Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or the

"Company”), an industry leader in Bitcoin (“BTC”) mining

and data center hosting, issues a statement in response to The New

York Times’ (“NYT”) April 9, 2023 article “The Real-World Cost of

the Digital Race for Bitcoin” (the “Article”).

Amid yet another banking crisis, Bitcoin offers consumers and

businesses much-needed optionality for storing value, and the

ability to take custody of their own assets. Bitcoin mining

operations are also providing jobs, tax revenues, and many other

benefits to rural communities, including grid stability and

incentives for alternative energy production.

That is why we were especially disappointed to read a false and

distorted view of our Company and our industry in the Article

published by The NYT. Worse still, The NYT chose to publish the

Article with information its authors knew to be false and

misleading, ignoring the factual information that we provided to

them.

To be clear, our Bitcoin mining operations do not generate any

greenhouse gas emissions, similar to any other data center for

Facebook, Amazon or Google – yet we have been singled out. Our data

center uses electricity from the Texas grid, which is the cleanest

and most renewable energy-sourced grid in the United States.

We also proudly participate in various programs that help to

stabilize the electric grid and actually reduce power prices,

despite what critics incorrectly assume. Unlike other industries,

we can shut down at a moment’s notice, making power available to

other users and critical infrastructure during extreme weather

events, while offsetting losses from curtailing our operations.

We are especially proud to be the largest employer in Milam

County, Texas, and that our dynamic and talented workforce is

spurring economic activity that is strengthening the local

economy.

This reporting appears to be driven by fringe political

interests, but we will not be deterred from our core mission of

helping to build a global, universally accessible network for

Bitcoin and supportive, resilient communities where our operations

are located.

In that spirit, we are compelled to publish here, our full

responses to the NYT questions we received in the weeks prior to

publication. As anyone can see, accurate information was blatantly

ignored because it did not fit the narrative the NYT was trying to

spin.

We wish to highlight below for the public and our shareholders

the truth compared to some of the story’s most glaring

deficiencies, which include at least the following:

1. NYT Distortion: The NYT compares electricity usage of

Bitcoin mining data centers to peoples’ homes. That is an

arbitrary, inflammatory, and political choice. It is very telling

that they compare Bitcoin miners to “another New York City’s worth

of residents.” The NYT appears unaware that this statement admits

condescension towards Americans who choose to inhabit rural areas

in the middle of the country. The obvious implication by the NYT is

that New York City residents should be allowed to consume

electricity; data centers in rural America should not.

Reality: The fact is that nearly any industry that uses

electricity, i.e., manufacturing, other data centers, iron and

steel, chemicals, or even home air conditioners, use orders of

magnitude more electricity, generated by a higher percentage of

fossil fuels, than Bitcoin mining data centers. (See: Cambridge

Bitcoin Electricity Consumption Index (CBECI) (ccaf.io).) The NYT

appears to have singled out this industry because the NYT has tied

itself to political interests opposed to decentralization of

authority. Choosing who can and cannot use energy based on

political considerations is a dangerous path inconsistent with the

values of a free society.

2. NYT Distortion: They state that Bitcoin mining

operations “can create costs” including “higher electricity bills

and enormous carbon pollution.”

Reality: Electricity bills have increased due to a

variety of reasons, including inflationary monetary and fiscal

policy, Russia’s invasion of Ukraine, and restrictive energy

policies by the U.S. federal government. Bitcoin miners do not emit

any pollutants at all. They simply use electricity—just like, say,

electric cars. Bitcoin miners actually decrease electricity bills

by purchasing power at off-peak times and competitively bidding for

demand response programs, which are particularly useful during peak

periods. In making their claims, the NYT relied on a proprietary

hypothetical simulation and failed to open-source the data so that

it can be properly challenged.

3. NYT Distortion: In “Texas … Bitcoin companies are paid

by the grid operator for promising to quickly power down if

necessary to prevent blackouts. In practice, they rarely are asked

to shut down and instead earn additional money while doing exactly

what they would have been doing anyway: seeking Bitcoin.” And they

go on to claim that operators made tens of millions of dollars.

Reality: This is an absurd characterization. How would

Bitcoin miners earn money from a program where they are—according

to the NYT—not participating? Riot is not compensated for

“promises,” we are compensated for providing ERCOT the ability to

directly manage Riot’s energy load. We also invest hundreds of

millions of dollars into developing our business in our Texas

community, for which we are then afforded the right to bid

competitively in demand response programs, in which we are

compensated for selling the curtailment decision to ERCOT. Under

these programs, ERCOT controls Riot’s curtailment in exchange for

competitive, market-based fees.

4. NYT Distortion: “Bitcoin mines bring

significantly fewer jobs, often employing only a few dozen people

once construction is complete, and spur less local economic

development. Their financial benefit flows almost exclusively to

their owners and operators.”

Reality: Notice the selective language here— “often” and

“almost.” The NYT deliberately avoided citing a specific example.

Had they cited Riot, they would have had to admit that Riot

employees hundreds of full-time employees, has used hundreds of

local contractors, and is the largest taxpayer in the county and

school district. They were provided with this information well

before publication and chose to circumvent it rather than

acknowledge it.

