A few weeks after the new industry rules

went into effect, some homebuyers are confused about fee agreements

and who is responsible for paying the buyer’s agent.

Most sellers are still willing to cover the

buyside commission–but negotiation has become more common in some

markets and at higher price points, which could put pressure on

fees

(NASDAQ: RDFN) — Redfin, the technology-powered real estate

brokerage, reported today that negotiation over commissions has

become more common in some markets and at higher price points in

the wake of industry rule changes mandated by the National

Association of Realtors legal settlement.

The report focuses on interviews with dozens of Redfin agents

around the country about how buyers and sellers are responding to

the reforms. While consumers and agents are still adjusting to the

new rules, Redfin agents are seeing different impacts in different

parts of the country. In some areas, negotiations over fees are

becoming more common, while other markets have not experienced much

change at all.

“We've found a tale of two markets," said Redfin Chief Economist

Daryl Fairweather. "In slow markets where there's less demand from

homebuyers, like Austin, agents report that most sellers are still

willing to pay the buyer's agent commission to attract buyers, and

agent fees are mostly the same as before. In markets with low

inventory and robust demand, like San Francisco and Boston, agents

report more instances of negotiation around fees, with sellers

asking buyers to make their best offer rather than preemptively

deciding what they want to offer a buyer’s agent. Now, like the

amount of earnest money deposit or including an inspection

contingency, the amount the buyer is asking the seller to pay her

agent is a term that impacts the strength of the offer. That will

likely drive fees down over time.”

A Redfin analysis in July found the typical buyer's agent

commission was 2.55%, down slightly from before the settlement was

announced. The new rules have made it harder to track fees by

removing them from the MLS.

Under the new requirements, which took effect August 17, listing

agents may no longer include a unilateral offer for the buyer’s

agent commission in NAR-affiliated multiple listing services

(MLSs), and agents must tell potential buyers what they charge

before buyers start touring homes.

Buyers are confused about signing an agreement before a home

tour.

The requirement that agents and buyers agree on fees before they

tour is intended to make fees more transparent. But buyers are

understandably wary about signing paperwork to tour homes.

Redfin’s approach is to ask house hunters to sign a simple fee

agreement–which can be signed online with one click–before their

first home tour. The agreement doesn’t obligate the customer to use

Redfin; its purpose is to tell prospective clients what Redfin

would charge if a Redfin agent were to represent them. Once a

prospective client has met a Redfin agent, they can decide whether

to continue working with them and take advantage of Redfin's best

pricing with its Sign & Save program. Redfin offers competitive

buyer agent fees as low as 1.75% depending on the market.

Many agents at other brokerages are taking a more heavy-handed

approach, requiring buyers to sign a full buyer agency agreement to

tour. These agreements typically obligate the buyer to work

exclusively with that agent for their home purchase for a certain

period of time.

Alex Galanis, a Redfin Premier agent in San Diego, says, “I

showed a $4.75 million home in Carlsbad. The buyer told me she

tried scheduling a showing with another agent, but immediately that

agent sent her a 12 page buyer representation agreement for

signatures. She found it very off-putting, and appreciated our

approach. I want to win a customer’s business as much as the next

agent, but I don’t think anyone should be forced to make such a big

decision before we’ve had a chance to meet.”

The biggest change: Buyers and sellers are negotiating over

who pays the buyer’s agent, and how much they’re paid. This is

especially true in the luxury market.

The NAR settlement has led more sellers to realize commissions

are negotiable, and that they might be able to get the buyer to

cover some or all of the buyside commission. The consensus from

agents: Like most parts of a real estate deal, how much a buyer or

seller can negotiate depends on demand for the listing.

"While I’ve always let my sellers know they can offer whatever

commission they want and don’t have to offer anything at all, my

sellers are having the conversation with me in more depth than ever

before,” explained Blakely Minton, a Redfin Premier agent in

Philadelphia. “I recently had a seller decide to offer 1.5%. I let

them know offering less commission would most likely mean the buyer

has to make up the difference, and it would only matter if you

don’t have demand for your home. That 1.5% home listed at $350,000

and got 12 offers. It was a great little home right near the

University of Delaware. Half the offers we got still asked for

2.5%. But the two highest offers accepted that the seller would pay

just 1.5% to the buyer’s agent."

Las Vegas Redfin Premier agent Fernanda Kriese says: “It’s all

price-specific and seller-specific. Sellers understand that agents

aren’t going to work for free, but they’re thinking about what

percentage they’re going to offer the buyer’s agent: Maybe it’s 2%,

maybe it’s 2.5%, maybe it’s 3%, depending on how desirable the

listing is. And ultimately, the commission goes together with the

price. Sellers may have to list slightly higher if they’re offering

to pay a higher commission to the buyer’s agent, and vice

versa.”

Agents are reporting there’s more downward pressure on buyer’s

agent commissions for high-end listings.

“Buyers and sellers of luxury homes are more likely to negotiate

agent fees, which makes sense because on a $5 million home every

half a percent is $25,000,” says Mimi Trieu, a Redfin Premier agent

in Silicon Valley. “They want to make sure they are getting value

from their agent. My luxury listings aren’t offering a certain

buyside commission. If the buyer makes a great offer, they’ll

consider paying the buyer’s agent.”

But even though negotiations are becoming more common, most

sellers are still willing to help cover the buyer’s agent

fees.

Before, sellers proactively advertised a commission in the MLS

that they were willing to pay any agent who represented the buyer.

And often the buyer’s agent accepted the commission offered. Now

sellers are evaluating their options and deciding on a strategy

based on the housing market and the competition they expect for

their home. By and large, most are still willing to cover the buyer

agent fee as long as they still net their desired amount.

In New Jersey, Redfin Premier agent Amira Elgoneimy continues to

see sellers proactively offer a commission to buyer’s agents.

“Sellers in my area are still offering to pay commission to the

buyer’s agent in all price points, so far. I wrote five offers the

first two weeks the rules were in effect. In all five, we knew the

seller was offering to pay commission.”

Gregory Eubanks, a Los Angeles Redfin Premier agent says,“With

sellers, I’m laying everything out upfront, presenting the options

for payment to the buyer’s agent. One, don’t offer a buyer’s agent

commission at all. Two, state that you’re open to paying buyside

commission but don’t provide an exact number. Three, go ahead and

put a number out there–it can’t be advertised over the MLS, but

listing agents can communicate it to buyer’s agents in different

ways.”

Removing the offer of compensation from the MLS has resulted in

more back and forth between agents when scheduling a showing, with

more buyers’ agents contacting listing agents to ask if the seller

is offering compensation or open to it. Redfin agents report some

listing agents are communicating what the seller is willing to pay

buyer’s agents in creative ways. In Dallas and Portland, for

example, our agents have seen instances of “3%” written on a

lockbox. Still, most agents report they’re mostly communicating

about fees via phone calls and texts.

To read the full report with additional agent anecdotes, visit:

https://www.redfin.com/news/redfin-agents-report-nar-rules-negotiation

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909960359/en/

Redfin Journalist Services: Alina Ptaszynski

press@redfin.com

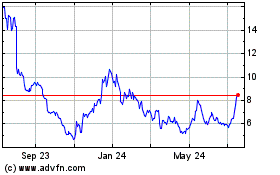

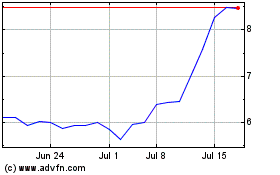

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Nov 2023 to Nov 2024