'24 1Q'24 2Q'23 CONSTRUCTION SUPERVISION REVENUES DHC $ 520 $ 1,056 $ 577 ILPT 73 124 138 OPI 771 1,712 2,620 SVC 1,696 2,182 467 Total Perpetual Capital 3,060 5,074 3,802 RMR Residential 406 67 — Other private entities 145 130 214 Total Private Capital 551 197 214 Total Construction Supervision Fees $ 3,611 $ 5,271 $ 4,016 TOTAL MANAGEMENT & ADVISORY SERVICES REVENUES DHC $ 6,089 $ 6,321 $ 5,482 ILPT 9,289 9,041 9,244 OPI 7,708 8,479 9,877 SVC 11,090 11,623 9,970 SEVN 1,135 1,134 1,139 TA — — 3,785 Total Perpetual Capital 35,311 36,598 39,497 AlerisLife 1,451 1,382 1,369 Sonesta 2,000 2,223 2,032 RMR Residential 5,462 714 — Other private entities 5,362 5,302 5,311 Total Private Capital 14,275 9,621 8,712 Total Management & Advisory Services Revenues $ 49,586 $ 46,219 $ 48,209

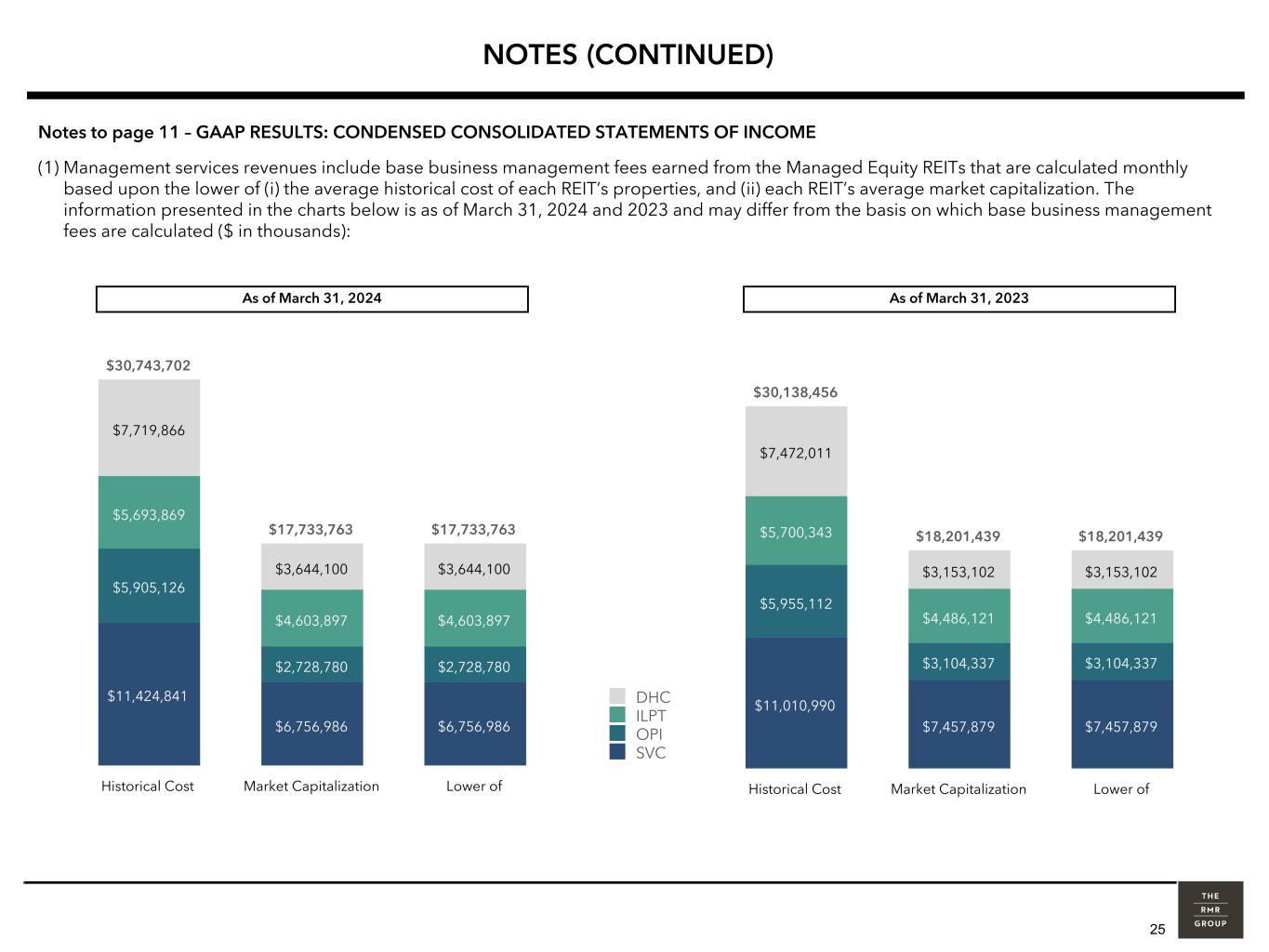

25 $30,138,456 $18,201,439 $18,201,439 $11,010,990 $7,457,879 $7,457,879 $5,955,112 $3,104,337 $3,104,337 $5,700,343 $4,486,121 $4,486,121 $7,472,011 $3,153,102 $3,153,102 Historical Cost Market Capitalization Lower of $30,743,702 $17,733,763 $17,733,763 $11,424,841 $6,756,986 $6,756,986 $5,905,126 $2,728,780 $2,728,780 $5,693,869 $4,603,897 $4,603,897 $7,719,866 $3,644,100 $3,644,100 Historical Cost Market Capitalization Lower of 0 DHC ILPT OPI SVC NOTES (CONTINUED) As of March 31, 2024 As of March 31, 2023 Notes to page 11 – GAAP RESULTS: CONDENSED CONSOLIDATED STATEMENTS OF INCOME (1) Management services revenues include base business management fees earned from the Managed Equity REITs that are calculated monthly based upon the lower of (i) the average historical cost of each REIT’s properties, and (ii) each REIT’s average market capitalization. The information presented in the charts below is as of March 31, 2024 and 2023 and may differ from the basis on which base business management fees are calculated ($ in thousands):

