Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or “the Company”), an

industry leader in Bitcoin (“BTC”) mining and data center hosting,

announces unaudited production and operations updates for August

2023.

Bitcoin Production and Operations

Updates for August 2023

|

|

|

|

|

|

Comparison (%) |

|

Metric |

August 2023 |

July 2023 |

August 2022 |

|

Month/Month |

Year/Year |

|

Bitcoin Produced |

333 |

410 |

374 |

|

-19% |

-11% |

|

Average Bitcoin Produced per Day |

10.8 |

13.2 |

12.1 |

|

-19% |

-11% |

|

Bitcoin Held1 |

7,309 |

7,275 |

6,720 |

|

0% |

9% |

|

Bitcoin Sold |

300 |

400 |

350 |

|

-25% |

-14% |

|

Bitcoin Sales - Net Proceeds |

$8.6 million |

$12.1 million |

$7.7 million |

|

-29% |

12% |

|

Average Net Price per Bitcoin Sold |

$28,617 |

$30,293 |

$21,926 |

|

-6% |

31% |

|

Deployed Hash Rate1 |

10.7 EH/s2 |

10.7 EH/s2 |

4.8 EH/s |

|

0% |

123% |

|

Deployed Miners1 |

95,9042 |

95,9042 |

46,658 |

|

0% |

106% |

|

Power Credits3,5 |

$24.2 million6 |

$6.0 million6 |

$3.0 million |

|

303% |

709% |

|

Demand Response Credits4,5 |

$7.4 million6 |

$1.8 million6 |

$0.2 million |

|

316% |

2,933% |

|

¹ As of end of month.² Exahash per second (“EH/s”). Excludes 17,040

miners that are offline as a result of damage to Building G from

the severe winter weather in late December 2022 in Texas.³ Power

curtailment credits received from the Company’s ability, under its

long-term power contracts, to sell power back to the ERCOT grid at

market-driven spot prices.⁴ Credits received from participation in

ERCOT demand response programs. ⁵ The Company discloses this figure

in its monthly updates if it exceeds $1 million for the current

month.⁶ Power Credits and Demand Response Credits for July and

August 2023 are estimates. |

“August was a landmark month for Riot in

showcasing the benefits of our unique power strategy,” said Jason

Les, CEO of Riot. “Riot achieved a new monthly record for Power and

Demand Response Credits, totaling $31.7 million in August, which

surpassed the total amount of all Credits received in 2022. Based

on the average Bitcoin price in August, Power and Demand Response

credits received equated to approximately 1,136 Bitcoin. The

effects of these credits significantly lower Riot’s cost to mine

Bitcoin and are a key element in making Riot one of the lowest cost

producers of Bitcoin in the industry. Riot’s power strategy is a

key competitive advantage, and when placed alongside our strong

financial position and efficient miner fleet, put Riot in a leading

position heading into the upcoming Bitcoin ‘halving’ event next

year.”

Estimated Hash Rate Growth

As previously disclosed, Riot is in the process

of repairing damage incurred in Building G during the severe winter

storm in Texas in December 2022, and Riot now anticipates achieving

a total self-mining hash rate capacity of 12.5 EH/s at its Rockdale

Facility by the end of 2023.

The Company has also entered into a long-term

purchase agreement with MicroBT, which includes an initial order of

7.6 EH/s of next-generation Bitcoin miners for its Corsicana

Facility. Upon full deployment of this initial order by mid-2024,

Riot’s total self-mining hash rate capacity is expected to reach

20.1 EH/s.

Riot’s Power Strategy Assists in

Stabilization of Texas Energy Grid During August Heat

Wave

Texas experienced another month of extreme heat

in August 2023, causing demand for electricity to spike, in some

cases approaching total available supply. Riot continued to execute

its power strategy by curtailing its power usage by more than 95%

during periods of peak demand, forgoing revenue from its Bitcoin

mining operations to instead provide energy resources to ERCOT. The

Company’s curtailment of operations meaningfully contributed to

reducing overall power demand in ERCOT, helping to ensure that

consumers did not experience interruptions in service.

For more information on Riot’s power strategy,

please refer to the Company’s updated Corporate Presentation,

available on the Company’s website.