5. NYT Distortion: “Many Bitcoin businesses promote their

ability to operate in rural areas where renewable energy is

abundant. But those claims have hit a hard reality: A vast majority

of that renewable energy would be used even in the absence of the

mines, so fossil fuel plants almost always need to produce

additional electricity as a result of their operations.” They go on

to state that Riot operates on 96% fossil fuel, using a “marginal

emissions” calculation.

Reality: This is utterly baseless and nonsensical. Riot

purchases electricity from the Texas energy grid, which uses

approximately 24% wind, 10% nuclear, and 4% solar. (See: Texas’

Energy Profile.) However, Riot operates exclusively in rural areas

where wind and solar are abundant and otherwise wasted during

off-peak times, thereby further diversifying the grid’s energy mix

and leaning much more heavily on renewable sources. The NYT even

admits that “renewable generation takes years to build and usually

requires commitments from customers who can guarantee that they

will buy power for a decade or more.” Bitcoin miners make such

commitments and are ideally positioned to do so.

6. NYT Distortion: “If Riot had been fully operating [on

June 23, 2022], it would have incurred an estimated $5.5 million in

fees — costs that are largely made up by other Texans. Over the

course of the year, this saved Riot more than $27 million in

potential fees.”

Reality: We believe this is false and demonstrates a

total lack of understanding of power markets. Riot provided the NYT

with a rational and factual explanation to clarify this erroneous

statement, which can be found in the link provided above. We even

noted that that it was “unclear” regarding what data they could

possibly be referring to.

By implication, the NYT’s preference appears to be that Riot

should refuse to curtail so that it pays higher fees; yet the

implication of the entire article is that Bitcoin miners should not

be allowed to operate at all. Both of these alternate realities are

incongruous and insidious.

The fact of the matter is that Riot participates in many of

ERCOT’s ancillary services programs, which add to grid reliability

and ultimately reduce power prices, benefiting all of the tens of

millions of ERCOT customers. Riot is proud to do so.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading

Bitcoin-driven infrastructure platform.

Our mission is to positively impact the sectors, networks and

communities that we touch. We believe that the combination of

an innovative spirit and strong community partnership allows the

Company to achieve best-in-class execution and create successful

outcomes.

Riot is a Bitcoin mining and digital infrastructure company

focused on a vertically integrated strategy. The Company has

Bitcoin mining data center operations in central Texas, Bitcoin

mining operations in central Texas, and electrical switchgear

engineering and fabrication operations in Denver, Colorado.

For more information, visit www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not historical facts

are forward-looking statements that reflect management’s current

expectations, assumptions, and estimates of future performance and

economic conditions. Such statements rely on the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Because such statements

are subject to risks and uncertainties, actual results may differ

materially from those expressed or implied by such forward-looking

statements. Words such as “anticipates,” “believes,” “plans,”

“expects,” “intends,” “will,” “potential,” “hope,” and similar

expressions are intended to identify forward-looking statements.

These forward-looking statements may include, but are not limited

to, statements about the benefits of acquisitions, including

financial and operating results, and the Company’s plans,

objectives, expectations, and intentions. Among the risks and

uncertainties that could cause actual results to differ from those

expressed in forward-looking statements include, but are not

limited to: unaudited estimates of Bitcoin production; our future

hash rate growth (EH/s); the anticipated benefits, construction

schedule, and costs associated with the Navarro site expansion; our

expected schedule of new miner deliveries; our ability to

successfully deploy new miners; M.W. capacity under development; we

may not be able to realize the anticipated benefits from

immersion-cooling; the integration of acquired businesses may not

be successful, or such integration may take longer or be more

difficult, time-consuming or costly to accomplish than anticipated;

failure to otherwise realize anticipated efficiencies and strategic

and financial benefits from our acquisitions; and the impact of

COVID-19 on us, our customers, or on our suppliers in connection

with our estimated timelines. Detailed information regarding the

factors identified by the Company’s management which they believe

may cause actual results to differ materially from those expressed

or implied by such forward-looking statements in this press release

may be found in the Company’s filings with the U.S. Securities and

Exchange Commission (the “SEC”), including the risks, uncertainties

and other factors discussed under the sections entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements”

of the Company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2021, as amended, and the other filings the

Company makes with the SEC, copies of which may be obtained from

the SEC’s website, www.sec.gov. All forward-looking statements

included in this press release are made only as of the date of this

press release, and the Company disclaims any intention or

obligation to update or revise any such forward-looking statements

to reflect events or circumstances that subsequently occur, or of

which the Company hereafter becomes aware, except as required by

law. Persons reading this press release are cautioned not to place

undue reliance on such forward-looking statements.

Alexis Brock

Riot Platforms, Inc

5129406014

PR@riot.inc

Phil McPherson

Riot Platforms, Inc.

303-794-2000 ext. 110

IR@riot.inc

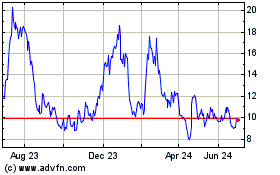

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

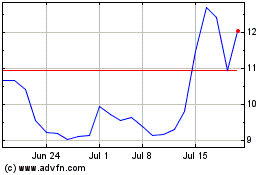

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Jul 2023 to Jul 2024