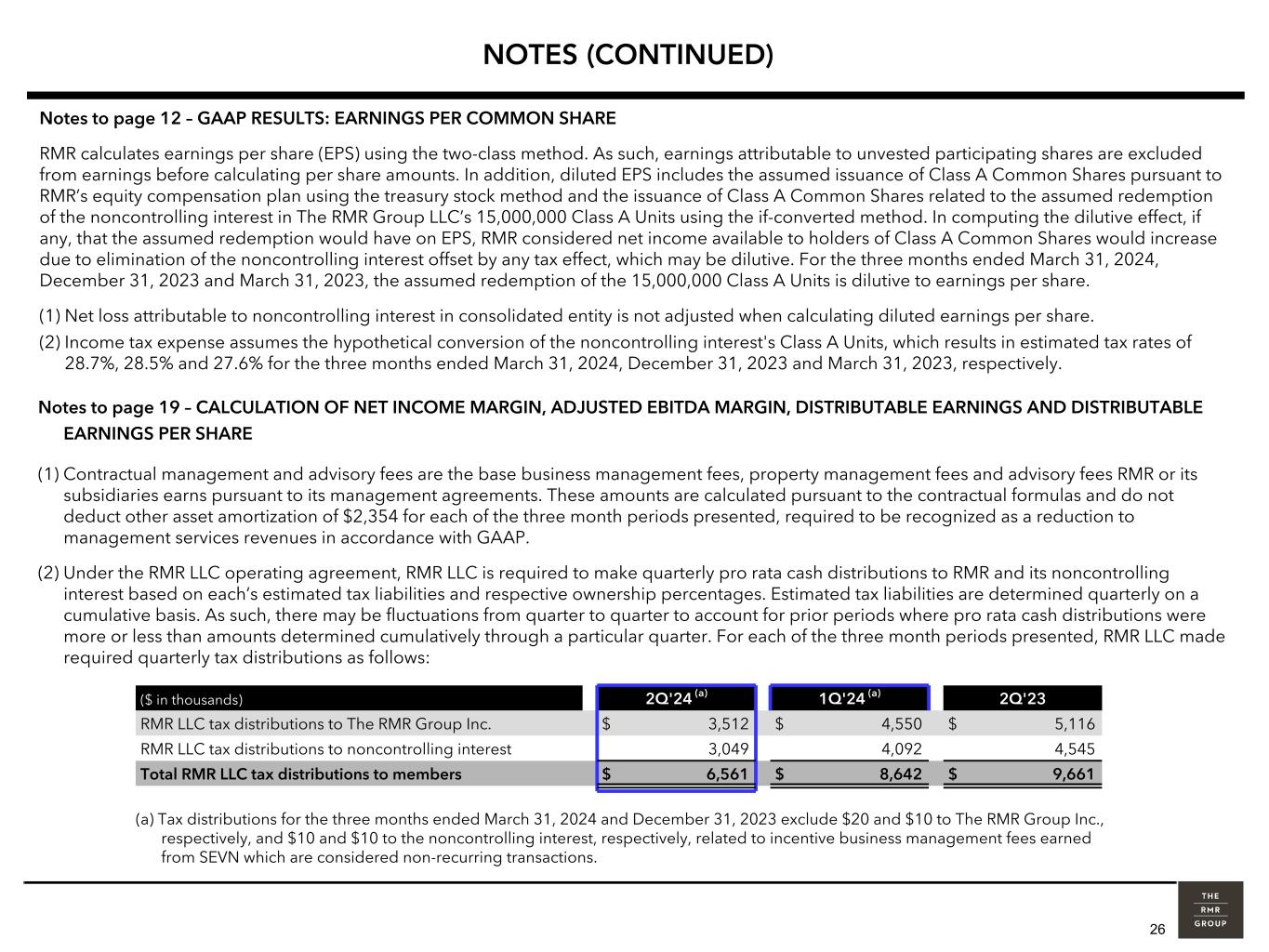

26 Notes to page 19 – CALCULATION OF NET INCOME MARGIN, ADJUSTED EBITDA MARGIN, DISTRIBUTABLE EARNINGS AND DISTRIBUTABLE EARNINGS PER SHARE (1) Contractual management and advisory fees are the base business management fees, property management fees and advisory fees RMR or its subsidiaries earns pursuant to its management agreements. These amounts are calculated pursuant to the contractual formulas and do not deduct other asset amortization of $2,354 for each of the three month periods presented, required to be recognized as a reduction to management services revenues in accordance with GAAP. (2) Under the RMR LLC operating agreement, RMR LLC is required to make quarterly pro rata cash distributions to RMR and its noncontrolling interest based on each’s estimated tax liabilities and respective ownership percentages. Estimated tax liabilities are determined quarterly on a cumulative basis. As such, there may be fluctuations from quarter to quarter to account for prior periods where pro rata cash distributions were more or less than amounts determined cumulatively through a particular quarter. For each of the three month periods presented, RMR LLC made required quarterly tax distributions as follows: NOTES (CONTINUED) Notes to page 12 – GAAP RESULTS: EARNINGS PER COMMON SHARE RMR calculates earnings per share (EPS) using the two-class method. As such, earnings attributable to unvested participating shares are excluded from earnings before calculating per share amounts. In addition, diluted EPS includes the assumed issuance of Class A Common Shares pursuant to RMR’s equity compensation plan using the treasury stock method and the issuance of Class A Common Shares related to the assumed