Conference Schedule:

- 3rd Annual Needham Crypto

Conference, on September 7th held virtually.

- 25th Annual H.C. Wainwright Global

Investment Conference, on September 11th and 12th in New York.

- Northland Capital Markets

Institutional Investor Conference, on September 19th held

virtually.

Legal Update

Riot is pleased to announce that on August 25,

2023, the New Jersey District Court dismissed Creighton Takata’s

shareholder class action against Riot with prejudice resulting in

the final dismissal of all claims. This victory is another example

of Riot's aggressive stance and determination to prevail when

litigating matters.

Human Resources Update

Riot is currently recruiting for positions

across the Company. Join our team in building, expanding, and

securing the Bitcoin network.

Open positions are available at:

https://www.riotplatforms.com/careers.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the

world’s leading Bitcoin-driven infrastructure platform.

Our mission is to positively impact the sectors,

networks, and communities that we touch. We believe that the

combination of an innovative spirit and strong community

partnership allows the Company to achieve best-in-class execution

and create successful outcomes.

Riot is a Bitcoin mining and digital

infrastructure company focused on a vertically integrated strategy.

The Company has data center hosting operations in central Texas,

Bitcoin mining operations in central Texas, and electrical

switchgear engineering and fabrication operations in Denver,

Colorado.

For more information, visit

www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not

historical facts are forward-looking statements that reflect

management’s current expectations, assumptions, and estimates of

future performance and economic conditions. Such statements rely on

the safe harbor provisions of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934.

Because such statements are subject to risks and uncertainties,

actual results may differ materially from those expressed or

implied by such forward-looking statements. Words such as

“anticipates,” “believes,” “plans,” “expects,” “intends,” “will,”

“potential,” “hope,” and similar expressions are intended to

identify forward-looking statements. These forward-looking

statements may include, but are not limited to, statements about

the benefits of acquisitions, including financial and operating

results, and the Company’s plans, objectives, expectations, and

intentions. Among the risks and uncertainties that could cause

actual results to differ from those expressed in forward-looking

statements include, but are not limited to: unaudited estimates of

Bitcoin production; our future hash rate growth (EH/s); the

anticipated benefits, construction schedule, and costs associated

with the Navarro site expansion; our expected schedule of new miner

deliveries; the impact of weather events on our operations and

results; our ability to successfully deploy new miners; the

variance in our mining pool rewards may negatively impact our

results of Bitcoin production; megawatt (“MW”) capacity under

development; we may not be able to realize the anticipated benefits

from immersion-cooling; the integration of acquired businesses may

not be successful, or such integration may take longer or be more

difficult, time-consuming or costly to accomplish than anticipated;

failure to otherwise realize anticipated efficiencies and strategic

and financial benefits from our acquisitions; and the impact of

COVID-19 on us, our customers, or on our suppliers in connection

with our estimated timelines. Detailed information regarding the

factors identified by the Company’s management which they believe

may cause actual results to differ materially from those expressed

or implied by such forward-looking statements in this press release

may be found in the Company’s filings with the U.S. Securities and

Exchange Commission (the “SEC”), including the risks, uncertainties

and other factors discussed under the sections entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements”

of the Company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2022, as amended, and the other filings the

Company makes with the SEC, copies of which may be obtained from

the SEC’s website, www.sec.gov. All forward-looking statements

included in this press release are made only as of the date of this

press release, and the Company disclaims any intention or

obligation to update or revise any such forward-looking statements

to reflect events or circumstances that subsequently occur, or of

which the Company hereafter becomes aware, except as required by

law. Persons reading this press release are cautioned not to place

undue reliance on such forward-looking statements.

Investor Contact:Phil McPherson303-794-2000 ext. 110

IR@Riot.Inc

Media Contact:Alexis Brock303-794-2000 ext. 118

PR@Riot.Inc

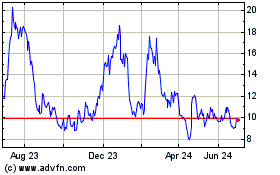

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

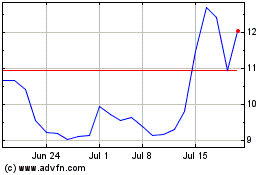

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Jul 2023 to Jul 2024