redemption of the noncontrolling interest in The RMR Group LLC’s 15,000,000 Class A Units using the if-converted method. In computing the dilutive effect, if any, that the assumed redemption would have on EPS, RMR considered net income available to holders of Class A Common Shares would increase due to elimination of the noncontrolling interest offset by any tax effect, which may be dilutive. For the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, the assumed redemption of the 15,000,000 Class A Units is dilutive to earnings per share. (1) Net loss attributable to noncontrolling interest in consolidated entity is not adjusted when calculating diluted earnings per share. (2) Income tax expense assumes the hypothetical conversion of the noncontrolling interest's Class A Units, which results in estimated tax rates of 28.7%, 28.5% and 27.6% for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively. (a) Tax distributions for the three months ended March 31, 2024 and December 31, 2023 exclude $20 and $10 to The RMR Group Inc., respectively, and $10 and $10 to the noncontrolling interest, respectively, related to incentive business management fees earned from SEVN which are considered non-recurring transactions. ($ in thousands) 2Q'24 (a) 1Q'24 (a) 2Q'23 RMR LLC tax distributions to The RMR Group Inc. $ 3,512 $ 4,550 $ 5,116 RMR LLC tax distributions to noncontrolling interest 3,049 4,092 4,545 Total RMR LLC tax distributions to members $ 6,561 $ 8,642 $ 9,661

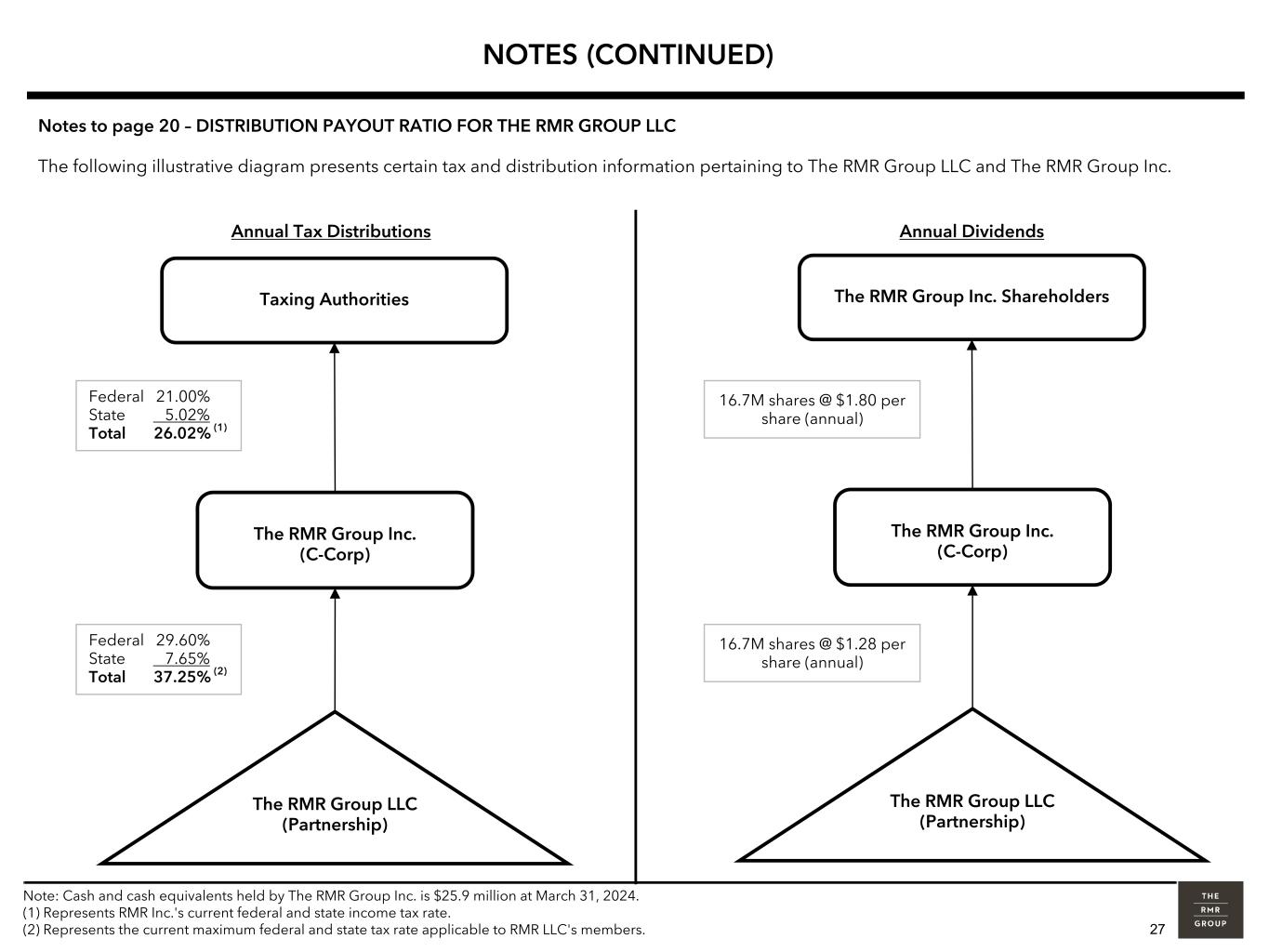

27 The RMR Group LLC (Partnership) The RMR Group Inc. (C-Corp) Taxing Authorities Federal 21.00% State 5.02% Total 26.02% (1) Federal 29.60% State 7.65% Total 37.25% (2) The RMR Group LLC (Partnership) The RMR Group Inc. (C-Corp) The RMR Group Inc. Shareholders 16.7M shares @ $1.80 per share (annual) 16.7M shares @ $1.28 per share (annual) Annual Tax Distributions Annual Dividends Notes to page 20 – DISTRIBUTION PAYOUT RATIO FOR THE RMR GROUP LLC The following illustrative diagram presents certain tax and distribution information pertaining to The RMR Group LLC and The RMR Group Inc. NOTES (CONTINUED) Note: Cash and cash equivalents held by The RMR Group Inc. is $25.9 million at March 31, 2024. (1) Represents RMR Inc.'s current federal and state income tax rate. (2) Represents the current maximum federal and state tax rate applicable to RMR LLC's members.

28 • Assets Under Management (AUM) All references in this presentation to AUM on, or as of, a date are calculated at a point in time. ▪ AUM is calculated as: (i) the historical cost of real estate and related assets, excluding depreciation, amortization, impairment charges or other non-cash reserves, of the Managed Equity REITs and certain Private Capital clients, plus (ii) the gross book value of real estate assets, property and equipment of AlerisLife, Sonesta and until May 15, 2023, TA, excluding depreciation, amortization, impairment charges or other non-cash reserves, plus (iii) the carrying value of loans held for investment and real estate owned by SEVN, plus (iv) the fair value of RMR Residential, both owned and third-party managed assets. Upon deconsolidation from a Managed Equity REIT, the respective real estate and related assets are characterized as Private Capital and their historical cost represents the fair value of the real estate at the time of deconsolidation. ▪ Fee-Earning AUM is calculated (i) monthly for the Managed Equity REITs, based upon the lower of the average historical cost of each REIT's properties and its average market capitalization, plus (ii) for all other clients, Fee-Earning AUM equals AUM and includes amounts that may differ from the measures used for purposes of calculating fees under the terms of the respective management agreements. For additional information on the calculation of AUM for purposes of the fee provisions of the business management agreements, see RMR's Annual Report on Form 10-K for the fiscal year ended September 30, 2023, filed with the SEC. RMR's SEC filings are available at the SEC website: www.sec.gov. • GAAP refers to U.S. Generally Accepted Accounting Principles. • Managed Equity REITs refers to Diversified Healthcare Trust (DHC), Industrial Logistics Properties Trust (ILPT), Office Properties Income Trust (OPI) and Service Properties Trust (SVC). • Mountain JV refers to Mountain Industrial REIT LLC, a joint venture in which ILPT owns a majority interest (and accordingly is presented in ILPT’s consolidated results). • Perpetual Capital refers to capital with an indefinite duration, which may be terminated under certain conditions, and includes the Managed Equity REITs, Seven Hills Realty Trust (SEVN), and until it was acquired by BP Products North America Inc. on May 15, 2023, TravelCenters of America Inc. (TA). • Private Capital consists of AlerisLife Inc. (AlerisLife), Sonesta International Hotels Corporation (Sonesta), residential real estate we manage from our acquisition of MPC Partnership Holdings LLC (RMR Residential) and other private capital vehicles including ABP Trust and other private entities that own commercial real estate. Some of the Managed Equity REITs own minority interests in certain of these entities. AlerisLife was a publicly traded company until March 20, 2023 when it was acquired by a subsidiary of ABP Trust. As a result, amounts for AlerisLife are characterized as Private Capital for all periods presented. DEFINITIONS